TSMC and Samsung Compete in 2nm Chip Production: Pricing, Yield, and AI Market Strategies

2 Sources

2 Sources

[1]

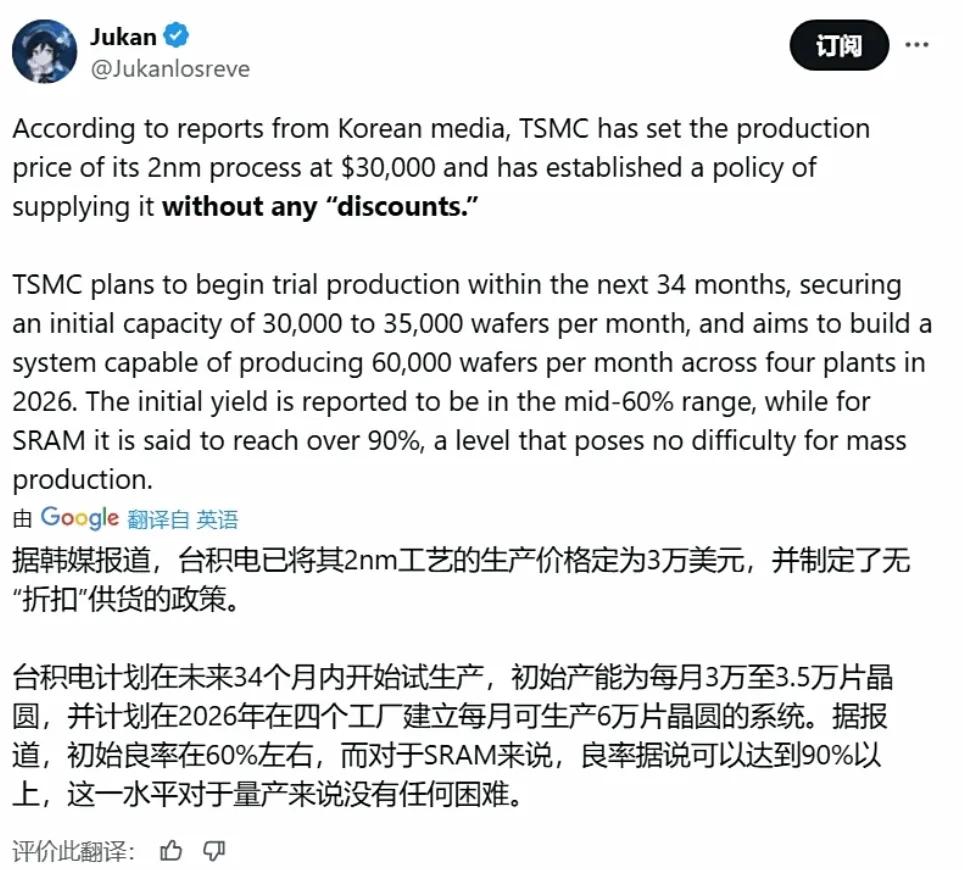

TSMC 2nm Process Wafers Priced at $30,000 with 60% Initial Yield

The race for next-generation semiconductors is heating up as TSMC and Samsung move forward with their 2nm process technologies. TSMC has announced that its wafers will carry a fixed price of $30,000 each, aimed squarely at the high-end artificial intelligence and high-performance computing markets. This marks a steep increase over current 3nm wafer costs, but it fits into TSMC's strategy of building a premium "high-price alliance" with industry leaders like Apple, Nvidia, and AMD. By contrast, Samsung is taking a more aggressive pricing stance, offering cheaper wafers with shorter delivery schedules to lure customers. This tactic has already helped Samsung secure a major deal with Tesla worth 23 trillion won for next-generation AI chips. On the production side, TSMC's roadmap shows a clear path toward large-scale output. The company expects to begin trial production within the next few months, followed by ramping up to 60,000 wafers per month in 2026 across four fabrication plants. Reports suggest that the initial yield rate for its 2nm nodes is around 60-65%, with SRAM modules achieving yields of over 90%. These numbers are strong for an early-stage process, and analysts believe TSMC does not face any major technical roadblocks to volume manufacturing. That stability is critical for customers who depend on predictable supply for high-value products such as AI accelerators and flagship mobile processors. The technical improvements offered by 2nm manufacturing are another factor driving interest. Chips built on this process can deliver a 10-15% boost in performance at the same power consumption, or alternatively, cut power requirements by 20-30% while keeping performance constant. For industries like AI servers, where power efficiency is as important as raw computing throughput, and for smartphones, where battery life is a critical factor, these advantages could translate into meaningful improvements. TSMC's early yields and clear capacity targets strengthen its competitive position, but Samsung's ability to offer cost savings and faster shipments may appeal to customers more focused on budget and turnaround times. Industry watchers point out that the 2nm era will not be defined by technology alone. While transistor scaling and power efficiency remain at the center, the business dynamics of pricing strategies, delivery timelines, and the strength of long-term partnerships will play an equally important role. TSMC's approach is to maintain high pricing but deliver stability and quality, which helps keep large customers loyal. Samsung, on the other hand, is trying to regain ground by presenting itself as the more cost-effective and flexible option, even if its current yields hover closer to 40%.

[2]

TSMC sets production price of 2nm node at $30,000 per wafer, no 'discounts' in its policy

TL;DR: TSMC sets its advanced 2nm chip production price at $30,000, targeting premium AI and HPC customers like Apple and NVIDIA with high yields and superior performance. Samsung competes by emphasizing lower prices and faster delivery despite slower yield improvements, making the 2nm market a balance of technology, cost, and partnerships. TSMC has reportedly set the production price of its bleeding-edge 2nm process at $30,000 and has established a new policy of supplying 2nm chips without any discounts according to new reports. The company plans to kick off trial production in the next 34 months, aiming for a monthly production capacity of 30,000 to 35,000 wafers. By 2026, TSMC plans to establish a production system with a monthly production capacity of 60,000 wafers across its four factories, with initial yields reportedly in the mid 60% range, and for SRAM, yields reportedly exceed 90%, with Korean media outlet DDaily reporting that there are "no obstacles to mass production". The high pricing on 2nm wafers isn't just a simple reflection of production costs, but rather a strategy to maximize profits by focusing its limited initial production capacity on "premium demand". TSMC is targeting customers with high-performance computing (HPC) and AI needs, including Apple, NVIDIA, and AMD. 2nm will deliver 10-15% more performance using the same power, or a 20-30% power reduction at the same power level, making it an alluring option for customers who want both performance boosts and power efficiency in upstream industries like AI, servers, and mobile. Samsung Foundry on the other hand is emphasizing price competitiveness in order to secure foundry customers, with Samsung's 2nm yields currently reported at around 40%, and its stabilization is considered "slower" than that of TSMC. Samsung Foundry is trying to restore technological credibility within the semiconductor foundry business, using a strategy of offering lower prices and responding quickly to secure new customers. Recently, Samsung Foundry secured an order from Tesla to build the company's next-generation AI6 processor, building Tesla's new AI6 chip on its new 2nm process node at its Taylor, Texas, USA-based fab. DDaily's industry insider explains: "TSMC is increasing the loyalty of large AI and HPC customers with a high-price, high-quality strategy, while Samsung is finding new customers with a low-price, high-speed strategy. The 2nm era will be determined by a complex mix of competitive factors, including not only technological prowess but also price, supply speed, and long-term partnerships".

Share

Share

Copy Link

TSMC sets 2nm wafer price at $30,000 with 60% initial yield, targeting high-end AI and HPC markets. Samsung competes with lower prices and faster delivery, securing a deal with Tesla for AI chips.

TSMC's Premium Pricing Strategy for 2nm Chips

Taiwan Semiconductor Manufacturing Company (TSMC) has set a fixed price of $30,000 for its 2nm process wafers, marking a significant increase from current 3nm wafer costs

1

. This pricing strategy is part of TSMC's efforts to build a "high-price alliance" with industry leaders such as Apple, Nvidia, and AMD, focusing on the high-end artificial intelligence (AI) and high-performance computing (HPC) markets2

.

Source: TweakTown

Production Roadmap and Yield Rates

TSMC's roadmap for 2nm chip production is ambitious and clear. The company plans to:

- Begin trial production within the next few months

- Ramp up to 60,000 wafers per month by 2026

- Utilize four fabrication plants for production

1

Initial yield rates for TSMC's 2nm nodes are reported to be around 60-65%, with SRAM modules achieving yields over 90%

1

. These strong early-stage numbers suggest that TSMC faces no major technical obstacles to volume manufacturing, which is crucial for customers relying on predictable supply for high-value products like AI accelerators and flagship mobile processors.Technical Advantages of 2nm Manufacturing

The 2nm process offers significant improvements over previous generations:

- 10-15% performance boost at the same power consumption

- 20-30% reduction in power requirements while maintaining performance

1

These advantages are particularly appealing for AI servers, where power efficiency is as critical as computing throughput, and for smartphones, where battery life is a key factor.

Samsung's Competitive Strategy

In contrast to TSMC's premium pricing approach, Samsung is adopting a more aggressive strategy:

- Offering cheaper wafers

- Providing shorter delivery schedules

- Aiming to attract cost-conscious customers

1

This approach has already yielded results, with Samsung securing a major deal with Tesla worth 23 trillion won for next-generation AI chips

1

. However, Samsung's current yield rates for 2nm chips are reported to be around 40%, lower than TSMC's2

.Related Stories

Market Dynamics and Customer Strategies

Source: Guru3D

The 2nm chip market is shaping up to be a complex battleground where technology, pricing, and partnerships all play crucial roles:

- TSMC is focusing on maintaining high pricing while delivering stability and quality to keep large customers loyal

- Samsung is positioning itself as a more cost-effective and flexible option to regain market share

1

Industry analysts note that while transistor scaling and power efficiency remain central, business dynamics such as pricing strategies, delivery timelines, and long-term partnerships will be equally important in defining the 2nm era

1

.Impact on AI and HPC Industries

The advancements in 2nm chip technology are expected to have a significant impact on AI and HPC industries:

- Improved performance and power efficiency for AI servers and accelerators

- Enhanced capabilities for mobile AI applications

- Potential for new innovations in high-performance computing

2

As TSMC and Samsung continue to compete and innovate in this space, the AI and HPC sectors are likely to see rapid advancements in chip capabilities, potentially driving new breakthroughs in artificial intelligence and computing technologies.

References

Summarized by

Navi

Related Stories

TSMC Accelerates 2nm Chip Production in Arizona, Expands US Operations

16 Oct 2025•Technology

TSMC's 5nm and 3nm Production Lines Fully Booked Until 2025, Driven by AI Chip Demand

13 Nov 2024•Technology

TSMC Achieves Record Profit Amid AI Boom, Highlighting Industry's Rapid Growth

16 Oct 2025•Business and Economy

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology