Quant Fund Giant AQR Capital Management Embraces AI for Trading Decisions

2 Sources

2 Sources

[1]

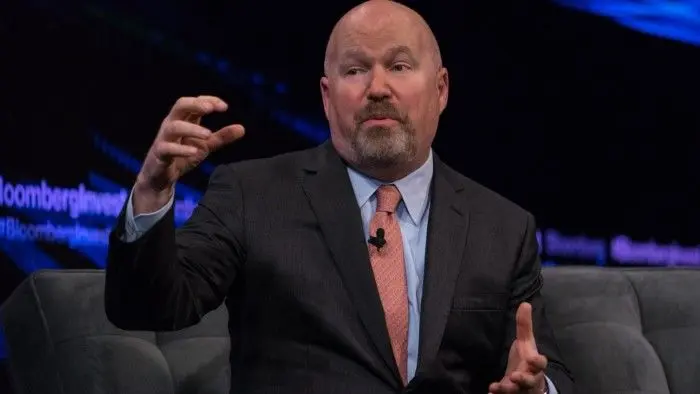

We have 'surrendered more to the machines', says quant fund titan Cliff Asness

Quant group AQR Capital Management is embracing artificial intelligence and machine learning techniques for trading decisions, ending years of reticence from one of the sector's historic holdouts. The Connecticut-based hedge fund that has $136bn under management, has "surrendered more to the machines" after years of experiments, its founder Cliff Asness told the Financial Times. "When you turn yourself over to the machine you obviously let data speak more," he said. All quantitative hedge funds -- including Two Sigma, Man Group's AHL division and Sir David Harding's Winton -- use computing power and algorithms to filter vast amounts of data and then employ sophisticated models to make investing decisions. But AQR has previously been hesitant about removing humans from trading decisions, instead favouring rules-based computer models developed by humans to target explainable market patterns. Despite first investing in broad-based machine learning technology in 2018, AQR has only more recently expanded the strategy beyond stocks to other asset classes, and is now using the technology to determine the weightings given to different factors in a portfolio at any time. The fund also now uses machine-learning algorithms to identify market patterns on which to place bets, even if in some cases it is not entirely clear why those patterns have developed. However, the firm says that in most cases it is able to find an economic rationale for the trades. While the shift has improved returns, a full-throated embrace of machine learning can have drawbacks during periods of poor performance, since it is hard to explain to panicked investors what is going wrong. Asness said embracing machine learning made the firm a "cloudy and complicated box" rather than a "black box". However he acknowledged: "It's been easier that this has been a very good period for us after a very bad period. Odds are it will be a little harder to explain [to investors] in a bad period, but we think it's clearly worth it." Returns have improved significantly since the "quant winter" of 2018 to 2020. AQR's assets dropped from $226bn to an eventual low of about $98bn in 2023, during a period in which a number of investment factors performed poorly. "What drives me most is revenge upon my enemies," Asness joked. "I want to show the world that we were right and that we can do even better. I have a chip on my shoulder about it." The group's top hedge fund strategies have performed well over the past five years, with the multi-strategy Apex fund and equity strategy Delphi delivering annualised net returns of 19 per cent and 14.6 per cent, respectively as of the end of May, according to a person familiar with the figures. But other alternative investment strategies have attracted Asness's ire, including the private equity industry, which he said had "deceived, usually wilfully", big institutional investors such as pension funds with the promise of high and stable returns, "and God forbid retail is now adding it to their portfolios too". The illiquidity and irregular valuation of private equity portfolios allowed executives to falsely claim that returns were more stable than those of public markets, he said. "There's a lot of BS out there," he said. "The ability to not report returns . . . is a feature you pay for, which bids up prices and lowers returns." Asness said the reporting gap was convenient for investors who wanted to avoid having their portfolios marked down during public market downturns, but did not mean that private equity companies matched up to a perception of high returns and low risk. As private equity groups have struggled to offload portfolio companies -- and institutional investors and endowments have become increasingly reluctant to commit new capital to the funds -- buyout companies have sought out retail investors as a new source of capital. Asness said the higher liquidity and more frequent valuations of the so-called evergreen funds into which retail investors have poured money could shatter the low risk "illusion", however. Democratising access to private assets "in this world means they give retail a worse deal than the already tough deal that they give institutional investors", Asness said.

[2]

Rage against the machines: Hedge fund titan Cliff Asness 'surrenders'...

Hot-tempered hedge fund titan Cliff Asness, who is worth a cool $2 billion according to Forbes, has admitted his AQR Capital Management has "surrendered to the machines" and fully embraced AI to make trading decisions. The 58-year-old New York-born money man, who also has admitted smashing his own computer screens in anger in the past, told the Financial Times his Connecticut-based firm is now using machine-based algorithms powered by artificial intelligence to make its bets. "When you turn yourself over to the machine you obviously let data speak more," Asness, whose firm has $136 billion worth of assets under management, was quoted by the British financial newspaper as saying. "It's been easier that this has been a very good period for us after a very bad period. Odds are it will be a little harder to explain (to investors) in a bad period, but we think it's clearly worth it. The move marks a shift in position for Asness, who had expressed skepticism in an interview with the same newspaper nearly eight years ago, saying that his firm was not ready to stand behind big data and machine learning. "We worry a lot about finding spurious patterns by data mining. In big data combined with machine learning this is even more dangerous because the data sets are so big and machine learning is so good at finding patterns," Asness said in December 2017. So-called quantitative hedge funds use supercomputers to analyze and filter reams of data and then process that information to make their investing decisions. The FT reported that AQR has recently expanded its use of AI and machine-based investing beyond stocks, despite first bringing the technology onboard in 2018. While the last time Asness's firm saw mass layoffs was in January 2020 after a poor year led to 10% of its global headcount getting the axe, Wall Street is expecting artificial intelligence to reshape the US financial industry over the next few years. A January report by Bloomberg Intelligence predicted that up to 200,000 jobs could be cut within five years thanks to the cutting-edge technology that can perform tasks in the way humans do. The study said major global banks would use AI to "streamline their operations", with back and middle office roles that perform routine items such as data entry and customer service are the most under threat. It also warned that the technology could be used to take on responsibilities typically assigned to entry-level junior bankers, such as drafting financial models and analyzing data for megabucks M&A deals. On Tuesday, the Wall Street Journal reported how Morgan Stanley had used AI to take on the translation of old, outdated coding languages, saving developers an estimated 280,000 hours of working time. That drive for efficiency is fueled by profit potential. The Bloomberg Intelligence report projects AI could boost bank pre-tax profits by 12% to 17% by 2027, adding up to $180 billion to the industry's bottom line. But Ray Dalio, the founder of the world's largest hedge fund Bridgewater Associates, has warned markets not to buy all the hype surrounding artificial intelligence. In an interview with the All-In podcast earlier this year, the 75-year-old, who has invested in AI himself, warned some investors are ignoring basic economic fundamentals, likening it the tech giant crash of the late 1990s. "This looks quite a lot like 1998 or '99," Dalio said, referencing the peak of the dot-com era. "A great company that gets expensive is much worse than a bad company that's really cheap."

Share

Share

Copy Link

AQR Capital Management, led by Cliff Asness, has shifted its stance on AI and machine learning, now fully incorporating these technologies into its trading strategies across various asset classes.

AQR Capital Management Embraces AI for Trading Decisions

Quant fund giant AQR Capital Management, led by founder Cliff Asness, has made a significant shift in its approach to artificial intelligence (AI) and machine learning technologies. The Connecticut-based hedge fund, managing $136 billion in assets, has "surrendered more to the machines" after years of experimentation

1

.The Shift to AI-Driven Trading

Source: FT

AQR's move marks a departure from its previous stance of favoring rules-based computer models developed by humans. The firm is now using machine learning algorithms to identify market patterns and determine portfolio weightings across various asset classes. This transition began in 2018 but has recently expanded beyond stocks

1

.Asness acknowledges the change, stating, "When you turn yourself over to the machine you obviously let data speak more"

2

. The shift has transformed AQR from a "black box" to what Asness describes as a "cloudy and complicated box," highlighting the increased complexity in their trading strategies1

.Impact on Performance and Investor Relations

The adoption of AI and machine learning has coincided with improved returns for AQR. The firm's top hedge fund strategies have performed well over the past five years, with the multi-strategy Apex fund and equity strategy Delphi delivering annualized net returns of 19% and 14.6%, respectively, as of May 2023

1

.However, Asness acknowledges potential challenges in explaining the new approach to investors during periods of poor performance. He states, "It's been easier that this has been a very good period for us after a very bad period. Odds are it will be a little harder to explain [to investors] in a bad period, but we think it's clearly worth it"

1

2

.Related Stories

Broader Industry Trends and Implications

Source: New York Post

AQR's shift reflects a broader trend in the financial industry towards AI adoption. A Bloomberg Intelligence report predicts that AI could boost bank pre-tax profits by 12% to 17% by 2027, potentially adding up to $180 billion to the industry's bottom line

2

.However, this technological shift also raises concerns about job displacement. The same report suggests that up to 200,000 jobs in the US financial industry could be cut within five years due to AI implementation, particularly affecting back and middle office roles

2

.Cautionary Notes

While the industry embraces AI, some veterans urge caution. Ray Dalio, founder of Bridgewater Associates, warns against ignoring basic economic fundamentals in the AI hype. He likens the current situation to the tech giant crash of the late 1990s, stating, "This looks quite a lot like 1998 or '99... A great company that gets expensive is much worse than a bad company that's really cheap"

2

.As the financial industry continues to evolve with AI integration, the balance between technological advancement and human expertise remains a critical consideration for firms like AQR and their investors.

References

Summarized by

Navi

Related Stories

Recent Highlights

1

OpenAI secures $110 billion funding round from Amazon, Nvidia, and SoftBank at $730B valuation

Business and Economy

2

Trump orders federal agencies to ban Anthropic after Pentagon dispute over AI surveillance

Policy and Regulation

3

Google releases Nano Banana 2 AI image model with Pro quality at Flash speed

Technology