Alibaba's AI Investments Boost Cloud Revenue Amid Overall Revenue Miss

7 Sources

7 Sources

[1]

Alibaba results likely to show limited AI payoff for China tech

BEIJING, Aug 27 (Reuters) - China's Alibaba (9988.HK), opens new tab is likely to highlight its artificial intelligence strategy with its quarterly results on Friday, but in line with its peers Tencent (0700.HK), opens new tab and Baidu (9888.HK), opens new tab, may struggle to show that its big AI investments are paying off. The companies have invested billions of dollars into AI over the past three years following the global success of ChatGPT, hailing it as a key revenue driver. They rolled out their own large language models and infused them into their flagship products. But making money from these efforts has proved difficult so far, as Chinese users, unlike Western customers, have demonstrated strong resistance to paid subscription models, analysts said. Alibaba has been among the most aggressive in China's AI industry, showcasing advancements on an almost weekly basis. The weak contribution from the AI push dampens Alibaba's growth outlook at a time when its core e-commerce business is locked in an intense price competition with rivals to keep consumers spending amid persistent economic weakness in China. Analysts estimate revenue from its cloud business which includes AI-related product sales grew just 4.3% in the April-June quarter from the previous quarter to 31.4 billion yuan ($4.4 billion), according to LSEG data. That would be up 18% from a year earlier, but suggests growth is slowing. Tencent's earnings showed this month that revenue from the business that includes selling AI services is growing more slowly than its core gaming business. Baidu's did not expand fast enough to offset declines in its advertising revenue. When it first launched its Ernie chatbot in late 2023, Baidu attempted a subscription model with a 59.9 yuan monthly fee. But it discontinued the paid service in April after poor take-up by users. "In China, in reality, it's actually very hard to use the user-paid model, which now populates the U.S. AI tools," Tencent President Martin Lau said during the company's earnings call this month. Baidu CEO Robin Li said this week the company would take a "prudent approach" to AI monetisation, while prioritising user experience. SHIFT TO ENTERPRISE CUSTOMERS With consumer subscriptions proving unviable, Chinese AI developers have pivoted to enterprise customers with application programming interface (API) services provided through their cloud platforms. "The consumer market is a challenge for AI developers in China. The more realistic path will be in the enterprise market," said Lian Jye Su, chief analyst at technology research firm Omdia. However, intense competition that started early last year has hammered API pricing, and the price war shows no sign of abating. In May, Alibaba slashed its Qwen-Long model API pricing by 97% to 0.0005 yuan per thousand tokens. A month later, ByteDance cut its Doubao model prices by 63% to as low as 2.6 yuan per million tokens. In a further challenge to the revenue opportunity, many Chinese companies including DeepSeek have committed to open-source their AI models, reducing the incentive for enterprises to buy similar models from cloud platforms. Still, companies argue that AI's importance to their operations goes beyond a direct revenue uplift and that the investments improve their advertising and e-commerce offerings. "The long-term commercial potential is remote but highly visible," said Charlie Chai, an analyst with consultancy 86Research. "The productivity gains across all industries will be substantial, and the enablers (through API, licensing or other delivery formats) will definitely be tapping into a huge market." Alibaba is expected to report quarterly revenue of 252.9 billion yuan on Friday, up 4% from a year ago, according to analysts' average estimate surveyed by LSEG. ($1 = 7.1529 Chinese yuan renminbi) Reporting by Liam Mo and Brenda Goh; Editing by Miyoung Kim and Sonali Paul Our Standards: The Thomson Reuters Trust Principles., opens new tab * Suggested Topics: * Artificial Intelligence Brenda Goh Thomson Reuters Brenda Goh is Reuters' Shanghai bureau chief and oversees coverage of corporates in China. Brenda joined Reuters as a trainee in London in 2010 and has reported stories from over a dozen countries.

[2]

Alibaba misses revenue estimates, but AI boosts cloud business

Aug 29 (Reuters) - China's Alibaba (9988.HK), opens new tab, missed market estimates for quarterly revenue on Friday as the company's e-commerce business grappled with tough competition and choppy consumer demand, eclipsing gains in its cloud computing business. U.S.-listed shares in the company were up 2% in premarket trading. Consumer confidence in China has taken a beating from an economy weighed down by a lingering property sector crisis, weak wage growth and global trade disruptions. Consumers remained cautious even as e-commerce companies resorted to steep discounts and price cuts to drum up demand. That eclipsed strong growth in Alibaba's cloud segment, where revenue surged 26% to 33.40 billion yuan ($4.67 billion) against 18% growth seen in the prior quarter. Analysts were expecting an 18.4% rise to 31.44 billion yuan, according to LSEG data. Alibaba has been among the most aggressive players in China's AI sector, unveiling upgrades on an almost weekly basis, most recently rolling out a model that converts portrait photos into lifelike video avatars. "AI-related product revenue is now a significant portion of revenue from external customers," said Alibaba Group CEO Eddie Wu. The company reported total revenue of 247.65 billion yuan in the first quarter ended June, compared with an estimate of 252.92 billion yuan compiled by LSEG. This is the first time Alibaba has reported revenue from its China E-commerce group, which includes platforms Taobao and Tmall, its new instant commerce business, food delivery app Ele.me and travel agency Fliggy. The group reported 10% growth in revenue. Alibaba's income from operations decreased 3% on the year, and adjusted earnings before interest, tax and amortisation (EBITA) fell 14% due largely to investments in the instant commerce business. Earlier this week, PDD and food delivery leader Meituan (3690.HK), opens new tab - which is locked in a subsidy-driven "instant retail" market share war with both Alibaba and JD.com - warned that increased investments would cause fluctuations in profit in future quarters. Executives at both firms said competition in the industry had intensified further in the quarter. PDD beat quarterly revenue estimates earlier this week, but flagged more volatility in future profits after reporting a 21% drop in its operating income. Meituan on Wednesday reported a 97% dive in net income, despite a 12% rise in revenue. Alibaba has also invested in improving its international business's foothold in key markets like Europe and the Middle East. The international unit reported a 20% rise in revenue to 6.5 billion yuan. ($1 = 7.1529 Chinese yuan renminbi) Reporting by Deborah Sophia in Bengaluru and Casey Hall in Shanghai; Editing by Pooja Desai and Jan Harvey Our Standards: The Thomson Reuters Trust Principles., opens new tab * Suggested Topics: * Technology Casey Hall Thomson Reuters Casey has reported on China's consumer culture from her base in Shanghai for more than a decade, covering what Chinese consumers are buying, and the broader social and economic trends driving those consumption trends. The Australian-born journalist has lived in China since 2007.

[3]

Alibaba's key cloud unit sales shine even as quarterly revenues miss

The Alibaba office building in Nanjing, Jiangsu province, China, on Aug. 28, 2024. Alibaba posted a better-than-expected bottom line in the June quarter fueled by accelerated sales at its cloud computing unit and a continued revival of its e-commerce business. Still, the Chinese giant's revenues came in under analyst forecasts. Alibaba's stock was up more than 1% in premarket trade in the U.S. after initially dipping. Here's how Alibaba did in its fiscal first quarter ended June, compared with LSEG estimates: Alibaba said revenue at its cloud division totaled 33.4 billion yuan, up 26% year-on-year. That was faster than the 18% growth rate seen in the previous quarter. Alibaba's cloud unit is seen as key to the company monetizing artificial intelligence, much like Microsoft or Google. New York-listed Alibaba shares have risen more than 40% this year as revenue growth at its core China e-commerce business has improved and its cloud computing division has accelerated. The company is dealing with uncertainty in the Chinese economy, which lost momentum in July. Earlier this year, Beijing had launched initiatives to boost consumption. Aside from e-commerce, investors are focused on Alibaba's investments in artificial intelligence, where it has become a major global player. The company has aggressively launched various AI models and is selling services through its cloud computing division.

[4]

Alibaba misses revenue estimates, but AI boosts cloud business - The Economic Times

Alibaba posted 26% cloud revenue growth to 33.4 billion yuan, fueled by heavy AI investment, even as weaker ecommerce sales dragged overall revenue 2% below estimates. China's Alibaba said on Friday artificial intelligence was key to expanding its cloud computing business, as it reported strong quarterly growth in the sector despite its wider operations missing revenue estimates. US-listed shares in the company were up 8% at the market open. Revenue in Alibaba's cloud segment surged 26% to 33.40 billion yuan ($4.67 billion), easily beating an expected 18.4% rise. However, that was eclipsed by weaker than expected growth in its e-commerce business, leaving overall revenue lagging estimates by 2%. Alibaba has been among the most aggressive players in China's AI sector, unveiling upgrades on an almost weekly basis. Over the past four quarters, the firm has cumulatively invested over 100 billion yuan in AI infrastructure and AI product research and development, Group CEO Eddie Wu told analysts on a post earnings call. "Our investments in AI have begun to yield tangible results," Wu said. "We are seeing an increasingly clear path for AI to drive Alibaba's robust growth." For the company overall, total revenue for the quarter ended June 30 came in at 247.65 billion yuan, below the 252.92 billion yuan average estimate compiled by LSEG. This is the first time Alibaba has reported revenue from its China E-commerce Group, which includes platforms Taobao and Tmall, its new instant commerce business, food delivery app Ele.me and travel agency Fliggy. The group reported 10% growth in revenue. Alibaba's income from operations decreased 3% on the year, and adjusted earnings before interest, tax and amortisation fell 14% due largely to investments in the instant commerce business. Earlier this week, rivals PDD Holdings and Meituan - both locked in a subsidy-driven battle for market share in the instant retail space alongside Alibaba and JD.com - warned that rising investments would weigh on profits in coming quarters. Executives from both firms said competition had intensified during the period. CFRA analyst Angelo Zino said that while the pivot toward quick commerce and AI investments had driven meaningful operational changes across the business, "profitability was impacted by growth initiatives, including user acquisition and technology infrastructure spending". Wu said Alibaba aims to use its quick commerce business to help build up its overall ecommerce consumer base, targeting a 30 trillion yuan addressable market. He projected the quick commerce segment could contribute 1 trillion yuan in annualised incremental gross merchandise volume over the next three years. International commerce revenue rose 19%, driven by expansion in key markets such as Europe and the Middle East. Alibaba also said on Friday it had repurchased shares in its logistics unit Cainiao from Fosun International for $349.8 million.

[5]

AI-Related Products Help Drive 26% Revenue Growth in Alibaba's Cloud Division | PYMNTS.com

By completing this form, you agree to receive marketing communications from PYMNTS and to the sharing of your information with our sponsor, if applicable, in accordance with our Privacy Policy and Terms and Conditions. Overall, during the quarter ended June 30, Alibaba reported year-over-year revenue growth of 2%, or 10% when revenue from two businesses it sold over the past year is excluded, according to a Friday (Aug. 29) earnings release. The company said in a presentation released Friday that it is "embarking on a new chapter of entrepreneurship by investing in two strategic pillars of consumption and AI + Cloud." Alibaba's cloud division earned 26% year-over-year revenue growth. The division's gains were driven in part by its customers' increasing adoption of AI-related products, according to the release. "During the quarter, AI-related revenue accounted for over 20% of revenue from external customers as AI demand continued to grow rapidly," Alibaba Group CEO Eddie Wu said Friday during the company's quarterly earnings call. "We're also seeing AI applications driving great growth momentum of traditional products, including compute and storage." The company's Alibaba International Digital Commerce Group (AIDC) delivered 19% year-over-year revenue growth. The group's cross-border business was especially strong, and its international wholesale platform gained new monetization opportunities as more merchants adopted its AI-powered tools for marketing, procurement and product listing, the release said. Alibaba's third business, its China E-Commerce Group, saw a 10% gain in year-over-year revenue growth. This increase was helped by gains in consumer use of the group's Taobao app after Alibaba launched the Taobao Instant Commerce service at the end of April, per the release. A company executive said in May that Alibaba launched "instant commerce," a fast delivery service, because there is huge demand in China for fast delivery and because the company has the merchant base and logistics capabilities to meet that demand. The company's fourth business, "all others," saw a 28% year-over-year decline in revenue, which Alibaba attributed to its sale of Sun Art and Intime. An Alibaba executive said in July that the company was paring away non-core businesses and focusing on eCommerce and cloud computing. Alibaba also reported in the earnings release that Ant Group, in which Alibaba is an investor, contributed 1.5 billion yuan (about $216 million) in profit during the quarter, down from 3.9 billion yuan a year earlier. Alibaba attributed the decline to Ant Group's "investments in new growth initiatives and technologies, and the decrease in fair value of certain investments."

[6]

Alibaba misses revenue estimates, but AI boosts cloud business

STORY: Alibaba missed market expectations for quarterly revenue on Friday (August 29). It reported total income of $34.6 billion in the first quarter ended June - just below analyst projections. The company's e-commerce business faced tough competition and challenging consumer demand. Buyer confidence in China has been hit by an economy weighed down by an ongoing property crisis. The country has also seen weak wage growth and global trade disruption. Consumers stayed cautious even as e-commerce firms brought in large discounts and price cuts to drive demand. Those challenges outran gains in its cloud computing business, where revenue surged more than a quarter to $4.67 billion - way above analyst estimates. Alibaba has been among the most aggressive companies in China's AI sector and has regularly rolled out upgrades. U.S.-listed shares in the company were up 8% at the market open.

[7]

Alibaba results likely to show limited AI payoff for China tech

BEIJING (Reuters) -China's Alibaba is likely to highlight its artificial intelligence strategy with its quarterly results on Friday, but in line with its peers Tencent and Baidu, may struggle to show that its big AI investments are paying off. The companies have invested billions of dollars into AI over the past three years following the global success of ChatGPT, hailing it as a key revenue driver. They rolled out their own large language models and infused them into their flagship products. But making money from these efforts has proved difficult so far, as Chinese users, unlike Western customers, have demonstrated strong resistance to paid subscription models, analysts said. Alibaba has been among the most aggressive in China's AI industry, showcasing advancements on an almost weekly basis. The weak contribution from the AI push dampens Alibaba's growth outlook at a time when its core e-commerce business is locked in an intense price competition with rivals to keep consumers spending amid persistent economic weakness in China. Analysts estimate revenue from its cloud business which includes AI-related product sales grew just 4.3% in the April-June quarter from the previous quarter to 31.4 billion yuan ($4.4 billion), according to LSEG data. That would be up 18% from a year earlier, but suggests growth is slowing. Tencent's earnings showed this month that revenue from the business that includes selling AI services is growing more slowly than its core gaming business. Baidu's did not expand fast enough to offset declines in its advertising revenue. When it first launched its Ernie chatbot in late 2023, Baidu attempted a subscription model with a 59.9 yuan monthly fee. But it discontinued the paid service in April after poor take-up by users. "In China, in reality, it's actually very hard to use the user-paid model, which now populates the U.S. AI tools," Tencent President Martin Lau said during the company's earnings call this month. Baidu CEO Robin Li said this week the company would take a "prudent approach" to AI monetisation, while prioritising user experience. SHIFT TO ENTERPRISE CUSTOMERS With consumer subscriptions proving unviable, Chinese AI developers have pivoted to enterprise customers with application programming interface (API) services provided through their cloud platforms. "The consumer market is a challenge for AI developers in China. The more realistic path will be in the enterprise market," said Lian Jye Su, chief analyst at technology research firm Omdia. However, intense competition that started early last year has hammered API pricing, and the price war shows no sign of abating. In May, Alibaba slashed its Qwen-Long model API pricing by 97% to 0.0005 yuan per thousand tokens. A month later, ByteDance cut its Doubao model prices by 63% to as low as 2.6 yuan per million tokens. In a further challenge to the revenue opportunity, many Chinese companies including DeepSeek have committed to open-source their AI models, reducing the incentive for enterprises to buy similar models from cloud platforms. Still, companies argue that AI's importance to their operations goes beyond a direct revenue uplift and that the investments improve their advertising and e-commerce offerings. "The long-term commercial potential is remote but highly visible," said Charlie Chai, an analyst with consultancy 86Research. "The productivity gains across all industries will be substantial, and the enablers (through API, licensing or other delivery formats) will definitely be tapping into a huge market." Alibaba is expected to report quarterly revenue of 252.9 billion yuan on Friday, up 4% from a year ago, according to analysts' average estimate surveyed by LSEG. (Reporting by Liam Mo and Brenda Goh; Editing by Miyoung Kim and Sonali Paul)

Share

Share

Copy Link

Alibaba's latest quarterly results show strong growth in its cloud division, driven by AI-related products, despite missing overall revenue estimates. The company's aggressive AI strategy is paying off in the cloud sector, even as its e-commerce business faces challenges.

Alibaba's Cloud Division Shines with AI-Driven Growth

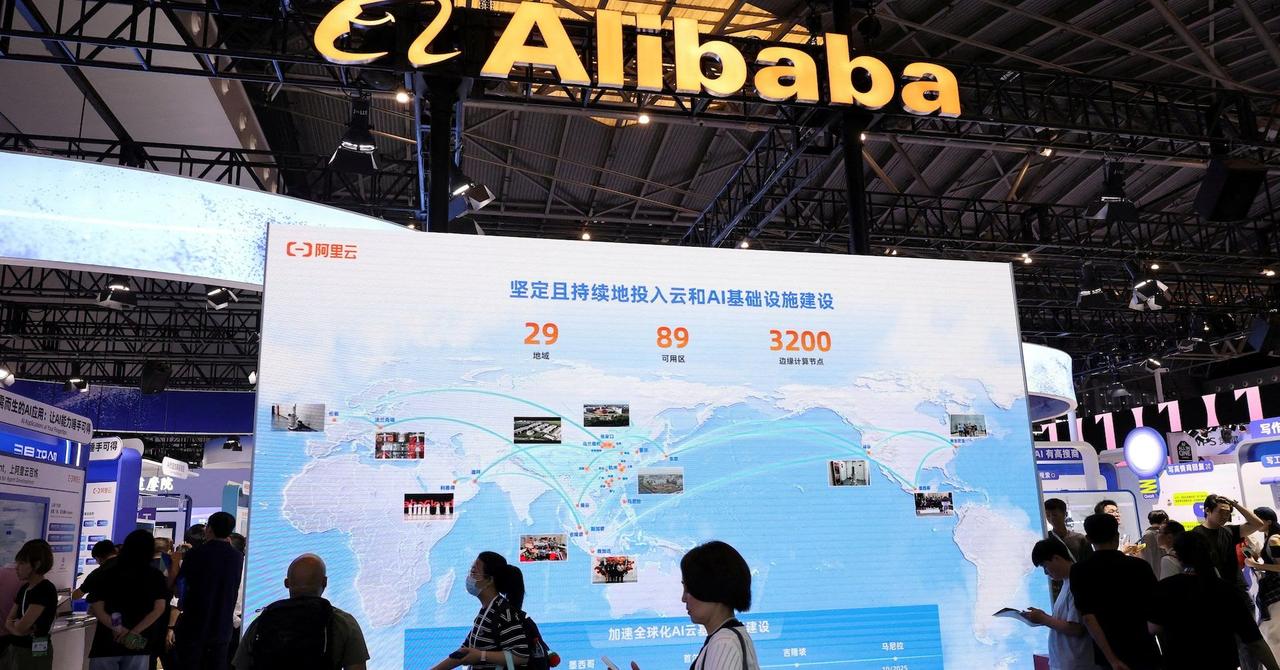

Alibaba, the Chinese tech giant, reported its fiscal first-quarter results, highlighting significant growth in its cloud computing division, largely attributed to its aggressive artificial intelligence (AI) strategy. Despite missing overall revenue estimates, the company's cloud segment showed promising results, indicating a potential shift in its business focus

1

.

Source: Market Screener

Cloud Revenue Surge and AI Investments

Alibaba's cloud division reported a remarkable 26% year-on-year revenue growth, reaching 33.40 billion yuan ($4.67 billion)

2

. This growth rate significantly outpaced the 18% seen in the previous quarter, surpassing analyst expectations of 31.44 billion yuan. The company attributed this success to the increasing adoption of AI-related products by its customers, with AI-related revenue accounting for over 20% of revenue from external customers5

.Alibaba Group CEO Eddie Wu emphasized the company's substantial investment in AI, stating that they have cumulatively invested over 100 billion yuan in AI infrastructure and product research and development over the past four quarters

4

. Wu expressed optimism about the tangible results of these investments, seeing a clear path for AI to drive Alibaba's robust growth.E-commerce Challenges and Overall Revenue Miss

While the cloud division flourished, Alibaba's core e-commerce business faced challenges, leading to an overall revenue miss. The company reported total revenue of 247.65 billion yuan for the quarter ended June 30, falling short of the estimated 252.92 billion yuan

1

. This underperformance reflects the ongoing struggles in China's consumer market, characterized by weak consumer confidence and intense competition in the e-commerce sector.Related Stories

Strategic Shift and Future Outlook

Source: Reuters

Alibaba's focus on AI and cloud computing appears to be a strategic pivot in response to the challenges in its traditional e-commerce business. The company has been among the most aggressive players in China's AI sector, unveiling upgrades on an almost weekly basis

3

.However, monetizing AI investments remains a challenge in the Chinese market. Unlike Western customers, Chinese users have shown strong resistance to paid subscription models for AI services

3

. As a result, Alibaba and its peers are focusing on enterprise customers through API services provided via their cloud platforms.Conclusion

Source: PYMNTS

Alibaba's latest quarterly results paint a picture of a company in transition. While its traditional e-commerce business faces headwinds, the strong performance of its cloud division, driven by AI investments, suggests a potential new growth engine for the company. As Alibaba continues to invest heavily in AI and cloud technologies, it remains to be seen how these efforts will shape its long-term strategy and market position in the evolving tech landscape.

References

Summarized by

Navi

Related Stories

Alibaba's AI-Driven Cloud Revenue Surge Signals Chinese Tech Giant's Strategic Pivot

18 Nov 2025•Business and Economy

Alibaba's Q4 Earnings Miss Raises Concerns Over E-commerce and AI Growth

16 May 2025•Business and Economy

Alibaba Shares Soar as New AI Model QwQ-32B Challenges DeepSeek R1

06 Mar 2025•Technology

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy