Palantir's Meteoric Rise: AI-Driven Growth Propels Company into Top 20 Most Valuable U.S. Firms

9 Sources

9 Sources

[1]

Palantir joins list of 20 most valuable U.S. companies, with stock more than doubling in 2025

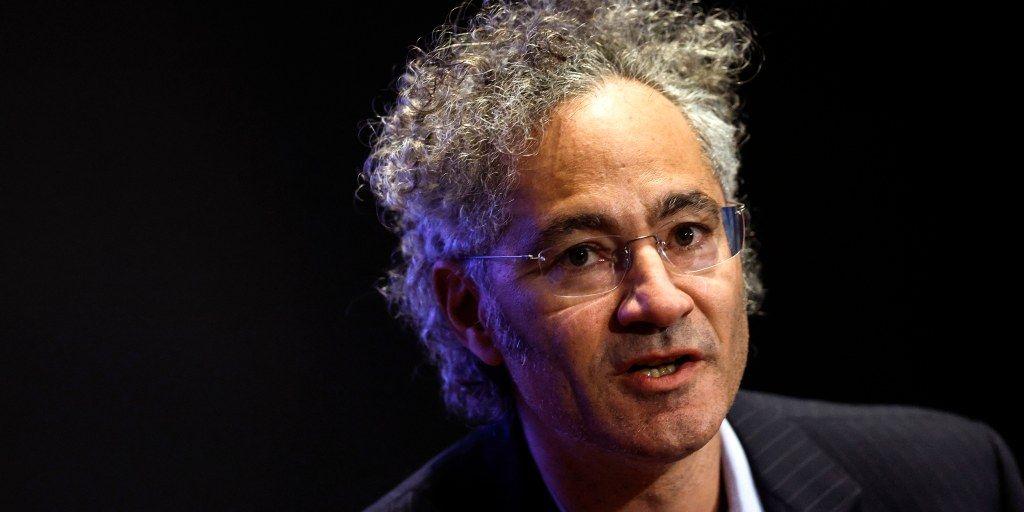

Alex Karp, CEO of Palantir Technologies, speaks on a panel titled Power, Purpose, and the New American Century at the Hill and Valley Forum at the U.S. Capitol on April 30, 2025 in Washington, DC. Palantir has hit another major milestone in its meteoric stock rise. It's now one of the 20 most valuable U.S. companies. The provider of software and data analytics technology to defense agencies saw its stock rise about 3% on Friday to another record, lifting the company's market cap to $375 billion, which puts it ahead of Home Depot and Procter & Gamble. The company's market value was already higher than Bank of America and Coca-Cola. Palantir has more than doubled in value this year as investors ramp up bets on the company's artificial intelligence business and closer ties to the U.S. government. Since its founding in 2003 by Peter Thiel, CEO Alex Karp and others, the company has steadily accrued a growing list of customers. Revenue in Palantir's U.S. government business increased 45% to $373 million in its most recent quarter, while total sales rose 39% to $884 million. The company next reports results on Aug. 4. Earlier this year, Palantir soared ahead of Salesforce, IBM and Cisco into the top 10 U.S. tech companies by market cap. Buying the stock at these levels requires investors to pay hefty multiples. Palantir currently trades for 273 times forward earnings, according to FactSet. The only other company in the top 20 with a triple-digit ratio is Tesla at 175. With $3.1 billion in total revenue over the past year, Palantir is a fraction the size of the next smallest company by sales among the top 20 by market cap. Mastercard, which is valued at $518 billion, is closest with sales over the past four quarters of roughly $29 billion.

[2]

Palantir joins list of 20 most valuable U.S. companies, with stock more than doubling in 2025

Alex Karp, CEO of Palantir Technologies, speaks on a panel at the U.S. Capitol on April 30.Kevin Dietsch / Getty Images file Palantir has hit another major milestone in its meteoric stock rise. It's now one of the 20 most valuable U.S. companies. The provider of software and data analytics technology to defense agencies saw its stock rise about 3% on Friday to another record, lifting the company's market cap to $375 billion, which puts it ahead of Home Depot and Procter & Gamble. The company's market value was already higher than Bank of America and Coca-Cola. Palantir has more than doubled in value this year as investors ramp up bets on the company's artificial intelligence business and closer ties to the U.S. government. Since its founding in 2003 by Peter Thiel, CEO Alex Karp and others, the company has steadily accrued a growing list of customers. Revenue in Palantir's U.S. government business increased 45% to $373 million in its most recent quarter, while total sales rose 39% to $884 million. The company next reports results on Aug. 4. Earlier this year, Palantir soared ahead of Salesforce, IBM and Cisco into the top 10 U.S. tech companies by market cap. Buying the stock at these levels requires investors to pay hefty multiples. Palantir currently trades for 273 times forward earnings, according to FactSet. The only other company in the top 20 with a triple-digit ratio is Tesla at 175. With $3.1 billion in total revenue over the past year, Palantir is a fraction the size of the next smallest company by sales among the top 20 by market cap. Mastercard, which is valued at $518 billion, is closest with sales over the past four quarters of roughly $29 billion.

[3]

What Analysts Think of Palantir Stock Ahead of Earnings

Despite -- or perhaps because of -- the meteoric rise, just two out of 12 brokers tracked by Visible Alpha have a "buy" or equivalent rating for Palantir stock, Palantir Technologies (PLTR) is scheduled to report second-quarter results after the closing bell Monday, with analysts divided on one of 2025's hottest stocks. Shares of Palantir have more than doubled in price this year, leading the best-performing S&P 500 companies, as the company's AI software has become a mainstay, particularly within U.S. government agencies. However, Wall Street largely has been wary of the meteoric rise. The consensus price target among analysts tracked by Visible Alpha is just over $107 -- roughly 30% lower than Palantir's Friday close above $154. Just two out of 12 analysts have a "buy" or equivalent rating for Palantir stock, alongside seven "hold" ratings and three "sell" recommendations, according to Visible Alpha data. One such bull is Wedbush Securities, which last month lifted its Palantir price target to $160. To hear Wedbush analyst Dan Ives tell it, the Street has it wrong. "We believe the Street is underestimating the $1 billion+ revenue stream that [Palantir's Artificial Intelligence Platform] US commercial business can evolve into over the next few years and the technology competitive moat that [CEO Alex] Karp & Co. have built," Wedbush said. For the second quarter, analysts expect Palantir to report revenue of $939.6 million, up 39% year-over-year, and adjusted earnings per share of 14 cents, rising from 9 cents a year earlier.

[4]

Can Palantir Be a Trillion-Dollar Company? | The Motley Fool

Palantir Technologies (PLTR 2.59%) is a polarizing name. For years, critics dismissed it as an overhyped defense contractor disguised as a tech firm. However, the narrative shifted lately. The company is experiencing rapid growth in commercial markets. Its new artificial intelligence (AI) platform is gaining traction and is now profitable. Shares surged 484% in the past year (as of writing), making it one of the largest companies globally, with a $374 billion market capitalization. Investors now face a big question: Could this new phase of Palantir's evolution eventually make it worth $1 trillion? Let's break it down. Palantir operates in two primary segments: government and commercial. For most of its history, the company was best known for its work with U.S. defense and intelligence agencies -- a sticky business, but one that didn't scale easily. That's changing. Palantir's Artificial Intelligence Platform (AIP) is emerging as a breakout commercial product. Unlike earlier tools that required significant engineering support from Palantir, AIP is modular, configurable, and deployable in days, not months. Companies can use it to integrate large language models (LLMs) with internal data while maintaining strict governance and security. To accelerate adoption, Palantir launched AIP Bootcamps -- short, high-intensity onboarding programs that enable potential clients to test-drive the platform using their own data. It's a clever growth hack that reduces friction and demonstrates to customers how AI can enhance their operations. Unsurprisingly, commercial revenue has been scaling nicely in recent quarters. In the first quarter, which ended March 31, 2025, U.S. commercial revenue surged 71% year over year, far surpassing groupwide revenue growth of 39%. Even Palantir's "boring" government business is getting an enormous boost thanks to the increase in AI adoption in the public sector, with U.S. government revenue growing 45% year over year in the same quarter. It's early days, but AI is a game-changer for Palantir. Palantir is currently valued at around $375 billion, so $1 trillion is about 3 times the current market capitalization. Still, to justify that valuation over time, Palantir must back it up with sustainable earnings. Let's assume the market assigns Palantir a generous valuation in the future -- say, a 25 times price-to-earnings (P/E) ratio, similar to other high-quality software companies with durable growth. That would imply the company needs to generate roughly $40 billion in annual net income. Even at a more aggressive 30x multiple, Palantir would still need around $33 billion in net profit. For perspective, Palantir reported an adjusted net income of $334 million in the first quarter of 2025, equivalent to $1.3 billion annualized. To reach $33 billion, net income must grow by over 25 times. For context, that's more profit than Adobe or Salesforce generate in today's market, and they've been building commercial software-as-a-service (SaaS) businesses for decades. In other words, reaching the trillion-dollar mark will require an enormous leap in revenue, margin, and scale, placing Palantir among the largest tech companies, such as Microsoft or Alphabet. Palantir might have a long growth runway, but the path to $1 trillion is very challenging. Here's what the company must do next to have a shot at reaching that goal. The government business is solid but limited. To become a dominant global software company, Palantir must drive widespread commercial adoption of AIP. That means winning Fortune 500 customers, expanding internationally, and proving that AIP is a mission-critical layer of the modern enterprise stack, including building an ecosystem with highly supportive partners. As enterprise AI heats up, every major cloud and data platform wants a piece of the action. Palantir's differentiation lies in secure deployment, strong data governance, and operational use cases. It must continue to invest in those strengths. Winning in this space means staying ahead not just in tech but also in trust. While Palantir is now profitable, its current operating margin remains modest compared to that of top-tier software companies. For perspective, the generally accepted accounting principles (GAAP) net income margin was 16% in 2024. If AIP succeeds in replacing manual customization with out-of-the-box deployment, margins are expected to rise over time due to operating leverage. In other words, net profit must grow even faster than revenue! On one level, Palantir is at a pivotal moment. With AIP gaining traction, commercial growth accelerating, and government demand rising, it has plenty of ingredients for growth. However, to justify a $1 trillion valuation, it must become one of the most profitable software companies on the planet. That means expanding globally, defending its competitive edge in enterprise AI, and scaling margins dramatically. And with its steep valuation, it will be a risky investment for most investors to participate in this ride.

[5]

Prediction: This Wildly Popular Growth Stock Could Underperform Over the Next Decade | The Motley Fool

Palantir (PLTR -0.10%) stock seems unstoppable. After rising 340% in 2024, shares have already more than doubled in 2025. This puts the company's market capitalization at about $372 billion as of this writing. For context, that's just shy of the combined size of Nike, Walt Disney, and Target. Viewed another way, it's about 36% of the size of Warren Buffett's Berkshire Hathaway -- a diversified conglomerate with a massive insurance operation, about $350 billion in cash and cash equivalents, an equity portfolio worth about $295 billion, and dozens of subsidiaries. Despite its huge run higher, Palantir bulls seem more optimistic than ever about the stock's potential to keep rising. The data analytics and artificial intelligence (AI)-focused company and its stock have many investors convinced it can do no wrong. But are there risks? Of course. Indeed, one risk in particular is in and of itself enough of a reason to avoid the stock entirely. What is that risk? Valuation. Accelerating revenue growth? Check. Soaring profits? Check. Significant cash flow? Check. Strong balance sheet? Check. The tech company checks off all of the boxes investors look for in a good growth stock. Even more, as a platform-based company designed for modern enterprises with AI and data analytics use cases, it is benefiting from companies' growing appetite for AI -- one of the market's favorite investing themes in 2025. No wonder Wall Street loves Palantir. The company's most recent quarterly results show just how fast Palantir is growing. Its first-quarter revenue rose 39% year over year -- well above its growth rate of 36% in the prior quarter. Its customer accounts also increased 39% year over year. Further, the company flexed its scalable business model, as earnings per share doubled. Meanwhile, Palantir's quarterly adjusted free cash flow swelled to $370 million -- up from $149 million in the year-ago period. Given the company's impressive momentum, management has big expectations for the full year. The company has guided for fiscal 2025 adjusted income from operations between $1.711 billion and $1.723 billion and adjusted free cash flow between $1.6 billion and $1.8 billion. Additionally, management said it expects positive net income on a generally accepted accounting principles (GAAP) basis in every quarter of the year. Palantir bulls obviously have good reason to love the business. But sometimes good businesses's stocks can simply rise to the point that shares are no longer attractive. I'd argue we've reached that point. Today, Palantir's market capitalization of more than $370 billion towers over the company's expected full-year sales of about $3.9 billion. Further, the company's price-to-earnings ratio of 656 as of this writing is borderline bananas. Even the ratio of price-to-management's guidance for fiscal 2025 adjusted income from operations is sitting at 218. Sure, the company deserves to trade at a premium valuation. But at a certain point, there is almost no room for error. We are at that point. Of course, we can't rule out the possibility of Palantir living up to its current valuation. Though the odds of this happening are slim. Sure, Palantir's business will almost certainly continue to do well. But this doesn't mean the stock is attractive. Given that the stock has grown much faster than the underlying business recently, I believe the market has bid Palantir stock up too high, creating a recipe for a high likelihood of share price underperformance over the next 10 years.

[6]

Palantir at All-Time Highs: Buy Now or Brace for a Reality Check? | The Motley Fool

Through the artificial intelligence (AI) boom over the past few years, Nvidia has gotten a lot of attention (rightfully so in many cases), but many would be surprised to see that its stock hasn't been the biggest beneficiary. That would be Palantir (PLTR -0.31%), which is up over 2,300% -- more than double Nvidia's gains in that span. Palantir is a software company that builds data and analytics tools that help governments and companies gather insights from large and complex datasets. It may sound relatively simple in theory, but it's fairly hard to do at the scale that Palantir does it. And investors have seemed to take notice. With Palantir's stock hovering near its all-time high, it's normal to wonder whether it's time to hop on the roller coaster while it's still on its way up, or brace for a reality check as investors begin to question if its valuation is warranted. In this case, I believe it's much closer to the latter. Let's start with some positive news, and that's Palantir's recent earnings. Palantir is mostly known for its work with U.S. government agencies like the CIA and the Department of Defense. That's been its bread and butter for a while, but its Artificial Intelligence Platform (AIP) has been a huge boost to its commercial business. In the first quarter, Palantir's U.S. government revenue grew 45% year over year to $373 million, and its U.S. commercial revenue grew 71% year over year to $255 million. Its $884 million in total revenue (up 39% year over year) continued its impressive growth, which has seen its revenue grow over 200% in the past five years. Much of this growth can be attributed to Palantir closing large six-figure-plus deals. It closed 139 deals of at least $1 million, 51 deals of at least $5 million, 31 deals of at least $10 million, and grew its total customers by 39% year over year. Palantir expects its fiscal year revenue to fall between $3.89 billion and $3.90 billion, which would be around a 36% increase from 2024. Palantir's recent stock price explosion is great news for investors who've held the stock. However, it's not-so-good news for investors looking to acquire their first shares or add to their existing holdings. To put it lightly, Palantir's stock is extremely expensive. As of July 29, Palantir's stock is trading at an absurd 270 times its forward earnings. That's hard to justify for any business in any industry, but especially one whose main business (government contracts) isn't known for being high-growth and has yet to show its current growth rates are sustainable long-term. Notable past software companies that have reached extremely high valuations -- and still much less than what Palantir currently is -- haven't fared well since that peak. Zoom Communications, Bill Holdings, and Snowflake each traded at triple-digit multiples of their sales at one point, and they're now down 86%, 86%, and 45% from their peaks, respectively. This doesn't mean Palantir will follow the same fate, but it would need to have a historical and unprecedented run to justify the levels it's currently trading at. And unfortunately, I don't see it happening. If you're a believer in Palantir's long-term potential, I would recommend dollar-cost averaging to begin or continue acquiring shares. When you dollar-cost average, you decide on an amount you're willing to invest in a stock and then put yourself on a set investing schedule, making the investments regardless of prices at that time. For example, if you have $1,000 you want to invest in Palantir, you could decide to invest $100 every other Monday, $250 on the first of each month, or whatever works best with your situation. The schedule you put yourself on isn't as important as making sure you stick to it and stay consistent through ups and downs. By dollar-cost averaging, you avoid a situation where you invest a lump sum right before a huge stock price drop happens. Palantir has had instances where its stock price dropped by double-digit percentages in a day, so it's not that far-fetched -- especially with its current stretched valuation.

[7]

Should You Buy Palantir Stock Before Aug. 4? | The Motley Fool

Palantir Technologies (PLTR -2.08%) has been one of the best-performing stocks over the past few years. The stock has more than doubled in 2025 and is up over 800% since the start of 2024. That's impressive performance, but it also raises the question: How much more room is there for Palantir's stock to run? One important date that Palantir has coming up on its calendar is Aug. 4, the day it reports Q2 earnings. This will provide an important update for investors and let everyone know how it's doing. Stocks can often have large movements after reporting earnings, which makes determining whether to buy the stock before or after earnings a key investing decision. So, is Palantir stock a buy before Aug. 4? Palantir's artificial intelligence (AI)-powered data analytics platform has become quite popular. While the mechanics behind the technology are complex, the function of the software can simply be described as data in, insights out. This simple concept has provided its users with unprecedented value and has transformed how many companies operate. One of Palantir's most exciting products is its AIP (Artificial Intelligence Platform). AIP enables users to integrate large language models and can automate several processes using AI agents. AIP has become an incredibly popular add-on to Palantir's base software package and is the source of a lot of its growth. Palantir has delivered strong growth rates over recent quarters, with revenue rising 39% in Q1 and expected to rise 38% in Q2. While that appears to be a slowdown, don't read too much into management's guidance. Palantir has a long track record of setting the bar low and exceeding guidance, so the true growth figure will likely be a few percentage points above that, as long as AI demand was strong in Q2. There haven't been any signs of weakening AI demand from any other company involved in that space, so I'd expect Palantir to report another solid quarter for Q2. But will that be enough? Palantir's stock has already been on a huge run, but its stock performance far outpaces its business results. While Palantir's projected 38% revenue growth is impressive, its stock has risen much more than that. Palantir's stock rose 438% between June 30, 2024, and June 30, 2025, the same time frame that year-over-year Q2 results will compare. That indicates that the stock far outpaces business results, which can be concerning for investors. Neither of those valuations is remotely reasonable, and they assume a massive amount of future growth. Take Nvidia (NVDA -1.73%), for example. While it's the largest company in the world by market cap, it has a forward P/E of 41 and delivered revenue growth of 69% in its last quarter. If we assume that Palantir can achieve a 30% profit margin, ignore the effects of stock-based compensation (which Palantir has a fair amount of), and assign it the same forward P/E that Nvidia receives now (41 times forward earnings), Palantir's projected revenue over the next 12 months would need to be $30.3 billion to produce profits of $9.1 billion to achieve that valuation at today's stock price. Right now, Palantir generates $3.1 billion in revenue and $571 million in profits. At Palantir's current 39% growth rate, it would take about seven years' worth of growth to reach $30.3 billion in revenue. As a result, I don't feel confident buying Palantir's stock at these levels, as the stock is driven by hype rather than realistic performance. If Palantir starts doubling or tripling its revenue year over year, I may change my stance, but we're nowhere near that level. Palantir's stock could rise after earnings, but if you zoom out to a three-to-five-year view, it already has all the growth it will likely deliver and then some baked into the stock price. As a result, investors should find a different AI stock to pick as the earnings season ramps up.

[8]

Palantir Has Doubled This Year. Is It Too Late to Buy, or Is There More Room to Run? | The Motley Fool

Shares of the deep data analytics company were up 109% year to date as of market close July 28, making it the top-performing stock on the S&P 500. For over a year, there's been concern that Palantir's valuation has gotten stretched, but that hasn't stopped the stock from continuing to soar this year. After the surge over the past year, Palantir is more expensive than ever before, and it now trades at a price-to-sales ratio of 126, a sky-high valuation that's far ahead of any other stock in the S&P 500. The second-highest P/S ratio in the index is for Texas Pacific Land at 31. In other words, Palantir stock could fall by 75%, and it would still be the most expensive stock on the S&P 500 on a P/S basis. As a result of that surge, the stock is now one of the 20 most valuable companies in the country, a new milestone for one of the biggest winners in the artificial intelligence (AI) boom. Investors are preparing for Palantir's next quarterly report Monday after the market closes, and many may be wondering: Is it too late to buy the stock? Let's take a look at what's driving the boom in Palantir stock before delving into the question of whether the stock is a buy. Palantir stock has soared over the last two years, primarily due to the success of its Artificial Intelligence Platform, which has driven accelerating revenue growth and expanding margins, and demonstrated that the company's analytics platform is in a class of its own. According to Palantir, the company is typically competing with homegrown solutions when it pitches to potential customers, a sign it doesn't have real direct competition. In the first quarter, revenue jumped 39% to $884 million, and it reported adjusted income from operations of $391 million. Palantir's revenue growth has now accelerated for seven quarters in a row, and its operating margin has soared along with it, going from a loss two years ago to nearly 20% on a generally accepted accounting principles (GAAP) basis. However, it's not just numbers supporting Palantir's surge, the company is also benefiting from a perceived windfall from the government under the Trump administration as Palantir is a key defense contractor, and it's been embraced by the current White House. President Donald Trump signed an executive order in March calling for agencies to share data with each other, using Palantir. There are also reports that Immigration and Customs Enforcement (ICE) is paying Palantir $30 million to build an "ImmigrationOS" surveillance platform to help the agency track self-deportation and information on people who have overstayed their visas. With the government likely to continue shoveling money at Palantir, the contractor should continue to post strong growth. There's a lot to like about Palantir's recent results and its embrace by the federal government, but the stock's valuation does seem to have gotten disconnected from reality, given a P/S valuation that's now well into the triple digits. With a P/S ratio of 126, Palantir would have a triple-digit P/E ratio even if its profit margin were 100%. Its 39% revenue growth is a strong clip, but it would take two years for revenue to double and about four for it to quadruple at that rate. On the other hand, Palantir is now clearly priced for perfection, meaning if the company comes up short on its earnings report, the stock could plunge, and the more inflated the valuation gets, the more likely it is to crash. At its current valuation, the stock could fall by 50%, and it would still be very expensive. Palantir shares could continue to rise, but at some point, the stock is going to have to grow into its valuation, which will put the brakes on its growth. At this point, the risk/reward doesn't favor buying the stock.

[9]

Palantir Just Became the 20th Most Valuable Company, But Is It a Buy Now? | The Motley Fool

It may come as a surprise to many investors that Palantir Technologies (PLTR -0.10%) is now the 20th most valuable company in the world. It has a market cap of around $372 billion, a notable achievement considering it was barely a large-cap stock during the low point of the 2022 bear market. Nonetheless, investors may struggle with managing Palantir stock amid these gains. Current shareholders may wonder whether the stock has risen too far, while prospective buyers may ponder whether the stock has more room to run. Thus, they need to take a closer look at the company and its financials before deciding how to manage Palantir holdings. Palantir has become known as a big-data company that can leverage functions such as artificial intelligence (AI) and machine learning to deliver analytical insights. It started in the national security realm, earning early recognition for helping the U.S. government find Osama bin Laden. Later, it applied these skills to commercial use, attracting more customers. However, its generative AI-driven Artificial Intelligence Platform (AIP) has revolutionized the company's operations. Customers began to report huge productivity gains. In one case, AIP helped a company achieve in one day more than what a hyperscaler could do in four months. One insurer also reduced its process for automating underwriting workflows from two days to just three hours. Seeing such results is bullish for Palantir's value proposition, and the company seems to have a bright future as more companies turn to its productivity tools. One Morningstar analyst believes Palantir's addressable market is between $1.2 trillion and $1.8 trillion. As investors discovered these benefits, they steadily bid the stock higher, a growth phase that reached a fever pitch after the 2024 presidential election. Consequently, the stock has risen 475% just in the last 12 months. Unfortunately, the financials seem to indicate more growth potential than results. Over the last 12 months, the company has generated around $3.1 billion in revenue. That figure indicates tremendous potential in what could be a $1.2 trillion addressable market. Nonetheless, it represents a small fraction of a $372 billion market capitalization, indicating a price-to-sales ratio (P/S) of 126. In comparison, the average P/S for the S&P 500 is 3.25, and even many growth stocks trade at less than 20 times sales. The earnings results also appear to point to considerable overvaluation. Over the last 12 months, the company reported a net income attributable to common shareholders of $570 million. That leaves investors with a price-to-earnings ratio (P/E) of more than 685. Unfortunately, significant improvements in earnings do not seem to bolster its buy case amid a forward P/E of more than 270. And even if the improved earnings were to continue, the forward one-year P/E is nearly 215, indicating that the growth would have to persist for several years to justify the current valuation. Thus, even if investors can still win in the long term with this stock, the potential downside that Palantir could face may not justify the risks associated with buying the stock now. Under current conditions, investors should refrain from purchasing additional shares of Palantir. Its addressable market and growth trajectory indicate that the stock is an eventual winner, even at today's prices. Still, the elevated valuation poses a significant risk. Currently, the stock could lose three-fourths of its value and still be considered "overvalued" in a technical sense. And if market sentiment turns negative, investors will likely turn on highly valued stocks such as Palantir, possibly leading to years of paper losses. For these reasons, you should probably wait for a considerable pullback before buying the stock or seek returns in other investments.

Share

Share

Copy Link

Palantir Technologies experiences a dramatic surge in stock value, driven by its AI business and government contracts, catapulting it into the ranks of the 20 most valuable U.S. companies.

Palantir's Remarkable Ascent

Palantir Technologies, the data analytics and artificial intelligence (AI) company, has achieved a significant milestone in 2025, joining the ranks of the 20 most valuable U.S. companies. The company's stock has more than doubled this year, propelling its market capitalization to an impressive $375 billion

1

. This meteoric rise has positioned Palantir ahead of established giants like Home Depot and Procter & Gamble, and even surpassing the market values of Bank of America and Coca-Cola2

.

Source: NBC

Driving Forces Behind the Growth

The company's success can be attributed to several key factors:

- AI Business Expansion: Investors are increasingly betting on Palantir's artificial intelligence capabilities, particularly its Artificial Intelligence Platform (AIP). The AIP has emerged as a breakout commercial product, offering modular and easily deployable solutions for integrating large language models with internal data

4

.

Source: Motley Fool

-

Government Contracts: Palantir's close ties to the U.S. government continue to be a significant revenue driver. In the most recent quarter, revenue from the U.S. government business increased by 45% to $373 million

1

. -

Commercial Sector Growth: The company has seen rapid growth in its commercial markets. U.S. commercial revenue surged 71% year-over-year in the first quarter of 2025

4

.

Financial Performance and Outlook

Palantir's financial results reflect its strong market position:

- Total sales rose 39% to $884 million in the most recent quarter

2

. - The company reported an adjusted net income of $334 million in Q1 2025

4

. - Management expects fiscal 2025 adjusted income from operations between $1.711 billion and $1.723 billion

5

.

Market Position and Valuation Concerns

Despite its impressive growth, Palantir's current valuation has raised eyebrows among analysts:

- The company trades at 273 times forward earnings, significantly higher than most of its peers in the top 20 most valuable U.S. companies

1

. - With $3.1 billion in total revenue over the past year, Palantir's sales are a fraction of the next smallest company among the top 20 by market cap

2

.

Related Stories

Analyst Perspectives

Wall Street remains divided on Palantir's prospects:

- Only two out of 12 analysts tracked by Visible Alpha have a "buy" or equivalent rating for Palantir stock

3

. - Wedbush Securities is bullish, lifting its price target to $160, citing potential underestimation of Palantir's AI platform in the U.S. commercial business

3

. - Some analysts warn of potential underperformance due to the stock's steep valuation

5

.

Future Challenges and Opportunities

Source: Motley Fool

As Palantir continues its growth trajectory, it faces several challenges and opportunities:

-

Commercial Adoption: To sustain its growth, Palantir must drive widespread commercial adoption of its AIP, winning Fortune 500 customers and expanding internationally

4

. -

Competitive Landscape: With enterprise AI heating up, Palantir must maintain its differentiation in secure deployment, strong data governance, and operational use cases

4

. -

Margin Improvement: While now profitable, Palantir's operating margins remain modest compared to top-tier software companies. Improving these margins will be crucial for long-term success

4

.

References

Summarized by

Navi

[1]

[2]

[3]

[4]

Related Stories

Palantir's AI Platform Drives Impressive Growth and Valuation Concerns

23 Jan 2025•Business and Economy

Palantir's Stock Soars Amid AI Boom: Analyzing the Surge and Future Prospects

12 Feb 2025•Business and Economy

Palantir's Stock Soars to Record Highs Amid AI Boom and Geopolitical Shifts

14 May 2025•Business and Economy

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology