Tech Stocks Surge: HPE, Salesforce, and Nvidia Lead the Rally

2 Sources

2 Sources

[1]

Top Stock Movers Now: Hewlett Packard Enterprise, Salesforce, Visa, and More

U.S. equities were mostly lower at midday Wednesday, a day after the Dow Jones Industrial Average and the S&P 500 closed at fresh record highs. The Dow and the S&P 500 were down, and the Nasdaq was little changed. Hewlett Packard Enterprise (HPE) shares jumped following an upgrade and price target increase from Barclays on the information technology firm's reach into the artificial intelligence (AI) market. An AI play lifted shares of Salesforce (CRM), which bought startup data management provider Zoomin for $450 million. Cintas (CTAS) shares climbed after the uniform and other business supplies provider posted better-than-expected results and raised its guidance as its gross margin improved. General Motors (GM) and Ford Motor (F) shares fell following downgrades from Morgan Stanley, which pointed to competition from Chinese automakers. Shares of Global Payments (GPN) declined when the financial technology firm told investors it was updating its "strategic focus" as it gave guidance for the next three fiscal years. Visa (V) shares declined for a second day on word the U.S. Department of Justice (DOJ) has filed an antitrust lawsuit against the payment processor. Oil futures dipped. Gold prices reached another all-time high. The yield on the 10-year Treasury note gained. The U.S. dollar was up on the euro, pound, and yen. Most major cryptocurrencies moved lower.

[2]

Hewlett Packard Enterprise, Nvidia, Progress Software And Other Big Stocks Moving Higher On Wednesday - NVIDIA (NASDAQ:NVDA)

U.S. stocks were mixed, with the Dow Jones index falling around 0.2% on Wednesday. Shares of Hewlett Packard Enterprise Company HPE rose sharply during Wednesday's session after Barclays upgraded the stock from Equal-Weight to Overweight and raised its price target from $20 to $24. Hewlett Packard Enterprise shares jumped 5.5% to $19.92 on Wednesday. Here are some other big stocks recording gains in today's session. SBC Medical Group Holdings Incorporated SBC shares jumped 26.2% to $8.37. Capricor Therapeutics, Inc. CAPR gained 21.8% to $11.09. Maxim Group and Oppenheimer increased price targets on the stock. Cipher Mining Inc. CIFR gained 15.5% to $3.9750. Northland Capital Markets analyst Mike Grondahl initiated coverage on Cipher Mining with an Outperform rating and announced a price target of $6. Rezolve AI Limited RZLV jumped 14% to $5.61. Progress Software Corporation PRGS shares jumped 12.9% to $64.52 after Oppenheimer raised its price target on the stock from $66 to $70. The stock is also moving on continued strength following strong third-quarter earnings and guidance yesterday. Xiao-I Corporation AIXI gained 10.8% to $4.98. Biohaven Ltd. BHVN surged 9% to $49.09. Biohaven recently announced its study of Troriluzole for the treatment of spinocerebellar ataxia in achieved the primary endpoint. Flutter Entertainment plc FLUT surged 8.3% to $246.99. Flutter Entertainment outlined long-term growth plan and up to $5 billion share repurchase program authorization. Rocket Lab USA, Inc. RKLB gained 8% to $8.20. The company announced its electron low Earth orbit mission on Friday Sept. 20th. Trump Media & Technology Group Corp. DJT gained 7.6% to $13.77. POET Technologies Inc. POET climbed 7.5% to $5.11. Upstart Holdings, Inc. UPST gained 7% to $40.26. MINISO Group Holding Limited MNSO gained 5.4% to $14.13. Intel Corporation INTC gained 4% to $23.73. NVIDIA Corporation NVDA shares rose 3% to $124.44. The company's CEO Jensen Huang adopted a Rule 10b5-1 trading plan earlier this year. According to a Barron's report, the Nvidia CEO has completed selling the maximum number of shares under the plan several months early. Now Read This: Top 5 Industrials Stocks That May Collapse In Q3 Market News and Data brought to you by Benzinga APIs

Share

Share

Copy Link

Major tech companies see significant stock price increases, with Hewlett Packard Enterprise, Salesforce, and Nvidia among the top performers. The market responds positively to earnings reports and AI-related developments.

Hewlett Packard Enterprise Leads the Charge

Hewlett Packard Enterprise (HPE) emerged as a standout performer in the stock market, with its shares surging by an impressive 9% following the release of its fiscal third-quarter earnings report. The company not only beat analysts' expectations but also raised its full-year profit outlook, signaling strong confidence in its future performance

1

.Salesforce's Stellar Performance

Salesforce (CRM) also made significant gains, with its stock price climbing by 3%. The company's robust fiscal second-quarter results, which exceeded Wall Street's projections, were the primary driver behind this upward movement. Salesforce's success underscores the continued demand for cloud-based customer relationship management solutions in the current business landscape

1

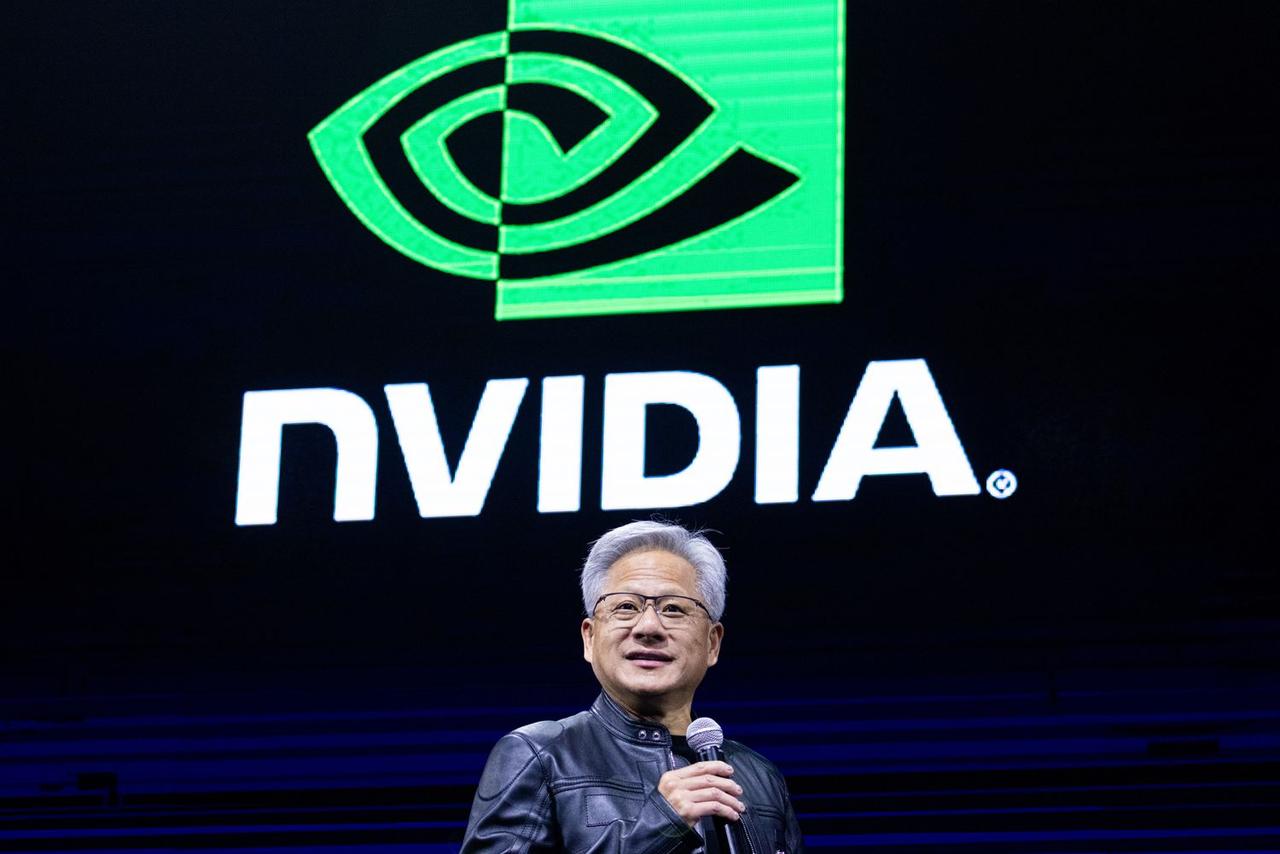

.Nvidia's Ongoing Rally

Nvidia (NVDA) continued its impressive run, with shares rising by 1.6%. The company's stock has been on an upward trajectory, buoyed by the growing demand for its AI chips and positive analyst sentiment. Nvidia's performance reflects the broader enthusiasm surrounding artificial intelligence technologies and their potential impact across various industries

2

.Related Stories

Other Notable Movers

Several other tech companies also experienced significant stock movements:

-

Progress Software (PRGS) saw its shares jump by 4.5%, indicating positive investor sentiment towards the company's recent performance and future prospects

2

. -

Visa (V) experienced a modest increase of 0.6% in its stock price, maintaining its position as a stable performer in the financial technology sector

1

.

Market Implications and Investor Sentiment

The strong performance of these tech stocks reflects a broader trend of investor optimism in the technology sector. Factors contributing to this positive sentiment include:

- Robust earnings reports that exceed analyst expectations

- Growing interest in artificial intelligence and related technologies

- Continued demand for cloud-based services and digital transformation solutions

As companies like HPE, Salesforce, and Nvidia continue to innovate and expand their offerings, investors appear to be betting on the long-term growth potential of the tech industry. This surge in stock prices may also indicate a broader market recovery and increased confidence in the face of ongoing economic uncertainties.

References

Summarized by

Navi

Related Stories

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy