OpenAI and Anthropic intensify enterprise AI push as business customers become primary revenue focus

3 Sources

3 Sources

[1]

OpenAI, Anthropic set sights on enterprise customers at Davos

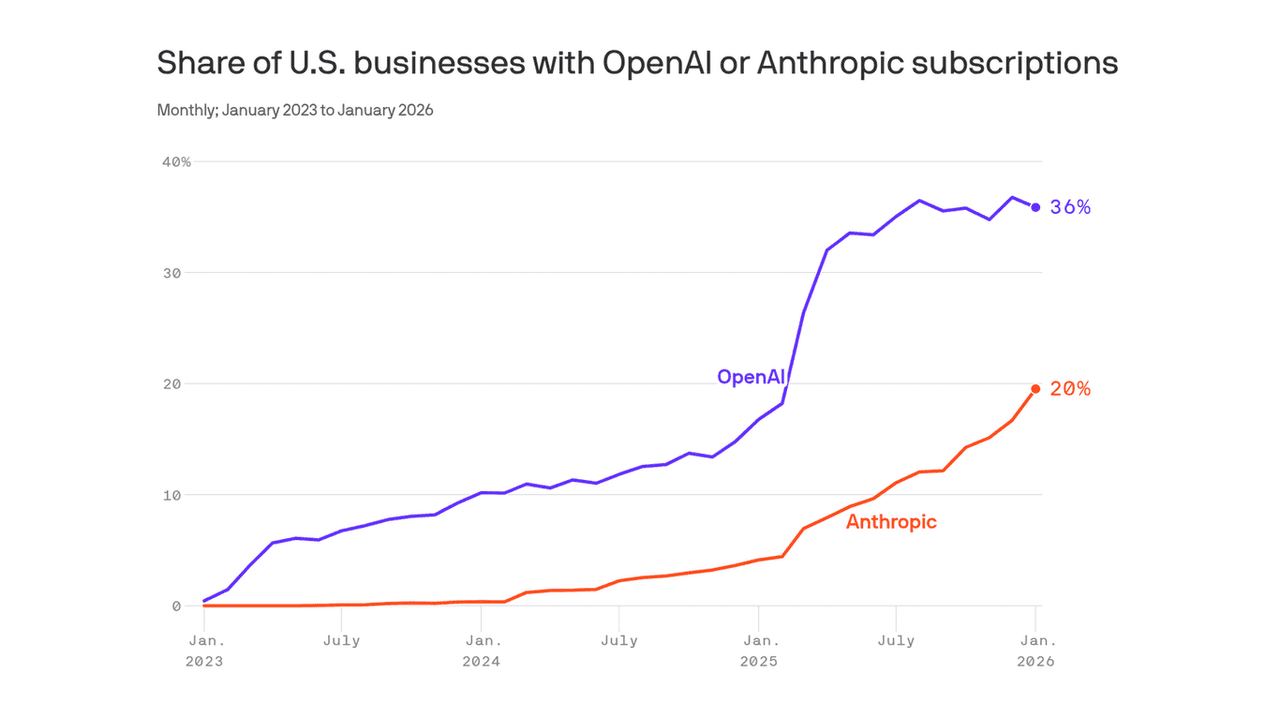

Enterprise customers account for roughly 40% of OpenAI's business and 80% of Anthropic's business, executives said. Artificial intelligence startups OpenAI and Anthropic have their sights set on enterprise customers this year as they race to win more revenue, users and market share. In separate interviews with CNBC at the World Economic Forum in Davos, Switzerland on Wednesday, Anthropic CEO Dario Amodei and OpenAI CFO Sarah Friar highlighted enterprise as a key revenue driver for their businesses. Enterprise customers account for roughly 40% of OpenAI's business as of January, but Friar said she expects that figure to grow to closer to 50% by the end of the year. OpenAI announced in November that more than 1 million business customers around the world are using the company's technology. OpenAI was founded as a nonprofit AI lab in 2015, and its valuation has swelled to $500 billion since the launch of its ChatGPT chatbot in 2022. "We're an incredibly strong business today," Friar said Wednesday. "As we look forward, for us, it's eyes on the prize of, 'How do we add value to the consumer? How do we add value to enterprises? And how do we close this capability gap?' You're going to hear us talk about this over and over again."

[2]

Enterprise customers are focus of OpenAI, Anthropic

AI companies OpenAI (OPENAI) and Anthropic (ANTHRO) have their eyes on enterprise customers this year as they race to win more revenue, users, and market share, CNBC reported. On Tuesday, Anthropic's CEO Dario Amodei said at the World Economic Forum, or Both companies emphasized a strategic focus on enterprise customers, highlighting enterprise as a key and growing revenue driver. As of January, about 40% of OpenAI's business comes from enterprises, expected to reach 50%. About 80% of Anthropic's business comes from enterprises. Anthropic views enterprises as a stable, predictable income source and believes its focus on AI safety and reliability aligns with enterprise needs.

[3]

OpenAI and Anthropic Compete for Enterprise Clients | PYMNTS.com

Both companies are looking to increase their market share in this segment, the report said, citing interviews with company executives. OpenAI Chief Financial Officer Sarah Friar told CNBC in an interview that she expects the share of OpenAI's business that is made up of enterprise customers to increase from the current 40% to 50% by the end of the year, according to the report. "As we look forward, for us, it's eyes on the prize of, 'How do we add value to the consumer? How do we add value to enterprises? And how do we close this capability gap?' You're going to hear us talk about this over and over again," Friar said, per the report. Anthropic CEO Dario Amodei told CNBC in a separate interview that enterprises account for 80% of Anthropic's business and that the company finds them to be a relatively stable source of income, according to the report. "Since the beginning, Anthropic has thought in terms of safety and reliability of AI systems, and one of the things we realized is that that was very synergistic with working with enterprises as compared to consumers," Amodei said, per the report. OpenAI said in November that it had gained more than 1 million business customers, which made it "the fastest-growing business platform in history." "Our enterprise momentum is fueled in part by consumer adoption," the company said at the time in a blog post. "With more than 800 million weekly users already familiar with ChatGPT, adoption and ROI within businesses is realized more rapidly -- pilots are shorter, and rollouts face less friction." OpenAI released a report in December that said there was broader adoption and deeper integration of AI across business functions. The company's report said enterprise workers attributed 40 minutes to 60 minutes of daily time savings to AI use, with data science, engineering and communications roles reporting the highest gains at 60 minutes to 80 minutes per active day. Anthropic Chief Product Officer Mike Krieger said in March that Anthropic was focusing on enterprise customers and concentrating on how its technology could "help with knowledge work" for "people who spend all day in meetings or in Excel or Google Docs." In December, Anthropic said it teamed up with consulting firm Accenture to help companies scale AI projects and to "help enterprise clients use our smartest AI models to make major productivity gains." For all PYMNTS AI and B2B coverage, subscribe to the daily AI and B2B Newsletters.

Share

Share

Copy Link

OpenAI and Anthropic revealed at Davos that enterprise customers now represent 40% and 80% of their respective businesses. Both artificial intelligence startups are racing to expand their enterprise footprint, with OpenAI projecting enterprise revenue to reach 50% by year-end as competition intensifies for lucrative business contracts.

OpenAI and Anthropic Shift Strategic Focus to Enterprise AI

Artificial intelligence startups OpenAI and Anthropic are intensifying their pursuit of enterprise customers as both companies compete to drive revenue and increase market share in the rapidly evolving AI landscape. Speaking at the World Economic Forum in Davos, Switzerland, executives from both companies outlined ambitious plans to expand their business customer base throughout 2026

1

.

Source: PYMNTS

OpenAI CFO Sarah Friar revealed that enterprise customers currently account for roughly 40% of the company's business as of January, with expectations to grow that figure closer to 50% by year-end

1

. Meanwhile, Anthropic CEO Dario Amodei disclosed that enterprises already represent 80% of Anthropic's business, positioning the company as heavily invested in the B2B sector from the outset2

.ChatGPT's Consumer Base Fuels Enterprise Momentum

OpenAI's enterprise strategy benefits significantly from consumer adoption of ChatGPT, which has reached more than 800 million weekly users. This widespread familiarity accelerates business integration, as the company announced in November that it had gained more than 1 million business customers, claiming to be "the fastest-growing business platform in history"

3

. The company's valuation has swelled to $500 billion since launching ChatGPT in 20221

.

Source: Seeking Alpha

Sarah Friar emphasized the dual focus during her CNBC interview at Davos: "As we look forward, for us, it's eyes on the prize of, 'How do we add value to the consumer? How do we add value to enterprises? And how do we close this capability gap?' You're going to hear us talk about this over and over again"

1

3

.AI Safety and Reliability Drive Anthropic's Enterprise Appeal

Anthropic positions AI safety and reliability as core differentiators in targeting enterprise customers. Dario Amodei explained that enterprises provide a relatively stable and predictable income source, aligning perfectly with the company's foundational principles. "Since the beginning, Anthropic has thought in terms of safety and reliability of AI systems, and one of the things we realized is that that was very synergistic with working with enterprises as compared to consumers"

3

.Anthropic Chief Product Officer Mike Krieger stated in March that the company focuses on how its technology could "help with knowledge work" for "people who spend all day in meetings or in Excel or Google Docs"

3

. In December, Anthropic partnered with consulting firm Accenture to help companies scale AI projects and enable enterprise clients to use AI models for major productivity gains3

.Related Stories

Measurable Productivity Gains Validate Enterprise Investment

OpenAI released data in December demonstrating broader adoption and deeper integration of AI across business functions. Enterprise workers attributed 40 minutes to 60 minutes of daily time savings to AI use, with data science, engineering and communications roles reporting the highest gains at 60 minutes to 80 minutes per active day

3

. These tangible productivity gains strengthen the business case for enterprise AI adoption and suggest that both startups will continue prioritizing this segment as a critical revenue driver. The competition between these AI lab giants will likely accelerate innovation in AI systems designed specifically for business applications, with enterprises watching closely to determine which platform delivers superior capability gap solutions.References

Summarized by

Navi

[2]

Related Stories

Anthropic doubles funding target to $20B as enterprise AI revenue surges toward $18B in 2026

27 Jan 2026•Business and Economy

OpenAI vs Anthropic: Diverging Strategies in the AI Race

28 Oct 2025•Technology

Anthropic captures 20% of business market as AI adoption accelerates to new highs

12 Feb 2026•Business and Economy

Recent Highlights

1

ByteDance Faces Hollywood Backlash After Seedance 2.0 Creates Unauthorized Celebrity Deepfakes

Technology

2

Microsoft AI chief predicts artificial intelligence will automate most white-collar jobs in 18 months

Business and Economy

3

Google reports state-sponsored hackers exploit Gemini AI across all stages of cyberattacks

Technology