AMD's AI Advancements and Market Position: Analysts Maintain Positive Outlook

8 Sources

8 Sources

[1]

Oppenheimer maintains perform rating on AMD shares By Investing.com

Oppenheimer maintained its Perform rating on shares of AMD (NASDAQ:AMD), ahead of the company's expected earnings announcement the week of October 28. The firm adjusted its fourth quarter sales estimate for AMD from $7.7 billion to $7.5 billion, citing more conservative expectations for the PC and gaming sectors. This revision comes despite AMD's recent artificial intelligence (AI) event, which offered limited new information beyond the established roadmap for the MI family of products. AMD's AI event last week highlighted the scheduled release of the MI325 chip in the fourth quarter of 2024, the MI350 in the second half of 2025, and the MI400 in 2026. The management's efforts have significantly expanded AMD's AI business, growing it to approximately $4 billion in just the past year. Despite the growth in the AI segment, Oppenheimer believes that the sales targets for the MI3XX family, which are around $10 billion for the year 2025, might be overly ambitious. The firm anticipates stable PC sales, a return to growth in embedded systems, and a greater than 25% increase in server CPU sales by the calendar year 2025. Nevertheless, Oppenheimer remains cautious, citing persistently high expectations for AMD's data center AI performance as the reason for its neutral stance on the stock. Advanced Micro Devices (NASDAQ:AMD) has launched the Alveo UL3422 accelerator card, designed to provide ultra-low latency trade execution for high-frequency trading applications. The company's Q2 revenues surpassed Street consensus, reaching $5.835 billion, with record revenue growth of 115% in its data center segment. Analyst firms such as Barclays (LON:BARC), KeyBanc Capital Markets, and TD Cowen have maintained positive ratings on AMD shares, citing the company's recent AI advancements and new product launches. Additionally, AMD has announced a strategic collaboration with Oracle (NYSE:ORCL) Cloud Infrastructure, strengthening its footprint in the cloud computing sector. To complement Oppenheimer's analysis, InvestingPro data offers additional insights into AMD's financial position. Despite the cautious outlook on PC and gaming sectors, AMD's revenue growth remains positive, with a 6.4% increase over the last twelve months as of Q2 2024. The company's gross profit margin stands at a healthy 51.42%, indicating strong pricing power in its product lines. InvestingPro Tips highlight that AMD is a "Prominent player in the Semiconductors & Semiconductor Equipment industry" and has shown a "High return over the last year," with a one-year price total return of 57.27%. This aligns with the company's growing presence in the AI market, as mentioned in the article. However, investors should note that AMD is "Trading at a high earnings multiple," with a P/E ratio of 197.49. This high valuation suggests that market expectations for AMD's future performance, particularly in the AI segment, are indeed elevated, supporting Oppenheimer's cautious stance. For readers seeking a more comprehensive analysis, InvestingPro offers 14 additional tips for AMD, providing a deeper understanding of the company's financial health and market position.

[2]

Barclays maintains AMD Overweight rating from Barclays By Investing.com

Barclays (LON:BARC) reiterated its Overweight rating on shares of Advanced Micro Devices (NASDAQ:AMD) with a price target of $180.00. The firm's analysis followed an event where AMD provided updates on its artificial intelligence (AI) business and product roadmap. Although the event raised the forecast for the AI total addressable market (TAM) to $500 billion by 2028, Barclays noted that AMD did not announce a new major customer, only providing a clearer view of the upcoming generations of AI GPUs. AMD's event was anticipated to reveal a heightened AI revenue forecast for the full year, a significant new customer partnership, and new product launches. However, the outcome centered around the AI GPU roadmap and an updated AI TAM projection, without further details on system and interconnect roadmaps. Barclays emphasized the importance of these details in influencing the stock's future performance. The analysis by Barclays pointed out that while AMD's custom silicon projects are progressing, there is competition from developments in NVIDIA (NASDAQ:NVDA)'s rack scale design. This competition is seen as a potential challenge to AMD's position in the GPU market. The firm suggested that more specific information on AMD's system architecture and interconnect strategies would be necessary for the stock to advance beyond its current standing. Despite the lack of certain anticipated announcements at the event, Barclays' stance on AMD remains positive with an unchanged price target of $180.00. The firm's outlook suggests confidence in AMD's long-term strategy and market position, especially within the AI sector, which is projected to grow significantly in the coming years. Barclays' commentary reflects a cautious yet optimistic view of AMD's potential in the evolving AI and GPU landscape. The firm is looking for AMD to provide more comprehensive updates on its system and connectivity solutions to fully assess the company's trajectory in a competitive market. Advanced Micro Devices (AMD) continues to make significant strides in the artificial intelligence (AI) and high-performance computing sector. The company's Q2 revenues surpassed Street consensus, reaching $5.835 billion, with its data center segment showing record revenue growth of 115% to $2.8 billion. KeyBanc Capital Markets and TD Cowen have maintained their positive ratings on AMD shares, citing the company's recent AI advancements and the unveiling of its new server CPU, Turin. AMD's strategic collaboration with Oracle (NYSE:ORCL) Cloud Infrastructure, powering its new AI supercluster with AMD's Instinct MI300X accelerators, underscores the company's expanding presence in the cloud computing sector. Piper Sandler, Northland, and Cantor Fitzgerald also reaffirmed their confidence in AMD's strategic initiatives and market position, with price targets ranging from $156 to $210. To complement Barclays' analysis of AMD's position in the AI market, InvestingPro data offers additional financial context. AMD's market capitalization stands at $267.36 billion, reflecting its significant presence in the semiconductor industry. The company's revenue for the last twelve months as of Q2 2024 reached $23.28 billion, with a notable revenue growth of 6.4% over the same period. InvestingPro Tips highlight AMD's strong market performance, with a high return over the last year and decade. This aligns with Barclays' Overweight rating and the overall positive outlook on AMD's potential in the AI sector. However, it's worth noting that AMD is trading at a high earnings multiple, with a P/E ratio of 195.64, which investors should consider in light of the company's growth prospects in the AI market. Another relevant InvestingPro Tip indicates that AMD operates with a moderate level of debt, which could provide financial flexibility as the company pursues its AI strategy and product development. This financial stability may be crucial as AMD competes in the rapidly evolving AI GPU market. For investors seeking a more comprehensive analysis, InvestingPro offers 14 additional tips for AMD, providing a deeper understanding of the company's financial health and market position.

[3]

AMD maintains buy rating with steady target amid AI advancements By Investing.com

An analyst from TD Cowen maintained a Buy rating for AMD (NASDAQ:AMD), with a price target set at $210. The decision follows AMD's recent Advancing AI Event, where the company showcased its expanding AI roadmap and generational improvements across its CPU, GPU, and DPU offerings. The analyst highlighted that while the event did not feature a new data center GPU customer or specific revenue targets, which may have led to some investor disappointment, this should not overshadow AMD's consistent performance enhancements. These strides are helping AMD to solidify its position as a key competitor to NVIDIA (NASDAQ:NVDA) in the artificial intelligence total addressable market (AI TAM). AMD's event detailed the company's progress and future plans in AI technology, emphasizing continuous improvements. The company's focus on advancing its product lineup across multiple processing platforms is part of its strategy to compete in the high-growth AI sector. Despite the absence of certain announcements that investors might have anticipated, the analyst emphasized the importance of AMD's steady execution in its product development. This methodical approach is seen as a fundamental strength for AMD as it challenges NVIDIA's dominance in the AI space. The reaffirmed $210 price target suggests confidence in AMD's growth trajectory and potential to gain market share in the AI industry. The company's ongoing commitment to innovation and performance upgrades plays a crucial role in its competitive strategy. Advanced Micro Devices (NASDAQ:AMD) continues to make significant strides in the artificial intelligence (AI) and high-performance computing sector. The company's Q2 revenues surpassed Street consensus, reaching $5.835 billion, with its data center segment showing record revenue growth of 115% to $2.8 billion. AMD recently launched its 5th Gen AMD EPYC server CPUs, AMD Instinct MI325X accelerators, and third-generation Ryzen AI PRO 300 Series mobile processors, all aimed at boosting AI performance. Analysts from Piper Sandler, Northland, Cantor Fitzgerald, Stifel, and Roth/MKM have expressed confidence in AMD's strategic initiatives and market position, with price targets ranging from $156 to $200. The company's recent AI event highlighted its market share momentum and advancements, including the launch of the MI325 GPU and the Turin CPU. AMD's strategic collaboration with Oracle (NYSE:ORCL) Cloud Infrastructure, powering its new AI supercluster with AMD's Instinct MI300X accelerators, further underscores the company's expanding presence in the cloud computing sector. Additionally, AMD unveiled networking components, the AMD Pensando Salina DPU and Pollara 400 NIC (NASDAQ:EGOV), expected to be available in the first half of 2025. These components aim to optimize front-end network clusters and enhance back-end network performance. To complement the analyst's perspective on AMD's position in the AI market, recent data from InvestingPro provides additional context for investors. AMD's market capitalization stands at an impressive $265.72 billion, reflecting its significant presence in the semiconductor industry. The company's revenue for the last twelve months as of Q2 2024 reached $23.28 billion, with a notable revenue growth of 8.88% in the most recent quarter. InvestingPro Tips highlight AMD's strong market performance, with the stock showing a high return of 51.58% over the past year. This aligns with the analyst's bullish stance and the $210 price target. Additionally, AMD is recognized as a prominent player in the Semiconductors & Semiconductor Equipment industry, further supporting its potential in the competitive AI space. It's worth noting that AMD is trading at a high earnings multiple, with a P/E ratio of 195.92. This valuation suggests that investors have high growth expectations for the company, possibly due to its expanding AI roadmap and potential market share gains against competitors like NVIDIA. For investors seeking a more comprehensive analysis, InvestingPro offers 14 additional tips for AMD, providing a deeper understanding of the company's financial health and market position.

[4]

AMD maintains Outperform rating from Northland amid AI growth By Investing.com

Northland has reiterated an Outperform rating and a $175.00 price target on shares of AMD (NASDAQ: AMD), following the company's AI event. AMD showcased its market share momentum in the server CPU market and its developments in the opensource ecosystem. The company also shared its roadmap for AI accelerators, reinforcing Northland's view of AMD's growing presence in cloud and enterprise data centers. AMD's AI event highlighted its expectations for the AI market, projecting growth from $45 billion in calendar year 2023 to $500 billion by calendar year 2028. Although Northland considers this estimate to be on the higher side, they anticipate the AI accelerator market could reach between $350 billion and $400 billion by 2028. AMD's market share in AI accelerators has increased from less than 0.1% in 2023 to 5% in 2024. The company's performance, improvements in its software stack, product roadmap, and customer partnerships contribute to Northland's forecast that AMD could capture over 20% of the AI accelerator market by 2028. This would translate to AI accelerator revenues of $70 billion to $80 billion. If AMD's other business segments remain constant, total revenue in 2028 could be between $91 billion and $101 billion, indicating a compound annual growth rate (CAGR) of approximately 39%. Northland's analysis suggests that if AMD achieves a midpoint revenue of $96 billion in 2028 with a 60% gross margin and operating expenses (OPEX) growing at half the rate of revenue, the company could earn roughly $24 per share. This projection underscores the firm's confidence in AMD's growth trajectory in the AI sector over the next several years. In other recent news, Advanced Micro Devices (NASDAQ:AMD) continues to make significant strides in the artificial intelligence (AI) and high-performance computing sector. AMD's Q2 revenues surpassed Street consensus, reaching $5.835 billion, with its data center segment showing record revenue growth of 115% to $2.8 billion. The company recently launched its 5th Gen AMD EPYC server CPUs, AMD Instinct MI325X accelerators, and third-generation Ryzen AI PRO 300 Series mobile processors, all aimed at boosting AI performance. Cantor Fitzgerald, Stifel, Roth/MKM, Truist Securities, and Citi reiterated their respective Overweight, Buy, Buy, Hold, and Buy ratings on AMD, reflecting confidence in the company's strategic initiatives and market position. These firms' analyses suggest that AMD is well-positioned to capitalize on the growing AI market and leverage its product strengths. AMD's strategic collaboration with Oracle (NYSE:ORCL) Cloud Infrastructure, powering its new AI supercluster with AMD's Instinct MI300X accelerators, further highlights the company's expanding presence in the cloud computing sector. In addition, AMD has unveiled networking components, the AMD Pensando Salina DPU and Pollara 400 NIC (NASDAQ:EGOV), expected to be available in the first half of 2025. Recent data from InvestingPro adds depth to Northland's optimistic outlook on AMD. The company's market capitalization stands at an impressive $265.72 billion, reflecting investor confidence in its growth potential. AMD's revenue for the last twelve months as of Q2 2024 reached $23.28 billion, with a notable revenue growth of 8.88% in Q2 2024 alone. This aligns with Northland's projections of AMD's expanding market presence. InvestingPro Tips highlight AMD's strong position in the semiconductor industry. The company is expected to see net income growth this year, and analysts predict profitability for the current fiscal year. These factors support Northland's positive stance on AMD's future earnings potential in the AI accelerator market. It's worth noting that AMD's stock has shown a high return over the last year, with a 51.58% price total return. This performance underscores the market's recognition of AMD's strategic moves in the AI space, as discussed in the article. For investors seeking a more comprehensive analysis, InvestingPro offers 14 additional tips for AMD, providing a deeper understanding of the company's financial health and market position.

[5]

Stifel maintains Buy rating on AMD shares post-AI event By Investing.com

Stifel has reiterated a Buy rating and a $200.00 price target for Advanced Micro Devices, Inc. (NASDAQ: NASDAQ:AMD), following the company's recent Advancing AI event. During the event held on Thursday, AMD unveiled its 5th generation EPYC processors, the MI325X accelerator family, and new networking solutions, including the Pensando Salina DPU family and Pollara 400 network interface cards. AMD's Advancing AI event, which featured the formal launch of these products, also highlighted collaborations with top-tier cloud service providers (CSPs) and server original equipment manufacturers (OEMs). These partnerships are aimed at discussing deployment plans and potential use cases for AMD's technologies. Key insights from the event included AMD's progress with its ROCm open software stack and an increased focus on networking and system-level offerings. These developments are seen as essential for AMD to expand its market share in the core artificial intelligence (AI) accelerator market, which is projected to grow to $500 billion by 2028. In other recent news, Advanced Micro Devices (AMD) continues to make significant strides in the artificial intelligence (AI) and high-performance computing sector. AMD's Q2 revenues exceeded Street consensus, reaching $5.835 billion, with its data center segment showing a record revenue growth of 115% to $2.8 billion. The company recently launched its 5th Gen AMD EPYC server CPUs, AMD Instinct MI325X accelerators, and third-generation Ryzen AI PRO 300 Series mobile processors, all aimed at boosting AI performance. AMD's strategic collaboration with Oracle (NYSE:ORCL) Cloud Infrastructure, powering its new AI supercluster with AMD's Instinct MI300X accelerators, further highlights the company's expanding presence in the cloud computing sector. Analysts from Roth/MKM, Truist Securities, Citi, and Wells Fargo (NYSE:WFC) maintained their respective Buy, Hold, Buy, and Overweight ratings on AMD, reflecting confidence in the company's strategic initiatives and market position. AMD's recent Advancing AI event aligns well with the company's strong market position and financial performance. According to InvestingPro data, AMD boasts a substantial market capitalization of $265.72 billion, reflecting its significant presence in the semiconductor industry. The company's revenue for the last twelve months stands at $23.28 billion, with a notable revenue growth of 6.4% over the same period. InvestingPro Tips highlight AMD as a "Prominent player in the Semiconductors & Semiconductor Equipment industry," which is consistent with its strategic focus on AI and high-performance computing. The company's high return over the last year, with a 1-year price total return of 51.58%, suggests investor confidence in AMD's growth trajectory and technological advancements. Another relevant InvestingPro Tip indicates that "Net income is expected to grow this year," which could be partly attributed to AMD's expanding AI product portfolio and partnerships with major cloud service providers and OEMs. This positive outlook is further supported by analysts' predictions that the company will be profitable this year. For investors seeking more comprehensive insights, InvestingPro offers 14 additional tips for AMD, providing a deeper understanding of the company's financial health and market position.

[6]

AMD maintains Buy rating from Roth/MKM on rising AI infrastructure demand By Investing.com

Roth/MKM has maintained a Buy rating on AMD (NASDAQ: AMD) with a steadfast $200.00 price target. The endorsement follows AMD's presentation at the Advancing AI event, where the company outlined its position in the rapidly growing AI infrastructure sector. AMD highlighted a surge in AI accelerator demand, now projected to reach a $500 billion addressable market by the calendar year 2028, marking a compound annual growth rate (CAGR) of 60%. This forecast is an increase from the previous estimate of a $400 billion market by 2027 with a CAGR of 50-70%. AMD reported a record 34% market share in cloud x86 processors for the third quarter of 2024, signaling robust gains with hyperscale providers and consistent traction in the enterprise market. The company's growth is attributed to its competitive product offerings in the cloud server segment, particularly the AMD Turin processor. According to AMD, this processor, along with AI efficiency improvements, could enable a new server to replace up to seven older servers. The firm anticipates that the need for advanced cloud servers will be further propelled by an upcoming server upgrade cycle. The cycle is expected to be driven by the AMD Turin processor's performance and its ability to facilitate AI efficiency gains. AMD's products are also seen as a go-to solution for hyperscalers that are preparing to meet the more demanding infrastructure needs of emergent agentic AI applications. These applications are likely to follow the recent installations based on generative AI technologies. In other recent news, Advanced Micro Devices (NASDAQ:AMD) has made significant strides in the realm of artificial intelligence (AI) and high-performance computing. AMD's Q2 revenues surpassed Street consensus, reaching $5.835 billion, with its data center segment showing record revenue growth of 115% to $2.8 billion. The company recently launched its 5th Gen AMD EPYC server CPUs, AMD Instinct MI325X accelerators, and third-generation Ryzen AI PRO 300 Series mobile processors, all aimed at boosting AI performance. Truist Securities maintained its Hold rating on AMD, setting a price target of $156, while Citi and Wells Fargo (NYSE:WFC) maintained their Buy and Overweight ratings respectively. AMD's strong position in the AI infrastructure sector, as highlighted in the article, is reflected in several key metrics from InvestingPro. The company's market capitalization stands at an impressive $265.72 billion, underscoring its significant presence in the semiconductor industry. AMD's revenue growth of 6.4% over the last twelve months and 8.88% in the most recent quarter aligns with the company's reported market share gains and increasing demand for AI accelerators. InvestingPro Tips further support AMD's growth narrative. One tip notes that AMD is a "Prominent player in the Semiconductors & Semiconductor Equipment industry," which is consistent with its leading position in cloud x86 processors. Another tip indicates that "Net income is expected to grow this year," suggesting continued financial strength as AMD capitalizes on the expanding AI infrastructure market. It's worth noting that AMD is trading at a high P/E ratio of 195.92, which may reflect investor optimism about the company's future growth prospects in the AI sector. For investors seeking a more comprehensive analysis, InvestingPro offers 14 additional tips on AMD, providing a deeper understanding of the company's financial health and market position.

[7]

Here is what analysts had to say after AMD's AI event By Investing.com

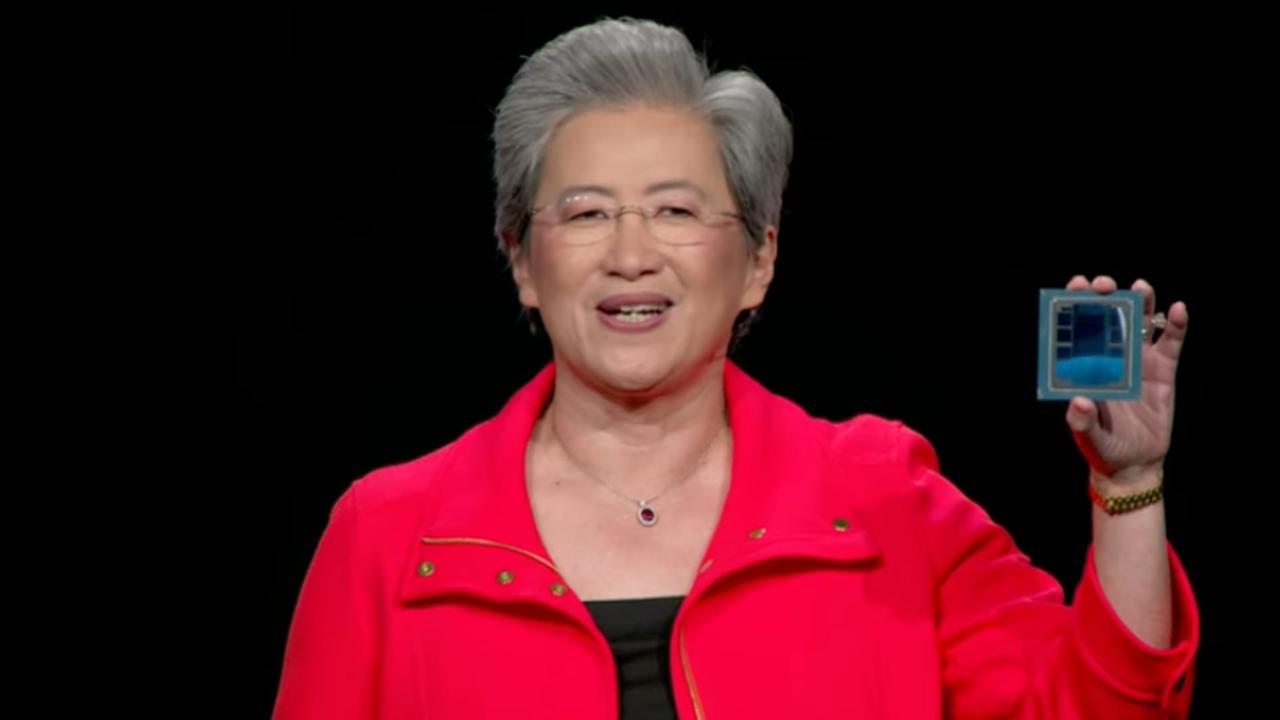

Investing.com -- AMD (NASDAQ:AMD) announced on Thursday that it will begin mass production of its new MI325X AI chip in Q4, as it looks to expand its footprint in a market dominated by Nvidia (NASDAQ:NVDA). At an event in San Francisco, CEO Lisa Su said AMD's next-generation MI350 chips will launch in the second half of 2025, offering more memory and a new architecture designed to significantly boost performance compared to the MI300X and MI250X models. Despite the announcements aligning with previous disclosures, AMD shares dropped 4% as investors reacted to the lack of major cloud-computing customers. Meanwhile, Nvidia shares rose 1.6%, and Intel (NASDAQ:INTC) fell 1%. AMD confirmed that vendors, including Super Micro Computer (NASDAQ:SMCI), will start shipping the MI325X AI chip in early 2025. The chip uses the same architecture as the MI300X but introduces a new memory type to accelerate AI computations. The Santa Clara, California-based chipmaker aims to challenge Nvidia's Blackwell architecture with the MI325X. In addition to the AI chips, AMD revealed new networking chips for data centers and three new laptop processors based on the Zen 5 architecture, optimized for AI tasks. The laptop chips will support Microsoft's Copilot+ software. Su also stated that AMD will continue to rely on Taiwan's TSMC for advanced chip manufacturing. Bernstein: "The stock sold off during and following the event in a typical sell-the-news response, perhaps understandable given some modest excitement into the day, lack of huge surprises, and MI325X performance specs that we believe were likely somewhat disappointing relative to NVIDIA's impending Blackwell launch. While we don't want to minimize things we didn't really hear anything to suggest we should anticipate substantial upside to current expectations, and would rather own NVDA at this point in front of Blackwell." Deutsche Bank (ETR:DBKGn): "We view the event as a successful continuation of AMD's impressive execution in delivering high-quality Data Center innovations. The increase in its Accelerator TAM from $400b in 2027 to $500b in 2028 suggests continued confidence in the strong growth and share gain opportunities in an important market." "Overall, we continue to expect AMD's Data Center segment to be a strong growth driver in 2025 via both share gains in CPUs and the potential for a near doubling of Instinct revenue." Bank of America (NYSE:BAC): "New MI325X performance generally remains a full year behind NVDA's latest Blackwell, with no near-term catalyst to change the dynamic. However, we highlight AMD's multi-vector growth opportunities across data center CPUs and GPUs remain unchanged, with the current 5-7% AI accelerator share consensus outlook presenting a minimum $25bn+ opportunity by CY28E, and a bull-case scenario of 10% AI share over the long-term still on the table, given continued hardware, software stack, and networking improvements." Truist Securities: "We see this as a product evolution rather than a revolution, which reinforced our longer-term concerns with the stock:(1) we see AMD's position in AI as likely confined vs. NVDA's (Buy) full-stack semis/hardware/software/services solutions, and (2) we expect the X86 market will slowly come under pressure from new CPU competitors. No change to our estimates or $156 PT. Hold." Morgan Stanley (NYSE:MS): "AMD launched the new Zen 5 server architecture, the mid-life kicker for MI300, and previewed the MI350. The bull case that MI350 lands them in a leadership position is very compelling, but in the interim MI300 seems likely to drive less upside than we see elsewhere in AI."

[8]

Why Analysts Say They're Bullish on AMD Stock After AI Event Disappointed

However, Jefferies analysts said they believe AMD's new AI chips could still drive gains for the stock with "enough demand to go around." Advanced Micro Devices (AMD) may have disappointed investors with its Advancing AI event Thursday, but analysts said they're still bullish on the chipmaker's growth prospects. While AMD unveiled a number of new AI products at the event, Jefferies analysts said investors may have been looking for clearer signs of competition with Nvidia (NVDA) and a new customer announcement, as well as "the potential for a raise of the AI guidance to $5 billion, which is likely now left to earnings." Shares of AMD fell 4% Thursday after the event, though they recovered some of those losses with a just over 2% gain Friday. Bank of America analysts said AMD's latest Instinct MI325X GPU "remains a full year behind NVDA's latest Blackwell, with no near-term catalyst to change the dynamic." Jefferies analysts suggested AMD's MI350 next year "would compete more favorably" with Nvidia's Blackwell, "leaving AMD chasing NVDA for now." However, the analysts said they believe AMD's new AI chips could still "drive further share gains" as companies race to build out their AI infrastructure, with "enough demand to go around." Jefferies maintained its "buy" rating for the stock and price target of $190, a more than 13% premium over Friday's closing price of $167.89. Bank of America also maintained a "buy" rating with a price objective of $180. About three-quarters or 13 of the other 17 analysts tracked by Visible Alpha also held "buy" or equivalent ratings for the stock as of Friday, with a consensus target of $192.13.

Share

Share

Copy Link

AMD's recent AI event showcases product roadmap and market projections, with analysts maintaining positive ratings despite some caution on ambitious targets.

AMD's AI Event Highlights and Analyst Reactions

Advanced Micro Devices (AMD) recently held its Advancing AI event, showcasing the company's expanding artificial intelligence (AI) roadmap and product lineup. The event, which was closely watched by investors and analysts, provided insights into AMD's strategy to compete in the rapidly growing AI market

1

2

3

.Key Announcements and Product Roadmap

AMD unveiled several new products and updates during the event:

- Launch of the 5th generation EPYC processors

- Introduction of the MI325X accelerator family

- Announcement of new networking solutions, including the Pensando Salina DPU family and Pollara 400 network interface cards

- Presentation of the AI GPU roadmap, including the MI325 chip (Q4 2024), MI350 (H2 2025), and MI400 (2026)

1

4

The company also raised its forecast for the AI total addressable market (TAM) to $500 billion by 2028, up from the current estimate of $45 billion for 2023

3

4

.Analyst Perspectives

Several prominent analyst firms have maintained positive ratings on AMD following the event:

- Oppenheimer: Maintained Perform rating, adjusting Q4 sales estimate from $7.7 billion to $7.5 billion

1

- Barclays: Reiterated Overweight rating with a $180 price target

2

- TD Cowen: Maintained Buy rating with a $210 price target

3

- Northland: Reiterated Outperform rating with a $175 price target

4

- Stifel: Maintained Buy rating with a $200 price target

5

Market Position and Growth Projections

AMD's market share in AI accelerators has grown from less than 0.1% in 2023 to 5% in 2024. Analysts project that AMD could capture over 20% of the AI accelerator market by 2028, potentially translating to revenues of $70-80 billion in this segment alone

4

.Financial Performance and Outlook

AMD's recent financial performance has been strong:

- Q2 revenues reached $5.835 billion, surpassing Street consensus

- Data center segment showed record revenue growth of 115% to $2.8 billion

1

2

3

InvestingPro data provides additional context:

- Market capitalization: $265.72 billion

- Revenue (LTM as of Q2 2024): $23.28 billion

- Revenue growth: 6.4% over the last twelve months

- Gross profit margin: 51.42%

1

2

3

4

5

Related Stories

Challenges and Cautionary Notes

Despite the overall positive outlook, some analysts expressed caution:

- Oppenheimer views the $10 billion sales target for the MI3XX family in 2025 as potentially ambitious

- Barclays noted the absence of a new major customer announcement and the need for more details on system architecture and interconnect strategies

1

2

Conclusion

AMD's recent AI event and subsequent analyst reactions highlight the company's growing presence in the AI market. While challenges remain, the overall sentiment towards AMD's AI strategy and market position remains positive, with analysts maintaining buy and outperform ratings on the stock.

References

Summarized by

Navi

[1]

Related Stories

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology