OpenAI's Trillion-Dollar Gamble: Ambitious Plans and Financial Challenges in the AI Race

10 Sources

10 Sources

[1]

OpenAI has five years to turn $13 billion into $1 trillion | TechCrunch

OpenAI is printing money right now. The company is pulling in roughly $13 billion in annual revenue, with 70% coming from everyday people paying $20 a month to chat with an AI, according to the Financial Times. That's pretty wild when you consider ChatGPT has 800 million regular users, but only 5% are actually paying subscribers. Raking in billions though it may be, OpenAI has also committed to spending over $1 trillion over the next decade (yes, trillion). The company has recently locked in deals for more than 26 gigawatts of computing capacity from Oracle, Nvidia, AMD, and Broadcom -- infrastructure that'll cost vastly more than what's coming in. To bridge this gap, OpenAI is getting creative, reports the FT. A five-year-plan include exploring government contracts, shopping tools, video services, consumer hardware, and even becoming a computing supplier itself through its Stargate data center project. A growing number of businesses need to math to work out. Some of America's most valuable companies are now leaning on OpenAI to fulfill major contracts, notes the FT; if OpenAI falters (no pressure!), it could potentially destabilize a U.S. market that has banked heavily on the AI boom.

[2]

ChatGPT: so popular, hardly anyone will pay for it

If you build it, they will come and expect the service to be free OpenAI is losing about three times more money than it's earning, and 95 percent of those using ChatGPT, which generates roughly 70 percent of the company's recurring revenue, aren't paying a dime to help stem the losses. For this level of success, the company is reportedly valued at about $500 billion, even as it commits to spending more than $1 trillion that it doesn't have in partnership deals over the next five years. According to a report published last month in The Information, OpenAI during the first half of 2025 collected $4.3 billion in revenue while still posting a net loss of $13.5 billion during that six month period. More than half of that loss is attributable to "remeasurement of convertible interest rights," which The Information suggests is a reference to billions of dollars' worth of convertible equity issued to investors. The Financial Times reports that OpenAI had an operating loss of about $8 billion for the first half of the year, which presumably excludes the equity obligations. The Financial Times also says that OpenAI is presently booking $13 billion in annual recurring revenue - a projection of future business based on revenue of over $1 billion in a recent month that some find dubious. About 70 percent of OpenAI's recurring revenue reportedly comes from those paying for ChatGPT subscriptions (Free, $20/month, $200/month). But of ChatGPT's 800 million users, just 5 percent pay, according to a senior executive who spoke to the Financial Times. Menlo Ventures came to a similar estimate based on a $10 billion annual run rate and about 800 million monthly active users - about 40 million would be paying $20 per month to generate that much revenue. Five percent is actually a higher-than-average figure for the percentage of those willing to pay for AI. Menlo Ventures calculates that just 3 percent of the 1.8 billion people using generative AI services overall pay. "This gap between usage and payment represents a major opportunity," the VC firm observed in June with no small amount of optimism. A ZDNET/Aberdeen study published in May suggests a limit to that optimism - only eight percent of respondents said they'd pay extra for AI. OpenAI did not respond to a request to comment. OpenAI aims to double its paying customer base in an unspecified time frame, per The Financial Times, which notes that CEO Sam Altman has committed to buying more than 26 gigawatts of datacenter capacity from AMD, Broadcom, Nvidia, and Oracle through the end of the decade at a cost of more than $1 trillion. This spending spree is supported by, among others, Nvidia, which says it will invest $100 billion in OpenAI - presumably much of which will take the form of GPU credits. More than a few have observed this circular investment scheme looks a lot like a bubble. OpenAI has other theoretical revenue streams, like charging a commission for items purchased through ChatGPT e-commerce integrations and ads - something CEO Sam Altman initially dismissed but now is considering. Automated e-commerce could be a thing, someday. Stranger things have happened. Ad support, however, has proven difficult for rival Perplexity, which recently paused accepting new advertisers to rethink its revenue plan. OpenAI's platforms account for about 80 percent of all web traffic for generative AI tools, representing 190 million of the 240 million average daily visits, according to SimilarWeb data [PDF] published in May. OpenAI's path to profitability is easier said than done - make a product so compelling that people will pay for it. We're not there yet. ®

[3]

OpenAI wants to own it all

OpenAI's boundless ambition has become the touchstone of the generative artificial intelligence boom. It isn't just the giant deals with which it has been shaking up the chip industry. If generative AI has the potential to change many aspects of business and daily life, then OpenAI intends to be the one leading the way. It wants to own it all, from consumer apps such as chat and social networking to the tools companies use to build AI agents. The question is how much it can realistically bite off without a serious case of indigestion. This feels particularly pressing in the enterprise market, selling AI-powered services to businesses and governments. Given the pressing need to find new sources of revenue to fund its huge data centre build-out, it's not hard to see why OpenAI has alighted on this as its next big money-spinner. OpenAI says tens of thousands of companies have been beating a path to its door, hoping to learn how to apply generative AI from the company behind ChatGPT. Why not welcome them with open arms? According to one person at the company, it has already signed one enterprise deal worth more than $1bn, a sign that it is starting to break into the big leagues. For previous generations of tech start-ups experiencing hypergrowth, the answer to the "why not" question was about focus. Making the most of limited resources, both of capital and talent, meant ignoring some opportunities. The list of limited resources also includes graphics processing units, at least until giant projects get off the ground. Like many companies riding the wave of a disruptive new technology, OpenAI appears to believe that this time it's different. AI has made its own workers more productive, increasing the number of new things it can take on. And it may have a window of opportunity to rebuild important tech products and services before older rivals catch up. A case in point is the internal software applications that OpenAI showed off late last month, sending a shockwave through the software investment world. The company is using these services, built on its large language models (LLMs), to do things such as filter sales leads and help its finance staff track and shape thousands of contracts under negotiation. Shares in companies that sell traditional software for such tasks, such as Docusign and HubSpot, dropped more than 10 per cent. But winning in the enterprise business takes much more than a flashy demo: it's about turning technology into services that can be configured, sold and supported in ways that produce measurable business results for customers. Google took years to learn that lesson in cloud computing, as it struggled to develop the different skills and culture required. Enterprise tech companies also need to integrate with existing technologies and tap into their customers' data sources. That means building broad ecosystems of partners around their products. OpenAI has sent confusing signals when it comes to ecosystem-building. Its internal apps were widely seen as a bravura demonstration of what has been called "AI eats software" -- an update of venture capitalist Marc Andreessen's famous 2011 assertion that "software eats the world". But a week later, at its developer day, the company chose to show a different face to the tech world, playing down the potential rivalry and demonstrating its technology working with companies such as HubSpot. That brought temporary relief for software investors, though established sector companies such as Salesforce and Adobe have been slow to get a lift from AI. The more time that goes by before they show traction from their AI-powered services, the greater the danger that they will miss out on this boom, at the same time that their existing software businesses face disruption. But companies such as these still have large customer bases and often act as "systems of record", the repositories of their customers' most important data. They are likely to fight to defend their turf. For OpenAI, the risk is that if others in the enterprise IT world can't decide whether you're an ally or a rival, they will choose to partner with someone else. That could weaken its bid to become the AI platform of choice, selling access to its LLMs to all-comers. Sooner or later, OpenAI will need to decide the limits of its ambition. But for now, as it looks for new ways to spin the raw materials of the generative AI revolution into gold, it seems to believe that everything is possible.

[4]

A guide to the $1 trillion-worth of AI deals between OpenAI, Nvidia and others

Many predict that the artificial intelligence boom will dramatically change how people live and work, and the scale and pace of recent AI deals seems to reflect this. At the center are a handful of companies that are increasingly turning to each other to finance and build out the necessary infrastructure. ChatGPT-maker OpenAI alone has racked up around $1 trillion in deals this year, according to a report from the Financial Times. In September, OpenAI confirmed that it would pay Oracle $300 billion for computer infrastructure over the course of five years. This deal is part of a $500 billion data center buildout project called Stargate, to which Japan's SoftBank Group is also contributing. OpenAI has also inked a $22 billion deal with CoreWeave for use of its data centers, which are packed with Nvidia graphics processing units. Most recently, OpenAI announced a partnership with Broadcom to develop and deploy racks of chips designed by the AI startup. That deal amount is undisclosed. OpenAI has been able to go on this shopping spree because of a $100 billion investment from Nvidia, though a large portion of that money likely be used for leasing Nvidia's GPUs. Microsoft has also invested about $14 billion in OpenAI since 2019. Nvidia has also spun a similar web of intertwining AI deals. Nvidia in September agreed to pay up to $6.3 billion for any of CoreWeave's unsold cloud-computing capacity through 2032. CoreWeave gets most of its GPUs that it then rents out to customers from Nvidia, which is also an investor in the AI cloud infrastructure company. Meanwhile, Oracle has purchased about $40 billion worth of Nvidia chips to build a data center for OpenAI, which is part of the Stargate project. Softbank has a $3 billion stake in Nvidia. Some experts are worried that these inflated AI company valuations "are at a bubble." A recent report by Bain & Company found that AI companies will need $2 trillion of annual revenue to fund the infrastructure needed to meet projected demand for AI by 2030. That's an $800 billion shortfall. But AI leaders are pushing back against concerns, saying that this is simply what it takes to make AI a reality. "The largest tech companies in the world are purchasing this infrastructure because they have demand," CoreWeave CEO Mike Intrator said on Mad Money on Oct. 8. "There's nothing circular about that. It's a fundamental infrastructure buildout that's taking place, and when you have such a massive-scale investment in infrastructure, it is not unusual to see partnerships as people try to serve infrastructure to the consumer. It happens in other markets, it's happening in this one." Watch the video for a visual representation of this entangled web of AI deals.

[5]

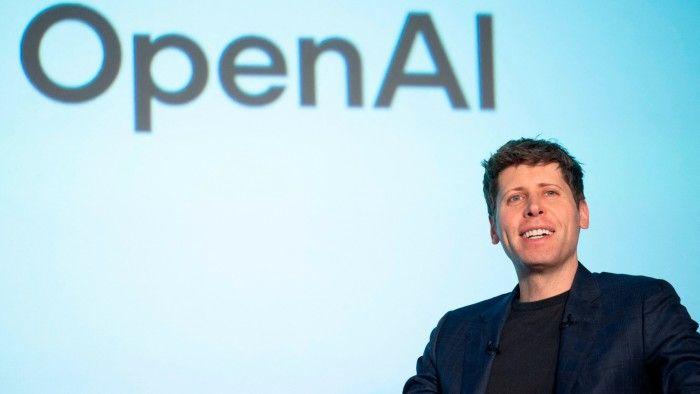

OpenAI makes five-year business plan to meet $1tn spending pledges

OpenAI is working on new revenue lines, debt partnerships and further fundraising as part of a five-year plan to make good on the more than $1tn in spending it has pledged to create world-leading artificial intelligence. OpenAI is planning on deals to serve governments and businesses with more bespoke products, creating more income from new shopping tools, and new sales from its video creation service Sora and AI agents, said multiple people familiar with the start-up's efforts. These people said it is exploring "creative" plans to raise new debt that can help it build out its AI infrastructure, while considering becoming a supplier of computing resources via its data centre initiative Stargate. It is also weighing ways to cash in on its intellectual property by developing new AI infrastructure, making forays into online advertising and plans to launch consumer hardware products, including a new AI-powered personal assistant device, with former Apple star designer Jony Ive. These ambitious plans will need to become reality if OpenAI is to meet its liabilities, as the group has made funding commitments that dwarf its income. In the past month, chief executive Sam Altman has committed to take more than 26 gigawatts of capacity from Oracle, Nvidia, AMD and Broadcom, at a rough cost of well over $1tn over the next decade, according to FT calculations. The ability to meet these costs is increasingly a concern for the wider economy. Some of the most valuable companies in the US are now reliant on OpenAI to fulfil major contracts and underpin demand, stoking fears of an AI-fuelled financial bubble. One senior OpenAI executive said "[investors] expect you to have a five-year model", but added "right now I'd say there's lots of fuzz on the horizon, and as it gets closer and it's going to start to take real shape". OpenAI books about $13bn in annual recurring revenue, 70 per cent of which comes from consumers using ChatGPT, which costs $20 for a standard subscription, according to people familiar with the company's finances. ChatGPT has more than 800mn regular users, but just 5 per cent of those are paying subscribers, a number OpenAI intends to double, the senior executive said. The company has also rolled out cheaper access to users in India, with plans to do the same in the Philippines, Brazil and elsewhere, they said. It also takes a cut of sales from items purchased through ChatGPT's new checkout feature and is exploring introducing advertising to its AI products. Altman last week said he liked Instagram's approach to personalised advertising: "Maybe there's something to do there, but, we approach ads with great caution." Recent partnerships with AMD and Nvidia include plans to share "technical expertise" in order to improve AI hardware, including chip and data centre design. One executive at the company compared those plans to Jeff Bezos launching cloud computing platform AWS using technical expertise gleaned from running his ecommerce business Amazon. OpenAI's operating loss in the first half of the year was about $8bn, even as revenue more than doubled on the year before, said a person with knowledge of the matter. The company's partners such as Oracle have taken on the upfront spending on infrastructure, with OpenAI hoping it can grow to meet its obligations to those partners as operational expenditure in future. The approach has been to "leverage other people's balance sheets" to give OpenAI "time to build the business", said the senior executive. Greg Brockman, the company's president, last week said recent spending commitments would pay for themselves: "If we had 10 [times] more compute [computing power], I don't know if we'd have 10 [times] more revenue, but I don't think we would be that far." If OpenAI continues its stratospheric growth, executives are also confident they can keep raising money from investors. Alternatively, the start-up could prioritise breaking even, though Altman last week said becoming profitable was "not in my top-10 concerns". OpenAI is also anticipating computing costs will fall sharply as a result of competition among suppliers and technical advancements. The company's deals with AMD and Nvidia are staggered so OpenAI will pay as new capacity is developed. But 20GW of capacity would require power roughly equivalent to that provided by 20 nuclear reactors, and analysts have questioned whether it is realistic for that demand to be met by a single company. Two-thirds of the cost of developing new computing power goes towards semiconductors. OpenAI is aiming to stimulate the nascent chip financing market by offering enormous demand, and by forging novel contracts, such as its Nvidia and AMD deals. Those deals have been criticised for their circularity -- the ChatGPT maker is expected to spend much of Nvidia's investment on the chipmaker's processors, for instance. But the transactions will help non-investment grade OpenAI raise the debt it requires to realise its infrastructure ambitions, said the senior executive at the start-up. The signal to the market is "we're good for the debt", they added. "We're working with everyone to come up with creative financing strategies." "I don't view them as drunken sailors going to bars and laying down IOUs everywhere," said a person who has advised the company on its dealmaking. "It might look and feel that way, but this is actually a strategy backed up by technology, products, business plans and visibility into what is happening."

[6]

ChatGPT Usage Has Peaked and Is Now Declining, New Data Finds

Earlier this month, data analyzed by Deutsche Bank showed that OpenAI's ChatGPT revenue was starting to plateau in Europe, suggesting that enthusiasm for the AI chatbot app to beat may be waning. That's despite the industry's sky-high promises of delivering a technological revolution, as astronomical amounts of money continue to be poured into building out AI infrastructure. Now it appears that a similar story may be playing out elsewhere in the world as well. As TechCrunch reports, third-party app intelligence firm Apptopia found that ChatGPT's mobile app usage appears to have stopped around the beginning of September -- and has actually started to decline since then. Despite only being two-thirds into October, Apptopia warns that ChatGPT global downloads are down over eight percent month-over-month. Even more ominously for OpenAI, data shows that ChatGPT users in the US are spending less and less time with the app, with average time spent per daily active user dropping 22.5 percent since July. Apptopia suggests that it's not simply a matter of people becoming more efficient with their ChatGPT prompts, since both average time spent and the average number of sessions are declining. It's far from a death knell for the Sam Altman-led company -- millions of people are still downloading the app each day. The data is also limited to mobile data and doesn't include desktop users. However, it does suggest that OpenAI's narrative of explosive growth is fading. Growing concerns over an AI bubble have stoked fear into investors as of late, with even industry insiders warning that large language models like ChatGPT may turn out to be a dead end. Simultaneously, widespread disillusionment with the tech, particularly concerning hallucinations, is becoming more apparent by the week. The company's latest GPT-5 model has also failed to impress, with a recent study finding that it's actually worse than its predecessor GPT-4o when it comes to ensuring AI safety. The model's rollout quickly turned messy in August and was met with a major user revolt. As OpenAI continues to search for alternative sources of revenue, from ads to monetizing its text-to-video generator app Sora, ChatGPT remains the firm's most important lifeline. As the Financial Times reported earlier this month, paying ChatGPT subscribers represent roughly 70 percent of its annual recurring revenue. While Altman boasted that 800 million people are using the app, only five percent are willing to pay for a subscription, indicating it's struggling to convince the vast majority of users that it's worth $20 per month. Besides growing disillusionment, users may also be flocking to OpenAI's ever-present competition, such as Google's Gemini. In short, OpenAI will have to find new ways to attract users -- and convince them to pay for a subscription. It's clearly desperate: the company recently announced it will allow for "mature" ChatGPT apps.

[7]

Tracking OpenAI's deals with Nvidia, Walmart, AMD, and more

OpenAI has entered its contract era. The company behind ChatGPT has stitched together chip supply at an unprecedented scale, widened its cloud footprint, and taught a chatbot how to close a sale. The through-line isn't mystique but mechanics: lock down what's scarce, rent what's flexible, and turn an audience into a checkout line. The scope finally matches the talk. A letter of intent with Nvidia puts at least 10 gigawatts of systems on OpenAI's roadmap, with up to $100 billion of Nvidia investment tied to the rollout. AMD arrives as a true second source -- with a warrant that could hand OpenAI up to 10% of AMD if milestones are hit -- while Broadcom signs on to build OpenAI's first in-house processor. Add Google Cloud as a supplier, and the single-vendor optics fade. The other lane for OpenAI is revenue. ChatGPT's "Instant Checkout" started with Etsy, moved to Shopify next, and is now part of a partnership with Walmart. Customers can now complete a purchase directly inside the ChatGPT interface. Stripe provides the payment infrastructure, and OpenAI earns a transaction fee on each sale. That moves ChatGPT from demo to storefront and, if the conversion math holds, it turns intent into income without sending users back to a browser. Money is following the build. As of June, OpenAI's annualized revenue run rate recently hit about $10 billion, nearly double December's pace. Last year's losses were heavy; the bet is that unit costs fall as capacity lands and that commerce and enterprise channels widen the margin. OpenAI is now the world's most valuable startup after a secondary stock sale pegged its valuation at $500 billion. OpenAI spent 2024 laying the groundwork for this year's sprint. Apple announced opt-in ChatGPT access across iOS, iPadOS, and macOS as part of Apple Intelligence; Microsoft relinquished its OpenAI board-observer seat under regulatory scrutiny; Oracle, Microsoft, and OpenAI said Azure AI capacity would be extended over Oracle Cloud Infrastructure; PwC became OpenAI's first ChatGPT Enterprise reseller and bought around 100,000 seats; and OpenAI signed licensing deals with the Financial Times, News Corp, and Reddit to allow attributed answers and data access. The question right now isn't whether OpenAI can sign deals. It can. And it will continue to do so. The question is whether these contracts buy real leverage -- on delivery windows, on price curves, on distribution -- fast enough to make the economics sing.

[8]

ChatGPT Is Already Stalling Out on New Subscribers

"The poster child for the AI boom may be struggling to recruit new subscribers to pay for it." OpenAI is planning to spend more than $1 trillion in AI infrastructure buildouts -- an enormous commitment, especially considering its meager income. Long term, it desperately needs revenue. For now, the vast majority of the money it's actually bringing in is coming from paying ChatGPT subscribers -- and while OpenAI CEO Sam Altman boasted last week that 800 million people are using the AI chatbot on a weekly basis, only roughly five percent of them are paying for a subscription, according to reporting by the Financial Times. And even ChatGPT revenue may already be plateauing, in what could turn into a major inflection point for an industry already struggling to justify its astronomical spending amid fears of an enormous AI bubble. According to a Tuesday blog post by the Deutsche Bank Research Institute, first highlighted by Fortune, "European spending on ChatGPT has stalled since May, suggesting the poster child for the AI boom may be struggling to recruit new subscribers to pay for it." That's not to say ChatGPT is bringing in nothing. Europeans spend more on ChatGPT subscriptions than on Disney Plus, according to Deutsche Bank. At its yearly growth rate, it could overtake Spotify in mid-2027 and Netflix in early 2028 -- if it can maintain that rate, that is, which hasn't been looking good for months. It's yet another major warning sign, undermining OpenAI leadership's repeated promises that more computing power from vast data centers will lead to more revenue. Data analyzed by Deutsche Bank shows that the value of OpenAI subscriptions "has flatlined in the major European markets over the past four months" after surging in early 2023. For now, OpenAI is going full steam ahead, signing huge contracts with partners including AI chipmakers Nvidia and AMD. The company has committed to delivering 26 gigawatts of computing capacity with their help, almost the amount of electricity required to power the entire state of New York during peak demand. But with revenue from its flagship chatbot looking dicey, OpenAI could be forced to investigate alternative revenue streams. The Altman-led company is already exploring online advertising, monetizing its latest text-to-video generator app Sora, and a new personal device with the help of former Apple designer Jony Ive. Whether those will amount to hundreds of billions of revenue to match its sky-high spending remains unclear at best. But that may not even be the goal. Altman has indicated that becoming profitable isn't a priority for the firm. With ChatGPT spending growth grinding to a halt in Europe, the company could soon be looking for ways to attract new users. Case in point, the company recently announced that it would allow "mature" ChatGPT apps -- despite Altman boasting in August that ChatGPT didn't host any "sexbots."

[9]

OpenAI earns $13 billion a year while planning a trillion-dollar AI future

To support its long-term growth, OpenAI has secured deals for more than 26 gigawatts of computing capacity from suppliers including Oracle, Nvidia, AMD, and Broadcom. OpenAI is generating approximately $13 billion in annual revenue, largely from user subscriptions, while concurrently committing to over $1 trillion in spending over the next decade to expand its computing infrastructure and capabilities. According to a report from the Financial Times, 70 percent of the company's revenue is derived from individuals paying $20 per month for chat access. Although ChatGPT has a base of 800 million regular users, only 5 percent of them are paying subscribers who contribute to this revenue. To support its long-term growth, OpenAI has secured deals for more than 26 gigawatts of computing capacity from suppliers including Oracle, Nvidia, AMD, and Broadcom. The cost of this infrastructure investment is expected to vastly exceed the revenue currently being generated by the company. To bridge this financial gap, OpenAI has formulated a five-year plan that involves diversifying its operations. The strategy includes pursuing government contracts, developing shopping tools, creating video services, and producing consumer hardware. The company also intends to become a computing supplier itself through its planned Stargate data center project. Several of America's most valuable companies now rely on OpenAI for the fulfillment of major contracts. The Financial Times noted that a significant failure at the AI firm could potentially destabilize the broader U.S. market due to this growing dependency.

[10]

If You Were Bankrolling OpenAI, the Percent of ChatGPT Users Willing to Pay for It Might Make You Break Out in a Cold Sweat

OpenAI CEO Sam Altman has committed to spending more than $1 trillion to build out AI infrastructure, totaling 26 gigawatts of compute capacity from tech companies including Nvidia, AMD, and Oracle, according to the Financial Times' calculations. And that's just over the last month. Recouping these astronomical costs isn't just OpenAI's problem, either -- vast portions of the wider economy are relying on OpenAI's success, highlighting growing concerns over an AI bubble that could have sweeping implications for the rest of the economy. For now, the company is desperately trying to build out new revenue lines and taking on even more debt to keep things running. It's looking at advertising online, monetizing its new text-to-video AI generator app Sora, and leaning into online shopping. The company is also working on a new personal device with the help of former Apple designer Jony Ive. But whether any of that will sufficiently grow its income to make a dent in the enormous amount of money it's planning to spend in the next five years remains anything but certain. The numbers are certainly far from confidence-inducing. OpenAI boasts that it has 800 million ChatGPT users. That's impressive, but only a tiny sliver -- roughly five percent -- of them are actually paying for a subscription, according to the FT's sources at the company. Despite running the most popular AI chatbot service by far, in other words, it's struggling to convince the vast majority of users that it's worth $20 per month, let alone $200 per month for a pro subscription. In an apparent effort to boost engagement, Altman recently reversed course on a prior promise, announcing that the company would soon allow "mature apps," despite boasting two months earlier that ChatGPT didn't host any "sexbots." This all comes as OpenAI is still bleeding cash at an alarming rate. In the first half of the year, OpenAI lost $8 billion, despite doubling revenue compared to the year before, per the FT. And insiders are worried that there isn't a cohesive plan to turn OpenAI into a viable business that isn't bleeding billions of dollars long-term. "[Investors] expect you to have a five-year model," a senior OpenAI executive told the FT, but "right now I'd say there's lots of fuzz on the horizon, and as it gets closer and it's going to start to take real shape." Altman has also indicated that it's still far from a concrete plan to monetize Sora, a resource-hogging app that could quickly turn into a major expense. And a personal AI chatbot device, even with the help of Ive, may also prove to be an uphill battle, considering the fate of previous attempts, including the disastrous Humane AI pin. In the meantime, the company is looking to lean on its partners, including Oracle, to take the hit on spending on AI infrastructure, giving it "time to build the business," the executive added. OpenAI leadership is hoping that with more compute, revenue will continue to grow, a belief that has quickly turned into a major point of contention. The stakes are incredibly high. Capital expenditures for AI have contributed more to the growth of the US economy as of August than all of consumer spending combined, as the Wall Street Journal reported earlier this year, raising the terrifying possibility that a crash could take down the US economy with it. Analysts have also voiced concerns after OpenAI announced it would be using investment money from AI chipmaker Nvidia to buy hardware from the company, one of several circular deals that are heightening concerns of a crash. Perhaps the most eyebrow-raising reality is that currently, stopping the bleeding isn't a main priority at OpenAI. Altman doesn't seem all too concerned about breaking even, telling reporters earlier this month that it's "not in my top ten concerns, but we obviously someday have to be very profitable."

Share

Share

Copy Link

OpenAI commits to over $1 trillion in spending for AI infrastructure, raising questions about its financial sustainability and future revenue streams. The company's ambitious five-year plan aims to bridge the gap between current income and massive expenditures.

OpenAI's Trillion-Dollar Ambition

OpenAI, the company behind ChatGPT, has embarked on an unprecedented spending spree, committing to over $1 trillion in infrastructure investments over the next decade. This massive undertaking, which includes deals with tech giants like Oracle, Nvidia, AMD, and Broadcom, aims to secure the computing power necessary for OpenAI's ambitious AI projects

1

4

5

.

Source: Quartz

Current Financial Landscape

Despite its lofty goals, OpenAI's current financial situation presents a stark contrast. The company is reportedly generating about $13 billion in annual recurring revenue, with 70% coming from ChatGPT subscriptions

1

5

. However, this income falls far short of its spending commitments, leading to significant operating losses. In the first half of 2025, OpenAI posted an operating loss of approximately $8 billion5

.

Source: FT

The ChatGPT Paradox

ChatGPT, OpenAI's flagship product, boasts an impressive user base of 800 million regular users. Yet, only 5% of these users are paying subscribers

1

2

. This low conversion rate highlights a critical challenge for OpenAI: monetizing its popular services effectively. The company aims to double its paying customer base, but the path to profitability remains uncertain2

5

.Five-Year Plan and New Revenue Streams

To bridge the gap between its current income and massive expenditures, OpenAI has developed a five-year plan that includes:

- Exploring government contracts and bespoke products for businesses

- Developing new shopping tools and video services

- Launching consumer hardware, including an AI-powered personal assistant device

- Potentially entering the computing supplier market through its Stargate data center project

- Considering advertising integration in its AI products

1

5

Industry-Wide Implications

OpenAI's aggressive spending and ambitious plans have far-reaching consequences for the tech industry. The company's deals with chip manufacturers and cloud providers have created a complex web of interdependencies. For instance, Nvidia's $100 billion investment in OpenAI is expected to be largely used for leasing Nvidia's GPUs

4

.This circular nature of investments and the sheer scale of financial commitments have raised concerns about a potential AI bubble. Some experts warn that AI companies will need $2 trillion in annual revenue by 2030 to fund the necessary infrastructure, highlighting an $800 billion shortfall

4

.Related Stories

Challenges and Criticisms

OpenAI's strategy has not been without criticism. The company's approach of leveraging "other people's balance sheets" to finance its growth has been questioned for its sustainability

5

. Additionally, the feasibility of meeting the enormous power requirements for its planned computing capacity has been challenged by analysts5

.

Source: FT

The Road Ahead

As OpenAI navigates this high-stakes landscape, its ability to execute its ambitious plans will be crucial. The company's success or failure could have significant implications for the broader AI industry and the tech sector as a whole. With its current trajectory, OpenAI is not just betting on its own future but potentially shaping the future of AI itself.

References

Summarized by

Navi

[2]

Related Stories

OpenAI's ChatGPT Pro Subscription Faces Unexpected Losses Despite High Price Tag

06 Jan 2025•Business and Economy

OpenAI's Revenue Surge: ChatGPT Maker Projects Triple Growth Amid Fierce Competition

27 Mar 2025•Business and Economy

OpenAI's Financial Gamble: Massive Stock Compensation Amid AI Talent War

09 Jul 2025•Business and Economy

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology