Chinese AI Data Centers Offload Nvidia RTX 4090D GPUs Amid Overcapacity and Market Shifts

4 Sources

4 Sources

[1]

Chinese data centers refurbing and selling Nvidia RTX 4090D GPUs due to overcapacity -- 48GB models sell for up to $5,500

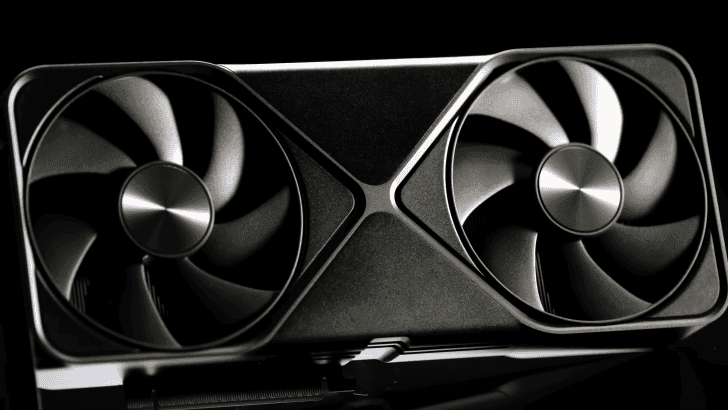

Companies are letting go of their idle GPUs for instant profits. Some AI data centers in China are reportedly holding large stocks of China-specific 48GB Nvidia RTX 4090D GPUs, dismantling and refurbishing them, and then reselling them on the market as new cards. DigiTimes Asia reports that a few companies are resorting to letting go of excess computing capacity to generate multiple times the profit compared to renting the GPUs out, which will take them about three to five years to recoup their investment. This move is a sign of how China's AI rush is leading to billions of dollars in idle infrastructure. The report states that an AI data center requires a utilization rate of more than 70% to 75% for it to turn a profit. However, activation rates remain below 20%, meaning a significant amount of capacity is left unused and many GPUs remain idle. To help them stay afloat, a few companies are turning to selling their unused assets to generate some quick cash and pay off the bank loans they used to purchase their hardware. Selling RTX 4090 cards is quite lucrative, too. Currently, these China-specific RTX 4090D GPUs with 48GB of VRAM are priced between CNY20,000 and CNY40,000, or approximately US$2,735 and US$5,470. We're unsure if these cards were used at all, but they still need to be modified if the data center wants to sell them to consumers. Data centers typically convert fan-cooled GPUs into blower-style cards, such as this blower-style RTX 5090D leaked on Bilibili, for improved efficiency when used in multi-GPU systems. However, these are much noisier and provide less cooling when used as a single unit. One surprising aspect is that AI data centers are doing this despite the uncertainty surrounding AI chip supply from the U.S. The White House has recently blocked China-compliant Nvidia H20 and AMD MI308 chips for export to China, and there are also some rumors that the 5090D might also be affected by the ban. In fact, it's rumored that Nvidia has mentioned suspending supplying 5090D chips to its board partners, although it did not mention stopping sales entirely. Despite this, companies are still letting go of excess capacity -- likely because they need to cover their financial costs, or they risk going under. Furthermore, as chip technologies advance, companies that use older-generation AI GPUs will no longer be competitive, and they will be forced to sell these cards anyway. Therefore, it probably makes sense for them to release these underutilized assets now and then purchase whatever is available when demand actually arises.

[2]

Too many GPUs, not enough demand: China's AI centers start flipping rare Nvidia RTX 4090Ds

Some say it's overcapacity, others claim preparation for newer tech Some Chinese AI data centers are dismantling and reselling China-specific Nvidia RTX 4090D GPUs, reports have claimed. A report from DigiTimes Asia says these 48GB cards, designed to circumvent U.S. export restrictions on the flagship AD102 gaming GPU, and initially deployed as part of China's AI infrastructure push, are now being pulled from racks, refurbished, and sold on the open market. Data center operators are reportedly finding that this offers a faster and more profitable return than waiting three to five years to recover their investment through GPU rental. Each RTX 4090D sells for between CNY20,000 and CNY40,000 (around US$2,735 to US$5,470), and even if lightly used, the cards require modification for consumer resale. Typically this means converting them from fan-style to blower-style coolers, which are better suited to dense server environments but less effective for single-GPU use. DigiTimes Asia says this move reflects deeper financial pressure, with many AI data centers struggling to keep their heads above water amid low demand. According to the report, data centers need utilization rates of at least 70% to break even - but current rates are often below 20%. That leaves expensive infrastructure sitting idle while loan repayments loom. This isn't an isolated case. As we reported recently, China's rapid AI infrastructure expansion - encouraged by state policy - has led to overbuilding. Hundreds of data center projects were launched across the country in 2023 and 2024, but actual usage has lagged behind expectations. It's no surprise therefore that developers are now offloading hardware to reduce losses. Although overcapacity is likely at least part of the reason behind the selloff, some operators may simply be clearing space for newer technology. With interest moving from large-scale model training to real-time inference, older training-focused systems may no longer be as relevant as they once were. Combined with the latest US export restrictions, which affect chips like Nvidia's H20, Chinese data centers will be looking at offloading old hardware and shifting to inference-ready setups.

[3]

Chinese AI data centers sell idle, refurbed RTX 4090D GPUs: 48GB models cost up to $5500

TL;DR: Chinese AI data center companies are selling off NVIDIA GeForce RTX 4090D graphics cards due to declining AI demand and low server utilization around 20%. With second-hand prices reaching $6000, firms aim to profit amid US export restrictions and reduced need for high-end AI hardware. China's AI data center companies are selling off their stacks of NVIDIA GeForce RTX 4090D graphics cards, because AI demand is dropping, and they no longer need the hardware and want to make a few quick (big) bucks with prices of the RTX 4090D hitting as high as $6000 in second-hand markets. We saw Chinese companies modding the RTX 4090D and doubling its 24GB of GDDR6X to a very hefty 48GB, which is a huge performance win for AI workloads. But in a new report from DigiTimes, we're hearing that Chinese AI companies are now selling their GPU inventory as AI power is being reduced, and they want to make some quick profits. Chinese AI companies are reportedly noticing a hefty 20% server utilization rate, so you can see why they're refurbing and selling off those high-end graphics cards. On top of that, there is a ton of uncertainty surrounding US export restrictions, and the latest ban on NVIDIA's custom made-for-China H20 AI GPU. NVIDIA's now previous-gen GeForce RTX 4090D with 48GB of GDDR6X memory is now being sold for as high as $6000, so with prices that high, you'd want to get in quick and get rid of your gear. AI companies are obviously noticing they don't need as much AI power as previously -- and DeepSeek is helping that in the middle of things -- where it has been reported that a huge 80% of China's AI computing power resources are sitting there idle, doing nothing.

[4]

Chinese AI Firms Are Reportedly Dumping NVIDIA's RTX 4090D GPUs Into The Market To Capitalize On The Rising Prices

Well, it seems like China's AI market is now actually selling their NVIDIA RTX 4090D GPUs, as they look to "shave off" the extra computing capacity for more profits. The AI frenzy in China was unique compared to the rest of the world because the nation, which didn't have cutting-edge chips, relied on other means for its hardware needs. One of the ways Chinese firms managed to get AI power was by modding consumer GPUs like the RTX 4090D, putting high VRAM onboard in order to get more computing capabilities. However, DigiTimes now reports that domestic firms in China are selling their GPU inventory as the need for AI power cools off and firms are looking for more ways to squeeze in profits. It is claimed that the GPU sell-off has occurred because many AI firms are experiencing significantly lower server utilization rates, going as low as 20%. This means that for such businesses to stay profitable, they would need to sell out their extra computing power, which is a major contributor to the sell-off. Apart from this, with the supply chain uncertainty in China following the new US export controls, it is certain that Chinese firms want to capitalize on it the most by selling GPUs at a time when prices are soaring. NVIDIA's RTX 4090D 48 GB is going for as high as $6,000 in local markets, and with AI firms now selling their inventory, we do expect it to come down. This is good news for domestic consumers, but it will take a lot of time before the prices return to their "pre-AI" era. It is clear now that the AI firms have realized that they don't need much computing power to cater to the market demand. We recently reported on how this situation is similar in the AI cluster segment, where it is reported that more than 80% of China's AI computing resources are idle. It will be interesting to see how the situation pans out regarding GPU availability in the Chinese markets, given that just a few weeks ago, such variants were pretty rare to acquire at decent prices.

Share

Share

Copy Link

Chinese AI data centers are selling refurbished Nvidia RTX 4090D GPUs due to overcapacity and low utilization rates, with 48GB models fetching up to $5,500 in the market.

Chinese AI Data Centers Offload High-End GPUs

Chinese AI data centers are reportedly dismantling and reselling large stocks of China-specific 48GB Nvidia RTX 4090D GPUs, a move that highlights the complexities of the AI hardware market in China. This development comes as a result of overcapacity and low utilization rates in the country's rapidly expanding AI infrastructure

1

2

.Market Dynamics and Pricing

The refurbished RTX 4090D GPUs are being sold for between CNY20,000 and CNY40,000 (approximately US$2,735 to US$5,470), with some reports suggesting prices as high as $6,000 in second-hand markets

1

3

. This price range represents a significant profit opportunity for data centers, especially compared to the alternative of renting out the GPUs, which would take three to five years to recoup the initial investment1

.Reasons Behind the Sell-Off

Several factors are driving this trend:

-

Low Utilization Rates: AI data centers in China are reportedly experiencing utilization rates below 20%, far short of the 70-75% required for profitability

2

. -

Overcapacity: China's rapid AI infrastructure expansion has led to overbuilding, with hundreds of data center projects launched in 2023 and 2024, outpacing actual usage

2

. -

Financial Pressure: Many AI data centers are struggling to stay afloat amid low demand and looming loan repayments

2

. -

Technological Shifts: Some operators may be clearing space for newer technology, as interest moves from large-scale model training to real-time inference

2

.

Impact of U.S. Export Restrictions

The sell-off is occurring against the backdrop of U.S. export restrictions on advanced AI chips to China. The White House has recently blocked China-compliant Nvidia H20 and AMD MI308 chips for export to China, creating uncertainty in the supply chain

1

4

. This situation may be influencing data centers' decisions to capitalize on current high prices for available GPUs.Related Stories

Modifications for Consumer Use

Data centers typically convert fan-cooled GPUs into blower-style cards for improved efficiency in multi-GPU systems. However, these modifications make the cards less suitable for single-GPU consumer use, as they are noisier and provide less cooling

1

.Broader Implications for China's AI Industry

This GPU sell-off reflects broader challenges in China's AI sector:

-

Idle Resources: Reports suggest that up to 80% of China's AI computing power resources are sitting idle

3

. -

Market Adjustment: The situation indicates a recalibration of China's AI hardware needs, as companies realize they may have overestimated their computing power requirements

4

. -

Future Uncertainty: With ongoing export restrictions and potential bans on newer GPU models, Chinese firms are navigating an uncertain future for AI hardware procurement

1

4

.

As the situation unfolds, it will likely have significant implications for the global AI hardware market, particularly in how it shapes China's approach to developing and sourcing AI computing resources in the face of international restrictions and domestic market realities.

References

Summarized by

Navi

[1]

[2]

[3]

Related Stories

NVIDIA's RTX 5090 GPUs Fetch Up to $10,000 on Black Markets as AI Demand Surges in China

10 Mar 2025•Technology

Chinese Firms Convert RTX 5090 GPUs into AI Accelerators, Bypassing Export Restrictions

26 Jul 2025•Technology

AI Server Boom: Vietnamese Retailer Builds Powerful Rigs with Multiple RTX 5090 GPUs

04 Apr 2025•Technology

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy