Nvidia overtakes Apple as TSMC's largest customer as AI demand reshapes chip industry

7 Sources

7 Sources

[1]

Jensen Huang says Nvidia has dethroned Apple as TSMC's largest customer -- rumor suggests that the chip fab is increasing its prices for Cupertino

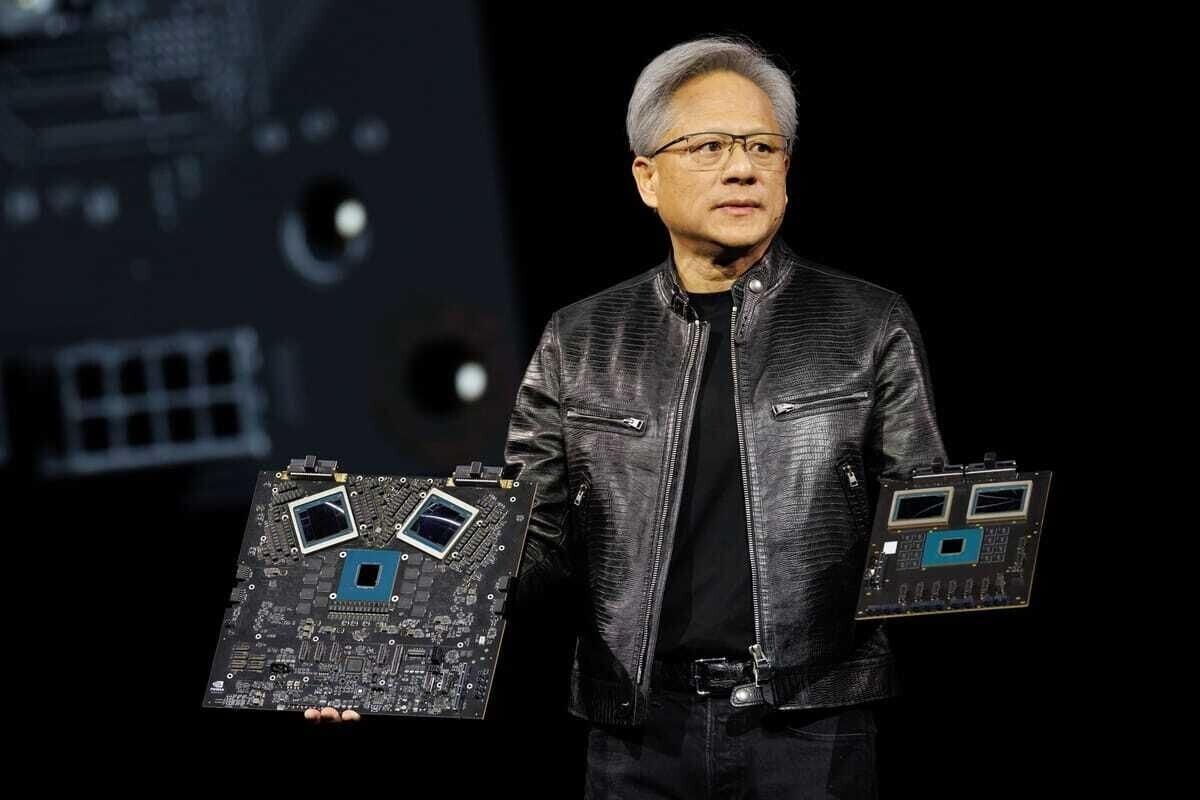

AI GPU demand is so high that it allowed Nvidia to overtake Apple as TSMC's number one customer. Nvidia CEO Jensen Huang has said in an interview that Nvidia is TSMC's largest customer at the moment, dethroning Apple, which has previously held the record for some time. The leather-clad CEO said this during the first episode of the "A Bit Personal with Jodi Shelton" podcast, wherein Shelton asked him where he gets his confidence. "I remember Morris Chang has a similar story when he first met you, that you immediately said, 'I'm going to be your biggest customer or one of your biggest customers. And he's like, 'Wow, that's a lot of gumption.' So, where did that confidence come from at such an early age?" Shelton asked. "Well, you know, it's rough to know everything -- I'm just kidding," Jensen said with a laugh. "By the way, Morris will be happy to know Nvidia is TSMC's largest customer now." The AI GPU company was once TSMC's top customer in the early 2000s. However, it was overtaken during the 2010s by Apple when TSMC took it on as a customer to build the iPhone and iPad processors, after Intel fumbled the potential partnership with Cupertino. This was especially true during recent years when the iPhone overtook Samsung in market share across the globe. But even if Apple's smartphones, tablets, and even the legendary Apple silicon on Macs and MacBooks are driving record sales for the company, the AI boom is also pushing demand for Nvidia's AI GPUs, resulting in skyrocketing revenue for the company. More than that, enterprise customers are willing to pay billions and billions to Team Green to get as many AI processors as they can, whereas many consumers have a price ceiling after which they will go with another brand if a smartphone, tablet, or laptop is priced too high. Aside from losing its top spot, there are also rumors -- reported by WCCFTech from the Apple leaker Fixed Focus Digital -- that TSMC is hiking up the prices it's charging Apple for chips, especially as the AI demand is squeezing capacity for other semiconductors. Furthermore, Cupertino might no longer have production priority. However, this is just speculation, and even if it's true, the companies will likely keep information like this confidential. Nvidia's success is directly tied to the AI hype, with many tech companies pouring money into acquiring thousands, if not hundreds of thousands, of GPUs just to get the horsepower to train the most advanced models. And with Team Green cornering the market for AI processors, it's basically printing cash as long as companies feel that they can make more money by adding more computing power. But if the AI bubble pops and we're left with a lot of AI data centers with no customers, then we expect Apple to retake its position as TSMC's number one customer. Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

[2]

Nvidia has overtaken Apple as TSMC's largest customer, Jensen Huang says

Serving tech enthusiasts for over 25 years. TechSpot means tech analysis and advice you can trust. What just happened? The world's most valuable semiconductor relationship just shifted: Nvidia has overtaken Apple as the largest customer of TSMC, according to CEO Jensen Huang. The disclosure, paired with his separate call for "trillions" of dollars in new AI infrastructure investment, illustrates how the center of gravity in tech hardware is moving rapidly from mobile devices to artificial intelligence systems. Huang made the remark about TSMC during an interview on the A Bit Personal with Jodi Shelton podcast. When the host referred to TSMC founder Morris Chang's recollection that a young Huang once promised to become one of the foundry's biggest clients, Huang laughed and said, "Morris will be happy to know Nvidia is TSMC's largest customer now." It's a symbolic turn: Apple seized that spot more than a decade ago, after TSMC became the exclusive manufacturer of its iPhone and iPad processors. Nvidia had been a leading partner in the early 2000s, before mobile silicon and Apple's custom chips vaulted Cupertino to the top. The reversal reflects the explosive economics of AI. Every major cloud provider and enterprise is racing to secure Nvidia GPUs - fueling record revenue for Nvidia and forcing chip foundries to reallocate capacity toward AI processors. A tipster says TSMC may even be raising prices for Apple's production runs and will no longer give Apple priority in shipments, though neither company has confirmed any such changes. A few days after his podcast appearance, Huang took a broader view at the World Economic Forum, where he joined BlackRock CEO Larry Fink in a fireside discussion about AI's economic footprint. There, he characterized the global AI system as a "five-layer cake," starting with energy at the base, followed by semiconductors, cloud infrastructure, AI models, and finally the application layer that generates revenue across industries. He described the current moment as the early stage of "the largest infrastructure buildout in human history" - a transformation already involving hundreds of billions of dollars and ultimately requiring trillions more. That scaffold, he explained, extends from electricity generation and chip production to data centers and specialized applications in sectors such as healthcare, manufacturing, and finance. TSMC plans roughly 20 new fabrication plants worldwide, while manufacturers like Foxconn, Quanta, and Inventec are developing dozens of new "AI factories" to assemble GPU-based systems. Semiconductor heavyweights, including Micron, SK Hynix, and Samsung, are also investing tens to hundreds of billions of dollars to meet soaring memory demand. Huang said venture capital spending now reflects this shift. 2025 was one of the biggest years on record for AI-focused startups, with funding flowing into so-called "AI-native" companies across key industrial categories. That momentum, he suggested, validates the confidence fueling Nvidia's rise from a graphics-card designer to a supplier critical to the entire digital economy. Both developments - the confirmation that Nvidia now leads TSMC's revenue chart and Huang's trillion-dollar forecast for AI buildout - capture a single trend: computing's gravitational pull has moved away from consumer electronics and toward industrial-scale intelligence. As long as that momentum continues, Nvidia's grip on both chip manufacturing demand and AI infrastructure design seems likely to deepen even further.

[3]

Apple Now Facing Unprecedented Competition for Chip Supply

Apple increasingly has to compete with other companies for chips made by Taiwan Semiconductor Manufacturing Co. (TSMC), as surging demand for artificial intelligence reshapes capacity and customer priority. According to a detailed report published by semiconductor analyst Tim Culpan on his blog Culpium, Apple is no longer guaranteed preferential access to leading-edge manufacturing capacity at TSMC, marking a notable change after more than a decade in which Apple's chips were central to the foundry's expansion strategy. Apple is now competing directly with AI-focused customers such as Nvidia and AMD for supply, particularly at the most advanced process nodes. AI accelerators consume substantially more wafer area per unit than smartphone system-on-chips, meaning that even a smaller number of AI customers can absorb a disproportionate share of advanced manufacturing output. As a result, Apple's chip designs are no longer automatically prioritized across TSMC's two dozen fabrication plants. Nvidia likely surpassed Apple as TSMC's largest customer by revenue in at least one or two quarters in 2025, but exact customer rankings are unknown. Apple ceased to be the primary driver of TSMC's revenue growth about five years ago. The report suggests that Apple may face higher silicon costs for future chip generations as it competes with AI customers willing to pay premiums for priority access. While Apple is unlikely to be unable to ship products due to insufficient wafers, sustained pricing pressure with advanced nodes could influence product margins or pricing strategies over the next several years.

[4]

Nvidia overtakes Apple as TSMC's largest customer

Nvidia CEO Jensen Huang said rising demand for AI computing has pushed the company past Apple to become the largest customer of Taiwan Semiconductor Manufacturing Company (TSMC). Huang made the comment during an appearance on the A Bit Personal with Jodi Shelton podcast. Recalling an early meeting with TSMC founder Morris Chang, Huang said with a laugh, "By the way, Morris will be happy to know Nvidia is TSMC's largest customer now." Nvidia was among TSMC's largest customers in the early 2000s, but Apple moved into the top position during the 2010s as the foundry ramped production of processors for the iPhone and iPad. Apple's role expanded further as its in-house silicon became central to Macs and MacBooks. That balance has shifted as spending on AI accelerators has increased. Nvidia's graphics processing units have become a key component of AI data centers, with enterprise customers committing large budgets to secure supply. Consumer electronics, by contrast, face clearer pricing limits, even as Apple's devices continue to post strong sales. Tom's Hardware cited reports from Wccftech, based on claims by Apple leaker Fixed Focus Digital, suggesting TSMC has raised prices charged to Apple and adjusted production priorities as AI demand tightens capacity. The reports remain unconfirmed, and neither company has commented publicly. Huang addresses concerns over AI investment Huang's remarks on TSMC come as he has defended the scale of investment flowing into AI. Speaking at the World Economic Forum in Davos, Switzerland, he said AI is already delivering economic benefits and requires further investment, according to Business Insider. Huang described AI as a five-layer stack consisting of energy, chips, cloud infrastructure, models and applications. He said the application layer is where economic returns ultimately emerge, while acknowledging investor concerns over whether current spending levels could lead to a bubble. "The AI bubble comes about because the investments are large, and the investments are large because we have to build the infrastructure necessary for all of the AI layers," Huang said in Davos. He added that demand for Nvidia's GPUs remains strong, noting that even older generations have become more expensive to rent as companies allocate a growing share of their budgets to AI. Infrastructure buildout lifts demand for skilled labor Huang also said the AI boom is driving demand beyond chips, particularly for workers needed to build and maintain data centers and semiconductor facilities. In a separate Davos discussion reported by Business Insider, he described the current wave of AI investment as "the single largest infrastructure buildout in human history." He pointed to rising demand for plumbers, electricians, construction workers and other tradespeople involved in building AI infrastructure, noting that wages for some roles in the US have nearly doubled and, in some cases, reached six figures. "Everybody should be able to make a great living," Huang said, adding that such jobs do not require advanced degrees in computer science. Huang has long argued that AI is unlikely to eliminate jobs on a large scale, saying it will instead change how work is done while creating new demand tied to the physical infrastructure supporting the technology.

[5]

Apple is no longer the apple of TSMC's eye, with Nvidia taking centre stage in the supply of wafers, according to one report

It essentially comes down to whoever is willing to pay the most and AI tops them all. For many years, it has been Apple that's been first in line to use TSMC's newest process nodes, as well as taking the lion's share of all those wafers. However, the meteoric rise in the demand for AI chips, backed by hundreds of billions of dollars, would appear to have pushed Apple aside in favour of Nvidia, according to a new report. This is what is being claimed by Tim Culpan, a technology reporter based in Taiwan. With years of experience at Bloomberg behind him, he is as good a source as you're going to get, unless any of the aforementioned parties decide to spill the beans directly. It certainly makes sense, though, because while the phone market is dominated by Apple, and is currently enjoying a marked rise in market share, the number of wafers it requires from TSMC will surely be less than what Nvidia is asking for. You only have to compare the physical size of their chips to realise this. Apple's latest A19 processor, as used in the iPhone 17, is manufactured via TSMC's N3P process node. It has a die area of around 100 square millimetres, which means a standard 300 mm wafer can yield many hundreds of dies. At the moment, Nvidia uses TSMC's N4 node for its current products, but it will switch to N3 for its Rubin-Vera AI behemoths. The Rubin GPU comprises two dies in its package, with each said to be 'reticle-sized', i.e. as big as TSMC can physically make them. That's around 750 to 800 square millimetres, so one wafer will only be able to churn fewer than 100 dies at best, and not all of those will be fully usable. While Apple sells hundreds of millions of iPhones every year, the demand for Nvidia's AI chips is so high that it's clear as to which company will be ordering the most wafers. One might think TSMC's long and close relationship with Apple will mean it gets preferential treatment, but money tops them all and AI is backed by a lot of money. Culpan argues that while Nvidia may indeed be the new Apple...sorry, apple...in TSMC's eye, it might not remain that way indefinitely or possibly even for very long. That's because Apple has huge excesses of cash and, despite all the expectations of the phone market slowing down due to saturation, it consistently sells millions of products every year. In other words, it's a safe bet. TSMC makes more than just phone chips for Apple, as its Macs, MacBooks, and other devices also sport Taiwan-made dies. Nvidia has consistency in the form of its consumer GPU sales (which are also used in its professional market), but the same can't be said for its AI chips, as there is no evidence to suggest that the rise in AI demand can be sustained. It's riding high right now, but who knows what will happen in the next few years? What does this mean in the short term, though? Well, TSMC is absolutely going to favour its HPC customers (AMD, Intel, Nvidia, etc) because collectively, they're spending huge sums of money on wafers for chips. They're all being charged more for ordering wafers on the latest nodes, and they can all afford it, too (plus they can always pass those cost increases on to the end user). But no matter how much they beg for bigger slots in the order books, no matter which customer is the most important, no matter which one is the safest bet, it's TSMC that holds all the cards. Designed an incredible new GPU, with trillions of transistors, but one that has to be made on the very best process node? You'll need to talk to TSMC to make it, and if they can't right now, then you'll just have to wait until they've made a new foundry to do so.

[6]

Jensen: Nvidia overtakes Apple at TSMC as AI demand surges

Nvidia CEO Jensen Huang has added fresh fuel to the ongoing "AI is reshaping everything" narrative by stating that Nvidia is currently TSMC's largest customer, pushing Apple out of the number one spot. The remark was made during an interview on the "A Bit Personal with Jodi Shelton" podcast and, while it is not an official disclosure from TSMC, it aligns with what the supply chain has been signaling for months: AI accelerators are now a dominant driver of leading-edge capacity consumption. For years, Apple has been the name most closely associated with TSMC's biggest-customer status. iPhone and iPad SoCs alone represent enormous volume, and Apple's expansion into Mac and MacBook processors with Apple Silicon reinforced a steady, predictable manufacturing cadence. That type of demand is attractive to any foundry: large, recurring, and tightly coordinated with product launches that can be planned well in advance. In many ways, Apple's scale and consistency helped define how modern advanced-node allocations work. AI infrastructure demand, however, is changing the shape of the queue. Hyperscalers and enterprise buyers scaling training and inference clusters tend to buy aggressively, with timelines that prioritize deployment speed and availability. When that spending ramps, it pulls hard on both wafer starts and the downstream constraints that matter just as much today, such as advanced packaging and supply of critical substrates. If you are Nvidia and your product roadmap is tightly matched to that spending, your foundry footprint can grow fast enough to rival or even eclipse high-volume consumer electronics, at least for certain quarters. The report also repeats an unconfirmed rumor that TSMC is increasing the prices it charges Apple and that Apple may not receive the same production priority it historically enjoyed. That claim is presented as speculation, and it is the kind of commercial detail that both sides would typically keep confidential. Still, the underlying logic is straightforward: when capacity is constrained and demand is urgent, the supplier's pricing power rises and allocations can shift toward the most capacity-hungry, highest-margin, or most time-sensitive orders. None of this guarantees a permanent reshuffle. If AI spending remains elevated, Nvidia's capacity share could stay unusually large as new accelerator generations roll through TSMC's advanced nodes. If the market cools materially and data center build-outs slow, the balance can swing back quickly to steadier consumer silicon volumes, where Apple's scale is difficult to match. The key point is that "largest customer" is not a trophy that stays put, it is a snapshot of who is driving the most manufacturing demand under the current set of constraints.

[7]

Nvidia Dethrones Apple As Taiwan Semiconductor's Largest Customer - NVIDIA (NASDAQ:NVDA), Taiwan Semiconductor (NYSE:TSM)

Nvidia Corp's (NASDAQ:NVDA) surge in artificial intelligence demand is reshaping the global semiconductor supply chain. Nvidia has overtaken Apple Inc. (NASDAQ:AAPL) as Taiwan Semiconductor Manufacturing Co. Ltd's (NYSE:TSM) largest customer. Nvidia chief Jensen Huang confirmed the change publicly for the first time during a recent podcast. Nvidia now ranks as Taiwan Semiconductor's biggest client -- an outcome he suggested would please Taiwan Semiconductor founder Morris Chang. Podcast host Jodi Shelton recalled that Chang once shared a story from their first meeting, when Huang boldly told him Nvidia would one day become his largest customer or one of his biggest, Futunn News reported on Thursday. The rapid rise of artificial intelligence has since shifted industry priorities. According to the report, Nvidia now contributes about 13% of Taiwan Semiconductor's total revenue. Nvidia previously held that position in the early 2000s. However, Apple took the lead in the 2010s after outsourcing production of iPhone and iPad processors to Taiwan Semiconductor. The report also mentions that Apple has reportedly secured about half of Taiwan Semiconductor's 2-nanometer capacity for its upcoming A20 and A20 Pro smartphone chips. Analysts See Nvidia's AI Leadership Extending Into 2026 The chip designer became the first company to hit the $4.5 trillion market cap in October as the AI ambitions of companies like Microsoft Corp (NASDAQ:MSFT), Google parent Alphabet Inc (NASDAQ:GOOGL), and Amazon.com Inc (NASDAQ:AMZN) continue to fuel demand for Nvidia's graphics processing units. JPMorgan analyst Harlan Sur said AI-driven demand continues to strongly favor Nvidia as the semiconductor sector heads into the fourth quarter of 2025 earnings season with momentum that should extend into 2026. Sur tied Nvidia's strength to sustained AI infrastructure spending. The analyst sees meaningful upside in the AI accelerator market, which he estimates at roughly $200 billion in 2025. Within that landscape, Sur keeps Nvidia as a top pick, citing its central role in accelerated compute. Price Actions: Nvidia shares were up 0.82% at $184.83 during premarket trading on Thursday, according to Benzinga Pro data. Taiwan Semiconductor stock is up 1.63%. Photo via Shutterstock NVDANVIDIA Corp $184.820.82% Overview TSMTaiwan Semiconductor Manufacturing Co Ltd $331.401.62% AAPLApple Inc $249.390.70% AMZNAmazon.com Inc $234.001.16% GOOGLAlphabet Inc $334.401.83% MSFTMicrosoft Corp $449.301.17% Market News and Data brought to you by Benzinga APIs

Share

Share

Copy Link

Jensen Huang confirmed that Nvidia has dethroned Apple as TSMC's largest customer, marking a significant shift in the semiconductor industry. The change reflects explosive AI demand, with enterprise customers pouring billions into AI GPUs while Apple faces unprecedented competition for advanced chip supply and potentially higher silicon costs.

Nvidia Dethroned Apple as TSMC's Largest Customer

Nvidia CEO Jensen Huang revealed during an interview on the "A Bit Personal with Jodi Shelton" podcast that Nvidia has become TSMC's largest customer, overtaking Apple after more than a decade of Cupertino's dominance

1

2

. When host Jodi Shelton referenced TSMC founder Morris Chang's recollection of a young Huang promising to become one of the foundry's biggest clients, Huang laughed and responded, "Morris will be happy to know Nvidia is TSMC's largest customer now"4

. This marks a symbolic reversal in the semiconductor industry, as Nvidia was among TSMC's top customers in the early 2000s before Apple seized that position during the 2010s when TSMC became the exclusive manufacturer of iPhone and iPad processors1

.

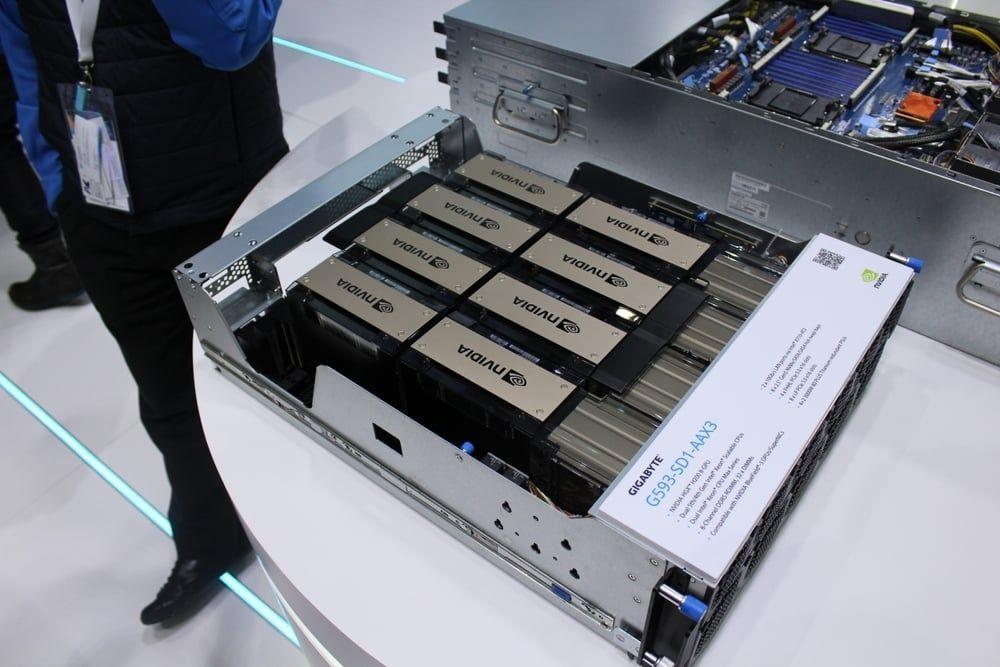

Source: Guru3D

Surging Demand for AI GPUs Drives the Shift

The reversal reflects the explosive economics of AI, with enterprise customers committing large budgets to secure supply of Nvidia's graphics processing units

4

. The AI boom is pushing demand for Nvidia's AI GPUs to unprecedented levels, resulting in skyrocketing revenue for the company as major cloud providers and enterprises race to acquire thousands, if not hundreds of thousands, of processors to train advanced AI models1

. AI accelerators consume substantially more wafer area per unit than smartphone system-on-chips, meaning even a smaller number of AI customers can absorb a disproportionate share of advanced manufacturing output3

. While Apple's A19 processor has a die area of around 100 square millimeters, Nvidia's Rubin GPU comprises two reticle-sized dies of approximately 750 to 800 square millimeters each, meaning one wafer yields fewer than 100 dies compared to hundreds for Apple chips5

.

Source: Benzinga

Apple Faces Unprecedented Competition for Advanced Chip Supply

According to semiconductor analyst Tim Culpan, Apple is no longer guaranteed preferential access to leading-edge manufacturing capacity at TSMC, marking a notable change after more than a decade in which Apple's chips were central to the foundry's expansion strategy

3

. Apple is now competing directly with AI-focused customers such as Nvidia and AMD for supply, particularly at the most advanced process nodes, and Apple's chip designs are no longer automatically prioritized across TSMC's two dozen fabrication plants3

. Reports from Apple leaker Fixed Focus Digital suggest TSMC may be raising prices charged to Apple and adjusted production priority as AI demand tightens capacity, though neither company has confirmed these claims1

4

. The report suggests Apple may face higher silicon costs for future chip generations as it competes with AI customers willing to pay premiums for production priority3

.Related Stories

Jensen Huang Calls for Trillions in AI Infrastructure Investment

At the World Economic Forum in Davos, Jensen Huang characterized the global AI system as a "five-layer cake" starting with energy at the base, followed by semiconductors, cloud infrastructure, AI models, and the application layer that generates revenue across industries

2

. He described the current moment as "the single largest infrastructure buildout in human history," a transformation already involving hundreds of billions of dollars and ultimately requiring trillions more4

. TSMC plans roughly 20 new fabrication plants worldwide, while manufacturers like Foxconn, Quanta, and Inventec are developing dozens of new "AI factories" to assemble GPU-based systems2

. Semiconductor heavyweights including Micron, SK Hynix, and Samsung are investing tens to hundreds of billions of dollars to meet soaring memory demand, while 2025 was one of the biggest years on record for AI-focused startups2

.

Source: DIGITIMES

What This Means for the Semiconductor Industry

The shift matters because it demonstrates how computing's gravitational pull has moved away from consumer electronics toward industrial-scale intelligence systems

2

. TSMC is favoring its HPC customers because collectively they're spending huge sums on wafers for chips, and they're all being charged more for ordering wafers on the latest nodes5

. However, analysts note this dynamic might not remain indefinitely, as Apple has huge excesses of cash and consistently sells millions of products every year, making it a safer long-term bet5

. If the AI bubble pops and data centers are left without customers, Apple could retake its position as TSMC's number one customer1

. For now, sustained pricing pressure with advanced nodes could influence Apple's product margins or pricing strategies over the next several years3

.References

Summarized by

Navi

[1]

[4]

Related Stories

Nvidia CEO warns TSMC must double capacity as AI demand threatens to overwhelm chip supply

01 Feb 2026•Business and Economy

NVIDIA CEO Jensen Huang Secures 50% Production Boost from TSMC Amid Soaring AI Chip Demand

09 Nov 2025•Business and Economy

Nvidia Briefly Overtakes Apple as World's Most Valuable Company Amid AI Boom

26 Oct 2024•Technology

Recent Highlights

1

OpenAI secures $110 billion funding round from Amazon, Nvidia, and SoftBank at $730B valuation

Business and Economy

2

Anthropic stands firm against Pentagon's demand for unrestricted military AI access

Policy and Regulation

3

Pentagon Clashes With AI Firms Over Autonomous Weapons and Mass Surveillance Red Lines

Policy and Regulation