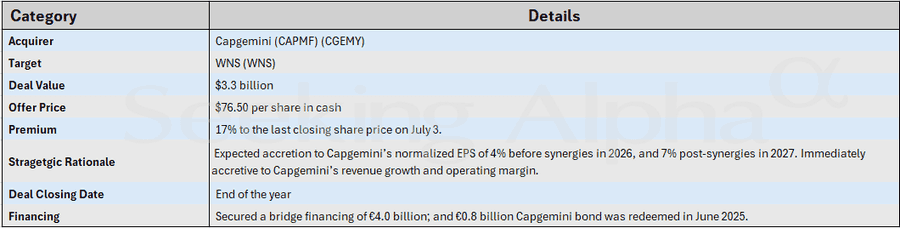

Capgemini Acquires WNS for $3.3 Billion to Boost AI-Powered Intelligent Operations

12 Sources

12 Sources

[1]

France's Capgemini to buy WNS for $3.3bn to improve AI offerings

The acquisition comes as Capgemini seeks to expand its AI operations, and WNS will also provide more access to the US market. Tech and consultancy group Capgemini has agreed to buy US-listed WNS Holdings Ltd. for $3.3 billion (€2.8bn), according to a statement released on Monday. The French firm said that it is offering $76.50 per WNS share, representing a premium of 17% on the stock's closing price on Thursday. This does not include WNS' financial debt. Capgemini forecasts that the deal will boost its earnings per share by about 4% on a normalized basis in 2026, rising to 7% in 2027 after combining operations. The French firm plans to generate additional annual revenues of €100 million to €140mn by the end of 2027 through revenue synergies. Cost and operating model synergies are also expected to come to €50mn to €70mn per year, before taxes, by the end of 2027. The acquisition comes as Capgemini seeks to expand its AI operations. "Capgemini's acquisition of WNS will provide the Group with the scale and vertical sector expertise to capture that rapidly emerging strategic opportunity created by the paradigm shift from traditional BPS (Business Process Services) to Agentic AI-powered Intelligent Operations," Aiman Ezzat, Chief Executive Officer of Capgemini, said in a statement. "Immediate cross-selling opportunities will be unlocked through the integration of our complementary offerings and clients," he added. As of the end of March, WNS had almost 65,000 employees across 64 delivery centres worldwide. The firm has a number of major clients, including Coca-Cola, T-Mobile, and United Airlines. The deal was unanimously approved by the board of the two firms and is expected to close by the end of the year, subject to shareholder and regulatory approval. At just after 10am CEST, Capgemini's share price was down around 3.5% at 140.10 on Monday morning.

[2]

Capgemini bets on agentic AI with $3.3bn WNS acquisition

Capgemini offices, Krakow, Poland. Image: Longfin Media /Stock.adobe.com French technology services company Capgemini is going all in on agentic AI services with its $3.3bn acquisition of US-based WNS. The cash acquisition of WNS at $76.50 per share has been approved by both board of directors and is expected to close by the end of 2025. Capgemini says it aims through the acquisition to create "a leader in Intelligent Operations to capture enterprise investment in Agentic AI to transform their end-to-end business processes". It is a further sign that IT services companies around the globe are seeing the rise of AI - and agentic AI in particular - as where future revenues lie. "Enterprises are rapidly adopting Generative AI and Agentic AI to transform their operations end-to-end," said Aiman Ezzat, CEO of Capgemini. "Business Process Services (BPS) will be the showcase for agentic AI. Capgemini's acquisition of WNS will provide the Group with the scale and vertical sector expertise to capture that rapidly emerging strategic opportunity created by the paradigm shift from traditional BPS to agentic AI-powered intelligent operations." "Together we will create a leader in Intelligent Operations, uniquely positioned to support organisations in their AI-powered business process transformation, blending the critical capabilities needed from consulting, technology and platforms to deep process and industry expertise," he continued, adding that the acquisition also offers the French company greater exposure to the US market. "Organisations that have already digitised are now seeking to reimagine their operating models by embedding AI at the core, shifting from automation to autonomy," said Keshav R Murugesh, CEO of WNS. "By combining our deep domain and process expertise with Capgemini's global reach, cutting-edge Gen AI and Agentic AI capabilities, a robust partner ecosystem, and advanced technology platforms, we are creating a powerful proposition that accelerates enterprise reinvention. WNS is a leader in Digital Business Process Services (BPS), and boast clients from United Airlines and Aviva to Centrica and McCain Foods. It reported revenues of $1,266m in its fiscal year 2024 with an 18.7pc operating margin. The combined entities would have generated a revenue of €23.3bn at a 13.6pc operating margin in 2024, according to Capgemini. Capgemini employs some 340,000 in more than 50 countries, and the Group reported 2024 global revenues of €22.1 billion. WNS employs over 64,000 and has operations in 13 countries including Canada, India, Turkey, the UK and the US. Don't miss out on the knowledge you need to succeed. Sign up for the Daily Brief, Silicon Republic's digest of need-to-know sci-tech news.

[3]

Capgemini to Acquire WNS for $3.3 Billion with Focus on Agentic AI | AIM

The acquisition is expected to strengthen Capgemini's presence in the US market. Capgemini has announced a definitive agreement to acquire WNS, a mid-sized Indian IT firm, for $3.3 billion in cash. This marks a significant step towards establishing a global leadership position in agentic AI. The deal, unanimously approved by the boards of both companies, values WNS at $76.50 per share -- a premium of 28% over the 90-day average and 17% above the July 3 closing price. The acquisition is expected to immediately boost Capgemini's revenue growth and operating margin, with normalised EPS accretion of 4% by 2026, increasing to 7% post-synergies in 2027. "Enterprises are rapidly adopting generative AI and agentic AI to transform their operations end-to-end. Business process services (BPS) will be the showcase for agentic AI," Aiman Ezzat, CEO of Capgemini, said. "Capgemini's acquisition of WNS will provide the group with the scale and vertical sector expertise to capture that rapidly emerging strategic opportunity created by the paradigm shift from traditional BPS to agentic AI-powered intelligent operations." Pending regulatory approvals, the transaction is expected to close by the end of 2025. WNS' integration is expected to strengthen Capgemini's presence in the US market while unlocking immediate cross-selling opportunities through its combined offerings and clientele. WNS, which reported $1.27 billion in revenue for FY25 with an 18.7% operating margin, has consistently delivered a revenue growth of around 9% over the past three fiscal years. "As a recognised leader in the digital BPS space, we see the next wave of transformation being driven by intelligent, domain-centric operations that unlock strategic value for our clients," Keshav R Murugesh, CEO of WNS, said. "Organisations that have already digitised are now seeking to reimagine their operating models by embedding AI at the core -- shifting from automation to autonomy." The companies expect to drive additional revenue synergies between €100 million and €140 million, with cost synergies of up to €70 million annually by the end of 2027. "WNS and Capgemini share a bold, future-focused vision for Intelligent Operations. I'm confident that Capgemini is the ideal partner at the right time in WNS' journey," Timothy L Main, chairman of WNS' board of directors, said. Capgemini, already a major player with over €900 million in GenAI bookings in 2024 and strategic partnerships with Microsoft, Google, AWS, Mistral AI, and NVIDIA, aims to solidify its position as a transformation partner for businesses looking to embed agentic AI at scale.

[4]

Capgemini buys business automation firm WNS for $3.3B to enhance its agentic AI expertise - SiliconANGLE

Capgemini buys business automation firm WNS for $3.3B to enhance its agentic AI expertise French technology consulting services giant Capgemini SE said today it has agreed to buy the Indian business process automation firm WNS Holdings Ltd. in a $3.3 billion cash deal, as part of an effort to expand the range of artificial intelligence tools it can offer to customers. The acquisition will enable Capgemini to create a consulting service that's focused on helping companies boost business process and cost efficiency through the use of generative AI and agentic AI technology. Capgemini said it's buying WNS for $76.50 per share, which represents a 17% premium over its last closing price on July 3. The deal does not include WNS's financial debt. WNS, which is based in India and specializes in business process outsourcing and data analytics, will bring its "high growth, margin accretive and resilient Digital Business Process Services while further increasing our exposure to the U.S. market," said Capgemini Chief Executive Aiman Ezzat (pictured, left, alongside WNS CEO Keshav Murugesh). WNS counts major customers including Coca-cola Co., T-Mobile USA Inc. and United Airlines Inc. When the acquisition closes, it's expected to position Capgemini as a leader in digital business process services, blending WNS's horizontal and vertical expertise with a global footprint. The two companies generated combined revenues in digital BPS of more than $1.9 billion. One of the largest opportunities for companies to create value with generative AI and AI agents is said to be in the redesign of business processes and operations. This is likely to attract a significant amount of AI investment budgets, as the technology promises to transform organizations into AI-powered companies with dramatically increased productivity through a new type of service known as intelligent operations. Intelligent operations is a consulting-led approach that aims to transform horizontal and vertical business processes with AI agents and generative AI, seeking to improve companies' efficiency, speed and agility and improve business outcomes through process automation. Capgemini and WNS already dabble in intelligent operations. Capgemini offers consulting-led transformation of business processes, advanced AI tools and BPS platforms, while WNS has built a number of industry-specific BPS offerings. Capgemini said the addition of WNS will act like a catalyst, transforming it into an intelligent operations leader, with both the required scale and unique capabilities ranging from strategy and transformation to horizontal and vertical sector expertise. "The mix of WNS and Capgemini's complementary offerings and clients will immediately unlock cross-selling opportunities," Ezzat said in a statement. "It will also lay down the foundations to build the capabilities to seize the Intelligent Operations strategic market opportunity." Forrester Research Inc. analyst Charlie Dai told Computerworld that hybrid automation and agentic AI will be major priorities for enterprise decision makers in the next three years. He said WNS's domain-specific AI agents and platforms such as its AI.Agentic suite and WNS Expirus will substantially improve Capgemini's own agent-focused BPS offerings. There's also a strategic angle to the acquisition, said Everest Group Managing Partner Rajesh Ranjan. He pointed out that agentic AI is still a nascent technology, and that most implementations up until now are pilot projects. "The key driver is less to do with the tools and software, but rather the access to business process operations expertise that WNS brings to the table," Ranjan told Computerworld. "This is a pre-requisite to develop and deploy real-world AI solutions." Capgemini said it expects the acquisition to be finalized by the end of the year, adding that it will be immediately accretive to both its revenue and its operating margin. The markets didn't react too kindly to the news, though. Capgemini's stock fell around 5% on Europe's benchmark STOXX 600 index, as analysts from Morgan Stanley warned that the acquisition would have a negative effect on its balance sheet flexibility, without adding any significant revenue boost.

[5]

Capgemini shares drop post-WNS deal on AI impact concerns - The Economic Times

Capgemini's shares experienced a drop following its agreement to acquire WNS, a BPO firm, in a cash transaction. Investors are expressing concerns about the potential impact of generative AI on the BPO sector, which could lead to increased automation and reduced revenue.Capgemini shares fell over 5% on Monday after the IT major announced a $3.3 billion (Rs 28,280 crore) cash acquisition of business process outsourcing (BPO) firm WNS. The decline reflects investor concerns about the potential impact of generative AI on the BPO market that Capgemini is targeting through this deal. Analysts at Morgan Stanley noted that AI could make the BPO sector highly automated, shifting it away from its traditional people-intensive model. This could lead to lower revenues and intensify competition from new entrants, they said. While WNS is not large enough to be transformational for Capgemini's overall financials, the acquisition will weigh on its balance sheet for a couple of years, the analysts added. Capgemini shares fell as much as 5.6% to €137.15 -- their lowest level since April. Under the deal, Capgemini will acquire WNS for $76.50 per share, representing a 17% premium to WNS's Friday closing price. Capgemini said the acquisition will be immediately accretive to revenue growth and operating margin, and will boost its normalised earnings per share by 4% in 2026 and 7% in 2027 after synergies kick in. The company forecasts €100-140 million ($118-165 million) in revenue synergies and expects annual pretax run-rate cost and operating model synergies of €50-70 million by end-2027. The transaction has been approved by the boards of both companies and is expected to close by year-end, subject to regulatory approvals. WNS provides BPO and data analytics services to clients including Coca-Cola, T-Mobile, and United Airlines. In fiscal 2025, it reported $1.27 billion in revenue with an 18.7% operating margin. Its revenue has grown around 9% at constant currency on average over the last three fiscal years.

[6]

Capgemini Doubles Down On Agentic AI With $3.3 Billion WNS Acquisition - Capgemini (OTC:CGEMY), WNS (Holdings) (NYSE:WNS)

Capgemini SE CGEMY announced Monday that it will acquire WNS Holdings Ltd. WNS in a $3.3 billion all-cash deal to create a global leader in Agentic AI-powered Intelligent Operations. The transaction, which offers $76.50 per WNS share, reflects a 17% premium over WNS' most recent closing price and has received unanimous approval from both companies' boards. Capgemini expects the deal to close by year-end, pending shareholder and court approvals. The acquisition gives Capgemini access to WNS's high-margin digital business process services and strengthens its position in the U.S. market. The combination is designed to capitalize on a growing enterprise shift toward AI-driven operational models. Also Read: IBM Just Tackled One Of Tech's Most Annoying Bottlenecks Aiman Ezzat, CEO of Capgemini, said the combination is designed to capture the surge in enterprise demand for Agentic AI, which is transforming how companies manage operations from end to end. He described the merger as a step toward building a new benchmark for Intelligent Operations that leverages automation, data, and domain expertise to deliver superior results at scale. Keshav R. Murugesh, CEO of WNS, echoed the enthusiasm, calling the deal a strategic leap toward embedding AI at the core of business models. He noted that the combined portfolio would expand Capgemini's footprint across industries and enhance its ability to support organizations as they shift from automation to autonomy in operational strategy. WNS reported $1.27 billion in revenue for fiscal 2025 and holds long-term contracts with companies like United Airlines and Aviva. Capgemini expects the deal to increase normalized EPS by 4% in 2026 and 7% by 2027, post-synergies. Estimated annual revenue synergies range between 100 million euros (~$108 million) and 140 million euros (~$151.2 million), with cost savings projected up to 70 million euros (~$75.6 million). Capgemini is funding the transaction with a 4 billion euros bridge loan, partially backed by internal cash and future debt issuance. The company plans to integrate WNS into its Global Business Services unit, citing a strong cultural fit and complementary capabilities across AI, platforms, and consulting. Related ETFs: Global X Artificial Intelligence & Technology ETF AIQ, iShares Expanded Tech-Software Sector ETF IGV. Price Action: WNS shares were trading higher by 12.44% to $73.51 premarket at last check Monday. Read Next: After Microsoft Lays Off 9,100 Workers, Xbox Executive Tells Fired Workers To Turn To AI For Mental Health Help Photo via Shutterstock CGEMYCapgemini SE$34.24-0.15%OverviewWNSWNS (Holdings) Ltd$73.7012.7%AIQGlobal X Artificial Intelligence & Technology ETF$43.87-0.30%IGViShares Expanded Tech-Software Sector ETF$110.43-0.75% This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Market News and Data brought to you by Benzinga APIs

[7]

Capgemini's Planned $3.3B Buy Of WNS Targeting Agentic AI Expansion

'This transaction positions [Capgemini] as a leader in the emerging market of intelligent operation, which is the most significant opportunity for our clients to create value in the era of GenAI and agentic AI. The strategic value of this transaction lies in the complementarity of capabilities and expertise between Capgemini and WNS to provide intelligent operations at scale,' says Capgemini CEO Aiman Ezzat. Global business and technology services provider Capgemini Monday unveiled the planned $3.3 billion acquisition of India-based WNS in a significant play to build scale in the business process services needed to provide agentic AI. Paris-based Capgemini, ranked No. 4 on CRN's 2025 Solution Provider 500, is a $23 billion global business and technology transformation company with a focus on AI, GenAI, cloud, and data. WNS, which is headquartered in New York, London, and Mumbai, is a $1.3 billion global provider of business process management. [Related: ServiceNow Launches Major Focus On Agentic AI With Emphasis On Channel Partners] Capgemini declined to discuss further details of the planned acquisition of WNS in response to a CRN request. However, in an analyst conference call after news of the acquisition was released, Capgemini CEO Aiman Ezzat (pictured above) said in his prepared remarks that the transaction targets the growing need for AI capabilities. "This transaction positions the group as a leader in the emerging market of intelligent operation, which is the most significant opportunity for our clients to create value in the era of GenAI and agentic AI," Ezzat said. "The strategic value of this transaction lies in the complementarity of capabilities and expertise between Capgemini and WNS to provide intelligent operations at scale." Ezzat said Capgemini expects the integration of the two companies' business services global capabilities to be straightforward based on the cultural fit and complementarity of capability. The $3.3 billion acquisition, which was unanimously approved by the boards of both companies, is expected to close by the end of 2025, Ezzat said. Capgemini plans to finance the acquisition with about 1 billion Euros of available cash plus 4 billion Euros in bridge funding. The acquisition comes at the right time for Capgemini and WNS, Ezzat said. "Since the advent of ChatGPT and GenAI, enterprises have focused significant attention and increasing amounts of investment around GenAI, and more broadly, AI," he said. "Clients today better comprehend what the technology can actually deliver. Their focus is shifting from individual productivity to the transformation of end-to-end business processes." Large enterprises want to invest in agentic AI to change how they operate for both efficiency and growth, Ezzat said. "It is the realization that end-to-end business processes provide the background to fully leverage the power of GenAI and agentic AI," he said. "It is a unique opportunity to make AI real and reap its expected benefits." Capgemini started investing in GenAI over five years ago, building over 25 strategic partnerships, upskilling its staff, and developing a wide portfolio of offerings, and in the process became a leader in GenAI and agentic AI, with data and AI becoming one of the company's core pillars, Ezzat said. "With GenAI, bookings are already hitting 900 million euros last year," he said. "Clients rely on Capgemini and their business and technology partners for the GenAI transformation journey." The last 12 months have seen a significant increase in client interest in the revolution of business process services driven by agentic AI, Ezzat said. "We are convinced that intelligent operations, which is a consulting-led approach to transform and operate business processes leveraging GenAI and agentic AI, will be the primary showcase for agentic AI in terms of value creation," he said. "This is about making GenAI and agentic AI real for our clients." Business process services, or BPS, have over the last 20 years shifted from a focus on cost reduction to things like robotic process automation and digital platforms, Ezzat said. "Intelligent operation is the next revolution in the BPS market," he said. "It includes consulting-led business process transformation, leveraging GenAI and agentic AI. It provides clients with efficiency, speed, and agility through process hyper automation at scale while significantly improving business outcomes by combining data, AI, and digital. Client focus has shifted from cost and efficiency to agility, speed, and significantly better business outcomes. This is about value creation. In parallel, the BPS market is shifting away from its labor-based drivers to being consulting-led and tech-driven." Intelligence operation requires strategy and transformation, consulting, deep technology expertise, and in-depth knowledge of horizontal and sector processes to deliver end-to-end process transformation, blending advanced agentic AI agents, custom GenAI assistance, enterprise data, data platform and management, and digital solutions, Ezzat said. "Capgemini has essentially all the ingredients to answer its clients' need for intelligent operation," he said. "It is about scaling BPS. It's about industry knowledge. It's about leading in intelligent operation. This is the real strategic value of this transaction." WNS is a global leader in digital business process services operating at scale with deep industry and process expertise, with offerings powered by a comprehensive stack of solutions and platforms and fueled by a set of data and analytics solutions, Ezzat said. "Their vertical industry specific expertise supports over 40 percent of their revenue, while data and analytics contributes 13 percent, underscoring WNS' commitment to data and insight-led business process transformation," he said. WNS and its 65,000 employees serve a blue-chip client base with clients including United Airlines, U.K.-based Centrica, MNC Bank, and McCain Foods, Ezzat said. Nearly half the company's revenue comes from North America, he said. "WNS brings deep industry expertise through outcome-based platforms tailored to key verticals for every industry it serves," he said. "WNS has developed and deployed proprietary platforms that deliver measurable value to its clients. This includes, for example, WNS Malkom. It's an end-to-end AI-powered shipment documentation platform. It automates bills of lading, invoices, and consignment notes, turning core manual and error-prone processes into digital workflows. ... Malkom intelligent architecture is delivering 40 [percent] to 60 percent productivity gains, ROI of up to four times, and 99 percent data accuracy, also reducing invoicing disputes by 20 percent and cutting documentation cycle times." Because of the complementary capabilities, offerings, and clients, the acquisition immediately unlocks cross-selling opportunities, Ezzat said. "[We will] fully leverage the extensive portfolio of Capgemini service offerings with WNS clients, mainly in the U.S. and the U.K.," he said. "We also see a great opportunity to leverage WNS' digital BPS offerings, notably its platform and sector expertise in our client base. You can think about banking and insurance clients, for example, where today we can benefit from their vertical process capabilities." The combined company will be differentiated in its data and AI capabilities, Ezzat said. "We have invested in talent, innovation, and [an] ecosystem of strategic partners," he said. "Our approach is industry-specific and AI-powered. All these capabilities will be supported by an extended delivery network that brings scale and geographic diversity enabling global reach. Together, we have a unique set of capabilities that enable end-to-end business process transformation." The acquisition is strategic to both Capgemini and WNS, Ezzat said. "We share the same vision of the market and the fast-emerging opportunity around intelligent operation driven by GenAI and agentic AI," he said. "We are convinced that the complementarity of our capabilities and offerings will position Capgemini as the leader in this fast-emerging intelligent operation market, while providing great cross-selling revenue."

[8]

Capgemini to Acquire WNS for $3.3 Billion to Lead in Agentic AI-Powered Intelligent Operations

The total cash consideration will amount to $3.3 billion, excluding WNS net financial debt. The transaction will be accretive to Capgemini's normalized EPS by 4% before synergies in 2026 and 7% post synergies in 2027. The transaction has been unanimously approved by both Capgemini's and WNS' Boards of Directors. "Enterprises are rapidly adopting Generative AI and Agentic AI to transform their operations end-to-end. Business Process Services will be the showcase for Agentic AI. Capgemini's acquisition of WNS will provide the Group with the scale and vertical sector expertise to capture that rapidly emerging strategic opportunity created by the paradigm shift from traditional BPS to Agentic AI-powered Intelligent Operations," comments Aiman Ezzat, Chief Executive Officer of Capgemini. "Together we will create a leader in Intelligent Operations, uniquely positioned to support organizations in their AI-powered business process transformation, blending the critical capabilities needed from consulting, technology and platforms to deep process and industry expertise. This will address the client needs for Agentic AI-driven process transformation to deliver efficiency and agility through hyper-automation while achieving superior business outcomes.

[9]

M&A Snapshot: Capgemini to buy WNS in $3.3 billion deal to deepen AI offering

Sale is about to end! Create a free account now + take 20% off your first year " Capgemini stock down 2% on Euronext Paris. More on Capgemini SE, WNS (Holdings) Limited Capgemini: Upside Confirmed In Q1'25, I'm Retaining My Positive Outlook Capgemini SE (CAPMF) Q1 2025 Earnings Call Transcript WNS (Holdings): Moving In The Right Direction, But Stronger Evidence Of Growth Is Needed Capgemini to buy WNS for $3.3 billion in push to boost AI SA Asks: Which Euro tech stocks are most attractive right now? 20% Off Sale: Create a free account to read the latest news See what's moving the market. Gain access to breaking stock news, leading investing newsletters, and top analysts.

[10]

Capgemini to buy outsourcing firm WNS for $3.3 billion in AI push

(Reuters) -France's Capgemini has agreed to buy technology outsourcing firm WNS for $3.3 billion in cash to expand the range of AI tools it offers for companies, the IT services group said on Monday. The deal equips Capgemini to create a consulting business service focused on helping companies improve their processes and cost efficiency with the use of artificial intelligence, namely generative AI and agentic AI, which it expects to attract significant investments. The purchase price translating to $76.50 per WNS share represents a 17% premium compared to their last closing price on July 3 and does not include WNS's financial debt, Capgemini said. Its interest in India-based WNS, whose services include business process outsourcing and data analytics, was first reported by Reuters in April. "WNS brings ... its high growth, margin accretive and resilient Digital Business Process Services ... while further increasing our exposure to the US market," Capgemini CEO Aiman Ezzat said in a press statement. WNS's customers include large organizations such as Coca-Cola, T-Mobile and United Airlines. On a conference call with media and analysts, Ezzat said the acquisition would immediately create cross-selling opportunities between the two companies, mainly in the U.S. and Britain. Capgemini expects the deal to be closed by the end of 2025 and be immediately accretive to its revenue and operating margin. However, its shares fell around 5% following the news, the biggest losers on Europe's benchmark STOXX 600 index as of 1024 GMT, with Morgan Stanley analysts saying the deal would limit its balance sheet flexibility while not having a major impact on financials. Some investors are also concerned that Gen AI could impact the typically staff-intensive business process outsourcing (BPO) market, which could bite into Capgemini's revenues and expose it to new competition, the analysts said in a research note. "We expect investors to be able to see the opportunity that could come from disrupting BPO with Gen AI but think some evidence will be needed to convince the market WNS is the right vehicle," they added. (Reporting by Mateusz Rabiega in Gdansk, editing by Milla Nissi-Prussak)

[11]

Capgemini: agreement to acquire WNS

Capgemini announces that it has signed a definitive agreement to acquire WNS for a cash consideration of $76.50 per share, representing a premium of 28% over the average share price over the last 90 days. The acquisition of this digital business process management services provider will enable Capgemini to create a leader in intelligent operations with the critical mass to capture the strategic opportunity offered by agentic AI. The transaction, for a total consideration of $3.3bn (before taking into account WNS's net financial debt), will have an accretive impact on Capgemini's normalized EPS of 4% before synergies in 2026 and 7% after synergies in 2027. Unanimously approved by the boards of directors, it is subject to approval by WNS shareholders and regulatory approvals, as well as other customary conditions. It is expected to close by the end of the year. Copyright (c) 2025 CercleFinance.com. All rights reserved.

[12]

Capgemini launches $3.3bn takeover bid on WNS

On July 7, Capgemini announced the acquisition of US-listed Indian company WNS for $3.3 billion, marking a major strategic step in its ambition to become a global leader in "intelligent operations." Capgemini took the opportunity to provide some details on its H1 performance, while reiterating its objectives. The French group is acquiring a recognized player in digital business process services (Digital BPS) at a time when generative and agentic artificial intelligence is redefining the contours of operational transformation for businesses. The transaction, which values each WNS share at $76.50, was unanimously approved by both boards of directors. The total price comes to $3.3bn, excluding debt. Capgemini has secured €4 billion in bridge financing, covering not only the purchase price of the shares, but also the assumption of gross debt and obligations. This combination will enable Capgemini to strengthen its footprint in the North American market and complement its offering with WNS's industry, technology and functional expertise. The transaction will have an immediate accretive impact on the group's revenue and operating margin, with an expected gain of 4% on normalized EPS in 2026, rising to 7% in 2027 once synergies are fully realized. WNS's services, which are growing steadily and are highly profitable, provide a solid foundation for accelerating the development of "Intelligent Operations," a new segment driven by advanced automation and the large-scale use of AI. By leveraging the convergence of consulting, technology and AI-powered platforms, Capgemini aims to meet the growing demand from businesses for more agile, autonomous and value-creating operational solutions. The integration of WNS, which is based on shared cultural and strategic foundations, is part of this ambition. The new entity, with combined revenues of $1.9bn in Digital BPS services, will be structured within the group's Business Services activities and positioned to capture the next wave of digital transformation. On the operational front, Capgemini anticipates a slight improvement in revenue growth in Q2 2025, compared with the 0.4% decline recorded in Q1, at constant exchange rates. The operating margin is expected to remain stable at 12.4% for the half-year. However, management warns that the final figures may differ slightly, given the timing of the announcement, with the H1 results still scheduled for July 30.

Share

Share

Copy Link

French tech giant Capgemini agrees to buy WNS Holdings for $3.3 billion, aiming to enhance its AI capabilities and expand its presence in the US market. The deal focuses on leveraging agentic AI for business process transformation.

Capgemini's Strategic Acquisition of WNS

French technology services giant Capgemini has announced a definitive agreement to acquire WNS Holdings Ltd., a US-listed Indian business process services (BPS) company, for $3.3 billion in cash

1

. The deal, unanimously approved by both companies' boards, values WNS at $76.50 per share, representing a 17% premium over its closing price on July 3, 20252

.

Source: AIM

Focus on AI-Powered Intelligent Operations

The acquisition is strategically positioned to capitalize on the rapidly growing market for AI-powered business process transformation. Capgemini aims to create a leader in Intelligent Operations, leveraging the combined capabilities of both companies in generative AI and agentic AI technologies

3

.Aiman Ezzat, CEO of Capgemini, stated, "Capgemini's acquisition of WNS will provide the Group with the scale and vertical sector expertise to capture that rapidly emerging strategic opportunity created by the paradigm shift from traditional BPS to Agentic AI-powered intelligent operations"

2

.

Source: CRN

Synergies and Financial Impact

Capgemini forecasts that the deal will boost its earnings per share by about 4% on a normalized basis in 2026, rising to 7% in 2027 after combining operations

1

. The company expects to generate additional annual revenues of €100 million to €140 million by the end of 2027 through revenue synergies, with cost and operating model synergies projected at €50 million to €70 million per year before taxes3

.Expanding Market Presence and Capabilities

WNS brings a strong portfolio of clients, including Coca-Cola, T-Mobile, and United Airlines, along with nearly 65,000 employees across 64 delivery centers worldwide

1

. The acquisition is expected to strengthen Capgemini's presence in the US market and unlock immediate cross-selling opportunities4

.Related Stories

Market Reaction and Analyst Perspectives

Despite the strategic benefits, Capgemini's shares experienced a drop of around 5% following the announcement

5

. Analysts from Morgan Stanley expressed concerns about the potential impact of generative AI on the BPO sector, suggesting that increased automation could lead to lower revenues and intensified competition5

.

Source: Seeking Alpha

Future Outlook

The acquisition is expected to close by the end of 2025, subject to shareholder and regulatory approvals

2

. As organizations seek to reimagine their operating models by embedding AI at the core, the combined entity of Capgemini and WNS aims to be at the forefront of this transformation, offering a powerful proposition that accelerates enterprise reinvention3

.References

Summarized by

Navi

[2]

[4]

Related Stories

Capgemini Completes $3.3 Billion Acquisition of WNS, Aiming to Lead in AI-Driven Intelligent Operations

17 Oct 2025•Business and Economy

Capgemini bets on AI transformation as generative AI bookings hit 10% of quarterly sales

13 Feb 2026•Business and Economy

WNS Acquires Kipi.ai to Boost AI and Data Analytics Capabilities

12 Mar 2025•Business and Economy

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology