Nvidia's Stock Dip After CES Keynote: Jim Cramer Sees Buying Opportunity Amid AI Revolution

2 Sources

2 Sources

[1]

Jim Cramer says Nvidia's pullback could be a good chance to buy

"Understand one thing, the keynote dazzled, the new projects are way ahead of any other company and this new industrial revolution belongs to Nvidia," he said. "That doesn't mean the stock can't go down. It just means that you can buy happily, buy the inevitable pullbacks." CNBC's Jim Cramer extolled Nvidia's stock and reviewed its Tuesday action, saying the decline was unrelated to the company and its prospects. He suggested this could be a good time to buy shares and applauded CEO Jensen Huang's remarks at CES. "Understand one thing, the keynote dazzled, the new projects are way ahead of any other company, and this new industrial revolution belongs to Nvidia," he said. "That doesn't mean the stock can't go down. It just means that you can buy happily, buy the inevitable pullbacks." Huang delivered a keynote speech Monday night at the annual conference in Las Vegas and revealed new chips for laptops and PCs that use Blackwell, the same technology used for Nvidia's advanced artificial intelligence server chips. Cramer was impressed by Huang, including his discussion of more physical uses for AI like humanoid robots and autonomous vehicles. He said the presentation was reassurance that "the new industrial revolution is alive and well and coming to you in a very short time." Nvidia stock sank during Tuesday's session and finished the day down 6.22%, leading a selloff in tech that saw the Nasdaq Composite close down 1.89%. Cramer attributed the pullback in Nvidia to "too much hot money in the stock" and Wall Street's worries about interest rates and inflation. Cramer told investors to wait for the Labor Department to release new employment data on Friday, saying sellers are likely to have regrets. "If you don't already own it, you can think about buying some now...nicely below its all-time high, and then wait until the labor report and buy more," he said. "If it comes in hot, you will get a chance to buy this stock lower, maybe much lower."

[2]

Jim Cramer Sees Buying Opportunity In Nvidia But Attributes 6% Fall To 'Too Much Hot Money' After Jensen Huang's CES Keynote - NVIDIA (NASDAQ:NVDA)

Jim Cramer urged investors to consider NVIDIA Corp.'s NVDA recent stock decline as a buying opportunity, despite the company's shares falling 6.22% on Tuesday following CEO Jensen Huang's CES 2025 keynote presentation. What Happened: "Understand one thing, the keynote dazzled, the new projects are way ahead of any other company, and this new industrial revolution belongs to Nvidia," Cramer said on CNBC, attributing the stock's decline to "too much hot money" and broader market concerns about interest rates and inflation rather than company fundamentals. During his Las Vegas presentation, Huang unveiled next-generation GeForce RTX 5000 series graphics cards and the Grace Blackwell NVLink 72 system, positioning Nvidia at the forefront of AI computing. The flagship RTX 5090, priced at $1,999, promises double the performance of its predecessor and features 32GB of GDDR7 memory. See Also: Amazon Set To Benefit From Mexico's Import Tariffs Affecting Temu, Shein -- Analysts See Window Of Opportunity For Established Players Why It Matters: The presentation sparked mixed reactions from Wall Street analysts. Bank of America's Vivek Arya maintained a Buy rating with a $190 price target, describing Nvidia as an "end-to-end AI shop." However, Benchmark analyst Cody Acree, while maintaining a Buy rating, noted the keynote may have been "too technical" for investors seeking near-term guidance. Cramer advised investors to consider purchasing shares below the all-time high and monitor the upcoming Labor Department employment data. "If it comes in hot, you will get a chance to buy this stock lower, maybe much lower," he said, suggesting current sellers might regret their decisions. Nvidia's expanding influence in AI infrastructure is evident in its partnership with Foxconn, which reported strong fourth-quarter results driven partly by AI server demand. The company is set to release its RTX 5090 and 5080 models on Jan. 30, with more affordable variants following later. Price Action: Nvidia's stock closed at $140.14 on Tuesday, down 6.22% for the day. In after-hours trading, the stock rose 1.04%. Over the past year, Nvidia's stock has surged 168.21%, according to data from Benzinga Pro. Nvidia has a consensus price target of $170.56. The highest target is $220, and the lowest is $120. Recent analyst ratings suggest an average target of $161.67, implying a 14.17% upside. Read Next: Tesla Supplier CATL, Riot Games Owner Tencent Plan Legal Action Over Pentagon Blacklist, Deny Military Ties Image Via Shutterstock Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Market News and Data brought to you by Benzinga APIs

Share

Share

Copy Link

Jim Cramer views Nvidia's recent stock decline as a potential buying opportunity, praising the company's CES keynote and its position in the AI-driven industrial revolution, despite a 6.22% drop in share price.

Nvidia's CES Keynote Impresses Despite Stock Decline

Nvidia Corporation, a leader in AI and graphics processing technology, experienced a 6.22% stock decline following CEO Jensen Huang's keynote speech at CES 2025 in Las Vegas. Despite this drop, CNBC's Jim Cramer remains bullish on the company's prospects, describing the presentation as "dazzling" and positioning Nvidia at the forefront of the new industrial revolution

1

2

.Cutting-Edge Technology Unveiled

During the keynote, Huang introduced several groundbreaking products:

- Next-generation GeForce RTX 5000 series graphics cards

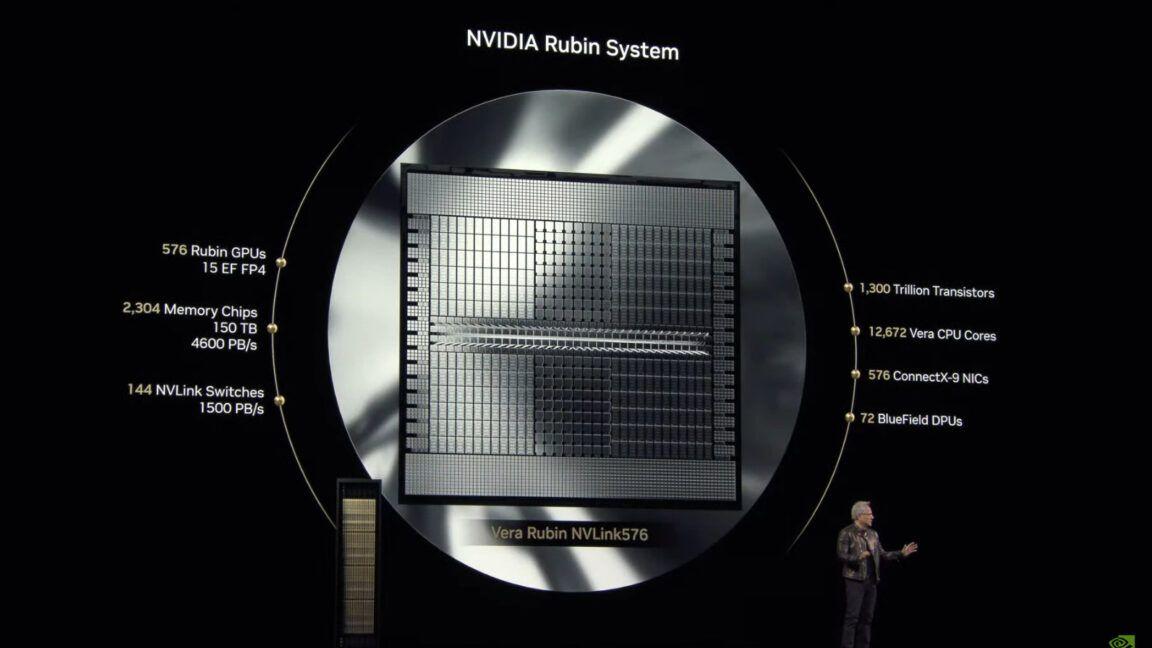

- Grace Blackwell NVLink 72 system for advanced AI computing

- RTX 5090, priced at $1,999, promising double the performance of its predecessor with 32GB of GDDR7 memory

2

These announcements showcase Nvidia's commitment to pushing the boundaries of AI and graphics technology, reinforcing its position as an "end-to-end AI shop," according to Bank of America analyst Vivek Arya

2

.Market Reaction and Analyst Perspectives

While the stock experienced a significant drop, Cramer attributes this to "too much hot money in the stock" and broader market concerns about interest rates and inflation, rather than company fundamentals

1

. Wall Street analysts have mixed reactions:- Bank of America maintains a Buy rating with a $190 price target

- Benchmark analyst Cody Acree keeps a Buy rating but notes the keynote may have been "too technical" for investors seeking near-term guidance

2

Related Stories

Nvidia's Expanding Influence in AI Infrastructure

Nvidia's growing impact on the AI industry is evident in its partnership with Foxconn, which reported strong fourth-quarter results partly driven by AI server demand

2

. The company's upcoming product releases include:- RTX 5090 and 5080 models launching on January 30

- More affordable variants to follow later in the year

2

Investment Opportunity and Market Outlook

Cramer advises investors to consider purchasing Nvidia shares below the all-time high, suggesting that current sellers might regret their decisions

1

. He recommends monitoring the upcoming Labor Department employment data, stating, "If it comes in hot, you will get a chance to buy this stock lower, maybe much lower"1

.Nvidia's stock closed at $140.14 on Tuesday, down 6.22% for the day, but rose 1.04% in after-hours trading. The company has seen a remarkable 168.21% surge over the past year

2

. Current analyst ratings indicate:- Consensus price target: $170.56

- Highest target: $220

- Lowest target: $120

- Average recent target: $161.67, implying a 14.17% upside

2

As Nvidia continues to lead the AI revolution, investors and industry watchers alike will be closely monitoring its performance and impact on the broader technology landscape.

References

Summarized by

Navi

Related Stories

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy