Andreessen Horowitz commits $3 billion to AI infrastructure, betting against bubble fears

3 Sources

3 Sources

[1]

Andreessen Horowitz Makes a $3 Billion Bet That There's No AI Bubble

An artificial intelligence startup that helps developers write and debug code is now worth nearly as much as United Airlines. A two-month-old AI computer company raised a massive $475 million seed round, with plans to secure even more financing soon. And a platform for ranking AI models is now valued at nearly $2 billion, less than a year after it was spun out of an academic project. The exuberance for all things AI has rapidly spilled over into the normally staid field of developer tools, benchmarking services and back-end systems -- areas that most regular consumers will never encounter directly -- becoming a focal point for a new wave of tech investment. And behind many of these companies, you'll find a relatively nascent multibillion-dollar fund run by an unconventional team at Andreessen Horowitz. The venture capital firm, which goes by the nickname a16z, set up a dedicated $1.25 billion war chest in 2024 for bets on AI infrastructure, a term that the fund defines more broadly than the costly chips and data centers that make AI run. This month, the firm said it would commit another $1.7 billion to the effort. To a16z, the word infrastructure encompasses any AI software marketed to technical buyers, rather than consumers. Think coding applications, foundational models and networking security, among others. "Some of the most important companies of tomorrow will be infrastructure companies," said Raghu Raghuram, a managing partner at the venture firm and former VMware chief executive officer. Those bets are starting to pay off. In recent months, Stripe Inc. agreed to buy Andreessen-backed billing platform Metronome for a reported $1 billion; Salesforce Inc. acquired Regrello, an AI provider for manufacturers; and Meta Platforms Inc. bought AI audio company WaveForms. In November, AI coding startup Cursor raised a new round of financing at a $29.3 billion valuation, far more than the $400 million it was worth in 2024 when a16z first backed it. The VC firm's co-founder Ben Horowitz cautions that it's too early to make any judgments about the fund's performance, which is usually assessed on a decade-long time horizon. But so far, he said, "It's one of the best funds, like, I've ever seen." As with so much in AI investing right now, however, it's unclear whether a16z's success with the fund defies an AI bubble or exemplifies it. Silicon Valley has proven AI businesses can raise unprecedented sums from investors at ever-higher valuations to fuel grandiose dreams of rewiring society. The central tension of the boom is whether businesses will find AI software valuable enough to pay up for it -- and soon. If companies don't spend as much as anticipated, trillions of dollars of tech investments will look more precarious, including for firms a16z is now backing. The task of guiding the prominent VC firm through the frothy AI infrastructure landscape falls to Martin Casado, a former computational physicist and longtime programmer who sold his startup, Nicira, to VMware for $1.26 billion. Casado joined a16z a decade ago and has become a successor of sorts to Horowitz, the firm's original infrastructure expert. "I'm completely replaced," Horowitz said. "I don't know nothing anymore." Casado acknowledges "private valuations are crazy," but professes not to be worried about an AI bubble. "This stuff is magic," he said. "The users are real. The demand is real. The GPU usage is real." Still, he and a16z have been careful to sidestep certain investment trends. For example, the firm has stayed away from directly backing the trillion-dollar AI data center buildout, though occasionally with some regrets. Casado rues not investing in so-called neocloud providers. One such company, CoreWeave Inc., now has a market capitalization of about $50 billion. "We just talked ourselves out of it stupidly," he said, noting his team's questions about whether these businesses had enough customers and differentiated technology. But the longer Casado does this job, the more he realizes that "sometimes you can be absolutely right and not rich." Typically, the fund writes relatively small checks, which helps insulate the firm from eye-watering valuations -- though not always. The firm co-led a funding round that valued startup Unconventional AI at $4.5 billion two months after its founding and led a round in former OpenAI executive Mira Murati's Thinking Machines Lab at a $10 billion valuation before it had released any products. "She created ChatGPT," Casado said, waving off concerns about the latter. "And she's Mira." (Murati's startup has since lost several staffers to OpenAI.) The infrastructure fund's largest investments are around $60 million and most are smaller. The goal is to be early. "We invest much before these crazy numbers typically," Casado said. "Even when you see these big headline numbers or whatever, often we're in earlier." To spot AI companies first, a16z's fund relies on a team with less traditional resumes for VCs - starting with Casado himself. Unlike some on Sand Hill Road, Casado doesn't hail from a tony background. His mother, a travel writer, met his father on a ship where he was a purser. She followed him to Southern Spain, where Casado was born, and eventually to Billings, Montana, followed by stints in Denver and Arizona. "We grew up very, very poor," Casado says. "We were always that weird European family in that western town." At times, his family was on food stamps, an experience that engendered a "level of resourcefulness" he's found useful later in life. Casado paid his tuition to Northern Arizona University with a mix of jobs, including video game programmer and teppanyaki chef. After college, Casado put his computational physics skills to work testing weapons systems for the Defense Department. Following the Sept. 11 attacks, Casado spent two years at an agency he isn't sure he's allowed to name. Later, he proved to be a talented coder at Stanford, winning competitions so often they took to naming two winners to give others a shot, according to Guido Appenzeller, a former Stanford teaching assistant and current a16z investor. At a16z, Casado surrounds himself with technical pros who have an eye for infrastructure, including Appenzeller and Jennifer Li, the only person who has risen from analyst to general partner at the firm. A former product leader at AppDynamics, Li joined a16z in 2018, despite thinking she'd never be an investor. She's distinguished herself by pushing her point of view with a16z's senior leadership -- "she'll talk me down," Horowitz said -- as well as by helping portfolio companies like AI voice startup ElevenLabs navigate difficult deals and departures. "This is what I love about startups -- all these little fire drills and battles," she said. With the addition of the new $1.7 billion for the fund, Matt Bornstein is being promoted to general partner. Bornstein, like Casado, was an early proponent of infrastructure investment at another firm. According to Bornstein, Casado recruited him by saying, "Come here and win deals instead of losing deals." "A lot of venture capitalists were hired from investment banking," said Jamin Ball, a partner at Altimeter Capital and longtime infrastructure investor alongside Casado. "Martin, when he was building his team, he just didn't care what the conventional wisdom or background was." That proved instrumental to spotting Cursor, which has been hailed as the fastest-growing startup in history. When a16z invested, many startups were competing to dethrone AI code-generation pioneer GitHub Copilot, but a16z's infrastructure team were all using Cursor for hobbyist coding projects. Casado's background in 3-D gaming models and computational physics also created a bond with AI pioneer Fei-Fei Li, leading him to back and assist her in founding World Labs, which develops so-called world models for simulating physical spaces, a contrarian idea at the time. "I was still very impressed that he actually understood it," she said. The fund's strategy, which is a hallmark of a16z, is to offer plenty of hands-on help to startups. Casado, who is on Cursor's board, has spoken with candidates to convince them to join the startup. When computing capacity ran short, he helped them secure more, and when some of it went down on a weekend, he helped the company get support, said Cursor President Oskar Schulz. Casado also goes into World Labs' offices every Wednesday to code. "People do joke that I work Martin really hard," Fei-Fei Li said. When necessary, Casado steps in to protect the firm's investments. In November, Cloudflare Inc. acquired Replicate, an Andreessen-backed company that eases deploying AI models to the cloud. Behind the scenes, Casado was engaged in a delicate matchmaking game to find a partner for a startup facing increasing competition that had not yet developed a strong enough business strategy for its promising technology, according to a person familiar with the process. He was aided by Bornstein, who sits on Replicate's board. Casado tapped a contact who had experience at Cloudflare to help sway Replicate's founder to sell and spent time convincing both parties that the price was fair. The timing was key because Replicate ran the risk of missing out on a good exit and falling behind competitors, said the person, who spoke on condition of anonymity to discuss private matters. Casado may be a nice person but he's a ruthless businessman, the person said. Casado also played a behind-the-scenes role in another notable acquisition, working over months to help a16z investment Tabular sell to Andreessen-backed Databricks Inc., for a larger sum than the startup had been discussing with Databricks rival Snowflake Inc., said people familiar with that deal. A keen eye for companies and a steely drive may be necessary to weather the uncertainty ahead in the AI boom. "There's going to be a bunch of companies that don't work," Casado said. "There's always fewer winners than people assume, but they are much larger than people assume."

[2]

Andreessen Horowitz makes a $3 billion bet against the AI bubble

The venture capital firm, which goes by the nickname a16z, set up a dedicated $1.25 billion war chest in 2024 for bets on AI infrastructure, a term that the fund defines more broadly than the costly chips and data centers that make AI run. This month, the firm said it would commit another $1.7 billion to the effort. An artificial intelligence startup that helps developers write and debug code is now worth nearly as much as United Airlines. A two-month-old AI computer company raised a massive $475 million seed round, with plans to secure even more financing soon. And a platform for ranking AI models is now valued at nearly $2 billion, less than a year after it was spun out of an academic project. The exuberance for all things AI has rapidly spilled over into the normally staid field of developer tools, benchmarking services and back-end systems -- areas that most regular consumers will never encounter directly -- becoming a focal point for a new wave of tech investment. And behind many of these companies, you'll find a relatively nascent multibillion-dollar fund run by an unconventional team at Andreessen Horowitz. The venture capital firm, which goes by the nickname a16z, set up a dedicated $1.25 billion war chest in 2024 for bets on AI infrastructure, a term that the fund defines more broadly than the costly chips and data centers that make AI run. This month, the firm said it would commit another $1.7 billion to the effort. To a16z, the word infrastructure encompasses any AI software marketed to technical buyers, rather than consumers. Think coding applications, foundational models and networking security, among others. "Some of the most important companies of tomorrow will be infrastructure companies," said Raghu Raghuram, a managing partner at the venture firm and former VMware chief executive officer. Those bets are starting to pay off. In recent months, Stripe Inc. agreed to buy Andreessen-backed billing platform Metronome for a reported $1 billion; Salesforce acquired Regrello, an AI provider for manufacturers; and Meta Platforms Inc. bought AI audio company WaveForms. In November, AI coding startup Cursor raised a new round of financing at a $29.3 billion valuation, far more than the $400 million it was worth in 2024 when a16z first backed it. The VC firm's co-founder Ben Horowitz cautions that it's too early to make any judgments about the fund's performance, which is usually assessed on a decade-long time horizon. But so far, he said, "It's one of the best funds, like, I've ever seen." As with so much in AI investing right now, however, it's unclear whether a16z's success with the fund defies an AI bubble or exemplifies it. Silicon Valley has proven AI businesses can raise unprecedented sums from investors at ever-higher valuations to fuel grandiose dreams of rewiring society. The central tension of the boom is whether businesses will find AI software valuable enough to pay up for it -- and soon. If companies don't spend as much as anticipated, trillions of dollars of tech investments will look more precarious, including for firms a16z is now backing. The task of guiding the prominent VC firm through the frothy AI infrastructure landscape falls to Martin Casado, a former computational physicist and longtime programmer who sold his startup, Nicira, to VMware for $1.26 billion. Casado joined a16z a decade ago and has become a successor of sorts to Horowitz, the firm's original infrastructure expert. "I'm completely replaced," Horowitz said. "I don't know nothing anymore." Casado acknowledges "private valuations are crazy," but professes not to be worried about an AI bubble. "This stuff is magic," he said. "The users are real. The demand is real. The GPU usage is real."Still, he and a16z have been careful to sidestep certain investment trends. For example, the firm has stayed away from directly backing the trillion-dollar AI data center buildout, though occasionally with some regrets. Casado rues not investing in so-called neocloud providers. One such company, CoreWeave Inc., now has a market capitalization of about $50 billion. "We just talked ourselves out of it stupidly," he said, noting his team's questions about whether these businesses had enough customers and differentiated technology. But the longer Casado does this job, the more he realizes that "sometimes you can be absolutely right and not rich." Typically, the fund writes relatively small checks, which helps insulate the firm from eye-watering valuations -- though not always. The firm co-led a funding round that valued startup Unconventional AI at $4.5 billion two months after its founding and led a round in former OpenAI executive Mira Murati's Thinking Machines Lab at a $10 billion valuation before it had released any products. "She created ChatGPT," Casado said, waving off concerns about the latter. "And she's Mira." (Murati's startup has since lost several staffers to OpenAI.)The infrastructure fund's largest investments are around $60 million and most are smaller. The goal is to be early. "We invest much before these crazy numbers typically," Casado said. "Even when you see these big headline numbers or whatever, often we're in earlier." To spot AI companies first, a16z's fund relies on a team with less traditional resumes for VCs - starting with Casado himself. Unlike some on Sand Hill Road, Casado doesn't hail from a tony background. His mother, a travel writer, met his father on a ship where he was a purser. She followed him to Southern Spain, where Casado was born, and eventually to Billings, Montana, followed by stints in Denver and Arizona. "We grew up very, very poor," Casado says. "We were always that weird European family in that western town." At times, his family was on food stamps, an experience that engendered a "level of resourcefulness" he's found useful later in life. Casado paid his tuition to Northern Arizona University with a mix of jobs, including video game programmer and teppanyaki chef. After college, Casado put his computational physics skills to work testing weapons systems for the Defense Department. Following the Sept. 11 attacks, Casado spent two years at an agency he isn't sure he's allowed to name. Later, he proved to be a talented coder at Stanford, winning competitions so often they took to naming two winners to give others a shot, according to Guido Appenzeller, a former Stanford teaching assistant and current a16z investor.At a16z, Casado surrounds himself with technical pros who have an eye for infrastructure, including Appenzeller and Jennifer Li, the only person who has risen from analyst to general partner at the firm. A former product leader at AppDynamics, Li joined a16z in 2018, despite thinking she'd never be an investor. She's distinguished herself by pushing her point of view with a16z's senior leadership -- "she'll talk me down," Horowitz said -- as well as by helping portfolio companies like AI voice startup ElevenLabs navigate difficult deals and departures. "This is what I love about startups -- all these little fire drills and battles," she said. With the addition of the new $1.7 billion for the fund, Matt Bornstein is being promoted to general partner. Bornstein, like Casado, was an early proponent of infrastructure investment at another firm. According to Bornstein, Casado recruited him by saying, "Come here and win deals instead of losing deals." "A lot of venture capitalists were hired from investment banking," said Jamin Ball, a partner at Altimeter Capital and longtime infrastructure investor alongside Casado. "Martin, when he was building his team, he just didn't care what the conventional wisdom or background was." That proved instrumental to spotting Cursor, which has been hailed as the fastest-growing startup in history. When a16z invested, many startups were competing to dethrone AI code-generation pioneer GitHub Copilot, but a16z's infrastructure team were all using Cursor for hobbyist coding projects. Casado's background in 3-D gaming models and computational physics also created a bond with AI pioneer Fei-Fei Li, leading him to back and assist her in founding World Labs, which develops so-called world models for simulating physical spaces, a contrarian idea at the time. "I was still very impressed that he actually understood it," she said. The fund's strategy, which is a hallmark of a16z, is to offer plenty of hands-on help to startups. Casado, who is on Cursor's board, has spoken with candidates to convince them to join the startup. When computing capacity ran short, he helped them secure more, and when some of it went down on a weekend, he helped the company get support, said Cursor President Oskar Schulz. Casado also goes into World Labs' offices every Wednesday to code. "People do joke that I work Martin really hard," Fei-Fei Li said.When necessary, Casado steps in to protect the firm's investments. In November, Cloudflare Inc. acquired Replicate, an Andreessen-backed company that eases deploying AI models to the cloud. Behind the scenes, Casado was engaged in a delicate matchmaking game to find a partner for a startup facing increasing competition that had not yet developed a strong enough business strategy for its promising technology, according to a person familiar with the process. He was aided by Bornstein, who sits on Replicate's board.Casado tapped a contact who had experience at Cloudflare to help sway Replicate's founder to sell and spent time convincing both parties that the price was fair. The timing was key because Replicate ran the risk of missing out on a good exit and falling behind competitors, said the person, who spoke on condition of anonymity to discuss private matters. Casado may be a nice person but he's a ruthless businessman, the person said.Casado also played a behind-the-scenes role in another notable acquisition, working over months to help a16z investment Tabular sell to Andreessen-backed Databricks, for a larger sum than the startup had been discussing with Databricks rival Snowflake Inc., said people familiar with that deal. A keen eye for companies and a steely drive may be necessary to weather the uncertainty ahead in the AI boom. "There's going to be a bunch of companies that don't work," Casado said. "There's always fewer winners than people assume, but they are much larger than people assume."

[3]

Andreessen Horowitz Investing Billions in AI Infrastructure Projects | PYMNTS.com

By completing this form, you agree to receive marketing communications from PYMNTS and to the sharing of your information with our sponsor, if applicable, in accordance with our Privacy Policy and Terms and Conditions. Now, the venture capital firm is committing an additional $1.7 billion to that effort in a bet against fears of an artificial intelligence bubble, Bloomberg News reported Monday (Jan. 19). For Andreessen Horowitz -- or a16z, to use its finance world nickname -- "infrastructure" means any AI software targeted towards technical buyers and not consumers, the report added. These include things like foundational models, networking security and coding applications. Andreessen Horowitz co-founder Ben Horowitz warned that it's too soon to make any judgments about the fund's performance, which is usually judged in terms of decades. So far, however, this is "one of the best funds, like, I've ever seen," he said. The Bloomberg report contends that it's not yet clear whether the firm's success with the fund exemplifies an AI bubble, or defies it. As PYMNTS CEO Karen Webster wrote last week, the debate about the reality of an AI bubble has obscured what was happening within companies that build projects and run operations. "Inside those organizations, the question was never whether AI was interesting. It was whether it could be fully trusted," she added. "For much of the year, the answer was no. AI was used as a helper, not a decision-maker. It summarized, suggested and analyzed, but humans remained firmly in control of outcomes." But a shift happened late in the year, not involving artificial intelligence itself but in how businesses judged their own readiness and that of the technology. Research by PYMNTS Intelligence followed 60 chief product officers at billion-dollar companies throughout last year, and the data shows a shift. In August of 2025, almost all (98%) of these executives said they were not willing to give autonomous agents any meaningful authority. But three months later, that position had softened, with the share of firms merely considering AI for core operations dropped from 52% to 30% between August and November.

Share

Share

Copy Link

Andreessen Horowitz has committed $3 billion to AI infrastructure investments, focusing on developer tools, coding applications, and foundational models rather than consumer-facing AI. Led by Martin Casado, the venture capital firm's strategy targets technical buyers while sidestepping data center investments, with early bets like Cursor already showing massive returns despite soaring valuations across the sector.

Andreessen Horowitz Doubles Down on AI Infrastructure with $3 Billion Commitment

Andreessen Horowitz, known in financial circles as a16z, has expanded its commitment to investing in AI infrastructure with an additional $1.7 billion fund, bringing its total dedicated capital to $3 billion

1

. The venture capital firm established its initial $1.25 billion war chest in 2024, specifically targeting what it defines as AI infrastructure—a term the firm interprets more broadly than traditional data centers and chips2

. For a16z, AI infrastructure encompasses any AI software marketed to technical buyers rather than consumers, including coding applications, foundational models, and networking security3

.

Source: PYMNTS

The billions in AI infrastructure represent a calculated bet against mounting concerns about an AI bubble, even as valuations across the sector reach extraordinary levels. An AI startup helping developers write code now carries a valuation nearly matching United Airlines, while a two-month-old AI computer company secured a massive $475 million seed round

1

. These eye-watering numbers reflect how AI software for technical buyers has become a focal point for tech investment, transforming the traditionally conservative developer tools market into a hotbed of speculation.Early Bets Deliver Spectacular Returns Despite Market Uncertainty

The strategy appears to be paying off for the venture capital firm. In November, AI coding startup Cursor raised financing at a $29.3 billion valuation—a staggering increase from the $400 million valuation when a16z first backed it in 2024

2

. Recent months have also seen Stripe acquire Andreessen-backed billing platform Metronome for a reported $1 billion, while Salesforce bought AI provider Regrello and Meta Platforms purchased AI audio company WaveForms1

.Ben Horowitz, co-founder of the firm, cautioned that performance assessments typically require a decade-long time horizon, but acknowledged the fund's exceptional early results. "It's one of the best funds, like, I've ever seen," he stated

2

. Yet the question remains whether this success defies the AI bubble or exemplifies it, as the central tension revolves around whether businesses will find AI software valuable enough to justify the high valuations of AI companies.Related Stories

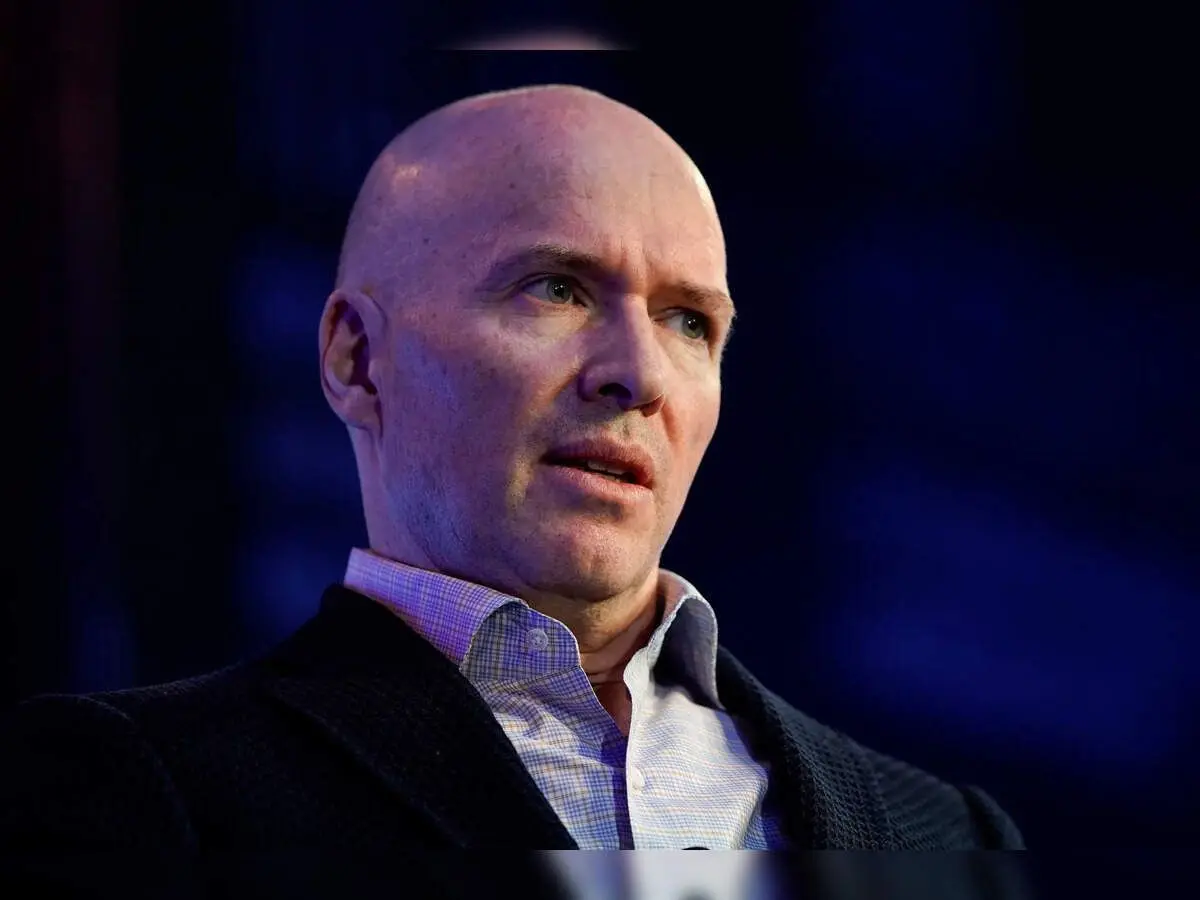

Martin Casado's Disciplined Approach Navigates Frothy Valuations

Martin Casado, a former computational physicist who sold his startup Nicira to VMware for $1.26 billion, leads the firm's AI infrastructure efforts

1

. While acknowledging that "private valuations are crazy," Casado maintains confidence that AI bubble concerns are overblown. "This stuff is magic," he said. "The users are real. The demand is real. The GPU usage is real"2

.

Source: ET

The fund typically writes relatively small checks, with largest investments around $60 million, helping insulate it from extreme valuations

1

. However, a16z has made notable exceptions, co-leading a funding round valuing startup Unconventional AI at $4.5 billion just two months after founding, and backing former OpenAI executive Mira Murati's Thinking Machines Lab at a $10 billion valuation before product release2

.The firm has deliberately avoided certain investment trends, particularly the trillion-dollar AI data center buildout. Casado expressed regret about not backing neocloud providers like CoreWeave, which now has a market capitalization of about $50 billion, admitting "we just talked ourselves out of it stupidly"

1

. This disciplined approach reflects the firm's focus on early-stage AI startups where user demand and real-world applications in developer tools can be more readily validated, even as questions persist about whether trillions of dollars in tech investment will find sufficient enterprise spending to justify current expectations.References

Summarized by

Navi

Related Stories

AI Dominates Venture Capital Landscape in 2025, Driving Record Investments and Reshaping Startup Ecosystem

04 Oct 2025•Business and Economy

AI Infrastructure Bubble Concerns Mount as CoreWeave's Financial Engineering Raises Red Flags

18 Nov 2025•Business and Economy

Andreessen Horowitz Aims to Raise $20 Billion Megafund for AI Investments

09 Apr 2025•Business and Economy

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology