Nvidia's Strategic AI Investments Fuel Market Dominance and Stock Volatility

2 Sources

2 Sources

[1]

Nvidia's Billion-Dollar A.I. Pitch: How the Chip Giant Ramps Up Startup Bets

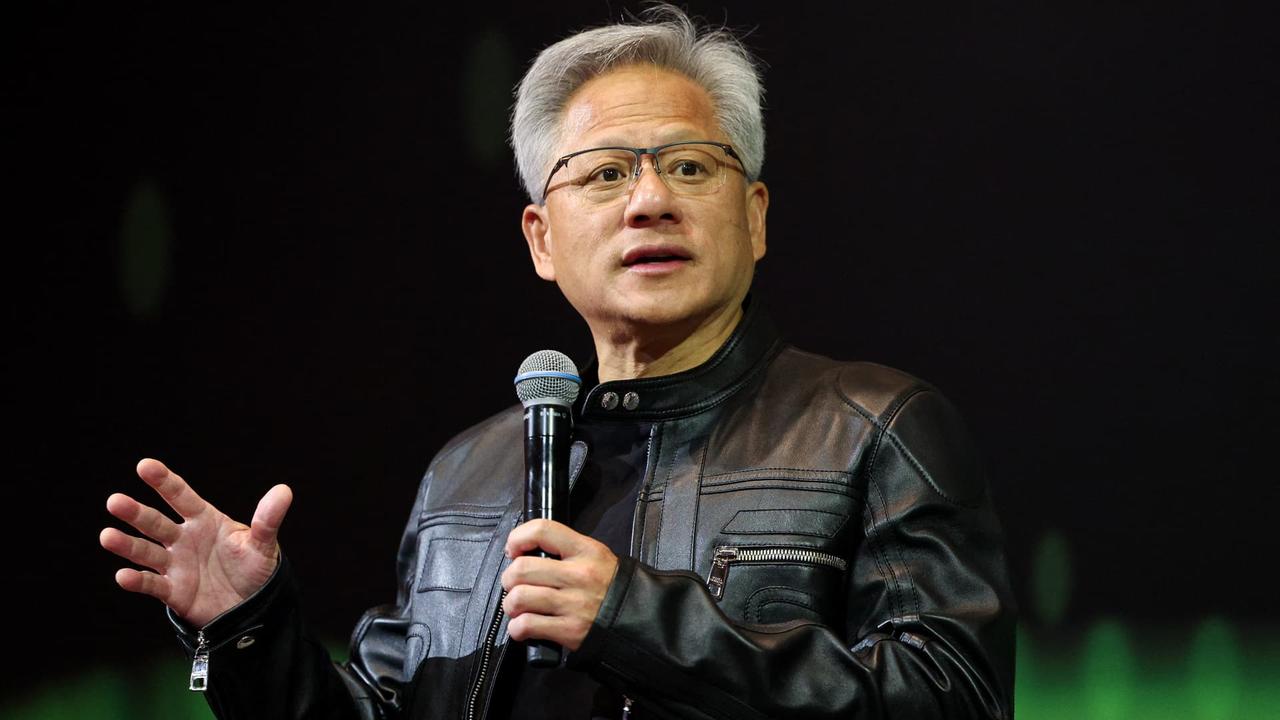

"We invest in these companies because they're incredible at what they do," Jensen Huang said an interview earlier this year. There's no question that Nvidia (NVDA) is one of the biggest winners of the A.I. boom so far. Funneled by an insatiable demand for its graphics processing units (GPUs), the chipmaker's stock has skyrocketed by more than 450 percent since early 2023. As Nvidia's market cap and revenue soar, so does the pace of its investing in A.I. startups. More than half of the company's startup investments since 2005 took place in the past two years. Sign Up For Our Daily Newsletter Sign Up Thank you for signing up! By clicking submit, you agree to our <a href="http://observermedia.com/terms">terms of service</a> and acknowledge we may use your information to send you emails, product samples, and promotions on this website and other properties. You can opt out anytime. See all of our newsletters The value of the company's startup investments reportedly totaled more than $1.5 billion at the beginning of 2024, a significant jump from the $300 million a year prior. The chipmaker has participated in more than ten $100 million-plus funding rounds for A.I. startups in 2024 alone, according to data from Crunchbase, and has backed more than 50 startups since 2023. That's not to mention a flurry of activity from the company's venture capital arm NVentures, which separately made 26 investments in 2023 and 2024. Nvidia's seemingly unflappable upward trajectory took a hit yesterday (Sept. 3) after reports surfaced that it had received a subpoena from the U.S. Department of Justice as part of an antitrust probe. The company's stock dropped nearly 10 percent, shaving $279 billion off its market cap, which currently stands at $2.6 trillion. But its falling stock price doesn't mean the company is slowing down in its startup department. In addition to eyeing an investment in an upcoming funding round in ChatGPT-maker OpenAI, Nvidia yesterday unveiled its participation in a more than $100 million funding round for the Tokyo-based Sakana AI, a company that specializes in accessible A.I. models trained on small datasets. "We invest in these companies because they're incredible at what they do," Nvidia founder and CEO Jensen Huang told Wired earlier this year. "These are some of the best minds in the world." From companies specializing in humanoid robots to autonomous vehicles, here's a look at some of Nvidia's most significant startup investments: Perplexity AI Huang hasn't been shy about his love for Perplexity AI, the A.I.-powered search engine positioned as a competitor to the likes of Google. The Nvidia CEO uses the startup's tool nearly every day for research, according to Huang's interview with Wired. He has also put his money where his mouth is, with Nvidia partaking in a $62.7 million funding round for Perplexity AI in April that valued the startup at $1 billion. Led by investor Daniel Gross, the round included participants like Amazon (AMZN)'s Jeff Bezos. It wasn't the first time Nvidia has backed the company -- the chipmaker also invested in Perplexity AI during another funding round in January that valued the startup at $73.6 million. Hugging Face Hugging Face, a startup providing open-source A.I. developer platforms, has long had close ties to Nvidia. The chipmaker participated in a $235 million funding round in Hugging Face in August 2023 that valued the company at $4.5 billion. Other corporate investors participating in the round included Google, Amazon, Intel, AMD and Salesforce. Hugging Face has previously included Nvidia hardware among its shared resources. In May, it launched a new program that donated $10 million worth of free, shared Nvidia GPUs to be used by A.I. developers. Adept AI Unlike more well-known A.I. assistants from companies such as OpenAI and Anthropic, Adept AI's primary product doesn't center around text or image generation. Instead, the startup is focused on building an assistant that can complete tasks on a computer, such as generating a report or navigating the web, and is able to use software tools. Nvidia is on board, having participated in a $350 million funding round in March 2023. Databricks After receiving a giant valuation of $43 billion last fall, Databricks became one of the world's most valuable A.I. companies. The data analytics software provider unsurprisingly uses Nvidia's GPUs and has been backed by the chipmaker alongside other investors like Andreessen Horowitz and Capital One Ventures, all of whom participated in a $500 million funding round in September 2023. "Databricks is doing incredible work with Nvidia technology to accelerate data processing and generative A.I. models," said Huang in a statement at the time. Cohere A formidable opponent to OpenAI and Anthropic, the Canadian startup Cohere specializes in A.I. models for enterprises. The company's growth over the past five years has attracted backers such as Nvidia, Salesforce and Cisco, which funded Cohere during a round held in July. Nvidia also took part in a May 2023 funding round that brought in some $270 million for the startup. Mistral AI Mistral AI is a French startup focusing on developing open-source A.I. models. It was founded by former Google DeepMind and Meta employees in April 2023. Nvidia has participated in two of the startup's fundraising rounds, a $518 million round in June and a $426 million round in December 2023. The collaboration between the two companies doesn't end there -- in July, Nvidia and Mistral AI jointly released a small and accessible language model for developers. Figure Huang has long reiterated his belief that A.I.-powered robots able to work among humans will constitute the next wave of technology. It is, therefore, no surprise that Nvidia is a backer of Figure, a startup developing humanoid robots for use in warehouses, transportation and retail. Nvidia reportedly funneled $50 million towards the company during a February funding round that raised a total of $675 million and included participants like Bezos and Microsoft. Scale AI To properly train A.I. tools like OpenAI's ChatGPT, tech companies need vast amounts of data. This is where A.I. startups like Scale AI, which provides troves of accurately labeled data and is headed by billionaire Alexandr Wang, come in. Nvidia participated in a $1 billion funding round for the company in May alongside Big Tech players like Amazon and Meta. Wayve Autonomous driving is another area of interest for A.I. leaders across the tech world. Huang himself said that "every single car, someday, will have to have autonomous capability" in a recent interview with Yahoo Finance. One of the startups at the forefront of this wave is the U.K.-based Wayve. Nvidia participated in a $1 billion funding round in the startup in May. Inflection AI Out of the 92 startups Nvidia has backed throughout the decades, Huang's company has only been a lead investor in 20 rounds. One of these occurred in June 2023, when Nvidia led a staggering $1.3 billion round for Inflection AI. The chipmaker co-led the round alongside Microsoft, Bill Gates and former Google CEO Eric Schmidt. The A.I. startup, which was co-founded by LinkedIn (LNKD) co-founder Reid Hoffman and Google DeepMind co-founder Mustafa Suleyman and most recently valued at $4 billion, produces a chatbot known as Pi. Much of the round's funding went towards bolstering Inflection A.I.'s computing cluster of 22,000 Nvidia H100 GPUs.

[2]

How Nvidia doubled earnings, lost almost $300 billion in value and shook the stock market

Nvidia's headquarters in Santa Clara, Calif.Tayfun Coskun / Anadolu via Getty Images It's been described as the most important company in the world at the moment. But new concerns surrounding Nvidia, the chipmaker powering the artificial intelligence revolution -- and which this summer became America's second-largest public company, behind Apple, when its valuation surpassed $3 trillion -- have prompted a fresh global market sell-off. On Tuesday, Nvidia shares dropped 9.5%, erasing $278.9 billion from the company's value -- the biggest such single-day loss ever for a U.S. stock. A host of factors appear to have helped drive the sell-off, which also sparked losses in broader market indexes like the Nasdaq Composite and Dow Jones Industrial Average. Nvidia's stock has become a bellwether for the global economy as a whole, as it has helped drive a boom in investment from large tech companies that have looked to AI to drive new innovation -- and profit. On Wednesday, its share price declined another 1.7%. Its overall market capitalization -- the value of the company based on its shares -- remains around $2.6 trillion. "The surge in NVIDIA's earnings comes from the massive investment in AI being done by the other big tech companies," Dario Perkins, managing director at TS Lombard financial group, wrote in a commentary this week. "This creates a circular dynamic that leaves NVIDIA (and now the US stock market in general) dependent on continued big AI investments." If the five-largest publicly traded companies, like Amazon and Microsoft, stop investing in Nvidia, Perkins said, "we could have a problem." Nvidia was once known for making graphics cards for computer games. But in a somewhat fortuitous twist, these cards happen to be perfect for handling the computing load AI requires to perform its tasks. As a result, Microsoft and Facebook-parent Meta both now spend more than 40% of their budgets for hardware on Nvidia gear. Nvidia is now so closely followed that a group of market watchers held a meetup at a bar last month to watch the company report its quarterly earnings -- though some later viewed the event itself as a sell signal. "Nvidia has changed the tech and global landscape as its [graphics processing units] have become the new oil and gold in the IT landscape, with its chips powering the AI revolution and being the only game in town for now," Wedbush Securities analyst Dan Ives wrote in a recent note. But growing fears of a broader economic slowdown, as well as renewed skepticism about the timetable for a payoff from AI -- basically, how soon all the current investment flowing into it will ultimately lead to well-defined use cases and greater profitability -- have helped drag Nvidia's stock price down. "I don't think AI will measure up to the internet in my opinion," Daron Acemoglu, an economist with the Massachusetts Institute of Technology, said in an interview with the Financial Times this week, calling the technology "a few-trick pony." "AI has some great capabilities, but it does not have the same breadth of impacting pretty much everything we do and creating lots of new things yet," Acemoglu said. "It might, but when it does, perhaps we'll call that a new technology, perhaps that will be another 10 years, and so on." The skepticism has coincided with fresh economic warning signals. In the U.S., the labor market has begun to show unmistakable signs of weakness following the jobs boom that accompanied a broader economic recovery from the Covid pandemic. In China, problems in the housing sector have begun to weigh on consumption. Oil prices, which tend to track global economic activity, have fallen to their lowest levels in three years. Meanwhile, a pair of new reports this week cast fresh doubt about when AI investments will pay off. "Investors are debating whether future revenues for top tech and cloud computing firms could justify billions of dollars of capital spending being poured into artificial intelligence (AI)," analysts with BlackRock Investment Institute wrote. A similar note of caution was sounded in commentary from JP Morgan Asset management, which said that companies would have to start to meaningfully shift emphasis from "training" to "production" for "adequate returns on AI infrastructure to materialize." Complicating matters further was a report Tuesday from Bloomberg News that the Justice Department had begun looking into antitrust issues surrounding Nvidia, which is estimated to maintain at least 90% market share in AI chips for the next two years. Another factor: Intel, once the dominant force in U.S. computer chips, has seen its share price decline 54% this year and, according to a Reuters report, is now in danger of being delisted from the Dow Jones Industrial Average. While investors have punished Intel for failing to adequately take advantage of the AI boom, it is likely that broader concerns about its payoff added to its losses. Steve Sosnick, chief strategist at Interactive Brokers financial group, told NBC News in an email that, even as it has powered higher, Nvidia remains one of the most volatile stocks on the market, meaning its price is subject to large changes, both higher and lower. "So investors who believe in the company had better get used to the swings," Sosnick wrote. "Investors love volatility on the way up (aka 'socially acceptable volatility') but hate it on the way down. Unfortunately, one usually brings the other." Tuesday's sell-off is far from a death-blow for Nvidia's stock price, which has more than doubled in 2024, to about $109. The tech-heavy Nasdaq index, too, remains 16% higher on the year, and since 2023 has climbed by nearly two-thirds. Sosnick says much of the selling of Nvidia's stock, which trades as NVDA, may ultimately have to do with investment managers making sure they cement the outsized price increase the company's shares have already seen this year. "I believe that while individual investors remain understandably enamored with NVDA -- heck, many of them made a lot of money -- I believe that institutional investors are taking a more sober view, focusing on locking in gains in the back half of the year, and that is pressuring the stock," Sosnick said. "They understand that no one ever went broke taking a profit."

Share

Share

Copy Link

Nvidia's aggressive investments in AI startups and its dominant position in the AI chip market have led to unprecedented stock growth and volatility. The company's future hinges on the continued expansion of AI technologies.

Nvidia's AI Investment Strategy

Nvidia, the leading manufacturer of graphics processing units (GPUs), has been making strategic investments in artificial intelligence (AI) startups, solidifying its position at the forefront of the AI revolution. The company has invested in over 35 AI startups since 2017, with a particular focus on generative AI companies

1

. This aggressive investment strategy has not only expanded Nvidia's influence in the AI ecosystem but also contributed to its remarkable stock performance.Record-Breaking Stock Performance

Nvidia's stock has experienced unprecedented growth, surging by an astounding 200% in 2023 alone

2

. This meteoric rise has propelled Nvidia to become one of the most valuable companies globally, with a market capitalization exceeding $1 trillion. The company's success is largely attributed to its dominance in the AI chip market, where its advanced GPUs are essential for training and running sophisticated AI models.Market Volatility and Investor Sentiment

Despite its impressive gains, Nvidia's stock has also experienced significant volatility. The company's shares have seen dramatic swings, sometimes moving by tens of billions of dollars in market value within a single trading day

2

. This volatility reflects the intense investor interest in AI technologies and the high expectations placed on Nvidia's continued growth and innovation.Dominance in AI Chip Market

Nvidia's GPUs have become the de facto standard for AI computations, with the company controlling an estimated 80% of the market for AI chips

2

. This near-monopoly has allowed Nvidia to charge premium prices for its products, contributing to its soaring revenues and profits. The company's latest AI chip, the H100, is in such high demand that customers often face long wait times and inflated prices in the secondary market.Future Outlook and Challenges

While Nvidia's current position seems unassailable, the company faces potential challenges. Competitors like AMD and Intel are working to develop their own AI chips, and tech giants such as Google and Amazon are designing custom AI processors

2

. Additionally, geopolitical tensions and export restrictions, particularly with China, could impact Nvidia's global market access.Related Stories

Impact on the AI Ecosystem

Nvidia's investments in AI startups have far-reaching implications for the broader AI ecosystem. By supporting these companies, Nvidia is not only securing future customers for its hardware but also gaining valuable insights into emerging AI technologies and applications

1

. This symbiotic relationship between Nvidia and AI startups is driving innovation and accelerating the development of new AI capabilities across various industries.Investor Considerations

As Nvidia's stock continues to attract attention, investors are grappling with questions about the company's valuation and future growth potential. While some analysts believe that Nvidia's dominant market position and the expanding AI industry justify its high valuation, others caution about the risks of overreliance on AI-driven growth

2

. The company's future success will likely depend on its ability to maintain its technological edge and navigate the rapidly evolving AI landscape.References

Summarized by

Navi

Related Stories

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

Anthropic takes Pentagon to court over unprecedented supply chain risk designation

Policy and Regulation

3

Meta smart glasses face lawsuit and UK probe after workers watched intimate user footage

Policy and Regulation