Tower Semiconductor beats profit estimates as AI chip demand fuels $920M silicon photonics push

2 Sources

2 Sources

[1]

Tower Semiconductor beats quarterly profit estimates on AI-driven chip demand

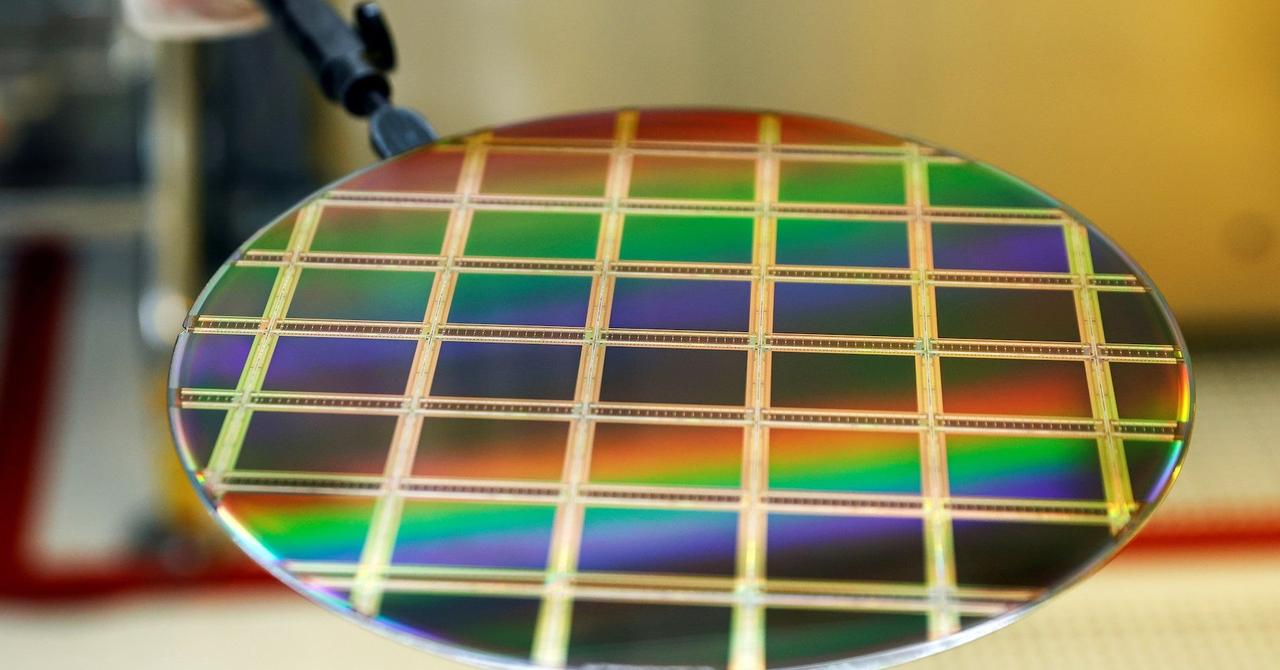

Feb 11 (Reuters) - Israeli contract chipmaker Tower Semiconductor (TSEM.TA), opens new tab beat Wall Street expectations for fourth-quarter profit on Wednesday, helped by demand for its chips for fast data transmission in artificial intelligence infrastructure. U.S.-listed shares were up nearly 5% in premarket trading. Demand for Tower's silicon photonics technology, which transmits data at high speeds using light, has made it an important supplier as data center operators race to build infrastructure capable of handling complex AI workloads. The company is making an additional $270 million investment in equipment for silicon photonics chips, it said on Wednesday, taking the total spending on the high-speed technology to $920 million. Tower aims to make over five times as many of these chips per month by the end of 2026 as it shipped in late 2025, CEO Russell Ellwanger said, adding that customers have already agreed to buy that additional volume. The company forecast first-quarter revenue of $412 million, plus or minus 5%, compared with estimates of $408.4 million, according to data compiled by LSEG. It reported revenue of $440.2 million for the fourth quarter, compared with estimates of $439.8 million. Adjusted profit for the quarter came in at 78 cents per share, beating estimates of 68 cents per share. Tower also makes analog semiconductor wafers for other companies in the U.S., Israel, Japan and Italy. Reporting by Anhata Rooprai in Bengaluru; Editing by Sahal Muhammed Our Standards: The Thomson Reuters Trust Principles., opens new tab

[2]

What's Going On With Tower Semiconductor Stock Wednesday? - Tower Semiconductor (NASDAQ:TSEM)

Tower Semiconductor Fires Up AI Growth Engine With Massive Capex Ramp The company reported quarterly revenue growth of 14% year-over-year (Y/Y) to $440.21 million, beating the analyst consensus estimate of $439.81 million. The Israel-based contract chipmaker's adjusted EPS of 78 cents beat the analyst consensus estimate of 68 cents. Profits And Margins Gross profit rose by 35.4% Y/Y to $117.61 million. The margin expanded to 26.7% from 22.4% Y/Y. Operating profit of $70.83 million increased 52.6% Y/Y. During the quarter, the company generated $40 million in operating cash flow (considering the inclusion of the previously announced $105 million Fab3 Newport Beach, California lease extension prepayment). In the third quarter of 2025, cash flow generated from operating activities was $139 million. The company held $1.15 billion in cash and equivalents as of December 31, 2025. Total Silicon Photonics Investment Swells To $920M Rising silicon photonics (SiPho) and silicon germanium (SiGe) demand is pushing the company to deepen alignment with key customers and expand beyond its previously announced $650 million capex plan. It is now executing an additional $270 million equipment investment to boost SiPho capacity and support next-generation capabilities, bringing total SiPho and SiGe spending to $920 million. The company aims to install and fully qualify all of this capex by the fourth quarter of 2026, setting up full production starts in 2027. Management expects the expanded buildout to deliver more than five times the annualized wafer shipment run-rate from the fourth quarter of 2025. The company says customers have already reserved -- or are in the process of reserving -- more than 70% of the total SiPho capacity through 2028, supported by customer prepayments. According to a Reuters report, surging demand for Tower's silicon photonics technology, which uses light to transmit data at ultra-high speeds, has positioned the company as a key supplier to data center operators racing to build infrastructure capable of supporting increasingly complex AI workloads. Intel Deal Hits Mediation More recently, Intel indicated it does not plan to move forward with the contract, and the two companies have entered mediation. The production flows that had already transferred -- or were in the process of transferring -- were initially qualified at Tower's Fab7 site in Japan. Tower is now redirecting customers back to Fab7 for continued support. Outlook Tower Semiconductor expects first-quarter revenue of $391.400 million-$432.600 million compared to the $408.381 million analyst consensus estimate. TSEM Price Action: Tower Semiconductor shares were down 3.19% at $132.22 at the time of publication on Wednesday, according to Benzinga Pro data. Photo via Shutterstock Market News and Data brought to you by Benzinga APIs To add Benzinga News as your preferred source on Google, click here.

Share

Share

Copy Link

Israeli chipmaker Tower Semiconductor surpassed fourth-quarter profit expectations, posting 78 cents per share versus estimates of 68 cents. The company announced a $920 million total investment in silicon photonics technology to meet surging demand from data center operators building AI infrastructure, aiming to quintuple production capacity by late 2026.

Tower Semiconductor Exceeds Quarterly Profit Expectations

Tower Semiconductor delivered fourth-quarter financial results that beat Wall Street expectations, posting adjusted earnings of 78 cents per share against analyst estimates of 68 cents. The Israeli contract chipmaker reported revenue of $440.2 million for the quarter, narrowly surpassing the $439.8 million consensus estimate

1

. This represents quarterly revenue growth of 14% year-over-year, signaling strong momentum in the company's core business2

. U.S.-listed shares of TSEM rose nearly 5% in premarket trading following the announcement, reflecting investor confidence in the company's positioning within the AI infrastructure buildout.Source: Benzinga

AI Chip Demand Drives Silicon Photonics Investment to $920M

The standout driver behind Tower Semiconductor's performance is surging demand for its silicon photonics technology, which transmits data at high speeds using light. This capability has become critical for data center operators racing to build artificial intelligence infrastructure capable of handling complex AI workloads

1

. Recognizing this opportunity, the company announced an additional $270 million investment in equipment for silicon photonics chips, bringing total capital expenditure on the technology to $920 million when combined with its previously announced $650 million plan2

. This aggressive expansion underscores how strong demand for chips designed for high-speed data transmission is reshaping the semiconductor landscape.

Source: Reuters

Increasing Production Capacity to Meet Customer Commitments

Tower Semiconductor CEO Russell Ellwanger outlined ambitious production targets, stating the company aims to manufacture more than five times as many silicon photonics semiconductor wafers per month by the end of 2026 compared to late 2025 shipment levels. Critically, customers have already agreed to purchase this additional volume, providing visibility into future revenue streams

1

. The company revealed that customers have reserved or are in the process of reserving more than 70% of total silicon photonics capacity through 2028, supported by customer prepayments2

. The company plans to install and fully qualify all equipment by the fourth quarter of 2026, positioning for full production starts in 2027.Related Stories

Financial Results Show Expanding Margins

Beyond beating quarterly profit expectations, Tower Semiconductor demonstrated improving operational efficiency. Gross profit rose 35.4% year-over-year to $117.61 million, with margins expanding to 26.7% from 22.4% in the prior year period. Operating profit increased 52.6% year-over-year to $70.83 million

2

. The company generated $40 million in operating cash flow during the quarter, though this figure includes a $105 million prepayment related to a lease extension at its Fab3 Newport Beach, California facility. Tower Semiconductor held $1.15 billion in cash and equivalents as of December 31, 2025, providing substantial financial flexibility to execute its expansion plans2

.Forward Guidance and Strategic Positioning

Looking ahead, Tower Semiconductor forecast first-quarter revenue of $412 million, plus or minus 5%, compared with analyst estimates of $408.4 million

1

. The company also produces analog semiconductor wafers for various industries across facilities in the U.S., Israel, Japan, and Italy, providing diversification beyond its silicon photonics focus. However, the company faces near-term uncertainty regarding a contract with Intel, which recently indicated it does not plan to move forward with the agreement. The two companies have entered mediation, and Tower is redirecting production flows back to its Fab7 site in Japan [2](https://www.benzinga.com/markets/earnings/26/02/50553815/tower-semiconductor-fires-up-ai-growth-engine-with-massive-caReferences

Summarized by

Navi

Related Stories

Tower Semiconductor Forecasts Strong Q3 Revenue Amid Rising Demand for AI and Data Center Chips

05 Aug 2025•Business and Economy

Taiwan Semiconductor's Strategic Moves: AI-Driven Growth, Global Expansion, and Geopolitical Challenges

07 Jan 2025•Business and Economy

TSMC's Q2 Profit Expected to Surge 30% Amid AI Chip Demand Boom

15 Jul 2024

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology