Alibaba's Q4 Earnings Miss Raises Concerns Over E-commerce and AI Growth

2 Sources

2 Sources

[1]

Alibaba shares drop 4% in premarket trading after big profit miss

The Alibaba office building in Nanjing, Jiangsu province, China, on Aug. 28, 2024. Alibaba shares fell on Thursday after the Chinese e-commerce giant missed earnings expectations for its fiscal fourth quarter on both the top and bottom line. Shares were down 4% in premarket trade in the U.S. at 5:51 a.m. ET. Here's how Alibaba did in its fiscal fourth quarter ended March versus LSEG estimates: While falling short of analyst expectations, revenue was nevertheless up 7% year-on-year. Investors will be looking at whether macroeconomic volatility has affected consumer sentiment in China. Washington's trade war with Beijing has created uncertainty in the world's second-largest economy, which has seen huge tariffs slapped on each other from both sides during the latest quarter in which Alibaba reported. Both sides agreed to suspend most tariffs on each other's goods this month. Over the last few months, China has also introduced policies to spur consumption and consumer purchases. In a move to boost purchases on its Tmall and Taobao platforms, Alibaba extended a partnership with Rednote, or Xiaohongshu, an Instagram-like service in China. The deal allows Taobao links to be embedded in Rednote posts, so users can be taken directly to a product shopping page. Investors are also focused on Alibaba's efforts in artificial intelligence, where it has become a leading player domestically and globally. In April, the Hangzhou-headquartered company launched the latest version of its open source large language model, Qwen 3, which is being used to power Alibaba's AI assistant Quark. AI competition in China is red hot and was exacerbated by DeepSeek's innovative model launched earlier this year. Chinese tech giant Tencent meanwhile on Tuesday announced a 91% year-on-year rise in capital expenditures in the first quarter, driven by investments in AI.

[2]

Alibaba shares slide as Q4 revenue miss sparks e-commerce, AI concerns By Investing.com

Investing.com-- Alibaba's Hong Kong shares fell sharply on Friday after the company's quarterly revenue missed expectations, sparking concerns over weak Chinese consumer spending and sluggish AI-linked growth. Alibaba's revenue for the three months to March 31 rose 7% to 236.5 billion yuan ($32.8 billion), missing street estimates of 237.9 billion yuan. Earnings per share also missed expectations. The weaker-than-expected print was driven by underwhelming growth in both the company's core e-commerce and cloud segments. Weakness in e-commerce revenue was due in part to sluggish consumer spending in China, as well as increased competition from other players- chiefly JD.com- as they struggle to grow market share in a weak environment. JD.com (HK:9618) shares fell about 2% in Hong Kong trade on Friday. Revenue from Alibaba's cloud unit also missed expectations, drumming up concerns over the company's AI prospects, as well as those of its Chinese peers. Alibaba is at the forefront of China's AI efforts, and had released a slew of updated models this year as it moved to catch up with DeepSeek. Its cloud services are also widely used in AI development. But disappointing earnings from Alibaba Cloud could indicate that local demand for AI is not as robust as initially thought.

Share

Share

Copy Link

Alibaba's shares drop after missing Q4 earnings expectations, sparking worries about Chinese consumer spending and AI development progress.

Alibaba's Q4 Earnings Disappoint Investors

Alibaba, the Chinese e-commerce giant, faced a setback as its shares dropped 4% in premarket trading following the release of its fiscal fourth-quarter earnings report. The company missed analyst expectations on both revenue and profit, raising concerns about consumer sentiment in China and the progress of its artificial intelligence (AI) initiatives

1

.Financial Performance and Market Reaction

For the quarter ending March 31, Alibaba reported revenue of 236.5 billion yuan ($32.8 billion), representing a 7% year-on-year increase. However, this fell short of the 237.9 billion yuan estimated by analysts. The earnings per share also missed expectations, contributing to the negative market reaction

2

.The disappointing results led to a sharp decline in Alibaba's Hong Kong-listed shares, reflecting investor concerns about the company's performance in key areas.

E-commerce Challenges and Consumer Spending

The underwhelming growth in Alibaba's core e-commerce segment has been attributed to sluggish consumer spending in China and increased competition from rivals like JD.com. The ongoing macroeconomic volatility, exacerbated by trade tensions between the United States and China, has created uncertainty in the world's second-largest economy

1

.To boost purchases on its Tmall and Taobao platforms, Alibaba has extended a partnership with Rednote (Xiaohongshu), an Instagram-like service in China. This collaboration allows Taobao links to be embedded in Rednote posts, potentially driving more traffic to product shopping pages

1

.Related Stories

AI Initiatives and Cloud Services

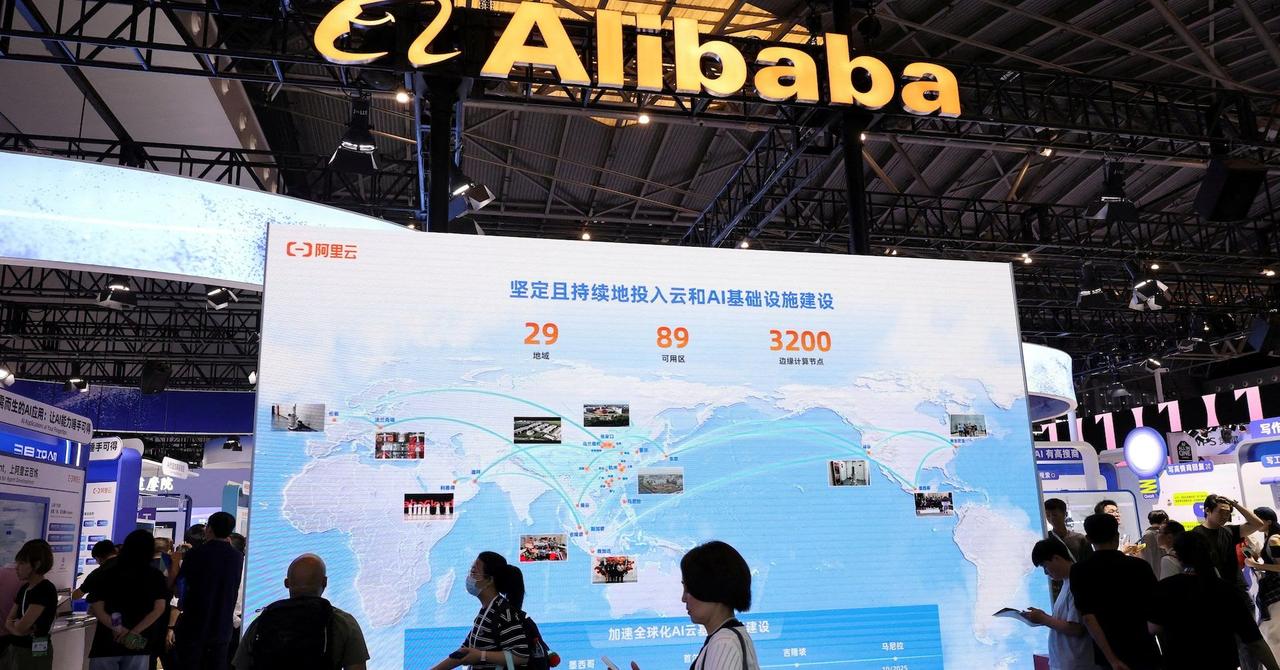

Investors have been closely watching Alibaba's efforts in artificial intelligence, where the company has emerged as a leading player both domestically and globally. In April, Alibaba launched the latest version of its open-source large language model, Qwen 3, which powers its AI assistant Quark

1

.However, the revenue from Alibaba's cloud unit also missed expectations, raising concerns about the company's AI prospects and those of its Chinese peers. The disappointing performance of Alibaba Cloud has led to speculation that local demand for AI may not be as robust as initially thought

2

.Competitive Landscape and Industry Trends

The AI competition in China remains intense, with companies like DeepSeek making significant strides. Chinese tech giant Tencent has also ramped up its investments in AI, reporting a 91% year-on-year increase in capital expenditures for the first quarter

1

.As Alibaba navigates these challenges, the company's performance will be closely monitored for signs of improvement in both its e-commerce and AI initiatives. The broader implications for Chinese consumer spending and the country's AI development efforts remain subjects of keen interest for investors and industry observers alike.

References

Summarized by

Navi

Related Stories

Alibaba's AI Investments Boost Cloud Revenue Amid Overall Revenue Miss

27 Aug 2025•Technology

Alibaba's AI-Driven Cloud Revenue Surge Signals Chinese Tech Giant's Strategic Pivot

18 Nov 2025•Business and Economy

Alibaba's Profit Dips Amid Food Delivery War, but AI Boom Offers Hope

29 Aug 2025•Business and Economy

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy