AMD Challenges Nvidia's AI Dominance with New Chips and Global Strategy

7 Sources

7 Sources

[1]

AMD Under Pressure to Show AI Gains With Stock Beating Nvidia

Advanced Micro Devices Inc. earnings are expected to show the chipmaker is increasingly benefiting from the artificial intelligence arms race. The question is whether it's enough to justify a rally that has outpaced Nvidia Corp.'s performance this year. AMD is the top-performing chipmaker, with shares up 46% in 2025, as companies spend increasing amounts on AI computing gear. Nvidia, which dominates the market for accelerators used to run and develop AI services, has gained 34%. AMD's outperformance of its much larger rival suggests high expectations from semiconductor investors at a time when they've been hard to impress.

[2]

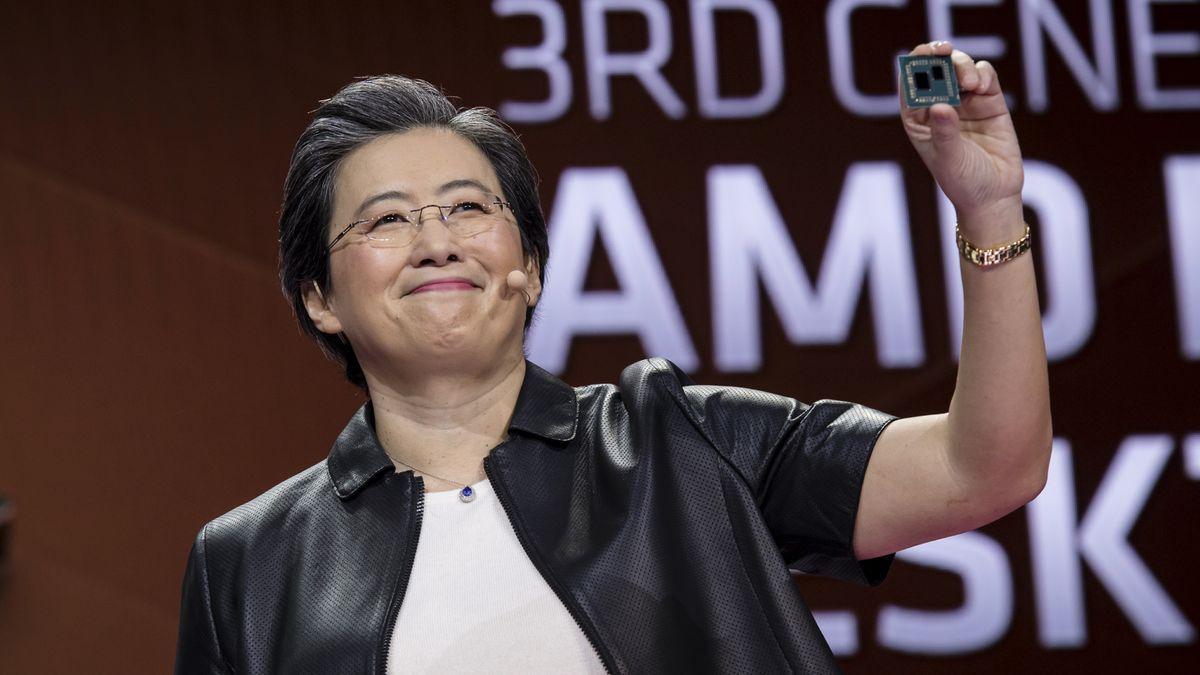

Lisa Su Says AMD's AI Chip MI355 Taking On Nvidia's B200, GB200 Head-On As AI Customers Seek Scalable GPU Alternatives - Meta Platforms (NASDAQ:META), Advanced Micro Devices (NASDAQ:AMD)

On Tuesday, Advanced Micro Devices Inc. AMD CEO Lisa Su said that the company's latest AI chip, the MI355, is ramping up production and gaining traction among customers seeking powerful and scalable alternatives to Nvidia Corporation's NVDA high-end GPUs. Trending Investment OpportunitiesAdvertisementArrivedBuy shares of homes and vacation rentals for as little as $100. Get StartedWiserAdvisorGet matched with a trusted, local financial advisor for free.Get StartedPoint.comTap into your home's equity to consolidate debt or fund a renovation.Get StartedRobinhoodMove your 401k to Robinhood and get a 3% match on deposits.Get StartedMI355 Gains Ground Amid Strong AI Demand During AMD's second-quarter earnings call, Su said that the company began producing its MI355 chips in June and has seen "strong ramp" heading into the third quarter. She said customers are showing growing interest in AMD's data center GPUs, positioning the MI355 as a direct competitor to Nvidia's B200 and GB200 chips. "What we're seeing with MI355 is very competitive versus the B200, GB200 family of products," Su said. "There's a strong desire to really use us at scale." Su noted that AMD's previous AI chip, the MI300, had smaller deployments initially. However, with the MI355, she said, demand is broader -- driven by the chip's performance in inferencing and training workloads, two key pillars of AI development. See Also: July's 20 Most-Searched Tickers On Benzinga Pro -- Where Do Opendoor, Nvidia, Apple Stock Rank? AMD Targets Growth Into Next Quarter And Beyond Su added that the company expects continued revenue growth from its data center GPU business throughout the second half of the year. "We're bullish on MI355 and where the AI opportunity is for us," she said. "And I think we're right on track to what we expected." AMD sees the MI355 as a stepping stone toward its next-generation MI400 series, set to launch in 2026. How AMD Chips Are Faring Compared To Nvidia As Nvidia struggles in the AI chip market due to U.S. export bans and supply shortages, AMD has emerged as a viable challenger -- especially in India and the UAE. Nvidia's H100 chips, priced up to $40,000, remain the go-to for tech giants like Microsoft Corporation MSFT and Meta Platforms, Inc. META. However, AMD's MI300 series offers a more affordable and power-efficient alternative. The MI300X features 192GB of memory -- double that of Nvidia's H100 -- and the MI350X is expected to cost around $25,000. In June, AMD unveiled its Instinct MI355X and MI350X GPUs at ISC 2025, showcasing significant performance gains for AI inference, particularly with support for low-precision formats such as FP4 and FP6. Based on the CDNA 4 architecture, the chips feature 288GB of HBM3E memory with up to 8 TB/s bandwidth, reported Tom's Hardware. The MI355X, designed for liquid cooling, consumes up to 1400W and delivers 20.1 PFLOPS in FP4/FP6 tasks, while the air-cooled MI350X consumes 1000W and hits 18.45 PFLOPS. Both surpass Nvidia's Blackwell B300 on paper but are limited to eight-GPU scaling, which may affect competitiveness. Real-world performance remains to be seen, the report added. Nvidia Rival's Q2 Results Beat Revenue Expectations For the second quarter, AMD reported revenue of $7.69 billion, beating analyst estimates of $7.41 billion. However, adjusted earnings came in at 48 cents per share, narrowly missing expectations of 49 cents. Segment-wise, data center revenue rose 14% year over year to $3.2 billion. Client and gaming revenue surged 69% to $3.6 billion, while embedded revenue declined 4% to $824 million. AMD expects third-quarter revenue of approximately $8.7 billion, plus or minus $300 million, ahead of analyst forecasts of $8.15 billion. Price Action: AMD shares have climbed about 44.50% year-to-date. However, the stock declined 6.34% in after-hours trading, falling to $163.25 at last check, per Benzinga Pro. Benzinga's Edge Stock Rankings indicate that AMD maintains strong upward momentum across short, medium and long-term periods. Additional performance details are available here. Read Next: Apple May See Fewer Searches In Safari, But Google CEO Sundar Pichai Insists AI Is Fueling Overall Query Growth: 'Far From A Zero-Sum Game' Photo Courtesy: jamesonwu1972 On Shutterstock.com Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. AMDAdvanced Micro Devices Inc$163.25-7.65%Stock Score Locked: Edge Members Only Benzinga Rankings give you vital metrics on any stock - anytime. Unlock RankingsEdge RankingsMomentum87.84Growth97.59Quality74.98Value10.84Price TrendShortMediumLongOverviewMETAMeta Platforms Inc$762.76-1.75%MSFTMicrosoft Corp$528.21-1.39%NVDANVIDIA Corp$176.81-1.77%Market News and Data brought to you by Benzinga APIs

[3]

AMD Looks To Usurp Nvidia AI Throne: Here's How - NVIDIA (NASDAQ:NVDA), Advanced Micro Devices (NASDAQ:AMD)

Nvidia Corp's NVDA AI chip empire is built on H100s, which cost up to $40,000. It is the go-to for tech titans like Microsoft Corp MSFT and Meta Platforms Inc META. But with supply shortages and U.S. export bans choking sales to China, startups and sovereign AI dreamers in India and the UAE are increasingly turning to Advanced Micro Devices Inc AMD. AMD's secret sauce lies in its cheaper alternative in the MI300 chips, and its open-source ROCm software. Track AMD's stock trajectory here. Can AMD's open-source ROCm software topple Nvidia's iron grip and spark the next AI revolution? Read Also: AMD Stock Is Rising Ahead Of Earnings This Week: What's Fueling The Momentum? AMD's Budget Chips: More Pack For The Punch AMD's MI300X chip packs 192GB of memory -- twice Nvidia's H100 -- perfect for building massive AI models. Priced at about $25,000 for the upcoming MI350X, it's a steal compared to Nvidia's wallet-busting chips. Indian startups coding AI for farmers or doctors, and UAE's bold Falcon AI project, can stretch their cash further. AMD's chips also save power, a win for data centers in steamy Dubai. While Nvidia's tangled in supply and trade-ban chaos, AMD's U.S.-focused hustle keeps it nimble, opening doors for scrappy innovators. AMD's Open-Source ROCm: The Startup Spark AMD's ROCm software is the real magic, letting coders run AI anywhere, unlike Nvidia's clingy CUDA, which locks you in like a bad date. India's open-source coders and UAE's homegrown AI builders love this freedom. Microsoft is using ROCm with MI300X on Azure, raving about its low cost. Hugging Face runs numerous AI models on it as well. Nvidia's CUDA has more fans, and its chips link faster, but ROCm's open vibe is stealing hearts. AMD's affordable MI300X and ROCm's open-source spark could let startups and sovereigns challenge Nvidia's pricey empire. The gap with Nvidia is still massive, of course. But AMD doesn't need to be a clone -- it just needs to be the alternative. And with export curbs hitting Nvidia's China business, AMD's more measured exposure could be an accidental advantage. The takeaway? AMD might not wear the AI crown -- but it's found the secret sauce to get invited to the royal table. Read Next: Broadcom Supercharges AI Infrastructure With Next-Gen Chip Photo: Shutterstock AMDAdvanced Micro Devices Inc$177.360.33%Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full ScoreEdge RankingsMomentum87.84Growth97.59Quality74.98Value10.84Price TrendShortMediumLongOverviewNVDANVIDIA Corp$179.26-0.41%METAMeta Platforms Inc$780.670.55%MSFTMicrosoft Corp$534.78-0.16%Market News and Data brought to you by Benzinga APIs

[4]

AMD CEO Lisa Su Says China Strategy Rebounding As MI308 AI Chips Await US License: 'Better Position Than We Were Ninety Days Ago' - Advanced Micro Devices (NASDAQ:AMD)

Advanced Micro Devices Inc.'s AMD Lisa Su said the company is making progress with U.S. regulators on AI chip export licenses to China and is preparing for eventual shipments of its MI308 GPUs. Progress With US Regulators On China AI Chip Licenses During AMD's second-quarter earnings call, Su addressed concerns over the company's business in China, stating that AMD has been working closely with the Donald Trump administration to secure licenses for its MI308 AI chips. "We're very pleased with the progress that's been made with the administration over the last couple of months," Su said. "This is a better position than we were 90 days ago." Su added that while AMD has not yet received export licenses for the MI308 chips, several applications are under review by the U.S. Department of Commerce. These licenses are required due to the ongoing U.S. export restrictions on advanced AI hardware to China. See Also: Lisa Su Says AMD's AI Chip MI355 Taking On Nvidia's B200, GB200 Head-On As AI Customers Seek Scalable GPU Alternatives China Remains A Strategic Market Amid Export Restrictions Su said that China continues to be an important market for AMD, despite the geopolitical challenges. She expressed support for the global use of U.S. technology, stating that the company is committed to contributing to that effort. The U.S. government has tightened export controls on AI hardware over concerns about China's military modernization. The MI308, one of AMD's advanced data center chips, falls under those restrictions. MI308 Inventory Largely In Process, Not Finished Goods While awaiting licenses, AMD has been holding inventory related to the MI308, but Su noted that most of it is still in the production phase. "In terms of the supply chain, most of our inventory was not in finished goods. So it was work in process and it'll take us a couple of quarters to run through that," she stated. The timeline for revenue contribution from the MI308 depends on when export approvals are granted. AMD Eyes Rebound In China Strategy As AI Demand Grows Su's comments suggest AMD is positioning itself to re-enter the Chinese AI market as soon as regulations allow. "China is an important market for us. Given the timing of licenses, we have a number of licenses that are under review now." AMD posted second-quarter revenue of $7.69 billion, surpassing the $7.41 billion forecast by analysts. However, its adjusted earnings came in at 48 cents per share, slightly below the expected 49 cents. AMD projects third-quarter revenue to be around $8.7 billion, give or take $300 million. In comparison, analysts are estimating revenue of roughly $8.15 billion. Price Action: AMD shares have risen approximately 44.50% year-to-date. However, as of the latest check on Wednesday, the stock was down 4.37% in pre-market trading, trading at $166.70, according to Benzinga Pro. Benzinga's Edge Stock Rankings show that AMD continues to demonstrate strong upward momentum across short, medium and long-term timeframes. More performance insights are available here. Read Next: July's 20 Most-Searched Tickers On Benzinga Pro -- Where Do Opendoor, Nvidia, Apple Stock Rank? Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Photo courtesy: Shutterstock AMDAdvanced Micro Devices Inc$165.93-4.81%Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full ScoreEdge RankingsMomentum87.84Growth97.59Quality74.98Value10.84Price TrendShortMediumLongOverviewMarket News and Data brought to you by Benzinga APIs

[5]

AMD's Lisa Su Sees Path To 'Tens Of Billions' In AI Revenue, With MI400, Helios, Sovereign Demand Driving Long-Term Growth - Advanced Micro Devices (NASDAQ:AMD)

Chipmaker Advanced Micro Devices Inc. AMD is doubling down on its AI ambitions, with CEO Lisa Su highlighting multiple tailwinds supporting the company's long-term vision and seeing a clear path to scaling the segment to "tens of billions of dollars in annual revenue." Check out the current price of AMD stock here. Highest Performance AI System In The World During the company's second-quarter earnings call on Tuesday, Su outlined the chipmaker's roadmap to transform itself into a full-stack AI infrastructure player. Central to that vision are the company's upcoming MI400 series GPUs and its new Helios rack-scale system, which she described as purpose-built for the "most demanding AI workloads." See Also: Under AMD, Qualcomm Competitive Heat, Intel Gets Hit With Fitch Credit Downgrade "These are the most advanced GPUs we have ever built with up to 40 petaflops of FP4 AI performance and 50% more memory, memory bandwidth and scale out throughput than the competition," she says, adding that Helios will "deliver up to a 10x generational performance increase" and could become "the highest performance AI system in the world." Sovereign AI Opportunity According to Su, the long-term opportunity lies in sovereign AI infrastructure. She says, "We announced a multibillion-dollar collaboration with Humain," which is a Saudi state-backed artificial company. As part of the deal, Humain's infrastructure will be powered entirely with AMD's stack, including CPUs, GPUs and software. Su further notes that her company has "more than 40 active engagements globally" with governments. She emphasized the role of AMD's open ecosystem for its growing traction among global governments. "What's attractive about our offering is our open ecosystem. And I think that really resonates with the sovereign community," she says. AMD Beats Sales Estimates, Misses On Earnings The company released its second-quarter results on Tuesday, reporting $7.69 billion in sales, ahead of consensus estimates at $7.41 billion, according to Benzinga Pro. Earnings came in at $0.48 per share, marginally missing analyst estimates at $0.49 per share. Shares of AMD were down 1.40% on Tuesday, closing at $174.31, and are down 6.34% after hours, following the company's earnings announcement. The stock does well in Benzinga's Edge Stock Rankings, scoring high on Momentum, Growth and Value. It also has a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock. Read More: Cathie Wood Drops $8.3 Million On AMD And Nvidia In Monday Trading Blitz, Sells Robinhood Stock Amid 'Project Crypto' Buzz Photo Courtesy: jamesonwu1972 On Shutterstock.com AMDAdvanced Micro Devices Inc$166.95-4.22%Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full ScoreEdge RankingsMomentum87.84Growth97.59Quality74.98Value10.84Price TrendShortMediumLongOverviewMarket News and Data brought to you by Benzinga APIs

[6]

AMD CEO Says China AI GPU Licenses Not Granted Yet & Defends Strong Data Center Growth

This is not investment advice. The author has no position in any of the stocks mentioned. Wccftech.com has a disclosure and ethics policy. AMD CEO Lisa Su asserted in an interview with CNBC earlier today that her firm is in a strong position heading into the year's second half. AMD's second quarter earnings report, released yesterday, sent the shares down by 5% in premarket trading today as the firm posted a GAAP operating loss and disappointed investors with its data center division. However, Su believes that the data center division is performing well and AMD is looking at good forecasts from its customers. AMD CEO Points At Importance Of Global Semiconductor Supply Chain While Discussing US Manufacturing Push Su believes that AMD is "coming off a very strong first half" and a "very strong first quarter" with a guide indicating a "very strong second half" as well. AMD suffered from an operating income drop in the second quarter due to US sanctions on its GPU sales to China. Commenting on the restrictions, Su highlighted that her firm was working closely with the Trump administration regarding its AI chip proliferation. She added that while the license approvals are being processed, they have not yet been granted. The AMD CEO is excited about the year's second half as she expects 28% growth in the coming quarter with 13% sequential growth. Shifting gears to AI, Su outlined that her firm is in the midst "of a tremendous AI opportunity." According to the CEO, AMD's AI revenue opportunity continues to be tens of billions of dollars. As for the data center business, Su shared that "I would say that our DC business is doing extremely well," and added that not only is her firm a key player in the high-performance computing industry, but it is also "seeing good forward-looking forecasts from our customers." "I think the data center business is the main driver of our growth," said Su, with AMD's goals aiming to become "the computing foundation for the largest hyperscalers" and benefiting from AI companies investing significantly in compute. The conversation then shifted to US domestic chip production and how much money AMD would have to lose or spend in order to source its chips domestically. On this front, while Su noted that AMD's"very supportive of manufacturing in the US" and that "it's good for" the firm "to have resiliency," she added that the chip supply chain is a global supply chain which requires time to diversify away from as AMD needs to access all of it in the short term. She also noted that AMD is "actively moving some of chips to US in Arizona." Circling back to the data center business, Su asserted that AMD is gaining significant share in the industry as evidenced by its 33 quarters of consecutive year-over-year growth in the server market. Customers want "reliable, high-performance, cost-effective chips," she added.

[7]

Is AMD the Next Major Threat to NVIDIA's Long-Standing AI Dominance? A Deep Dive into How the Firm's Recent Strategies Might Put It in a Much More Competitive Position

Well, NVIDIA has dominated the AI markets since the boom back in 2022, and while the company has managed to get past competition pretty easily, it won't be wrong to say that AMD is significantly ramping up its AI lineup, under the leadership of CEO Lisa Su. And, by the looks of it, the competition is going to get a lot tougher for Jensen moving ahead. If someone still doesn't know why NVIDIA managed to front-run AI, well, Team Green was one of the first to introduce market-ready solutions for AI chips, while competitors like AMD and Intel were still stuck with CPUs and GPUs. Following the advent of ChatGPT, AMD realized that AI was turning out to be massive, which is why, back in 2023, CEO Lisa Su announced that the company would shift towards AI completely. But by then, NVIDIA had already flooded the market with its Ampere and Hopper solutions, along with a robust software ecosystem, so for AMD, they were entering a one-sided market. Back in 2023, pivoting away from NVIDIA wasn't an easy job, since Big Tech had contracts with Team Green, which basically made it necessary for them to rely on the firm's AI chips, instead of opting for alternatives. Moreover, with a "proprietary" ecosystem created by NVIDIA's CUDA and other services, customers couldn't opt for the likes of AMD, and under Jensen, a market was created that couldn't rely on anyone else. Well, this led to Team Red facing difficulties with customer adoption, despite announcing solutions like the Instinct MI300X AI accelerators. AMD's first major AI solution was the Instinct MI300 series, which was claimed to rival NVIDIA's popular H100. It featured twice as memory as NVIDIA's counterpart, on-par memory bandwidth, and more importantly, the CDNA 3 architecture, which promises massive performance gains. Internal results did show that the MI300X poses a viable threat to NVIDIA, especially in inferencing applications, but the key problem here wasn't beating a single entity; it was basically AMD vs a whole ecosystem. NVIDIA's ecosystem lock-in currently holds back AMD from becoming as mainstream as Team Green. NVIDIA has tight control over developer tools and AI frameworks, positioning the firm as the 'default place' for your AI needs, while AMD emerged as a challenger brand. Since building up AI infrastructure isn't only about acquiring millions of AI chips, it requires adoption into a whole system, or what we call, into Jensen's arena. For Big Tech, switching to AMD was a more expensive venture relative to using NVIDIA's chips, despite Team Red offering higher capabilities. While many might not agree, investor/media hype often drives company decisions, and in this case, NVIDIA saw a really sweet spot. Big Tech mentioned NVIDIA's equipment in their respective PR statements, which not only boosted investor confidence but also gave companies a massive edge since NVIDIA's chips were seen as the go-to solution. So, in a scenario, if a company like OpenAI or Microsoft announced buying AMD's equipment, the usual retailer would perceive it as a sub-par development, so Team Red did have an image issue as well. In this case, AMD was left with few choices: either ramp up its solutions or abandon the race entirely, just like Intel did. But Lisa Su chose to keep on competing, which is why AMD is arriving at a position where it is seen on par with NVIDIA in computing solutions. With that, Big Tech is responding accordingly since they need to follow the hype train to keepup with the giant CapEX. Well, AMD started from ground zero at a point when NVIDIA reached trillions in valuation. After introducing capable products, the company began pitching them to Big Tech by offering competitive prices, higher availability, and robust ecosystems. AMD's Instinct MI300 series is known to be generally 20%-30% cheaper than NVIDIA's counterparts, and offering a much better price-to-performance ratio, which is why firms like Microsoft and OpenAI are known to have employed Team Red's tech stack. But Big Tech's investments in AMD aren't up to par with the spotlight NVIDIA sees, and that's probably expected, considering that for now, AMD has a lot to do to compete with its arch-rival. If you ask me how this post came into thought, it was probably after AMD's 'Advancing AI' event, since when Lisa Su took up the stage, the developments she announced weren't ordinary at all, especially when you stack them up in 'computing terms'. The more optimistic announcements are the next-gen Instinct MI400 series, which is set to offer cutting-edge HBM4 technology and 50% higher memory compared to existing solutions. There's a lot to what MI400 will offer, but for a quick summary, it will give Rubin a hard time competing in the market. More importantly, AMD has diverted its attention towards rack-scale solutions, as the firm will introduce its top-end 'Helios' AI server rack as well, which will feature EPYC Venice CPUs onboard, and is claimed to rival against Rubin NVL144 offerings. I dove into next-gen announcements because they show that on the computing side, AMD is ready with its weapons to combat NVIDIA. But when it comes to cracking into a monopolized market, superior performance won't do much alone. The market needs to ensure that AMD is ready to offer an ecosystem that rivals NVIDIA entirely, from hardware to software. However, another general perception that needs to be ruled out is that AMD doesn't need to replace Team Green entirely, but rather co-exist, similar to what it does with consumer GPUs. AMD is set to report Q2 earnings tomorrow, and that would likely tell us where the company is heading in the future. Analysts expect an increase in YoY revenue, driven by adoption from OpenAI and others, along with demand across multiple segments. In the AI space alone, AMD is expected to show positivity, but when it comes to competing with NVIDIA, you want to be at your absolute best.

Share

Share

Copy Link

AMD is making significant strides in the AI chip market, challenging Nvidia's dominance with new products and strategies. The company's CEO, Lisa Su, outlines AMD's roadmap to become a full-stack AI infrastructure player.

AMD's AI Chip Advancements

Advanced Micro Devices (AMD) is making significant strides in the artificial intelligence (AI) chip market, challenging Nvidia's long-standing dominance. AMD's latest AI chip, the MI355, is gaining traction among customers seeking powerful and scalable alternatives to Nvidia's high-end GPUs

2

. CEO Lisa Su reported that production of the MI355 chips began in June, with a "strong ramp" heading into the third quarter2

.

Source: Benzinga

The MI355X, designed for liquid cooling, consumes up to 1400W and delivers 20.1 PFLOPS in FP4/FP6 tasks, while the air-cooled MI350X consumes 1000W and hits 18.45 PFLOPS

2

. Both chips feature 288GB of HBM3E memory with up to 8 TB/s bandwidth, surpassing Nvidia's Blackwell B300 on paper2

.Competitive Pricing and Performance

AMD's strategy involves offering more affordable alternatives to Nvidia's expensive chips. The MI300X chip, for instance, packs 192GB of memory - twice that of Nvidia's H100 - and is priced at about $25,000 for the upcoming MI350X, significantly less than Nvidia's chips that can cost up to $40,000

3

. This pricing strategy makes AMD's chips attractive to startups and sovereign AI projects in countries like India and the UAE3

.Open-Source Software Advantage

A key differentiator for AMD is its open-source ROCm software, which allows developers to run AI anywhere, unlike Nvidia's proprietary CUDA software

3

. This open approach has garnered interest from companies like Microsoft, which is using ROCm with MI300X on Azure, and Hugging Face, which runs numerous AI models on it3

.Global Strategy and Regulatory Challenges

AMD is making progress with U.S. regulators on AI chip export licenses to China. While awaiting approvals for its MI308 chips, the company is preparing for eventual shipments

4

. Su stated that AMD is in a "better position than we were 90 days ago" regarding regulatory progress4

.Related Stories

Future Outlook and Revenue Projections

Source: Wccftech

AMD is setting ambitious goals for its AI business. Su outlined the company's roadmap to become a full-stack AI infrastructure player, with the upcoming MI400 series GPUs and new Helios rack-scale system at the center of this vision

5

. The MI400 series is described as "the most advanced GPUs we have ever built," with up to 40 petaflops of FP4 AI performance5

.The company sees a clear path to scaling its AI segment to "tens of billions of dollars in annual revenue"

5

. A significant part of this growth is expected to come from sovereign AI infrastructure, with AMD announcing a multibillion-dollar collaboration with Humain, a Saudi state-backed artificial intelligence company5

.Financial Performance

Source: Benzinga

For the second quarter, AMD reported revenue of $7.69 billion, beating analyst estimates of $7.41 billion

2

. The company expects third-quarter revenue of approximately $8.7 billion, ahead of analyst forecasts of $8.15 billion2

. Despite these positive results, AMD's stock experienced some volatility, declining 6.34% in after-hours trading following the earnings announcement5

.As AMD continues to challenge Nvidia's dominance in the AI chip market, the company's focus on affordable, high-performance chips and open-source software appears to be gaining traction among a diverse range of customers, from startups to sovereign AI projects. The coming quarters will be crucial in determining whether AMD can significantly disrupt Nvidia's market leadership and achieve its ambitious AI revenue goals.

References

Summarized by

Navi

[3]

Related Stories

AMD Unveils Next-Generation AI Chips and Roadmap, Challenging Nvidia's Dominance

13 Jun 2025•Technology

AMD Reports Record Q3 Revenue of $9.25 Billion Driven by AI Chip Demand, But Faces Growing Competition

04 Nov 2025•Business and Economy

AMD's Q2 Earnings: AI Chip Sector Gains and Data Center Growth Boost Optimism

31 Jul 2024

Recent Highlights

1

ByteDance Faces Hollywood Backlash After Seedance 2.0 Creates Unauthorized Celebrity Deepfakes

Technology

2

Microsoft AI chief predicts artificial intelligence will automate most white-collar jobs in 18 months

Business and Economy

3

Google reports state-sponsored hackers exploit Gemini AI across all stages of cyberattacks

Technology