US Approves Nvidia's Multibillion-Dollar AI Chip Deal with UAE, Marking New Era in Tech Diplomacy

9 Sources

9 Sources

[1]

U.S. finally grants Nvidia license to ship AI GPUs to UAE: 500,000 Blackwell GPUs coming to the Gulf region

The U.S. government has finally granted Nvidia an export license to ship tens of billions of dollars' worth of leading-edge AI GPUs to the United Arab Emirates, initiating the first stage of a large bilateral technology partnership, reports Bloomberg. However, none of the AI accelerators shipped to the UAE will be destined for Abu Dhabi-based AI outfit G42, but will be operated by American companies that have datacenters in the UAE. The authorization follows a May agreement allowing the UAE to purchase up to 500,000 advanced Nvidia processors each year (Blackwell for now, Rubin and Feynman in the coming years), while committing to $1.4 trillion of investment in the U.S. over the next decade. Each side is expected to match contributions on a dollar-for-dollar basis. The initial set of permits excludes chips for G42, Abu Dhabi's state-backed AI firm that is developing a 5 GW data center primarily for OpenAI. However, under the terms of the arrangement, G42 will get 20% of AI processors bound for the UAE in the future. The policy marks a sharp shift from the Biden administration, which had restricted AI chip exports to prevent potential diversion to China. Under the new direction, national caps are being lifted in favor of bilateral frameworks where allies commit to using U.S.-operated cloud infrastructure. Commerce Secretary Howard Lutnick confirmed that only data centers managed by approved American operators will be eligible to run these systems. To a large degree, the deal marks the start of a new era of U.S. 'AI diplomacy' that links AI hardware sales with equal Emirati investment and tighter control over regional AI infrastructure, which essentially ties economics with strategic interests. U.S. gains large-scale UAE investment and keeps a foothold in Middle Eastern AI expansion, while the UAE secures access to top-tier computing power that remains under American operational oversight. The U.S. government considers the initiative as a tool to counter China's influence in the region. By embedding U.S. cloud providers and hardware into UAE infrastructure, they aim to prevent Huawei and other Chinese companies from introducing their standards and gaining market share in the country. However, the plan has drawn skepticism from opponents. Several officials and legislators argue that the agreement lacks precise safeguards to ensure that Nvidia's AI accelerators are used exclusively in vetted environments, especially given the UAE's long-standing economic connections with Beijing. Some believe the U.S. conceded too much when expanding the yearly export limit from an earlier proposal of 100,000 processors to half a million, without tightening security obligations in return. Future licensing rounds will depend on how the UAE's investments unfold. If successful, this partnership could serve as a prototype for similar deals with other allies seeking advanced AI hardware while reinforcing American control over their deployment.

[2]

Nvidia CEO Jensen Huang frustrated by UAE AI chip delay, claims report -- White House said to be pressing nation to finalize U.S. investments before chip deliveries are authorized

Nvidia CEO Jensen Huang and several administration officials have been frustrated by delays to the AI chip company's multi-billion-dollar deal with the United Arab Emirates (UAE). The deal was first announced during President Donald Trump's visit to the country, where the U.A.E. promised to invest up to a billion dollars in the U.S. in exchange for approval to purchase a billion dollars' worth of Nvidia chips. However, the Wall Street Journal reports that the Middle Eastern nation is yet to finalize its investments -- a crucial requirement for U.S. Commerce Secretary Howard Lutnick before he approves Nvidia's export licenses to the country. UAE has been fast in jumping on the AI bandwagon, with G42, a UAE-based AI datacenter keen on getting its hands on Nvidia's latest chips. It's also the first to partner with OpenAI with the launch of Stargate UAE under its OpenAI for Countries global initiative. However, it seems that the UAE's plans are being derailed as it faces some headwinds in its talks with Washington. The reason for the delay is unclear, but there are reportedly some private complaints that Sec. Lutnick was causing the slowdown. On the other hand, there are also conflicting reports that deny this, with an Nvidia executive reportedly saying that it has no concerns about how the deal is going down. "Sacks and Secretary Lutnick are integral to the President's AI agenda and are working diligently to get deals done on behalf of the American people," said White House spokesperson Kush Desai. David Sacks is the White House Special Advisor for Artificial Intelligence and Cryptocurrency, dubbed the White House AI Czar. Under his purview, the White House removed several regulations that were "burdensome" to AI development and focused on supporting the rapid innovation of American AI. There are reports that the delays are caused by the Emiratis' slow commitment to their investments. It has already been months since the deal was first announced, but it seems that there hasn't been any progress with the talks. Aside from this, there were also some national security concerns because of the UAE's ties with China. Despite all this, industry executives and administration officials see the UAE as crucial to maintaining the U.S.' global lead in AI. With the country willing to invest billions of dollars in infrastructure, it would allow American AI hardware to scale outside of the U.S. and its western allies. Aside from that, it's also seen as a key partner in expanding the United States' influence in artificial intelligence and advanced tech in the region.

[3]

Nvidia Gains As US Greenlights Major AI Deal With UAE - NVIDIA (NASDAQ:NVDA)

Nvidia (NASDAQ:NVDA) stock gained on Thursday after Washington approved billions of dollars in Nvidia chip exports to the United Arab Emirates (U.A.E.). The Commerce Department's Bureau of Industry and Security issued export licenses for Nvidia under a bilateral AI agreement finalized in May, Bloomberg reported on Thursday, citing unnamed sources familiar with the deal. The U.A.E. has promised to invest $1.4 trillion in the U.S. over the next decade, dedicated to advancing AI infrastructure and committed to developing a large 5-gigawatt data center in the U.A.E., which will house OpenAI as an anchor tenant. Also Read: Nvidia Scores Big As Trump Brokers Major AI Export Pact With UAE and US Tech Giants Nvidia on Thursday traded above its 52-week high of $191.05. Nvidia CEO Jensen Huang had expressed frustration over the delay of a multibillion-dollar deal to supply advanced AI chips to the U.A.E. Despite the U.S. Commerce Secretary Howard Lutnick's urging Abu Dhabi to finalize investments before shipments can proceed, the agreement had stalled. They announced the deal in May to strengthen U.S. tech influence abroad and counter China's AI ambitions. However, delays in the Emirati investments have baffled officials, with some viewing it as a setback in the race to maintain a U.S. tech edge over China. Huang and White House AI Czar David Sacks see such agreements as vital to advancing the U.S. tech strategy. Lutnick has conditioned the Commerce Department's approval on the U.A.E. completing its U.S. investments, also raising concerns about the U.A.E.'s ties to China. Despite the holdup, Nvidia remains supportive of the Trump administration's AI strategy. Nvidia stock gained 41% year-to-date. In the first week of October, Nvidia became the first company to reach a $4.5 trillion cap as Big Tech giants led by Microsoft (NASDAQ:MSFT) remain aggressively invested in their AI ambitions. Price Action: NVIDIA shares were up 2.66% at $194.14 at the time of publication on Thursday. The stock is trading at a new 52-week high, according to Benzinga Pro data. Read Next: ASML Taps Insider Marco Pieters To Lead Technology In AI Era Photo by Below the Sky via Shutterstock NVDANVIDIA Corp$194.382.79%OverviewMSFTMicrosoft Corp$521.07-0.72%Market News and Data brought to you by Benzinga APIs

[4]

Nvidia Stock Could Get Another Boost After U.S. Approves UAE AI Chip Deal | The Motley Fool

Washington reportedly approved an export license for Nvidia to ship 500,000 AI chips a year. It's only been a few weeks since China froze Nvidia (NVDA 2.02%) from selling its high-powered chips in the Chinese market. China has been an important market for Nvidia, accounting for 13% of its sales in the company's 2025 fiscal year, so the loss was troubling for Nvidia shareholders. However, the stock got a boost on Thursday when Bloomberg reported that the U.S. has now granted an export license for Nvidia to ship tens of billions of dollars worth of its top artificial intelligence (AI) graphics processing units (GPUs) to the United Arab Emirates. The authorization stems from a May trade agreement that permits the UAE to buy up to 500,000 advanced Nvidia processors each year in exchange for committing to $1.4 trillion of investment in the U.S. over the next decade. Bloomberg reports that the AI accelerators being shipped to the UAE will be earmarked for American companies that have data centers in the UAE, rather than being used by G42, an Abu Dhabi-based AI company. Nvidia stock was up more than 2% in morning trading. These are chips that Nvidia already planned to sell -- the company and investors had anticipated the U.S. would issue the license. But clearing government red tape is always an important accomplishment, especially since some of the company's foreign sales were blocked in the past. However, the impact of the sales is indisputable. Blackwell chips reportedly cost roughly $30,000 each, so selling 500,000 annually would mean $15 billion in annual revenue for Nvidia. That's significant, even for this company, which is expecting between $180 billion and $200 billion in revenue for the current fiscal year. There's a bigger picture here, as well. As Bloomberg reports, the UAE deal allows the U.S. to have a foothold in the lucrative Middle East, where AI is expanding rapidly in the UAE, Saudi Arabia, and Qatar. China's manufacturing is increasingly becoming a competitor with U.S. companies. Huawei topped Apple's position as the leading smartphone supplier, and Beijing's willingness to freeze Nvidia from China indicates the government is increasingly confident in its ability to develop its own technology infrastructure, including high-powered chips to run AI applications. Washington's deal with the UAE is meant to give American companies an opportunity to compete in the Middle East, rather than ceding the region to China. The newly awarded export license, if successful, could serve to be a model for future deals.

[5]

US approves Nvidia chip exports to UAE in bilateral AI deal -- Bloomberg (NVDA:NASDAQ)

The United States has approved billions of dollars' worth of Nvidia (NASDAQ:NVDA) AI chip exports to the United Arab Emirates (UAE), marking a significant step in implementing a high-profile bilateral artificial intelligence agreement, according to a Bloomberg report. In exchange, the The exports mark a significant step in the US-UAE AI agreement, enabling major infrastructure deployments like a new Abu Dhabi data center and setting a precedent for future diplomatic efforts in AI. The US aims to counter China's tech influence by maintaining American control over critical AI infrastructure in the Middle East and ensuring US companies' dominance in the region's tech sector. Some US officials are concerned about critical infrastructure being built in a country with strong business ties to China and potential national security implications.

[6]

Nvidia Tax Scores UAE Upgrade: How AI's Golden Goose Gains Again - NVIDIA (NASDAQ:NVDA)

The UAE's AI buildout could be running into Silicon Valley's priciest roadblock -- the "Nvidia Tax." The term refers to the steep markups that come with using Nvidia Corp's (NASDAQ:NVDA) high-end GPUs, which have become the default choice for large-scale AI systems. Track NVDA stock here. The Desert Meets The Bottleneck With Washington's approval for 500,000 Nvidia chips annually heading to UAE projects, the move might boost local AI capabilities -- but it also risks locking in Nvidia's premium pricing. Sovereign players like G42, which is scaling its Falcon models, may find that GPU costs add 20-50% to project budgets before a single watt is spent on cooling. Read Also: Nvidia's $1.5 Billion Lambda Loop Looks A Lot Like CoreWeave 2.0 Why Nvidia Still Calls The Shots Nvidia's dominance comes not from hype but from hardware reality. Its H100 and Blackwell chips remain unmatched in performance, forcing governments, startups, and hyperscalers to pay up or fall behind. Alphabet Inc's (NASDAQ:GOOGL) (NASDAQ:GOOG) Google skirts the squeeze with its TPUs, while OpenAI and Microsoft Corp (NASDAQ:MSFT) are investing in Advanced Micro Devices Inc (NASDAQ:AMD) partnerships to reduce dependency. Meanwhile, startups are chasing efficiency breakthroughs to counter the 700-watt-per-chip energy draw that drives up operational expenses. Even with new supply chains forming, Nvidia's ecosystem remains the gravitational center of AI compute -- and that gravitational pull comes with a price tag. Trade The Toll, Not The Travelers For investors, the "Nvidia Tax" isn't a burden -- it's a map. Chipmakers like AMD and Broadcom Inc (NASDAQ:AVGO) could benefit as hyperscalers diversify. Enablers like Taiwan Semiconductor Manufacturing Co Ltd (NYSE:TSM) and Super Micro Computer Inc (NASDAQ:SMCI) thrive as AI heat drives demand for more fabs and cooling. And for those betting on volatility, Nvidia itself remains the tollbooth of the AI economy -- the one selling the shovels while everyone else digs for gold. Read Next: Nvidia Gives. Nvidia Gets. Nvidia Grows -- Jensen Huang's $100 Billion Brainwave Photo: JRdes / Shutterstock NVDANVIDIA Corp$192.601.85%OverviewAMDAdvanced Micro Devices Inc$237.120.66%AVGOBroadcom Inc$344.35-0.33%GOOGAlphabet Inc$245.980.21%GOOGLAlphabet Inc$245.240.25%MSFTMicrosoft Corp$523.89-0.18%SMCISuper Micro Computer Inc$57.90-1.33%TSMTaiwan Semiconductor Manufacturing Co Ltd$304.32-0.07%Market News and Data brought to you by Benzinga APIs

[7]

Nvidia CEO Jensen Huang Reportedly Frustrated As Trump's Commerce Secretary Slows UAE Chips Deal Over China Link - NVIDIA (NASDAQ:NVDA), Taiwan Semiconductor (NYSE:TSM)

A multibillion-dollar deal for Nvidia Corporation (NASDAQ:NVDA) to supply advanced AI chips to the UAE has been stalled for months, reportedly frustrating CEO Jensen Huang as U.S. Commerce Secretary Howard Lutnick pushes Abu Dhabi to finalize investments before shipments proceed. Nvidia's market cap has reached $4.59 trillion, with shares climbing 58.97% over the past year and advancing 36.61% in 2025 to date. On Thursday, the stock rose 0.91%, according to Benzinga Pro. Deal Faces Unexpected Delays The agreement, announced in May, was meant to showcase the White House's push to expand U.S. tech influence abroad while countering China's AI ambitions. However, the Emirati investments have yet to materialize, baffling some administration officials, reported the Wall Street Journal, citing people familiar with the matter. The stalled deal is seen as a setback for Huang and White House AI Czar David Sacks, who view such agreements as crucial to advancing U.S. tech strategy and maintaining an edge over China in the AI race. "Sacks and Secretary Lutnick are integral to the President's AI agenda and are working diligently to get deals done on behalf of the American people," White House spokesman Kush Desai told the publication. See Also: Mitch McConnell Says Trump Tariffs-Ushered Era Has 'Similarities' With The 1930s Security Concerns Over UAE-China Ties The Commerce Department's approval is required before Nvidia can deliver the chips. Lutnick has conditioned approval on the UAE finalizing its U.S. investments, while also raising concerns about the Gulf nation's close relationship with China, the report added. Nvidia Execs And CEO Jensen Huang's Frustration Huang and Nvidia executives have privately expressed frustration over the delays, the sources said. One senior Nvidia executive denied that the company is alarmed, the report added. Nvidia and the Commerce Department did not immediately respond to Benzinga's request for comments. Trump's Broader AI Strategy The UAE deal was touted by President Donald Trump during his May visit to Abu Dhabi, part of what the White House said was more than $200 billion in bilateral agreements. The UAE pledged to fund U.S. data centers for AI training while purchasing billions in Nvidia chips. For now, the deal remains stuck, with one official saying at least $1 billion in investments and chips could still be exchanged by year's end. UAE Aims To Become Global AI Hub With OpenAI Collaboration Last week, UAE President Sheikh Mohammed bin Zayed met OpenAI CEO Sam Altman in Abu Dhabi to discuss AI collaboration. The talks focused on building an integrated AI ecosystem to support the UAE's development goals. Separately, in July, it was reported that Taiwan Semiconductor Manufacturing Co. (NYSE:TSM) is reportedly considering building a six-factory gigafab in the UAE, pending U.S. regulatory approval due to the Gulf nation's ties with China and Iran. Benzinga's Edge Stock Rankings rank Nvidia's growth in the 97th percentile, showing its performance relative to other top AI companies like TSMC and AMD. Read next: Apple May See Fewer Searches In Safari, But Google CEO Sundar Pichai Insists AI Is Fueling Overall Query Growth: 'Far From A Zero-Sum Game' Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Photo courtesy: jamesonwu1972 / Shutterstock.com NVDANVIDIA Corp$188.980.93%OverviewTSMTaiwan Semiconductor Manufacturing Co Ltd$288.990.18%Market News and Data brought to you by Benzinga APIs

[8]

Nvidia Momentum Builds on UAE Chip Exports and Global AI Expansion | Investing.com UK

NVIDIA Corporation shares rose approximately 2.33% on October 9, 2025, trading at $193.52 as of 10:53 AM EDT, following significant news about U.S. government approval of billions of dollars in AI chip exports to the United Arab Emirates. The stock opened at $192.28, up from a previous close of $189.11, and reached an intraday high of $195.30. This development marks a major milestone in the Trump administration's AI diplomacy strategy and represents NVIDIA's first export licenses to the Gulf nation since the current administration took office. The approval signals progress on a bilateral AI agreement announced in May 2025, which ties chip exports to reciprocal UAE investments in American projects. The Commerce Department's Bureau of Industry and Security recently issued export licenses to NVIDIA under terms of a bilateral AI framework reached in May 2025. The approval came after the UAE made concrete plans for reciprocal investment on American soil, with the Gulf nation committing approximately $1.4 trillion to U.S. projects over the next decade. Under the agreement, the UAE will match chip imports with equivalent U.S. investments on a dollar-for-dollar basis, ensuring that American economic interests directly benefit from the technology transfer. The licenses pave the way for AI hardware shipments supporting a massive five-gigawatt data center in Abu Dhabi, where OpenAI serves as a key partner. The overall agreement allows for up to 500,000 high-end chips annually, with 20% allocated for Abu Dhabi-based AI firm G42, though initial approvals reportedly exclude that company. The first batch of permits does not include chips for G42, and future licenses will depend on how specific Emirati investment plans unfold. U.S. officials have positioned this initiative as part of a broader strategy to limit China's influence in AI infrastructure while strengthening American technology ties in the Middle East. As of October 9, 2025, NVIDIA trades with a market capitalization of $4.694 trillion, maintaining its position as a dominant force in the semiconductor industry. The stock has delivered remarkable returns, posting a year-to-date gain of 43.62% and a one-year return of 45.41%, significantly outperforming the S&P 500's 14.40% and 16.17% returns over the same periods. Over longer timeframes, NVIDIA's performance has been even more extraordinary, with three-year and five-year returns of 1,498.72% and 1,305.38% respectively, cementing its status as a primary beneficiary of the AI boom. The company currently trades at a forward P/E ratio of 29.94 and maintains an impressive profit margin of 52.41%, with trailing twelve-month revenue of $165.22 billion and net income of $86.6 billion. Analysts remain largely bullish on the stock, with a consensus price target of $214.85, representing potential upside from current levels. However, some analysts note that at approximately 22 times forward sales, NVIDIA's valuation reflects extremely high expectations. The company's next earnings report is scheduled for November 19, 2025, which will provide further insight into how AI chip demand is evolving globally and whether the UAE export approvals translate into meaningful revenue growth. *** Looking to start your trading day ahead of the curve?

[9]

US approves several billion dollars of Nvidia chip sales to UAE- Bloomberg By Investing.com

Investing.com-- The U.S. has approved several billion dollars worth of NVIDIA Corporation (NASDAQ:NVDA) chip sales to the United Arab Emirates, Bloomberg reported on Thursday, ending months of uncertainty over an investment deal with the Gulf federation would proceed. The Commerce Department's Bureau of Industry and Security recently issued export licenses to Nvidia, Bloomberg reported, citing people familiar with the matter. The licenses were under the terms of a bilateral artificial intelligence agreement signed between the Donald Trump administration and the UAE in May, which had outlined hundreds of thousands of Nvidia chip sales to the region. In return, the UAE pledged to invest billions of dollars in the United States. Reports last week said the deal was in limbo due to U.S. concerns over national security risks stemming from the UAE's proximity to China. This had frustrated several key participants, including Nvidia CEO Jensen Huang. Approval of the UAE sales present a positive outlook for Nvidia, whose foreign sales garnered increased scrutiny from the Trump administration. The White House has sought to tighten its hold on advanced, U.S.-made AI technology, which it sees as a critical technology. Sales to China have been a major point of contention, with Nvidia only being cleared to resume some chip sales in the country after Washington and Beijing signed a trade deal earlier this year.

Share

Share

Copy Link

The US government has granted Nvidia an export license to ship advanced AI GPUs to the UAE, as part of a bilateral agreement. This deal, worth tens of billions of dollars, allows for up to 500,000 Nvidia processors to be exported annually, in exchange for significant UAE investment in the US.

US Approves Landmark AI Chip Deal with UAE

The United States government has granted Nvidia a long-awaited export license to ship advanced AI GPUs to the United Arab Emirates (UAE), marking a significant milestone in bilateral technology partnerships

1

. This multibillion-dollar deal, which has been in the works since May, allows for the export of up to 500,000 advanced Nvidia processors annually to the UAE1

3

.

Source: Seeking Alpha

Terms of the Agreement

In exchange for access to cutting-edge AI hardware, the UAE has committed to investing $1.4 trillion in the United States over the next decade

1

3

. The agreement stipulates that each side will match contributions on a dollar-for-dollar basis. Initially, the AI accelerators will be operated by American companies with data centers in the UAE, rather than by local entities such as Abu Dhabi-based AI firm G421

.

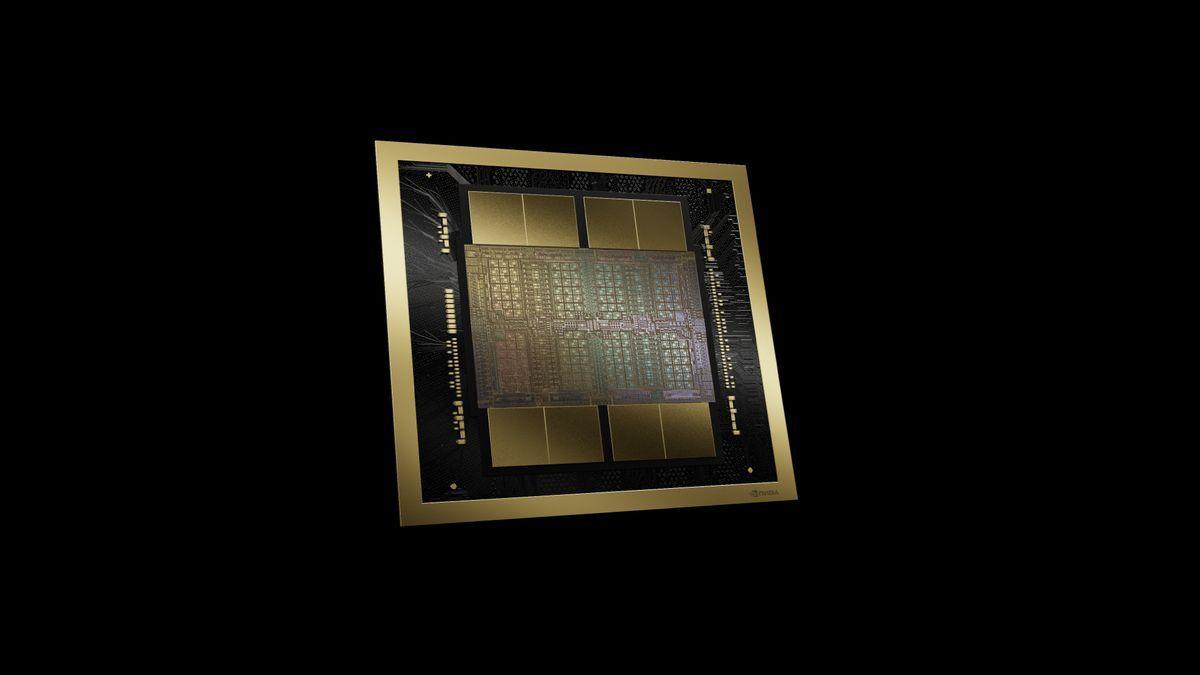

Source: Tom's Hardware

Strategic Implications

This deal represents a shift in U.S. policy, moving from national export caps to bilateral frameworks that ensure allies use U.S.-operated cloud infrastructure

1

. It's seen as a tool to counter China's influence in the region by embedding U.S. cloud providers and hardware into UAE infrastructure1

5

.Economic Impact

For Nvidia, this deal could potentially generate $15 billion in annual revenue, based on the reported cost of around $30,000 per Blackwell chip

4

. The news has already had a positive impact on Nvidia's stock, which gained over 2% following the announcement3

4

.Related Stories

Challenges and Concerns

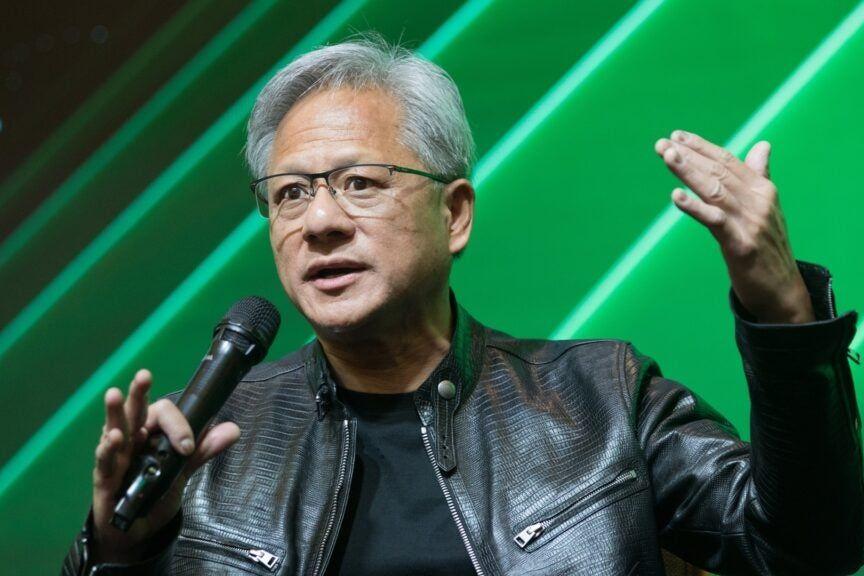

Despite the deal's approval, there have been delays and concerns along the way. Nvidia CEO Jensen Huang expressed frustration over the initial hold-ups

2

. Some U.S. officials and legislators have raised concerns about the lack of precise safeguards and the UAE's economic connections with Beijing1

5

.

Source: Benzinga

Future Outlook

If successful, this partnership could serve as a model for similar deals with other allies seeking advanced AI hardware while reinforcing American control over their deployment

1

4

. It represents a new era of 'AI diplomacy' that links AI hardware sales with strategic interests and economic investments.References

Summarized by

Navi

[1]

[4]

Related Stories

Nvidia Stock Soars as U.S. Approves Resumption of AI Chip Sales to China

09 Jul 2025•Technology

Nvidia Soars Past $3 Trillion Valuation on Saudi AI Deal and U.S.-China Trade Truce

14 May 2025•Business and Economy

Nvidia's Record-Breaking Earnings Fuel AI Boom Amid Market Scrutiny

22 Aug 2025•Business and Economy

Recent Highlights

1

ByteDance Faces Hollywood Backlash After Seedance 2.0 Creates Unauthorized Celebrity Deepfakes

Technology

2

Microsoft AI chief predicts artificial intelligence will automate most white-collar jobs in 18 months

Business and Economy

3

Google reports state-sponsored hackers exploit Gemini AI across all stages of cyberattacks

Technology