Veterans Spearhead Europe's Defence Tech Revolution Amid Ukraine War Investment Surge

3 Sources

3 Sources

[1]

Europe's defence tech start-ups attract investment surge

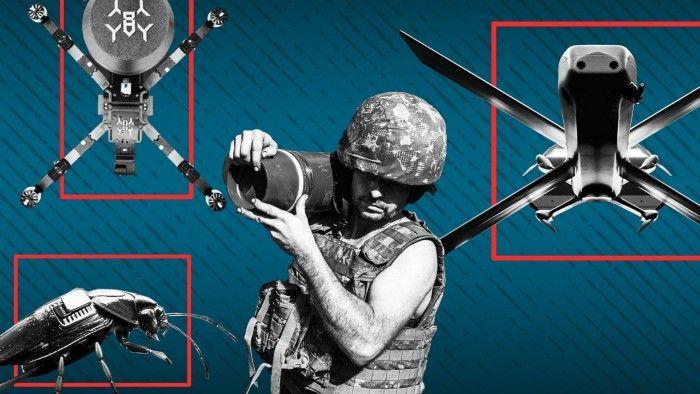

Investment in Europe's booming defence technology start-ups has surged since Russia's full-scale invasion of Ukraine, as venture capital firms abandon earlier caution and pile in to military businesses. Companies in the sector have raised €2.4bn since the start of 2022 including €1.4bn in the first seven months of this year alone, up from just €30mn in 2020 and €150mn in 2021, according to data compiled for the Financial Times by PitchBook. The figures are the latest evidence of the strength of investor appetite for the wave of new companies developing everything from unmanned mini-submarines and autonomous drones to "bio-robotic" cockroaches. Europe now boasts three defence start-ups with a "unicorn" valuation of more than €1bn: drone makers Helsing, Quantum Systems and Tekever. Several VC executives said there had been a step change in investor interest in defence tech after February's Munich security conference, when a combative speech by US vice-president JD Vance stoked alarm that America's long-standing alignment with Europe was under threat. At the time of the speech "there were just a handful of European venture investors specialising in defence tech", said Mikolaj Firlej, co-founder and general partner of VC firm Expeditions Fund. "Now we are getting to the point where these tier 1 branded funds are recognising defence tech as a viable opportunity". Start-ups based in Germany have captured the biggest share of VC funding. Europe's largest economy is the biggest supplier of military support to Ukraine after the US and has unleashed unlimited borrowing to fund defence in the years ahead. Prominent German players such as Helsing have secured the lion's share but money has also flowed into others including Swarm Biotactics. The company, which is developing controllable living cockroaches equipped with micro-backpacks that can covertly conduct surveillance in the most inaccessible of places, said in June it had raised €13mn in early-stage funding, with the latest round backed by investors from Europe, the US and Australia. The UK has also started to attract more attention, with several start-ups, including Tekever and attack drone maker Stark, committing to set up manufacturing facilities in the country. Technology start-ups will also feature strongly at this week's flagship arms trade show in London. Rana Yared, partner at recent Quantum Systems backer Balderton Capital, said there was "movement to Europe being more participatory in its own security . . . That is, I think, the arc of the next 10 years." Ukraine remains the drone capital of the western world with a thriving domestic start-up scene. Foreign companies have also flocked to the country, offering their technology to its armed forces while embracing the ability to test it on the battlefield. "One of the really important things in this space is practical feedback vs theoretical building," said Yared, adding that the companies likely to emerge as winners were "the ones who are able to be practically in the action. Today that means getting field-tested in Ukraine." Below are some of the defence tech companies that European investors are talking about this year. Tim Bradshaw In just four years Helsing has established itself as Europe's most prominent new defence-tech company. The business was recently valued at €12bn in a round led by Spotify founder Daniel Ek's investment group, Prima Materia. Co-founded by a video-games entrepreneur, a former German defence ministry official and an artificial intelligence researcher, Helsing started out focusing on software to track battlefield data. But over the past year it has built strike drones for Ukraine, bought German aircraft manufacturer Grob (which came with its own airfield) and unveiled plans to manufacture autonomous submarines in the UK. "We are going from a software company to an all-domain AI software and hardware company," Ek, Helsing's chair, told the FT in June. Laura Pitel After the full-scale invasion of Ukraine in 2022, Munich-based reconnaissance drone maker Quantum Systems wanted to move into producing lethal weapons but the idea was opposed by some investors. Co-founder and former German army officer Florian Seibel instead set up a sister company, Stark, which since launching in 2024 has become one of Europe's fastest-growing defence tech companies. In August it closed a new €60mn funding round that valued the company at €500mn, with backers including Thiel Capital and Sequoia Capital. Along with its rival Helsing, Stark this year received an order for a "large number" of lethal drones from the German armed forces so they could test, experiment with and help develop the weapons. The company has not yet secured any other government or military contracts, although it has a team in Ukraine engaged in testing and development. In July it announced it would open a factory in the English town of Swindon. Christopher Miller A video posted on Telegram in June showed southern Ukraine from an altitude of 11km. But it wasn't shot from one of the commercial airliners that fly at that altitude but by a copter drone that could soon be used to knock down Russia's high-flying reconnaissance drones. Its maker is Wild Hornets, a start-up founded in 2023. It has half a dozen drone models including the Hornet Queen bomber and its newest, the high-speed Sting interceptor, designed to take down the Iranian-designed Shahed-type drones that Russia launches by the hundreds. Emblematic of Ukraine's ingenuity, design prowess and grassroots manufacturing culture, Wild Hornets is financed by donations and crowdfunding on social media, where it shares photos of civilians teaming up to help with production. It collaborates closely with some of Ukraine's elite combat units to test and improve its drones and boasts that it has neutralised 1,738 enemy assets worth $1,69bn, including at least 150 Russian tanks, 800 military vehicles and 122 heavy artillery systems. Sylvia Pfeifer Founded in late 2024, the UK-based start-up hopes to tap into the growing market for more cost-effective air defence systems to counter threats such as drones and missiles, and this year launched its first product, Skyhammer. Designed to be a low-cost interceptor for cruise missiles and large drones, Skyhammer has a range of up to 30km and a speed of up to 700km/h. The company counts Lakestar, Lux Capital, Accel and Spark Capital among its backers and has raised $136mn to date with its latest round, led by Spark, valuing it at $400mn. Grant Shapps, a UK defence minister under the previous Conservative government, has been recruited as chair. Sylvia Pfeifer Headquartered in Munich, Arx Robotics has raised €54mn to date to expand its fleet of autonomous land drones. The company, which counts the Nato Innovation Fund and venture capital firm Project A among its backers, has developed a range of vehicles that can be fitted with equipment for reconnaissance purposes or casualty evacuation. Some of its vehicles are in active deployment in Ukraine. Its AI-based operating system, Mithra OS, can also be integrated on to legacy fleets to modernise them. The start-up is partnering with Daimler Truck and Renk to integrate it on to existing vehicles. Arx this year also announced plans for a UK factory.

[2]

Veterans lead Europe's defence tech revolution as Ukraine war fuels investment boom

PRAGUE/STOCKHOLM, Sept 4 (Reuters) - When former German army officer Matt Kuppers evaluated an Austrian startup's anti-drone weapons system, his military eye spotted what the young civilian founders had missed: the heated gun barrel lost accuracy after repeated firings. That insight exemplifies how military veterans are reshaping Europe's defence technology landscape, bringing their experience to boardrooms and development labs, as the Ukraine war drives unprecedented investment in the sector. "They did not realise a weapon barrel heats up during prolonged firing and can subtly skew [its targeting accuracy] due to the heat," said Kuppers, a co-founder of venture capital firm Defence Invest, comprising former German and British soldiers, which is testing the technology with the Austrian military. "This is something an experienced infantry soldier would instinctively account for by adjusting their aim." Veterans lead a quarter of Europe's 80-plus defence startups, a Reuters analysis shows, while the CEOs of the region's top 10 defence contractors tend to have no military background. The war in Ukraine and NATO's spending push have driven defence investment to record levels for both established firms like Germany's Rheinmetall (RHMG.DE), opens new tab and a startup ecosystem that has long lagged the United States. These emerging companies are attracting record funding, with VC investment hitting $5.2 billion in 2024, up over 500% from pre-war levels, according to NATO Innovation Fund and Dealroom data. Reuters spoke to more than two dozen veterans, start-up founders, VC firms and soldiers on the ground in Ukraine to shed light on the critical advice, know-how and investment that former military personnel bring to the defence technology sector. On the battleground, their role has helped satisfy demand for tested technology, ranging from kamikaze drones to AI-powered battle-planning software. 'CAN'T SOLVE A PROBLEM YOU DON'T KNOW' Efforts to support Ukraine have compressed development timelines to weeks or months, from years, with veteran-led startups able to make rapid refinements based on frontline experience in Ukraine since Russia's 2022 full-scale invasion. "You can't solve a problem you don't know - one you've never felt yourself," said Marc Wietfeld, a former German officer who founded unmanned ground vehicle maker ARX Robotics. At the same time, rising NATO defence budgets are creating further opportunities for soldier-entrepreneurs across Europe. Emmanuel Jacob, president of the European Organisation of Military Associations and Trade Unions, said he was witnessing long-serving soldiers joining defence startups at the fastest pace he has seen in his 40 years in the industry. Some veterans also bring along knowledge of military procurement vital to a new product's success and underlining their value to startups new to navigating these processes, former soldiers and investors say. "I see people who spent their life in the military in Europe really seeing opportunities now for the first time," said Ragnar Sass, founder of Estonian unicorn Pipedrive who now backs defence startups through the Darkstar consortium. BATTLE-TESTED SOLUTIONS Three factors have helped drive the soldier-entrepreneur boom: Ukraine creating billions in new defence markets, record venture capital investment, and AI tools that accelerate product development. Florian Seibel, a former German helicopter pilot, co-founded drone maker Quantum Systems, now valued at $1 billion, and launched another drone company, Stark, last year. Other veteran-led companies include Arondite, founded by a British Army officer making battle-planning software, and BlinkTroll, run by former Norwegian soldiers producing military training equipment. The low barrier to entry for drone technology, unlike fighter jets or submarines, has enabled rapid startup formation. Francisco Serra-Martins, an ex-Australian Army combat engineer who co-founded Ukraine-based Terminal Authority in 2022, said veterans brought an edge beyond development. "Veterans see firsthand what solutions are missing on the battlefield, and ... have a deep understanding of what works, and what is hype and marketing," Serra-Martins told Reuters. "You understand the user, the constraints, and what will or will not be adopted. It is also a credibility builder with customers." His firm has expanded from kamikaze drones into cruise missile development and now supplies drones to German defence AI startup Helsing. STARTUP INVESTMENT SOARS A McKinsey analysis shows European defence tech startup investment skyrocketed over 500% between 2021-2024 compared to 2018-2020, with military veterans playing key roles as founders, advisors and investors. Veterans say starting a defence company is easier than joining established contractors, as technology has lowered barriers to entry and offered those with specialised skills the opportunity to become entrepreneurs rather than employees. "Soldiers on the front line don't have time to figure out technology while being shot at," said Jan-Erik Saarinen, founder of Double Tap investments and former Finnish soldier who served in Bosnia and Afghanistan. "You need actual combat soldiers in your company if you're providing technology to Ukraine." Dymytro Kuzmenko, head of the Ukrainian Venture Capital and Private Equity Association, told a conference startups sending technology to Ukraine need battlefield-tested solutions, not prototypes requiring extensive trial and error. The expertise gap also becomes critical when lives depend on the technology. Viktoriia Honcharuk, a Ukrainian soldier with the 3rd Assault Brigade, described how one unmanned vehicle looked great on paper but failed at the front lines, wasting 300,000 euros. "I wish more companies were founded by military people," she told Reuters. Reporting by Michael Kahn Editing by Bernadette Baum Our Standards: The Thomson Reuters Trust Principles., opens new tab * Suggested Topics: * Aerospace & Defense Supantha Mukherjee Thomson Reuters Supantha leads the European Technology and Telecoms coverage, with a special focus on emerging technologies such as AI and 5G. He has been a journalist for about 18 years. He joined Reuters in 2006 and has covered a variety of beats ranging from financial sector to technology. He is based in Stockholm, Sweden.

[3]

Analysis-Veterans Lead Europe's Defence Tech Revolution as Ukraine War Fuels Investment Boom

By Michael Kahn and Supantha Mukherjee PRAGUE/STOCKHOLM (Reuters) -When former German army officer Matt Kuppers evaluated an Austrian startup's anti-drone weapons system, his military eye spotted what the young civilian founders had missed: the heated gun barrel lost accuracy after repeated firings. That insight exemplifies how military veterans are reshaping Europe's defence technology landscape, bringing their experience to boardrooms and development labs, as the Ukraine war drives unprecedented investment in the sector. "They did not realise a weapon barrel heats up during prolonged firing and can subtly skew [its targeting accuracy] due to the heat," said Kuppers, a co-founder of venture capital firm Defence Invest, comprising former German and British soldiers, which is testing the technology with the Austrian military. "This is something an experienced infantry soldier would instinctively account for by adjusting their aim." Veterans lead a quarter of Europe's 80-plus defence startups, a Reuters analysis shows, while the CEOs of the region's top 10 defence contractors tend to have no military background. The war in Ukraine and NATO's spending push have driven defence investment to record levels for both established firms like Germany's Rheinmetall and a startup ecosystem that has long lagged the United States. These emerging companies are attracting record funding, with VC investment hitting $5.2 billion in 2024, up over 500% from pre-war levels, according to NATO Innovation Fund and Dealroom data. Reuters spoke to more than two dozen veterans, start-up founders, VC firms and soldiers on the ground in Ukraine to shed light on the critical advice, know-how and investment that former military personnel bring to the defence technology sector. On the battleground, their role has helped satisfy demand for tested technology, ranging from kamikaze drones to AI-powered battle-planning software. 'CAN'T SOLVE A PROBLEM YOU DON'T KNOW' Efforts to support Ukraine have compressed development timelines to weeks or months, from years, with veteran-led startups able to make rapid refinements based on frontline experience in Ukraine since Russia's 2022 full-scale invasion. "You can't solve a problem you don't know - one you've never felt yourself," said Marc Wietfeld, a former German officer who founded unmanned ground vehicle maker ARX Robotics. At the same time, rising NATO defence budgets are creating further opportunities for soldier-entrepreneurs across Europe. Emmanuel Jacob, president of the European Organisation of Military Associations and Trade Unions, said he was witnessing long-serving soldiers joining defence startups at the fastest pace he has seen in his 40 years in the industry. Some veterans also bring along knowledge of military procurement vital to a new product's success and underlining their value to startups new to navigating these processes, former soldiers and investors say. "I see people who spent their life in the military in Europe really seeing opportunities now for the first time," said Ragnar Sass, founder of Estonian unicorn Pipedrive who now backs defence startups through the Darkstar consortium. BATTLE-TESTED SOLUTIONS Three factors have helped drive the soldier-entrepreneur boom: Ukraine creating billions in new defence markets, record venture capital investment, and AI tools that accelerate product development. Florian Seibel, a former German helicopter pilot, co-founded drone maker Quantum Systems, now valued at $1 billion, and launched another drone company, Stark, last year. Other veteran-led companies include Arondite, founded by a British Army officer making battle-planning software, and BlinkTroll, run by former Norwegian soldiers producing military training equipment. The low barrier to entry for drone technology, unlike fighter jets or submarines, has enabled rapid startup formation. Francisco Serra-Martins, an ex-Australian Army combat engineer who co-founded Ukraine-based Terminal Authority in 2022, said veterans brought an edge beyond development. "Veterans see firsthand what solutions are missing on the battlefield, and ... have a deep understanding of what works, and what is hype and marketing," Serra-Martins told Reuters. "You understand the user, the constraints, and what will or will not be adopted. It is also a credibility builder with customers." His firm has expanded from kamikaze drones into cruise missile development and now supplies drones to German defence AI startup Helsing. STARTUP INVESTMENT SOARS A McKinsey analysis shows European defence tech startup investment skyrocketed over 500% between 2021-2024 compared to 2018-2020, with military veterans playing key roles as founders, advisors and investors. Veterans say starting a defence company is easier than joining established contractors, as technology has lowered barriers to entry and offered those with specialised skills the opportunity to become entrepreneurs rather than employees. "Soldiers on the front line don't have time to figure out technology while being shot at," said Jan-Erik Saarinen, founder of Double Tap investments and former Finnish soldier who served in Bosnia and Afghanistan. "You need actual combat soldiers in your company if you're providing technology to Ukraine." Dymytro Kuzmenko, head of the Ukrainian Venture Capital and Private Equity Association, told a conference startups sending technology to Ukraine need battlefield-tested solutions, not prototypes requiring extensive trial and error. The expertise gap also becomes critical when lives depend on the technology. Viktoriia Honcharuk, a Ukrainian soldier with the 3rd Assault Brigade, described how one unmanned vehicle looked great on paper but failed at the front lines, wasting 300,000 euros. "I wish more companies were founded by military people," she told Reuters. (Reporting by Michael KahnEditing by Bernadette Baum)

Share

Share

Copy Link

Military veterans are leading a transformation in Europe's defence technology sector, leveraging their expertise to drive innovation and attract unprecedented investment. The Ukraine war has catalyzed this shift, creating new opportunities for soldier-entrepreneurs.

Europe's Defence Tech Boom: Veterans at the Helm

The European defence technology sector is experiencing an unprecedented surge, driven by the ongoing conflict in Ukraine and increased NATO spending. At the forefront of this revolution are military veterans, who are leveraging their unique expertise to reshape the industry landscape

1

2

.Investment Surge and Startup Growth

Since Russia's full-scale invasion of Ukraine, investment in Europe's defence technology startups has skyrocketed. The sector has raised €2.4 billion since the start of 2022, with €1.4 billion in the first seven months of 2023 alone, a dramatic increase from just €30 million in 2020

1

. Venture capital investment hit $5.2 billion in 2024, marking a 500% increase from pre-war levels2

.Veterans' Unique Advantage

Military veterans are playing a crucial role in this boom, with a quarter of Europe's 80-plus defence startups led by former service members

2

. Their battlefield experience provides invaluable insights that civilian founders might overlook. For instance, Matt Kuppers, a former German army officer and co-founder of Defence Invest, identified a critical flaw in an anti-drone weapon system that civilian developers had missed2

.Rapid Innovation and Battle-Tested Solutions

The ongoing conflict in Ukraine has accelerated product development timelines from years to mere weeks or months. Veteran-led startups are able to make rapid refinements based on frontline feedback. Francisco Serra-Martins, an ex-Australian Army combat engineer and co-founder of Ukraine-based Terminal Authority, emphasizes that veterans bring a deep understanding of battlefield needs and can distinguish between effective solutions and marketing hype

2

.Related Stories

Notable Veteran-Led Ventures

Several veteran-led companies are making significant strides in the sector. Florian Seibel, a former German helicopter pilot, co-founded drone maker Quantum Systems, now valued at $1 billion, and recently launched another drone company, Stark

2

3

. Other notable startups include Arondite, founded by a British Army officer developing battle-planning software, and BlinkTroll, run by former Norwegian soldiers producing military training equipment2

.The Future of European Defence Tech

As NATO defence budgets rise and the demand for innovative military technologies grows, the role of veteran-led startups is likely to become even more prominent. Emmanuel Jacob, president of the European Organisation of Military Associations and Trade Unions, notes that long-serving soldiers are joining defence startups at an unprecedented rate

2

. This trend, coupled with the lowered barriers to entry in technologies like drones, is reshaping the European defence industry and challenging traditional contractors.References

Summarized by

Navi

Related Stories

Germany's AI-Driven Defense Revolution: From Spy Cockroaches to Autonomous Robots

23 Jul 2025•Technology

Ukraine's Military Tech Innovation: Reshaping Modern Warfare and Global Defense Dynamics

19 Sept 2025•Technology

Ukraine: The Ultimate Testing Ground for European Drone Manufacturers

19 Jun 2025•Technology

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology