Nvidia Stock Stumble Sparks AI Industry Concerns and Market Volatility

3 Sources

3 Sources

[1]

AI Industry Trembles as Nvidia's Stock Nosedives

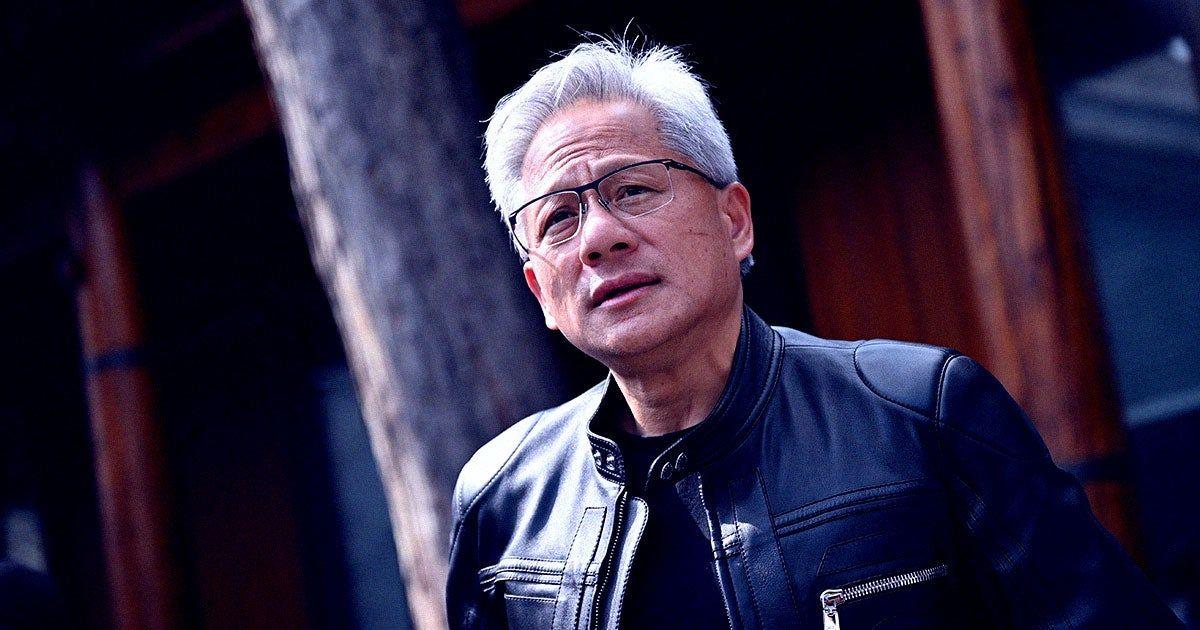

Image by Johannes Neudecker/picture alliance via Getty Images Shares of AI chipmaker Nvidia plunged on Wednesday, dropping by more than three percent in early trading -- for a total slide of over five percent in the past week. Other major AI players fell as well, including Google, Meta, and Tesla. AI software company Palantir's stock fell by nearly nine percent this morning. Nvidia is particularly interesting, though, because while those other companies mainly produce software, Nvidia has been making bank by selling the hardware powering the AI industry's explosive ascent. If the AI industry is a gold rush, then Nvidia is selling shovels -- and when the shovel seller starts to struggle, everybody gets nervous. Analysts were left perplexed by the selloff, casting around for specific causes. Could muted enthusiasm and AI data center Coreweave's 38 percent collapse post Q2 earnings be coming after the AI industry's top performers? Nvidia's shares fell after Reuters reported that the firm was working on a new generation AI chip for the Chinese market, which could potentially outperform its H20 workhorse. There are also certain signs of internal shakiness, with CEO Jensen Huang recently 150,000 shares for tens of millions of dollars last week. However, the sale was planned in March, and was triggered by hitting predetermined parameters, such as price and volume. In other words, it's not entirely clear what's causing the selloff. Nvidia and its ilk are still up considerably if you zoom out; both Nvidia and Palantir hit all-time highs earlier this month. Palantir alone rose more than 150 percent since April. Could the latest selloff be a market correction, a reality check in light of some sky-high valuations? There has been considerable talk of the AI industry showing signs of a dot com era-style bubble. Even OpenAI CEO Sam Altman himself acknowledged last week that we're in a "phase where investors as a whole are overexcited about AI." How long Nvidia's drop in share price will last remains to be seen. The company's meteoric rise has repeatedly been met by bullish investors buying the dip, sending it to all-time highs. Nvidia will be reporting its second-quarter earnings a week from now. Investors expect strong Q2 results, and given enormous sales and continued optimism surrounding AI, it's not a stretch to assume they'll be satisfied. If anything, investors are as optimistic as ever, suggesting that the AI industry's gravy train isn't likely to stop any time soon. "NVDA is now the most under-owned large-cap tech stock," Morgan Stanley analyst Erik Woodring wrote in a note this week, as quoted by Yahoo Finance.

[2]

Nvidia Stock Stumble Shows Why Investors Must Widen Their AI Lens | Investing.com UK

The sudden slide in Nvidia (NASDAQ:NVDA) this week, wiping more than three percent from a company that has become the emblem of artificial intelligence, jolted markets out of their summer calm. The Nasdaq 100 fell 1.4% in one of its steepest drops since April, exposing just how heavily investors have come to rely on a narrow group of tech giants to keep equity markets marching higher. I have no doubt about Nvidia's central role in shaping one of the most profound technological transformations of our time. Its chips are powering breakthroughs in machine learning, cloud computing, and data infrastructure. Its dominance is real, and its importance is enduring. However, the fact that a single stumble in one company can rattle the entire market is a clear warning sign. It shows that too much capital has been concentrated in too few names, and that complacency has crept in just as valuations reach levels not seen since the dot-com era. The Nasdaq 100 now trades at roughly 27 times forward earnings, a multiple that demands perfection in both corporate execution and macro conditions. The so-called Magnificent Seven have carried much of the burden of global equity performance, lifting indexes to record highs. Yet this concentration means the market's calm is always more fragile than it appears. When Nvidia slips, the entire edifice wobbles. Belief in AI as the growth engine of this decade is justified. The opportunity is not in question. But the way many investors are positioning themselves leaves them exposed. AI is far bigger than one or two stocks. It is an ecosystem -- spanning data centres, cybersecurity, semiconductors beyond Nvidia, cloud platforms, and the industries from healthcare to finance that are embedding AI into their business models. The gains will not be confined to Silicon Valley megacaps. They will be global, and they will be spread across sectors. The challenge for investors is to recognise this breadth and to position accordingly. This week's volatility coincides with a critical moment for monetary policy. Markets are almost fully pricing in a September rate cut, with expectations of another before year-end. Treasury yields slipped on the back of the Nvidia-led selloff, reflecting the assumption that policy will be looser by autumn. But inflation has been erratic, labour data has softened, and tariff-led price pressures remain alive. There's no guarantee the Federal Reserve will move as quickly or as smoothly as the market hopes. Investors who are narrowly exposed to a handful of expensive tech names are taking on a double risk: concentration in equities that dominate benchmarks, and reliance on policy easing to keep those valuations intact. If Jerome Powell sounds less dovish at Jackson Hole than expected, or if another inflation spike forces caution, the fallout will be magnified in precisely those same megacaps. The other complicating factor is geopolitics. President Donald Trump has accelerated his push for peace talks between Russia and Ukraine, encouraging both sides to show flexibility. Any progress is welcome, but the road to resolution is long, and the potential for setbacks is high. Global markets are moving too fast and are too interconnected to rely on a single theme or a single region. Headlines from geopolitics, energy, or trade can shift sentiment in an instant. So, where does this leave global investors? For me, the lesson is clear. Volatility around Nvidia is not a reason to retreat from AI, but it is a reason to engage with it more intelligently. The real opportunity lies in participating in the wider ecosystem, not chasing only the names that have already multiplied in value. Beyond semiconductors, there are immense possibilities in firms building the infrastructure for AI, in software developers creating applications across industries, and in global leaders adopting AI to drive efficiency and productivity. This is, I believe, where the next wave of growth will emerge. Diversification is the most powerful tool available. That means diversification within AI, diversification across sectors, and diversification across geographies. It also means recognising that portfolios should not be one-dimensional, tilted entirely toward US megacaps, however dominant they may appear today. The AI revolution is global. Opportunities in Europe, Asia, and emerging markets will be critical to capturing its full scope. The turbulence we have just witnessed is not the end of the AI boom. It's a reminder that markets are never a straight line, that concentration creates fragility, and that investors who fail to prepare for shocks are the ones most likely to be caught off guard. AI will continue to transform the global economy, and Nvidia will remain at its heart. But it's not the whole story. Investors who widen their lens now, rather than waiting for another shock to force the change, will be best placed to capture the wealth-creating power of AI over the years ahead.

[3]

Magnificent 7 Face AI Doubts as Investors Rotate to Defensives | Investing.com UK

After leading indexes to record highs, these giants are now facing skepticism about stretched valuations, the durability of AI-driven growth, and competition from other corners of the market. Nvidia's earnings this week will be a critical test of whether enthusiasm can translate into profits. Signs of fatigue are clear. Retail investors, often the most loyal buyers of tech, turned net sellers for the first time in two months, trimming holdings in Palantir (NASDAQ:PLTR), Alphabet, and Broadcom (NASDAQ:AVGO). The AI trade has also shown fragility before, with DeepSeek's launch of a cheaper model earlier this year erasing $1 trillion of market value in a single day. More recently, OpenAI's GPT-5 disappointed, undermining some of the hype that had fueled tech valuations. The Nasdaq has climbed more than 40% since April, pushing multiples for megacaps to uncomfortable levels. At the same time, high inflation and cracks in the labor market have left investors nervous. Even after Powell opened the door to rate cuts, tech dropped 1.6% last week, lagging energy, real estate, and materials, which all gained over 2%. Some traders are rotating into defensives like Duke Energy (NYSE:DUK), DR Horton (NYSE:DHI), healthcare funds, and Walmart (NYSE:WMT), betting they'll hold up better if growth slows. Thin August trading volumes are adding to volatility, but the bigger issue remains the AI hype cycle: big rallies followed by sudden reversals. Nvidia's earnings could either reignite momentum or expose fresh doubts. For now, investors are questioning whether the Magnificent Seven can keep carrying the market, or if leadership will shift toward the sectors gaining strength from lower rates.

Share

Share

Copy Link

Nvidia's recent stock decline has raised questions about the AI industry's stability and market concentration, prompting investors to reassess their strategies and consider diversifying beyond tech giants.

Nvidia's Stock Decline Triggers AI Industry Concerns

Nvidia, the leading AI chipmaker, experienced a significant stock price drop, falling over 5% in a week and more than 3% in early trading on Wednesday

1

. This decline has sent ripples through the AI industry, affecting other major players such as Google, Meta, and Tesla. Palantir, an AI software company, saw its stock plummet by nearly 9%1

.

Source: Futurism

The sudden slide in Nvidia's stock has jolted markets out of their summer calm, with the Nasdaq 100 falling 1.4% in one of its steepest drops since April

2

. This volatility has exposed the heavy reliance of investors on a narrow group of tech giants to keep equity markets moving higher.Potential Causes and Market Reactions

Analysts are puzzled by the selloff, searching for specific causes. Some potential factors include:

- Muted enthusiasm and the collapse of AI data center Coreweave post Q2 earnings

1

. - Reuters report on Nvidia working on a new generation AI chip for the Chinese market

1

. - CEO Jensen Huang's recent sale of 150,000 shares, although this was a planned sale

1

.

Despite the recent decline, both Nvidia and Palantir hit all-time highs earlier this month, with Palantir rising more than 150% since April

1

. This has led to speculation about a potential market correction or reality check in light of sky-high valuations.AI Industry Valuation Concerns

The AI industry has shown signs of a dot-com era-style bubble, with even OpenAI CEO Sam Altman acknowledging that investors are "overexcited about AI"

1

. The Nasdaq 100 now trades at roughly 27 times forward earnings, a multiple that demands perfection in both corporate execution and macro conditions2

.Related Stories

Investor Strategies and Market Diversification

The recent volatility has highlighted the need for investors to diversify their portfolios beyond the so-called "Magnificent Seven" tech giants. Experts suggest that the real opportunity lies in participating in the wider AI ecosystem, including:

- Firms building AI infrastructure

- Software developers creating applications across industries

- Global leaders adopting AI to drive efficiency and productivity

2

Some traders are rotating into defensive stocks like Duke Energy, DR Horton, healthcare funds, and Walmart, betting they'll hold up better if growth slows

3

.Upcoming Nvidia Earnings and Market Outlook

Nvidia will be reporting its second-quarter earnings in a week, which is seen as a critical test for the AI sector. Investors expect strong Q2 results, given enormous sales and continued optimism surrounding AI

1

. However, the earnings report could either reignite momentum or expose fresh doubts about the sustainability of AI-driven growth3

.As the market grapples with these uncertainties, investors are questioning whether the Magnificent Seven can continue to carry the market or if leadership will shift toward sectors benefiting from lower interest rates. The AI revolution is expected to continue transforming the global economy, with Nvidia remaining at its heart, but investors are advised to widen their lens and prepare for potential shocks in the market

2

.References

Summarized by

Navi

[1]

[2]

Related Stories

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

Anthropic takes Pentagon to court over unprecedented supply chain risk designation

Policy and Regulation

3

Meta smart glasses face lawsuit and UK probe after workers watched intimate user footage

Policy and Regulation