Alibaba's Profit Dips Amid Food Delivery War, but AI Boom Offers Hope

2 Sources

2 Sources

[1]

Alibaba's Profit Slides After China Food War Slashes Margins

Alibaba Group Holding Ltd. reported a surge in revenue from China's AI boom, helping offset a surprise drop in profit tied to a worsening battle with Meituan and JD.com Inc. in internet commerce. China's e-commerce leader reported a 3% fall in operating income to 35 billion yuan ($4.9 billion), missing the average estimate. Revenue for the three months ended June rose a less-than-projected 2% to 247.7 billion yuan, despite a triple-digit percentage gain in AI-related product revenue. Sales from the cloud division -- the business most closely tied to the artificial intelligence boom -- rose a better-than-anticipated 26%. The company's shares gained slightly in pre-market US trading.

[2]

China's Food-Delivery Price War Takes Bite Out of Alibaba's Earnings -- Update

The fierce competition in China's food-delivery industry has started to show up in Alibaba Group's results, with the e-commerce titan reporting weakness in a key profitability metric in its latest quarter. The Hangzhou, China-based company said Friday that adjusted net profit--which excludes the effects of share-based compensation expenses, investment gains and losses, some impairments and other items--dropped 18% to 33.51 billion yuan, equivalent to $4.70 billion, for three months ended June. The decline comes as Alibaba has been locked in a delivery price war with Meituan and JD.com as it tries to seize market share. Alibaba said its investment in the on-demand delivery business was the main reason for a 14% drop in its adjusted Ebita. Its net profit beat expectations, however, rising 78% from a year earlier to 43.12 billion yuan. The company attributed the increase to changes in equity investments and gains from the disposal of Trendyol's local consumer service business, which offset lower income from operations. Revenue for the quarter increased by a smaller-than-expected 1.8% to 247.65 billion yuan. The company has been facing a cooling Chinese economy and rising competition in online shopping from the likes of PDD Holdings' Pinduoduo e-commerce platform and ByteDance's short-video app Douyin. E-commerce players have in recent quarters rolled out initiatives to support merchants, such as charging a lower service fee, part of efforts to strengthen their ecosystem and drive platform growth. To gain more market share in the food-delivery sector, Alibaba, along with JD.com and Meituan, has resorted to aggressive promotions and steep discounts, prompting China's top market regulator to call for the companies to engage in "rational" competition. For the latest quarter, Alibaba's fast-expanding overseas e-commerce unit posted a 19% increase in revenue. Total revenue from its China e-commerce division, which includes Taobao and Tmall as well as on-demand delivery platform Ele.me, rose 10%. Alibaba Chief Executive Eddie Wu described the company's investment in the quick commerce business during the period as decisive, saying it "achieved key milestones as we won consumer mindshare." With all eyes on the price battle in on-demand delivery, some analysts have said that the market could be overlooking Alibaba's long-term growth potential in AI. Revenue from its cloud business grew 26% during the April-June period on the back of surging demand for AI services, one of the best-performing quarters for the segment in recent years. The Chinese internet giant's large-model capabilities and access to rich data position it to benefit from China's AI growth, analysts at Morningstar said in a note. It also has one of the world's highest-rated AI models, called Qwen. Alibaba has also accelerated development of its own chips as Beijing pushes for tech self-reliance. The cloud-computing company has developed a new AI chip that is more versatile than its older chips, The Wall Street Journal reported Friday.

Share

Share

Copy Link

Alibaba reports a decline in profit due to intense competition in China's food delivery market, while its AI-related revenue shows significant growth, highlighting the company's potential in the AI sector.

Alibaba's Financial Performance Amidst Market Challenges

Alibaba Group Holding Ltd., China's e-commerce giant, reported mixed financial results for the quarter ending June 2025. The company experienced a 3% decline in operating income to 35 billion yuan ($4.9 billion), falling short of average estimates

1

. Despite this setback, Alibaba's revenue saw a modest 2% increase to 247.7 billion yuan, driven by significant growth in AI-related product sales1

.

Source: Bloomberg

Impact of Food Delivery Price War

The company's profitability has been significantly impacted by the fierce competition in China's food delivery industry. Alibaba's adjusted net profit, excluding various factors such as share-based compensation and investment gains/losses, dropped 18% to 33.51 billion yuan ($4.70 billion)

2

. This decline is largely attributed to Alibaba's aggressive investment in its on-demand delivery business, as it battles for market share against competitors like Meituan and JD.com2

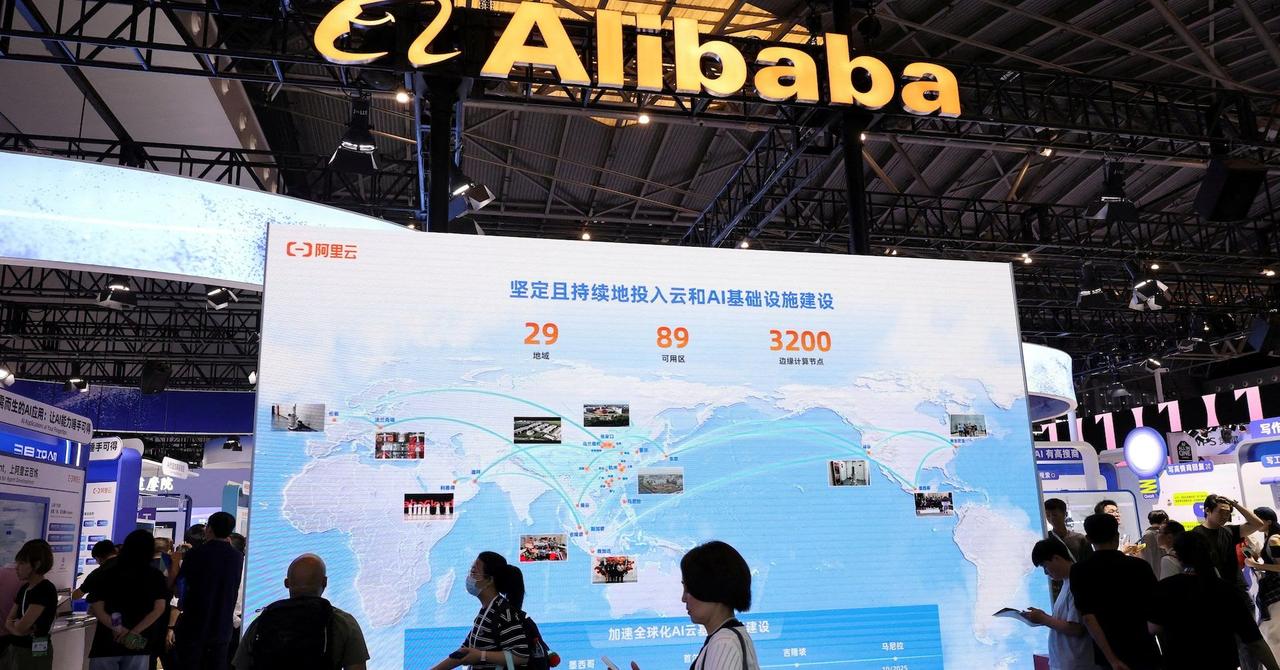

.AI Boom and Cloud Division Growth

Despite challenges in the e-commerce sector, Alibaba's cloud division, which is closely tied to the artificial intelligence boom, showed promising results. The division reported a 26% increase in sales, surpassing expectations

1

. This growth underscores Alibaba's strong position in the rapidly expanding AI market in China.E-commerce and International Expansion

Alibaba's core e-commerce business in China, including platforms like Taobao and Tmall, saw a 10% increase in revenue

2

. The company's international e-commerce unit also performed well, with a 19% rise in revenue2

. These figures indicate Alibaba's continued strength in its primary market and successful expansion into overseas markets.Related Stories

AI Development and Technological Advancements

Alibaba has been making significant strides in AI development. The company's large-model capabilities and access to rich data position it favorably to benefit from China's AI growth

2

. Notably, Alibaba has one of the world's highest-rated AI models, called Qwen2

.In line with Beijing's push for technological self-reliance, Alibaba has accelerated the development of its own chips. The company has created a new AI chip that offers greater versatility compared to its previous iterations

2

. This development showcases Alibaba's commitment to innovation and its alignment with national technological priorities.Market Outlook and Analyst Perspectives

Despite the challenges posed by the ongoing price war in the food delivery sector, some analysts believe that the market might be underestimating Alibaba's long-term growth potential in AI

2

. The company's strong performance in cloud services and AI-related products suggests a promising future in these high-growth areas.Alibaba's CEO, Eddie Wu, described the company's investment in quick commerce as "decisive," stating that it has "achieved key milestones as we won consumer mindshare"

2

. This indicates the company's strategic focus on maintaining its competitive edge in the rapidly evolving Chinese e-commerce landscape.As Alibaba navigates the challenges in its traditional e-commerce business, its investments in AI and cloud computing appear to be paying off, potentially offsetting the pressures from intense market competition in other sectors.

References

Summarized by

Navi

Related Stories

Alibaba's AI-Driven Cloud Revenue Surge Signals Chinese Tech Giant's Strategic Pivot

18 Nov 2025•Business and Economy

Alibaba's AI Investments Boost Cloud Revenue Amid Overall Revenue Miss

27 Aug 2025•Technology

Alibaba's Q4 Earnings Miss Raises Concerns Over E-commerce and AI Growth

16 May 2025•Business and Economy

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy