SoftBank's Son says he 'was crying' over $5.8B Nvidia stake sale to fund AI investments

8 Sources

8 Sources

[1]

SoftBank's Son 'Cried' About Nvidia Stake Sale to Fund AI Bets

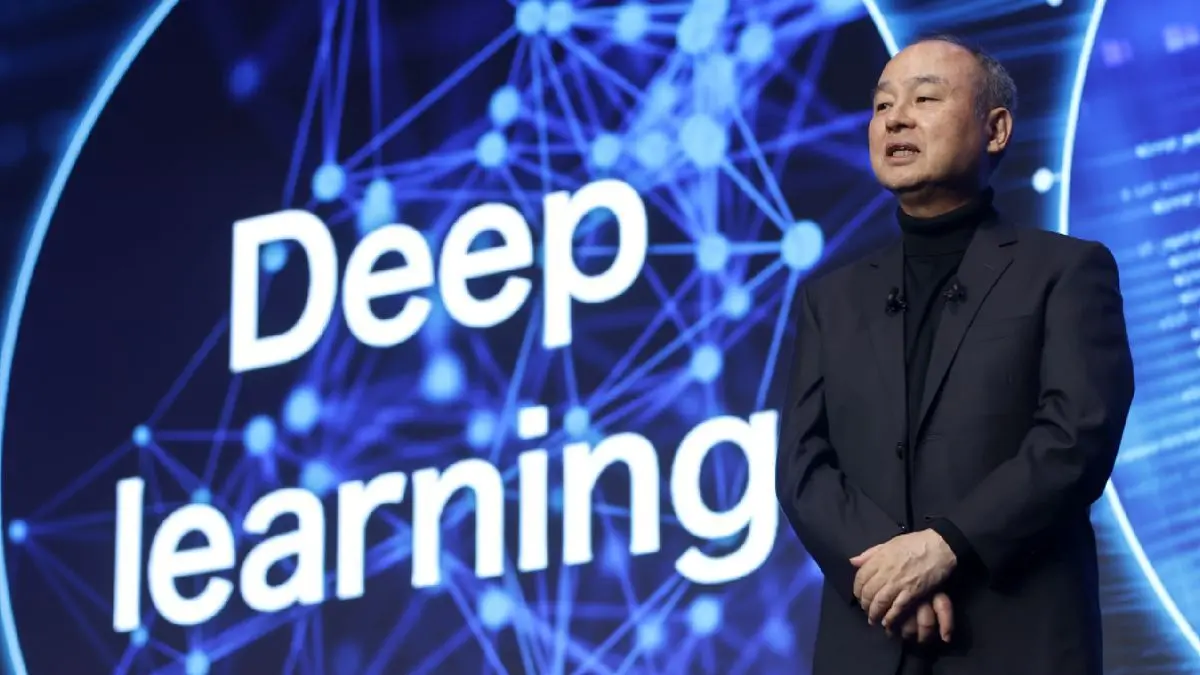

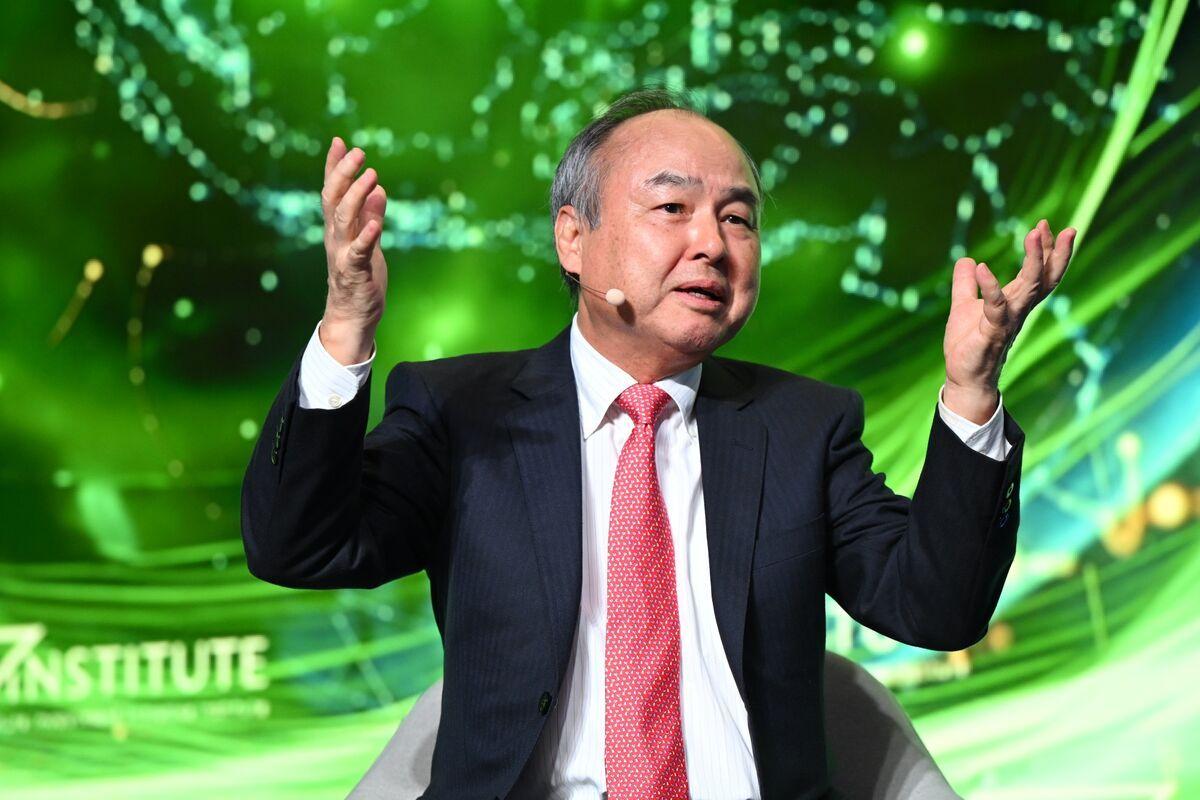

SoftBank Group Corp. founder Masayoshi Son said he wouldn't have sold off Nvidia Corp. shares if his company had unlimited money to bankroll its next investments in artificial intelligence, which include a big bet on OpenAI. Son, addressing for the first time the surprise November disclosure that SoftBank had unloaded its entire stake in the world's most valuable company, also slammed talk of an AI investment bubble. The Japanese company simply needed to raise capital to fund projects including data center construction, he told a forum in Tokyo Monday.

[2]

SoftBank's Son 'was crying' about the firm's need to sell its Nvidia stake

SoftBank Group founder Masayoshi Son on Monday downplayed the decision to offload the conglomerate's entire Nvidia stake, saying he "was crying" over parting with the shares. Speaking at a forum in Tokyo Monday, Son addressed SoftBank's November disclosure that the firm had sold its holding in the American chip darling for $5.83 billion. According to Son, SoftBank wouldn't have made the move if it didn't need to bankroll its next artificial intelligence investments, including a big bet on OpenAI and data center projects. "I don't want to sell a single share. I just had more need for money to invest in OpenAI and other projects, Son said during the FII Priority Asia forum. "I was crying to sell Nvidia shares." Son's comments are consistent with what analysts and other Softbank executives said in November, describing the sale as part of broader efforts to bolster SoftBank Vision Fund's AI war chest. SoftBank has doubled down on its AI plans this year with a series of projects, including work on Stargate Project data centers and the acquisition of U.S. chip designer Ampere Computing. The Japanese giant could also "potentially" increase its investment in OpenAI depending on the performance of the ChatGPT maker and the valuation of further rounds, a person familiar with the matter previously told CNBC. Earlier this year, Son said that SoftBank was "all in" on OpenAI and predicted the AI startup would one day become the most valuable company in the world. So far, that bet has reaped some dividends, with SoftBank reporting last month that its second-quarter net profit more than doubled to 2.5 trillion yen ($16.6 billion), driven by valuation gains in its OpenAI holdings. However, SoftBank's massive AI bets come amid growing fears and jitters in markets about a potential AI bubble. In his Monday talk, Son also pushed back against these concerns, arguing that those who talk about an AI bubble are "not smart enough." He predicted that "super [artificial] intelligence" and AI robots will generate at least 10% of global gross domestic product over the long term, which he said would outweigh trillions of dollars of investment into the technology.

[3]

SoftBank's Son says he cried selling Nvidia to fund AI bets

SoftBank founder Masayoshi Son has revealed how reluctant he was to part with the company's entire Nvidia stake, describing the sale as an emotional decision driven by the need to raise cash for a new wave of AI investments. Speaking at an investment forum in Tokyo Monday, he said: "I wish to have unlimited money. I respect Nvidia so much, I don't want to sell a single share. I just had more need for money to invest into OpenAI, invest into our opportunities, so I was crying to sell Nvidia shares. If I had more money, of course, I wanted to keep Nvidia shares, all the time, any time." SoftBank's decision to sell its Nvidia stake for about $5.83 billion caught investors off guard last month, sparking fresh fears that AI-related stocks could be overvalued. But Son pushed back against warnings that the sector is in a bubble, saying skeptics are "not smart enough." He added that the economic impact of advanced AI systems will be large enough to justify the enormous sums now being poured into the sector, asking, "Where is the bubble?" Nonetheless, SoftBank's stock has slumped almost 40% in U.S. trading since late October as investors grow uneasy about the scale of its AI spending. Much of that spending has been funneled into ambitious hardware and infrastructure projects such as the company's "Stargate" data-center plan and its move into in-house chip design via Ampere Computing. Both demand enormous capital outlays long before any payoff materializes. Son's comments come as short-seller Jim Chanos, most famous for his prescient Enron call in the early 2000s, warned of the risk of debt defaults in the growing AI cloud computing space. "Business models like the neoclouds, a lot of the AI companies themselves ... are just loss-making enterprises right now," Chanos said in an interview with Yahoo Finance last week. "You've gotta hope that changes, because if it doesn't, there's going to be debt defaults on these things."

[4]

SoftBank's Son Says He 'Was Crying' Over NVIDIA Stake Sale, But Needed Cash to Fund OpenAI | AIM

The decision wasn't driven by doubts about NVIDIA but by SoftBank's need to finance major new AI projects. SoftBank founder Masayoshi Son said he was emotional about parting with the company's entire NVIDIA stake, but insisted the sale was unavoidable as the group accelerates its push into AI. Speaking at the FII Priority Asia forum in Tokyo on Monday, Son addressed SoftBank's November disclosure that it had sold its NVIDIA shares for $5.83 billion. The tech billionaire said the decision wasn't driven by doubts about the chipmaker but by SoftBank's need to finance major new AI projects. "I don't want to sell a single share. I just had more need for money to invest in OpenAI and other projects," Son said. "I was crying to sell NVIDIA shares." SoftBank has spent the year ramping up its AI ambitions, pouring resources into initiatives including the massive Stargate Project data centres and the acquisition of US chip designer Ampere Computing. The company is also preparing to expand its backing of OpenAI, with a potential increase depending on the startup's performance and valuation in future funding rounds, a person familiar with the discussions previously told CNBC. Son has repeatedly positioned OpenAI at the centre of SoftBank's next phase, declaring earlier this year that the group is "all in" on the ChatGPT maker and predicting it could eventually become the world's most valuable company. That conviction has already delivered financial returns. SoftBank reported that second-quarter net profit more than doubled to 2.5 trillion yen ($16.6 billion), supported by gains tied to its OpenAI stake. The company's aggressive posture comes as investors debate whether the AI sector is overheating. Son dismissed those concerns on Monday, saying people warning of an AI bubble are "not smart enough." He argued that advancements in "super [artificial] intelligence" and robotics will eventually create at least 10% of global GDP, easily justifying the trillions of dollars currently flowing into the technology. Despite selling NVIDIA, now one of the world's most valuable semiconductor firms, Son made clear that the move was purely strategic. SoftBank, he suggested, is reallocating capital not away from AI, but deeper into it.

[5]

Masayoshi Son 'Crying' Over Nvidia Sale as SoftBank Doubles Down on A.I.

The SoftBank CEO remains unfazed by bubble fears, insisting A.I. growth will dwarf today's soaring valuations. Last month, SoftBank sold $5.8 billion worth of Nvidia shares, and CEO Masayoshi Son now says he's "crying" over the decision. "I don't want to sell a single share," he said at the FII Priority Asia forum in Tokyo today (Dec. 1). Son explained that the sale was meant to fund SoftBank's investment in OpenAI and other A.I. bets -- not because he believes Nvidia's stock has entered bubble territory. Sign Up For Our Daily Newsletter Sign Up Thank you for signing up! By clicking submit, you agree to our <a href="http://observermedia.com/terms">terms of service</a> and acknowledge we may use your information to send you emails, product samples, and promotions on this website and other properties. You can opt out anytime. See all of our newsletters Son is currently Japan's second wealthiest person, with an estimated net worth of $52.8 billion. His fortune stems from founding and running SoftBank, which has increasingly shifted its focus toward A.I. initiatives and startups in recent years. Today, SoftBank's Vision Funds hold stakes in more than 400 A.I.-related companies. Major deals this year include backing U.S.-based data centers through Project Stargate, promising to funnel more than $30 billion into OpenAI by the end of the year, and acquiring Ampere, a semiconductor design company, for $6.5 billion last month. Son's optimism places him at odds with a growing group of investors worried that today's sky-high valuations for A.I. companies aren't sustainable. Nvidia shares have fluctuated in recent weeks amid concerns about a potential A.I. bubble. "People that talk about such a stupid question are not smart enough, period," said Son in response to such concerns. The billionaire argued that A.I.'s rapid growth will quickly justify the massive inflows of capital. If the technology eventually captures 10 percent of global GDP, he said, it could generate tens of trillions of dollars in just a few months. With that in mind, Son asked, "Where is the bubble?" known for his bold projections, Son predicted that A.I. could become 10,000 to 100,000 times smarter than humans in the coming decades. "Nothing is actually stopping the process to make AGI and ASI happen," said Son, referring to artificial general intelligence and artificial superintelligence. "The funding is coming, chips are coming, models are evolving -- whole world is waiting." But Son was less bullish when discussing Japan's own A.I. strategy, which he has criticized as lagging behind global rivals. "The biggest opportunity is still in the United States," he said, warning that Japan is moving too conservatively and too slowly when it comes to embracing generative A.I. "Wake up, Japan."

[6]

SoftBank's Masayashi Son 'cried' about Nvidia stake sale to fund AI bets

SoftBank founder Masayoshi Son expressed regret over selling Nvidia shares, stating the capital was needed for significant AI investments, including a major bet on OpenAI. He dismissed concerns about an AI investment bubble, arguing that AI's potential to generate substantial global GDP justifies the spending. SoftBank Group Corp. founder Masayoshi Son said he wouldn't have sold off Nvidia Corp. shares if his company had unlimited money to bankroll its next investments in artificial intelligence, which include a big bet on OpenAI. Son, addressing for the first time the surprise November disclosure that SoftBank had unloaded its entire stake in the world's most valuable company, also slammed talk of an AI investment bubble. The Japanese company simply needed to raise capital to fund projects including data center construction, he told a forum in Tokyo Monday. "I don't want to sell a single share. I just had more need for money to invest in OpenAI" and other projects, Son said during the FII Priority Asia forum. "I was crying to sell Nvidia shares." SoftBank has doubled down on its bets on AI through a flurry of projects that include a Stargate data center with Hon Hai Precision Industry Co., the acquisition of US chip designer Ampere Computing LLC, and plans to invest more in OpenAI by the end of this year. People who talk about a bubble around AI investment are "not smart enough," the 68-year-old SoftBank chief executive officer said. If AI is able to earn 10% of global gross domestic product over the long term, that would more than make up for even trillions of dollars' worth of cumulative spending, he said. "Where is the bubble?" Son made his remarks at an offshoot of one of Saudi Arabia's biggest investment summits. The Tokyo forum featured appearances by Prime Minister Sanae Takaichi and the country's finance and economy ministers, reflecting deepening ties between the kingdom and Japan. Son's first Vision Fund was set up with $45 billion in funding from Saudi Arabia's Public Investment Fund. The PIF has invested about $11.5 billion in Japan from 2017 to 2024 and expects that total to grow to around $27 billion by the end of 2030, Governor Yasir Al-Rumayyan said at the same event.

[7]

Why Softbank CEO Was 'Crying' Over Selling Nvidia Stake - NVIDIA (NASDAQ:NVDA), SoftBank Group (OTC:SFTBF), SoftBank Group (OTC:SFTBY)

Softbank Group Corp (OTC:SFTBY) (OTC:SFTBF) founder Masayoshi Son admitted he sold the company's entire Nvidia Corp. (NASDAQ:NVDA) stake only out of necessity. Son said he reluctantly sold the company's entire Nvidia stake to free up cash for new AI bets, telling an audience in Tokyo that he "was crying" as he parted with the shares. Son addressed SoftBank's November disclosure that it unloaded its Nvidia position for $5.83 billion, saying the company would never have sold "a single share" if it didn't need the capital to fund major artificial-intelligence investments, including its expanding partnership with OpenAI and large-scale data center projects. Also Read: SoftBank Says Skipping AI Is Riskier Than Betting Big "I just had more need for money to invest in OpenAI and other projects," CNBC cited Son at the FII Priority Asia forum. Meanwhile, Nvidia became the first company to top the $5 trillion market cap on October 29, after hitting the highs of $4.5 trillion at the beginning of the month. Bank of America Securities fueled the rally by reaffirming its Buy rating and hiking its price forecast from $235 to $275, a move that signaled strong institutional conviction in Nvidia's continued leadership. Geopolitics And Nvidia's Global Influence CEO Jensen Huang amplified investor optimism during the week by urging Washington to take a balanced approach to the U.S.-China tech rivalry, warning that isolating China's developer ecosystem would backfire. At the same time, President Donald Trump said he plans to discuss Nvidia's "super duper" Blackwell chips with Chinese President Xi Jinping, underscoring Nvidia's central role in global tech diplomacy. Huang also announced partnerships to build seven U.S. supercomputers and introduced NVQLInk, a breakthrough that links Nvidia GPUs with quantum computers. SoftBank's Expanding AI Strategy SoftBank has accelerated its AI push this year through initiatives like the Stargate Project, data centers, and its acquisition of chip designer Ampere Computing. The company may "potentially" deepen its investment in OpenAI depending on performance and future valuation rounds, a person familiar with the matter told CNBC. Son has repeatedly said SoftBank is "all in" on OpenAI and predicted the startup could become the world's most valuable company. That conviction has already lifted SoftBank's financials: the company reported second-quarter profit more than doubling to 2.5 trillion yen ($16.6 billion), helped by valuation gains tied to OpenAI. AI Bubble Doubters Are 'Not Smart Enough' Son also dismissed rising concerns that the AI industry is overheating, arguing that critics "are not smart enough" to understand the scale of what's coming. He predicted that future superintelligent AI and robotics will generate at least 10% of global GDP, easily justifying the trillions flowing into the sector. NVDA Price Action: Nvidia shares were up 0.61% at $182.56 during premarket trading on Wednesday, according to Benzinga Pro data. Read Next: Arm Becomes 'Power-Efficiency Engine' For AI, Wins Big With Amazon, Google And Meta Photo by glen photo via Shutterstock NVDANVIDIA Corp$182.330.48%OverviewSFTBFSoftBank Group Corp$103.00-%SFTBYSoftBank Group Corp$51.780.25%Market News and Data brought to you by Benzinga APIs

[8]

SoftBank's Son 'cried' about Nvidia stake sale to fund AI bets

SoftBank Group founder Masayoshi Son said he wouldn't have sold off Nvidia shares if his company had unlimited money to bankroll its next investments in artificial intelligence, which include a big bet on OpenAI. Son, addressing for the first time the surprise November disclosure that SoftBank had unloaded its entire stake in the world's most valuable company, also slammed talk of an AI investment bubble. The Japanese company simply needed to raise capital to fund projects including data center construction, he told a forum in Tokyo Monday. "I don't want to sell a single share. I just had more need for money to invest in OpenAI" and other projects, Son said during the FII Priority Asia forum. "I was crying to sell Nvidia shares."

Share

Share

Copy Link

SoftBank CEO Masayoshi Son revealed he was emotional about selling the company's entire Nvidia stake for $5.83 billion. The Japanese tech giant needed capital to bankroll major AI investments including OpenAI, data center construction, and chip design projects. Son dismissed concerns about an AI investment bubble, predicting super artificial intelligence will generate at least 10% of global GDP.

SoftBank's Emotional Departure from Nvidia

SoftBank founder Masayoshi Son has openly acknowledged the difficulty of parting with the company's entire Nvidia stake, describing the decision as one that brought him to tears. Speaking at the FII Priority Asia forum in Tokyo on Monday, Son addressed the surprise November disclosure that SoftBank had sold its complete holding in the world's most valuable chipmaker for $5.83 billion

1

. "I don't want to sell a single share. I just had more need for money to invest in OpenAI and other projects," Son explained during his talk. "I was crying to sell Nvidia shares" . The billionaire made clear that if SoftBank had unlimited capital, he would have retained every share of the semiconductor giant, which he deeply respects3

.

Source: Benzinga

Strategic Move to Fund AI Investments

The Nvidia stake sale wasn't driven by doubts about the chipmaker's future but by SoftBank's urgent need to raise capital for AI projects that demand enormous upfront investment

4

. SoftBank has aggressively expanded its AI ambitions throughout the year, pouring resources into ambitious hardware and infrastructure initiatives. The company is heavily involved in the Stargate Project for data center construction and recently acquired U.S. chip design firm Ampere Computing for $6.5 billion . These ventures require massive capital outlays long before any returns materialize, forcing SoftBank to liquidate valuable assets to fund its vision3

.

Source: Observer

Doubling Down on Investment in OpenAI

At the center of SoftBank's strategy sits OpenAI, the ChatGPT maker that Son has positioned as the cornerstone of the company's next phase. Earlier this year, Son declared that SoftBank is "all in" on OpenAI and predicted the AI startup could eventually become the world's most valuable company . The company has promised to funnel more than $30 billion into OpenAI by year's end and could "potentially" increase this investment depending on the startup's performance and valuation in future funding rounds . This conviction has already delivered financial results, with SoftBank reporting that second-quarter net profit more than doubled to 2.5 trillion yen ($16.6 billion), driven by valuation gains in its OpenAI holdings .

Dismissing the AI Investment Bubble Narrative

Son's comments come as growing fears about a potential AI investment bubble rattle markets, with some investors questioning whether sky-high valuations for AI companies are sustainable. The SoftBank founder pushed back forcefully against these concerns during his Monday talk, arguing that those who warn of an AI bubble are "not smart enough" . Son predicted that super artificial intelligence and AI robotics will generate at least 10% of global GDP over the long term, easily justifying the trillions of dollars currently flowing into the technology

4

. "Where is the bubble?" he asked, suggesting that if AI captures 10% of global GDP, it could generate tens of trillions of dollars .

Source: Bloomberg

Related Stories

Market Concerns and Contrarian Voices

Despite Son's optimism, SoftBank's stock has slumped almost 40% in U.S. trading since late October as investors grow uneasy about the scale of its AI spending

3

. Much of that spending has been funneled into ambitious hardware and infrastructure projects that demand enormous capital outlays before any payoff materializes. Short-seller Jim Chanos, famous for his prescient Enron call, has warned of potential debt defaults in the growing AI cloud computing space. "Business models like the neoclouds, a lot of the AI companies themselves ... are just loss-making enterprises right now," Chanos told Yahoo Finance, adding that without changes, "there's going to be debt defaults on these things"3

.Vision for Artificial General Intelligence and Beyond

Son's aggressive posture reflects his broader vision for artificial general intelligence (AGI) and artificial superintelligence (ASI). The billionaire, currently Japan's second wealthiest person with an estimated net worth of $52.8 billion, predicted that AI could become 10,000 to 100,000 times smarter than humans in the coming decades . "Nothing is actually stopping the process to make AGI and ASI happen," Son stated. "The funding is coming, chips are coming, models are evolving -- whole world is waiting." Today, SoftBank's Vision Funds hold stakes in more than 400 AI-related companies, demonstrating the scale of its commitment to the sector . While Son remains bullish on generative AI globally, he was critical of Japan's conservative approach, warning "Wake up, Japan" and noting that "the biggest opportunity is still in the United States" .

References

Summarized by

Navi

[4]

Related Stories

SoftBank Sells Entire $5.8 Billion Nvidia Stake to Fund AI Ambitions, Sparking Market Concerns

11 Nov 2025•Business and Economy

Nvidia's AI Dominance and Missed Opportunities: Insights from Masayoshi Son and Jensen Huang

14 Nov 2024•Business and Economy

SoftBank's Masayoshi Son Aims to Dominate 'Artificial Super Intelligence' with Massive OpenAI Investment

27 Jun 2025•Technology

Recent Highlights

1

Pentagon threatens Anthropic with Defense Production Act over AI military use restrictions

Policy and Regulation

2

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

3

Anthropic accuses Chinese AI labs of stealing Claude through 24,000 fake accounts

Policy and Regulation