Nvidia disputes upfront payment claims for H200 AI chips as China approval looms

19 Sources

19 Sources

[1]

Nvidia's reportedly asking Chinese customers to pay upfront its for H200 AI chips

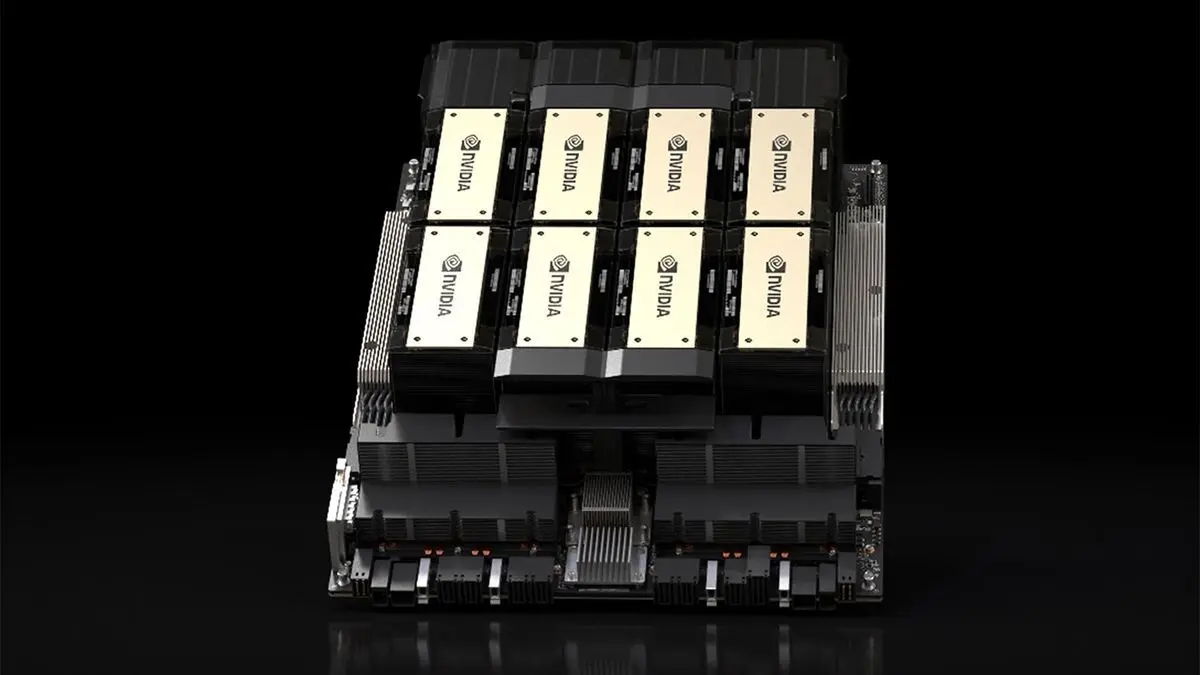

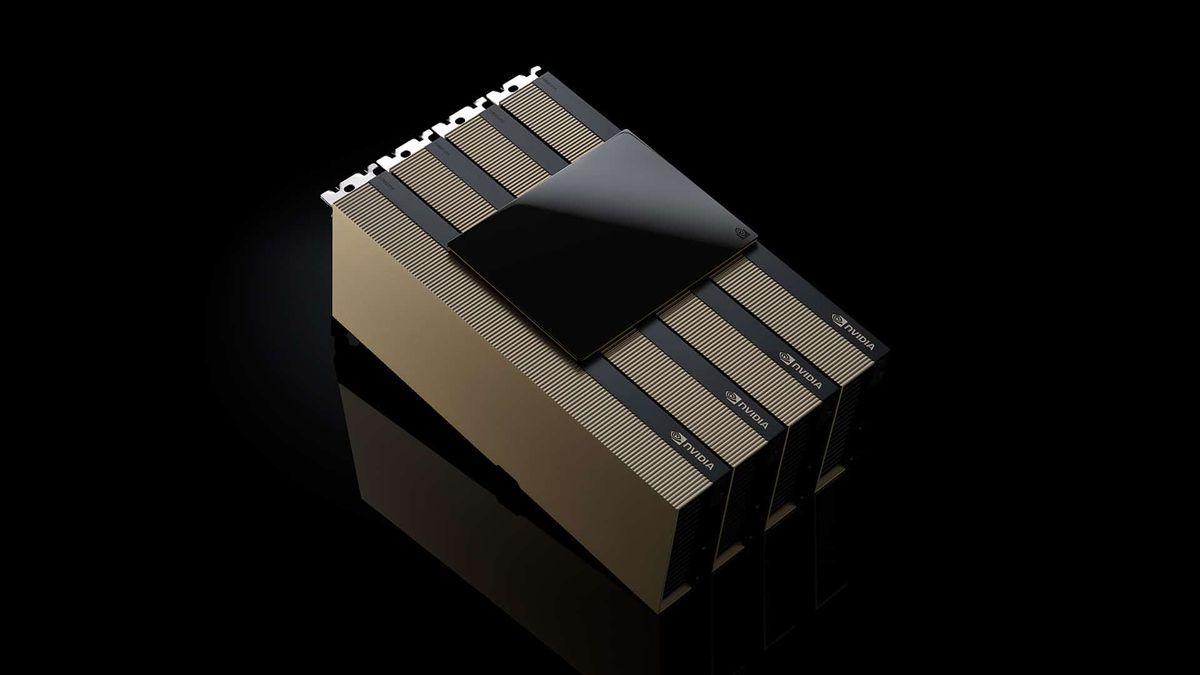

Nvidia is now requiring its customers in China to pay upfront in full for its H200 AI chips even as approval Stateside and from Beijing remains uncertain, Reuters reported, citing anonymous sources. The chipmaker isn't leaving any room for refunds or changes to orders, the report said. While some customers may be allowed to use commercial insurance or asset collateral, the terms are far stricter than Nvidia's earlier policies, which sometimes permitted partial deposits, Reuters reported. Nvidia declined to comment. China is expected to allow Nvidia to sell its H200 chips in the country, per Bloomberg, though Beijing wants to prevent the chips from being used by its military, state-owned firms, and sensitive infrastructure concerns. Despite the challenges, demand for Nvidia's H200 remains strong, and Chinese companies have reportedly placed orders for more than 2 million of the GPUs in 2026, prompting the chipmaker to ramp up production. Nvidia is trying to strike a careful balance between meeting strong demand for its chips while managing political risk in both the U.S. and China. The U.S. chipmaker has suffered costly setbacks, when the Trump administration said it would need a license to export its H20 chips to China, forcing the company to write down $5.5 billion worth of inventory.

[2]

Nvidia fires back at rumors it will require upfront payment from clients for H200 orders -- company says that it 'would never require customers to pay for products that they do not receive'

This move will build goodwill towards its Chinese customers. Nvidia has refuted the rumor that it would require full advanced payment for H200 orders from its Chinese customers. The AI chip maker stated that it will not ask its clients to completely pay for an item that it has yet to receive. "We do not require upfront payment and would never require customers to pay for products that they do not receive," an Nvidia spokesperson said in an email to Tom's Hardware. Nvidia's comment was first reported by Reuters. According to that report, one source claimed that Nvidia had previously required advanced payments from Chinese clients, sometimes only a deposit instead of a full upfront payment. The article claims that because it's unclear whether Beijing will allow its tech companies to purchase Nvidia H200 GPUs, the company has been "particularly strict" in enforcing these conditions to reduce financial risk. Even though China-based tech giants like Alibaba and ByteDance are reportedly ready to order over 200,000 of these chips each, the H200 is a last-generation chip that has since been superseded by the Blackwell family. Aside from that, Nvidia has already announced the succeeding Vera Rubin architecture, which is miles ahead in performance and efficiency over the previous-generation GPUs. As such, companies that have no restrictions will likely only want to purchase the latest available technology as they spend billions of dollars on AI infrastructure to gain an advantage over their competitors. So, if the Chinese government changes its tone at the last moment and refuses to approve the H200 orders of its tech companies, then Nvidia risks being left with hundreds of thousands of H200 GPUs that it would probably have a lot of difficulty selling. Furthermore, those chips would have taken up the production capacity of Nvidia's contracted fabs, which it could have instead used for building GB200 or even newer chips that will sell for a much higher margin. The assertion that Nvidia won't require upfront payment for the H200 chips from Chinese customers will be welcome news, as it reduces their risk while waiting for the final green light from Beijing. The AI chip maker is likely able to easily do this because it reportedly still has over 80,000 H200 chips available in existing stock, reducing its exposure to vacillating political decisions. More than that, it will build goodwill towards Chinese companies and the government -- something that the company is carefully balancing with its relationship with the U.S. government, the Trump administration, and the American people.

[3]

Nvidia reportedly wants up front payments for Chinese H200s

Beijing could green-light sales to select customers as soon as this quarter Nvidia's H200 GPUs could begin trickling into China as soon as this quarter, but there's a catch. Due to all the geopolitical turmoil that's ravaged US-China trade relations over the past year, buyers may need to pay up front for the coveted AI accelerators. And they won't get a refund if China decides to block the imports! On Thursday, Bloomberg reported that authorities in Beijing could green-light shipments of H200s - currently the most powerful GPU Uncle Sam has ever allowed Nvidia to sell in China - as soon as this quarter. However, on the off chance that the Chinese government changes its mind, Reuters, citing multiple anonymous sources, reports Nvidia is requiring advance payment for the chips with no option for a refund if they're canceled. These conditions, the report notes, aren't entirely new. Apparently, Nvidia has previously required advance payments from customers in the Middle Kingdom, but it wasn't uncommon for the chip biz to grant exceptions allowing orders to be placed with just a deposit. For the H200, the newswire claims Nvidia has cracked down on this mandate in order to de-risk the transactions with some exceptions being made to allow for commercial insurance or asset collateral. The Trump administration lifted a Biden-era restriction on Nvidia's H200 sales to China last month in exchange for a 25 percent fee on the resulting revenue. Since then, Chinese hyperscalers and model builders are said to have placed orders for more than two million of the now two-year-old AI accelerators. Despite its advancing age and a growing number of domestic alternatives, the H200 is still among the most potent chips available in the region, boasting performance roughly 6x that of the H20. TikTok parent company ByteDance is apparently so enthused by the chip that it plans to spend about $14 billion on them in 2026 alone. Unfortunately for Nvidia, its existing stockpile of H200s won't be enough to satiate Chinese customers. According to earlier reports, Nvidia currently has about 700,000 H200 accelerators in its inventory and has approached TSMC about reramping production of the chips, which use an older process tech than what's found in its Blackwell and Rubin generations, to meet demand. Those chips, we'll note, still aren't available for sale in China, though Nvidia CEO Jensen Huang remains optimistic that, with time, its latest generation of chips will find their way to the Middle Kingdom. Huang certainly has reason to be excited about regaining access to the Chinese market. During an earnings call last summer, he quipped that China would have been a $50 billion a year market if the chip biz were able to flog its best products there. With that said, reramping production of the aging chips is inherently risky. With two generations of Blackwell GPUs and Nvidia's next-gen Rubin GPUs unveiled this week, the market for H200s outside of China has never been smaller. If trade relations were to sour between the US and China, Nvidia could find itself with a glut of outdated silicon on its hands. It wouldn't be the first time US trade policy has caused headaches for the AI arms dealer. Last spring, the Trump administration moved to block sales of H20 accelerators to China. That decision was later reversed, but not before dealing Nvidia a roughly $10.5 billion revenue hit across the first half of its 2026 fiscal year.

[4]

China to Approve Nvidia H200 Purchases as Soon as This Quarter

Chinese companies such as Alibaba Group Holding Ltd. and ByteDance Ltd. have expressed interest in ordering the H200 chip, with both companies telling Nvidia they are interested in ordering more than 200,000 units each. China plans to approve some imports of Nvidia Corp.'s H200 chips as soon as this quarter, according to people familiar with the situation, giving the company renewed access to a critical market. Chinese officials are preparing to allow local companies to buy the component from Nvidia for select commercial use, said the people, who asked not to be identified because the deliberations are private. Click here to read this story in Chinese language.A video guide to reading Bloomberg Chinese news here. However, the H200 chip will be barred from the military, sensitive government agencies, critical infrastructure and state-owned enterprises due to security concerns, they said. That mirrors similar measures that the Chinese government adopted for foreign products such as Apple Inc. devices and Micron Technology Inc. chips. If these organizations still ask to use the component, their applications will be reviewed on a case-by-case basis, the people added. Even with the qualifications, the move represents a major win for Nvidia. China is the world's largest market for semiconductors, and Chief Executive Officer Jensen Huang has said that the AI chip segment alone could generate $50 billion in the coming years. In the US firm's absence, local rivals such as Huawei Technologies Co. and Cambricon Technologies Corp. have thrived and plan to sharply increase production in 2026. The H200 is an older-generation chip that the Trump administration has said can be exported to China. The US government restricts sales of more advanced processors on national security grounds. Nvidia is the leading maker of artificial intelligence accelerators -- the chips that help develop and run AI models -- which are highly prized by the world's data center operators. Alibaba Group Holding Ltd. and ByteDance Ltd. have both told Nvidia in private that they are interested in ordering more than 200,000 units each of the H200, according to a person familiar with the matter. Both companies -- alongside prominent Chinese startups, including DeepSeek -- are rapidly upgrading their models to compete with OpenAI and other US rivals. It's unclear what Beijing will view as critical infrastructure, beyond the more obvious areas such as military or government networks. Private-sector firms such as Alibaba or Baidu Inc. typically provide computing services to a swath of state firms and government agencies, much as Amazon.com Inc. or Microsoft Corp. work with US federal bodies. Developing advanced semiconductors and artificial intelligence models is a top priority for China, and the country has vowed to come together as a nation to win a technology race with the US. Get the Tech Newsletter bundle. Get the Tech Newsletter bundle. Get the Tech Newsletter bundle. Bloomberg's subscriber-only tech newsletters, and full access to all the articles they feature. Bloomberg's subscriber-only tech newsletters, and full access to all the articles they feature. Bloomberg's subscriber-only tech newsletters, and full access to all the articles they feature. Bloomberg may send me offers and promotions. Plus Signed UpPlus Sign UpPlus Sign Up By submitting my information, I agree to the Privacy Policy and Terms of Service. Nvidia executives said during this week's CES show in Las Vegas that there's strong demand from Chinese customers for the H200. But they indicated that the company hasn't spoken directly to Beijing about approval and don't know when China may green-light the sale. They added that license applications have been submitted to Washington and the last details of approval from the US government are being finalized. Nvidia declined to comment beyond the CES remarks. China's Ministry of Commerce did not respond to a faxed request for comment. Alibaba and ByteDance did not respond to emailed requests for comment. Nvidia has faced an effective ban on selling its best AI hardware to customers in the Asian country since 2022, restrictions imposed over fears that those semiconductors could lend Beijing a military edge. The rules, which US policymakers ratcheted up several times, have driven Nvidia's market share in China from a 95% peak to zero, according to Huang. He's also said that the US government doesn't need to be concerned about the Chinese military using Nvidia chips. Even with the curbs, the company's overall sales outlook continues to grow. In October, Nvidia had projected about half a trillion dollars of revenue from current and future data center chips by the end of 2026. The chipmaker said this week that it's now poised to exceed the $500 billion target. In early December, US President Donald Trump reversed a prior ban and granted Nvidia permission to ship its H200 chip to China in exchange for a 25% surcharge, a move that lets the world's most valuable company potentially regain billions of dollars in lost business from the market. The H200 was introduced in 2023 and began shipping to customers the following year. It's part of the Hopper generation of Nvidia's chips, second-best to the Blackwell line and two generations behind the upcoming Rubin series. An 18-month lag behind the latest Nvidia chips was part of the Trump administration's justification for allowing it to be exported to China. But Beijing hasn't publicly indicated whether it will allow the imports of H200. The company is largely focused on a self-sufficiency drive to build up its chipmaking capabilities, a push that's included readying a new round of incentives of as much as $70 billion for the chip sector. Around mid-2025, Chinese officials urged local companies to avoid using Nvidia's less powerful H20 processors, an AI accelerator the US previously allowed to be shipped to China. China's cyberspace agency also told companies such as Alibaba to halt orders for Nvidia's RTX Pro 6000D, a workstation chip that can be repurposed for AI applications. Meanwhile, Nvidia's rivals in China are making inroads. Huawei and manufacturing partner Semiconductor Manufacturing International Corp. have improved their chip production technology, despite US attempts to limit their progress. The Kirin 9030 processor -- part of Huawei's latest flagship Mate 80 Pro Max smartphone -- was produced using an evolved version of SMIC's technology, research firm TechInsights has found. Huawei's smaller peer Cambricon is also planning to more than triple its production of AI chips in 2026, aiming to expand its market share in China and fill a void left by Nvidia. Still, Nvidia's AI accelerators are considered the gold standard for the AI industry, and some of the company's older products are still more powerful than Huawei's latest offerings -- especially on a chip-by-chip basis.

[5]

Nvidia to demand full upfront payment for H200 GPUs from China customers, report claims -- more than two million chips may have been ordered despite uncertain Beijing stance

Nvidia now demands full advance payment for its H200 GPUs for AI applications from its customers in China amid uncertainties with approvals of H200 imports, reports Reuters, citing sources with knowledge of the matter. Clients in the People's Republic also cannot cancel orders even if the government bans them from importing them to the country. Under the new terms, Chinese buyers must pay 100% of the H200 order value at placement with no option to change configurations afterward. In limited cases, customers may substitute cash with commercial insurance or asset collateral, but the overall approach is far stricter than Nvidia's terms for Chinese clients earlier, which sometimes allowed partial deposits rather than full prepayment, according to Reuters. Although it is expected that the Chinese government will approve H200 imports early in 2026, the situation remains particularly uncertain as authorities are projected to allow H200 imports only for selected customers in the commercial sector and under certain conditions, so it is natural for Nvidia to hedge its risks. Purchases by the military, sensitive government organizations, critical infrastructure operators, and state-owned enterprises are expected to remain barred due to security concerns. Meanwhile, regulators have asked certain Chinese firms to temporarily pause orders while they are figuring out how many domestically produced AI accelerators must be bought alongside each imported H200. Despite strict terms on Nvidia's side, demand for H200 remains robust in China. Chinese technology companies have ordered more than two million H200 processors priced at roughly $27,000 per unit, which exceeds Nvidia's available inventory of around 700,000 units. Nvidia plans to fulfill initial Chinese H200 orders from existing stock, and the first deliveries are expected before the Lunar New Year in mid-February. To get the remaining 1.3 million units or more, Nvidia has to place new orders with TSMC (or rather allocate its pre-paid production capacity from other products to H200), make the silicon, and then package it using CoWoS-S technology, which takes over three months. As a result, the company will be able to ship additional H200 units to Chinese clients only sometimes in Q2 at the earliest.

[6]

Beijing tells companies to pause H200 purchases -- China govt deliberating terms for letting local tech companies buy US chips while still growing homegrown semiconductors

Beijing has told Chinese tech companies to hold off on their plans to acquire Nvidia H200 chips, according to some sources. This is only a temporary measure, though, reports The Information, as the central government is considering how it will go forward with allowing local businesses acquire the latest chips they can without jeopardizing its long-term goal of building up its homegrown semiconductor industry. President Donald Trump approved exports of the H200 early last month, with Washington, D.C., charging Nvidia a 25% fee for every H200 GPU exported to China. Even though the H200 chip is the last-generation GPU following the release of Blackwell AI GPU, Chinese companies are still lining up to get their hands on these relatively powerful chips that domestic chipmakers struggle to match. The Chinese government claims that homegrown semiconductors can now match H20 and RTX Pro 6000D chips, but these are still far behind the latest Blackwell and even the just-allowed full-fledged Hopper AI GPUs. It might seem that this command to hold orders came suddenly, but Beijing has already been in discussion with its biggest tech giants following Trump's reversal on the H200 ban. Despite the directive, several server manufacturers were said to have already placed non-refundable and non-modifiable orders with Nvidia. It's also reported that the AI chip company is preparing a shipment of 82,000 GPUs, with the hardware expected to arrive by mid-February 2026. This shows that demand for these chips is so high that they're willing to take the risk, as Beijing is still deciding on how it will approach the influx of these chips. The biggest conundrum the CCP is facing is how it will balance the need to support local chipmaking initiatives without stunting AI development. China has made inroads in semiconductor manufacturing, but its latest chips still cannot compete with Nvidia's last-generation offerings. One solution to this is to force companies importing foreign chips to purchase a ratio of or maybe even an equal amount of locally built processors. They could then use the domestically made semiconductors for inferencing tasks while reserving the more powerful H200 chips for training. But without an official announcement from Beijing, Chinese tech companies have no choice but to wait to know whether they could purchase Nvidia GPUs -- and, if so, how many.

[7]

China reportedly moves to pause Nvidia H200 orders

Nvidia, the U.S. government, and China can't seem to get on the same page about Nvidia's chips. The U.S. has seesawed on foreign chip policy, finally allowing H200 sales to China -- despite severe consternation from policy experts. Nvidia CEO Jensen Huang said this week that Chinese customer demand for H200s is "high -- quite high" and that the company has "fired up our supply chain" accordingly. But now, Beijing is reportedly asking Chinese tech companies to stop shopping. The Information, citing two people familiar with the matter, reported Wednesday that the Chinese government asked some tech companies to temporarily halt plans to buy Nvidia's H200 AI chips, a pause intended to discourage a last-minute U.S. chip-buying spree as Beijing officials decide whether -- and under what conditions -- they'll allow access. The report didn't name the companies involved or say how broad the guidance was -- but it did say that the Chinese government is expected to mandate domestic AI chip purchases. An Nvidia spokesperson declined to comment; the Chinese government hasn't publicly commented on the report. Chinese companies have been trying to build around their Nvidia dependence for years, with domestic champions -- Huawei most visibly, Baidu in the mix, too -- closing the gap. The Financial Times previously reported that Beijing had planned to limit domestic access to H200s and force buyers to justify why they need Nvidia hardware instead of Huawei's Ascend chips or other homegrown GPUs. State-backed systems already run on local silicon. Domestic GPU startups have been minted and listed as mascots for self-reliance. China's public posture, such as it is, remains broad and diplomatic. A spokesperson for the Chinese Embassy in the U.S. told Reuters that China is committed to "basing its national development on its own strengths" while also being willing to maintain "dialogue and cooperation" to safeguard supply-chain stability. That's boilerplate language, but it shows where this story lives: China wants leverage, control, and optionality, and it rarely announces those goals by holding a press conference about one specific GPU. This hullabaloo is landing in the middle of a week when Nvidia is doing what it always does at CES: projecting supply-chain confidence like it's a product feature. On Tuesday, Huang told reporters that "H200s are flowing through the line" and offered a bit of process realism: "approval," he said, won't arrive with a ceremonial statement -- it'll show up as "purchase orders." He said, "If the purchase orders come, it's because they're able to place purchase orders." Nvidia reportedly told Chinese clients that it aimed to begin shipping the H200 chips to China before the Lunar New Year holiday in mid-February, contingent on Beijing's approval. And Reuters reported last week that Nvidia has already sounded out TSMC about ramping H200 production as Chinese demand jumped, after Chinese tech firms placed orders for more than 2 million H200 chips for delivery in 2026, while Nvidia had about 700,000 units in stock. At CES this week, Nvidia showed off its next Vera Rubin generation, which is currently in production. It's available to U.S. companies and has 22 times the performance value of the chips Nvidia is now allowed to sell to China. The U.S.-China-Nvidia chip policy whiplash has been building all year. In mid-April, the U.S. tightened rules on Nvidia's China-focused H20 chip, imposing licensing requirements that forced Nvidia to take a $5.5 billion charge and effectively froze a product designed to comply with earlier controls. By August, the U.S. had issued export licenses to Nvidia, a sign that "no" could still quietly turn into "maybe," depending on the month and the paperwork. Trump's December announcement framed H200 exports to "approved customers" as a compromise -- Blackwell stays out, H200 can go, and the U.S. takes a 25% cut. But even with a presidential green light, Nvidia still has to clear the mechanical gate: export licenses. Nvidia chief financial officer Collette Kress said Tuesday that the U.S. government is "working feverishly" on license applications, though there's no ship-date clarity in sight. And Huang suggested this week that the "last details" of the White House arrangement would be finalized soon. In today's market, the future ships on schedule; the present ships when it's allowed to.

[8]

Nvidia says no upfront payment needed for its H200 chips

The company said it "would never require customers to pay for products they do not receive", in a response to a Reuters story on January 8 about the company having imposed unusually stringent terms requiring full upfront payment from Chinese customers seeking its artificial intelligence chips. Nvidia does not require upfront payment for H200 chips, a spokesperson for the U.S. chipmaker said in a statement to Reuters on Tuesday. The company said it "would never require customers to pay for products they do not receive", in a response to a Reuters story on January 8 about the company having imposed unusually stringent terms requiring full upfront payment from Chinese customers seeking its artificial intelligence chips. One source told Reuters that Nvidia's standard terms for Chinese clients have previously included advance payment requirements, but they were sometimes allowed to place a deposit rather than make a full payment upfront. But for the H200, the company has been particularly strict in enforcing conditions given the lack of clarity on whether Chinese regulators would greenlight the shipments, the person added. Such a payment structure for the H200 would effectively transfer financial risk from Nvidia to its customers, who must commit capital without certainty that Beijing will approve the chip imports or that they will be able to deploy the technology as planned.

[9]

Nvidia Tightens H200 Chip Sales To China, Shift Risk to Buyers - NVIDIA (NASDAQ:NVDA)

Nvidia Corp (NASDAQ:NVDA) is tightening its terms for selling H200 artificial intelligence chips to China as it tries to reopen a key market while navigating shifting regulatory signals in both Washington and Beijing. Nvidia Shifts Risk To Chinese Buyers Nvidia now requires Chinese customers to pay in full upfront for H200 orders and accept strict, no-flexibility terms, Reuters reported on Thursday, citing people familiar with the arrangements. The policy goes beyond Nvidia's prior approach, which sometimes allowed partial deposits. In limited cases, some buyers can use commercial insurance or asset collateral instead of cash, the sources told Reuters. The tighter structure effectively pushes regulatory risk onto customers. Beijing Prepares Conditional Green Light For H200 Imports Chinese officials are preparing to approve some H200 imports as soon as this quarter for select commercial uses, while restricting access for the military, sensitive government agencies, critical infrastructure, and state-owned enterprises, Bloomberg reported on Thursday, citing people familiar with the deliberations. The framework mirrors earlier Chinese restrictions applied to certain foreign products. Regulators have also asked some Chinese tech companies to pause H200 orders temporarily. Officials are weighing how many domestically produced chips each buyer must purchase alongside imported Nvidia chips. Demand Surges, But Supply And Politics Still Set The Ceiling Nvidia faces intense demand from Chinese cloud and internet players that see the H200 as a major upgrade from the H20, which is now blocked in China. Executives have said demand is strong and that the company has ramped its supply chain, but they've also indicated the company lacks direct visibility into Beijing's timing for approvals. Nvidia is also managing capacity constraints as it transitions from Blackwell to the next Rubin platform and competes for production capacity at Taiwan Semiconductor Manufacturing Co (NYSE:TSM). Nvidia became the first company to hit the $4.5 trillion market cap in October. NVDA Price Action: Nvidia shares were up 0.33% at $189.74 during premarket trading on Thursday, according to Benzinga Pro data. Image by Hepha1st0s via Shutterstock NVDANVIDIA Corp$189.830.38%OverviewTSMTaiwan Semiconductor Manufacturing Co Ltd$323.651.56%Market News and Data brought to you by Benzinga APIs

[10]

Fearing Sudden Pullouts and Policy Shocks, NVIDIA Makes H200 AI Chip Sales to Chinese Customers Pay-First, With Zero Room for Refunds

NVIDIA is reportedly adopting a new strategy regarding the sales of its H200 AI chip to China, and it is claimed that the company is demanding that domestic clients pay upfront. The China business for NVIDIA has evolved dramatically over the past few months, and it has been filled with drastic events that have created uncertainity for Team Green's suppliers. A prime example of this is how recently, after the US lifted the ban on the H20 AI chips, China decided to hinder its access to domestic hyperscalers, through regulatory investigations and strict policies. With the H200 AI chip, Reuters reports that NVIDIA wants to "hedge" against the uncertainity by demanding clients to pay entirely for their orders upfront, with no room for cancellations and modifications. The strict payment requirements underscore the delicate balancing act Nvidia faces as it attempts to capitalise on surging Chinese demand while navigating regulatory uncertainty in both countries. - Reuters This policy makes sense, considering that NVIDIA needs to ensure a seamless order flow for the H200 AI chip to prepare the AI supply chain for incoming demand. It has been reported earlier that Chinese AI giants are looking to place orders of up to two million H200 AI chips, which is far higher than NVIDIA's current inventory. To restart production lines, Team Green is seeking to secure guaranteed customer commitments by receiving full payment upfront. However, this policy could cause trouble for Chinese customers, as the nation's government has shown that it can change policies aggressively overnight, which could hinder access to the H200 AI chips. It's also important to note that the H200 capacity is being integrated into the supply chain at a time when NVIDIA is focused on Blackwell Ultra and Vera Rubin. For suppliers like TSMC, catering to Hopper demand is a significant concern, as it requires ramping up production of nodes like 4nm. Chinese AI giants have few options at hand, as they are in dire need of NVIDIA's high-end silicon for progression with frontier models. This ultimately means they must comply with NVIDIA's policies.

[11]

Nvidia requires full upfront payment for H200 chips in China: Report

Nvidia reportedly is demanding a full upfront payment for its H200 AI chips from Chinese buyers. This strict policy aims to mitigate risks amid uncertainty over Beijing's approval for shipments. Chinese tech firms have placed significant orders for these advanced chips. Nvidia is requiring full upfront payment from Chinese customers seeking its H200 artificial intelligence chips, hedging it against ongoing uncertainty over Beijing's approval of the shipments, said two people briefed on the matter. The U.S. chipmaker has imposed unusually stringent terms requiring full payment for orders with no options to cancel, ask for refunds or change configurations after placement, the people said. In special circumstances, clients may provide commercial insurance or asset collateral as an alternative to cash payment, one of the people added. Nvidia's standard terms for Chinese clients have previously included advance payment requirements, but they were sometimes allowed to place a deposit rather than make a full payment upfront, the person said. But for the H200, the company has been particularly strict in enforcing conditions given the lack of clarity on whether Chinese regulators would greenlight the shipments, the person added. Both people spoke on condition of anonymity because the information is not public. The stepped-up policy enforcement has not been reported previously. Nvidia and China's industry ministry had yet to respond to requests for comment at the time of publication. Chinese technology companies have placed orders for more than 2 million H200 chips that are priced at around $27,000 each, Reuters reported last month, exceeding its inventory of 700,000 of the chips. While Chinese chipmakers like Huawei have developed AI processors including the Ascend 910C, their performance still lags behind Nvidia's H200 for large-scale training of advanced AI models. Beijing in recent days asked some Chinese tech companies to temporarily pause their H200 chip orders as regulators are still deciding how many domestically produced chips each customer will need to buy alongside each H200 order, the second person said. The Information first reported the pause on Wednesday. Nvidia CEO Jensen Huang said on Tuesday that customer demand for H200 chips was "quite high" and that the company has "fired up our supply chain" to ramp up production. Huang said he did not expect China's government to make a formal declaration on approval, but "if the purchase orders come, it's because they're able to place purchase orders." Balancing act The strict payment requirements underscore the delicate balancing act Nvidia faces as it attempts to capitalise on surging Chinese demand while navigating regulatory uncertainty in both countries. The Biden administration had banned advanced AI chip exports to China, but President Donald Trump reversed that policy last month, allowing H200 sales with a 25% fee to be paid to the U.S. government. Nvidia has been burned in the past. Last year, it wrote down $5.5 billion in inventory after the Trump administration abruptly banned it from selling the H20 chip to China, previously the most powerful product it was able to offer there. While the U.S. has reversed that decision, China has since banned H20 shipments. But the payment structure for the H200 effectively transfers financial risk from Nvidia to its customers, who must commit capital without certainty that Beijing will approve the chip imports or that they will be able to deploy the technology as planned. Chinese internet giants including ByteDance and others view the H200 as a significant upgrade over currently available chips. The H200, currently Nvidia's second-most powerful chip, delivers roughly six times the performance of the now-blocked H20 chip that Nvidia had designed specifically for the Chinese market. Nvidia plans to fulfill initial orders from existing stock, with the first batch of H200 chips expected to arrive before the Lunar New Year holiday in mid-February, Reuters reported last month. The company has approached contract chipmaker Taiwan Semiconductor Manufacturing Co about ramping up H200 production to meet the Chinese demand, with additional manufacturing expected to begin in the second quarter of 2026, Reuters reported last week. For Nvidia, adding new capacity is also challenging at a time when it is not only transitioning from its current most-powerful chip Blackwell to the even more advanced Rubin, but also competing with companies including Alphabet's Google for limited advanced chipmaking production capacity from TSMC.

[12]

China Tells Tech Firms To Stop Nvidia H200 Chip Orders - NVIDIA (NASDAQ:NVDA)

Authorities in China have instructed several local technology firms to pause orders of Nvidia Corp. (NASDAQ:NVDA) H200 hardware. NVDA stock is moving. See the chart and price action here. Beijing likely intends to enforce a requirement that these organizations prioritize domestic artificial intelligence processors instead, according to Reuters and reported originally by The Information on Wednesday. China's Shift Toward Domestic Chips The directive aims to prevent Chinese corporations from amassing large inventories of American-designed chips before official policy changes. China's move reflects a broader strategy to reduce dependence on U.S. hardware as the semiconductor industry remains a primary source of friction between the two global powers. The current landscape for these high-end components is shaped by several factors: Regulatory Hurdles: Although the Trump administration authorized H200 exports late in 2025, those deals require a 25% revenue-sharing payment to the United States government. Pending Approval: Many export licenses are still undergoing review without a clear date for completion. Market Demand: Despite tensions, Nvidia CEO Jensen Huang stated at the recent Consumer Electronics Show that interest in the company's latest hardware remains exceptionally high in China. Perspectives on Trade Stability While the Chinese Ministry of Commerce has not issued a formal statement, the nation's diplomatic stance emphasizes self-reliance alongside global cooperation. Regarding the current situation, Liu Pengyu, representing the Chinese Embassy in the U.S., stated: "China is committed to basing its national development on its own strengths, and is also willing to maintain dialogue and cooperation with all parties to safeguard the stability of global industrial and supply chains," Pengyu said, per Reuters. Industry Impact Nvidia continues to navigate a difficult path between Washington's strict export limitations and Beijing's push for technological autonomy. While Huang interprets the high volume of purchase requests as a sign of tacit approval from regulators, the expected mandate for domestic chip usage could significantly alter the company's long-term market share in the region. NVDA Price Action: Nvidia shares were up 1.46% at $189.97 at the time of publication Wednesday, according to Benzinga Pro. NVDANVIDIA Corp$190.161.56%Overview This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Market News and Data brought to you by Benzinga APIs

[13]

China asks tech firms to halt orders for Nvidia's H200 chips: Report - The Economic Times

Beijing has asked some Chinese tech companies to halt orders for Nvidia's H200 chips this week, and is expected to mandate domestic artificial intelligence chip purchases, the Information reported on Wednesday, citing people familiar with the matter. Nvidia has been caught between Washington and Beijing, as the United States tightens controls on exports of advanced semiconductors used in AI, while Chinese companies seek to reduce reliance on US-designed chips. Tensions over technology trade have been a central feature of broader US-China conflicts, with semiconductors emerging as a strategic flashpoint. China's directive to suspend orders was issued as the government considers whether, and under what conditions, to allow access to Nvidia's high-performance chips. Beijing is aiming to discourage local technology companies from rushing to stockpile U.S. chips before a decision is reached, the report said. Nvidia and the Chinese embassy in the U.S. did not immediately respond to Reuters' requests for comment. China's Ministry of Commerce and Ministry of Industry and Information Technology also did not immediately return calls outside business hours. Nvidia CEO Jensen Huang said at the Consumer Electronics Show this week that demand in China for its H200 chip was strong and the company is viewing purchase orders as a signal of approval rather than expecting any formal announcement from Beijing. U.S. export licenses for the chips are still being processed, with no set timeline. Late last year, U.S. President Donald Trump's administration approved the export of H200 chips to China, a significant reversal of previous bans on advanced AI hardware. The approval was based on a condition that the company pay a unique 25% revenue-sharing tax to the U.S. government. The H200 is the predecessor to Nvidia's current flagship "Blackwell" chips.

[14]

Nvidia says no upfront payment required for H200 chips- Reuters By Investing.com

Investing.com-- NVIDIA Corporation (NASDAQ:NVDA) will not require upfront payment for its H200 chips, Reuters reported on Tuesday, citing comments from a company spokesperson. The comments were in response to earlier reports that the company had imposed unusually strict terms requiring full upfront payment from Chinese customers for its H200 chips, which were recently approved by Washington for sale in the country. For more breaking news on Nvidia and other AI majors, upgrade to InvestingPro Reports in December said Chinese technology companies had ordered more than 2 million H200 chips, indicating strong demand for the most advanced AI chip that Nvidia is allowed to sell in the country. But Beijing's stance on the H200 remained unclear, as China pushes for complete self-reliance across the artificial intelligence stack. China was seen blocking Nvidia chip imports in 2025, in part due to a bitter trade war with the United States. Nvidia had last year signaled it would stop incorporating China into its earnings outlook due to heightened uncertainty over the country.

[15]

Nvidia demands full upfront payment from Chinese clients for H200 AI chips - report By Investing.com

Investing.com -- Nvidia is asking Chinese customers to pay the full amount upfront when ordering its H200 artificial intelligence chips, Reuters reported on Thursday, citing two people briefed on the matter. The chipmaker has set strict terms that require complete payment for orders with no possibility to cancel, request refunds, or modify configurations after an order is placed. In certain special cases, clients may provide commercial insurance or asset collateral instead of cash payment. Nvidia has been particularly rigid in enforcing these conditions for the H200 chips due to uncertainty about whether Chinese regulatory authorities would approve the shipments. This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.

[16]

Nvidia says no upfront payment needed for its H200 chips

BEIJING, Jan 13 (Reuters) - Nvidia does not require upfront payment for H200 chips, a spokesperson for the U.S. chipmaker said in a statement to Reuters on Tuesday. The company said it "would never require customers to pay for products they do not receive", in a response to a Reuters story on January 8 about the company having imposed unusually stringent terms requiring full upfront payment from Chinese customers seeking its artificial intelligence chips. One source told Reuters that Nvidia's standard terms for Chinese clients have previously included advance payment requirements, but they were sometimes allowed to place a deposit rather than make a full payment upfront. But for the H200, the company has been particularly strict in enforcing conditions given the lack of clarity on whether Chinese regulators would greenlight the shipments, the person added. Such a payment structure for the H200 would effectively transfer financial risk from Nvidia to its customers, who must commit capital without certainty that Beijing will approve the chip imports or that they will be able to deploy the technology as planned. (Reporting by Liz Lee and Liam Mo; Editing by Christian Schmollinger and Jamie Freed)

[17]

Nvidia wants full upfront payment for H200 chips in China, sources say

STORY: Nvidia is reportedly requiring full upfront payment from Chinese customers seeking its H200 AI chips. Two sources told Reuters it's due to ongoing uncertainty over Beijing's approval of the shipments. They said the U.S. chipmaker has imposed unusually strict terms. Including full payment for orders with no options to cancel, ask for refunds or change configurations after placement. Nvidia and China's industry ministry have yet to respond to requests for comment. Last month, Reuters reported Chinese tech firms have placed orders for more than 2 million H200 chips, priced at around $27,000 each. That exceeds Nvidia's inventory of 700,000 of the chips. While Chinese chipmakers have developed AI processors, their performance still lags behind Nvidia's H200 for large-scale training of advanced AI models. Bloomberg reported Thursday that China plans to approve some H200 imports as soon as this quarter. The report said Chinese officials are preparing to allow purchases for select commercial uses. But will still ban purchases by the military, sensitive government agencies, critical infrastructure and state-owned enterprises due to security concerns.

[18]

Beijing suspends orders for Nvidia's H200 chips, turning to local alternatives

Chinese authorities this week asked some technology companies to suspend their orders for Nvidia-made H200 chips, according to The Information. The move is part of Beijing's strategy to promote the use of domestically made components for artificial intelligence, against a backdrop of persistent tensions with the US in the semiconductor sector. China wants to curb its reliance on US technologies while tightening control over access to critical components such as high-performance chips. The Chinese government wants to avoid a strategic stockpiling of H200 chips before an official decision is made on the terms of their import. Meanwhile, Washington has tightened its restrictions on exports of advanced technologies, while export licences for the H200 remain under review. Nvidia secured authorisation late last year to sell to China, provided that it pays 25% of the revenue from those sales as a tax to the US government. Despite the lack of clear communication from Beijing, Nvidia has seen strong demand for its H200 chip in the Chinese market, according to comments by CEO Jensen Huang at the CES trade show. The H200 precedes the new generation of "Blackwell" chips aimed at AI. Officially, China says it remains open to international cooperation, while accelerating the development of a domestic semiconductor industry to guarantee the country's technological sovereignty.

[19]

Nvidia requires full upfront payment for H200 chips in China, sources say

BEIJING/SHANGHAI, Jan 8 (Reuters) - Nvidia is requiring full upfront payment from Chinese customers seeking its H200 artificial intelligence chips, hedging it against ongoing uncertainty over Beijing's approval of the shipments, said two people briefed on the matter. The U.S. chipmaker has imposed unusually stringent terms requiring full payment for orders with no options to cancel, ask for refunds or change configurations after placement, the people said. In special circumstances, clients may provide commercial insurance or asset collateral as an alternative to cash payment, one of the people added. Nvidia's standard terms for Chinese clients have previously included advance payment requirements, but they were sometimes allowed to place a deposit rather than make a full payment upfront, the person said. But for the H200, the company has been particularly strict in enforcing conditions given the lack of clarity on whether Chinese regulators would greenlight the shipments, the person added. Both people spoke on condition of anonymity because the information is not public. The stepped-up policy enforcement has not been reported previously. Nvidia and China's industry ministry had yet to respond to requests for comment at the time of publication. Chinese technology companies have placed orders for more than 2 million H200 chips that are priced at around $27,000 each, Reuters reported last month, exceeding its inventory of 700,000 of the chips. While Chinese chipmakers like Huawei have developed AI processors including the Ascend 910C, their performance still lags behind Nvidia's H200 for large-scale training of advanced AI models. Beijing in recent days asked some Chinese tech companies to temporarily pause their H200 chip orders as regulators are still deciding how many domestically produced chips each customer will need to buy alongside each H200 order, the second person said. The Information first reported the pause on Wednesday. Nvidia CEO Jensen Huang said on Tuesday that customer demand for H200 chips was "quite high" and that the company has "fired up our supply chain" to ramp up production. Huang said he did not expect China's government to make a formal declaration on approval, but "if the purchase orders come, it's because they're able to place purchase orders." BALANCING ACT The strict payment requirements underscore the delicate balancing act Nvidia faces as it attempts to capitalise on surging Chinese demand while navigating regulatory uncertainty in both countries. The Biden administration had banned advanced AI chip exports to China, but President Donald Trump reversed that policy last month, allowing H200 sales with a 25% fee to be paid to the U.S. government. Nvidia has been burned in the past. Last year, it wrote down $5.5 billion in inventory after the Trump administration abruptly banned it from selling the H20 chip to China, previously the most powerful product it was able to offer there. While the U.S. has reversed that decision, China has since banned H20 shipments. But the payment structure for the H200 effectively transfers financial risk from Nvidia to its customers, who must commit capital without certainty that Beijing will approve the chip imports or that they will be able to deploy the technology as planned. Chinese internet giants including ByteDance and others view the H200 as a significant upgrade over currently available chips. The H200, currently Nvidia's second-most powerful chip, delivers roughly six times the performance of the now-blocked H20 chip that Nvidia had designed specifically for the Chinese market. Nvidia plans to fulfill initial orders from existing stock, with the first batch of H200 chips expected to arrive before the Lunar New Year holiday in mid-February, Reuters reported last month. The company has approached contract chipmaker Taiwan Semiconductor Manufacturing Co about ramping up H200 production to meet the Chinese demand, with additional manufacturing expected to begin in the second quarter of 2026, Reuters reported last week. For Nvidia, adding new capacity is also challenging at a time when it is not only transitioning from its current most-powerful chip Blackwell to the even more advanced Rubin, but also competing with companies including Alphabet's Google for limited advanced chipmaking production capacity from TSMC. (Reporting by Liam Mo and Brenda Goh; Editing by Jamie Freed)

Share

Share

Copy Link

Nvidia has refuted reports claiming it requires full advance payment from Chinese customers for H200 AI chips. The chipmaker stated it would never require customers to pay for products they don't receive, pushing back against Reuters reporting. Beijing is expected to approve H200 imports this quarter for select commercial use, with Chinese companies ordering over 2 million units despite ongoing US-China trade tensions.

Nvidia Refutes Upfront Payment Requirements for H200 AI Chips

Nvidia has firmly denied reports that it demands full advance payment from Chinese customers for its H200 AI chips, stating through a spokesperson that the company "would never require customers to pay for products that they do not receive"

2

. The clarification comes after Reuters reported that Nvidia was requiring 100% upfront payment with no refund options, even if regulatory approvals fall through1

. According to Reuters sources, the terms were far stricter than Nvidia's earlier policies, which sometimes permitted partial deposits rather than full prepayment5

.

Source: Tom's Hardware

Nvidia's denial represents a strategic move to build goodwill with Chinese customers and the government as the company navigates complex geopolitical risk between Washington and Beijing

2

. The chipmaker reportedly has over 80,000 H200 chips in existing stock, which reduces its exposure to vacillating political decisions and allows it to absorb potential order cancellations without significant financial risk.China Prepares Import Approvals From China for Select Commercial Use

Beijing is preparing to approve Nvidia H200 imports as soon as this quarter, according to sources familiar with the situation

4

. Chinese officials plan to allow local companies to purchase the GPU for select commercial applications, though the chips will be barred from military use, sensitive government agencies, critical infrastructure, and state-owned enterprises due to security concerns4

. This mirrors similar restrictions China adopted for foreign products from Apple and Micron Technology.

Source: Market Screener

The regulatory approvals process remains uncertain, with authorities asking certain Chinese firms to temporarily pause orders while determining how many domestically produced AI accelerators must be purchased alongside each imported H200

5

. If organizations in restricted sectors request access to the AI hardware, their applications will be reviewed case-by-case, according to people familiar with the deliberations.Demand for H200 Chips Exceeds Available Inventory

Despite uncertainties surrounding regulatory approvals, demand for H200 chips from Chinese customers remains robust. Chinese technology companies have placed orders for more than 2 million H200 processors, with tech giants Alibaba and ByteDance each expressing interest in ordering over 200,000 units . The orders, priced at roughly $27,000 per unit, far exceed Nvidia's current inventory of approximately 700,000 units

5

.To meet this extraordinary demand, Nvidia has approached TSMC about ramping up production of the H200 chips

3

. The company plans to fulfill initial orders from existing stock before the Lunar New Year in mid-February, but producing the remaining 1.3 million or more units will require allocating pre-paid production capacity and utilizing CoWoS-S packaging technology, a process that takes over three months5

.Related Stories

US-China Trade Relations Create Complex Balancing Act

The H200 situation reflects the delicate balance Nvidia must maintain amid volatile US-China trade relations. The Trump administration lifted Biden-era US export restrictions on H200 sales to China in December in exchange for a 25% surcharge on resulting revenue

3

. This represents a significant shift after Nvidia faced an effective ban on selling its best AI hardware to China since 2022 over concerns the semiconductors could provide Beijing with a military edge4

.

Source: Benzinga

Nvidia CEO Jensen Huang has previously stated that China could represent a $50 billion annual market if the company could sell its best products there

3

. The company's market share in China plummeted from a 95% peak to zero under previous restrictions4

. Trade policy shifts have already cost Nvidia dearly, with the company taking a $5.5 billion inventory write-down when the Trump administration initially required licenses for H20 chip exports1

, contributing to a roughly $10.5 billion revenue hit across the first half of fiscal 20263

.Strategic Risks of Ramping Older Generation Production

Restarting H200 production carries inherent risks for Nvidia, as the chip represents last-generation technology that has been superseded by the Blackwell family and the recently announced Vera Rubin architecture

2

. The H200 uses older process technology than what's found in Blackwell and Rubin generations, and companies without restrictions will likely prioritize purchasing the latest AI accelerators as they invest billions in AI infrastructure2

.If US-China trade relations sour again or Beijing reverses its approval stance, Nvidia could face a glut of outdated silicon with limited market appeal outside China

3

. The H200 boasts performance roughly 6x that of the H20, making it still among the most potent chips available in the region despite its age3

. Chinese companies like ByteDance reportedly plan to spend approximately $14 billion on H200 chips in 2026 alone, underscoring the massive opportunity—and risk—Nvidia faces in this market.References

Summarized by

Navi

[3]

Related Stories

Nvidia prepares to ship up to 80,000 H200 AI chips to China as political hurdles loom

22 Dec 2025•Policy and Regulation

Nvidia's Next-Gen AI Chip for China: Geopolitical Tensions and Market Demand

29 Aug 2025•Technology

Nvidia's H200 AI chip sales to China stalled by US security review despite initial approvals

28 Jan 2026•Policy and Regulation

Recent Highlights

1

Pentagon threatens Anthropic with Defense Production Act over AI military use restrictions

Policy and Regulation

2

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

3

Anthropic accuses Chinese AI labs of stealing Claude through 24,000 fake accounts

Policy and Regulation