Shopify Emerges as 'Under-the-Radar' AI Player in E-Commerce, Wells Fargo Analyst Predicts

2 Sources

2 Sources

[1]

Wells Fargo calls this e-commerce stock an 'under-the-radar' AI story

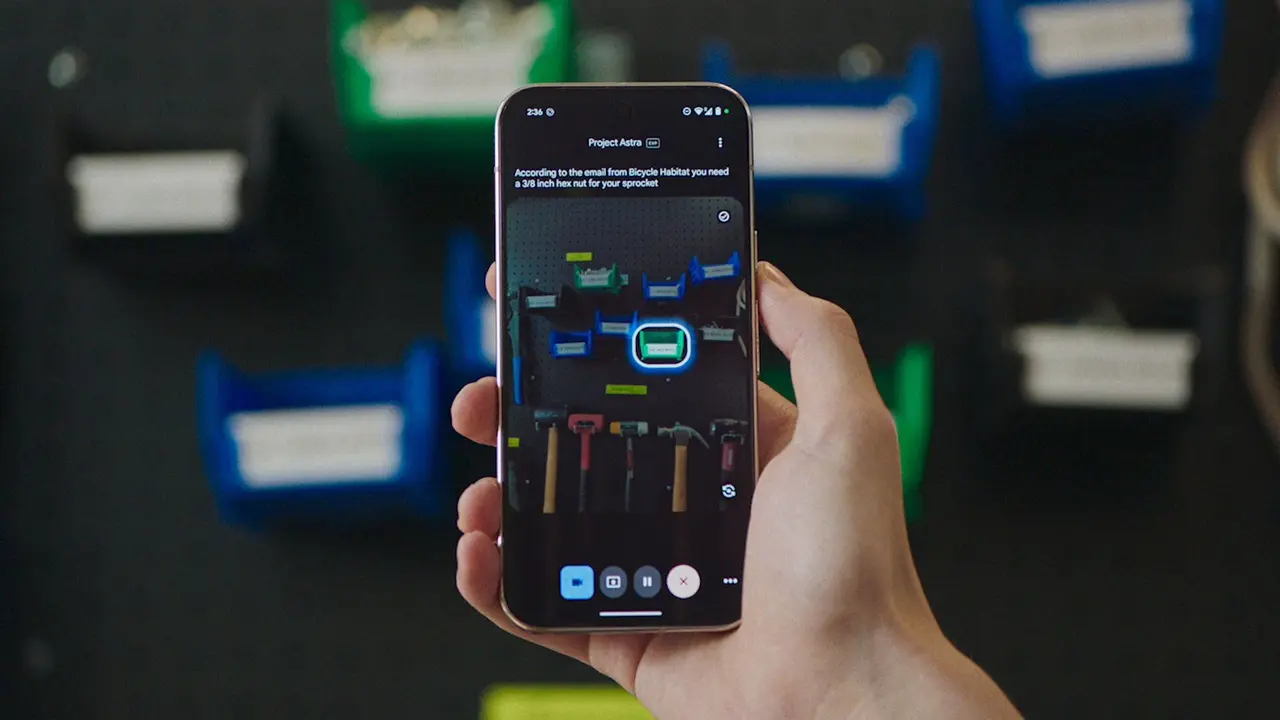

Investors should pick up shares of Shopify as the company continues to innovate in an increasingly AI-powered e-commerce industry, according to Wells Fargo. Analyst Andrew Bauch reiterated his overweight rating on Shopify shares and lifted his price target by $18 to $125, which suggests the stock has about 19% upside ahead. Bauch said Shopify has a strong product portfolio and strategic partnerships in artifical intelligence that will allow it to capture similar market share in "agentic" commerce as it does in traditional U.S. e-commerce. Agentic commerce refers to AI agents acting on behalf of the customer or business in e-commerce transactions such as managing inventory, giving customized recommendations and executing payments and other tasks. "While not typically perceived as an AI play, we believe Shopify's AI efforts are differentiated and can serve as another important growth & efficiency driver for years to come," Bauch wrote in a Friday note to clients, calling the stock an "under-the-radar AI story." "Overall, we see AI as an important piece to the Shopify story, and see the business as well-positioned to ride the wave, rather than getting knocked off course. We're taking our growth and margin estimates up modestly on alleviating tariff risks, and the multiple higher on AI confidence," he added. Shares of Shopify are up nearly 3% this year. The stock took a hit in early May after it reported mixed first-quarter results and issued a weak forecast for the current period. However, shares have jumped roughly 17% over the past month following an announcement that Shopify would be included in the Nasdaq 100 index. SHOP 1Y mountain Shopify stock over the past year. According to Bauch, Shopify can be seen as a "thematic AI story" given that its employees leverage AI internally, it offers differentiated AI-powered merchant solutions and is growing partnerships with leading AI companies such as OpenAI, Meta and Perplexity. Shopify and Meta share a longstanding partnership that allows Shopify retailers to sync their products to a catalog on Meta's Facebook and Instagram platforms, therefore growing their reach and sales opportunities. Shopify merchants can also use Meta's advertising tools to target ads and track their customers. In addition, AI-powered search engine Perplexity last year announced it will use Shopify technology for its AI-powered shopping tool called "Shop like a Pro." "While some may perceive the AI wave as a threat, we see layers of opportunity via use cases, efficiencies, and adoption," Bauch said. The analyst projected a $50 billion dollar gross merchandise value, or GMV, opportunity for agentic commerce by 2030, with roughly 30% growth annually between now and then. That, he said, is similar to the early days of e-commerce.

[2]

Shopify, Citi named signature picks at Wells Fargo By Investing.com

Investing.com -- Shopify could emerge as an under-the-radar beneficiary of the artificial intelligence boom, according to Wells Fargo (NYSE:WFC), which called the stock its signature pick, raising its price target on the stock to $125 from $107. Brokerage called the Canadian e-commerce firm a "thematic AI story." While Shopify (NASDAQ:SHOP) isn't typically viewed as an AI play, Wells Fargo said its internal AI adoption, AI-powered merchant tools, and partnerships with major players like OpenAI, Meta (NASDAQ:META), and Perplexity point to "layers of opportunity" across user experience and merchant efficiency. The brokerage expects AI to reshape e-commerce by enabling personalized shopping, automating customer service, and optimizing pricing and inventory. Shopify's positioning, it said, could allow the company to gain share in what it calls "agentic commerce," a market it estimates will reach $505 billion in gross merchandise value by 2030. Internally, CEO Tobi Lütke has mandated AI adoption across the company, limiting new hires to roles AI cannot fill today, as per analyst. Wells Fargo said this cultural shift supports Shopify's long-term margin outlook and gives it confidence in the company's ability to maintain flat headcount while growing. Meanwhile, on Citigroup (NYSE:C) was also named signature pick. Brokerage said the ongoing restructuring, including Thursday's announcement of 3,500 job cuts in Asia, highlights progress on costs, though only a fraction of financial benefits are reflected in current numbers. Citi is about three-quarters through its restructuring, Wells Fargo said, but has captured only a quarter of the expected financial gains. The firm expects expenses to fall through 2026, with efficiency ratios improving to 59% by 2027 from 72% in 2023. The confirmation of a new Federal Reserve vice chair is also seen as supportive, especially if regulatory scrutiny becomes more flexible, easing compliance burdens tied to past consent orders.

Share

Share

Copy Link

Wells Fargo analyst Andrew Bauch highlights Shopify's potential in AI-driven e-commerce, raising the price target and calling it an "under-the-radar AI story" with significant growth opportunities.

Wells Fargo Identifies Shopify as an AI Innovator in E-Commerce

Wells Fargo analyst Andrew Bauch has identified Shopify as an "under-the-radar AI story" in the e-commerce sector, highlighting the company's potential to leverage artificial intelligence for significant growth. Bauch reiterated an overweight rating on Shopify shares and increased the price target from $107 to $125, suggesting a 19% upside

1

.Shopify's AI Initiatives and Partnerships

Shopify's AI efforts are seen as differentiated and poised to drive growth and efficiency in the coming years. The company's approach to AI includes:

-

Internal AI adoption: CEO Tobi Lütke has mandated AI integration across the company, limiting new hires to roles that AI cannot currently fill

2

. -

AI-powered merchant solutions: Shopify offers innovative tools to enhance the e-commerce experience for its clients.

Source: CNBC

- Strategic partnerships: Collaborations with leading AI companies such as OpenAI, Meta, and Perplexity position Shopify at the forefront of AI integration in e-commerce

1

.

The Rise of Agentic Commerce

Wells Fargo projects a $50 billion gross merchandise value (GMV) opportunity for "agentic commerce" by 2030, with an estimated 30% annual growth rate. Agentic commerce refers to AI agents acting on behalf of customers or businesses in e-commerce transactions, including inventory management, personalized recommendations, and payment processing

1

.Shopify's Market Position and Performance

Shopify's strong product portfolio and AI partnerships are expected to help the company capture a significant market share in agentic commerce, similar to its position in traditional U.S. e-commerce. Despite mixed first-quarter results and a weak forecast for the current period, Shopify's stock has shown resilience:

- Shares are up nearly 3% this year

- The stock has jumped roughly 17% over the past month following its inclusion in the Nasdaq 100 index

1

Related Stories

AI's Impact on E-Commerce

Wells Fargo anticipates that AI will reshape e-commerce by enabling:

- Personalized shopping experiences

- Automated customer service

- Optimized pricing and inventory management

2

Long-term Outlook and Efficiency

The cultural shift towards AI adoption at Shopify is expected to support the company's long-term margin outlook. Wells Fargo expressed confidence in Shopify's ability to maintain a flat headcount while continuing to grow, thanks to AI-driven efficiencies

2

.As the e-commerce landscape evolves with AI integration, Shopify's strategic positioning and innovative approach to artificial intelligence may well position the company as a leader in the next generation of online retail technologies.

References

Summarized by

Navi

[2]

Related Stories

Shopify's AI Capabilities Drive Upgrade and Optimistic Growth Forecast

07 Dec 2024•Business and Economy

Shopify Doubles Down on AI Commerce Revolution with 7x Traffic Surge

05 Nov 2025•Business and Economy

Shopify's Q2 Earnings Soar, Boosted by AI Innovations and Strong E-commerce Demand

07 Aug 2025•Business and Economy

Recent Highlights

1

Elon Musk merges SpaceX with xAI, plans 1 million satellites to power orbital data centers

Business and Economy

2

SpaceX files to launch 1 million satellites as orbital data centers for AI computing power

Technology

3

Google Chrome AI launches Auto Browse agent to handle tedious web tasks autonomously

Technology