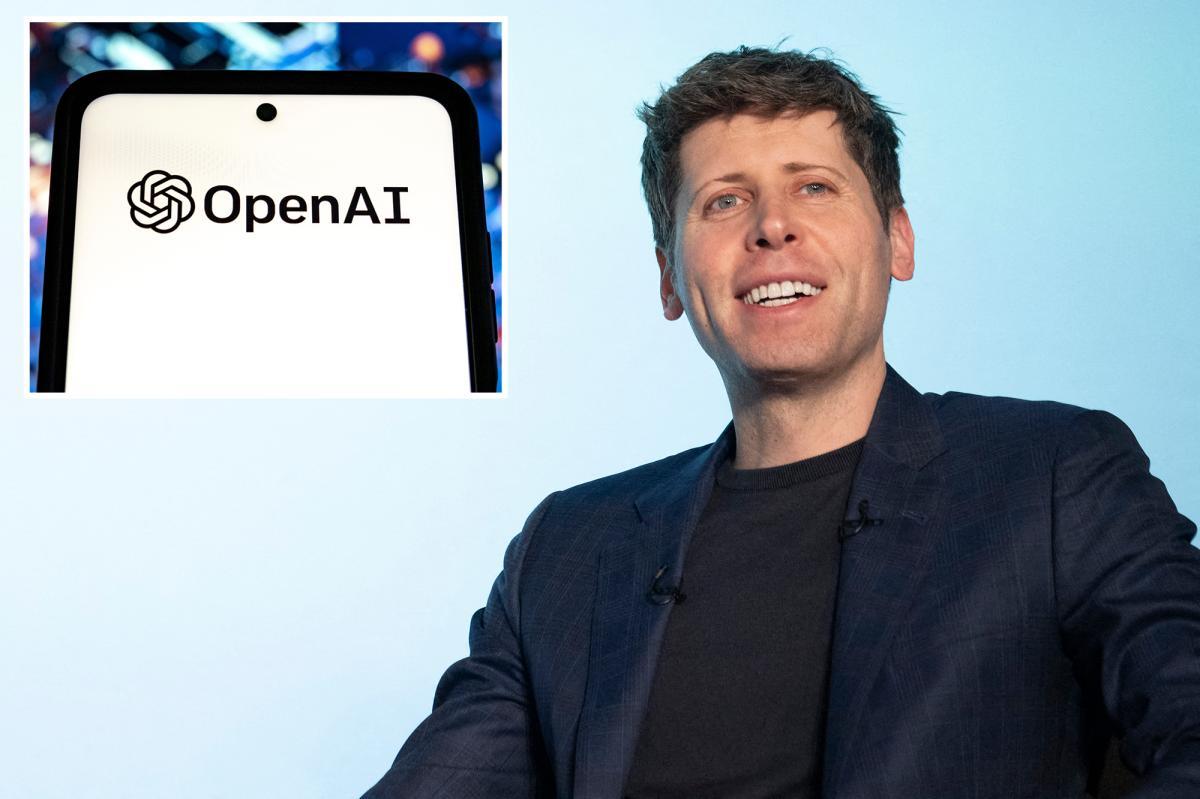

OpenAI employee compensation reaches $1.5 million per worker, shattering Silicon Valley records

3 Sources

3 Sources

[1]

OpenAI's employee compensation dwarfs every major tech IPO of the past 25 years

Serving tech enthusiasts for over 25 years. TechSpot means tech analysis and advice you can trust. Bottom line: OpenAI's financial model reflects the intense pressure to retain the people driving its breakthroughs. The company's willingness to spend aggressively on equity has redefined what competitive pay looks like in artificial intelligence - and raised the stakes for every firm vying to shape the field's future. Internal financial disclosures show that OpenAI is distributing more equity per employee than any major technology startup on record. Its stock-based compensation - averaging roughly $1.5 million per worker across a staff of about 4,000 - far exceeds the benchmarks set by historical peers, according to data the company shared with investors. Adjusted for inflation to 2025 dollars, that figure is seven times higher than the stock-based pay Google reported in 2003, the year before its initial public offering. A Wall Street Journal analysis of 18 other major tech companies found that OpenAI's average equity payout is 34 times larger than typical pre-IPO compensation levels over the past 25 years, based on data compiled by compensation research firm Equilar. OpenAI declined to comment on the figures. The data marks an extraordinary shift in how top AI firms compete for talent. Founded less than a decade ago, OpenAI is now compensating researchers and engineers at levels once reserved for IPO-bound companies flush with capital. Those stock-based packages are intended to secure the company's lead in the AI arms race, while also driving up operating losses and diluting shareholder value, according to people familiar with OpenAI's financials. Costs have risen sharply as competition for elite AI specialists has intensified. The pay surge accelerated after Meta's CEO Mark Zuckerberg began offering compensation packages worth hundreds of millions of dollars - and in rare cases as much as $1 billion - to senior AI researchers and executives as part of an aggressive recruitment campaign. That effort lured more than 20 OpenAI employees, including ChatGPT co-creator Shengjia Zhao, prompting the company to issue one-time retention bonuses in August, some valued in the millions. Financial projections shared with investors indicate that OpenAI expects its stock-based compensation to grow by approximately $3 billion annually through 2030, underscoring how central pay incentives have become to its growth strategy. In another change likely to push costs higher, the company recently ended a policy requiring employees to work at least six months before their equity vests, eliminating a standard cliff used by most Silicon Valley firms to manage turnover risk. By 2025, OpenAI's compensation costs are projected to account for 46% of total revenue, a higher ratio than any large tech firm prior to going public, except for EV maker Rivian, which reported no revenue in the year before its IPO. For comparison, Palantir's stock-based pay equaled 33% of revenue in 2020, Google's stood at 15% before its IPO, and Facebook's was just 6%, according to the Equilar analysis. On average, pre-IPO tech companies devoted about 6% of revenue to stock-based pay. Image credit: The Wall Street Journal

[2]

Inside OpenAI's $1.5 million compensation packages

OpenAI is paying its employees at levels that have little precedent in Silicon Valley history -- $1.5 million in stock-based compensation per employee in 2025. That's according to financial projections shared with investors and first reported by the Wall Street Journal. Such compensation dwarfs what earlier generations of tech giants paid their workforces before going public. Adjusted for inflation, OpenAI's equity payouts are multiples above the norm for large tech firms over the past two decades, and even several times higher than what Alphabet or Meta disclosed ahead of their IPOs. As generative AI models become central to corporate strategy, researchers and engineers with the most relevant expertise are becoming some of the most expensive employees anywhere in the world. To retain current employees and win sought-after job candidates, rival research labs and tech giants must make staggering offers. In this case, if leading AI firms collectively capped compensation, they'd all benefit from lower costs and less-diluted equity. But no single company can afford restraint when competitors are bidding aggressively -- not when falling behind in talent means falling behind in the technology itself. The result is a bidding war none of the participants can escape, even as it pushes the economics of AI development into increasingly unprecedented territory. Accordingly, OpenAI has had to loosen internal equity rules to stay competitive. One recent change removed a waiting period that required employees to stay six months before stock awards began vesting -- a nod to a job market where researchers frequently move between companies and can command immediate payouts. In historical terms, the numbers are even more jarring. Among major tech companies that eventually went public, stock-based compensation typically accounted for a modest, single-digit percentage of revenue in pre-IPO years. But at OpenAI, it now approaches 50%. What's more, per Wall Street Journal reporting, OpenAI's investor materials suggest those costs will keep rising for years, even as the company continues to invest heavily in infrastructure and development.

[3]

OpenAI's pay tops every major tech startup as stock awards hit...

OpenAI is reportedly paying its employees more than any major tech startup, showering workers with an average of $1.5 million each in stock-based compensation -- a staggering sum that amounts to nearly half of the company's projected 2025 revenue. The unusually rich payouts, disclosed in financial materials reviewed by investors, put OpenAI far ahead of peers, with stock compensation averaging more than seven times what Google paid employees before its 2004 IPO and roughly 34 times the average at other major tech companies ahead of their public debuts. The largesse reflects OpenAI's aggressive push to retain top artificial-intelligence talent as competition intensifies, with equity awards swelling operating losses and rapidly diluting existing shareholders, according to the investor materials obtained by the Wall Street Journal. Across its roughly 4,000-person workforce, the equity payouts translate into one of the most expensive payrolls Silicon Valley has ever seen, with OpenAI's stock-based compensation projected to climb by about $3 billion a year through 2030, the data shows. The spending surge accelerated after Meta CEO Mark Zuckerberg began dangling nine-figure -- and in some cases, billion-dollar -- pay packages to poach elite AI researchers, triggering defections from OpenAI and forcing the company to sweeten retention bonuses. The recruiting battle intensified over the summer after Meta's hiring blitz lured away more than 20 OpenAI employees, including a co-creator of ChatGPT, prompting the startup to issue one-time bonuses worth millions of dollars to some research and engineering staff. The generous pay has come as OpenAI races to defend its position in generative AI -- even as the equity-heavy compensation inflates losses and reportedly pushes stock-based pay to about 46% of projected revenue in 2025, the highest level among major tech startups analyzed. OpenAI recently told employees it would scrap a policy requiring them to stay at the company for at least six months before equity begins vesting -- a move that could further drive up compensation as workers gain faster access to lucrative stock awards, according to The Journal. OpenAI's pay structure dwarfs that of most large tech companies, which traditionally spend about 6% of revenue on stock compensation in the year before their IPOs, according to data compiled by Equilar. Google spent about 15% of revenue on stock-based compensation ahead of its 2004 IPO, while Facebook's figure was roughly 6% before it went public in 2012, according to data compiled by the Journal. Founded in 2015 as a nonprofit, OpenAI initially rejected profit motives altogether. That stance shifted in 2019, when the company created a capped-profit subsidiary to attract outside investment. OpenAI justified its decision at the time by arguing that the cost of advanced AI research had grown too large to sustain through philanthropy alone. The evolution accelerated in recent years as OpenAI sought ever-larger funding rounds to finance the growing costs of large-scale AI research. After public backlash, legal threats and internal debate, the company completed a restructuring earlier this year that left it operating under a hybrid model. Its commercial arm now functions as a public benefit corporation, while the original nonprofit foundation retains control and a significant equity stake.

Share

Share

Copy Link

OpenAI is paying its 4,000 employees an average of $1.5 million each in stock-based compensation, far exceeding what Google, Facebook, or any major tech company offered before going public. The aggressive pay structure reflects the intense competition for AI talent, with costs projected to reach 46% of revenue by 2025—the highest among major tech startups analyzed over the past 25 years.

OpenAI Sets Record With $1.5 Million Compensation Packages

Internal financial disclosures reveal that OpenAI is distributing more equity per employee than any major technology startup on record. The company's stock-based compensation averages roughly $1.5 million per worker across a staff of about 4,000, according to data shared with investors and first reported by the

Wall Street Journal

1

. This aggressive pay structure marks an extraordinary shift in how top AI firms compete for talent, redefining what competitive compensation looks like in artificial intelligence.

Source: New York Post

Adjusted for inflation to 2025 dollars, OpenAI employee compensation is seven times higher than the stock-based pay Google reported in 2003, the year before its initial public offering. An analysis of 18 other major tech companies found that OpenAI's average equity payouts are 34 times larger than typical pre-IPO compensation levels over the past 25 years, based on data compiled by compensation research firm

Equilar

1

. The unprecedented level of pay reflects the company's determination to secure its lead in the generative AI landscape.Competition for AI Talent Drives Costs to Record Highs

The bidding war for top AI talent has intensified dramatically as researchers and engineers with relevant expertise become some of the most expensive employees anywhere in the world. Costs surged after

Meta

3

CEO Mark Zuckerberg began offering compensation packages worth hundreds of millions of dollars—and in rare cases as much as $1 billion—to senior AI researchers and executives as part of an aggressive recruitment campaign.

Source: Quartz

That effort lured more than 20 OpenAI employees, including

ChatGPT

3

co-creator Shengjia Zhao, prompting OpenAI to issue one-time retention bonuses in August, some valued in the millions. The competition for AI talent has created a situation where no single company can afford restraint when competitors are bidding aggressively—not when falling behind in talent means falling behind in the technologyitself

2

.Stock-Based Compensation Approaches Half of Revenue

By 2025, OpenAI's compensation costs are projected to account for 46% of total revenue, the highest among major tech startups and a higher ratio than any large tech firm prior to going public except for EV maker Rivian, which reported no revenue in the year before its IPO. For comparison, Palantir's stock-based pay equaled 33% of revenue in 2020, Google's stood at 15% before its IPO, and Facebook's was just 6%, according to the Equilar

analysis

1

. On average, pre-IPO tech companies devoted about 6% of revenue to stock-based compensation.Financial projections shared with investors indicate that OpenAI expects its stock-based compensation to grow by approximately $3 billion annually through 2030, underscoring how central pay incentives have become to its growth

strategy

1

. Those stock-based packages are intended to secure the company's lead in the AI arms race, while also driving up operating losses and diluting shareholder value, according to people familiar with OpenAI's financials.Related Stories

Vesting Changes Accelerate Talent Retention Strategy

In another change likely to push costs higher, OpenAI recently ended a policy requiring employees to work at least six months before their equity vests, eliminating a standard cliff used by most Silicon Valley firms to manage turnover

risk

1

. The move reflects a job market where researchers frequently move between companies and can command immediate payouts, forcing OpenAI to loosen internal equity rules to staycompetitive

2

.

Source: TechSpot

This shift in talent retention strategy comes as OpenAI races to defend its position in generative AI, even as the equity-heavy compensation inflates losses. Founded in 2015 as a nonprofit, OpenAI initially rejected profit motives altogether before creating a capped-profit subsidiary in 2019 to attract outside investment. The company's willingness to spend aggressively on equity payouts has redefined competitive pay in artificial intelligence and raised the stakes for every firm vying to shape the field's future.

References

Summarized by

Navi

[3]

Related Stories

AI Startups Offer Staggering Salaries to Attract Top Talent in Competitive Market

02 Jul 2025•Business and Economy

OpenAI's Financial Gamble: Massive Stock Compensation Amid AI Talent War

09 Jul 2025•Business and Economy

Silicon Valley's Billion-Dollar Battle for AI Talent Intensifies

21 May 2025•Business and Economy

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy