Tech Analyst Gene Munster Predicts AI-Driven Bull Run, Highlighting Apple and Nvidia

2 Sources

2 Sources

[1]

Tech Bull Gene Munster Maintains AI Will Have 'Bigger Impact' On Humanity And Investing Than Internet Even As Nvidia's Market Cap Nosedives Nearly $300B, Dragging Nasdaq By Over 3% - NVIDIA (NASDAQ:NVDA)

Deepwater Asset Management's managing partner Gene Munster remains bullish on the transformative potential of AI, even as Nvidia Corp.'s NVDA market cap nosedived by nearly $300B, dragging Nasdaq down by over 3%. What Happened: On Tuesday, Munster took to X, formerly Twitter, and said that he still believes in the long-term impact of AI, despite the short-term market fluctuations. He first commented on the unfortunate timing of his earlier statement during an appearance on CNBC, where the analyst said that tech stocks would likely continue to rise in September. However, the Nasdaq ended up dropping 3.3% on the same day -- a rare occurrence, as it was only the eighth time in the last 500 trading days that the index declined by more than 3%, Munster noted. See Also: Trump Misunderstands Taiwan's Role In Chip Industry, Says Economy Minister: 'The President Has A Lot On His Plate' "Shame on me for trying to predict what the market will do in the near-term. That said, the fundamentals of AI are most important to what the market does over the next 3-5 years," he posted. "I continue to believe AI will have a bigger impact on our lives and on investing than the internet." Why It Matters: The plunge in Nvidia's market cap comes after the company's second-quarter earnings report in which it exceeded expectations on earnings and revenue, yet investors pulled back afterward - its stock price fell about 10% in a single day, resulting in a loss of $300 billion from the chipmaker's market capitalization. This was part of a broader market downturn, with the Dow Jones sliding 1.5% and the Nasdaq pulling back 3.3%. On the same day, the Jensen Huang-led company also received a subpoena from the U.S. Department of Justice, as it stepped up its investigation into possible antitrust violations by the AI computing giant. Price Action: At the time of writing, in after-hours trading, Nvidia shares have fallen by 2.41% to $105.40. The tech giant closed Tuesday's session at $108, down 9.53%, according to Benzinga Pro data. Read Next: Cathie Wood Congratulates Elon Musk On xAI Milestone After AI Firm Brings 100K Nvidia GPU Colossus Cluster Online In Just 122 Days: 'Many Big Announcements Ahead' Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Photo courtesy: Shutterstock Market News and Data brought to you by Benzinga APIs

[2]

Apple, Nvidia Will Lead 3-To-5-Year Tech Bull Run, Analyst Says: 'I Am A Buyer Here' - NVIDIA (NASDAQ:NVDA), Apple (NASDAQ:AAPL)

"Ultimately I believe that this can go much higher," Munster says. Deepwater Asset Management's Gene Munster was asked Tuesday morning if he would buy, sell or hold big tech stocks at current levels. He emphatically recommended buying the Magnificent Seven, specifically highlighting Apple Inc AAPL and NVIDIA Corp NVDA as being positioned for significant upside over the coming years. What To Know: Tuesday on CNBC's "Squawk Box," Munster argued mega-cap tech stocks are still in the beginning stages of a massive bull run being driven by AI. "I am a buyer here. I continue to believe we're in the first stage -- this may be hard to wrap many heads around -- first stage of a three- to five-year bull market," Munster said. Munster is bullish even in the near term as there are multiple upcoming catalysts that are likely to help push stocks higher in September, he said. Munster expects anticipation over Tesla Inc's TSLA upcoming autonomous vehicle event to start building this month. The analyst expects investors to begin changing how they view Nvidia and Munster also highlighted Apple's upcoming event on Sept. 9 in which the company is expected to unveil new AI features for its smartphones and introduce the iPhone 16. "I think when you put those three kind of cornerstone elements together, I think you are going to continue to see the tech trade move higher in the month of September," Munster said. See Also: Brazil Considers Tax On Big Tech Companies To Meet 2025 Fiscal Goals After Banning Elon Musk's X And Freezing Finances Of Starlink Apple's September event is the biggest of the last decade, according to Munster. He expects Apple's new AI functionality to drive a huge upgrade cycle similar to what happened when the company introduced larger screens on the iPhone 6. That upgrade cycle should help push shares higher, he said. "Ultimately I believe that this can go much higher. I think if you look at what happened [with the iPhone 5] a decade ago, it was up 12%. With the iPhone 6, it was up 52%, it just absolutely ripped," Munster said. If the new AI features are as strong as Munster believes they will be, he expects consumers to view them as "must-have." If just 10% of iPhone users expected to upgrade in 2026 end up upgrading early in 2025 to gain access to the AI features, iPhone growth will climb to 15% next year versus Street estimates of 7%, the analyst explained. "I think consumers, overwhelmingly, are going to embrace these features. It may take a few quarters, but I think you are going to see meaningful upside at Apple over that period," he said. Munster also believes Nvidia continues to be well positioned for the multi-year bull run given its continued dominance in the AI chip world. The Deepwater analyst told CNBC that the recent decline in shares appears to be a misunderstanding related to the company's guidance. Nvidia guided up by 2.5% for the October quarter, but raised guidance by 5% in the July quarter, which has created a narrative around deceleration, Munster said, adding what people are missing is that Blackwell delays account for about $3 billion. If Blackwell wasn't delayed, Nvidia would have guided up by 12% instead of 2.5%, he said. "We think that it is still reasonably priced at 35 times [earnings] and can grow faster than what the Street thinks next year and in 2026. Ultimately, the risk for big companies not to invest in this is just too high and Nvidia is going to be a big beneficiary of that," Munster said. AAPL, NVDA Price Action: At publication time, Apple shares were down 2.59% at $223.06 and Nvidia shares were down 7.26% at $109.13, according to Benzinga Pro. This illustration was generated using artificial intelligence via Midjourney. Read Next: Stock Of The Day: Berkshire Hathaway Trades Above Usual Range -- Time To Sell The Warren Buffett Stock? Market News and Data brought to you by Benzinga APIs

Share

Share

Copy Link

Gene Munster, a prominent tech analyst, forecasts a 3-5 year tech bull run led by AI advancements. He emphasizes the transformative impact of AI on humanity and investment landscapes, with Apple and Nvidia at the forefront.

AI's Transformative Impact on Technology and Investments

Gene Munster, a renowned tech analyst and managing partner at Deepwater Asset Management, has made bold predictions about the future of technology and its impact on investments. Munster asserts that artificial intelligence (AI) will have a more significant influence on humanity and the investment landscape than the internet did in the 1990s

1

.Tech Bull Run Forecast

Munster anticipates a 3-5 year tech bull run, primarily driven by advancements in AI technology. This optimistic outlook is based on the potential for AI to revolutionize various sectors and create new investment opportunities

2

.Key Players: Apple and Nvidia

In his analysis, Munster highlights two tech giants as leaders in this upcoming bull run:

-

Apple: Despite recent challenges, including a 5% decline in stock value following reports of Chinese government restrictions on iPhone use, Munster remains bullish on Apple. He believes the company's long-term prospects, particularly in AI integration, position it well for future growth

2

. -

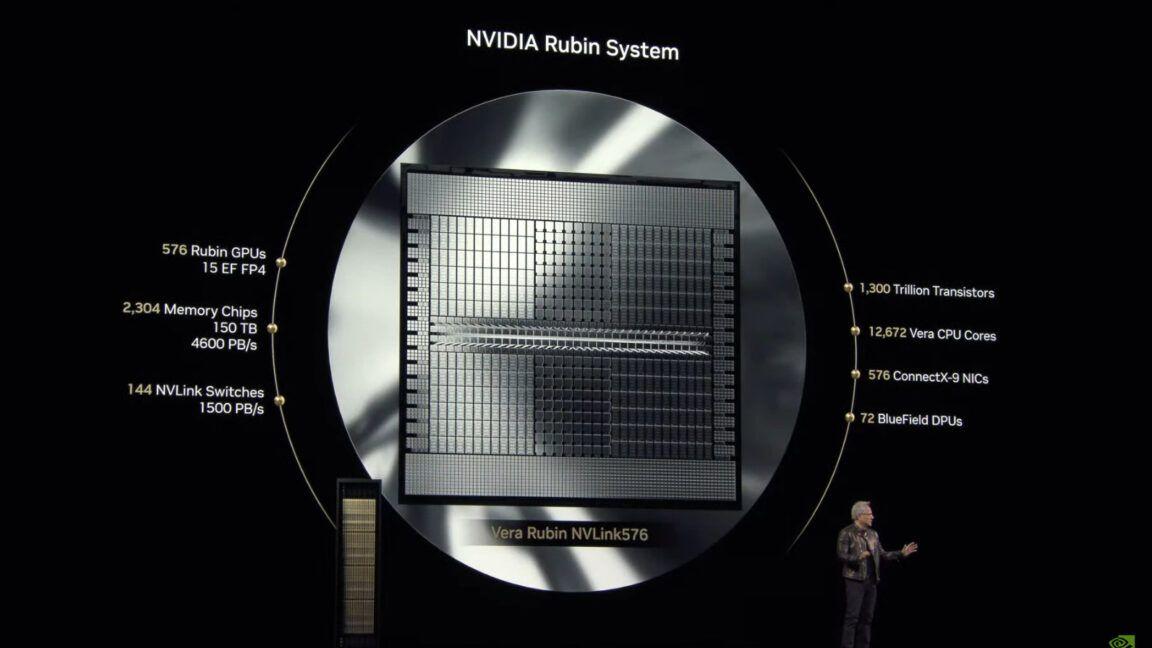

Nvidia: Known for its graphics processing units (GPUs) crucial for AI development, Nvidia is seen as a key player in the AI-driven tech boom. Munster's confidence in Nvidia stems from its central role in providing hardware essential for AI advancements

2

.

Investment Strategy and Market Outlook

Munster advises investors to consider the long-term potential of these companies, stating, "I am a buyer here," referring to the current market conditions

2

. He emphasizes the importance of looking beyond short-term fluctuations and focusing on the transformative power of AI in shaping future technological landscapes.Related Stories

AI's Broader Impact

The analyst's predictions extend beyond mere market performance. Munster believes that AI's influence will be more profound and far-reaching than that of the internet in the 1990s. This comparison underscores the potential for AI to reshape not just technology sectors but various aspects of human life and society

1

.Challenges and Considerations

While Munster's outlook is overwhelmingly positive, it's important to note that the tech sector faces various challenges, including regulatory scrutiny and geopolitical tensions. The recent issues faced by Apple in China serve as a reminder of the volatile nature of the global tech market

2

.As the tech industry continues to evolve, with AI at its forefront, investors and industry watchers will be keenly observing how companies like Apple and Nvidia navigate these exciting yet challenging times. Munster's predictions offer a glimpse into a future where AI could potentially drive unprecedented growth and innovation in the tech sector.

References

Summarized by

Navi

Related Stories

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology