SoftBank and OpenAI Launch Joint Venture in Japan Amid Growing AI Investment Concerns

2 Sources

2 Sources

[1]

SoftBank, OpenAI launch new joint venture in Japan as AI deals grow ever more circular

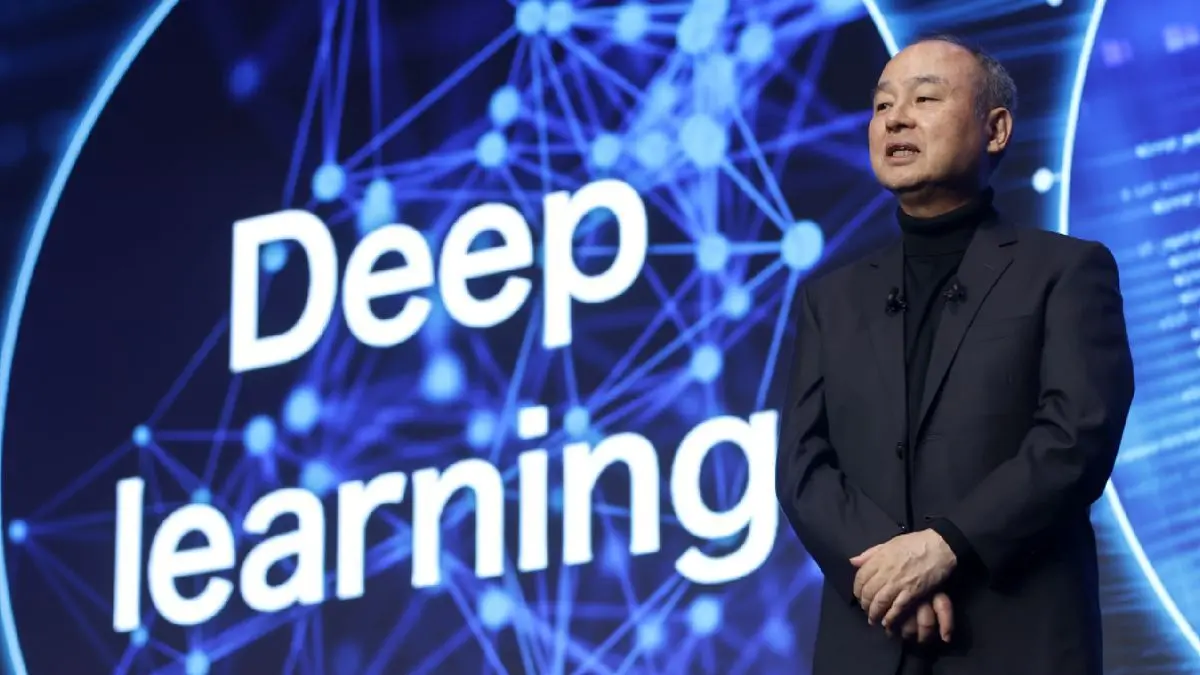

If you look at how AI deals are conducted these days, it seems AI companies and their investors are imitating the circle of life. Only, it's a circle of profit that ensures the money eventually comes back to their own coffers. Case in point: SoftBank, which is investing tens of billions into OpenAI and committing dozens more to build AI data centers and infrastructure, just launched a joint venture with the ChatGPT maker in Japan that will localize and sell the AI company's enterprise tech to companies in the country. And the first customer of this joint venture is going to be SoftBank itself. Called SB OAI Japan, the joint venture will be owned 50-50 by SoftBank and OpenAI, and will provide what the companies are calling "Crystal intelligence," which is being defined as a "packaged enterprise AI solution" targeted at corporate management and operations in Japan. "Crystal intelligence is designed to help organizations enhance productivity and management efficiency through the adoption of advanced AI tools. The solution combines OpenAI's enterprise offerings with localized implementation and support provided through SB OAI Japan," SoftBank said in a statement. It seems SoftBank is intent on fueling the AI hype cycle, and the resultant revenues: The conglomerate said all its employees are "actively utilizing AI in their daily operations," and that it has so far created 2.5 million custom ChatGPT instances for internal use. The conglomerate said it would put the joint venture's solutions to use throughout its various businesses, validate their effectiveness for product development and "business transformation," and then pass on the insights and expertise it gains to other companies back through SB OAI Japan. The joint venture comes as analysts raise concerns about the truckloads of cash being thrown at AI development and associated efforts, as well as the stratospheric valuations awarded to companies benefiting from it. The movement is being likened to the dot-com boom, when the widespread adoption of the internet resulted in a wave of venture capital and sky-high valuations, and similar booms over the past couple of decades where massive sums were spent on developing unproven business models without a clear sign of meaningful returns on investment.

[2]

SoftBank chases actual revenue with OpenAI in corporate Japan

SoftBank Group's Japanese mobile unit and OpenAI will launch AI services for local companies next year, seeking to realize real revenue in the face of growing concerns over sky-high valuations. SoftBank Corp. and Open AI are still fine-tuning the products the two companies are co-developing for Japanese enterprises, said Junichi Miyakawa, president of the country's third-largest mobile carrier. Miyakawa said he has seen a test version of the services, which once launched would "completely change" the speed in which business is done. One feature is voice recognition that would allow users to rely less on manual typing, he said. "This will become a seed of growth to look forward to next year and beyond," he said during an earnings call on Wednesday, which also marked the launch of SoftBank and OpenAI's local joint venture, SB OAI Japan.

Share

Share

Copy Link

SoftBank and OpenAI have established a 50-50 joint venture in Japan to localize enterprise AI solutions, with SoftBank becoming the first customer. The move comes as analysts raise concerns about circular AI investments and inflated valuations.

New Joint Venture Targets Japanese Enterprise Market

SoftBank and OpenAI have announced the formation of a new joint venture in Japan, marking a significant expansion of their partnership into the lucrative Japanese enterprise market. The 50-50 joint venture, named SB OAI Japan, will focus on localizing and selling OpenAI's enterprise technology to Japanese companies, with SoftBank itself serving as the first customer

1

.

Source: Japan Times

The venture will provide what the companies are calling "Crystal intelligence," described as a packaged enterprise AI solution specifically designed for corporate management and operations in Japan. According to SoftBank's statement, this solution combines OpenAI's enterprise offerings with localized implementation and support services tailored to the Japanese market

1

.Product Development and Features

Junichi Miyakawa, president of SoftBank Corp., Japan's third-largest mobile carrier, revealed that the two companies are still fine-tuning the products they are co-developing for Japanese enterprises. During an earnings call, Miyakawa described seeing a test version of the services and predicted they would "completely change" the speed at which business is conducted

2

.One notable feature of the upcoming services is advanced voice recognition technology that would allow users to rely less on manual typing, potentially streamlining business operations significantly. Miyakawa expressed optimism about the venture's prospects, stating that "this will become a seed of growth to look forward to next year and beyond"

2

.SoftBank's AI Integration Strategy

SoftBank has positioned itself as a major proponent of AI adoption, with the conglomerate stating that all its employees are "actively utilizing AI in their daily operations." The company has reportedly created 2.5 million custom ChatGPT instances for internal use, demonstrating its commitment to AI integration across its various business units

1

.The company plans to use the joint venture's solutions throughout its various businesses to validate their effectiveness for product development and business transformation. SoftBank intends to leverage the insights and expertise gained from this internal implementation to better serve other companies through SB OAI Japan

1

.Related Stories

Concerns About Circular Investment Patterns

The joint venture announcement comes amid growing analyst concerns about the circular nature of AI investments and the massive amounts of capital being deployed in the sector. SoftBank, which is investing tens of billions into OpenAI and committing additional funds to build AI data centers and infrastructure, now finds itself as both an investor in and customer of OpenAI's technology through this new venture

1

.

Source: TechCrunch

This pattern has raised questions about the sustainability of current AI valuations and investment strategies. Analysts are drawing comparisons to the dot-com boom, when widespread internet adoption led to a wave of venture capital investment and sky-high valuations, often without clear signs of meaningful returns on investment. The concern is that similar dynamics may be at play in today's AI market, where massive sums are being spent on developing business models that have yet to prove their long-term viability

1

.References

Summarized by

Navi

[1]

Related Stories

SoftBank and OpenAI Launch Joint Venture in Japan, Unveiling Cristal AI Service

30 Jan 2025•Business and Economy

SoftBank Acquires $676M Sharp Plant for AI Data Center in Collaboration with OpenAI

14 Mar 2025•Business and Economy

SoftBank's AI investments deliver $1.62 billion profit as OpenAI stake drives turnaround

12 Feb 2026•Business and Economy

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy