Cash App Launches MoneyBot: AI-Powered Financial Assistant Can Execute Transactions and Create Savings Plans

5 Sources

5 Sources

[1]

Cash App's MoneyBot might know your spending habits better than you do

NEW YORK (AP) -- Imagine if your bank could move money for you with only the slightest of digital nods for your approval. Or that could tell you that you're overspending but more importantly know how to address that overspending and put you on better financial footing. That's what you'll get with MoneyBot, a new financial services chatbot shown off this week by Cash App that will be integrated into its banking app this winter. Unlike existing bank chatbots, which can handle routine tasks like changing an address, MoneyBot can take advanced actions for a customer like creating a savings plan, buying or selling stock, or even evaluating a customer's spending habits. MoneyBot is part of the next generation of chatbots using what the tech industry calls "agentic" AI, which turns tools like ChatGPT into an "AI agent" that can take action online on a person's behalf. That means, instead of just writing text, answering questions or recommending products found online, an "agentic" chatbot could also buy a product. Amazon now has Rufus to go with Alexa, which both either provide information on products or can buy things on customers' behalf. Walmart is rolling out "Chat & Buy" and Microsoft has Copilot Shopping. Agentic AI, for being so new, is already causing some controversy. Amazon is suing an AI chatbot company, Perplexity, for alleged computer fraud over AI shopping agents that Amazon says are disguising themselves as human buyers to access customer accounts without Amazon's permission. Perplexity has denied the claims. Traditional banks have had chatbots for a while, notably Bank of America's "Erica" or "Ask Amex" from American Express, but have hesitated to roll out agentic AI. They worry about possible liability if a chatbot buys a product by mistake for a customer or is maliciously used to buy things it is not supposed to. "Our top priority is to keep our customers' and clients' data safe above all else," said Mark Birkhead, chief data officer at JPMorgan Chase, in an interview with the consulting firm McKinsey back in June. Cash App on the other hand is diving in head first. One notable feature of MoneyBot is its prompts and suggestions. When MoneyBot launches, it does an analysis of the the customer's transactions and spending and gives them independent recommendations on actions they could take. Unlike other bank chatbots, which take you to other parts of a banks' website, MoneyBot's transactions and analysis happen inside a single screen. Cash App's executives see MoneyBot becoming the primary way people interact with CashApp in the future. Want to know your biggest spending categories instantly and how to cut your spending? MoneyBot gives several suggestions in a matter of seconds, showing you the merchants you spent with. Need to save $1,000 toward a vacation in six months? MoneyBot creates an automated savings plan for you with only a couple of prompts. Want to put money into the stock market? It takes only a request and confirmation in MoneyBot, which will buy Tesla stock for you or even bitcoin. MoneyBot will remind you, however, that it does not give investing advice. MoneyBot may even anticipate why the customer is opening up the app in the first place. "We have such a deep understanding of who you are that it's almost a failure if we have to rely on customers to ask right questions," said Owen Jennings, executive officer and business lead at Block, in an interview. Company officials pointed out that, despite having these agent abilities, MoneyBot will still need active confirmation from the user to do many of its money-moving tasks. But that confirmation is often just a simple push of a button or a "yes" in a chat box. Cash App executives say MoneyBot uses three different AI models, choosing the most appropriate one for the customer's question. Some are easier to recognize, including the eager-to-please tone that often comes with ChatGPT 5. A Cash App employee demo'ing MoneyBot, much to his chagrin, showed that he spent heavily at Nordstrom last month. MoneyBot kindly suggested he might want to cut back on his clothing purchases if he needs to save money. There are things MoneyBot cannot do because of the legal and privacy questions that have yet to be answered. MoneyBot won't offer you a loan but feels like it could do so if the toggle were ever turned on. Because of the way the prompts are written, Cash App employees acknowledged there could be privacy and legal implications with what MoneyBot suggests if appropriate guardrails are not put into place. For instance, what's to stop MoneyBot from favoring a buy now, pay later loan from AfterPay -- also owned by Cash App's parent company Block -- for purchases instead of Affirm or Klarna? In the meantime, asking for a loan inside MoneyBot will transfer a customer to a human agent. Not surprisingly, MoneyBot has the usual disclosure found at the bottom of most chatbots these days: Artificial intelligence can make mistakes. Somehow, that feels a bit more important than an AI chatbot accidentally providing the wrong amount of cumin in a fajita recipe.

[2]

You can now manage your finances in Cash App by chatting with an AI

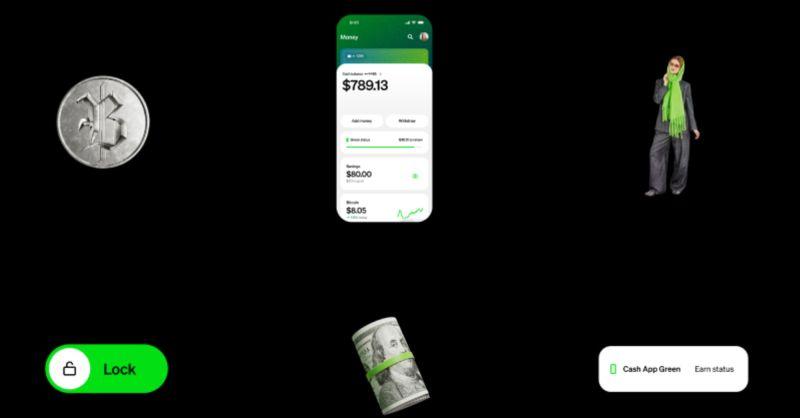

What's happened? Cash App has launched a major update that introduces Moneybot, an AI-powered assistant to help you manage your money smarter. It's part of a wider update that brings a new benefits program and expanded crypto features like finding places that accept Bitcoin payments and performing Bitcoin transactions using USD. * It analyzes your income, spending patterns, and saving goals to give you personalized suggestions. * Moneybot lets you ask direct questions like: "What were my total expenses this month?" or "How much can I safely save right now?" * The AI feature is rolling out initially to select users and will expand more broadly over the coming months. This is important because: For many users, finance apps stop at "here's your balance"; they don't help you figure out what to do next. Moneybot attempts to close that gap by acting as a smart companion rather than just a ledger, similar to how AI tools in Google Finance are evolving. * The feature learns from your spending and income patterns to offer insights and actionable suggestions. * You get tailored feedback instead of generic charts. * It's great for beginners to understand the concept of savings, investments, and budgeting without getting overwhelmed. Why should I care? Moneybot does more than answer basic questions. For example, it could identify your biggest expense category and propose an automatic savings plan or investment entry point, much like the smarter guidance now appearing inside the latest trading and investment apps. * You can ask Moneybot questions like "What are my monthly income, expenses, and spending patterns?" and receive tailored replies. * Every suggestion still requires your confirmation, keeping control in your hands. Recommended Videos OK, what's next? Check your Cash App to see if Moneybot is available. * Tap the assistant icon in your app once it's live. * Ask Moneybot a question and compare its suggestion to what you were already doing.

[3]

Cash App's Moneybot might know your spending habits better than you do

Imagine if your bank could move money for you with only the slightest of digital nods for your approval. Or that could tell you that you're overspending but more importantly know how to address that overspending and put you on better financial footing. That's what you'll get with Moneybot, a new financial services chatbot shown off this week by Cash App that will be slowly introduced into its banking app this winter. Unlike existing bank chatbots, which can handle routine tasks like changing an address, Moneybot can take advanced actions for a customer like creating a savings plan, buying or selling stock, or even evaluating a customer's spending habits. Moneybot is part of the next generation of chatbots using what the tech industry calls "agentic" AI, which turns tools like ChatGPT into an "AI agent" that can take action online on a person's behalf. That means, instead of just writing text, answering questions or recommending products found online, an "agentic" chatbot could also buy a product. Amazon now has Rufus to go with Alexa, which both either provide information on products or can buy things on customers' behalf. Walmart is rolling out "Chat & Buy" and Microsoft has Copilot Shopping. Agentic AI, for being so new, is already causing some controversy. Amazon is suing an AI chatbot company, Perplexity, for alleged computer fraud over AI shopping agents that Amazon says are disguising themselves as human buyers to access customer accounts without Amazon's permission. Perplexity has denied the claims. Traditional banks have had chatbots for a while, notably Bank of America's "Erica" or "Ask Amex" from American Express, but have hesitated to roll out agentic AI. They worry about possible liability if a chatbot buys a product by mistake for a customer or is maliciously used to buy things it is not supposed to. "Our top priority is to keep our customers' and clients' data safe above all else," said Mark Birkhead, chief data officer at JPMorgan Chase, in an interview with the consulting firm McKinsey back in June on the issue of why the bank hasn't rolled out agentic AI yet to customers. Cash App on the other hand is diving in head first. One notable feature of Moneybot is its prompts and suggestions. When Moneybot launches, it does an analysis of the the customer's transactions and spending and gives them independent recommendations on actions they could take. Unlike other bank chatbots, which take you to other parts of a banks' website, Moneybot's transactions and analysis happen inside a single screen. Cash App's executives see Moneybot becoming the primary way people interact with CashApp in the future. Want to know your biggest spending categories instantly and how to cut your spending? Moneybot gives several suggestions in a matter of seconds, showing you the merchants you spent with. Need to save $1,000 toward a vacation in six months? Moneybot creates an automated savings plan for you with only a couple of prompts. Want to put money into the stock market? It takes only a request and confirmation in Moneybot, which will buy Tesla stock for you or even bitcoin. Moneybot will remind you, however, that it does not give investing advice. Moneybot may even anticipate why the customer is opening up the app in the first place. "We have such a deep understanding of who you are that it's almost a failure if we have to rely on customers to ask right questions," said Owen Jennings, executive officer and business lead at Block, in an interview. Company officials pointed out that, despite having these agent abilities, Moneybot will still need active confirmation from the user to do its money-moving tasks. But that confirmation is often just a simple push of a button or a "yes" in a chat box. Cash App executives say Moneybot uses three different AI models, choosing the most appropriate one for the customer's question. Some are easier to recognize, including the eager-to-please tone that often comes with ChatGPT 5. A Cash App employee demo'ing Moneybot, much to his chagrin, showed that he spent heavily at Nordstrom last month. Moneybot kindly suggested he might want to cut back on his clothing purchases if he needs to save money. There are things Moneybot cannot do because of the legal and privacy questions that have yet to be answered. Moneybot won't offer you a loan but feels like it could do so if the toggle were ever turned on. Because of the way the prompts are written, Cash App employees acknowledged there could be privacy and legal implications with what Moneybot suggests if appropriate guardrails are not put into place. Policymakers have raised concerns about how these chatbots could steer customers into one product or another, even if one product may not be in the best interest for the customer. For instance, what's to stop a future version of Moneybot from favoring a buy now, pay later loan from AfterPay -- also owned by Cash App's parent company Block -- for purchases instead of Affirm or Klarna? "If firms cannot manage using a new technology in a lawful way, then they should not use the technology," said Rohit Chopra in 2024, when he was director of the Consumer Financial Protection Bureau. Chopra spent much of his tenure at the bureau raising concerns about the adoption of AI in financial services. In the meantime, asking for a loan inside Moneybot will transfer a customer to a human agent. Not surprisingly, Moneybot has the usual disclosure found at the bottom of most chatbots these days: Artificial intelligence can make mistakes. Somehow, that feels a bit more important in banking than an AI chatbot accidentally providing the wrong amount of cumin in a fajita recipe or buying the wrong size of shirt.

[4]

Cash App's MoneyBot might know your spending habits better than you do

NEW YORK (AP) -- Imagine if your bank could move money for you with only the slightest of digital nods for your approval. Or that could tell you that you're overspending but more importantly know how to address that overspending and put you on better financial footing. That's what you'll get with MoneyBot, a new financial services chatbot shown off this week by Cash App that will be integrated into its banking app this winter. Unlike existing bank chatbots, which can handle routine tasks like changing an address, MoneyBot can take advanced actions for a customer like creating a savings plan, buying or selling stock, or even evaluating a customer's spending habits. MoneyBot is part of the next generation of chatbots using what the tech industry calls "agentic" AI, which turns tools like ChatGPT into an "AI agent" that can take action online on a person's behalf. That means, instead of just writing text, answering questions or recommending products found online, an "agentic" chatbot could also buy a product. Amazon now has Rufus to go with Alexa, which both either provide information on products or can buy things on customers' behalf. Walmart is rolling out "Chat & Buy" and Microsoft has Copilot Shopping. Agentic AI, for being so new, is already causing some controversy. Amazon is suing an AI chatbot company, Perplexity, for alleged computer fraud over AI shopping agents that Amazon says are disguising themselves as human buyers to access customer accounts without Amazon's permission. Perplexity has denied the claims. Traditional banks have had chatbots for a while, notably Bank of America's "Erica" or "Ask Amex" from American Express, but have hesitated to roll out agentic AI. They worry about possible liability if a chatbot buys a product by mistake for a customer or is maliciously used to buy things it is not supposed to. "Our top priority is to keep our customers' and clients' data safe above all else," said Mark Birkhead, chief data officer at JPMorgan Chase, in an interview with the consulting firm McKinsey back in June. Cash App on the other hand is diving in head first. One notable feature of MoneyBot is its prompts and suggestions. When MoneyBot launches, it does an analysis of the the customer's transactions and spending and gives them independent recommendations on actions they could take. Unlike other bank chatbots, which take you to other parts of a banks' website, MoneyBot's transactions and analysis happen inside a single screen. Cash App's executives see MoneyBot becoming the primary way people interact with CashApp in the future. Want to know your biggest spending categories instantly and how to cut your spending? MoneyBot gives several suggestions in a matter of seconds, showing you the merchants you spent with. Need to save $1,000 toward a vacation in six months? MoneyBot creates an automated savings plan for you with only a couple of prompts. Want to put money into the stock market? It takes only a request and confirmation in MoneyBot, which will buy Tesla stock for you or even bitcoin. MoneyBot will remind you, however, that it does not give investing advice. MoneyBot may even anticipate why the customer is opening up the app in the first place. "We have such a deep understanding of who you are that it's almost a failure if we have to rely on customers to ask right questions," said Owen Jennings, executive officer and business lead at Block, in an interview. Company officials pointed out that, despite having these agent abilities, MoneyBot will still need active confirmation from the user to do many of its money-moving tasks. But that confirmation is often just a simple push of a button or a "yes" in a chat box. Cash App executives say MoneyBot uses three different AI models, choosing the most appropriate one for the customer's question. Some are easier to recognize, including the eager-to-please tone that often comes with ChatGPT 5. A Cash App employee demo'ing MoneyBot, much to his chagrin, showed that he spent heavily at Nordstrom last month. MoneyBot kindly suggested he might want to cut back on his clothing purchases if he needs to save money. There are things MoneyBot cannot do because of the legal and privacy questions that have yet to be answered. MoneyBot won't offer you a loan but feels like it could do so if the toggle were ever turned on. Because of the way the prompts are written, Cash App employees acknowledged there could be privacy and legal implications with what MoneyBot suggests if appropriate guardrails are not put into place. For instance, what's to stop MoneyBot from favoring a buy now, pay later loan from AfterPay -- also owned by Cash App's parent company Block -- for purchases instead of Affirm or Klarna? In the meantime, asking for a loan inside MoneyBot will transfer a customer to a human agent. Not surprisingly, MoneyBot has the usual disclosure found at the bottom of most chatbots these days: Artificial intelligence can make mistakes. Somehow, that feels a bit more important than an AI chatbot accidentally providing the wrong amount of cumin in a fajita recipe.

[5]

Cash App's MoneyBot Might Know Your Spending Habits Better Than You Do

NEW YORK (AP) -- Imagine if your bank could move money for you with only the slightest of digital nods for your approval. Or that could tell you that you're overspending but more importantly know how to address that overspending and put you on better financial footing. That's what you'll get with MoneyBot, a new financial services chatbot shown off this week by Cash App that will be integrated into its banking app this winter. Unlike existing bank chatbots, which can handle routine tasks like changing an address, MoneyBot can take advanced actions for a customer like creating a savings plan, buying or selling stock, or even evaluating a customer's spending habits. MoneyBot is part of the next generation of chatbots using what the tech industry calls "agentic" AI, which turns tools like ChatGPT into an "AI agent" that can take action online on a person's behalf. That means, instead of just writing text, answering questions or recommending products found online, an "agentic" chatbot could also buy a product. Amazon now has Rufus to go with Alexa, which both either provide information on products or can buy things on customers' behalf. Walmart is rolling out "Chat & Buy" and Microsoft has Copilot Shopping. Agentic AI, for being so new, is already causing some controversy. Amazon is suing an AI chatbot company, Perplexity, for alleged computer fraud over AI shopping agents that Amazon says are disguising themselves as human buyers to access customer accounts without Amazon's permission. Perplexity has denied the claims. Traditional banks have had chatbots for a while, notably Bank of America's "Erica" or "Ask Amex" from American Express, but have hesitated to roll out agentic AI. They worry about possible liability if a chatbot buys a product by mistake for a customer or is maliciously used to buy things it is not supposed to. "Our top priority is to keep our customers' and clients' data safe above all else," said Mark Birkhead, chief data officer at JPMorgan Chase, in an interview with the consulting firm McKinsey back in June. Cash App on the other hand is diving in head first. One notable feature of MoneyBot is its prompts and suggestions. When MoneyBot launches, it does an analysis of the the customer's transactions and spending and gives them independent recommendations on actions they could take. Unlike other bank chatbots, which take you to other parts of a banks' website, MoneyBot's transactions and analysis happen inside a single screen. Cash App's executives see MoneyBot becoming the primary way people interact with CashApp in the future. Want to know your biggest spending categories instantly and how to cut your spending? MoneyBot gives several suggestions in a matter of seconds, showing you the merchants you spent with. Need to save $1,000 toward a vacation in six months? MoneyBot creates an automated savings plan for you with only a couple of prompts. Want to put money into the stock market? It takes only a request and confirmation in MoneyBot, which will buy Tesla stock for you or even bitcoin. MoneyBot will remind you, however, that it does not give investing advice. MoneyBot may even anticipate why the customer is opening up the app in the first place. "We have such a deep understanding of who you are that it's almost a failure if we have to rely on customers to ask right questions," said Owen Jennings, executive officer and business lead at Block, in an interview. Company officials pointed out that, despite having these agent abilities, MoneyBot will still need active confirmation from the user to do many of its money-moving tasks. But that confirmation is often just a simple push of a button or a "yes" in a chat box. Cash App executives say MoneyBot uses three different AI models, choosing the most appropriate one for the customer's question. Some are easier to recognize, including the eager-to-please tone that often comes with ChatGPT 5. A Cash App employee demo'ing MoneyBot, much to his chagrin, showed that he spent heavily at Nordstrom last month. MoneyBot kindly suggested he might want to cut back on his clothing purchases if he needs to save money. There are things MoneyBot cannot do because of the legal and privacy questions that have yet to be answered. MoneyBot won't offer you a loan but feels like it could do so if the toggle were ever turned on. Because of the way the prompts are written, Cash App employees acknowledged there could be privacy and legal implications with what MoneyBot suggests if appropriate guardrails are not put into place. For instance, what's to stop MoneyBot from favoring a buy now, pay later loan from AfterPay -- also owned by Cash App's parent company Block -- for purchases instead of Affirm or Klarna? In the meantime, asking for a loan inside MoneyBot will transfer a customer to a human agent. Not surprisingly, MoneyBot has the usual disclosure found at the bottom of most chatbots these days: Artificial intelligence can make mistakes. Somehow, that feels a bit more important than an AI chatbot accidentally providing the wrong amount of cumin in a fajita recipe.

Share

Share

Copy Link

Cash App introduces MoneyBot, an advanced AI chatbot that goes beyond traditional banking assistants by analyzing spending habits, creating automated savings plans, and executing stock purchases with minimal user confirmation.

Revolutionary AI Banking Assistant Enters Market

Cash App has unveiled MoneyBot, a sophisticated AI-powered financial assistant that represents a significant leap forward in banking technology. Unlike traditional bank chatbots that handle routine tasks like address changes, MoneyBot can execute complex financial actions including creating savings plans, buying and selling stocks, and providing detailed spending analysis

1

.

Source: AP

The chatbot will be integrated into Cash App's banking platform this winter, initially rolling out to select users before expanding more broadly

2

. Cash App executives envision MoneyBot becoming the primary interface for user interactions with the platform, fundamentally changing how customers manage their finances.Agentic AI Technology Powers Advanced Capabilities

MoneyBot utilizes what the technology industry calls "agentic" AI, which transforms traditional chatbots into AI agents capable of taking real-world actions on behalf of users

3

. This represents a significant evolution from conventional AI assistants that merely provide information or recommendations.The system employs three different AI models, selecting the most appropriate one based on the customer's specific question or request

4

. Some models exhibit characteristics recognizable from ChatGPT 5, including an eager-to-please conversational tone.MoneyBot's capabilities extend far beyond basic banking inquiries. Users can request instant analysis of their biggest spending categories, receive suggestions for reducing expenses, and even execute investment transactions. For example, purchasing Tesla stock or Bitcoin requires only a simple request and confirmation through the chatbot interface

5

.

Source: Digital Trends

Personalized Financial Intelligence and Automation

One of MoneyBot's most distinctive features is its proactive analysis and recommendation system. Upon launch, the AI automatically analyzes customer transactions and spending patterns, providing independent recommendations without requiring specific user prompts

1

."We have such a deep understanding of who you are that it's almost a failure if we have to rely on customers to ask right questions," explained Owen Jennings, executive officer and business lead at Block, Cash App's parent company

3

.The AI can create automated savings plans with minimal user input. For instance, if a customer wants to save $1,000 for a vacation in six months, MoneyBot can establish and manage the entire savings strategy through just a few conversational prompts

2

.Related Stories

Industry Context and Competitive Landscape

Cash App's aggressive adoption of agentic AI contrasts sharply with traditional banking institutions' cautious approach. Major banks like JPMorgan Chase have expressed concerns about potential liability issues if AI chatbots make erroneous purchases or are exploited maliciously

4

."Our top priority is to keep our customers' and clients' data safe above all else," stated Mark Birkhead, chief data officer at JPMorgan Chase, explaining the bank's hesitancy to implement agentic AI systems

1

.The broader technology sector is embracing agentic AI across various applications. Amazon has deployed Rufus alongside Alexa for product recommendations and purchases, while Walmart is rolling out "Chat & Buy" functionality and Microsoft has introduced Copilot Shopping

5

.Privacy Concerns and Regulatory Challenges

The implementation of agentic AI in financial services raises significant privacy and regulatory questions. Cash App employees have acknowledged potential legal implications regarding MoneyBot's recommendation algorithms, particularly concerning conflicts of interest

3

.Concerns center on whether MoneyBot might favor products from Block's other subsidiaries, such as promoting AfterPay buy-now-pay-later loans over competitors like Affirm or Klarna. Currently, loan requests through MoneyBot are transferred to human agents to address these concerns

1

.The controversy surrounding agentic AI extends beyond financial services. Amazon is currently suing AI company Perplexity for alleged computer fraud, claiming their AI shopping agents disguise themselves as human buyers to access customer accounts without permission

2

.References

Summarized by

Navi

[2]

Related Stories

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

Meta strikes up to $100 billion AI chips deal with AMD, could acquire 10% stake in chipmaker

Technology

3

Pentagon threatens Anthropic with supply chain risk label over AI safeguards for military use

Policy and Regulation