Positron raises $230M Series B to challenge Nvidia with energy-efficient AI chips at $1B valuation

3 Sources

3 Sources

[1]

EXCLUSIVE: Positron raises $230M Series B to take on Nvidia's AI chips | TechCrunch

Semiconductor startup Positron has secured $230 million in Series B funding, TechCrunch has exclusively learned. The semiconductor startup plans to use the capital to speed up deployment of its high-speed memory chips, a critical component for the chips used for AI workloads, sources familiar with the matter told TechCrunch. Investors in the round include Qatar Investment Authority (QIA), the country's sovereign wealth fund, which has been increasingly focused on building out AI infrastructure, the sources said. The Reno-based startup's Series B comes as hyperscalers and AI firms push to reduce their reliance on longstanding leader Nvidia. These firms include OpenAI, which, despite being one of Nvidia's largest and most important customers, is reportedly unsatisfied with some of the firm's latest AI chips and has been seeking alternatives since last year. Meanwhile, Qatar, through QIA, has been accelerating a broader push into so-called "sovereign" AI infrastructure - a priority repeatedly underscored at Web Summit Qatar in Doha this week. Several sources told TechCrunch the country views compute capacity as critical to staying competitive on the global economic stage, and is positioning itself as a leading AI services hub in the Middle East, fueling interest in startups like Positron. The strategy is already taking shape through major commitments, including a $20 billion AI infrastructure joint venture with Brookfield Asset Management that was announced in September. Positron's fundraise brings the three-year-old startup's total capital raised to just over $300 million. The startup previously raised $75 million last year from investors including Valor Equity Partners, Atreides Management, DFJ Growth, Flume Ventures and Resilience Reserve. The company claims its first-generation chip Atlas, manufactured in Arizona, can match the performance of Nvidia's H100 GPUs for less than a third of the power. Positron is focused on inference - computing needed to run AI models for real-world applications - rather than training large language models, positioning the company as demand surges for inference hardware as businesses increasingly shift focus from building large models to deploying them at scale. Sources tell TechCrunch that beyond its memory capabilities, Positron's chips also perform strongly in high-frequency and video-processing workloads. TechCrunch has reached out to Positron for more information.

[2]

AI Chip Startup Positron Raises $230 Million From Arm, Qatar to Compete With Nvidia

Positron's CEO Mitesh Agrawal said the company wants to match Nvidia on product cadence, and that its chip will have more memory attached than Nvidia's Rubin chip, which will make it perform well when reasoning and video models answer queries. AI chip startup Positron, which is trying to compete with Nvidia Corp., raised $230 million in a funding round from investors including Arm Holdings Plc and the Qatar Investment Authority. The round values the company at more than $1 billion, including funds raised, Chief Executive Officer Mitesh Agrawal said in an interview. The round was co-led by Arena Private Wealth, formerly Objective Capital Management, Positron customer Jump Trading, and Unless. Helena, as well as previous investors including Valor Equity Partners, Atreides Management and DFJ Growth, also participated. Positron, based in Reno, Nevada, is trying to compete with Nvidia by offering energy-efficient AI chips for inference, or running AI models. The company, which also has listed Cloudflare Inc. and Parasail as customers, is currently selling a first version of its product based on existing reprogrammable chip technology. The second version is being designed from the ground up, and the company expects to have that done by September or October. "In an ideal world we want to match Nvidia on product cadence," Agrawal said. "That's one of the things that AI silicon companies haven't done in the past." Positron's chip will have more memory attached than Nvidia's Rubin chip, which comes out later this year, he said. That will make Positron's product perform well when reasoning and video models answer queries, he said. Agrawal said the company wasn't trying to raise money until Jump, a proprietary trading firm, tested Positron's first-generation product and became interested in its plan for the next chip. Jump's chief technology officer suggested the company invest. Arena knew Agrawal from its investment in Lambda, a so-called neocloud company, where Agrawal served as chief operating officer. Nvidia's chips are the dominant products to training and run AI models, but that will change, said Alex Davies, Jump's CTO. "We don't think there's going to be one winner," Davies said. "I don't think in five years' time there's going to be one company making a piece of hardware that everyone does inference on." Jump often has tasks where it needs access to more memory and where it can't get endless amounts of power, making Positron's design appealing. "We look a bit more like a customer that has constraints, rather than an OpenAI or an Anthropic who are just putting infinite power into buildings." Recent interest in companies that make AI chips that can perform some inference tasks better, faster or cheaper is boosting enthusiasm for AI chip makers like Positron. There's also so much demand for semiconductors to power AI that companies like OpenAI are signing deals with various vendors. In December, Nvidia signed a license with AI chip startup Groq for a reported $20 billion and hired most of that company's chip engineers, while last month OpenAI reached a multiyear deal to use hardware from Cerebras Systems Inc. for 750 megawatts' worth of computing power. The deals signal an opening for products other than Nvidia's chips if they can offer an advantage in performance per dollar or performance per watt of energy. Buyers are now more willing to have AI data centers that aren't all based on Nvidia's chips. "What folks are saying is, especially on the inference side, because the demand is growing so much, we are OK with heterogeneous architectures," Agrawal said. "The workloads are so large that, if you can save whatever percentage, it's worth it."

[3]

Positron AI raises $230M at over $1B valuation to build energy-efficient AI accelerator hardware - SiliconANGLE

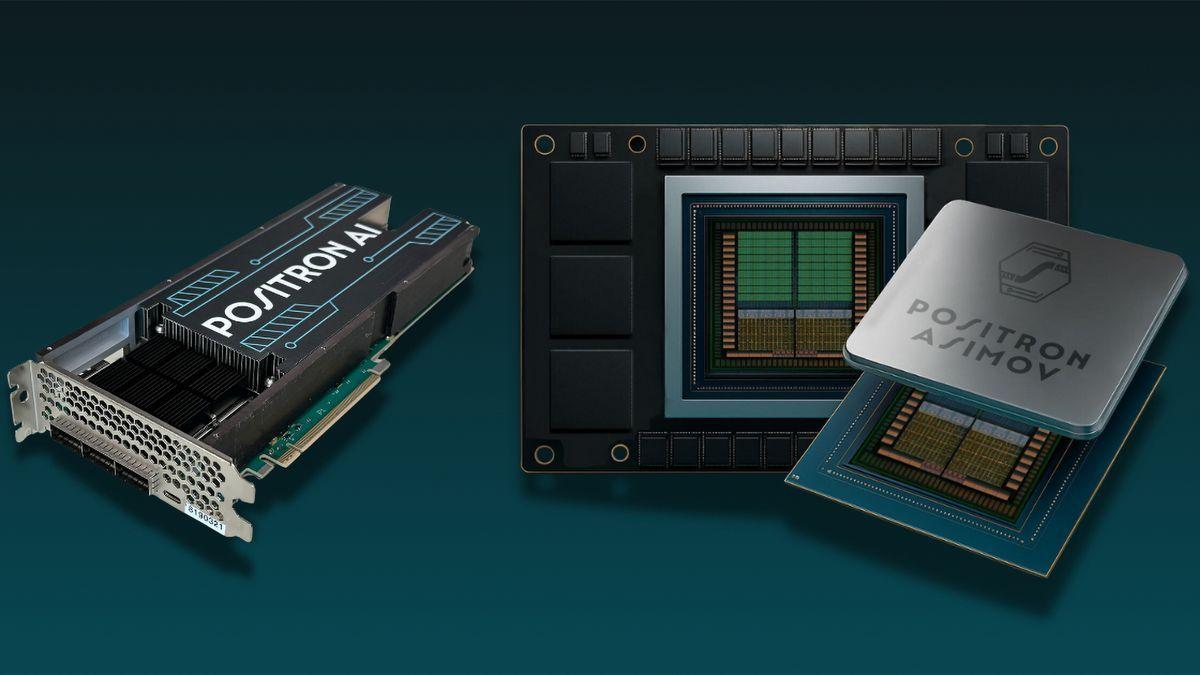

Positron AI raises $230M at over $1B valuation to build energy-efficient AI accelerator hardware Positron AI, a builder of custom silicon and hardware for energy-efficient artificial intelligence inference, today announced it raised an oversubscribed $230 million Series B funding round at a $1 billion valuation. The round was co-led by Arena Private Wealth, Jump Trading and Unless, with participation from new and strategic investors Qatar Investment Authority, Arm and Helena. Existing investors joining the round included Valor Equity Partners, Atreides Management and DFJ Growth, among others. "Energy availability has emerged as a key bottleneck for AI deployment," said Mitesh Agrawal, chief executive of Positron. "And our next-generation chip will deliver 5x more tokens per watt in our core workloads versus Nvidia's upcoming Rubin GPU." Continuing the comparison to AI chip and graphics processing unit, Nvidia Corp.'s Rubin, Agrawal said memory is the next bottleneck in inference. Asimov, the custom silicon developed by Positron, ships in early 2027 and will roll out with over 2,304 gigabytes of RAM per device compared to just 384 gigabytes on Rubin. "This will be a critical differentiator in workloads including video, trading, multi-trillion parameter models and anything requiring an enormous context window," Agrawal said. He added that he expected Positron's custom silicon to beat Rubin in performance per dollar for specific memory-intensive workloads. Nvidia unveiled its most recent flagship GPU chip, Rubin, at CES 2026, built with 336 billion transistors, which can provide around 50 petaflops of performance when processing NVFP4 data. Positron said it is building an infrastructure layer to make AI useful at scale by lowering the cost and power required to run models. The company's current product is Atlas, an inference system for rapid deployment and scaling built entirely in American-fabricated systems. "Memory bandwidth and capacity are two of the key limiters for scaling AI inference workloads for next-generation models," said Dylan Patel, founder and CEO of SemiAnalysis LLC, an advisor and investor in Positron. The company said Asimov is designed around a reality of AI models: they depend more heavily on memory bandwidth than sheer compute. Asimov aims to support 2 terabytes of memory per accelerator and 8 terabytes of memory per Titan system at a similar realized bandwidth compared to Rubin GPUs. In the GPU and AI chip space, Nvidia is the company to beat. According to market reports, although the company is facing competition, Nvidia currently holds a market share of around 85% with competitors such as Advanced Micro Devices and Qualcomm. As the next closest rival, AMD holds only 7% of the market, and grew 0.8% in the third quarter of 2025, showing how much weight Nvidia currently throws around. Positron AI builds purpose-built AI hardware and software to dramatically reduce energy costs for inference. The company said it expects its roadmap with Asimov will position it as one of the fastest-growing companies and give it strong commercial traction, which it has already seen working with multiple "frontier customers" across cloud, advanced computing and performance-sensitive industries. Additionally, the company said it is building its platform with an ecosystem with industry leaders, including Arm Holdings plc, Super Micro Computer, Inc. and other key technology and supply-chain partners.

Share

Share

Copy Link

Semiconductor startup Positron has raised $230 million in Series B funding at over $1 billion valuation to accelerate development of energy-efficient AI chips. Backed by Qatar Investment Authority and Arm Holdings, the Reno-based company claims its upcoming Asimov chip will deliver five times more tokens per watt than Nvidia's Rubin GPU while offering six times more memory capacity for inference workloads.

Positron Secures $230M Series B Funding to Compete in AI Chips Market

Semiconductor startup Positron has closed an oversubscribed $230 million Series B funding round at a valuation exceeding $1 billion, bringing the three-year-old company's total capital raised to just over $300 million

1

. The Positron Series B funding was co-led by Arena Private Wealth, Jump Trading, and Unless, with participation from strategic investors including Qatar Investment Authority, Arm Holdings, and Helena2

. Existing investors Valor Equity Partners, Atreides Management, and DFJ Growth also joined the round3

.

Source: Bloomberg

The Reno-based company plans to use the capital to accelerate deployment of its high-speed memory chips, critical components for AI inference chips that power real-world applications

1

. CEO Mitesh Agrawal emphasized that energy availability has emerged as a key bottleneck for AI deployment, positioning Positron's technology as a solution to this growing challenge3

.Energy-Efficient AI Hardware Takes Aim at Nvidia Competitor Status

Positron is positioning itself as a Nvidia competitor by focusing on energy-efficient AI hardware specifically designed for inference computing rather than training large language models. The company's first-generation Atlas chip, manufactured in Arizona, can reportedly match the performance of Nvidia's H100 GPUs while consuming less than a third of the power

1

. This approach targets the surging demand for AI accelerator hardware as businesses shift focus from building large models to deploying them at scale.

Source: TechCrunch

The company's upcoming custom silicon, Asimov, expected to ship in early 2027, promises even more aggressive specifications. Agrawal stated that the next-generation chip will deliver five times more tokens per watt in core workloads versus Nvidia's upcoming Rubin GPU

3

. Beyond energy efficiency, Positron's chips also perform strongly in high-frequency and video-processing workloads, according to sources1

.Memory Bandwidth Emerges as Critical Differentiator for AI Chips

Positron has identified memory as the next bottleneck in inference, designing its Asimov chip around this reality. The custom silicon will ship with over 2,304 gigabytes of RAM per device, compared to just 384 gigabytes on Nvidia's Rubin GPU

3

. This sixfold advantage in memory capacity targets memory-intensive AI workloads including video processing, trading, multi-trillion parameter models, and applications requiring enormous context windows."Memory bandwidth and capacity are two of the key limiters for scaling AI inference workloads for next-generation models," said Dylan Patel, founder and CEO of SemiAnalysis and an advisor to Positron

3

. The Asimov chip aims to support 2 terabytes of memory per AI accelerator and 8 terabytes of memory per Titan system at similar realized memory bandwidth compared to Rubin GPU3

.Mitesh Agrawal stated he expects Positron's custom silicon to beat Rubin in performance per dollar for specific memory-intensive workloads, positioning the company to capture market share as reasoning and video models become more prevalent

2

.Related Stories

Qatar Investment Authority Backs Sovereign AI Infrastructure Push

The Qatar Investment Authority's participation signals the country's accelerating push into sovereign AI infrastructure, a priority repeatedly underscored at Web Summit Qatar in Doha this week

1

. Sources told TechCrunch that Qatar views compute capacity as critical to staying competitive on the global economic stage and is positioning itself as a leading AI services hub in the Middle East.This strategy is already taking shape through major commitments, including a $20 billion AI infrastructure joint venture with Brookfield Asset Management announced in September

1

. The investment in Positron aligns with Qatar's broader ambition to build out AI infrastructure independent of traditional technology powers.Market Dynamics Favor Heterogeneous AI Architectures

Positron's fundraise comes as hyperscalers and AI firms push to reduce their reliance on longstanding leader Nvidia, which currently holds approximately 85% market share in the GPU and AI chip space

3

. OpenAI, despite being one of Nvidia's largest customers, has reportedly been unsatisfied with some of the firm's latest AI chips and seeking alternatives since last year1

.Alex Davies, Jump Trading's CTO, articulated the shifting landscape: "We don't think there's going to be one winner. I don't think in five years' time there's going to be one company making a piece of hardware that everyone does inference on". Jump often has tasks requiring access to more memory bandwidth where it can't access endless amounts of power, making Positron's design appealing compared to customers like OpenAI or Anthropic with unlimited power budgets.

Agrawal noted that buyers are now more willing to have AI data centers that aren't all based on Nvidia's chips: "What folks are saying is, especially on the inference side, because the demand is growing so much, we are OK with heterogeneous architectures. The workloads are so large that, if you can save whatever percentage, it's worth it".

Recent deals signal this opening for alternative products. In December, Nvidia signed a license with AI chip startup Groq for a reported $20 billion and hired most of that company's chip engineers, while last month OpenAI reached a multiyear deal to use hardware from Cerebras Systems for 750 megawatts' worth of computing power. Positron has already secured customers including Cloudflare, Parasail, and now investor Jump Trading.

Agrawal said the company wants to match Nvidia on product cadence, something AI silicon companies haven't achieved in the past. The company is building its platform with an ecosystem including industry leaders Arm Holdings, Super Micro Computer, and other key technology and supply-chain partners

3

.References

Summarized by

Navi

Related Stories

Positron Secures $23.5 Million to Challenge NVIDIA with Made-in-America AI Chips

13 Feb 2025•Technology

Positron AI Challenges Nvidia with Energy-Efficient AI Inference Chips

29 Jul 2025•Technology

Cerebras Systems raises $1B at $23B valuation as Benchmark doubles down with $225M investment

04 Feb 2026•Business and Economy

Recent Highlights

1

Pentagon threatens Anthropic with Defense Production Act over AI military use restrictions

Policy and Regulation

2

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

3

Anthropic accuses Chinese AI labs of stealing Claude through 24,000 fake accounts

Policy and Regulation