Paytm Shifts Focus to Core Payment Business and Profitability Amid Regulatory Challenges

6 Sources

6 Sources

[1]

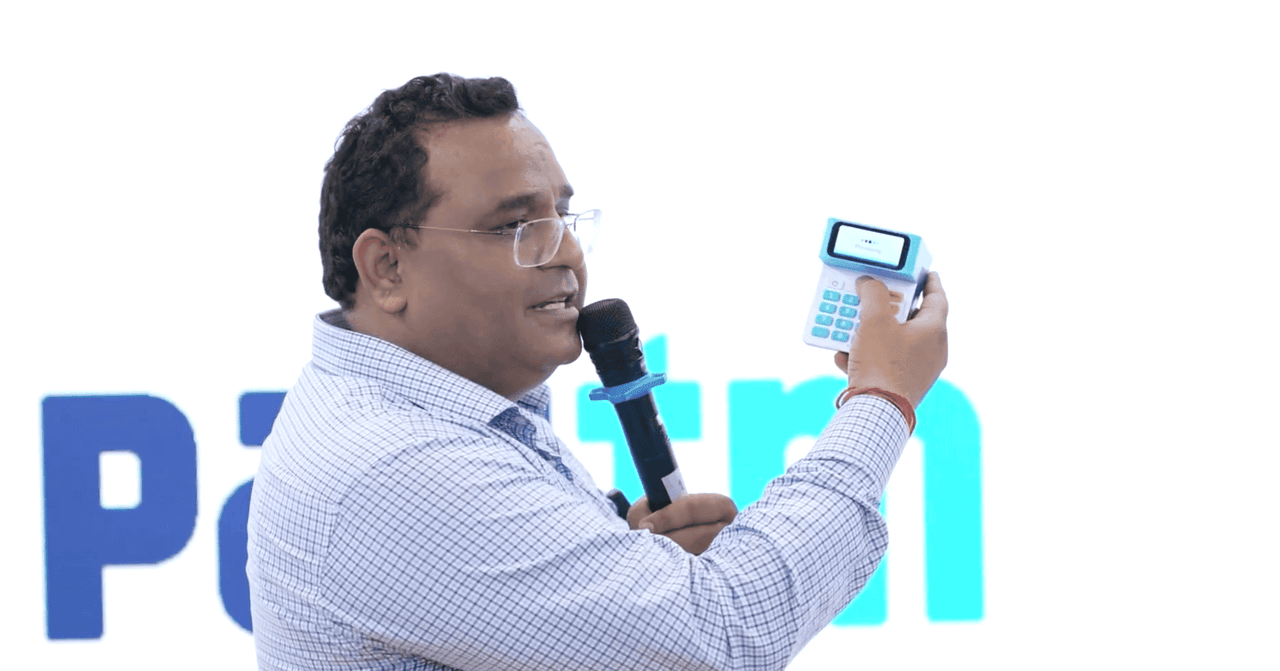

Paytm Moving to Fee-Based Model: CEO Vijay Sharma

Speaking at Paytm's Annual General Meeting Founder and CEO Vijay Shekhar Sharma said that the fintech company was moving towards a fee-based model and intends to focus on its core payments business. He stated that Paytm aims to create a profitable, sustainable, cash-generating and scalable business. Sharma charted out Paytm's strategy to achieve this in the future. The company now intends to move to a "fee-based business model" that Sharma believed was "scalable." Paytm plans to generate revenue by charging subscription fees for its soundbox (device that announces payment confirmation), as well as fees for loans distributed through banks and non-banking financial companies, and credit card transactions. Sharma also stated that it planned to reapply for a payment aggregator license. This comes after the Ministry of Finance approved its Foreign Direct Investment (FDI) into its payments arm, Paytm Payment Services Limited (PPSL). Paytm streamlined its business in recent quarters to focus on its core payments business. It sold its entertainment ticketing business to Zomato for Rs 2,048 crore in August this year and withdrew Paytm General Insurance Limited's (PGIL) application for registering as a general insurance company with the Insurance Regulatory and Development Authority of India (IRDAI). Sharma stated that the company would follow compliance in "letter and spirit" in the coming quarter. The company has faced regulatory action in the past for non-compliance. The RBI banned the now defunct Paytm Payments Bank Limited (PPBL) in 2022, from carrying out a range of activities, including accepting deposits, carrying out fund transfers, and performing credit transactions, due to non-compliance. Paytm attributed, in part, its loss in revenue in the last quarter to the disruption of these PPBL products. Similarly, the Securities and Exchange Board of India (SEBI) also issued a warning to OCL for lack of compliance in related party transactions ("RPTs") with PPBL. In its financial results for Q4FY24 and Q1FY25, Paytm revealed that SEBI issued show-cause notices to Sharma and various other board members for alleged misrepresentation of facts during its Initial Public Offering (IPO). Paytm intends to cater to the market for merchants in India. Sharma said that acquiring merchants would enable them to cross-sell a range of products. This means the company intends to sell its loan, insurance, or mutual fund to its onboarded merchant. In its Q1FY25 earnings, it said that it aimed to create "merchant payment innovations" and provide marketing services to merchants. It recorded 4.12 crore merchants on its platform in the same quarter, a 16% YoY increase. Merchant transactions saw a 13% YoY increase to Rs 900 crore growing . It distributed Rs 2,508 crores in merchant loans in the quarter. However, the value of personal and merchant loans distributed decreased by 26% YoY to Rs. 5,008 crore. Sharma said that Paytm aims to make AI a core part of its business. Its team, technology, product, business, operations have already incorporated AI into its functions. He also said that these AI use cases could be used to expand Paytm's operations. However, Paytm will focus on payments for now. Paytm has suffered major losses in the past quarters. Its net loss widened to Rs 840 crore in Q1FY25, from Rs 550 crore in the previous quarter and from Rs 338 crore in the previous year. Its payments and financial services revenue declined 39% YoY, to Rs 1,164 crore from Rs 1,918 crore. Revenue from its payment services to merchants also declined 5% YoY to Rs 801 crore.

[2]

Paytm has a compliance first approach; aims to deliver profitability soon: Vijay Shekhar Sharma - Times of India

MUMBAI: Paytm has adopted a compliance first approach and is focusing on achieving profitability, founder and CEO Vijay Shekhar Sharma said at the company's 24th annual general meeting (AGM) on Thursday. "We have had a lot of learnings in the past six months. Now, we are talking compliance first business...a business that take care of every regulation fully and in letter and spirit," Sharma said. The Noida-based fintech has come under regulatory scanner after the Reserve Bank of India (RBI) flagged persistent non-compliance at its banking unit and directed the company to wind down its payments bank in January. The RBI restrictions impacted its business with losses widening to Rs 840 crore in the June quarter on a consolidated basis from Rs 358.4 crorein the year-ago period. "With commitment to the core payments business, we aim to deliver PAT (profit after tax) profitability soon," Sharma told shareholders, adding that Paytm has been able to scale its payment centric business model and the market opportunity is huge. Sharma said that artificial intelligence (AI) is the future on which payments and Paytm's business will grow. "Our team is already utilising AI across all areas -- technology, product, business and operations. Some of these technologies are so advanced that they could potentially form entire businesses on their own. However, we remain focused on our core payments business and cross-selling financial services," Sharma said. Paytm will apply for a payment aggregator license with the RBI, Sharma added. Last month, the company had received approval from the finance ministry to invest in its payment services business. Post the grant of license by RBI, Paytm will be able to add new online merchants which was under embargo.

[3]

Paytm To Shift Focus From EBITDA Before ESOP To PAT For Better Clarity

Sharma also said that the company would apply for a payment aggregator licence with RBI in due course Paytm will now shift its focus from EBITDA before ESOP to profit after tax (PAT), a move aimed at offering a clearer view of the company's overall financial health. While intimating about Paytm's strategic pivot during the annual general meeting today (September 12), founder and managing director Vijay Shekhar Sharma underscored the company's commitment to demonstrating genuine financial performance and operational maturity. "My board members advised me to shift the focus from EBITDA before ESOP as a benchmark to PAT. We recognise that EBITDA before ESOP, due to its large ESOP charge, provides only a partial picture of our financial health. Our commitment is now to focus on PAT, reflecting our drive towards true profitability," Sharma said. EBITDA, short for earnings before interest, taxes, depreciation, and amortization, is an alternate measure of profitability to net income. It's used to assess a company's profitability and financial performance. Sharma also said that the company would apply for a payment aggregator licence with RBI in due course. Paytm's CEO reaffirmed the company's focus on its core payments business while expanding into financial services like loans, mutual funds, and insurance to drive profitability. He emphasised that Paytm is harnessing AI to develop innovative technologies, which have already been integrated across all business segments. He said that AI will revolutionise industries, with early adopters gaining a significant competitive edge. Sharma also forecasted that India will emerge as a global leader in financial technology within the next five years, with a responsibility to lead advancements in AI. He further acknowledged the growing demand for Paytm to establish an AI-powered risk management committee, reflecting forward-looking expectations. Paytm saw its consolidated net loss widen 134% year-on-year to INR 840.1 C in the June quarter (Q1) of the financial year 2024-25 (FY25) as compared to INR 358.4 Cr in the year ago-period. Revenue from operations also declined 36% in Q1 FY25 to INR 1,502 Cr from INR 2,342 Cr in the corresponding quarter last year.

[4]

Paytm To Reapply For Payment Aggregator Licence: Vijay Shekhar Sharma

Paytm's payment business revenue stood at INR 900 Cr during the quarter under review, which took a hit due to disruption of Paytm Payments Bank products, among other things, the company had said in its Q1 FY25 earnings release Shares of fintech giant Paytm climbed over 2% during early trading hours today after founder and managing director Vijay Shekhar Sharma reiterated the company's intention to resubmit application for a payment aggregator (PA) licence with the Reserve Bank of India. "We will apply for a payment aggregator licence with RBI in due course," Sharma said at Paytm's 24th annual general meeting. The Paytm CEO also reiterated the company's commitment to focus on its core payment business and cross-selling financial services as it seeks to achieve profitability. In its Q1 FY25 earnings statement, Paytm had said that it is eyeing at least one profitable quarter this fiscal year. This comes days after Paytm received approval from the Centre, the finance ministry and the department of financial services to invest INR 50 Cr in its payments arm, Paytm Payments Bank. In an exchange filing, the company then said that it would reapply for a payment aggregator licence with India's banking regulator. It is pertinent to note that Paytm incorporated Paytm Payment Services to secure a PA licence. While the company initially tried to get the PA licence in 2020, the RBI directed it to resubmit the application to ensure compliance with the FDI rules. At Paytm's 2024 AGM, Sharma also said that the company is committed to integrate artificial intelligence into its core payment business as it seeks to cut operating costs. Paytm previously said that it aims to reduce employee costs by an estimated INR 400-500 Cr every year. Paytm saw its consolidated net loss widen 134% year-on-year to INR 840.1 C in the June quarter (Q1) of the financial year 2024-25 (FY25) as compared to INR 358.4 Cr in the year ago-period. Revenue from operations also declined 36% in Q1 FY25 to INR 1,502 Cr from INR 2,342 Cr in the corresponding quarter last year. Paytm's payment business revenue stood at INR 900 Cr during the quarter under review, which took a hit due to disruption of Paytm Payments Bank products, among other things, the company had said in its Q1 FY25 earnings release.

[5]

Paytm AGM: One97 Communications share price in green as CEO confirms plans to reapply for payment aggregator license | Mint

Paytm share price: Shares of One97 Communications, the parent company of Paytm, saw a 2 per cent increase during early trading hours after CEO and founder Vijay Shekhar Sharma reiterated the company's intention to reapply for a payment aggregator (PA) license with the Reserve Bank of India (RBI). Sharma confirmed in a statement, "We will apply for a payment aggregator license to RBI in due course." Recently, Paytm received approval from the Ministry of Finance to invest in its payment services business. According to a company filing, "PPSL has received approval from the government of India, Ministry of Finance, Department of Financial Services, vide its letter dated August 27, 2024, for downstream investment from the company into PPSL." With this approval, Paytm Payments Services Limited (PPSL) plans to resubmit its application for a PA license. In the meantime, the company will continue providing online payment aggregation services to existing partners. Paytm's earlier application for a PA license was rejected by the RBI in November 2022, with instructions to reapply in compliance with Press Note 3 under the foreign direct investment (FDI) norms. Press Note 3 mandates government approval for investments from nations that share land borders with India. "India stands at a stage where the whole world is talking about the country's payments and its digital revolution," said Sharma. "We, as a nation, have leapfrogged to become leaders in financial technology, and now we have the opportunity and obligation to extend that leadership into AI technology. Paytm is committed to lead the industry with our advanced AI capabilities." Sharma explained that Paytm now focuses on its core businesses -- payments and financial services distribution. The company also sees the potential to reduce costs by incorporating AI technology into its operations. Sharma added that the board had advised shifting focus from EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) before ESOP (Employee Stock Ownership Plan) to PAT as a more comprehensive measure of the company's financial health. "Our commitment is now to focus on PAT, reflecting our drive towards true profitability," Sharma said. Despite these plans, One97 Communications reported a wider consolidated net loss for the first quarter of FY25. The Q1FY25 net loss expanded to ₹839 crore, more than double the ₹357 crore loss from the same period a year ago, primarily due to the impact of RBI-imposed restrictions on its payments bank business. Revenue from operations dropped 36 per cent year-over-year to ₹1,502 crore in Q1FY25, down from ₹2,342 crore in the corresponding period last year. In response to rising losses, Paytm has implemented cost-cutting measures, including plans to save ₹400- ₹500 crore annually in employee-related expenses. The company also reported a reduction in ESOP costs, which fell to ₹247 crore, as many stock options lapsed due to layoffs and resignations.

[6]

Paytm AGM: Vijay Shekhar Sharma Says Will Reapply For RBI Payment Aggregator Licence, Shares Jump - News18

Paytm AGM: One 97 Communications, Paytm parent, saw its shares rise two percent in the morning session as CEO and founder Vijay Shekhar Sharma reiterated the intention to reapply for a payment aggregator (PA) licence to Reserve Bank of India in due course. "We will apply for payment aggregator license to RBI in due course," said Vijay Shekhar Sharma. Paytm recently got the Finance Ministry's approval to invest in its payment services business. "We would like to inform you that PPSL has received approval from the government of India, Ministry of Finance, Department of Financial Services, vide its letter dated August 27, 2024, for downstream investment from the company into PPSL. "With this approval in place, PPSL will proceed to resubmit its PA application. In the meantime, PPSL will continue to provide online payment aggregation services to existing partners," Paytm filing said earlier. The Reserve Bank of India (RBI) had rejected Paytm's PA licence permit application in November 2022 and instructed the company to reapply with Press Note 3 compliance under the foreign direct investment norms. As per Press Note 3, the government had made its prior approval mandatory for investments from nations that share land borders with India. "We would like to inform you that PPSL has received approval from the Government of India, Ministry of Finance, Department of Financial Services, vide its letter dated August 27, 2024, for downstream investment from the Company into PPSL," the company said in a filing. On Achieving PAT Profitability The Paytm CEO announced the company's commitment to achieving PAT profitability during the Paytm AGM. "India stands at a stage where the whole world is talking about the country's payments and its digital revolution," added Sharma. "We, as a nation, have leapfrogged to become leaders in financial technology, and now we have the opportunity and obligation to extend that leadership into AI technology. Paytm is committed to lead the industry with our advanced AI capabilities." Today, Paytm's focus is on its core business - payments and distribution of financial services. However, the firm sees an opportunity to cut down costs with the adoption of AI . "My board members advised me to shift the focus from EBITDA before ESOP as a benchmark to PAT (Profit After Tax). We recognise that EBITDA before ESOP, due to its large ESOP charge, provides only a partial picture of our financial health. Our commitment is now to focus on PAT, reflecting our drive towards true profitability," added Sharma. For the first quarter of FY25, One 97 Communications reported its Q1FY25 consolidated net loss widened two-and-half times to Rs 839 crore from Rs 357 crore a year ago, as the company continues to cope with the impact the RBI curbs shutting the payments bank business. The fintech firm's revenue from operations declined 36 percent to Rs 1,502 crore in Q1FY25 as against Rs 2,342 crore in the year-ago period. In response to escalating losses, PayTM had launched an aggressive plan to save Rs 400-Rs 500 crore annually on employee costs. Further, the ESOP cost was down at Rs 247 crore as many were lapsed on the back of layoffs and resignations. At 10 am, Paytm shares were quoting Rs 681.05 on the NSE, higher by 2.2 per cent compared to the previous session's closing price.

Share

Share

Copy Link

Paytm, led by CEO Vijay Shekhar Sharma, announces strategic changes including a move to a fee-based model, focus on core payment business, and plans to reapply for a payment aggregator license. The company aims for profitability and improved financial clarity.

Paytm's Strategic Shift to Fee-Based Model

Paytm, one of India's leading digital payment platforms, is undergoing significant strategic changes as announced by CEO Vijay Shekhar Sharma. The company is moving towards a fee-based model and refocusing on its core payment business

1

. This shift comes as Paytm aims to strengthen its financial position and adapt to evolving market conditions.Emphasis on Compliance and Profitability

Sharma emphasized Paytm's commitment to a "compliance-first approach" in its operations. The company is actively working towards achieving profitability, with a particular focus on delivering value to its shareholders

2

. This approach aligns with the increasing regulatory scrutiny in the fintech sector and demonstrates Paytm's dedication to maintaining high standards of corporate governance.Changes in Financial Reporting

In a move to provide greater transparency and clarity on its financial performance, Paytm is shifting its focus from EBITDA before ESOP to Profit After Tax (PAT)

3

. This change in reporting metrics is expected to offer investors and stakeholders a more accurate picture of the company's profitability and financial health.Related Stories

Reapplication for Payment Aggregator License

A significant development in Paytm's regulatory compliance efforts is its plan to reapply for a payment aggregator license

4

. This move comes after the company's previous application was returned by the Reserve Bank of India (RBI) with certain observations. Sharma confirmed this intention during Paytm's Annual General Meeting (AGM), highlighting the company's commitment to meeting regulatory requirements5

.Market Response and Future Outlook

The announcement of these strategic changes has been received positively by the market, with Paytm's share price showing an upward trend following the AGM

5

. As Paytm navigates through these transitions, the focus remains on strengthening its core business, ensuring regulatory compliance, and working towards sustainable profitability. The company's ability to adapt to regulatory challenges while maintaining its market position will be crucial in shaping its future in the competitive digital payments landscape.References

Summarized by

Navi

[1]

Related Stories

Paytm's Vijay Shekhar Sharma Outlines Future Plans for Sustainable Profitability

22 Aug 2024

Paytm's AI-First Transformation: Vijay Shekhar Sharma's Vision for India's AI Future

12 Jul 2025•Business and Economy

Paytm Partners with Groq to Power AI-Driven Financial Services Revolution

05 Nov 2025•Business and Economy

Recent Highlights

1

Samsung unveils Galaxy S26 lineup with Privacy Display tech and expanded AI capabilities

Technology

2

Anthropic refuses Pentagon's ultimatum over AI use in mass surveillance and autonomous weapons

Policy and Regulation

3

AI models deploy nuclear weapons in 95% of war games, raising alarm over military use

Science and Research