AI and Self-Driving Cars Take Center Stage at CES as Automakers Shift Focus from EVs

8 Sources

8 Sources

[1]

At CES, EVs take a backseat to robotaxis and AI

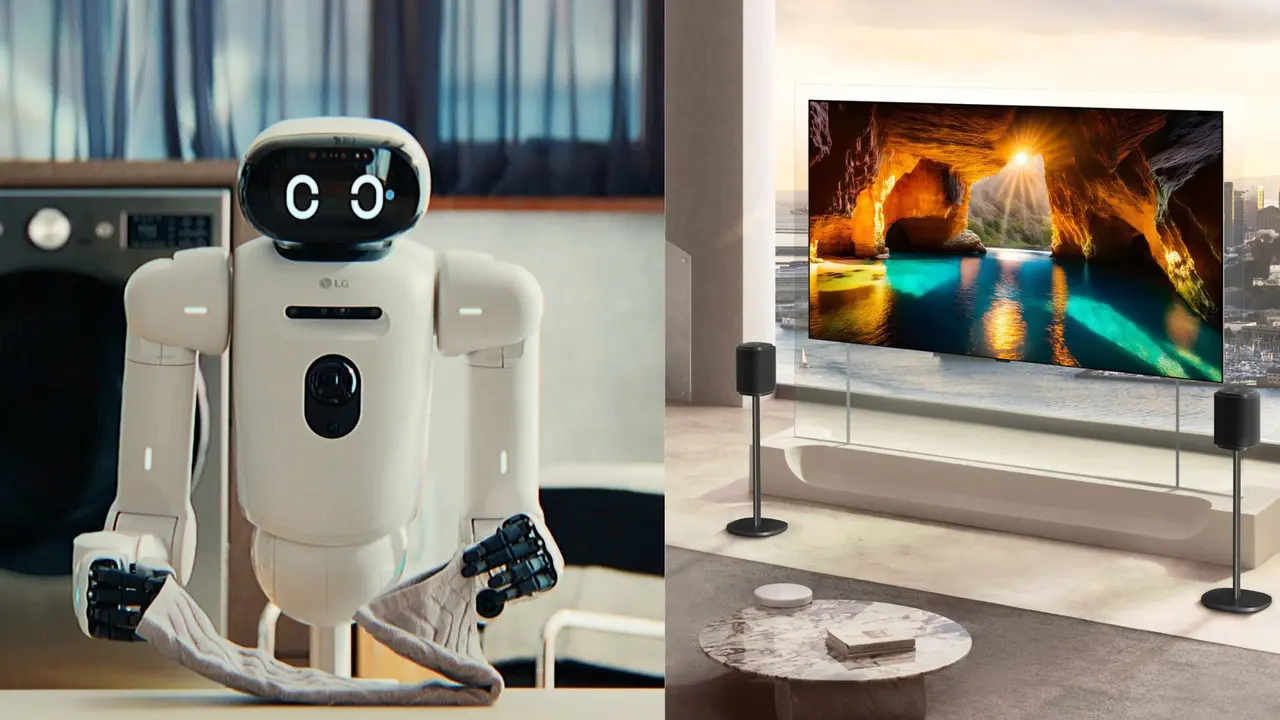

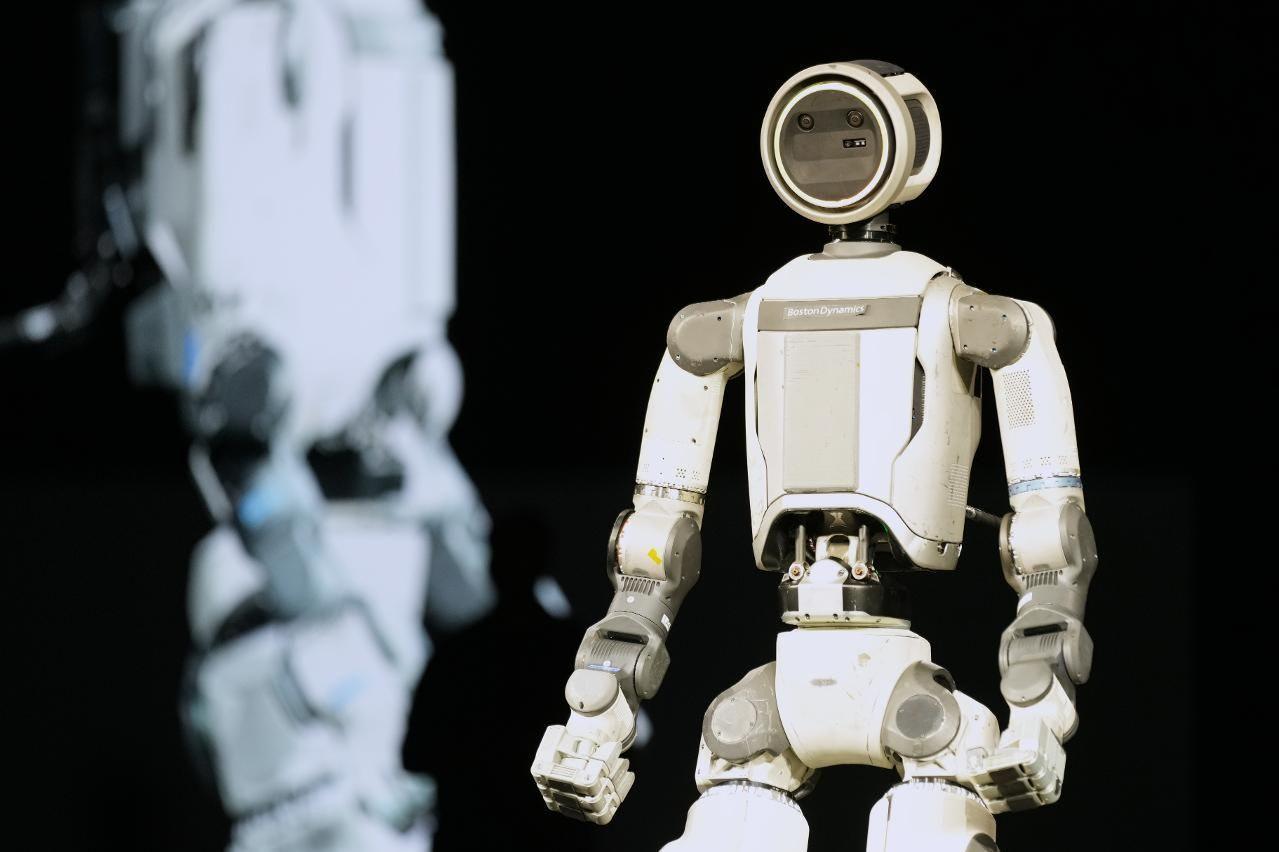

It says a lot about the current moment when one of the world's largest EV sellers shows up at the world's biggest electronics show to announce not a new, more affordable model or a cool futuristic concept car, but a humanoid robot. And one we've seen already. Hyundai's decision to use its CES keynote to tout Boston Dynamics' Atlas robot sends a pretty clear message about how the auto industry is absorbing the bad news about EVs in the United States in 2025, and where it thinks things are heading in the new year. EVs are out, and AI and robotaxis are in. In addition to Hyundai, Mercedes announced its plans to roll out its Nvidia-powered Level 2++ driver assist feature in the US later this year. Also coming in 2026 is Uber's new Lucid Gravity robotaxi, which was also on display at CES. And Nvidia, the world's biggest chipmaker and arguably the company most responsible for the current AI bubble, announced a new family of open-source models called Alpamayo, which it says will power new autonomous and driver-assistance features. CES has always been a hotbed for robots and other assorted AI ephemera, but it also used to be the hottest car show around. It's where Chevy announced its first mass-market EV, the Bolt, and where everyone from Honda to BMW to Ram would gather to show off future battery-powered concepts. You could see color-changing cars, shape-shifting vans, and even a few flying cars if you were lucky. This year, the only thing with four-wheels to make its debut was Sony and Honda's new Afeela SUV prototype. The regular Afeela was there too, five years after its initial debut and still just short of production. It shouldn't come as much of a surprise given the current dour mood around EVs. Growth in global sales is expected to slow significantly in 2026, as China winds down some EV subsidies, Europe wavers on its ban on the sale of gas cars, and the US reverses much of its own policies to get more people to buy EVs. Automakers across the board are reining in their EV plans, pivoting instead to hybrids and extended-range EVs. Meanwhile, AI continues to suck all the air out of the room. Car companies seem to think that in order to be taken seriously by Wall Streets' overly exuberant investors they need to have an AI strategy, or a chatbot, or even a humanoid robot. It's not enough to just sell cars anymore. Maybe someday CES will reemerge as a car show. Maybe when the auto industry is feeling less anxious about global trade and rising manufacturing costs, it'll be ready to give us a glimpse of the future again.

[2]

Self-driving tech, AI take center stage at CES as automakers dial back EV plans

LAS VEGAS, Jan 5 (Reuters) - Autonomous driving technology is expected to dominate the CES trade show in Las Vegas this week as investors bet that artificial intelligence will invigorate an industry beset by slow progress, high costs, safety incidents and regulatory scrutiny. Just as automakers have hit the brakes on electric vehicle (EV) plans and look for their next money maker, a slew of auto suppliers and start ups are lining up to show off their latest autonomous vehicle hardware and software. Partnerships and deals that promise to take away much of a driver's responsibilities, or remove the need for a human driver completely, are expected to be announced. "This year you will see more and more focus on AI and autonomous," said C.J. Finn, U.S. automotive industry leader for PwC, adding that how companies use AI to solve the challenge of rolling out driverless cars safely will be closely watched. "That connectivity on autonomous, I do think will be front and center." AI, though, is expected to be imbued into products well beyond autos - from robots and wearable gadgets to home devices and health technology. Tech heavyweights including AI chip giant Nvidia's (NVDA.O), opens new tab CEO Jensen Huang and AMD (AMD.O), opens new tab CEO Lisa Su are among the key speakers this year. NO ELECTRIC VEHICLES CES 2026, one of the largest technology exhibits in the United States, will run from Jan. 6 to 9 this year. Formerly called the Consumer Electronics Show and known traditionally as the launchpad for the latest in tech such as TVs, laptops and wearables, CES, in recent years, has emerged as a key destination for automakers debuting their EVs. But a pullback on EV-friendly incentives and policies by the Trump administration have dampened demand and forced many automakers to abandon plans to launch new EVs and rethink their strategy. The upheaval will be evident at CES. Most major automakers have no plans to launch any new EVs this year - a stark difference from the past few years. MONEY ON AUTONOMY Commercializing autonomous vehicles has been not been easy. High investments, regulatory challenges and investigations after collisions have forced many companies to shut down. But Tesla's launch of a small robotaxi service with safety monitors in Austin, Texas, last year as well as quicker expansion by Alphabet's (GOOGL.O), opens new tab Waymo has breathed new life into the industry. Driver-assist systems for personal vehicles have also improved, with some automakers offering hands-free driving and automatic lane change on highways. Some, such as Rivian (RIVN.O), opens new tab, aim to launch "eyes-off" functionality and self-driving on city streets. "That's starting to align with where people are putting forward their money and how they're allocating capital," Finn said. COST WORRIES LINGER Companies, especially automakers, are being strategic about capital investments after swallowing billions of dollars in write-offs due to changes in EV strategies. They are also dealing with the effects of high tariffs on auto and auto part imports imposed by U.S. President Donald Trump. Many automakers have chosen to absorb most of the cost of tariffs, instead of passing them on to customers, adding pressure on profit margins. That, along with growing competition from Chinese players, will also be top of mind for automakers at CES, said Felix Stellmaszek, global leader of the automotive and mobility sector at Boston Consulting Group. "The main theme that we actually expect to see also popping up at CES is around cost and cost competitiveness," Stellmaszek said. Reporting by Abhirup Roy in San Francisco; Editing by Sayantani Ghosh and Nick Zieminski Our Standards: The Thomson Reuters Trust Principles., opens new tab * Suggested Topics: * Autos & Transportation * ADAS, AV & Safety * EV Battery * Sustainable & EV Supply Chain Abhirup Roy Thomson Reuters Abhirup Roy is a U.S. autos correspondent based in San Francisco, covering Tesla and the wider electric and autonomous vehicle industry. He previously reported from India on global corporations, capital markets regulation, white-collar crime, and corporate litigation. Contact him at (415) 941-8665 or connect securely via Signal on abhiruproy.10

[3]

CES 2026: The auto industry's next battle is intelligence, not horsepower

As the transformation of the auto industry comes into sharper focus, CES in Las Vegas has quietly evolved from a technology showcase into a bellwether for the global car business. In recent years, CES was often jokingly described as a "world-class auto show," dominated by demonstrations of the industry's shift from internal combustion engines to electric drivetrains. However, starting in 2025, the frenzy of brand and component competition began to cool. By CES 2026, the center of gravity had unmistakably shifted. If the past five years of CES were an exhibition of electrification performance, this year marked something more profound: the moment when cars began to be treated not merely as vehicles, but as physical embodiments of AI. From specs to software At CES 2026, range figures and acceleration times -- once the core metrics of EV bragging rights -- faded into the background. As global demand for EVs slowed and government incentives were recalibrated, automakers redirected their investment toward making autonomous driving practical rather than aspirational. Ford announced that it would fully integrate AI assistants into its mobile applications by 2026, with plans to achieve "eyes-off" autonomous capability by 2028. Hyundai, for its part, centered its exhibit on a software-led strategy, highlighting its partnership with Boston Dynamics and showcasing the next-generation Atlas humanoid robot -- a signal that artificial intelligence is extending seamlessly from factory floors into vehicle cabins. The shift reflects a growing consensus among automakers: in the post-electrification era, advanced automation and intelligence, not raw performance, will be the primary source of differentiation and pricing power. Software-defined vehicles come of age At CES 2026, the idea of the software-defined vehicle (SDV) -- long a buzzword -- took on the contours of a mature commercial architecture. Great Wall Motor, which began previewing its Hi4-Z hybrid platform, semi-solid-state batteries, and intelligent driving systems at last year's event, returned this year with fully realized production models. The company showcased vehicles under its WEI, Tank, and other brands, alongside its ASL 2.0 intelligent agent, a full-scenario VLA large model, semi-solid-state battery, hydrogen fuel-cell technology, and advanced hybrid drivetrains. Geely emphasized its fourth consecutive year of progress in intelligent mobility, unveiling what it described as a mass-production-ready L3 autonomous driving solution, an "ultra-humanlike" smart cockpit, and an AI-driven digital chassis. Hyundai drew particular attention by unveiling both research and production versions of Boston Dynamics' Atlas humanoid robot, announcing plans to begin mass production in 2028 at its Georgia plant, with a target of 30,000 units annually to handle hazardous and repetitive manufacturing tasks. In the sensing and perception arena, the Chinese lidar maker Hesai Technology introduced a new generation of L3 automotive-grade sensors, including ultra-long-range and solid-state units. To meet rising demand from advanced driver-assistance systems and robotics, the company plans to double its annual production capacity to four million units in 2026. Sony Honda Mobility also made its mark, unveiling the latest iteration of its EV, the Afeela 1, slated for release in the US at the end of 2026. The company framed the car not simply as a mode of transport, but as a redefinition of the relationship between humans and mobility through intelligent driving systems. Cross-industry convergence and Taiwan's role CES 2026 also underscored the expanding boundaries of the mobility ecosystem. Advances in electric vertical takeoff and landing (EVTOL) aircraft and drone technology pointed toward the emergence of three-dimensional transportation, while solid-state batteries moved closer to scaled commercialization, including through partnerships such as that between ProLogium and the engineering firm FEV. Taiwanese companies emerged as critical enablers of this transition. Firms including FIH Mobile, AUO, and Kinpo showcased end-to-end solutions spanning high-performance computing, displays, and intelligent cockpits, reinforcing Taiwan's role as a backbone of the global semiconductor and information-technology supply chain underpinning smart mobility. In the second half of the auto industry's transformation, the contest is no longer about horsepower, but brainpower. As artificial intelligence becomes deeply embedded, the automobile is evolving from a means of transport into an intelligent terminal -- one that senses, reasons, and proactively serves its users. This shift, from hardware to software and from energy to intelligence, is poised to reshape how people move over the next five years.

[4]

AI helps pave the way for self-driving cars

Las Vegas (AFP) - Even if Elon Musk's dream of robotaxis for everyone is a long way off, sleek electric cars powered by artificial intelligence packed the Consumer Electronics Show, promising to liberate people from the tedium of driving. Letting go of the steering wheel is no longer a fantasy: Waymo's robotaxis in the United States and China's Apollo Go, which has been growing rapidly over the past year, have demonstrated the reliability of fully autonomous driving, where responsibility lies with the machine and not the human. Rivals such as Uber are fast emerging. The ride-sharing giant used the CES event in Las Vegas to debut a Lucid robotaxi, aiming to put a fleet of them to work in San Francisco later this year. Offering the fully autonomous experience -- known as Level 4 autonomy -- to vehicle owners on a mass scale remains the industry's goal. "I don't see it happening for years," said Marc Amblard, of Orsay Consulting. Only Tensor, a Silicon Valley start-up, is present in Vegas with a Level 4 passenger car. A first model is expected to hit the road in the coming months. Touted as the "first personal robot car on Earth," it is a luxury vehicle equipped with 34 cameras, five lidar lasers, and over a hundred sensors, with analysts estimating its price tag at around $200,000. Its autonomous driving will be limited. The company currently is authorized to conduct tests in California and could benefit from favorable legislation in Texas, Nevada, and Arizona, as well as its partnership in the United Arab Emirates. Roadblocks But regulatory approval and societal acceptance have remained roadblocks to self-driving cars becoming commonplace. "From a technology standpoint, it is there," said Pier Paolo Porta, marketing director at Ambarella, which specializes in autonomous driving systems. "But from a legal and from a liability standpoint, it is still a gray area." Given the roadblocks, it is in the area of Level 2 assisted driving -- where the driver must be ready to take back control -- the industry's flagship projects are flourishing. And these are going further in terms of automation, largely thanks to advances in AI that make computers more efficient with fewer expensive sensors. Driving where the steering wheel and pedals can be fully operated by a computer, while remaining legally under the driver's responsibility, is the experience already offered by Musk's Tesla in the United States with its Full Self-Driving system, and by Xiaomi and BYD in China. 'ChatGPT moment'? It is at this level of autonomy that competition is intensifying. Chip powerhouse Nvidia on Monday unveiled Alpamayo, an AI platform specially designed for autonomous driving, which will be available on electric Mercedes CLA models in the United States this year. "Alpamayo brings reasoning to autonomous vehicles, allowing them to think through rare scenarios, drive safely in complex scenarios and explain their driving decisions," Nvidia chief executive Jensen Huang said during a presentation at CES. Huang declared that a "ChatGPT moment for physical AI" was here, essentially enabling cars and robots to interact with the real world independently. During a demonstration for AFP in December, a self-driving Mercedes negotiated congested San Francisco traffic with a human safety driver only intervening to navigate around an ambulance stopped in the middle of the road. Unlike autonomous driving systems that rely on mapping data, the Alpamayo system can handle driving on streets that vehicles have not previously encountered. Nvidia rival Qualcomm was at CES with its own autonomous driving software project involving on-board AI powered by its Snapdragon chip. Nissan announced last month that it will soon integrate AI-enabled autonomous driving software from British startup Wayve in much of its vehicle line. All these innovations have the same goal: to offer the feeling of autonomy while leaving legal responsibility to human beings.

[5]

Self-driving tech, AI take center stage at CES as automakers dial back EV plans

Autonomous driving technology is expected to dominate the CES trade show in Las Vegas this week as investors bet that artificial intelligence will invigorate an industry beset by slow progress, high costs, safety incidents and regulatory scrutiny. Just as automakers have hit the brakes on electric vehicle (EV) plans and look for their next money maker, a slew of auto suppliers and start ups are lining up to show off their latest autonomous vehicle hardware and software. Partnerships and deals that promise to take away much of a driver's responsibilities, or remove the need for a human driver completely, are expected to be announced. "This year you will see more and more focus on AI and autonomous," said C.J. Finn, U.S. automotive industry leader for PwC, adding that how companies use AI to solve the challenge of rolling out driverless cars safely will be closely watched. "That connectivity on autonomous, I do think will be front and center."

[6]

CES 2026 highlights Korea's tech challenges in era of physical AI - The Korea Times

LAS VEGAS -- The CES 2026 tech fair has raised critical alarm bells for Korea's tech firms, signaling that long-term growth cannot rely merely on superficial hype over artificial intelligence (AI) and software in this rapidly evolving era of physical AI. As expected, AI took center stage at this year's tech exhibition and all the Korean manufacturing giants -- from IT to carmakers -- went all out to showcase their updated AI visions converged with hardware. This was inevitable, as the tech paradigm shift does not allow any firms to survive without the adoption of concrete AI business strategies. Samsung Electronics, LG Electronics and Hyundai Motor remain arguably the three most influential tech players for the annual tech fair, driven largely by their top-notch technological prowess in hardware. However, CES 2026 clearly showed that the old days when the Korean tech firms could ensure continued growth only with hardware-centric business models are gone. Visitors to the show could easily spot Amazon's self-driving robotaxi Zoox operating on streets near the Las Vegas Convention Center (LVCC) and major hotels during the four-day exhibition which ended on Friday. The completely self-driving robotaxi was busy carrying passengers from the show's venue to nearby hotels, and vice versa. Hyundai Motor Group also displayed its plan to initiate its self-driving service no later than this year, but the Korean carmaker is still considered a latecomer in terms of the global race for autonomous driving. The carmaker garnered massive attention at CES for its display of multiple AI-powered robots, such as the Atlas humanoid robot, but in terms of the self-driving vision, it still has a long way to go compared with market leaders such as Tesla or Waymo. Nvidia's attention-grabbing announcement of its Alpamayo open AI platform for self-driving cars also raises concerns among Korean carmakers that they could become dependent on the U.S. AI chipmaker for autonomous driving software. Samsung Electronics and LG Electronics also proved their unmatched hardware strength during this year's exhibition, focusing on promoting their own AI strategies. However, the long-established IT giants are still not regarded as strong players in software and the AI-driven global tech paradigm shift. The rapid rise of Chinese rivals also adds more challenges to the Korean firms, as a number of Chinese players have expanded their presence at the world's largest IT fair each year. TCL, a Chinese electronics maker, set up the largest exhibition hall in LVCC, displaying multiple AI-powered smart product portfolios. Geely also unveiled its Geely Afari Smart Driving (G-ASD) intelligent driving system for the first time at CES 2026, aiming to accelerate its autonomous driving capabilities. Chinese players also dominated Eureka Park, a startup-dedicated exhibition area of CES. The booth of Roborock, an intelligent robot vacuum cleaner maker, stood at the very center of the exhibition hall, attracting huge attention from visitors by showcasing multiple intelligent cleaners powered by AI. "Korean firms still have technological upsides, but the status quo cannot persist unless they map out a clearer AI and software vision to stay ahead with their Chinese rivals," an industry official said.

[7]

Concept cars eclipsed by AI hype at CES - The Korea Times

LAS VEGAS -- The global artificial intelligence (AI) frenzy has stolen the spotlight at the mobility zone at CES 2026, once dominated by concept cars and hardware that assists drivers. Fewer carmakers were seen promoting futuristic concept vehicles, apparently due to this rapid technological paradigm shift. Instead, they focused on showcasing their software-dedicated visions and strategies amid the rise of physical AI. Hyundai Motor Group has arguably drawn the most attention at this year's mobility zone, but that was driven by the carmaker's renewed AI strategy converging with robotics, rather than its technologies related to automobiles. The carmaker's auto hardware moved out of the spotlight as the company shifted its focus onto physical AI by showcasing a diverse lineup of AI-powered robots, such as the Atlas humanoid robot. This was not the case two years earlier, when Kia unveiled its much-hyped plan to tap into the industry of purpose-built vehicles (PBVs). PBVs feature interchangeable upper bodies, so vehicles can be transformed for multiple purposes by changing their top modules. However, no Hyundai Motor Group brands focused on hardware strategy at this year's CES, as the auto conglomerate pinned its strategic focus on the future of AI robotics. Most other major international carmakers skipped CES altogether. While the exhibition was once a key venue for them to showcase concept cars, the trend has lost steam in recent years. Mercedes-Benz, Volkswagen and Toyota Motor all decided not to participate in CES 2026 in an apparent view that hardware development makes little difference in this era of autonomous driving. Carmakers that are attending the tech fair have similarly put more focus on software, though each company's strategic direction differs. BMW announced its plan to equip its iX3 electric SUV with Amazon's Alexa+ in-vehicle voice assistant on the sidelines of CES 2026. The vehicle will be available for sale in the latter half of this year. China's Geely has also drawn attention for its humanoid robot's performance at its CES booth this year. Officials from the mobility zone said the rapid rise of AI has brought a major paradigm shift in the global auto industry. "Major carmakers are looking to rapidly reshape their future growth strategy in line with the two catchwords during CES 2026: AI and robots," an official from an automaker that participated in the tech fair said. "Carmakers are identifying AI as their next growth engine, and the trend has been proven by the lack of any eye-catching concept cars during CES 2026."

[8]

Self-driving tech, AI take center stage at CES as automakers dial back EV plans

LAS VEGAS, Jan 5 (Reuters) - Autonomous driving technology is expected to dominate the CES trade show in Las Vegas this week as investors bet that artificial intelligence will invigorate an industry beset by slow progress, high costs, safety incidents and regulatory scrutiny. Just as automakers have hit the brakes on electric vehicle (EV) plans and look for their next money maker, a slew of auto suppliers and start ups are lining up to show off their latest autonomous vehicle hardware and software. Partnerships and deals that promise to take away much of a driver's responsibilities, or remove the need for a human driver completely, are expected to be announced. "This year you will see more and more focus on AI and autonomous," said C.J. Finn, U.S. automotive industry leader for PwC, adding that how companies use AI to solve the challenge of rolling out driverless cars safely will be closely watched. "That connectivity on autonomous, I do think will be front and center." AI, though, is expected to be imbued into products well beyond autos - from robots and wearable gadgets to home devices and health technology. Tech heavyweights including AI chip giant Nvidia's CEO Jensen Huang and AMD CEO Lisa Su are among the key speakers this year. NO ELECTRIC VEHICLES CES 2026, one of the largest technology exhibits in the United States, will run from Jan. 6 to 9 this year. Formerly called the Consumer Electronics Show and known traditionally as the launchpad for the latest in tech such as TVs, laptops and wearables, CES, in recent years, has emerged as a key destination for automakers debuting their EVs. But a pullback on EV-friendly incentives and policies by the Trump administration have dampened demand and forced many automakers to abandon plans to launch new EVs and rethink their strategy. The upheaval will be evident at CES. Most major automakers have no plans to launch any new EVs this year - a stark difference from the past few years. MONEY ON AUTONOMY Commercializing autonomous vehicles has been not been easy. High investments, regulatory challenges and investigations after collisions have forced many companies to shut down. But Tesla's launch of a small robotaxi service with safety monitors in Austin, Texas, last year as well as quicker expansion by Alphabet's Waymo has breathed new life into the industry. Driver-assist systems for personal vehicles have also improved, with some automakers offering hands-free driving and automatic lane change on highways. Some, such as Rivian, aim to launch "eyes-off" functionality and self-driving on city streets. "That's starting to align with where people are putting forward their money and how they're allocating capital," Finn said. COST WORRIES LINGER Companies, especially automakers, are being strategic about capital investments after swallowing billions of dollars in write-offs due to changes in EV strategies. They are also dealing with the effects of high tariffs on auto and auto part imports imposed by U.S. President Donald Trump. Many automakers have chosen to absorb most of the cost of tariffs, instead of passing them on to customers, adding pressure on profit margins. That, along with growing competition from Chinese players, will also be top of mind for automakers at CES, said Felix Stellmaszek, global leader of the automotive and mobility sector at Boston Consulting Group. "The main theme that we actually expect to see also popping up at CES is around cost and cost competitiveness," Stellmaszek said. (Reporting by Abhirup Roy in San Francisco; Editing by Sayantani Ghosh and Nick Zieminski)

Share

Share

Copy Link

CES 2026 marks a turning point for the auto industry as AI and autonomous driving technology dominate the Las Vegas trade show. With automakers dialing back EV plans amid slowing demand, the focus has shifted to robotaxis, software-defined vehicles, and AI assistants. Companies like Nvidia, Hyundai, and Mercedes are betting on intelligence over horsepower to drive the future of mobility.

Auto Industry Shift Takes Center Stage at CES

CES 2026 in Las Vegas has revealed a stark transformation in the auto industry's priorities. Where electric vehicles once dominated the trade show floor, AI and self-driving cars now command attention as automakers dial back EV plans and redirect investments toward autonomous driving technology

1

. Hyundai's decision to showcase Boston Dynamics' Atlas humanoid robot during its keynote, rather than unveiling a new electric vehicle, signals how dramatically the industry landscape has shifted1

.

Source: Korea Times

The pullback on electric vehicles reflects broader market realities. Growth in global EV sales is expected to slow significantly in 2026 as China winds down subsidies, Europe wavers on its ban of gas cars, and the Trump administration reverses policies designed to boost EV adoption

1

. Most major automakers have no plans to launch new EVs this year, a stark difference from previous CES events where battery-powered concepts dominated2

.AI Takes Center Stage as Intelligence Replaces Horsepower

The future of mobility now centers on software rather than hardware specifications. Range figures and acceleration times have faded into the background as automakers focus on making autonomous driving practical rather than aspirational

3

. Ford announced plans to fully integrate AI assistants into its mobile applications by 2026, with "eyes-off" autonomous capability targeted for 20283

.Nvidia emerged as a central player, with CEO Jensen Huang unveiling Alpamayo, an AI platform specifically designed for autonomous driving that will power Level 2++ driver-assist features in Mercedes CLA models in the United States this year

1

4

. Huang declared this a "ChatGPT moment for physical AI," enabling cars and robotics to interact with the real world independently4

. The Alpamayo system brings reasoning to autonomous vehicles, allowing them to think through rare scenarios and explain their driving decisions4

.

Source: Japan Times

Robotaxis and Software-Defined Vehicles Drive Investment

Robotaxis represent one of the most visible manifestations of this shift. Uber used CES to debut a Lucid Gravity robotaxi, aiming to deploy a fleet in San Francisco later this year

1

4

. Tesla's launch of a small robotaxi service with safety monitors in Austin, Texas, along with quicker expansion by Waymo, has breathed new life into the industry despite high investments, regulatory challenges, and safety incidents2

.Software-defined vehicles have moved from buzzword to mature commercial architecture. Great Wall Motor showcased production models featuring its ASL 2.0 intelligent agent and full-scenario VLA large model

3

. Geely unveiled what it described as a mass-production-ready L3 autonomous driving solution and an "ultra-humanlike" smart cockpit3

. Hyundai announced plans to begin mass production of Boston Dynamics' Atlas humanoid robot in 2028 at its Georgia plant, targeting 30,000 units annually for hazardous and repetitive manufacturing tasks3

.Related Stories

Driver-Assist Systems Push Boundaries as Level 4 Autonomy Faces Hurdles

While fully autonomous Level 4 autonomy remains years away from mass-market availability, driver-assist systems are advancing rapidly

4

. Companies are focusing on Level 2 assisted driving, where the driver must be ready to take control, but automation is extending further thanks to AI advances that make computers more efficient with fewer expensive sensors4

.Regulatory approval and societal acceptance remain roadblocks to widespread adoption of fully autonomous vehicles. "From a technology standpoint, it is there," said Pier Paolo Porta, marketing director at Ambarella. "But from a legal and from a liability standpoint, it is still a gray area"

4

. Only Tensor, a Silicon Valley start-up, presented a Level 4 passenger car at CES, with a first model expected in coming months and an estimated price tag around $200,0004

.Strategic Capital Allocation Reflects Industry Priorities

Investors are betting that AI will invigorate an industry beset by slow progress, high costs, and regulatory scrutiny

2

. "This year you will see more and more focus on AI and autonomous," said C.J. Finn, U.S. automotive industry leader for PwC. "That connectivity on autonomous, I do think will be front and center"2

.Automakers are being strategic about capital investments after absorbing billions of dollars in write-offs due to changes in EV strategies

2

. They're also managing the effects of high tariffs on auto and auto part imports imposed by President Donald Trump, with many choosing to absorb costs rather than pass them to customers, adding pressure on profit margins2

. "The main theme that we actually expect to see also popping up at CES is around cost and cost competitiveness," said Felix Stellmaszek, global leader of the automotive and mobility sector at Boston Consulting Group2

.The shift from hardware to software, from energy to intelligence, positions the automobile as an intelligent terminal that senses, reasons, and proactively serves its users

3

. Car companies believe they need an AI strategy to be taken seriously by Wall Street's investors, making it no longer enough to just sell cars1

.References

Summarized by

Navi

[1]

[4]

Related Stories

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

Meta strikes up to $100 billion AI chips deal with AMD, could acquire 10% stake in chipmaker

Technology

3

Pentagon threatens Anthropic with supply chain risk label over AI safeguards for military use

Policy and Regulation