Wedbush Maintains AI Bull Thesis Despite Tech Sell-Off Concerns

2 Sources

2 Sources

[1]

Tech sell-off draws worries, but Wedbush maintains AI bull thesis

"While we recognize the bumpy macro/job data and the drumroll for the US Presidential elections into November, we view this sell-off in tech stocks as a buying opportunity for our core winners in this AI Revolution," said Wedbush analysts, led by Daniel Ives, in an investor note. Per every $1 spent on an Nvidia GPU, it creates an $8 to $10 multiplier throughout the broader tech sector, according to Wedbush. "AI starts with Nvidia, but the ramifications for broader tech are essentially a 4th Industrial Revolution now being built out across semis, software, infrastructure, Internet and smartphones over the next 12 to 18 months," Ives said.

[2]

Wedbush says tech bull thesis unchanged after September selloff By Investing.com

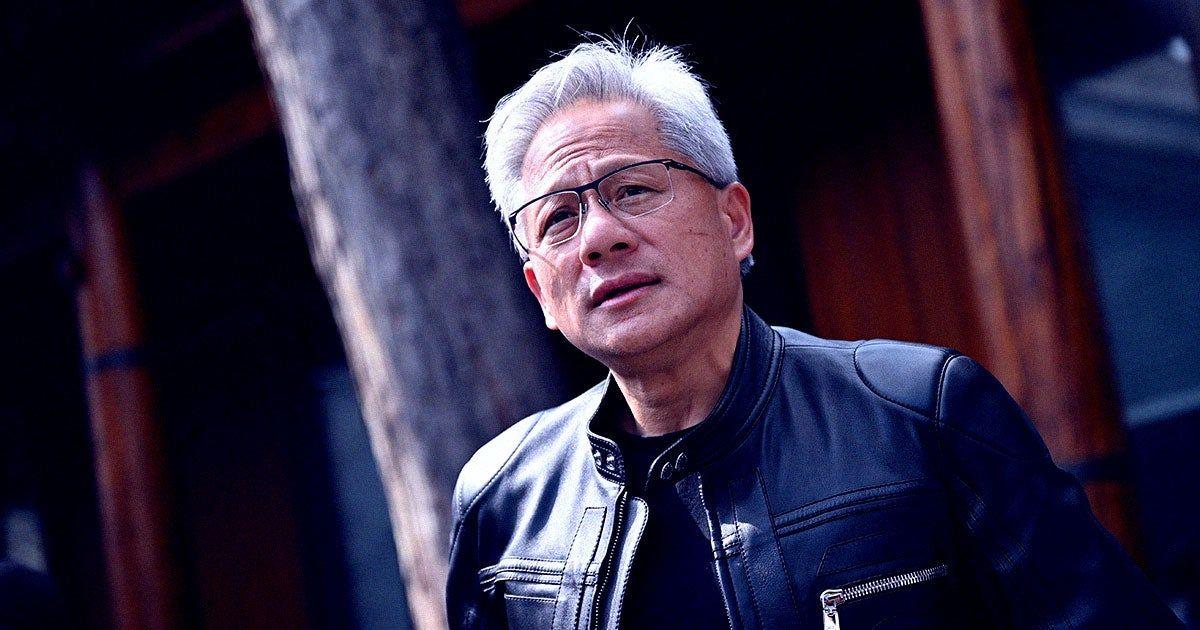

Investing.com -- After the market reopened following the Labor Day weekend, tech stocks faced significant pressure in a broader risk-off market. However, analysts at Wedbush remain unphased by the latest sell-off, emphasizing that their "tech bull thesis remains unchanged." "While we recognize the bumpy macro/job data and the drumroll for the US Presidential elections into November, we view this sell-off in tech stocks as a buying opportunity for our core winners in this AI Revolution," Wedbush analysts said in a Tuesday note. The investment firm highlighted last week's Nvidia (NASDAQ:NVDA) earnings and conference call as a key moment in solidifying the AI bull case. Although the immediate reaction to Nvidia's strong results and guidance was muted, they believe that demand for AI is surpassing supply considerably. With concerns over Blackwell delays now addressed, analysts see no major obstacles to the continued growth of the AI sector heading into year-end, despite some recession concerns. "The stage is set for tech stocks to move higher into year-end and 2025, in our opinion," analysts wrote, as they expect the Federal Reserve to begin cutting rates, the economy to experience a soft landing, and AI spending to drive a long-term, generational shift in tech investment. Wedbush continues to estimate that for every $1 spent on an Nvidia GPU chip, there is an $8-$10 multiplier across the tech sector, reinforcing their bullish stance on tech stocks for the year ahead. "Taking a step back, Nvidia has changed the tech and global landscape as its GPUs have become the new oil and gold in the IT landscape with its chips powering the AI Revolution and being the only game in town for now," Wedbush's team continued. Nvidia shares plunged 9.5% on Tuesday, marking the largest single-day loss in market value for a U.S. company and erasing $279 billion in capitalization, as investor enthusiasm for AI cooled amid weak economic data and a broad market selloff. The broader PHLX Semiconductor Sector chip index also fell 7.75%, its steepest drop since 2020.

Share

Share

Copy Link

Despite a significant tech sell-off in September, Wedbush Securities remains optimistic about the AI sector, maintaining its bull thesis for major tech companies.

September Tech Sell-Off Raises Concerns

The tech sector experienced a notable sell-off in September, causing concern among investors and market watchers. This downturn affected major tech companies, particularly those heavily invested in artificial intelligence (AI) technologies

1

. The sell-off was part of a broader market trend, with rising interest rates and economic uncertainties contributing to the decline.Wedbush Securities Maintains Bullish Stance

Despite the market turbulence, Wedbush Securities, a prominent financial services and investment firm, has maintained its bullish outlook on the tech sector, particularly for companies at the forefront of AI innovation

2

. The firm's analysts, led by Dan Ives, believe that the recent sell-off presents a buying opportunity for investors rather than a reason for concern.Focus on AI Leaders

Wedbush's optimism is primarily centered on tech giants that are leading the AI revolution. Companies such as Microsoft, Apple, and Nvidia are viewed as well-positioned to benefit from the growing AI market

1

. The firm argues that these companies have strong fundamentals and are at the forefront of developing and implementing AI technologies across various sectors.Long-Term Growth Potential

The investment firm's bull thesis is based on the long-term growth potential of AI technologies. Wedbush analysts predict that AI will drive significant innovation and create new market opportunities in the coming years

2

. They estimate that AI could represent a $1 trillion market opportunity by 2025, suggesting substantial room for growth and investment returns.Short-Term Challenges vs. Long-Term Opportunities

While acknowledging the short-term challenges posed by the recent sell-off, Wedbush emphasizes the importance of focusing on the long-term potential of AI-driven technologies

1

. The firm suggests that current market conditions may offer attractive entry points for investors looking to capitalize on the AI trend.Related Stories

Investor Sentiment and Market Dynamics

The contrasting views between current market sentiment and Wedbush's optimistic outlook highlight the complex dynamics at play in the tech sector. While some investors may be cautious due to the recent sell-off, others see it as a chance to invest in potentially undervalued AI-focused companies

2

.Implications for the Tech Industry

Wedbush's maintained bull thesis has implications for the broader tech industry. It suggests that despite short-term market fluctuations, the underlying growth drivers for AI technologies remain strong

1

. This could encourage continued investment and innovation in the AI space, potentially accelerating the development and adoption of AI-driven solutions across various industries.References

Summarized by

Navi

[1]

Related Stories

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy