Senators Push SAFE Chips Act to Block Advanced AI Chips Sales to China for 30 Months

6 Sources

6 Sources

[1]

Senators lobby for SAFE Chips Act, which would curb leading-edge AI chip exports to China -- proposed bill would restrict AMD and Nvidia to H20/MI308-class accelerator sales until 2028

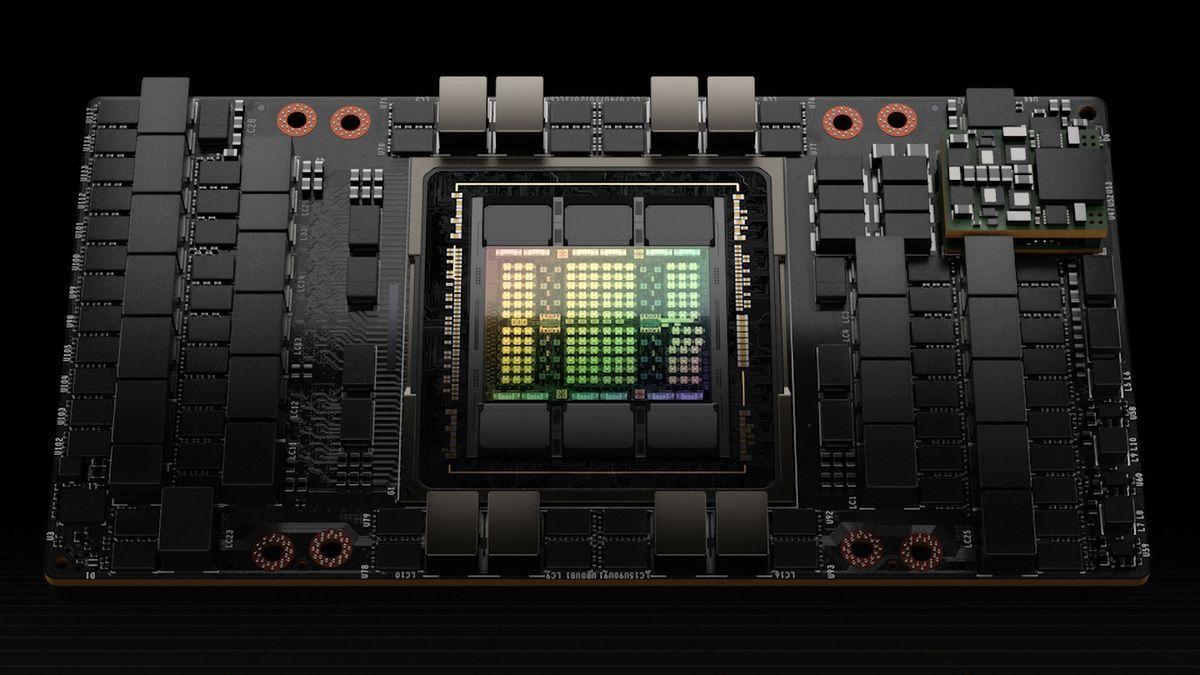

A new SAFE Chips Act proposed by a bipartisan group aims to lock current export rules into law, preventing AMD and Nvidia from selling any AI accelerators based on the latest architectures to China for the next 30 months and forcing companies to compete with H20 and MI308 against China's latest AI processors. A bipartisan group of U.S. senators has introduced new legislation designed to lock in the existing export control rules on AI and HPC processors from companies like AMD and Nvidia to China and other "adversary" nations for 30 months. If the Secure and Feasible Exports of Chips Act of 2025 (SAFE Chips Act) passes, then the current GPUs tailored for China -- AMD's MI308 and Nvidia's H20 -- will be the best processors these companies can supply to China and other foes for the next 30 months. The proposed definition of an advanced processor mirrors technical thresholds used in the U.S. Commerce Department's existing ECCN 3A090/4A090 controls, which means that an export license is required for any device specifically listed under the ECCN 3A090/4A090 controls (e.g., B300, B200, H200, H100, A100, etc.), or that exceeds specific performance parameters. A processor is considered advanced if it meets one of the preset parameters that include total processing performance (TPP score is listed as processing power multiplied by the length of operation), performance density (PD counted by dividing TPP by the die area measured in square millimeters), memory bandwidth, interconnect bandwidth, or combined memory and interconnect bandwidth. The bill excludes consumer and gaming hardware not designed or marketed for data centers from the regulation, allowing AMD and Nvidia to sell their highest-end consumer GPUs to adversary countries as long as they are not listed in the ECCN 3A090/4A090 regulations. Specific performance metrics mentioned in the new (or not so new?) export control rules are as follows: Both AMD and Nvidia already have processors -- AMD's Instinct MI308 and Nvidia's H20 -- that comply with the aforementioned thresholds, so the companies can continue to ship them to China (including Hong Kong and Macau), Iran, North Korea, or Russia even without a U.S. export license. Assuming, of course, China lifts its self-inflicted ban on Nvidia hardware. However, both H20 and MI308 were originally introduced in 2023, and by now, Chinese companies have already introduced AI accelerators that offer comparable or higher performance. For example, even Huawei's existing Ascend 910C beats H20 in FP16/BF16 (780 TFLOPS vs. 148 TFLOPS), with the next generation Ascend 950PR/950DT NPUs, the company will offer 1 FP8 PFLOPS (vs. H20's 296 TFLOPS) and 2 FP4 PFLOPS of performance for training and inference, offering new levels of performance, efficiency, and scalability that will open doors to ZetaFLOPS-scale AI systems in the coming years. Therefore, to be competitive in China, Nvidia and its peers from America must offer something better to stay relevant and continue pushing their standards for compute and AI around the world. So, for months, Nvidia has been courting the U.S. government and legislators to let it sell cut-down versions of its Blackwell processors or even full-fat Hopper H200 processors (which beat both Ascend 910C and upcoming Ascend 950PR/950DT in FP16/BF16 and FP8) to China, according to media reports. However, if the bill passes as law, then the best things that Nvidia will be able to sell to its Chinese customers in the next 30 months (i.e., till mid-2028) will be its HGX H20, L20 PCIe, and L2 PCIe GPUs that are outdated today and will look antique several years down the road. Nvidia argues that if it cannot sell reasonably competitive, but performance-capped GPUs to Chinese entities, local hardware developers like Huawei, Biren Technologies, or Moore Threads will quickly dominate the market, which will permanently displace U.S. technology in the People's Republic and will challenge it elsewhere as Chinese companies tend to expand. Nvidia also claims that allowing exports of controlled, downgraded accelerators slows China more effectively than a total ban, because it maintains dependence on U.S. hardware and standards rather than encouraging China to accelerate its own ecosystem. Finally, Nvidia warns that losing China revenue weakens America's overall leadership in high-performance AI computing, as it affects revenue and R&D. 30 months after enactment, the U.S. Department of Commerce will be able to adjust these technical thresholds originally set in 2023, but only with the majority approval of the End-User Review Committee. Furthermore, any planned modifications, along with a detailed assessment of how such changes could alter the capabilities of Chinese AI developers or influence military and cyber applications, must be disclosed to Congress at least 30 days in advance. The new bill was proposed by Pete Ricketts (R), Chris Coons (D), Tom Cotton (R), Jeanne Shaheen (D), Dave McCormick (R), and Andy Kim (D). "The rest of the 21st Century will be determined by who wins the AI race, and whether this technology is built on American values of free thought and free markets or the values of the Chinese Communist Party," said Senator Coons. "As China races to close our lead in AI, we cannot give them the technological keys to our future through advanced semiconductor chips. This bipartisan bill will protect America's advantage in computing power so that the world's most next-generation AI models are built at home by American companies, and the world's infrastructure is built on the American tech stack."

[2]

Trump's go-ahead for Nvidia chips to China draws GOP blowback

Some key Republicans are raising alarm over President Trump's blessing for Nvidia to sell advanced semiconductor chips to China, warning that there are no real safeguards to prevent Beijing from using the technology to challenge American dominance in artificial intelligence. Rep. John Moolenaar (R-Mich.) issued a stark warning on the X account of the Select Committee on Competition with China, which he chairs. "The CCP [Chinese Communist Party] will use these highly advanced chips to strengthen its military capabilities and totalitarian surveillance," he said. "Finally, Nvidia should be under no illusions - China will rip off its technology, mass produce it themselves, and seek to end Nvidia as a competitor. That is China's playbook and it is using it in every critical industry." Trump announced on his social media site TruthSocial on Monday that he was greenlighting the sale of Nvidia's advanced H200 chips to "approved customers in China and other Countries, under conditions that allow for continued strong National Security." Nvidia's CEO Jensen Huang lobbied for permission to sell advanced chips to China and the company applauded Trump's announcement in a statement to The Hill, arguing it would "allow America's chip industry to compete to support high paying jobs and manufacturing in America." "Offering H200 to approved commercial customers, vetted by the Department of Commerce, strikes a thoughtful balance that is great for America," it added. Sen. Josh Hawley (R-Mo.), an outspoken China hawk, said he remained skeptical of the arrangement. "I will just say as a general matter, I'm not a huge fan of sending our hardware to China," Hawley told The Hill. "I don't want them, A, to use it to continue the build out of their surveillance state. B, I don't want them to have better AI than we do," he said. "On the president's specific action," he added, "I need to see the security precautions that he says are part of this deal. I just haven't seen those, so I can't comment with specificity on that." Trump also said that 25 percent of the Nvidia chip sales "will be paid to the United States of America," an apparent profit-sharing deal. The unusual arrangement comes as Trump has sought public stake in various U.S. firms, a move that cuts against GOP free-market orthodoxy. The H200 is Nvidia's second-tier artificial intelligence chip, described as being 10 times slower than its premier Blackwell chip, which Trump has not signaled would be sold to China. Trump said he notified Chinese President Xi Jinping of his decision and that Xi responded positively, although the Financial Times reported that Beijing is moving to limit access to the H200 chips. The president's announcement was met with immediate outrage from Democrats. Rep. Gregory Meeks (D-N.Y.), ranking member of the House Foreign Affairs Committee, and Rep. Raja Krishnamoorthi (D-Ill), Ranking Member of the House Select Committee on Competition with China, each issued their own rebuke of Trump's action. "Under this administration, our national security is for sale," Meeks said in a statement. "Weakening export controls gives Beijing exactly what it needs to close [the AI] gap," Krishnamoorthi said in a statement. "Instead of opening the spigot for H200 sales to China, we should strengthen guardrails, build cutting-edge capacity here in the United States, and ensure that American workers and our national security -- not the CCP -- benefit from the future of AI." Nikki Haley, the 2024 Republican presidential candidate who served as Ambassador to the United Nations during Trump's first term, joined the chorus of critics. "Ending the ban on powerful AI chips to China will backfire, costing America more than we gain financially," she said on X. "By selling the very tools China needs to out-compete us, we undermine our own national security." Republicans in Congress were more cautious in their criticism, but have also backed legislation that would prevent such sales. Sen. Pete Ricketts (R-Neb.), a member of the Senate Committee on Banking, Housing, and Urban Affairs, which has jurisdiction over export controls, told The Hill he wants to keep as many "high-end AI chips out China's hands as we can," in response to Trump's announcement. Ricketts introduced last week the bipartisan Secure and Feasible Exports (SAFE) Chips Act, a bill that would freeze in place the current limits on the number and types of advanced semiconductor chips exported to other countries, in particular China. The limits would remain in place for 30 months -- or two and a half years -- and then can be reassessed. Ricketts played down any potential conflicts between his bill and Trump's announcement. "The goal is the same, to be able to make sure we're dominating the AI race," he answered. "The SAFE chips act doesn't revoke anybody's license, and it gives the Commerce secretary the ability to go back and review this after 30 months. So I think what our bill does actually supplements the administration and what we're trying to do with regard to dominating the AI race." Hawley suggested working with the administration to try and find a "middle way." "I'm sure we can impose export controls by law," he said. "And maybe we ought to work with the White House to do that in a way that -- I think the president wants to help American companies, that's good. But maybe there's a middle way here to be reached where we do that in a way that is protective of our overall national security and our economic security." Rush Doshi, who served as deputy senior director for China and Taiwan on the National Security Council under President Biden, called Trump's Nvidia announcement "possibly decisive in the AI race." "Compute is our main advantage -- China has more power, engineers, and the entire edge layer -- so by giving this up we increase the odds the world runs on Chinese AI," he posted on the social media site X. Democratic criticism focused on the various ways the technology could ultimately help Beijing hurt America, both economically and militarily. Sens. Jeanne Shaheen (D-N.H.), ranking member of the Senate Foreign Relations Committee, Jack Reed (D-R.I.), ranking member of the Senate Armed Services Committee, Chris Coons (D-Del.), Elizabeth Warren (D-Mass.), Brian Schatz (D-Hawaii), Andy Kim (D-N.J.), Michael Bennet (D-Colo.) and Elissa Slotkin (D-Mich.) warned the H200 chips are "vastly more capable than anything China can make" and could cost the U.S. its advantage on AI. "Access to these chips would give China's military transformational technology to make its weapons more lethal, carry out more effective cyberattacks against American businesses and critical infrastructure and strengthen their economic and manufacturing sector," they wrote in a joint statement.

[3]

Senators Unveil Bill to Keep Trump From Easing Curbs on AI Chip Sales to China

WASHINGTON, Dec 4 (Reuters) - A bipartisan group of U.S. senators, including prominent Republican China hawk Tom Cotton, on Thursday unveiled a bill that would block the Trump administration from loosening rules that restrict Beijing's access to artificial intelligence chips for 2.5 years. The bill, known as the SAFE CHIPS Act, was filed by Republican Senator Pete Ricketts and Democrat Chris Coons. It would require the Commerce Department, which oversees export controls, to deny any license requests for buyers in China, Russia, Iran or North Korea to receive U.S. AI chips more advanced than the ones they currently are allowed to obtain for 30 months. After that, Commerce would have to brief Congress on any proposed rule changes a month before they take effect. "Denying Beijing access to (the best American) AI chips is essential to our national security," Ricketts said in a statement. The legislation, which was co-sponsored by Republican Dave McCormick and Democrats Jeanne Shaheen and Andy Kim, represents a rare effort led in part by Trump's own party to stop him from further relaxing tech export restrictions on China. Faced with new Chinese export curbs on the rare earth metals that global tech companies rely on, Trump's Commerce Department imposed and then rolled back curbs on Nvidia's H20 AI chips, a move that was criticized by Republican Representative John Moolenaar, who chairs the House China Select Committee. As part of negotiations with China to delay its own rare earth controls, Trump pushed back by a year a rule to restrict U.S. tech exports to units of already-blacklisted Chinese companies and has vowed to nix a Biden-era rule restricting AI chip exports globally to countries based in part on concerns around chip smuggling to China. The bill comes as the Trump administration mulls greenlighting sales of Nvidia's H200 artificial intelligence chips to China, Reuters reported. China hawks in Washington fear that Beijing could use the prized chips to supercharge its military with AI-powered weapons and more powerful intelligence and surveillance capabilities. (Reporting by Alexandra Alper; Editing by Leslie Adler)

[4]

US senators unveil bill to prevent easing of curbs on Nvidia chip sales to China

A bipartisan group of U.S. senators, including prominent Republican China hawk Tom Cotton, on Thursday unveiled a bill that would block the Trump administration from loosening rules that restrict Beijing's access to artificial intelligence chips from Nvidia and AMD for 2.5 years. The bill, known as the SAFE CHIPS Act, was filed by Republican Senator Pete Ricketts and Democrat Chris Coons. It would require the Commerce Department, which oversees export controls, to deny any license requests for buyers in China, Russia, Iran or North Korea to receive U.S. AI chips more advanced than the ones they currently are allowed to obtain for 30 months. After that, Commerce would have to brief Congress on any proposed rule changes a month before they take effect. The legislation, which was co-sponsored by Republican Dave McCormick and Democrats Jeanne Shaheen and Andy Kim, represents a rare effort led in part by Trump's own party to stop him from further relaxing tech export restrictions on China. "Denying Beijing access to (the best American) AI chips is essential to our national security," Ricketts said in a statement. The bill comes as the Trump administration mulls greenlighting sales of Nvidia's H200 artificial intelligence chips to China, Reuters reported. China hawks in Washington fear that Beijing could use the prized chips to supercharge its military with AI-powered weapons and more powerful intelligence and surveillance capabilities. Faced with new Chinese export curbs on the rare earth metals that global tech companies rely on, Trump's Commerce Department imposed and then rolled back curbs on Nvidia's H20 AI chips, a move that was criticized by Republican Representative John Moolenaar, who chairs the House China Select Committee. Advanced Micro Devices, a Nvidia rival, is also eager to sell to China. As part of negotiations with China to delay its own rare earth controls, Trump pushed back by a year a rule to restrict U.S. tech exports to units of already-blacklisted Chinese companies and has vowed to nix a Biden-era rule restricting AI chip exports globally to countries based in part on concerns around chip smuggling to China. Greg Allen, a senior adviser at the Center for Strategic and International Studies, a Washington, D.C.-based think tank, called the bill a common-sense measure that should be passed urgently, noting that the United States cannot dissuade China from seeking to swiftly end its reliance on U.S. technology. "The only choice for America is whether or not we should sell China the technology to make their decoupling strategy fast and convenient," he said. (Reporting by Alexandra Alper; Editing by Leslie Adler)

[5]

New Bill Seeks To Stop China From Getting Nvidia's Top AI Chips - NVIDIA (NASDAQ:NVDA)

U.S. lawmakers introduced legislation Thursday aimed at blocking the Trump administration from granting China broader access to advanced artificial intelligence chips. A bipartisan group of U.S. senators, including Republican China hawk Tom Cotton, introduced a bill on Thursday to prevent the Trump administration from easing restrictions on China's access to advanced artificial intelligence chips from Nvidia Corp (NASDAQ:NVDA) and Advanced Micro Devices, Inc (NASDAQ:AMD) for the next 2.5 years. Republican Senator Pete Ricketts and Democrat Chris Coons filed the SAFE CHIPS Act, which would require the Commerce Department to deny any license requests from buyers in China, Russia, Iran, or North Korea seeking AI chips more advanced than what they can currently obtain for 30 months. Also Read: Nvidia Bought by Major Investor Betting on 'Broader' AI Growth After that period, Commerce would need to brief Congress 30 days before making any rule changes, Reuters reported on Friday. Co-sponsors include Republican Dave McCormick and Democrats Jeanne Shaheen and Andy Kim, marking a rare instance of lawmakers in Trump's own party moving to block the administration from loosening tech export controls on China. America's expanding chip crackdown on China dominated the week as Nvidia CEO Jensen Huang and several investors warned that U.S. policy could reshape the semiconductor industry. Huang met President Donald Trump on Wednesday to discuss export restrictions while Congress weighed bills to curb China's access to advanced AI chips. Huang said he supports giving U.S. firms priority but criticized the proposed GAIN AI Act, arguing it would hurt the country, and welcomed reports that lawmakers dropped it from the defense bill. He also urged Congress to replace state-by-state AI rules with a single federal standard, warning that 50 different laws would stall innovation and threaten national security. But House Majority Leader Steve Scalise said the plan lacks the votes. China's Market Impact on Nvidia Beijing has already shut Nvidia out of its AI-chip market, slashing the company's share "from 95% to 0%" by banning foreign chips from state data centers, tightening import checks, and racing to triple domestic AI-chip output by 2026. With stockpiles and improving homegrown alternatives, Chinese demand has collapsed. Huang countered that Nvidia can thrive without China, projecting $3 trillion to $4 trillion in global AI-infrastructure spending by 2030. Concerns Over Potential Sales to China Meanwhile, the bill comes as the Trump administration considers allowing sales of Nvidia's H200 AI chips to China, a move that Washington's China hawks warn could help Beijing accelerate AI-powered military systems and surveillance capabilities. The Trump administration has recently imposed and then rolled back restrictions on Nvidia's H20 chips, responding to China's new export curbs on rare earth metals. Criticism of Administration's Actions The back-and-forth drew criticism from Republican Representative John Moolenaar, who chairs the House China Select Committee. AMD, Nvidia's rival, is also pushing to sell to China. During negotiations with Beijing aimed at delaying China's rare earth controls, Trump delayed by one year a rule tightening U.S. tech export restrictions on subsidiaries of already-blacklisted Chinese companies. He has also vowed to overturn a Biden-era rule that restricts AI chip exports globally based partly on concerns about smuggling to China. In October, Nvidia became the biggest company in terms of market cap, leapfrogging its Big Tech peers like Apple Inc (NASDAQ:AAPL), Microsoft Corp (NASDAQ:MSFT) NVDA Price Action: Nvidia shares were up 0.67% at $184.60 during premarket trading on Friday, according to Benzinga Pro data. Read Next: Broadcom's New Google Chips Could Be 40% Cheaper To Run Than Nvidia's, Analyst Says Image by Below the Sky via Shutterstock NVDANVIDIA Corp$184.250.47%OverviewAAPLApple Inc$280.09-0.22%AMDAdvanced Micro Devices Inc$217.600.75%MSFTMicrosoft Corp$482.690.38%Market News and Data brought to you by Benzinga APIs

[6]

US senators unveil bill to prevent easing of curbs on Nvidia chip sales to China

WASHINGTON, Dec 4 (Reuters) - A bipartisan group of U.S. senators, including prominent Republican China hawk Tom Cotton, on Thursday unveiled a bill that would block the Trump administration from loosening rules that restrict Beijing's access to artificial intelligence chips from Nvidia and AMD for 2.5 years. The bill, known as the SAFE CHIPS Act, was filed by Republican Senator Pete Ricketts and Democrat Chris Coons. It would require the Commerce Department, which oversees export controls, to deny any license requests for buyers in China, Russia, Iran or North Korea to receive U.S. AI chips more advanced than the ones they currently are allowed to obtain for 30 months. After that, Commerce would have to brief Congress on any proposed rule changes a month before they take effect. The legislation, which was co-sponsored by Republican Dave McCormick and Democrats Jeanne Shaheen and Andy Kim, represents a rare effort led in part by Trump's own party to stop him from further relaxing tech export restrictions on China. "Denying Beijing access to (the best American) AI chips is essential to our national security," Ricketts said in a statement. The bill comes as the Trump administration mulls greenlighting sales of Nvidia's H200 artificial intelligence chips to China, Reuters reported. China hawks in Washington fear that Beijing could use the prized chips to supercharge its military with AI-powered weapons and more powerful intelligence and surveillance capabilities. Faced with new Chinese export curbs on the rare earth metals that global tech companies rely on, Trump's Commerce Department imposed and then rolled back curbs on Nvidia's H20 AI chips, a move that was criticized by Republican Representative John Moolenaar, who chairs the House China Select Committee. Advanced Micro Devices, a Nvidia rival, is also eager to sell to China. As part of negotiations with China to delay its own rare earth controls, Trump pushed back by a year a rule to restrict U.S. tech exports to units of already-blacklisted Chinese companies and has vowed to nix a Biden-era rule restricting AI chip exports globally to countries based in part on concerns around chip smuggling to China. Greg Allen, a senior adviser at the Center for Strategic and International Studies, a Washington, D.C.-based think tank, called the bill a common-sense measure that should be passed urgently, noting that the United States cannot dissuade China from seeking to swiftly end its reliance on U.S. technology. "The only choice for America is whether or not we should sell China the technology to make their decoupling strategy fast and convenient," he said. (Reporting by Alexandra Alper; Editing by Leslie Adler)

Share

Share

Copy Link

A bipartisan group of U.S. senators has introduced the SAFE Chips Act to lock in export controls on AI chips from Nvidia and AMD to China for 30 months. The bill would prevent the Trump administration from loosening restrictions, limiting sales to older H20 and MI308 models while China advances its own semiconductor capabilities.

Bipartisan Group of U.S. Senators Introduces SAFE Chips Act

A bipartisan group of U.S. senators has unveiled legislation designed to block the Trump administration from relaxing export controls on advanced artificial intelligence chips to China and other adversary nations. The Secure and Feasible Exports of Chips Act of 2025, known as the SAFE Chips Act, was filed by Republican Senator Pete Ricketts and Democrat Chris Coons, with co-sponsors including prominent China hawk Tom Cotton, Dave McCormick, Jeanne Shaheen, and Andy Kim

1

3

. The bill represents a rare effort led in part by Donald Trump's own party to prevent further relaxation of tech export restrictions on China4

.

Source: ET

Leading-Edge AI Chip Exports Frozen for 30 Months

If passed, the SAFE Chips Act would require the Commerce Department to deny any license requests for buyers in China, Russia, Iran, or North Korea to receive U.S. AI chips more advanced than currently permitted for 30 months

3

. This means Nvidia's H20 and AMD's MI308 processors would remain the best AI chips these companies could supply to China until mid-20281

. The proposed definition of an advanced processor mirrors technical thresholds used in the U.S. Commerce Department's existing ECCN 3A090/4A090 controls, encompassing total processing performance, performance density, memory bandwidth, and interconnect bandwidth1

. After 30 months, Congress would need to be briefed on any proposed rule changes at least 30 days before they take effect5

.

Source: Tom's Hardware

National Security Concerns Drive Legislative Push

"Denying Beijing access to the best American AI chips is essential to our national security," Pete Ricketts said in a statement

3

. China hawks in Washington fear that Beijing could use advanced semiconductors to supercharge its military capabilities with AI-powered weapons and more powerful surveillance capabilities3

. Rep. John Moolenaar, who chairs the House China Select Committee, issued a stark warning: "The CCP will use these highly advanced chips to strengthen its military capabilities and totalitarian surveillance"2

. The bill comes as the Trump administration mulls greenlighting sales of Nvidia's H200 AI chips to China, a move that has drawn criticism from both Republicans and Democrats4

.

Source: Market Screener

Nvidia and AMD Face Competitive Disadvantage

Both H20 and MI308 were originally introduced in 2023, and Chinese companies have already developed AI accelerators offering comparable or higher performance. Huawei's existing Ascend 910C beats H20 in FP16/BF16 performance with 780 TFLOPS versus 148 TFLOPS, while the next generation Ascend 950PR/950DT NPUs will offer 1 FP8 PFLOPS compared to H20's 296 TFLOPS

1

. Nvidia has been courting the U.S. government for months to sell cut-down versions of its Blackwell processors or full-fat Hopper H200 processors to China1

. The company argues that if it cannot sell reasonably competitive, performance-capped GPUs to Chinese entities, local hardware developers like Huawei, Biren Technologies, or Moore Threads will quickly dominate the market, permanently displacing U.S. technology in China1

.Related Stories

Trump Administration Faces GOP Blowback

Donald Trump announced on his social media site TruthSocial that he was greenlighting the sale of Nvidia's H200 AI chips to "approved customers in China and other Countries, under conditions that allow for continued strong National Security"

2

. The announcement drew immediate criticism from lawmakers. Sen. Josh Hawley told The Hill: "I don't want them to use it to continue the build out of their surveillance state. I don't want them to have better AI than we do"2

. Trump also revealed that 25 percent of the Nvidia chip sales "will be paid to the United States of America," an unusual profit-sharing arrangement2

. The Commerce Department recently imposed and then rolled back curbs on Nvidia's H20 AI chips, a move criticized by Congress4

.U.S. Leadership in the AI Sector at Stake

Nvidia warns that losing China revenue weakens U.S. leadership in the AI sector, as it affects revenue and research and development capabilities

1

. Beijing has already shut Nvidia out of much of its AI-chip market, slashing the company's share from 95% to near zero by banning foreign chips from state data centers and racing to triple domestic AI-chip output by 20265

. Greg Allen, a senior adviser at the Center for Strategic and International Studies, called the bill a common-sense measure that should be passed urgently, noting that "the only choice for America is whether or not we should sell China the technology to make their decoupling strategy fast and convenient"4

. The legislation excludes consumer and gaming hardware not designed for data centers from regulation, allowing AMD and Nvidia to continue selling high-end consumer GPUs to adversary countries1

.References

Summarized by

Navi

Related Stories

Congress advances AI Overwatch Act, seeking veto power over Trump's AI chip exports to China

21 Jan 2026•Policy and Regulation

U.S. Legislator Challenges Trump Administration's Decision to Resume Nvidia H20 GPU Sales to China

19 Jul 2025•Policy and Regulation

Bipartisan Congressional Support Emerges for Trump's Nvidia China Chip Ban

06 Nov 2025•Policy and Regulation

Recent Highlights

1

ByteDance Faces Hollywood Backlash After Seedance 2.0 Creates Unauthorized Celebrity Deepfakes

Technology

2

Microsoft AI chief predicts artificial intelligence will automate most white-collar jobs in 18 months

Business and Economy

3

Google reports state-sponsored hackers exploit Gemini AI across all stages of cyberattacks

Technology