SoftBank Reports $2.4 Billion Loss Amid Major AI Investment Plans

12 Sources

12 Sources

[1]

SoftBank reveals $2.4 billion loss in Q3

Japanese technology company SoftBank Group Corp. reported a 369.2 billion yen ($2.4 billion) loss for the fiscal third quarter as it racked up red ink from its Vision Fund investments. That's compared to a 950 billion yen profit in October-December 2023. Quarterly sales rose 3% from the previous year to 1.83 trillion yen ($11.9 billion), the Tokyo-based company said Wednesday. The report comes barely a month after Masayoshi Son, the founder and chief executive, appeared with President Donald Trump in Washington, as well as with Sam Altman of OpenAI and Larry Ellison of Oracle, to announce an investment of up to $500 billion into an artificial intelligence project called Stargate. Son has repeatedly said the company is banking on a future in artificial intelligence. SoftBank Group invests in an array of companies that it sees as holding long-term potential, including unlisted upstarts, so its financial performance tends to swing wildly. For the nine months of this fiscal year through December, it recorded a profit of 636 billion yen ($4 billion), a reversal from a loss of 459 billion for the previous year. Investment gains were recorded in its holdings in Chinese e-commerce company Alibaba; Coupang, a South Korean retailer based in the U.S.; a mobility service provider DiDi Global and Grab Holdings, a Singaporean technology company, while improved sales came in its British semiconductor company Arm's business. Some of the investment gains from the earlier months of this fiscal year were erased in the latest quarter. The company does not issue an annual forecast.

[2]

Japan's SoftBank reports loss weeks after announcing AI investment with U.S. President Trump

TOKYO -- Japanese technology company SoftBank Group Corp. reported a 369.2 billion yen ($2.4 billion) loss for the fiscal third quarter as it racked up red ink from its Vision Fund investments. That's compared to a 950 billion yen profit in October-December 2023. Quarterly sales rose 3% from the previous year to 1.83 trillion yen ($11.9 billion), the Tokyo-based company said Wednesday. The report comes barely a month after Masayoshi Son, the founder and chief executive, appeared with President Donald Trump in Washington, as well as with Sam Altman of OpenAI and Larry Ellison of Oracle, to announce an investment of up to $500 billion into an artificial intelligence project called Stargate. Son has repeatedly said the company is banking on a future in artificial intelligence. SoftBank Group invests in an array of companies that it sees as holding long-term potential, including unlisted upstarts, so its financial performance tends to swing wildly. For the nine months of this fiscal year through December, it recorded a profit of 636 billion yen ($4 billion), a reversal from a loss of 459 billion for the previous year. Investment gains were recorded in its holdings in Chinese e-commerce company Alibaba; Coupang, a South Korean retailer based in the U.S.; a mobility service provider DiDi Global and Grab Holdings, a Singaporean technology company, while improved sales came in its British semiconductor company Arm's business. Some of the investment gains from the earlier months of this fiscal year were erased in the latest quarter. The company does not issue an annual forecast.

[3]

Japan's SoftBank reports loss weeks after announcing AI investment with U.S. President Trump

TOKYO (AP) -- Japanese technology company SoftBank Group Corp. reported a 369.2 billion yen ($2.4 billion) loss for the fiscal third quarter as it racked up red ink from its Vision Fund investments. That's compared to a 950 billion yen profit in October-December 2023. Quarterly sales rose 3% from the previous year to 1.83 trillion yen ($11.9 billion), the Tokyo-based company said Wednesday. The report comes barely a month after Masayoshi Son, the founder and chief executive, appeared with President Donald Trump in Washington, as well as with Sam Altman of OpenAI and Larry Ellison of Oracle, to announce an investment of up to $500 billion into an artificial intelligence project called Stargate. Son has repeatedly said the company is banking on a future in artificial intelligence. SoftBank Group invests in an array of companies that it sees as holding long-term potential, including unlisted upstarts, so its financial performance tends to swing wildly. For the nine months of this fiscal year through December, it recorded a profit of 636 billion yen ($4 billion), a reversal from a loss of 459 billion for the previous year. Investment gains were recorded in its holdings in Chinese e-commerce company Alibaba; Coupang, a South Korean retailer based in the U.S.; a mobility service provider DiDi Global and Grab Holdings, a Singaporean technology company, while improved sales came in its British semiconductor company Arm's business. Some of the investment gains from the earlier months of this fiscal year were erased in the latest quarter. The company does not issue an annual forecast.

[4]

SoftBank falls to $2.4bn loss amid plans for huge AI investments

SoftBank tumbled to a $2.4bn loss in its fiscal third quarter as the Japanese conglomerate and its founder Masayoshi Son gear up to finance one of the world's largest-ever bets on artificial intelligence. The tech group said on Wednesday it fell to a loss of ¥369.2bn ($2.4bn), compared with a gain of ¥950bn in the same quarter last year and missing analysts' forecasts for a net profit of ¥234bn, according to LSEG data. SoftBank was hit by a ¥352.7bn loss in its tech-heavy investment vehicles, the Vision Funds, following two successive quarters of gains. "It looks like the biggest change is that they had some losses in their private portfolio, in the Vision Funds, which they don't break out, but quarter to quarter it's not clear the number matters that much," said Kirk Boodry at Astris Advisory in Tokyo. The often volatile Vision Funds were also hit by drops in the valuation of some of their higher profile public companies, including South Korean ecommerce group Coupang and Chinese ride-hailing group Didi. "However, what everyone wants to know is what they are going to do with AI, what is happening with Stargate, and how they are going to fund it," Boodry added. Son is on the hook to help finance a massive US AI infrastructure project dubbed "Stargate", which he announced last month as a partnership with Sam Altman's OpenAI. The Japanese group plans to put about $15bn to $20bn into Stargate initially, with spending of as much as $500bn predicted over the next four years. SoftBank is also set to invest between $15bn and $25bn in OpenAI as the centrepiece of a wider funding round that could lead to ChatGPT's creator raising as much as $40bn.

[5]

SoftBank Group Posts Quarterly Loss on Weak Tech Funds Business -- Update

SoftBank Group reported a quarterly loss, partly due to the weakness in its technology funds business, as it geared up to make more investments in artificial intelligence. The Japanese technology investment company said Wednesday that it booked a net loss for the three months ended December, swinging from a net profit a year earlier and missing analysts' estimates. Its Vision Funds business posted a loss as the value of e-commerce company Coupang, Indian electric-scooter maker Ola and some other startups declined. In January, SoftBank Group and OpenAI announced a plan to invest up to half a trillion dollars in AI infrastructure in the U.S., together with other partners such as Oracle and Abu Dhabi-based MGX. SoftBank Group said Wednesday that the venture, called Stargate, will be funded primarily through project finance and that equity investment will be limited. Chief Financial Officer Yoshimitsu Goto said the company will be able to maintain its fiscal discipline while making investments for Stargate. The company's cash position stood at 5.0 trillion yen, equivalent to $32.79 billion, as of the end of 2024. SoftBank Group said it revised margin-loan terms using Arm shares in December, raising the borrowing limit to $13.5 billion from $8.5 billion. The increased borrowing capacity of $5.0 billion was untouched as of December. SoftBank's earnings are susceptible to fluctuations in technology stocks. The recent emergence of Chinese AI startup DeepSeek raised concerns about demand for advanced chips and data centers, triggering a selloff in AI-related stocks late last month. Shares in SoftBank were also caught in the market rout, slumping more than 13% over two days. SoftBank Group and ChatGPT maker OpenAI said last week that they plan to team up to offer AI services, initially targeting Japanese businesses to lay the groundwork for potential expansion worldwide. For its third quarter, SoftBank Group booked a net loss of 369.165 billion yen, equivalent to $2.42 billion, compared with a net profit of Y950.00 billion in the year-earlier period. That missed the estimated net profit of Y322.2 billion in a poll of analysts by data provider Visible Alpha. Its Vision Funds business posted a loss of Y309.93 billion, compared with a profit of Y422.74 billion. Even so, continued hopes for growing AI-related demand at the company's investees, including subsidiary Arm Holdings, have boosted SoftBank Group's stock in recent months, with its shares rising 3.8% on Wednesday ahead of the results. A few months ago, SoftBank Group Chief Executive Masayoshi Son predicted that artificial general intelligence, or AGI, in which computers have human-level cognitive abilities, would be achieved within two to three years. "I now realize that AGI would come much earlier," he said in February. Write to Kosaku Narioka at [email protected]

[6]

SoftBank Posts Quarterly Loss, Gears Up for Giant AI Project -- 2nd Update

SoftBank Group reported a quarterly loss, partly due to the weakness in its technology funds business, as it geared up for a giant artificial-intelligence infrastructure project with ChatGPT maker OpenAI and other partners. The Japanese technology investment company said Wednesday that it booked a net loss for the three months ended December, swinging from a net profit a year earlier and missing analysts' estimates. In January, SoftBank Group and OpenAI announced a plan to invest up to half a trillion dollars in AI infrastructure in the U.S., together with other partners such as Oracle and Abu Dhabi-based MGX. The companies said they were committing $100 billion to the venture and aiming to spend up to $500 billion over the next four years. The joint venture, called Stargate, will build data centers for OpenAI. SoftBank Group said Wednesday that Stargate will be funded primarily through project finance and that equity investment will be limited. Much of the funding for each data-center project would come from lenders and debt investors such as banks, insurers, pension funds and investment funds. Chief Financial Officer Yoshimitsu Goto said the company will be able to maintain its fiscal discipline while making investments for Stargate. If debt financing becomes difficult, the company should slow the pace of investments, Goto said. He said the company has a long history of using project finance and is well versed in that. "We hope Elon-san will find that out," he said. Billionaire Elon Musk publicly questioned whether the joint venture would have enough capital to follow through on their pledges shortly after the Stargate project's announcement in January. SoftBank Group wants to earnestly undertake investments in AI, which "has just begun," Goto said. A few months ago, SoftBank Group Chief Executive Masayoshi Son predicted that artificial general intelligence, or AGI, in which computers have human-level cognitive abilities, would be achieved within two to three years. "I now realize that AGI would come much earlier," he said last week. SoftBank itself has invested $2.0 billion in OpenAI through its Vision Fund 2, after the Japanese company bought $1.5 billion of existing shares in January. The company's cash position stood at 5.0 trillion yen, equivalent to $32.79 billion, as of the end of 2024. SoftBank Group said it revised margin-loan terms using shares of subsidiary Arm Holdings in December, raising the borrowing limit to $13.5 billion from $8.5 billion. The increased borrowing capacity of $5.0 billion was untouched as of December. SoftBank's earnings are susceptible to fluctuations in technology stocks. The recent emergence of Chinese AI startup DeepSeek raised concerns about demand for advanced chips and data centers, triggering a selloff in AI-related stocks late last month. Shares in SoftBank were also caught in the market rout, slumping more than 13% over two days. Goto said the entrance of new service providers such as DeepSeek is good for the AI industry. SoftBank Group and OpenAI said last week that they plan to team up to offer AI services, initially targeting Japanese businesses to lay the groundwork for potential expansion worldwide. For its third quarter, SoftBank Group booked a net loss of 369.165 billion yen, equivalent to $2.42 billion, compared with a net profit of Y950.00 billion in the year-earlier period. That missed the estimated net profit of Y322.2 billion in a poll of analysts by data provider Visible Alpha. Its Vision Funds business posted a loss of Y309.93 billion, compared with a profit of Y422.74 billion in the year-earlier period, as the value of e-commerce company Coupang, Indian electric-scooter maker Ola and some other startups declined. Even so, continued hopes for growing AI-related demand at the company's investees, including Arm, have boosted SoftBank Group's stock in recent months, with its shares rising 3.8% on Wednesday ahead of the results. Last week, Arm reported record quarterly sales for the three months ended Dec. 31, buoyed by a rush of AI chip buying. Write to Kosaku Narioka at [email protected]

[7]

Japan's SoftBank reports loss weeks after announcing AI investment with U.S. President Trump

TOKYO (AP) -- Japanese technology company SoftBank Group Corp. reported a 369.2 billion yen ($2.4 billion) loss for the fiscal third quarter as it racked up red ink from its Vision Fund investments. That's compared to a 950 billion yen profit in October-December 2023. Quarterly sales rose 3% from the previous year to 1.83 trillion yen ($11.9 billion), the Tokyo-based company said Wednesday. The report comes barely a month after Masayoshi Son, the founder and chief executive, appeared with President Donald Trump in Washington, as well as with Sam Altman of OpenAI and Larry Ellison of Oracle, to announce an investment of up to $500 billion into an artificial intelligence project called Stargate. Son has repeatedly said the company is banking on a future in artificial intelligence. SoftBank Group invests in an array of companies that it sees as holding long-term potential, including unlisted upstarts, so its financial performance tends to swing wildly. For the nine months of this fiscal year through December, it recorded a profit of 636 billion yen ($4 billion), a reversal from a loss of 459 billion for the previous year. Investment gains were recorded in its holdings in Chinese e-commerce company Alibaba; Coupang, a South Korean retailer based in the U.S.; a mobility service provider DiDi Global and Grab Holdings, a Singaporean technology company, while improved sales came in its British semiconductor company Arm's business. Some of the investment gains from the earlier months of this fiscal year were erased in the latest quarter. The company does not issue an annual forecast. ___ Yuri Kageyama is on Theads: https://www.threads.net/@yurikageyama

[8]

SoftBank Group Posts Quarterly Loss on Weak Tech Funds Business

SoftBank Group reported a quarterly loss, partly due to the weakness in its technology funds business. The Japanese technology investment company said Wednesday that it booked a net loss of 369.165 billion yen, equivalent to $2.42 billion, for the three months ended Dec. 31, compared with a net profit of Y950.00 billion in the year-earlier period. That missed the estimated net profit of Y322.2 billion in a poll of analysts by data provider Visible Alpha. Its Vision Funds business posted a loss of Y309.93 billion, compared with a profit of Y422.74 billion a year earlier. SoftBank's earnings are susceptible to fluctuations in technology stocks. The emergence of Chinese artificial-intelligence startup DeepSeek raised concerns about demand for advanced chips and data centers and triggered a selloff in AI-related stocks late last month. In January, SoftBank Group and OpenAI announced a plan to invest up to half a trillion dollars in AI infrastructure in the U.S., together with other partners such as Oracle and Abu Dhabi-based MGX. SoftBank Group and the ChatGPT maker said last week that they plan to team up to offer AI services, initially targeting Japanese businesses to lay the groundwork for potential expansion worldwide. SoftBank Group's stock has been boosted in recent months by hopes for growing AI-related demand at the company's investees, including subsidiary Arm Holdings. Just a few months ago, SoftBank Group Chief Executive Masayoshi Son predicted that artificial general intelligence, or AGI, in which computers have human-level cognitive abilities, would be achieved within two to three years. "I now realize that AGI would come much earlier," he said last week. Write to Kosaku Narioka at [email protected]

[9]

SoftBank swings to a loss ahead of big Stargate AI bet

SoftBank Group swung to a loss in the December quarter due to a drop in the value of its Vision Fund unit's public holdings, boding ill for founder Masayoshi Son who has to raise $500 billion for the Stargate artificial intelligence project. The Tokyo-based company reported a net loss of ¥369.2 billion ($2.4 billion) for the fiscal third quarter compared with a profit of ¥950 billion a year earlier. The Vision Fund unit logged a ¥309.9 billion loss, hurting the bottom line after shares of public holdings such as Coupang and Didi Global gave up some of their gains from the previous quarter. Volatility in the Vision Fund's quarterly performance consistently dogs SoftBank, which has embarked on a project with OpenAI to invest $500 billion on the infrastructure needed to support and propel AI development. Japanese billionaire Son is exploring project financing to raise money. One scenario under review is to raise 10% of the total sum through equity with senior loans contributing as much as 70%.

[10]

SoftBank Swings to a Loss Ahead of Big Stargate AI Bet

SoftBank Group Corp. swung to losses for the December quarter due to a drop in the value of the Vision Fund's public holdings, boding ill for founder Masayoshi Son who has to raise $500 billion for the Stargate artificial-intelligence project. The Tokyo-based company reported a net loss of ¥369.2 billion ($2.4 billion) for the fiscal third quarter compared with a profit of ¥950 billion a year ago. The Vision Fund unit logged a ¥309.9 billion loss, hurting the bottomline after shares of public holdings such as Coupang Inc. and Didi Global Inc. gave up some of their gains from the previous quarter.

[11]

SoftBank Group posts USD2.4B third-quarter net loss

AFP - SoftBank Group said yesterday it plunged back into the red for the three months to December, following an announcement that it will form a joint venture with United States (US) tech giant OpenAI. The company's results often swing dramatically because it invests heavily in tech start-ups and semiconductor firms, whose share prices are volatile. The tech investor logged JPY369 billion (USD2.4 billion) in net losses for October-December, compared with a profit of JPY950 billion from a year earlier. A recent joint statement by SoftBank Group and OpenAI said the former will "spend USD3 billion annually to deploy OpenAI's solutions across its group companies". SoftBank and OpenAI are already working together on the Stargate drive announced in January by US President Donald Trump to invest up to USD500 billion in artificial intelligence infrastructure in the US.

[12]

SoftBank Vision Fund Hit With More Losses

SoftBank reported a net loss of nearly $2.4 billion for its fiscal third quarter, with another quarter in the red for its once-heralded Vision Fund unit. The Vision Fund drop is nothing new, as SoftBank has pulled back on investments since 2022 -- after interest rates began to rise and venture capital as a whole saw a significant pullback. In mid-2023, founder Masayoshi Son told investors the multinational investment holding behemoth would again shift from "defense mode" as it looks to be a leader in AI and robotics. Since then, the company has doubled down on AI deals even as it has shifted away from its Vision Fund. However, just this week SoftBank put its Vision Fund unit back to work. SoftBank and Google Quantum AI both took part in a whopping $230 million round for Boston-based neutral-atom quantum firm QuEra Computing. The fund unit also took part in this week's $125 million Series C for AI-powered workflows startup Tines. The new round valued the company at $1.1 billion.

Share

Share

Copy Link

SoftBank Group Corp. reported a significant loss in its fiscal third quarter, primarily due to its Vision Fund investments. This comes shortly after announcing a massive AI infrastructure project, highlighting the company's pivot towards artificial intelligence.

SoftBank's Financial Performance

SoftBank Group Corp., the Japanese technology investment company, reported a substantial loss of 369.2 billion yen ($2.4 billion) for its fiscal third quarter ending December 2024

1

2

3

. This marks a significant reversal from the 950 billion yen profit recorded in the same period the previous year. The loss was primarily attributed to the poor performance of its Vision Fund investments, which posted a loss of 309.93 billion yen5

.Despite the quarterly setback, SoftBank's sales rose by 3% year-on-year to 1.83 trillion yen ($11.9 billion)

1

2

3

. For the first nine months of the fiscal year, the company recorded a profit of 636 billion yen ($4 billion), a turnaround from the 459 billion yen loss in the previous year1

2

3

.Vision Funds and Investment Portfolio

SoftBank's Vision Funds, known for their tech-heavy investments, experienced losses following two consecutive quarters of gains

4

. The funds were impacted by valuation drops in high-profile public companies, including South Korean e-commerce group Coupang and Chinese ride-hailing group Didi4

5

.However, the company also reported investment gains in several holdings, including Chinese e-commerce giant Alibaba, U.S.-based South Korean retailer Coupang, mobility service provider DiDi Global, and Singaporean technology company Grab Holdings

1

2

3

. Additionally, improved sales were noted in SoftBank's British semiconductor company Arm's business1

2

3

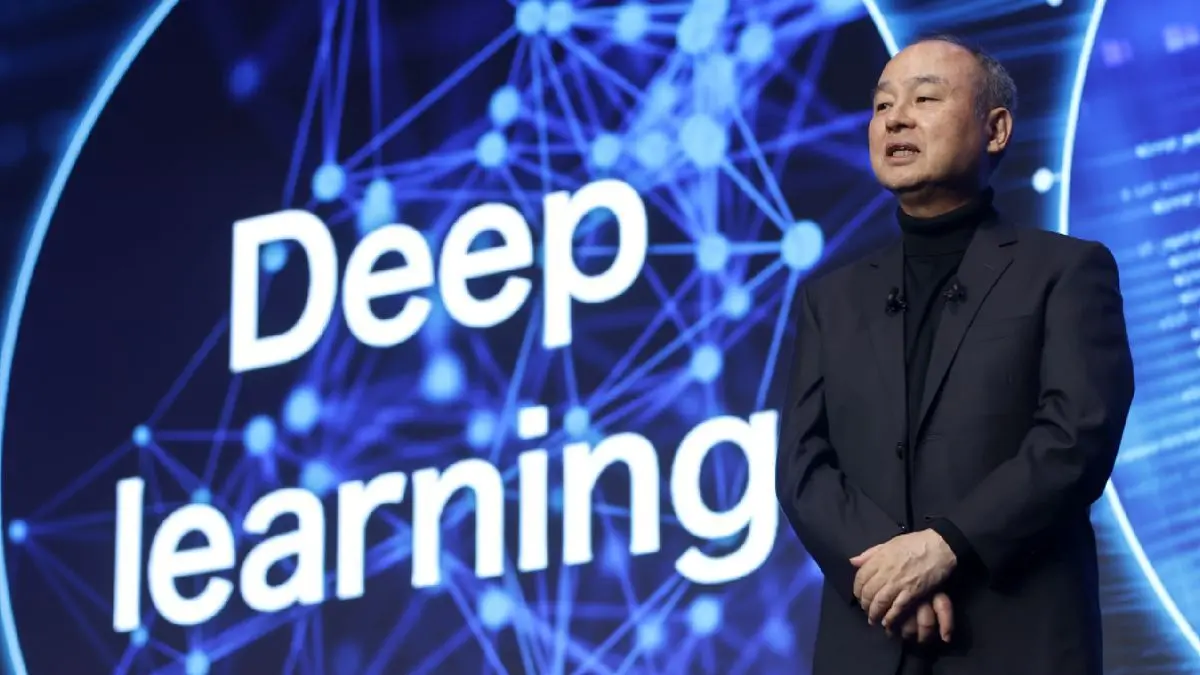

.Pivot to Artificial Intelligence

The financial report comes on the heels of a major announcement by SoftBank's founder and CEO, Masayoshi Son. In January, Son appeared alongside U.S. President Donald Trump, OpenAI's Sam Altman, and Oracle's Larry Ellison to unveil plans for a massive artificial intelligence project called Stargate

1

2

3

4

.SoftBank, in partnership with OpenAI and other entities, plans to invest up to $500 billion in AI infrastructure in the U.S. over the next four years

4

. The company stated that the Stargate venture would be primarily funded through project finance, with limited equity investment to maintain fiscal discipline5

.Related Stories

Future Outlook and AI Investments

Despite the current losses, SoftBank remains bullish on artificial intelligence. The company is set to invest between $15 billion and $25 billion in OpenAI as part of a wider funding round that could see ChatGPT's creator raise up to $40 billion

4

.SoftBank and OpenAI also announced plans to collaborate on offering AI services, initially targeting Japanese businesses with potential for global expansion

5

. CEO Masayoshi Son has expressed optimism about the rapid advancement of AI, predicting that artificial general intelligence (AGI) could arrive sooner than previously anticipated5

.As of the end of 2024, SoftBank's cash position stood at 5.0 trillion yen ($32.79 billion), and the company has revised its margin-loan terms using Arm shares, increasing its borrowing limit to $13.5 billion

5

. These financial maneuvers position SoftBank to continue its ambitious AI investment strategy while navigating the volatilities of the tech investment landscape.References

Summarized by

Navi

[1]

[2]

[5]

Related Stories

SoftBank Group Faces Q4 Loss Amid AI Investments and Vision Fund Struggles

12 May 2025•Business and Economy

SoftBank Group Reports Unexpected Q1 Loss Amid Investment Challenges

07 Aug 2024

SoftBank's AI investments deliver $1.62 billion profit as OpenAI stake drives turnaround

12 Feb 2026•Business and Economy

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy