SoftBank Group Reports Strong Q1 Profit, Shares Surge on AI Investment Optimism

24 Sources

24 Sources

[1]

SoftBank Group posts $2.87 billion net profit in first quarter

TOKYO, Aug 7 (Reuters) - Japanese technology investor SoftBank Group (9984.T), opens new tab logged a net profit of 421.8 billion yen ($2.87 billion) for the April-June quarter. The result compared with a net loss of 174.3 billion yen for the same period a year earlier and the 127.6 billion yen average profit from three analyst estimates compiled by LSEG. The Vision Fund investment unit posted an investment gain of 726.8 billion yen ($4.94 billion). The results mark SoftBank's second consecutive quarter of profit and follow its first annual profit in four years when it was helped by a strong performance by its telecom holdings and higher valuations for its later-stage startups. The results will be welcomed by investors as SoftBank has embarked on its biggest spending spree since the launch of its Vision Funds in 2017 and 2019, this time making mammoth investments in artificial intelligence companies. Investors and analysts are awaiting updates on how these investments will be financed, the timeline for returns to materialise and whether assets will be sold to fund the new projects. SoftBank is leading a $40 billion funding round for ChatGPT maker OpenAI. SoftBank has until the end of the year to fund its $22.5 billion portion, although the remainder has been subscribed, according to a source familiar with the matter. It is also leading the financing for the Stargate project - a $500 billion scheme to develop data centres in the United States, part of its effort to position itself as the "organiser of the industry," founder Masayoshi Son said in June. SoftBank has yet to release details on what kinds of returns its financing of the Stargate project could generate. The extent of third-party investment will determine what other financing tools, such as bank loans and debt issuance, it may have to deploy. In July, SoftBank raised $4.8 billion by selling off a portion of its holding in T-Mobile (TMUS.O), opens new tab. ($1 = 147.0600 yen) Reporting by Anton Bridge; Additional reporting by Krystal Hu; Editing by Edwina Gibbs and Christopher Cushing Our Standards: The Thomson Reuters Trust Principles., opens new tab

[2]

SoftBank Group swings to profit in first quarter on market enthusiasm for tech stocks

TOKYO, Aug 7 (Reuters) - Japanese technology investor SoftBank Group (9984.T), opens new tab on Thursday booked a net profit of $2.87 billion in the first quarter, driven by gains among larger listed investments in its Vision Fund portfolio. The result will likely be welcomed by investors as SoftBank pursues its biggest spending spree since the launch of its Vision Funds in 2017 and 2019, this time making mammoth investments in artificial intelligence companies. Investors and analysts are awaiting updates on how these investments will be financed, the timeline for returns to materialise and whether assets will be sold to fund the new projects. Favourable market conditions for technology companies over the quarter raised valuations of SoftBank's array of startup stakes, potentially fuelling monetisation opportunities that can be directed toward newer investments. SoftBank's Vision Funds hold $45 billion worth of late-stage companies ready to list soon, up from $36 billion at the end of March. The group overall logged a net profit of 421.8 billion yen ($2.87 billion) for the April-June quarter. The result compared with a net loss of 174.3 billion yen for the same period a year earlier and the 127.6 billion yen average profit from three analyst estimates compiled by LSEG. The Vision Fund unit posted an investment gain of 726.8 billion yen ($4.94 billion), around half of which derived from a surge in the share price of South Korean e-commerce firm Coupang (CPNG.N), opens new tab over the quarter. AI INVESTMENT SPREE SoftBank is leading a $40 billion funding round for ChatGPT maker OpenAI. SoftBank has until the end of the year to fund its $22.5 billion portion, although the remainder has been subscribed, according to a source familiar with the matter. It is also leading the financing for the Stargate project - a $500 billion scheme to develop data centres in the United States, part of its effort to position itself as the "organiser of the industry," founder Masayoshi Son said in June. SoftBank has yet to release details on what kinds of returns its financing of the Stargate project could generate. The extent of third-party investment will determine what other financing tools, such as bank loans and debt issuance, it may have to deploy. In July, SoftBank raised $4.8 billion by selling off a portion of its holding in T-Mobile (TMUS.O), opens new tab. However SoftBank's performance in exiting from investments and distributing profit has been patchy of late. The Vision Funds have made a cumulative investment gain of just $5 billion out of a total committed capital of $172.2 billion as of the end of June. ($1 = 147.0600 yen) Reporting by Anton Bridge; Additional reporting by Krystal Hu; Editing by Edwina Gibbs and Christopher Cushing Our Standards: The Thomson Reuters Trust Principles., opens new tab

[3]

SoftBank Group swings to profit in first quarter, Stargate timeline delayed

TOKYO, Aug 7 (Reuters) - Japanese technology investor SoftBank Group (9984.T), opens new tab on Thursday booked a net profit of $2.87 billion in the first quarter, driven by gains among larger listed investments in its Vision Fund portfolio. The result will likely be welcomed by investors as SoftBank pursues its biggest spending spree since the launch of its Vision Funds in 2017 and 2019, this time making mammoth investments in artificial intelligence companies. Investors and analysts are awaiting updates on the timeline for returns to materialise and to what extent assets will be monetised to fund the new projects. The Stargate project - a $500 billion scheme to develop data centres in the United States for which SoftBank is leading financing - has been delayed by longer than expected negotiations with other parties and deciding on sites, chief financial officer Yoshimitsu Goto told a briefing in Tokyo. "It's taking a little longer than our initial timeline but I want to pick up the pace," Goto said. SoftBank has identified sites across the U.S. and several are progressing, Goto said, but he declined to provide details on the schedule or the order sites would be built out. Favourable market conditions for technology companies over the quarter raised valuations of SoftBank's array of startup stakes, potentially fuelling monetisation opportunities that can be directed toward newer investments. SoftBank's Vision Funds hold $45 billion worth of late-stage companies ready to list soon, up from $36 billion at the end of March, although much of the increase derives from the additional $7.5 billion Vision Fund 2 invested in OpenAI in June. The group overall logged a net profit of 421.8 billion yen ($2.87 billion) for the April-June quarter. The result compared with a net loss of 174.3 billion yen for the same period a year earlier and the average profit estimate of 127.6 billion yen compiled by LSEG from three analysts. The Vision Fund unit posted an investment gain of 726.8 billion yen ($4.94 billion), around half of which derived from a surge in the share price of South Korean e-commerce firm Coupang (CPNG.N), opens new tab over the quarter. AI INVESTMENT SPREE SoftBank is leading a $40 billion funding round for ChatGPT maker OpenAI. SoftBank has until the end of the year to fund its $22.5 billion portion, although the remainder has been subscribed, according to a source familiar with the matter. The OpenAI investment and Stargate project form part of SoftBank's effort to position itself as the "organiser of the industry," founder Masayoshi Son said in June. Concerning Stargate, SoftBank remains committed to its target of building out $500 billion worth of data centres over four years and the banks involved in the project financing, including Japan's "Megabanks" and major U.S. banks, have shown positive interest in the scheme, Goto said. SoftBank has yet to release details on what kinds of returns its financing of the Stargate project could generate. The extent of third-party investment will determine what other financing tools, such as bank loans and debt issuance, it may have to deploy. SoftBank has raised $7.8 billion by selling off a portion of its holding in T-Mobile (TMUS.O), opens new tab in June and August, Goto said. However SoftBank's performance in exiting from investments and distributing profit has been patchy of late. The Vision Funds have made a cumulative investment gain of just $5 billion out of a total committed capital of $172.2 billion as of the end of June. ($1 = 147.0600 yen) Reporting by Anton Bridge. Additional reporting by Krystal Hu. Editing by Edwina Gibbs, Christopher Cushing and Mark Potter Our Standards: The Thomson Reuters Trust Principles., opens new tab

[4]

SoftBank shares surge to record after optimism for AI prospects boosted Q1 earnings

TOKYO, Aug 8 (Reuters) - Shares in SoftBank Group (9984.T), opens new tab jumped more than 13% to a record high on Friday morning in a show of investor support for the Japanese technology investor's AI push after first quarter profit beat expectations. SoftBank's share price hit 14,205 yen at the close of morning trading. SoftBank has announced a series of mammoth investments this year, including committing $30 billion to ChatGPT maker OpenAI, as well as leading the financing for Stargate - a $500 billion data centre project in the United States. The firm beat analysts' expectations to report a net profit of 421.8 billion yen ($2.87 billion) for the April-June quarter, compared to a loss in the same period a year ago. Market enthusiasm for AI-related companies also pushed up valuations for its portfolio of listed and unlisted technology companies such that SoftBank's loan to value ratio improved to 17% at the end of June compared to 18% at the end of March. The results were "evidence of SoftBank's quality diversified portfolio, strong underlying fundamentals, thematic/secular tailwinds for its equity holdings, and the resilience of its balance sheet," Macquarie analyst Paul Golding wrote in a note. SoftBank was the biggest contributor to gains for Japan's Topix index (.TOPX), opens new tab, which rose some 1.5% to trade above the 3,000 point mark for the first time in its history. The jump will provide some relief to SoftBank investors as its shares have traded at a more than 50% discount to the value of its assets over the past five quarters. "Active investors scooped up SoftBank Group shares to beat the Topix's gain," said Seiichi Suzuki, chief equity market analyst at Tokai Tokyo Research Institute. "When the main indexes rise, they need to buy heavyweights that are rising. SoftBank's strong earnings and the Topix's gains came at the same time." Reporting by Anton Bridge and Junko Fujita; Editing by Kate Mayberry Our Standards: The Thomson Reuters Trust Principles., opens new tab

[5]

SoftBank shares hit record high on AI prospects

TOKYO, Aug 8 (Reuters) - Shares in SoftBank Group (9984.T), opens new tab jumped more than 13% to a record high on Friday in a show of investor support for the Japanese technology investor's AI push after first quarter profit beat expectations. SoftBank's share price hit 14,205 yen at the close of morning trading and finished the day up 10.39% at 13,865 yen. SoftBank has announced a series of mammoth investments this year, including committing $30 billion to ChatGPT maker OpenAI, as well as leading the financing for Stargate - a $500 billion data centre project in the United States. The firm beat analysts' expectations to report a net profit of 421.8 billion yen ($2.87 billion) for the April-June quarter, compared to a loss in the same period a year ago. Market enthusiasm for AI-related companies also pushed up valuations for its portfolio of listed and unlisted technology companies such that SoftBank's loan to value ratio improved to 17% at the end of June compared to 18% at the end of March. The results were "evidence of SoftBank's quality diversified portfolio, strong underlying fundamentals, thematic/secular tailwinds for its equity holdings, and the resilience of its balance sheet," Macquarie analyst Paul Golding wrote in a note. SoftBank was the biggest contributor to gains for Japan's Topix index (.TOPX), opens new tab, which rose some 1.5% to trade above the 3,000 point mark for the first time in its history. The index closed the day up 1.21% at 3,024. The jump will provide some relief to SoftBank investors as its shares have traded at a more than 50% discount to the value of its assets over the past five quarters. "Active investors scooped up SoftBank Group shares to beat the Topix's gain," said Seiichi Suzuki, chief equity market analyst at Tokai Tokyo Research Institute. "When the main indexes rise, they need to buy heavyweights that are rising. SoftBank's strong earnings and the Topix's gains came at the same time." Reporting by Anton Bridge and Junko Fujita; Editing by Kate Mayberry Our Standards: The Thomson Reuters Trust Principles., opens new tab

[6]

SoftBank's AI investment spree to be in focus on at Q1 earnings

TOKYO, Aug 7 (Reuters) - When Japan's SoftBank Group (9984.T), opens new tab reports earnings on Thursday, its mammoth investments in artificial intelligence companies are set to take the spotlight. Analysts and investors are keen for updates on how they will be financed, the timeline for returns to materialise and whether assets will be sold to fund the new projects. SoftBank has embarked on its biggest spending spree since the launch of its Vision Funds in 2017 and 2019. It is leading a $40 billion funding round for ChatGPT maker OpenAI. SoftBank has until the end of the year to fund its $22.5 billion portion, although the remainder has been subscribed, according to a source familiar with the matter. It is also leading the financing for the Stargate project - a $500 billion scheme to develop data centres in the United States, part of its effort to position itself as the "organiser of the industry," founder Masayoshi Son said in June. SoftBank has yet to release details on what kinds of returns its financing of the Stargate project could generate. The extent of third-party investment will determine what other financing tools, such as bank loans and debt issuance, it may have to deploy. In July, SoftBank raised $4.8 billion by selling off a portion of its holding in T-Mobile (TMUS.O), opens new tab. "If other sources of capital are less supportive, SoftBank could look to asset-backed finance, which is collateralised by equity in other holdings," Macquarie analyst Paul Golding said. The Japanese conglomerate is expected to post a net profit of 127.6 billion yen ($865 million) in the April-June quarter, according to the average estimate of three analysts polled by LSEG. That would mark SoftBank's second consecutive quarter of profit and follow its first annual profit in four years when it was helped by a strong performance by its telecom holdings and higher valuations for its later-stage startups. Its results are, however, typically very volatile and difficult to estimate due to manifold investments, many of which are not listed. SoftBank's performance in exiting from investments and distributing profits has been patchy of late. The Vision Funds had made a cumulative investment loss of $475 million as of end-March. That said, 13 of 18 analysts have a "buy" or "strong buy" rating for SoftBank's stock, according to LSEG. Although there is some concern in the market that AI-related valuations have become bubbly, they continue to climb. OpenAI is in early-stage discussions about a stock sale that would allow employees to cash out and could value the company at about $500 billion, according to the source - a huge jump from its current valuation of $300 billion. Reporting by Anton Bridge; Additional reporting by Krystal Hu; Editing by Edwina Gibbs Our Standards: The Thomson Reuters Trust Principles., opens new tab

[7]

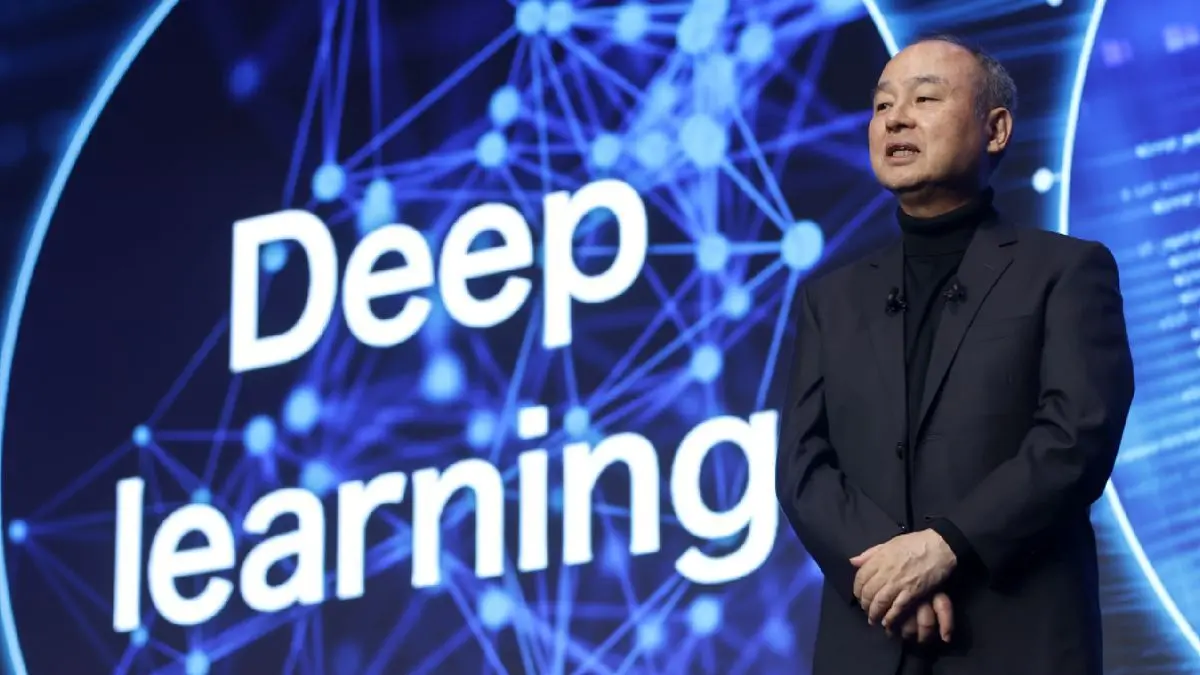

SoftBank Vision Fund posts $4.8 billion gain to drive second straight quarter of group profit

Masayoshi Son, chairman and chief executive officer of SoftBank Group Corp., speaks at the SoftBank World event in Tokyo, Japan, on Wednesday, July 16, 2025. SoftBank Group on Thursday reported fiscal first-quarter profit that topped expectations, driven by gains in its Vision Fund tech investment arm. The Japanese giant reported 421.8 billion yen ($2.87 billion) in the quarter ended June, versus 127.6 billion yen expected, according to LSEG consensus estimates. It is the second straight quarter of profit for SoftBank. The company reported a 174.28 billion yen loss in the same period last year. In the fiscal first quarter, SoftBank said the value of its Vision Funds rose $4.8 billion. Profit for the Vision Funds segment, which takes into account other factors like expenses, hit 451.4 billion yen in the quarter, versus a loss in the same period last year. SoftBank has been on spending spree related to AI. The Japanese giant is leading a $40 billion funding round into ChatGPT developer OpenAI and it is currently waiting for its $6.5 proposed acquisition of AI chip firm Ampere Computing to close. Meanwhile, SoftBank is a key company in the massive $500 billion Stargate project in the U.S. that aims to build data centers and AI infrastructure in the country. Investors are waiting for details on how SoftBank plans to fund this spending. In May, SoftBank posted its first annual profit in four years for the fiscal year ended March, helped by gains in SoftBank's older investments in Alibaba, T-Mobile and Deutsche Telekom.

[8]

Japan tech giant SoftBank Group sees better fortunes on surging AI stocks

TOKYO (AP) -- Japanese technology conglomerate SoftBank Group Corp. posted a 421.8 billion yen ($2.9 billion) profit in the April-June quarter, rebounding from a loss a year earlier as its investments benefited from the craze for artificial intelligence. Quarterly sales at Tokyo-based SoftBank Group, which invests heavily in AI companies like Nvidia and Open AI, rose 7% to 1.8 trillion yen ($12 billion), the company said Thursday. SoftBank's loss in April-June 2024 was 174 billion yen. The company's fortunes tend to fluctuate because it invests in a range of ventures through its Vision Funds, a move that carries risks. The group's founder Masayoshi Son has emphasized that he sees a vibrant future in AI. SoftBank has also invested in Arm Holdings and Taiwan Semiconductor Manufacturing Co. Both companies, which produce computer chips, have benefitted from the growth of AI. "The era is definitely AI, and we are focused on AI," SoftBank senior executive Yoshimitsu Goto he told reporters. "An investment company goes through its ups and downs, but we are recently seeing steady growth." Some of SoftBank's other investments also have paid off big. An example is Coupang, an e-commerce company known as the "Amazon of South Korea," because it started out in Seoul. Coupang now operates in the U.S. and other Asian nations. Goto said preparations for an IPO for PayPay, a kind of cashless payment system, were going well. The company has already held IPOs for Chime, a U.S. "neobank" that provides banking services for low-credit consumers, and for Etoro, a personal investment platform. ___ Yuri Kageyama on Threads: https://www.threads.com/@yurikageyama

[9]

SoftBank stakes in Nvidia, TSMC show Son's focus on AI gear

The Japanese technology investor raised its stake in Nvidia to about $3 billion by the end of March, up from $1 billion in the prior quarter, according to regulatory filings. It bought around $330 million worth of TSMC shares and $170 million in Oracle Corp., they show. That's while SoftBank's signature Vision Fund has monetized almost $2 billion of public and private assets in the first half of 2025, according to a person familiar with the fund's activities. The Vision Fund prioritizes its returns on investment and there is no particular pressure from SoftBank to monetize its assets, said the person, who asked not to be named discussing private information. A representative of SoftBank declined to comment. At the heart of SoftBank's AI ambitions is chip designer Arm Holdings Plc. Son is gradually building a portfolio around the Cambridge, UK-based company with key industry players, seeking to catch up after largely missing a historic rally that's made Nvidia into a $4 trillion behemoth and boosted its contract chipmaker TSMC near a $1 trillion value. "Nvidia is the picks and shovels for the gold rush of AI," said Ben Narasin, founder and general partner of Tenacity Venture Capital, referring to a concerted effort by the world's largest technology companies to spend hundreds of billions of dollars to get ahead. SoftBank's purchase of the U.S. company's stock may buy more influence and access to Nvidia's most sought-after chips, he said. "Maybe he gets to skip the line." SoftBank, which reports quarterly earnings Thursday, should've benefited from that bet on Nvidia -- at least on paper. Nvidia has gained around 90% in market value since hitting a year's low around early April, while TSMC has climbed over 40%. That's helping to make up for missing out on much of Nvidia's post-ChatGPT rally -- one of the biggest of all time. SoftBank, which was early to start betting on betting on AI long before OpenAI's seminal chatbot, parted with a 4.9% stake in Nvidia in early 2019 that would be worth more than $200 billion today. Crippling losses at the Vision Fund also hampered SoftBank's ability to be an early investor in generative AI. The company's attempts to buy back some Nvidia shares, alongside those of proxy TSMC, would help Son regain access to some of the most lucrative parts of the semiconductor supply chain. The 67-year-old SoftBank founder now seeks to play a more central role in the spread of AI through sweeping partnerships. These include SoftBank's $500 billion Stargate data center foray with OpenAI, Oracle and Abu Dhabi-backed investment fund MGX. Son is also courting TSMC and others about taking part in a $1 trillion AI manufacturing hub in Arizona. As Arm's intellectual property is used to power the majority of mobile chips and is increasingly used in server chips, SoftBank could carve out a unique position without being a manufacturer itself, according to Richard Kaye, co-head of Japan equity strategy at Comgest Asset Management and a long-time SoftBank investor. "I think he sees himself as the natural provider of AI semiconductor technology," he said. "What Son really wants to do is capture the upstream and the downstream of everything." Investors have cheered Son's audacious plans, while analysts say they expect SoftBank to report a swing back to a net income in the June quarter. SoftBank shares marked a record high last month. SoftBank's planned $6.5 billion deal to acquire U.S. chip firm Ampere Computing LLC and another $30 billion investment in OpenAI are further encouraging investors who see the stock as a way to ride the US startup's momentum. Son, however, remains dissatisfied, according to people close to the billionaire. Son sees the big projects in the U.S. as having the potential to help SoftBank leapfrog the current leaders in AI to become a trillion-dollar or bigger company, they said. The stock continues to trade at a roughly estimated 40% discount to SoftBank's total assets -- which includes a roughly 90% stake in the $148 billion-valued Arm. SoftBank's market capitalization stands at around $118 billion, a fraction of Nvidia's $4.4 trillion valuation and that of other tech companies most closely associated with AI progress. Son, who in the past has seen Washington hamper or derail merger plans like the union of Arm and Nvidia, seeks to leverage his relationship with Donald Trump and is arranging frequent meetings with White House officials. Those efforts are now critical as AI and semiconductors become geopolitical flash points. SoftBank's plan to buy Ampere is facing a probe by the Federal Trade Commission. Attention at its June quarter earnings will be on what other assets SoftBank might sell down to help it secure the liquidity it needs to double down on hardware investments. The Japanese company has so far raised around $4.8 billion through a sale of some of its T-Mobile share holding in June. Its Chief Financial Officer Yoshimitsu Goto has cited the company's end-March net asset value of ¥25.7 trillion ($175 billion), saying the company has ample capital to cover its funding needs. In the business year ended March, the Vision Fund's exits included DoorDash Inc. and View Inc., as well as cloud security company Wiz Inc. and enterprise software startup Peak, even as SoftBank bought up the stakes in Nvidia, TSMC and Oracle. "We're after AI using an array of startups and group companies," Son told shareholders in June. "We have one goal," he said. "We're going to become the No. 1 platformer in artificial super intelligence."

[10]

SoftBank's profit rebounds on AI stocks

The company's fortunes tend to fluctuate because it invests in a range of ventures through its Vision Funds, a move that carries risks. The group's founder, Masayoshi Son, has emphasized that he sees a vibrant future in AI. SoftBank has also invested in Arm Holdings and Taiwan Semiconductor Manufacturing Co. Both companies, which produce computer chips, have benefitted from the growth of AI. "The era is definitely AI, and we are focused on AI," SoftBank senior executive Yoshimitsu Goto told reporters. "An investment company goes through its ups and downs, but we are recently seeing steady growth."

[11]

Japan tech giant SoftBank Group sees better fortunes on surging AI stocks

TOKYO -- Japanese technology conglomerate SoftBank Group Corp. posted a 421.8 billion yen ($2.9 billion) profit in the April-June quarter, rebounding from a loss a year earlier as its investments benefited from the craze for artificial intelligence. Quarterly sales at Tokyo-based SoftBank Group, which invests heavily in AI companies like Nvidia and Open AI, rose 7% to 1.8 trillion yen ($12 billion), the company said Thursday. SoftBank's loss in April-June 2024 was 174 billion yen. The company's fortunes tend to fluctuate because it invests in a range of ventures through its Vision Funds, a move that carries risks. The group's founder Masayoshi Son has emphasized that he sees a vibrant future in AI. SoftBank has also invested in Arm Holdings and Taiwan Semiconductor Manufacturing Co. Both companies, which produce computer chips, have benefitted from the growth of AI. "The era is definitely AI, and we are focused on AI," SoftBank senior executive Yoshimitsu Goto told reporters. "An investment company goes through its ups and downs, but we are recently seeing steady growth." Some of SoftBank's other investments also have paid off big. An example is Coupang, an e-commerce company known as the "Amazon of South Korea," because it started out in Seoul. Coupang now operates in the U.S. and other Asian nations. Goto said preparations for an IPO for PayPay, a kind of cashless payment system, were going well. The company has already held IPOs for Chime, a U.S. "neobank" that provides banking services for low-credit consumers, and for Etoro, a personal investment platform. SoftBank Group stock, which has risen from a year ago, finished 1.3% higher on the Tokyo Stock Exchange after its earnings results were announced.

[12]

Japan tech giant SoftBank Group sees better fortunes on surging AI stocks

TOKYO (AP) -- Japanese technology conglomerate SoftBank Group Corp. posted a 421.8 billion yen ($2.9 billion) profit in the April-June quarter, rebounding from a loss a year earlier as its investments benefited from the craze for artificial intelligence. Quarterly sales at Tokyo-based SoftBank Group, which invests heavily in AI companies like Nvidia and Open AI, rose 7% to 1.8 trillion yen ($12 billion), the company said Thursday. SoftBank's loss in April-June 2024 was 174 billion yen. The company's fortunes tend to fluctuate because it invests in a range of ventures through its Vision Funds, a move that carries risks. The group's founder Masayoshi Son has emphasized that he sees a vibrant future in AI. SoftBank has also invested in Arm Holdings and Taiwan Semiconductor Manufacturing Co. Both companies, which produce computer chips, have benefitted from the growth of AI. "The era is definitely AI, and we are focused on AI," SoftBank senior executive Yoshimitsu Goto he told reporters. "An investment company goes through its ups and downs, but we are recently seeing steady growth." Some of SoftBank's other investments also have paid off big. An example is Coupang, an e-commerce company known as the "Amazon of South Korea," because it started out in Seoul. Coupang now operates in the U.S. and other Asian nations. Goto said preparations for an IPO for PayPay, a kind of cashless payment system, were going well. The company has already held IPOs for Chime, a U.S. "neobank" that provides banking services for low-credit consumers, and for Etoro, a personal investment platform. ___ Yuri Kageyama on Threads: https://www.threads.com/@yurikageyama

[13]

Japan Tech Giant SoftBank Group Sees Better Fortunes on Surging AI Stocks

TOKYO (AP) -- Japanese technology conglomerate SoftBank Group Corp. posted a 421.8 billion yen ($2.9 billion) profit in the April-June quarter, rebounding from a loss a year earlier as its investments benefited from the craze for artificial intelligence. Quarterly sales at Tokyo-based SoftBank Group, which invests heavily in AI companies like Nvidia and Open AI, rose 7% to 1.8 trillion yen ($12 billion), the company said Thursday. SoftBank's loss in April-June 2024 was 174 billion yen. The company's fortunes tend to fluctuate because it invests in a range of ventures through its Vision Funds, a move that carries risks. The group's founder Masayoshi Son has emphasized that he sees a vibrant future in AI. SoftBank has also invested in Arm Holdings and Taiwan Semiconductor Manufacturing Co. Both companies, which produce computer chips, have benefitted from the growth of AI. "The era is definitely AI, and we are focused on AI," SoftBank senior executive Yoshimitsu Goto he told reporters. "An investment company goes through its ups and downs, but we are recently seeing steady growth." Some of SoftBank's other investments also have paid off big. An example is Coupang, an e-commerce company known as the "Amazon of South Korea," because it started out in Seoul. Coupang now operates in the U.S. and other Asian nations. Goto said preparations for an IPO for PayPay, a kind of cashless payment system, were going well. The company has already held IPOs for Chime, a U.S. "neobank" that provides banking services for low-credit consumers, and for Etoro, a personal investment platform. ___ Yuri Kageyama on Threads: https://www.threads.com/@yurikageyama

[14]

SoftBank builds Nvidia, TSMC stakes under Masayoshi Son's focus on AI gear - The Economic Times

At the heart of SoftBank's AI ambitions is chip designer Arm Holdings Plc. Son is gradually building a portfolio around the Cambridge, UK-based company with key industry players, seeking to catch up after largely missing a historic rally that's made Nvidia into a $4 trillion behemoth and boosted its contract chipmaker TSMC near a $1 trillion value.SoftBank Group Corp. is building up stakes in Nvidia Corp. and Taiwan Semiconductor Manufacturing Co., the latest reflection of Masayoshi Son's focus on the tools and hardware underpinning artificial intelligence. The Japanese technology investor raised its stake in Nvidia to about $3 billion by the end of March, up from $1 billion in the prior quarter, according to regulatory filings. It bought around $330 million worth of TSMC shares and $170 million in Oracle Corp., they show. That's while SoftBank's signature Vision Fund has monetized almost $2 billion of public and private assets in the first half of 2025, according to a person familiar with the fund's activities. The Vision Fund prioritizes its returns on investment and there is no particular pressure from SoftBank to monetize its assets, said the person, who asked not to be named discussing private information. A representative of SoftBank declined to comment. At the heart of SoftBank's AI ambitions is chip designer Arm Holdings Plc. Son is gradually building a portfolio around the Cambridge, UK-based company with key industry players, seeking to catch up after largely missing a historic rally that's made Nvidia into a $4 trillion behemoth and boosted its contract chipmaker TSMC near a $1 trillion value. "Nvidia is the picks and shovels for the gold rush of AI," said Ben Narasin, founder and general partner of Tenacity Venture Capital, referring to a concerted effort by the world's largest technology companies to spend hundreds of billions of dollars to get ahead. SoftBank's purchase of the US company's stock may buy more influence and access to Nvidia's most sought-after chips, he said. "Maybe he gets to skip the line." SoftBank, which reports quarterly earnings Thursday, should've benefited from that bet on Nvidia -- at least on paper. Nvidia has gained around 90% in market value since hitting a year's low around early April, while TSMC has climbed over 40%. That's helping to make up for missing out on much of Nvidia's post-ChatGPT rally -- one of the biggest of all time. SoftBank, which was early to start betting on betting on AI long before OpenAI's seminal chatbot, parted with a 4.9% stake in Nvidia in early 2019 that would be worth more than $200 billion today. Crippling losses at the Vision Fund also hampered SoftBank's ability to be an early investor in generative AI. The company's attempts to buy back some Nvidia shares, alongside those of proxy TSMC, would help Son regain access to some of the most lucrative parts of the semiconductor supply chain. The 67-year-old SoftBank founder now seeks to play a more central role in the spread of AI through sweeping partnerships. These include SoftBank's $500 billion Stargate data center foray with OpenAI, Oracle and Abu Dhabi-backed investment fund MGX. Son is also courting TSMC and others about taking part in a $1 trillion AI manufacturing hub in Arizona. As Arm's intellectual property is used to power the majority of mobile chips and is increasingly used in server chips, SoftBank could carve out a unique position without being a manufacturer itself, according to Richard Kaye, co-head of Japan equity strategy at Comgest Asset Management and a long-time SoftBank investor. "I think he sees himself as the natural provider of AI semiconductor technology," he said. "What Son really wants to do is capture the upstream and the downstream of everything." Investors have cheered Son's audacious plans, while analysts say they expect SoftBank to report a swing back to a net income in the June quarter. SoftBank shares marked a record high last month. SoftBank's planned $6.5 billion deal to acquire US chip firm Ampere Computing LLC and another $30 billion investment in OpenAI are further encouraging investors who see the stock as a way to ride the US startup's momentum. Son, however, remains dissatisfied, according to people close to the billionaire. Son sees the big projects in the US as having the potential to help SoftBank leapfrog the current leaders in AI to become a trillion-dollar or bigger company, they said. The stock continues to trade at a roughly estimated 40% discount to SoftBank's total assets -- which includes a roughly 90% stake in the $148 billion-valued Arm. SoftBank's market capitalization stands at around $119 billion, a fraction of Nvidia's $4.4 trillion valuation and that of other tech companies most closely associated with AI progress. Son, who in the past has seen Washington hamper or derail merger plans like the union of Arm and Nvidia, seeks to leverage his relationship with Donald Trump and is arranging frequent meetings with White House officials. Those efforts are now critical as AI and semiconductors become geopolitical flash points. SoftBank's plan to buy Ampere is facing a probe by the Federal Trade Commission. Attention at its June quarter earnings will be on what other assets SoftBank might sell down to help it secure the liquidity it needs to double down on hardware investments. The Japanese company has so far raised around $4.8 billion through a sale of some of its T-Mobile share holding in June. Its Chief Financial Officer Yoshimitsu Goto has cited the company's end-March net asset value of ¥25.7 trillion ($175 billion), saying the company has ample capital to cover its funding needs. In the business year ended March, the Vision Fund's exits included DoorDash Inc. and View Inc., as well as cloud security company Wiz Inc. and enterprise software startup Peak, even as SoftBank bought up the stakes in Nvidia, TSMC and Oracle. "We're after AI using an array of startups and group companies," Son told shareholders in June. "We want to become the organizer of the No. 1 platformer in the artificial super intelligence era."

[15]

SoftBank shares surge to record after optimism for AI prospects boosted Q1 earnings

Shares in SoftBank Group jumped more than 13% to a record high on Friday morning in a show of investor support for the Japanese technology investor's AI push after first quarter profit beat expectations. SoftBank's share price hit 14,205 yen at the close of morning trading. SoftBank has announced a series of mammoth investments this year, including committing $30 billion to ChatGPT maker OpenAI, as well as leading the financing for Stargate - a $500 billion data centre project in the United States. The firm beat analysts' expectations to report a net profit of 421.8 billion yen ($2.87 billion) for the April-June quarter, compared to a loss in the same period a year ago. Market enthusiasm for AI-related companies also pushed up valuations for its portfolio of listed and unlisted technology companies such that SoftBank's loan to value ratio improved to 17% at the end of June compared to 18% at the end of March. The results were "evidence of SoftBank's quality diversified portfolio, strong underlying fundamentals, thematic/secular tailwinds for its equity holdings, and the resilience of its balance sheet," Macquarie analyst Paul Golding wrote in a note. SoftBank was the biggest contributor to gains for Japan's Topix index, which rose some 1.5% to trade above the 3,000 point mark for the first time in its history. The jump will provide some relief to SoftBank investors as its shares have traded at a more than 50% discount to the value of its assets over the past five quarters. "Active investors scooped up SoftBank Group shares to beat the Topix's gain," said Seiichi Suzuki, chief equity market analyst at Tokai Tokyo Research Institute. "When the main indexes rise, they need to buy heavyweights that are rising. SoftBank's strong earnings and the Topix's gains came at the same time."

[16]

SoftBank shares surge to record high after optimism for AI prospects boosted Q1 earnings - The Economic Times

Shares in SoftBank Group jumped more than 13% to a record high on Friday morning in a show of investor support for the Japanese technology investor's AI push after first quarter profit beat expectations. SoftBank's share price hit 14,205 yen at the close of morning trading. SoftBank has announced a series of mammoth investments this year, including committing $30 billion to ChatGPT maker OpenAI, as well as leading the financing for Stargate - a $500 billion data centre project in the United States. The firm beat analysts' expectations to report a net profit of 421.8 billion yen ($2.87 billion) for the April-June quarter, compared to a loss in the same period a year ago. Market enthusiasm for AI-related companies also pushed up valuations for its portfolio of listed and unlisted technology companies such that SoftBank's loan to value ratio improved to 17% at the end of June compared to 18% at the end of March. The results were "evidence of SoftBank's quality diversified portfolio, strong underlying fundamentals, thematic/secular tailwinds for its equity holdings, and the resilience of its balance sheet," Macquarie analyst Paul Golding wrote in a note. SoftBank was the biggest contributor to gains for Japan's Topix index, which rose some 1.5% to trade above the 3,000 point mark for the first time in its history. The jump will provide some relief to SoftBank investors as its shares have traded at a more than 50% discount to the value of its assets over the past five quarters. "Active investors scooped up SoftBank Group shares to beat the Topix's gain," said Seiichi Suzuki, chief equity market analyst at Tokai Tokyo Research Institute. "When the main indexes rise, they need to buy heavyweights that are rising. SoftBank's strong earnings and the Topix's gains came at the same time."

[17]

SoftBank builds Nvidia and TSMC stakes under Son's focus on AI gear

SoftBank Group is building up stakes in Nvidia and Taiwan Semiconductor Manufacturing, the latest reflection of Masayoshi Son's focus on the tools and hardware underpinning artificial intelligence. The Japanese technology investor raised its stake in Nvidia to about $3 billion by the end of March, up from $1 billion in the prior quarter, according to regulatory filings. It bought around $330 million worth of TSMC shares and $170 million in Oracle, they show. That's while SoftBank's signature Vision Fund has monetized almost $2 billion of public and private assets in the first half of 2025, according to a person familiar with the fund's activities. The Vision Fund prioritizes its returns on investment, and there is no particular pressure from SoftBank to monetize its assets, said the person, who asked not to be named discussing private information. A representative of SoftBank declined to comment.

[18]

Nvidia, AI Bets Lift SoftBank To Profit After Brutal Year-Ago Loss - SoftBank Group (OTC:SFTBF), SoftBank Group (OTC:SFTBY), ARM Holdings (NASDAQ:ARM)

Japanese investment holding company SoftBank Group SFTBF SFTBY reported first-quarter results on Thursday. The company reported quarterly net sales of 1.82 trillion Japanese yen ($12.54 billion), up from 1.70 trillion yen ($11.71 billion) a year ago. SoftBank segment net sales grew 8% to 1.66 trillion yen ($11.43 billion). Arm ARM net sales rose 4% to 152.9 billion yen ($1.05 billion). The division incurred a loss of 8.7 billion yen ($60 million) compared to a profit of 10.2 billion yen a year ago due to higher research and development expenses. Also Read: SoftBank May Want To Outdo Microsoft With $40 Billion Investment in OpenAI's Latest Funding Round The income before tax for SoftBank was 689.9 billion yen. SoftBank's net income was 421.8 billion yen (or $2.91 billion), compared to a loss of 174.3 billion yen a year ago. The gain on investments was 486.9 billion yen (or $3.35 billion), as investment losses on T-Mobile US TMUS shares and Alibaba BABA shares were partially offset by a gain on Nvidia NVDA shares. Vision Fund investments reported a 660.2 billion yen profit (or $4.55 billion), compared to 32.4 billion yen a year ago. This was driven by higher share prices of some public portfolio companies, including Coupang CPNG, Symbotic SYM, and Auto1. SoftBank reported a segment income of 278.5 billion yen (or $1.92 billion) compared to 279.9 billion yen a year ago. SoftBank is aggressively investing in AI, leading a $40 billion funding round into ChatGPT developer OpenAI and awaiting the closure of its proposed $6.5 billion acquisition of AI chip firm Ampere Computing. SoftBank said it and other investors have already committed $10 billion to OpenAI, with the remaining $30 billion expected by December. SoftBank plays a key role in the massive $500 billion Stargate project in the U.S., which aims to build data centers and AI infrastructure. Investors are awaiting details on how SoftBank plans to finance this investment. Price Action: ARM stock is trading higher by 2.4% to $139.38 at last check Thursday. Read Next: Nvidia Holds Near Highs As AMD, Super Micro Disappoint Photo by Michael Vi via Shutterstock ARMARM Holdings PLC$138.842.00%Stock Score Locked: Edge Members Only Benzinga Rankings give you vital metrics on any stock - anytime. Unlock RankingsEdge RankingsMomentum48.34GrowthN/AQualityN/AValue6.14Price TrendShortMediumLongOverviewSFTBFSoftBank Group Corp$62.27-26.4%SFTBYSoftBank Group Corp$43.102.15%BABAAlibaba Group Holding Ltd$120.69-0.14%CPNGCoupang Inc$28.431.19%NVDANVIDIA Corp$182.111.50%SYMSymbotic Inc$53.72-14.6%TMUST-Mobile US Inc$239.690.20%Market News and Data brought to you by Benzinga APIs

[19]

SoftBank Stock Surges 10% After Exec Teases $12 Billion OpenAI Windfall -- But $500 Billion 'Stargate' AI Project Pitched To Trump Hits Snags - SoftBank Group (OTC:SFTBF), SoftBank Group (OTC:SFTBY)

SoftBank Group Corp. SFTBY SFTBF shares surged 10.47% to JPY 13,875 ($94.11) on Friday on the Tokyo exchange following the company's first quarter of 2026 earnings call, where executives highlighted massive gains from artificial intelligence investments while acknowledging delays in the ambitious Stargate data center project. Vision Fund Recovery Drives Strong Quarter The Japanese conglomerate reported net income of JPY 421.8 billion ($2.86 billion) for the first quarter, a dramatic JPY 569.1 billion improvement year-over-year. Vision Fund investments generated $5 billion in gains, driven by public portfolio companies including Korean e-commerce giant Coupang and warehouse automation firm Symbotic. "The era is AI and our focus is definitely AI," said CFO Yoshimitsu Goto during the earnings presentation. Net asset value climbed to JPY 32.4 trillion ($220 billion), while the loan-to-value ratio improved to 17%, well below the company's 25% target. See Also: 'Zuck Poaching Effect' Pushes OpenAI To Announce $1.5 Million Bonus For All Employees -- Even New Hires, Says Tech Entrepreneur OpenAI Partnership Shows Explosive Growth SoftBank executives revealed OpenAI's annual recurring revenue is expected to reach $12 billion, more than doubling from $5.5 billion in December 2024. The AI company's weekly active users have grown from 500 million in March to an expected 700 million by August. "OpenAI is not just an investee. For us, OpenAI is one of our most important partners in the AI revolution," Goto said. SoftBank committed $40 billion to OpenAI, with $30 billion from the company and $10 billion syndicated to external investors. Stargate Project Faces Implementation Challenges Despite the OpenAI success, SoftBank's $500 billion Stargate AI infrastructure project with OpenAI has encountered significant delays. Goto acknowledged the project is progressing "slower than usual," citing complex site selection processes and stakeholder alignment issues. "Once model is built, you can repeat the model," Goto explained, emphasizing the importance of establishing a successful first facility. The project aims to deploy $500 billion over four years across multiple U.S. data centers. Tesla Inc. TSLA CEO Elon Musk has repeatedly questioned the project's financial viability, recently posting "They simply don't" have the money on the social media platform X. Market Outlook and Strategic Focus The NAV discount narrowed to 39.8% from over 50% earlier this year, indicating growing investor confidence in the AI-focused strategy. The company maintains strong liquidity with JPY 3.7 trillion ($25 billion) in cash reserves and completed a ¥330 billion ($2.24 billion) share buyback program. Read Next: Amazon Opens Used Vehicle Listings To Dealers Across US, Starting In LA With Over 130 Cities In Pipeline Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Photo Courtesy: Michael Vi/Shutterstock SFTBFSoftBank Group Corp$62.27-26.4%OverviewSFTBYSoftBank Group Corp$43.352.74%TSLATesla Inc$320.920.32%Market News and Data brought to you by Benzinga APIs

[20]

SoftBank swings to profit after Masayoshi Son's AI bets pay off

SoftBank Group swung to a quarterly profit, riding on gains from its bets on Nvidia and startups in a boon for founder Masayoshi Son's bets on artificial intelligence technologies. A recovery at SoftBank's signature Vision Fund and the sale of assets such as its T-Mobile U.S. holdings are helping Son double down on bets geared to help him capitalize on booming investment in AI hardware. SoftBank, which had sold $4.8 billion worth of its stake in the U.S. telecom company in June, on Thursday revealed the sale of another $3 billion of the U.S. carrier's stock. The Tokyo-based company reported net income of ¥421.82 billion ($2.9 billion) in its fiscal first quarter, more than double the average of analyst estimates. The Vision Fund logged a ¥451.39 billion profit, helped by a recovery in tech valuations and gains on holdings such as Coupang, Auto1 Group SE, Symbotic and Swiggy.

[21]

SoftBank shares surge on AI hope and sign of Stargate progress

SoftBank Group's shares jumped as much as 8% on Tuesday on bets that the tech investor would be able to capitalize on its yearslong focus on artificial intelligence. The Tokyo-based company is the unnamed buyer of Foxconn Technology Group's electric vehicle plant in Ohio and plans to incorporate the facility into its $500 billion Stargate data center project with OpenAI and Oracle. That's spurring optimism that SoftBank may be able to kick-start the stalled Stargate endeavor and benefit from a rush to build AI hardware in the U.S. Its stock is up for the fifth straight day and on track to close at a record. SoftBank has been gradually cashing in on some of its Vision Fund bets in recent years. SoftBank's stock also received a boost after a report emerged that the Japanese company has picked investment banks for a possible initial public offering for Japanese payments app operator PayPay. PayPay was originally set up through a venture with former Vision Fund portfolio company Paytm. Last week, Foxconn's flagship unit Hon Hai Precision Industry said it had agreed to sell the EV plant to a buyer it referred to as Crescent Dune for $375 million without identifying the company behind the entity.

[22]

Japan tech giant SoftBank Group sees better fortunes on surging AI stocks

TOKYO -- Japanese technology conglomerate SoftBank Group Corp. posted a 421.8 billion yen (US$2.9 billion) profit in the April-June quarter, rebounding from a loss a year earlier as its investments benefited from the craze for artificial intelligence. Quarterly sales at Tokyo-based SoftBank Group, which invests heavily in AI companies like Nvidia and Open AI, rose 7% to 1.8 trillion yen ($12 billion), the company said Thursday. SoftBank's loss in April-June 2024 was 174 billion yen. The company's fortunes tend to fluctuate because it invests in a range of ventures through its Vision Funds, a move that carries risks. The group's founder Masayoshi Son has emphasized that he sees a vibrant future in AI. SoftBank has also invested in Arm Holdings and Taiwan Semiconductor Manufacturing Co. Both companies, which produce computer chips, have benefitted from the growth of AI. "The era is definitely AI, and we are focused on AI," SoftBank senior executive Yoshimitsu Goto told reporters. "An investment company goes through its ups and downs, but we are recently seeing steady growth." Some of SoftBank's other investments also have paid off big. An example is Coupang, an e-commerce company known as the "Amazon of South Korea," because it started out in Seoul. Coupang now operates in the U.S. and other Asian nations. Goto said preparations for an IPO for PayPay, a kind of cashless payment system, were going well. The company has already held IPOs for Chime, a U.S. "neobank" that provides banking services for low-credit consumers, and for Etoro, a personal investment platform. SoftBank Group stock, which has risen from a year ago, finished 1.3% higher on the Tokyo Stock Exchange after its earnings results were announced.

[23]

SoftBank shares surge to record after optimism for AI prospects boosted Q1 earnings

TOKYO (Reuters) -Shares in SoftBank Group jumped more than 13% to a record high on Friday morning in a show of investor support for the Japanese technology investor's AI push after first quarter profit beat expectations. SoftBank's share price hit 14,205 yen at the close of morning trading. SoftBank has announced a series of mammoth investments this year, including committing $30 billion to ChatGPT maker OpenAI, as well as leading the financing for Stargate - a $500 billion data centre project in the United States. The firm beat analysts' expectations to report a net profit of 421.8 billion yen ($2.87 billion) for the April-June quarter, compared to a loss in the same period a year ago. Market enthusiasm for AI-related companies also pushed up valuations for its portfolio of listed and unlisted technology companies such that SoftBank's loan to value ratio improved to 17% at the end of June compared to 18% at the end of March. The results were "evidence of SoftBank's quality diversified portfolio, strong underlying fundamentals, thematic/secular tailwinds for its equity holdings, and the resilience of its balance sheet," Macquarie analyst Paul Golding wrote in a note. SoftBank was the biggest contributor to gains for Japan's Topix index, which rose some 1.5% to trade above the 3,000 point mark for the first time in its history. The jump will provide some relief to SoftBank investors as its shares have traded at a more than 50% discount to the value of its assets over the past five quarters. "Active investors scooped up SoftBank Group shares to beat the Topix's gain," said Seiichi Suzuki, chief equity market analyst at Tokai Tokyo Research Institute. "When the main indexes rise, they need to buy heavyweights that are rising. SoftBank's strong earnings and the Topix's gains came at the same time." (Reporting by Anton Bridge and Junko Fujita; Editing by Kate Mayberry) By Anton Bridge and Junko Fujita

[24]

SoftBank's AI investment spree to be in focus on at Q1 earnings

TOKYO (Reuters) -When Japan's SoftBank Group reports earnings on Thursday, its mammoth investments in artificial intelligence companies are set to take the spotlight. Analysts and investors are keen for updates on how they will be financed, the timeline for returns to materialise and whether assets will be sold to fund the new projects. SoftBank has embarked on its biggest spending spree since the launch of its Vision Funds in 2017 and 2019. It is leading a $40 billion funding round for ChatGPT maker OpenAI. SoftBank has until the end of the year to fund its $22.5 billion portion, although the remainder has been subscribed, according to a source familiar with the matter. It is also leading the financing for the Stargate project - a $500 billion scheme to develop data centres in the United States, part of its effort to position itself as the "organiser of the industry," founder Masayoshi Son said in June. SoftBank has yet to release details on what kinds of returns its financing of the Stargate project could generate. The extent of third-party investment will determine what other financing tools, such as bank loans and debt issuance, it may have to deploy. In July, SoftBank raised $4.8 billion by selling off a portion of its holding in T-Mobile. "If other sources of capital are less supportive, SoftBank could look to asset-backed finance, which is collateralised by equity in other holdings," Macquarie analyst Paul Golding said. The Japanese conglomerate is expected to post a net profit of 127.6 billion yen ($865 million) in the April-June quarter, according to the average estimate of three analysts polled by LSEG. That would mark SoftBank's second consecutive quarter of profit and follow its first annual profit in four years when it was helped by a strong performance by its telecom holdings and higher valuations for its later-stage startups. Its results are, however, typically very volatile and difficult to estimate due to manifold investments, many of which are not listed. SoftBank's performance in exiting from investments and distributing profits has been patchy of late. The Vision Funds had made a cumulative investment loss of $475 million as of end-March. That said, 13 of 18 analysts have a "buy" or "strong buy" rating for SoftBank's stock, according to LSEG. Although there is some concern in the market that AI-related valuations have become bubbly, they continue to climb. OpenAI is in early-stage discussions about a stock sale that would allow employees to cash out and could value the company at about $500 billion, according to the source - a huge jump from its current valuation of $300 billion. (Reporting by Anton Bridge; Additional reporting by Krystal Hu; Editing by Edwina Gibbs)

Share

Share

Copy Link

SoftBank Group posts a $2.87 billion net profit in Q1 2023, driven by AI investments and tech stock gains. The company's shares hit a record high as investors show enthusiasm for its AI-focused strategy.

SoftBank's Q1 Financial Performance

SoftBank Group, the Japanese technology investor, reported a net profit of 421.8 billion yen ($2.87 billion) for the April-June quarter of 2023

1

. This marks a significant turnaround from the 174.3 billion yen net loss recorded in the same period last year. The result exceeded analysts' expectations, with the average estimate being 127.6 billion yen1

.

Source: ET

The Vision Fund investment unit, a key component of SoftBank's portfolio, posted an investment gain of 726.8 billion yen ($4.94 billion)

2

. Approximately half of this gain was attributed to the surge in share price of South Korean e-commerce firm Coupang over the quarter2

.AI Investment Strategy

SoftBank's recent financial performance is closely tied to its aggressive investment strategy in artificial intelligence (AI). The company is leading a $40 billion funding round for OpenAI, the creator of ChatGPT, with SoftBank committing to fund $22.5 billion of this amount by the end of the year

3

.

Source: Reuters

In addition to the OpenAI investment, SoftBank is spearheading the Stargate project, a $500 billion scheme to develop data centers in the United States

1

. This project is part of SoftBank's effort to position itself as the "organizer of the industry," according to founder Masayoshi Son1

.Market Response and Share Performance

The market responded positively to SoftBank's Q1 results and its AI-focused strategy. On August 8, 2023, SoftBank's shares surged by more than 13% to a record high of 14,205 yen at the close of morning trading

4

. The stock finished the day up 10.39% at 13,865 yen5

.

Source: Reuters

This surge in share price provided relief to SoftBank investors, as the company's shares had been trading at more than a 50% discount to the value of its assets over the past five quarters

4

.Related Stories

Challenges and Future Outlook

Despite the positive Q1 results, SoftBank faces challenges in its investment strategy. The Vision Funds have made a cumulative investment gain of just $5 billion out of a total committed capital of $172.2 billion as of the end of June

2

. This highlights the need for improved performance in exiting investments and distributing profits.The Stargate project has also experienced delays due to prolonged negotiations with other parties and decisions on site locations

3

. However, SoftBank remains committed to its target of building out $500 billion worth of data centers over four years3

.As SoftBank continues its AI-focused investment strategy, investors and analysts will be closely watching for updates on how these investments will be financed, the timeline for returns to materialize, and whether assets will be sold to fund the new projects

1

.References

Summarized by

Navi

Related Stories

SoftBank Reports $7.8 Billion Annual Profit, Doubles Down on AI Investments

13 May 2025•Business and Economy

SoftBank, OpenAI, and Partners Unveil $500 Billion 'Stargate' AI Infrastructure Project

22 Jan 2025•Business and Economy

SoftBank Returns to Profit, Fueled by Tech Investments and AI Ambitions

12 Nov 2024•Business and Economy

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy