Surf Raises $15 Million to Build AI Platform Specialized for the Crypto World

2 Sources

2 Sources

[1]

Exclusive: Surf, an AI platform just for for crypto, raises $15 million | Fortune

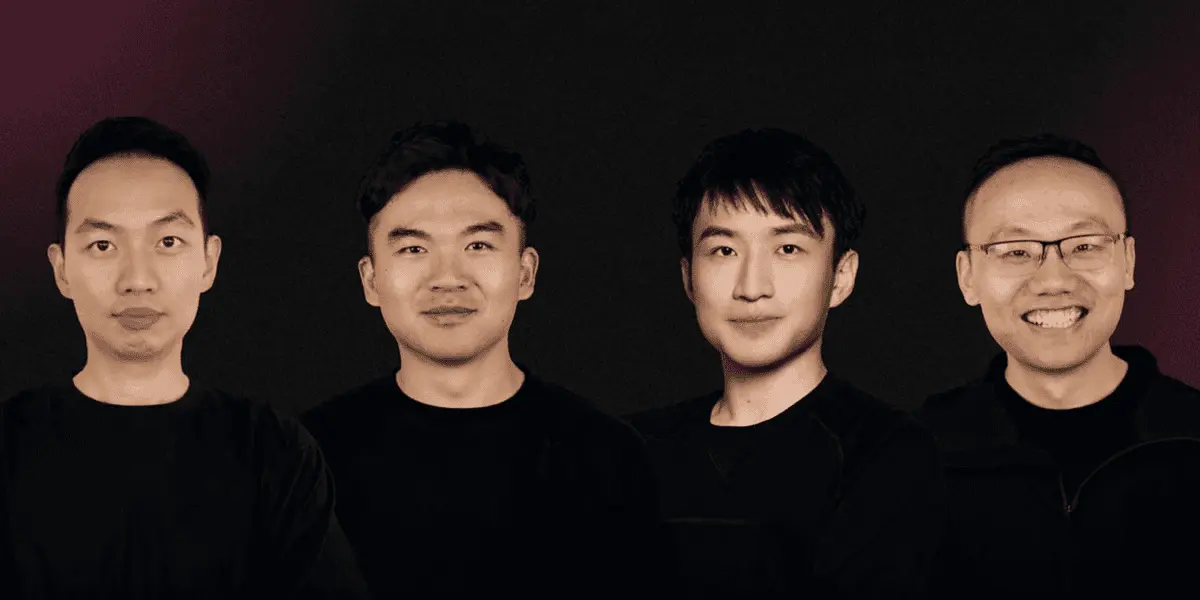

Ryan Li has long been steeped in the worlds of both AI and crypto. He started working with AI about ten years ago as an undergrad at UC Berkeley and has since built two crypto startups. That experience has led him to conclude that popular AI platforms like ChatGPT and Perplexity give rise to far too many hallucinations about crypto -- and that those errors can cost traders millions, if not billions, of dollars. That's why he cofounded Surf, an AI platform specialized for the world of crypto. On Wednesday, his startup announced that it raised $15 million from Pantera Capital, with participation from Coinbase Ventures and Digital Currency Group. Li, the startup's CEO, did not disclose the company's valuation in an interview with Fortune. "Surf was something that we wanted to build for ourselves, and it turns out the market loves it," he said. "I think Surf is the best model for crypto, and we want to make sure people trust Surf instead of relying on hallucinations from other models." The product launched as an invite-only service in July before opening to the general public in September. It has more than 300,000 people using the platform and has generated more than a million search results, according to the company. Li says that the platform can answer a spectrum of questions about crypto, from the most basic to the most technical concepts. He says that 80% of the platform's users are regular people who don't work in crypto, and the remaining 20% are from venture capital firms, exchanges, and other crypto-affiliated companies. The startup says that it has a couple of million dollars in revenue and hopes to reach $10 million by the end of 2026. Surf generates revenue by charging a subscription fee, with users paying $15 to $399 per month on different tiers of the service. People can access a free version in which they can only ask a few questions per day. The company currently has just under 30 employees. Li views his startup's competition as mainstream AI models like ChatGPT, Perplexity, and Grok. The company says that its platform performs four times better than ChatGPT and Grok on crypto tasks, based on benchmark testing it co-authored with Princeton University. While ChatGPT may be slightly faster, Surf had answers that were more specific to crypto and had more citations, based on a side-by-side comparison of the two platforms that Li shared with Fortune. "ChatGPT is a really good generalist, but it doesn't know the crypto industry enough," Li said. "Surf is like that expert that worked in the industry for a long time by us training the model just for crypto." With the new funding, the startup plans to launch Surf 2.0, a more advanced model, in February 2026.

[2]

Pantera, Coinbase back Surf's $15M push to build crypto-native AI models

The funding will support Surf's next AI model aimed at delivering deeper onchain analysis and automating research for crypto companies and traders. Surf, an AI platform built for digital-asset analysis, raised $15 million in a round led by Pantera Capital with participation from Coinbase Ventures and DCG, to expand its AI models and enterprise tools. The company offers a domain-specific model used by exchanges and research companies to analyze onchain activity, market behavior and sentiment. The funding will go toward Surf 2.0, which will introduce more advanced models, broader proprietary data sets and additional agents designed to handle multi-step analytical tasks. Surf said its platform has seen rapid uptake since its launch in July, generating more than one million research reports and claiming millions in annual recurring revenue, with usage from a large share of major exchanges and research firms. Surf's model uses a multi-agent architecture that evaluates onchain data, social sentiment and token activity, delivering its analysis through a chat interface for research and reducing manual workloads for analysts and traders. Related: How to turn ChatGPT into your personal crypto trading assistant Artificial intelligence and blockchain are increasingly intersecting as more companies develop tools that leverage both technologies. In April, decentralized AI startup Nous Research closed a $50 million Series A round led by Paradigm. The company is developing open-source AI models powered by decentralized infrastructure and uses the Solana blockchain to coordinate and incentivize global participation in training. In May, Catena Labs, led by Circle co-founder Sean Neville, announced it had raised $18 million to develop a bank built around native AI infrastructure. The company said the system will be designed for both AI agents and human contributors, with AI handling day-to-day operations under human supervision. In October, Coinbase introduced "Based Agent," a tool that lets users create an AI agent with an integrated crypto wallet in just a few minutes to perform onchain actions such as trading, swapping, and staking. As crypto and AI continue to converge, the role of human traders may also be shifting. The decentralized exchange Aster is running a "human vs AI" trading showdown, funding up to 100 human traders with $10,000 each to compete against top-performing AI agents Dec. 9-23. Though the competition still has 13 days to go, Team Human was in the lead as of Wednesday, with a return on investment (ROI) of 13.36% compared to Team AI's ROI of 0.54%.

Share

Share

Copy Link

Surf, an AI platform designed specifically for cryptocurrency analysis, has raised $15 million in funding led by Pantera Capital, with participation from Coinbase Ventures and Digital Currency Group. The startup aims to eliminate hallucinations that plague mainstream AI models when answering crypto questions, offering traders accurate and reliable information for traders through specialized models trained exclusively on digital assets.

Surf Secures Major Funding to Tackle Crypto AI Challenges

Surf, an AI platform specialized for the crypto world, announced it has raised $15 million in a funding round led by Pantera Capital, with participation from Coinbase Ventures and Digital Currency Group

1

2

. The investment underscores growing demand for crypto AI solutions that can deliver accurate and reliable information for traders without the errors that plague general-purpose models. CEO Ryan Li, who has spent a decade working with AI and has built two crypto startups, founded Surf to address a critical gap in the market: mainstream AI platforms like ChatGPT and Perplexity generate too many hallucinations about cryptocurrency, potentially costing traders millions or even billions of dollars1

.

Source: Fortune

Rapid Growth Since Launch

The AI platform for digital-asset analysis launched as an invite-only service in July before opening to the general public in September

1

. Since then, Surf has attracted more than 300,000 users and generated over one million search results, demonstrating significant market appetite for specialized crypto-native AI models1

. The platform serves a diverse user base, with 80% being regular people who don't work in crypto, while the remaining 20% come from venture capital firms, exchanges, and other crypto-affiliated companies1

. Surf currently generates a couple of million dollars in revenue through subscription fees ranging from $15 to $399 per month across different service tiers, with a free version available for limited daily queries1

.Superior Performance Through Specialization

Surf's multi-agent architecture evaluates onchain data, social sentiment, and token activity to deliver deeper onchain analysis through a chat interface

2

. The company claims its platform performs four times better than ChatGPT and Grok on crypto tasks, based on benchmark testing co-authored with Princeton University1

. While ChatGPT may be slightly faster, Surf delivers answers that are more specific to cryptocurrency with more citations, according to side-by-side comparisons1

. Li explained that ChatGPT is a good generalist but lacks deep knowledge of the crypto industry, whereas Surf functions like an expert who has worked in the sector for years through specialized training1

.Related Stories

Automated Research for Crypto Companies and Beyond

The platform has become essential infrastructure for automated research for crypto companies, exchanges, and research firms seeking to reduce manual workloads for analysts and traders

2

. Surf has generated more than one million research reports since launch and claims millions in annual recurring revenue, with usage from a large share of major exchanges2

. The company projects reaching $10 million in revenue by the end of 20261

. With just under 30 employees currently, the startup plans to use the new funding to launch Surf 2.0 in February 2026, which will introduce more advanced models, broader proprietary data sets, and additional agents designed to handle multi-step analytical tasks1

2

.The Convergence of Artificial Intelligence and Blockchain

Surf's funding reflects the broader convergence of artificial intelligence and blockchain, as more companies develop tools leveraging both technologies

2

. Recent examples include Nous Research closing a $50 million Series A round led by Paradigm in April to develop open-source AI models powered by decentralized infrastructure on the Solana blockchain2

. In May, Catena Labs raised $18 million to build a bank around native AI infrastructure designed for both AI agents and human contributors2

. Coinbase introduced "Based Agent" in October, allowing users to create an AI agent with an integrated crypto wallet in minutes to perform onchain actions like trading, swapping, and staking2

. As these technologies continue to intersect, platforms like Surf that eliminate hallucinations and provide domain-specific expertise will likely become increasingly critical for market participants navigating the complex digital asset landscape.

Source: Cointelegraph

References

Summarized by

Navi

Related Stories

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy