SoftBank Reports $7.8 Billion Annual Profit, Doubles Down on AI Investments

10 Sources

10 Sources

[1]

SoftBank reports surprise $3.5bn profit as telco valuations improve

Masayoshi Son's SoftBank Group recorded a surprise $3.5bn profit in its latest quarter, driven by gains in its telecommunications holdings and improved valuations for other key investments. The Japanese tech conglomerate said on Tuesday it made a net profit of ¥517.2bn ($3.5bn) in its fiscal fourth quarter, well up on the ¥231bn in the same period last year. It also beat analyst expectations of a small ¥26.9bn loss, according to LSEG data, underlining the volatility in the business. "It's a surprise . . . but in the bigger scheme of things what really matters is their plans for Stargate and OpenAI," said Kirk Boodry, a SoftBank analyst at Astris Advisory. Boodry attributed the unexpected profit to gains in telecom holdings, including T-Mobile and Deutsche Telekom, as well as in Alibaba shares and its portfolio of private companies. The results come at a critical point for SoftBank, which is investing heavily in artificial intelligence, including $30bn in OpenAI and preparing to deploy an initial $100bn in its joint Stargate AI infrastructure project. Stargate involves a massive build-out of data centres, primarily in the US, funded through project financing and in a partnership with OpenAI, as well as other groups including Oracle, Microsoft and Nvidia. The moves are all part of Son's grand strategy for AI, which he believes is about to usher in a new economic and social revolution. The group recorded an investment gain of ¥177bn in its tech-heavy Vision Funds, with South Korean ecommerce group Coupang and TikTok owner ByteDance helping to lift performance. Last quarter, the Vision Funds fell to a ¥352bn loss. SoftBank also said on Tuesday it would centralise its robotics-related companies under one entity.

[2]

Japanese tech giant SoftBank records its first profit in 4 years

TOKYO (AP) -- Japanese technology company SoftBank Group posted its first profit in four years Tuesday, as it raked in gains from its investment portfolios. SoftBank warned of major uncertainties ahead because of President Donald Trump's tariff policies, tensions between the U.S. and China, and other global conflicts. Tokyo-based Softbank's profit for the fiscal year through March totaled 1.15 trillion yen ($7.8 billion), a reversal from the 227.6 billion yen loss it racked up the previous year. Annual sales climbed 7% to 7.2 trillion yen ($49 billion). SoftBank has a wide-ranging partnership with OpenAI, the U.S. artificial intelligence research organization behind ChatGPT. It said it remains focused on promoting technology related to artificial intelligence. The company said it will continue to aggressively invest in new AI companies like Glean and Helion, both U.S. companies. SoftBank also recently decided to acquire the total equity of Ampere, a U.S. cloud-and AI-focused semiconductor design company, for $6.5 billion. It expects to complete the transaction in the second half of this year. Its investments include stakes in Chinese e-commerce giant Alibaba and T-Mobile, a European mobile communications outfit. Both gained value over the latest period. Also helping its bottom line were strong results and royalties at Arm, a British semiconductor and software design company in which SoftBank is a major investor. The company also logged gains from its SoftBank Vision Funds. SoftBank invests in various companies, including ByteDance, the Chinese multinational that's behind TikTok, and PayPay, a popular Japanese mobile payment application. SoftBank said it was planning an IPO for PayPay. Launched in 2018, PayPay is now used by more than 68 million people, according to SoftBank. Japan's population is about 125 million.

[3]

Japan's SoftBank posts $7.8 bn annual net profit

Tokyo (AFP) - Japanese tech investor SoftBank Group, a major player in the US Stargate artificial intelligence drive, on Tuesday posted a bumper full-year net profit of $7.8 billion. The 1.15 trillion yen net profit for the 12 months to March 2025 was up from a net loss of 227 billion yen in the previous financial year. The company's earnings often swing dramatically because it invests heavily in tech start-ups and semiconductor firms, whose share prices are volatile. Tuesday's result marked its first full-year net profit since the 2020-21 financial year. SoftBank Group has been actively investing in AI in recent years under its flamboyant founder and CEO Masayoshi Son. He has repeatedly said "artificial superintelligence" will arrive in a decade -- bringing new inventions, medicine, knowledge and ways to invest. The company is leading the $500 billion Stargate project to build AI infrastructure in the United States along with cloud giant Oracle and ChatGPT-maker OpenAI. SoftBank Group and OpenAI announced in February that the Japanese giant would spend $3 billion annually to deploy OpenAI's technologies across its group companies. SoftBank also said in March it had reached a deal to acquire US semiconductor firm Ampere for $6.5 billion, reinforcing its aggressive push into AI. The purchase is expected to close in the second half of the year. The Japanese company is a majority shareholder in Arm Holdings, whose technology is used in 99 percent of smartphones. Hideki Yasuda, an analyst at brokerage Toyo Securities, told AFP ahead of the announcement that he expected the firm to reveal strong figures. "The market was not bad from January to March, so I think (the results) will land relatively well," he said. "The market environment only worsened from the end of March to the beginning of April when the tariffs were announced," he said, referring to US President Donald Trump's multi-pronged free trade war. "When AI first came out, it was mostly a dream and we couldn't do anything with it," Yasuda said. "But as of 2025, we are at the stage where it will be put to practical use, so the company is now investing in various businesses that are using AI."

[4]

Japanese tech giant SoftBank records its first profit in 4 years

TOKYO (AP) -- Japanese technology company SoftBank Group posted its first profit in four years Tuesday, as it raked in gains from its investment portfolios. SoftBank warned of major uncertainties ahead because of President Donald Trump's tariff policies, tensions between the U.S. and China, and other global conflicts. Tokyo-based Softbank's profit for the fiscal year through March totaled 1.15 trillion yen ($7.8 billion), a reversal from the 227.6 billion yen loss it racked up the previous year. Annual sales climbed 7% to 7.2 trillion yen ($49 billion). SoftBank has a wide-ranging partnership with OpenAI, the U.S. artificial intelligence research organization behind ChatGPT. It said it remains focused on promoting technology related to artificial intelligence. The company said it will continue to aggressively invest in new AI companies like Glean and Helion, both U.S. companies. SoftBank also recently decided to acquire the total equity of Ampere, a U.S. cloud-and AI-focused semiconductor design company, for $6.5 billion. It expects to complete the transaction in the second half of this year. Its investments include stakes in Chinese e-commerce giant Alibaba and T-Mobile, a European mobile communications outfit. Both gained value over the latest period. Also helping its bottom line were strong results and royalties at Arm, a British semiconductor and software design company in which SoftBank is a major investor. The company also logged gains from its SoftBank Vision Funds. SoftBank invests in various companies, including ByteDance, the Chinese multinational that's behind TikTok, and PayPay, a popular Japanese mobile payment application. SoftBank said it was planning an IPO for PayPay. Launched in 2018, PayPay is now used by more than 68 million people, according to SoftBank. Japan's population is about 125 million. ___ Yuri Kageyama is on Threads: https://www.threads.com/@yurikageyama

[5]

Japanese tech giant SoftBank records its first profit in 4 years

TOKYO -- Japanese technology company SoftBank Group posted its first profit in four years Tuesday, as it raked in gains from its investment portfolios. SoftBank warned of major uncertainties ahead because of President Donald Trump's tariff policies, tensions between the U.S. and China, and other global conflicts. Tokyo-based Softbank's profit for the fiscal year through March totaled 1.15 trillion yen ($7.8 billion), a reversal from the 227.6 billion yen loss it racked up the previous year. Annual sales climbed 7% to 7.2 trillion yen ($49 billion). SoftBank has a wide-ranging partnership with OpenAI, the U.S. artificial intelligence research organization behind ChatGPT. It said it remains focused on promoting technology related to artificial intelligence. The company said it will continue to aggressively invest in new AI companies like Glean and Helion, both U.S. companies. SoftBank also recently decided to acquire the total equity of Ampere, a U.S. cloud-and AI-focused semiconductor design company, for $6.5 billion. It expects to complete the transaction in the second half of this year. Its investments include stakes in Chinese e-commerce giant Alibaba and T-Mobile, a European mobile communications outfit. Both gained value over the latest period. Also helping its bottom line were strong results and royalties at Arm, a British semiconductor and software design company in which SoftBank is a major investor. The company also logged gains from its SoftBank Vision Funds. SoftBank invests in various companies, including ByteDance, the Chinese multinational that's behind TikTok, and PayPay, a popular Japanese mobile payment application. SoftBank said it was planning an IPO for PayPay. Launched in 2018, PayPay is now used by more than 68 million people, according to SoftBank. Japan's population is about 125 million.

[6]

SoftBank profit doubles as AI demand boosts chip sales and startup valuations

SoftBank Group reported a 124% jump in quarterly profit on resilient AI demand that's supporting startup valuations and chip unit sales, a boost to its aggressive data center investment plans. The Tokyo-based company reported net income of ¥517.18 billion ($3.5 billion) in its fiscal fourth quarter. It was helped by the Vision Fund, which swung to a profit of ¥26.1 billion. The earnings come at a critical juncture for SoftBank as it plans to invest $30 billion in OpenAI while leading a $100 billion foray into building AI hardware in the U.S. Maintaining a healthy cash flow and balance sheet is key to securing the billions of dollars needed at minimum cost.

[7]

SoftBank Books $3.6 Billion Profit On Arm, ByteDance Gains While AI Bets Face Trade Policy Hurdles - SoftBank Group (OTC:SFTBF), SoftBank Group (OTC:SFTBY)

Japanese investment holding company SoftBank Group Corp SFTBF SFTBY reported fourth-quarter results on Tuesday. The company reported quarterly net sales of 1.94 trillion yen ($12.69 billion), up from 1.75 trillion yen a year ago. SoftBank segment net sales grew 10.2% to 1.73 trillion yen ($11.33 billion). Arm Holdings ARM net sales rose 38.3% to 189.81 billion yen ($1.24 billion). The income before tax for the company was 433.79 billion yen. The net income was 545.42 billion yen (or $3.57 billion) compared to a profit of 328.9 billion yen a year ago. Also Read: OpenAI And SoftBank's Stargate Considers Major UK Investment To Fuel AI Growth The gain on investments was 1.53 trillion yen (or $10.01 billion). Vision Fund investments reported a 177.26 billion yen profit (or $1.16 billion), compared to a loss of (57.53) billion yen a year ago. The segment reported a 26.07 billion yen profit (or $0.17 billion) versus a loss of (96.74) billion yen backed by rise in the value of TikTok owner ByteDance, CNBC reported on Tuesday. SoftBank reported a segment income of 142.32 billion yen (or $0.93 billion) versus 123.55 billion yen a year ago. Arm's segment income is 30.44 billion yen (or $0.2 billion) compared to a loss of (16.77) billion yen a year ago. The Board resolved to propose a fiscal dividend per share of 22 yen at the annual general meeting on June 27. The annual dividend per share for the fiscal year, including the interim dividend, will be 44 yen, the same as the previous fiscal year. In January, the Trump Administration announced an AI infrastructure joint venture in the U.S. dubbed "Stargate," comprising OpenAI, SoftBank Group, Oracle Corp ORCL, and Abu Dhabi's MGX. The venture will deploy $100 billion initially and up to $500 billion over the next four years. SoftBank invested $30 billion in OpenAI under a broader $40 billion financing round in March that valued the startup at $300 billion. Reports indicated SoftBank weighing an investment of $15 billion-$25 billion in OpenAI, making it the largest investor in the ChatGPT creator. However, President Donald Trump's aggressive trade policies have slowed down SoftBank's plans to invest $100 billion in artificial intelligence infrastructure in the U.S., Bloomberg reported on Monday. The tariff policies have triggered concerns over higher capital costs, with lenders and debt investors dumping high-risk bets and fears about potential global recession taking a toll on data center demand. Read Next: Nvidia's Jensen Huang Meets Japanese PM To Discuss AI's Growing Energy Needs Photo by Michael Vi via Shutterstock SFTBFSoftBank Group Corp$62.2722.8%OverviewSFTBYSoftBank Group Corp$27.111.90%ARMARM Holdings PLC$127.281.98%ORCLOracle Corp$162.203.17%Got Questions? AskHow will SoftBank's profits influence tech stocks?Which AI companies might benefit from SoftBank's investment?What impact will tariff policies have on U.S. tech investments?Could ByteDance's growth affect social media stocks?What opportunities lie in AI infrastructure due to Stargate?How might OpenAI's valuation impact investor sentiment?Which data center companies could thrive amidst rising costs?How will Oracle benefit from AI joint ventures?What sectors could be disrupted by SoftBank's AI ambitions?Is there potential in fintech due to SoftBank's market moves?Powered ByMarket News and Data brought to you by Benzinga APIs

[8]

SoftBank profit doubles as AI demand boosts chip sales and startups

SoftBank reported a 124% jump in quarterly profit on resilient AI demand that's supporting startup valuations and chip unit sales, a boost to its aggressive data center investment plans. The Tokyo-based company reported net income of ¥517.18 billion ($3.5 billion) in its fiscal fourth quarter. It was helped by the Vision Fund, which swung to a profit of ¥26.1 billion mainly on a surge in the value of TikTok owner ByteDance and its strong international sales. The earnings come at a critical juncture for SoftBank as it plans to invest $30 billion in OpenAI while leading a $100 billion foray into building AI hardware in the United States. Maintaining a healthy cash flow and balance sheet is key to securing the billions of dollars needed at minimum cost.

[9]

SoftBank Group FY net income beats expectations as AI cheer boosts tech holdings By Investing.com

Investing.com-- Softbank Group Corp. (TYO:9984) booked a stronger-than-expected annual net income on Tuesday, as increasing hype over artificial intelligence drove up the value of its key tech holdings in the past year. {{0|Softbank} } posted a net income attributable of 1.15 trillion yen ($7.8 billion) for the year to March 31, much higher than Bloomberg estimates of 709.69 billion yen. Softbank also swung to an annual profit from a 227.65 billion yen loss in the prior year. Softbank's net sales rose 7.2% to 7.243 trillion yen for the year. For the three months to March 31, Softbank reported a net profit of 517 billion yen ($3.49 billion), which was stronger than Reuters expectations for a modest loss of 26.9 billion yen. Its performance through the quarter was boosted chiefly by strength in its telecom units, which helped offset a decline in tech valuations in the first three months of 2025. The tech investment conglomerate logged a 3.70 trillion yen gain on its investments through the past year, as increasing optimism over artificial intelligence drove up tech valuations across the board. Of this, its annual gain on investment at its flagship Vision Funds was 387.58 billion yen, boosted by its holdings in Coupang Inc, DiDi Global, and ByteDance. But this was offset by investment losses on AutoStore and Symbotic Inc (NASDAQ:SYM), which saw its Vision Fund 2 clock an overall investment loss. Softbank has leaned heavily into investing in artificial intelligence infrastructure and chips over the past two years, having recently acquired U.S. chipmaker Ampere for $6.5 billion. The company also earlier this year announced a $500 billion project with OpenAI- called Project Stargate- to build more AI infrastructure in the United States.

[10]

Japan's SoftBank Group books first annual profit in four years

TOKYO (Reuters) -Japan's SoftBank Group reported its first annual profit in four years on Tuesday, likely bringing relief to investors scarred by high-profile failures as the tech investor embarks on another series of mammoth investments. The Tokyo-based conglomerate reported 1.15 trillion yen ($7.78 billion) for the year ended March versus a loss of 227.6 billion yen a year earlier. The figure got a boost from the 517 billion yen booked for January-March - more than double that earned in same period a year earlier - on strong performance from telecommunications holdings and higher valuations in its later-stage startups. The turnaround illustrates the risk and reward of SoftBank's approach of investing in high-growth technology companies, epitomised by the success of its investment in Chinese e-commerce leader Alibaba Group and bankruptcy of U.S. office-space startup WeWork. Its Vision Fund 1, which invests in later-stage startups, recorded an investment gain of 940 billion yen in the fourth quarter, boosted by increases in the fair value of holdings such as TikTok operator Bytedance and e-commerce platform Coupang. In contrast, its Vision Fund 2, which invests in earlier-stage startups, booked an investment loss of 526 billion yen. SoftBank's holdings in mature telecommunications companies, including T-Mobile US and Deutsche Telekom, have been a consistent source of investment gain in recent quarters. T-Mobile shares hit an all-time high in March and ended the quarter up more than 20%. SoftBank is in the midst of its most extensive spending spree since the launch of its Vision Funds - in 2017 and 2019 - this time targeting companies it deems to be leading the development of artificial intelligence. In March, it said it would acquire U.S. semiconductor design company Ampere for $6.5 billion and announced new investment of up to $30 billion in ChatGPT maker OpenAI. SoftBank is also leading financing for the "Stargate" project - a $500 billion scheme to develop data centres in the United States - saying most of the money would come through lenders in project finance schemes. The scale of the commitments has prompted analysts and investors to question SoftBank's ability to weather market volatility brought about by new U.S. tariffs. ($1 = 147.9700 yen) (Reporting by Anton Bridge; Editing by Christopher Cushing)

Share

Share

Copy Link

SoftBank Group, the Japanese tech giant, posts its first profit in four years, driven by gains in telecom holdings and AI investments. The company emphasizes its commitment to artificial intelligence, including partnerships with OpenAI and the Stargate project.

SoftBank's Financial Turnaround

Japanese technology conglomerate SoftBank Group has reported a surprising annual net profit of ¥1.15 trillion ($7.8 billion) for the fiscal year ending March 2025, marking its first profit in four years

1

2

3

. This represents a significant turnaround from the ¥227.6 billion loss recorded in the previous year. The company's fourth-quarter performance was particularly strong, with a net profit of ¥517.2bn ($3.5bn), surpassing analyst expectations1

.Driving Factors Behind the Profit

SoftBank's unexpected profit can be attributed to several factors:

- Gains in telecommunications holdings, including T-Mobile and Deutsche Telekom

1

. - Improved valuations of key investments, such as Alibaba shares

1

4

. - Strong performance of the SoftBank Vision Funds, with companies like Coupang and ByteDance contributing to positive results

1

5

. - Robust results and royalties from Arm, the British semiconductor and software design company

4

5

.

Focus on Artificial Intelligence

SoftBank's financial success comes at a crucial time as the company intensifies its focus on artificial intelligence:

- The company has invested $30 billion in OpenAI and is preparing to deploy an initial $100 billion in the joint Stargate AI infrastructure project

1

3

. - SoftBank is leading the $500 billion Stargate project to build AI infrastructure in the United States, partnering with Oracle and OpenAI

3

. - A $3 billion annual investment has been announced to deploy OpenAI's technologies across SoftBank's group companies

3

. - The company plans to acquire Ampere, a U.S. cloud-and AI-focused semiconductor design company, for $6.5 billion

2

4

5

.

Strategic Investments and Future Plans

SoftBank continues to make strategic investments and plans for the future:

- Ongoing investments in AI companies such as Glean and Helion

2

4

5

. - Centralization of robotics-related companies under one entity

1

. - Plans for an IPO of PayPay, a popular Japanese mobile payment application used by over 68 million people

4

5

.

Related Stories

Market Outlook and Challenges

Despite the positive financial results, SoftBank has warned of potential challenges ahead:

- Uncertainties due to President Trump's tariff policies and U.S.-China tensions

2

4

5

. - Volatility in tech start-up and semiconductor firm share prices, which can significantly impact SoftBank's earnings

3

.

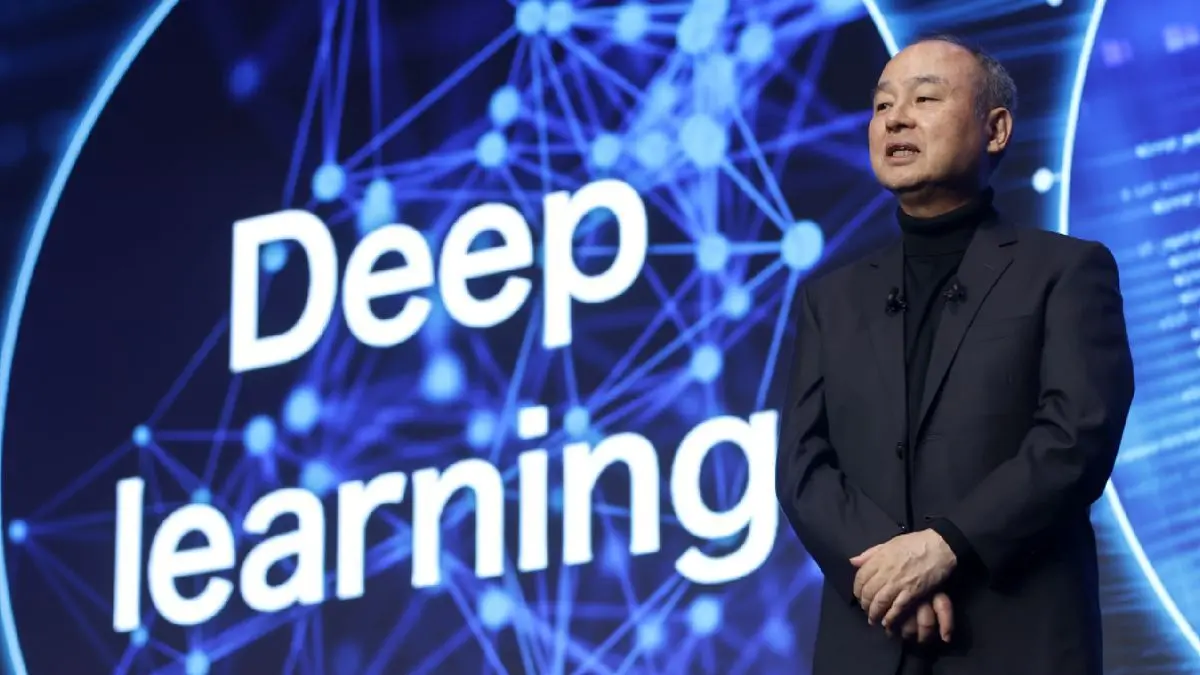

SoftBank's AI Vision

Masayoshi Son, SoftBank's founder and CEO, remains bullish on AI's potential:

- He believes "artificial superintelligence" will arrive within a decade, bringing new inventions, medical advancements, and investment opportunities

3

. - The company is positioning itself at the forefront of AI development and implementation across various sectors

2

3

4

.

As SoftBank continues to invest heavily in AI and related technologies, its financial performance and strategic decisions will likely play a significant role in shaping the future of the AI industry.

References

Summarized by

Navi

[3]

[4]

Related Stories

SoftBank Returns to Profit, Fueled by Tech Investments and AI Ambitions

12 Nov 2024•Business and Economy

SoftBank's AI investments deliver $1.62 billion profit as OpenAI stake drives turnaround

12 Feb 2026•Business and Economy

SoftBank Group Reports Strong Q1 Profit, Shares Surge on AI Investment Optimism

05 Aug 2025•Business and Economy

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy