Chinese Entities Leverage US Cloud Services to Access Advanced AI Chips

16 Sources

16 Sources

[1]

Exclusive-Chinese entities turn to Amazon cloud and its rivals to access high-end US chips, AI

BEIJING/SINGAPORE/NEW YORK (Reuters) - State-linked Chinese entities are using cloud services provided by Amazon or its rivals to access advanced U.S. chips and artificial intelligence capabilities that they cannot acquire otherwise, recent public tender documents showed. The U.S. government has restricted the export of high-end AI chips to China over the past two years, citing the need to limit the Chinese military's capabilities. Providing access to such chips or advanced AI models through the cloud, however, is not a violation of U.S. regulations since only exports or transfers of a commodity, software or technology are regulated. A Reuters review of more than 50 tender documents posted over the past year on publicly available Chinese databases showed that at least 11 Chinese entities have sought access to restricted U.S. technologies or cloud services. Among those, four explicitly named Amazon Web Services (AWS) as a cloud service provider, though they accessed the services through Chinese intermediary companies rather than from AWS directly. The tender documents, which Reuters is the first to report on, show the breadth of strategies Chinese entities are employing to secure advanced computing power and access generative AI models. They also underscore how U.S. companies are capitalising on China's growing demand for computing power. "AWS complies with all applicable U.S. laws, including trade laws, regarding the provision of AWS services inside and outside of China," a spokesperson for Amazon's cloud business said. AWS controls nearly a third of the global cloud infrastructure market, according to research firm Canalys. In China, AWS is the sixth-largest cloud service provider, according to research firm IDC. Shenzhen University spent 200,000 yuan ($27,996) on an AWS account to gain access to cloud servers powered by Nvidia A100 and H100 chips for an unspecified project, according to a March tender document. It got this service via an intermediary, Yunda Technology Ltd Co, the document showed. Exports to China of the two Nvidia chips, which are used to power large-language models (LLM) such as OpenAI's ChatGPT, are banned by the U.S. Shenzhen University and Yunda Technology did not respond to requests for comment. Nvidia declined to comment on Shenzhen University's spending or on any of the other Chinese entities' deals. Zhejiang Lab, a research institute developing its own LLM, GeoGPT, said in a tender document in April that it intended to spend 184,000 yuan to purchase AWS cloud computing services as its AI model could not get enough computing power from homegrown Alibaba. A spokesperson for Zhejiang Lab said that it did not follow through with the purchase but did not respond to questions about the reasoning behind this decision or how it met its LLM's computing power requirements. Alibaba's cloud unit, Alicloud, did not respond to a request for comment. Reuters could not establish whether or not the purchase went ahead. The U.S. government is now trying to tighten regulations to restrict access through the cloud. "This loophole has been a concern of mine for years, and we are long overdue to address it," Michael McCaul, chair of the U.S. House of Representatives Foreign Affairs Committee, told Reuters in a statement, referring to the remote access of advanced U.S. computing through the cloud by foreign entities. Legislation was introduced in Congress in April to empower the commerce department to regulate remote access of U.S. technology, but it is not clear if and when it will be passed. A department spokesperson said it was working closely with Congress and "seeking additional resources to strengthen our existing controls that restrict PRC companies from accessing advanced AI chips through remote access to cloud computing capability." The commerce department also proposed a rule in January that would require U.S. cloud computing services to verify large AI model users and report to regulators when they use U.S. cloud computing services to train large AI models capable of "malicious cyber-enabled activity". The rule, which has not been finalized, would also enable the commerce secretary to impose prohibitions on customers. "We are aware the commerce department is considering new regulations, and we comply with all applicable laws in the countries in which we operate," the AWS spokesperson said. CLOUD DEMAND IN CHINA The Chinese entities are also seeking access to Microsoft's cloud services. In April, Sichuan University said in a tender document it was building a generative AI platform and purchasing 40 million Microsoft Azure OpenAI tokens to support the delivery of this project. The university's procurement document in May showed that Sichuan Province Xuedong Technology Co Ltd supplied the tokens. Microsoft did not respond to requests for comment. Sichuan University and Sichuan Province Xuedong Technology did not respond to requests for comment on the purchase. OpenAI said in a statement its own services are not supported in China and that Azure OpenAI operates under Microsoft's policies. It did not comment on the tenders. The University of Science and Technology of China's (USTC) Suzhou Institute of Advanced Research said in a tender document in March that it wanted to rent 500 cloud servers, each powered by eight Nvidia A100 chips, for an unspecified purpose. The tender was fulfilled by Hefei Advanced Computing Center Operation Management Co Ltd, a procurement document showed in April, but the document did not name the cloud service provider and Reuters could not determine its identity. USTC was added to a U.S. export control list known as the 'Entity List' in May for acquiring U.S. technology for quantum computing that could help China's military, and involvement in its nuclear program development. USTC and Hefei Advanced Computing Center did not respond to requests for comment. BEYOND RESTRICTED AI CHIPS Amazon has offered Chinese organisations access not only to advanced AI chips but also to advanced AI models such as Anthropic's Claude which they cannot otherwise access, according to public posts, tenders and marketing materials reviewed by Reuters. "Bedrock provides a selection of leading LLMs including prominent closed-source models such as Anthropic's Claude 3," Chu Ruisong, President of AWS Greater China, told a generative AI-themed conference in Shanghai in May, referring to its cloud platform. In various Chinese-language posts for AWS developers and clients, Amazon highlighted the opportunity to try out "world-class AI models" and mentioned Chinese gaming firm Source Technology as one of its clients using Claude. Amazon has dedicated sales teams serving Chinese clients domestically and overseas, according to two former company executives. After Reuters contacted Amazon for comment, it updated dozens of posts on its Chinese-language channels with a note to say some of its services were not available in its China cloud regions. It also removed several promotional posts, including the one about Source Technology. Amazon did not give a reason for removing the posts and did not answer a Reuters query on that. "Amazon Bedrock customers are subject to Anthropic's end user license agreement, which prohibits access to Claude in China both via Amazon's Bedrock API (application programming interface) and via Anthropic's own API," the AWS spokesperson said. Anthropic said it does not support or allow customers or end-users within China to access Claude. "However, subsidiaries or product divisions of Chinese-headquartered companies may use Claude if the subsidiary itself is located in a supported region outside of China," an Anthropic spokesperson said. Source Technology did not respond to a request for comment. (Reporting by Eduardo Baptista, Fanny Potkin and Karen Freifeld; Additional reporting by Krystal Hu, Alexandra Alper and Beijing newsroom; Editing by Miyoung Kim and Muralikumar Anantharaman) By Eduardo Baptista, Fanny Potkin and Karen Freifeld

[2]

China-based entities eyed cloud services from Amazon and rivals to access US AI tech

Government-linked Chinese entities are using cloud services offered by Amazon (NASDAQ:AMZN) or its competitors to access advanced U.S. chips and AI capabilities which they cannot buy due to U.S. export curbs, Reuters reported citing public tender documents. U.S. export curbs are aimed at restricting China's access to advanced chips and equipment, including those used for making AI products, to limit the Chinese military's capabilities. However, giving access to such chips or AI models via the cloud is not a breach of U.S. rules as only exports or transfers of products, software or technology are regulated, the report noted. At least 11 Chinese entities had tried to gain access to U.S. technologies or cloud services which are restricted, the report added, citing over 50 tender documents posted in the last one-year on publicly available Chinese databases. Among the entities, four have cited Amazon Web Services, or AWS, as a cloud service provider. However, these organizations got access to the services via Chinese intermediary companies rather from AWS directly, according to the report. "AWS complies with all applicable U.S. laws, including trade laws, regarding the provision of AWS services inside and outside of China," said a spokesperson for Amazon's cloud business. Shenzhen University spent 200,000 yuan ($27,996) on an AWS account to get access to cloud servers powered by Nvidia A100 and H100 chips for an undisclosed project, the report noted citing a March tender file. The university received the service through an intermediary, Yunda Technology Ltd Co. In October 2023, the U.S. brought in updates to its export restrictions which curbed the sale of chips that Nvidia made for the Chinese market, such as the A800 and H800 chips. Later, the U.S. also restricted Nvidia from selling the A100 and more powerful successors, including the H100, in China. In a tender file from April, a research institute called Zhejiang Lab, which is developing its own large-language model, or LLM, GeoGPT, said that it planned to spend 184,000 yuan to buy AWS cloud services as its AI model did not get enough computing power from local tech giant Alibaba (BABA). Zhejiang Lab did not go ahead with its plan to buy the services, the report added citing a spokesperson for Zhejiang. The Chinese organizations are also trying to access to Microsoft's (MSFT) cloud services. Sichuan University said in an April tender document that it was developing a generative AI platform and buying 40 million Microsoft Azure OpenAI tokens to help deliver the project. The university's procurement file in May revealed that Sichuan Province Xuedong Technology Co. supplied the tokens. OpenAI noted its services are not active in China and that Azure OpenAI operates under Microsoft's policies, according to a statement by the ChatGPT creator to the news agency. In a March, tender document, the University of Science and Technology of China's, or USTC, Suzhou Institute of Advanced Research noted that it needed to rent 500 cloud servers, each driven by eight Nvidia (NVDA) A100 chips, for an undisclosed reason. Hefei Advanced Computing Center Operation Management Co. fulfilled the tender, as per an April document. However, the file did not have the name of the cloud service provider. The U.S. had added USTC to its export control list called 'Entity List' in May, for buying U.S. technology for quantum computing which could help China's military, and involvement in its nuclear program, the report added. Amazon has offered Chinese entities access to advanced AI chips and also advanced AI models like Anthropic's Claude, which the organizations cannot access, the report added citing public posts, tenders and marketing materials. In May, Chu Ruisong, president of AWS Greater China, told a generative AI-themed conference in Shanghai that the company's cloud platform, "Bedrock provides a selection of leading LLMs including prominent closed-source models such as Anthropic's Claude 3. In some Chinese-language posts for AWS developers and clients, Amazon had mentioned Chinese gaming company Source Technology as one of its clients which used Claude. However, after the news agency contacted Amazon, the company updated several posts on its Chinese-language channels with a note saying that some of its services were not available in its China cloud regions. The company also removed some promotional posts, including the one about Source Technology. An AWS spokesperson noted that Amazon Bedrock customers are subject to Anthropic's end user license agreement, which prohibits access to Claude in China through Amazon's Bedrock API (application programming interface) and Anthropic's own API, the report added. Anthropic -- which is backed by Amazon and Alphabet's (GOOG) (GOOGL) unit Google -- stated that it does not support or allow customers or end-users in China to access Claude, as per the report. However, subsidiaries or product divisions of China-headquartered companies could use Claude if the unit is located in a supported region outside China, according to an Anthropic spokesperson. The U.S. government now intends to tighten the curbs to limit access via cloud. "This loophole has been a concern of mine for years, and we are long overdue to address it," said Michael McCaul, chair of the U.S. House of Representatives Foreign Affairs Committee, to the news agency. McCaul was referring to remote access of advanced U.S. computing technology via the cloud by foreign organizations. In April, a legislation was brought in Congress to give power to the commerce department to regulate remote access of U.S. technology, but it is unclear when or if the bill will get clearance.

[3]

Exclusive-Chinese entities turn to Amazon cloud and its rivals to access high-end US chips, AI

Providing access to such chips or advanced AI models through the cloud, however, is not a violation of U.S. regulations since only exports or transfers of a commodity, software or technology are regulated. A Reuters review of more than 50 tender documents posted over the past year on publicly available Chinese databases showed that at least 11 Chinese entities have sought access to restricted U.S. technologies or cloud services. Among those, four explicitly named Amazon Web Services (AWS) as a cloud service provider, though they accessed the services through Chinese intermediary companies rather than from AWS directly. The tender documents, which Reuters is the first to report on, show the breadth of strategies Chinese entities are employing to secure advanced computing power and access generative AI models. They also underscore how U.S. companies are capitalising on China's growing demand for computing power. "AWS complies with all applicable U.S. laws, including trade laws, regarding the provision of AWS services inside and outside of China," a spokesperson for Amazon's cloud business said. AWS controls nearly a third of the global cloud infrastructure market, according to research firm Canalys. In China, AWS is the sixth-largest cloud service provider, according to research firm IDC. Shenzhen University spent 200,000 yuan ($27,996) on an AWS account to gain access to cloud servers powered by Nvidia A100 and H100 chips for an unspecified project, according to a March tender document. It got this service via an intermediary, Yunda Technology Ltd Co, the document showed. Exports to China of the two Nvidia chips, which are used to power large-language models (LLM) such as OpenAI's ChatGPT, are banned by the U.S. Shenzhen University and Yunda Technology did not respond to requests for comment. Nvidia declined to comment on Shenzhen University's spending or on any of the other Chinese entities' deals. Zhejiang Lab, a research institute developing its own LLM, GeoGPT, said in a tender document in April that it intended to spend 184,000 yuan to purchase AWS cloud computing services as its AI model could not get enough computing power from homegrown Alibaba. A spokesperson for Zhejiang Lab said that it did not follow through with the purchase but did not respond to questions about the reasoning behind this decision or how it met its LLM's computing power requirements. Alibaba's cloud unit, Alicloud, did not respond to a request for comment. Reuters could not establish whether or not the purchase went ahead. The U.S. government is now trying to tighten regulations to restrict access through the cloud. "This loophole has been a concern of mine for years, and we are long overdue to address it," Michael McCaul, chair of the U.S. House of Representatives Foreign Affairs Committee, told Reuters in a statement, referring to the remote access of advanced U.S. computing through the cloud by foreign entities. Legislation was introduced in Congress in April to empower the commerce department to regulate remote access of U.S. technology, but it is not clear if and when it will be passed. A department spokesperson said it was working closely with Congress and "seeking additional resources to strengthen our existing controls that restrict PRC companies from accessing advanced AI chips through remote access to cloud computing capability." The commerce department also proposed a rule in January that would require U.S. cloud computing services to verify large AI model users and report to regulators when they use U.S. cloud computing services to train large AI models capable of "malicious cyber-enabled activity". The rule, which has not been finalized, would also enable the commerce secretary to impose prohibitions on customers. "We are aware the commerce department is considering new regulations, and we comply with all applicable laws in the countries in which we operate," the AWS spokesperson said. The Chinese entities are also seeking access to Microsoft's cloud services. In April, Sichuan University said in a tender document it was building a generative AI platform and purchasing 40 million Microsoft Azure OpenAI tokens to support the delivery of this project. The university's procurement document in May showed that Sichuan Province Xuedong Technology Co Ltd supplied the tokens. Microsoft did not respond to requests for comment. Sichuan University and Sichuan Province Xuedong Technology did not respond to requests for comment on the purchase. OpenAI said in a statement its own services are not supported in China and that Azure OpenAI operates under Microsoft's policies. It did not comment on the tenders. The University of Science and Technology of China's (USTC) Suzhou Institute of Advanced Research said in a tender document in March that it wanted to rent 500 cloud servers, each powered by eight Nvidia A100 chips, for an unspecified purpose. The tender was fulfilled by Hefei Advanced Computing Center Operation Management Co Ltd, a procurement document showed in April, but the document did not name the cloud service provider and Reuters could not determine its identity. USTC was added to a U.S. export control list known as the 'Entity List' in May for acquiring U.S. technology for quantum computing that could help China's military, and involvement in its nuclear program development. USTC and Hefei Advanced Computing Center did not respond to requests for comment. Amazon has offered Chinese organisations access not only to advanced AI chips but also to advanced AI models such as Anthropic's Claude which they cannot otherwise access, according to public posts, tenders and marketing materials reviewed by Reuters. "Bedrock provides a selection of leading LLMs including prominent closed-source models such as Anthropic's Claude 3," Chu Ruisong, President of AWS Greater China, told a generative AI-themed conference in Shanghai in May, referring to its cloud platform. In various Chinese-language posts for AWS developers and clients, Amazon highlighted the opportunity to try out "world-class AI models" and mentioned Chinese gaming firm Source Technology as one of its clients using Claude. Amazon has dedicated sales teams serving Chinese clients domestically and overseas, according to two former company executives. After Reuters contacted Amazon for comment, it updated dozens of posts on its Chinese-language channels with a note to say some of its services were not available in its China cloud regions. It also removed several promotional posts, including the one about Source Technology. Amazon did not give a reason for removing the posts and did not answer a Reuters query on that. "Amazon Bedrock customers are subject to Anthropic's end user license agreement, which prohibits access to Claude in China both via Amazon's Bedrock API (application programming interface) and via Anthropic's own API," the AWS spokesperson said. Anthropic said it does not support or allow customers or end-users within China to access Claude. "However, subsidiaries or product divisions of Chinese-headquartered companies may use Claude if the subsidiary itself is located in a supported region outside of China," an Anthropic spokesperson said. Source Technology did not respond to a request for comment. (Reporting by Eduardo Baptista, Fanny Potkin and Karen Freifeld; Additional reporting by Krystal Hu, Alexandra Alper and Beijing newsroom; Editing by Miyoung Kim and Muralikumar Anantharaman)

[4]

Chinese entities turn to Amazon cloud and its rivals to access high-end U.S. chips, AI

State-linked Chinese entities are using cloud services provided by Amazon or its rivals to access advanced U.S. chips and artificial intelligence capabilities that they cannot acquire otherwise, recent public tender documents showed. The U.S. government has restricted the export of high-end AI chips to China over the past two years, citing the need to limit the Chinese military's capabilities. Providing access to such chips or advanced AI models through the cloud, however, is not a violation of U.S. regulations since only exports or transfers of a commodity, software or technology are regulated. A Reuters review of more than 50 tender documents posted over the past year on publicly available Chinese databases showed that at least 11 Chinese entities have sought access to restricted U.S. technologies or cloud services. Among those, four explicitly named Amazon Web Services (AWS) as a cloud service provider, though they accessed the services through Chinese intermediary companies rather than from AWS directly. The tender documents, which Reuters is the first to report on, show the breadth of strategies Chinese entities are employing to secure advanced computing power and access generative AI models. They also underscore how U.S. companies are capitalising on China's growing demand for computing power. "AWS complies with all applicable U.S. laws, including trade laws, regarding the provision of AWS services inside and outside of China," a spokesperson for Amazon's cloud business said. AWS controls nearly a third of the global cloud infrastructure market, according to research firm Canalys. In China, AWS is the sixth-largest cloud service provider, according to research firm IDC. Shenzhen University spent 200,000 yuan ($27,996) on an AWS account to gain access to cloud servers powered by Nvidia A100 and H100 chips for an unspecified project, according to a March tender document. It got this service via an intermediary, Yunda Technology Ltd Co, the document showed. Exports to China of the two Nvidia chips, which are used to power large-language models (LLM) such as OpenAI's ChatGPT, are banned by the U.S. Shenzhen University and Yunda Technology did not respond to requests for comment. Nvidia declined to comment on Shenzhen University's spending or on any of the other Chinese entities' deals. Zhejiang Lab, a research institute developing its own LLM, GeoGPT, said in a tender document in April that it intended to spend 184,000 yuan to purchase AWS cloud computing services as its AI model could not get enough computing power from homegrown Alibaba. A spokesperson for Zhejiang Lab said that it did not follow through with the purchase but did not respond to questions about the reasoning behind this decision or how it met its LLM's computing power requirements. Alibaba's cloud unit, Alicloud, did not respond to a request for comment. Reuters could not establish whether or not the purchase went ahead. The U.S. government is now trying to tighten regulations to restrict access through the cloud. "This loophole has been a concern of mine for years, and we are long overdue to address it," Michael McCaul, chair of the U.S. House of Representatives Foreign Affairs Committee, told Reuters in a statement, referring to the remote access of advanced U.S. computing through the cloud by foreign entities. Legislation was introduced in Congress in April to empower the commerce department to regulate remote access of U.S. technology, but it is not clear if and when it will be passed. A department spokesperson said it was working closely with Congress and "seeking additional resources to strengthen our existing controls that restrict PRC companies from accessing advanced AI chips through remote access to cloud computing capability." The commerce department also proposed a rule in January that would require U.S. cloud computing services to verify large AI model users and report to regulators when they use U.S. cloud computing services to train large AI models capable of "malicious cyber-enabled activity". The rule, which has not been finalized, would also enable the commerce secretary to impose prohibitions on customers. "We are aware the commerce department is considering new regulations, and we comply with all applicable laws in the countries in which we operate," the AWS spokesperson said. Cloud demand in China The Chinese entities are also seeking access to Microsoft's cloud services. In April, Sichuan University said in a tender document it was building a generative AI platform and purchasing 40 million Microsoft Azure OpenAI tokens to support the delivery of this project. The university's procurement document in May showed that Sichuan Province Xuedong Technology Co Ltd supplied the tokens. Microsoft did not respond to requests for comment. Sichuan University and Sichuan Province Xuedong Technology did not respond to requests for comment on the purchase. OpenAI said in a statement its own services are not supported in China and that Azure OpenAI operates under Microsoft's policies. It did not comment on the tenders. The University of Science and Technology of China's (USTC) Suzhou Institute of Advanced Research said in a tender document in March that it wanted to rent 500 cloud servers, each powered by eight Nvidia A100 chips, for an unspecified purpose. The tender was fulfilled by Hefei Advanced Computing Center Operation Management Co Ltd, a procurement document showed in April, but the document did not name the cloud service provider and Reuters could not determine its identity. USTC was added to a U.S. export control list known as the 'Entity List' in May for acquiring U.S. technology for quantum computing that could help China's military, and involvement in its nuclear program development. USTC and Hefei Advanced Computing Center did not respond to requests for comment. Beyond restricted AI chips Amazon has offered Chinese organisations access not only to advanced AI chips but also to advanced AI models such as Anthropic's Claude which they cannot otherwise access, according to public posts, tenders and marketing materials reviewed by Reuters. "Bedrock provides a selection of leading LLMs including prominent closed-source models such as Anthropic's Claude 3," Chu Ruisong, President of AWS Greater China, told a generative AI-themed conference in Shanghai in May, referring to its cloud platform. In various Chinese-language posts for AWS developers and clients, Amazon highlighted the opportunity to try out "world-class AI models" and mentioned Chinese gaming firm Source Technology as one of its clients using Claude. Amazon has dedicated sales teams serving Chinese clients domestically and overseas, according to two former company executives. After Reuters contacted Amazon for comment, it updated dozens of posts on its Chinese-language channels with a note to say some of its services were not available in its China cloud regions. It also removed several promotional posts, including the one about Source Technology. Amazon did not give a reason for removing the posts and did not answer a Reuters query on that. "Amazon Bedrock customers are subject to Anthropic's end user license agreement, which prohibits access to Claude in China both via Amazon's Bedrock API (application programming interface) and via Anthropic's own API," the AWS spokesperson said. Anthropic said it does not support or allow customers or end-users within China to access Claude. "However, subsidiaries or product divisions of Chinese-headquartered companies may use Claude if the subsidiary itself is located in a supported region outside of China," an Anthropic spokesperson said. Source Technology did not respond to a request for comment. Read Comments

[5]

Chinese entities turn to Amazon cloud, rivals to access US chips, AI

State-linked Chinese entities are using cloud services provided by Amazon or its rivals to access advanced U.S. chips and artificial intelligence capabilities that they cannot acquire otherwise, recent public tender documents showed. The U.S. government has restricted the export of high-end AI chips to China over the past two years, citing the need to limit the Chinese military's capabilities. Providing access to such chips or advanced AI models through the cloud, however, is not a violation of U.S. regulations since only exports or transfers of a commodity, software or technology are regulated. A Reuters review of more than 50 tender documents posted over the past year on publicly available Chinese databases showed that at least 11 Chinese entities have sought access to restricted U.S. technologies or cloud services. Among those, four explicitly named Amazon Web Services, or AWS, as a cloud service provider, although they accessed the services through Chinese intermediary companies rather than from AWS directly. The tender documents, which Reuters is the first to report on, show the breadth of strategies Chinese entities are employing to secure advanced computing power and access generative AI models. They also underscore how U.S. companies are capitalizing on China's growing demand for computing power. "AWS complies with all applicable U.S. laws, including trade laws, regarding the provision of AWS services inside and outside of China," a spokesperson for Amazon's cloud business said. AWS controls nearly a third of the global cloud infrastructure market, according to research firm Canalys. In China, AWS is the sixth-largest cloud service provider, according to research firm IDC. Shenzhen University spent $27,996 (200,000 yuan) on an AWS account to gain access to cloud servers powered by Nvidia A100 and H100 chips for an unspecified project, according to a March tender document. It got this service via an intermediary, Yunda Technology Ltd Co, the document showed. Exports to China of the two Nvidia chips that are used to power large-language models, or LLM, such as OpenAI's ChatGPT, are banned by the United States. Shenzhen University and Yunda Technology did not respond to requests for comment. Nvidia declined to comment on Shenzhen University's spending or on any of the other Chinese entities' deals. Zhejiang Lab, a research institute developing its own LLM, called GeoGPT, said in a tender document in April that it intended to spend 184,000 yuan to purchase AWS cloud computing services as its AI model could not get enough computing power from homegrown Alibaba. A spokesperson for Zhejiang Lab said that it did not follow through with the purchase but did not respond to questions about the reasoning behind this decision or how it met its LLM's computing power requirements. Alibaba's cloud unit, Alicloud, did not respond to a request for comment. Reuters could not establish whether the purchase went ahead. Moving to tighten access The U.S. government is now trying to tighten regulations to restrict access through the cloud. "This loophole has been a concern of mine for years, and we are long overdue to address it," Michael McCaul, chair of the U.S. House of Representatives Foreign Affairs Committee, told Reuters in a statement, referring to the remote access of advanced U.S. computing through the cloud by foreign entities. Legislation was introduced in Congress in April to empower the Commerce Department to regulate remote access of U.S. technology, but it is not clear if and when it will be passed. A department spokesperson said it was working closely with Congress and "seeking additional resources to strengthen our existing controls that restrict PRC companies from accessing advanced AI chips through remote access to cloud computing capability." The Commerce Department also proposed a rule in January that would require U.S. cloud computing services to verify large AI model users and report to regulators when they use U.S. cloud computing services to train large AI models capable of "malicious cyber-enabled activity." The rule, which has not been finalized, would also enable the Commerce secretary to impose prohibitions on customers. "We are aware the Commerce Department is considering new regulations, and we comply with all applicable laws in the countries in which we operate," the AWS spokesperson said. Cloud demand in China The Chinese entities are also seeking access to Microsoft's cloud services. In April, Sichuan University said in a tender document it was building a generative AI platform and purchasing 40 million Microsoft Azure OpenAI tokens to support the delivery of this project. The university's procurement document in May showed that Sichuan Province Xuedong Technology Co Ltd supplied the tokens. Microsoft did not respond to requests for comment. Sichuan University and Sichuan Province Xuedong Technology did not respond to requests for comment on the purchase. OpenAI said in a statement that its own services are not supported in China and that Azure OpenAI operates under Microsoft's policies. It did not comment on the tenders. The University of Science and Technology of China's Suzhou Institute of Advanced Research said in a tender document in March that it wanted to rent 500 cloud servers, each powered by eight Nvidia A100 chips, for an unspecified purpose. The tender was fulfilled by Hefei Advanced Computing Center Operation Management Co Ltd, a procurement document showed in April, but the document did not name the cloud service provider. Reuters could not determine its identity. The University of Science and Technology of China, or USTC, was added to a U.S. export control list known as the "Entity List" in May for acquiring U.S. technology for quantum computing that could help China's military, and for involvement in its nuclear program development. USTC and Hefei Advanced Computing Center did not respond to requests for comment. Beyond restricted AI chips Amazon has offered Chinese organizations access not only to advanced AI chips but also to advanced AI models such as Anthropic's Claude, which they cannot otherwise access, according to public posts, tenders and marketing materials reviewed by Reuters. "Bedrock provides a selection of leading LLMs, including prominent closed-source models such as Anthropic's Claude 3," Chu Ruisong, president of AWS Greater China, told a generative AI-themed conference in Shanghai in May, referring to its cloud platform. In various Chinese-language posts for AWS developers and clients, Amazon highlighted the opportunity to try out "world-class AI models" and mentioned Chinese gaming firm Source Technology as one of its clients using Claude. Amazon has dedicated sales teams serving Chinese clients domestically and overseas, according to two former company executives. After Reuters contacted Amazon for comment, it updated dozens of posts on its Chinese-language channels with a note to say some of its services were not available in its China cloud regions. It also removed several promotional posts, including the one about Source Technology. Amazon did not give a reason for removing the posts and did not answer a Reuters query about that. "Amazon Bedrock customers are subject to Anthropic's end user license agreement, which prohibits access to Claude in China both via Amazon's Bedrock API [application programming interface] and via Anthropic's own API," the AWS spokesperson said. Anthropic said it does not support or allow customers or end-users within China to access Claude. "However, subsidiaries or product divisions of Chinese-headquartered companies may use Claude if the subsidiary itself is located in a supported region outside of China," an Anthropic spokesperson said. Source Technology did not respond to a request for comment.

[6]

Chinese entities turn to Amazon cloud and its rivals to access high-end US chips, AI

The US government has restricted the export of high-end AI chips to China over the past two years, citing the need to limit the Chinese military's capabilities. "AWS complies with all applicable US laws, including trade laws, regarding the provision of AWS services inside and outside of China," a spokesperson for Amazon's cloud business said.State-linked Chinese entities are using cloud services provided by Amazon or its rivals to access advanced U.S. chips and artificial intelligence capabilities that they cannot acquire otherwise, recent public tender documents showed. The US government has restricted the export of high-end AI chips to China over the past two years, citing the need to limit the Chinese military's capabilities. Providing access to such chips or advanced AI models through the cloud, however, is not a violation of U.S. regulations since only exports or transfers of a commodity, software or technology are regulated. A Reuters review of more than 50 tender documents posted over the past year on publicly available Chinese databases showed that at least 11 Chinese entities have sought access to restricted U.S. technologies or cloud services. Among those, four explicitly named Amazon Web Services (AWS) as a cloud service provider, though they accessed the services through Chinese intermediary companies rather than from AWS directly. The tender documents, which Reuters is the first to report on, show the breadth of strategies Chinese entities are employing to secure advanced computing power and access generative AI models. They also underscore how U.S. companies are capitalising on China's growing demand for computing power. "AWS complies with all applicable US laws, including trade laws, regarding the provision of AWS services inside and outside of China," a spokesperson for Amazon's cloud business said. AWS controls nearly a third of the global cloud infrastructure market, according to research firm Canalys. In China, AWS is the sixth-largest cloud service provider, according to research firm IDC. Shenzhen University spent 200,000 yuan ($27,996) on an AWS account to gain access to cloud servers powered by Nvidia A100 and H100 chips for an unspecified project, according to a March tender document. It got this service via an intermediary, Yunda Technology Ltd Co, the document showed. Exports to China of the two Nvidia chips, which are used to power large-language models (LLM) such as OpenAI's ChatGPT, are banned by the U.S. Shenzhen University and Yunda Technology did not respond to requests for comment. Nvidia declined to comment on Shenzhen University's spending or on any of the other Chinese entities' deals. Zhejiang Lab, a research institute developing its own LLM, GeoGPT, said in a tender document in April that it intended to spend 184,000 yuan to purchase AWS cloud computing services as its AI model could not get enough computing power from homegrown Alibaba. A spokesperson for Zhejiang Lab said that it did not follow through with the purchase but did not respond to questions about the reasoning behind this decision or how it met its LLM's computing power requirements. Alibaba's cloud unit, Alicloud, did not respond to a request for comment. Reuters could not establish whether or not the purchase went ahead. The U.S. government is now trying to tighten regulations to restrict access through the cloud. "This loophole has been a concern of mine for years, and we are long overdue to address it," Michael McCaul, chair of the U.S. House of Representatives Foreign Affairs Committee, told Reuters in a statement, referring to the remote access of advanced U.S. computing through the cloud by foreign entities. Legislation was introduced in Congress in April to empower the commerce department to regulate remote access of U.S. technology, but it is not clear if and when it will be passed. A department spokesperson said it was working closely with Congress and "seeking additional resources to strengthen our existing controls that restrict PRC companies from accessing advanced AI chips through remote access to cloud computing capability." The commerce department also proposed a rule in January that would require U.S. cloud computing services to verify large AI model users and report to regulators when they use U.S. cloud computing services to train large AI models capable of "malicious cyber-enabled activity". The rule, which has not been finalized, would also enable the commerce secretary to impose prohibitions on customers. "We are aware the commerce department is considering new regulations, and we comply with all applicable laws in the countries in which we operate," the AWS spokesperson said. Cloud demand in China The Chinese entities are also seeking access to Microsoft's cloud services. In April, Sichuan University said in a tender document it was building a generative AI platform and purchasing 40 million Microsoft Azure OpenAI tokens to support the delivery of this project. The university's procurement document in May showed that Sichuan Province Xuedong Technology Co Ltd supplied the tokens. Microsoft did not respond to requests for comment. Sichuan University and Sichuan Province Xuedong Technology did not respond to requests for comment on the purchase. OpenAI said in a statement its own services are not supported in China and that Azure OpenAI operates under Microsoft's policies. It did not comment on the tenders. The University of Science and Technology of China's (USTC) Suzhou Institute of Advanced Research said in a tender document in March that it wanted to rent 500 cloud servers, each powered by eight Nvidia A100 chips, for an unspecified purpose. The tender was fulfilled by Hefei Advanced Computing Center Operation Management Co Ltd, a procurement document showed in April, but the document did not name the cloud service provider and Reuters could not determine its identity. USTC was added to a U.S. export control list known as the 'Entity List' in May for acquiring U.S. technology for quantum computing that could help China's military, and involvement in its nuclear program development. USTC and Hefei Advanced Computing Center did not respond to requests for comment. Beyond restricted AI chips Amazon has offered Chinese organisations access not only to advanced AI chips but also to advanced AI models such as Anthropic's Claude which they cannot otherwise access, according to public posts, tenders and marketing materials reviewed by Reuters. "Bedrock provides a selection of leading LLMs including prominent closed-source models such as Anthropic's Claude 3," Chu Ruisong, President of AWS Greater China, told a generative AI-themed conference in Shanghai in May, referring to its cloud platform. In various Chinese-language posts for AWS developers and clients, Amazon highlighted the opportunity to try out "world-class AI models" and mentioned Chinese gaming firm Source Technology as one of its clients using Claude. Amazon has dedicated sales teams serving Chinese clients domestically and overseas, according to two former company executives. After Reuters contacted Amazon for comment, it updated dozens of posts on its Chinese-language channels with a note to say some of its services were not available in its China cloud regions. It also removed several promotional posts, including the one about Source Technology. Amazon did not give a reason for removing the posts and did not answer a Reuters query on that. "Amazon Bedrock customers are subject to Anthropic's end user license agreement, which prohibits access to Claude in China both via Amazon's Bedrock API (application programming interface) and via Anthropic's own API," the AWS spokesperson said. Anthropic said it does not support or allow customers or end-users within China to access Claude. "However, subsidiaries or product divisions of Chinese-headquartered companies may use Claude if the subsidiary itself is located in a supported region outside of China," an Anthropic spokesperson said. Source Technology did not respond to a request for comment. ($1 = 7.1440 Chinese yuan renminbi)

[7]

Chinese entities using Amazon and rival cloud services to access high-end US chips - Reuters By Investing.com

Chinese state-linked entities are increasingly turning to cloud services from Amazon (NASDAQ:AMZN) and its rivals to access advanced U.S. chips and artificial intelligence (AI) capabilities, according to a report from Reuters on Friday. Due to U.S. export restrictions, these entities cannot directly acquire high-end AI chips, but they can still access these technologies through cloud platforms. A Reuters review of over 50 tender documents revealed that at least 11 Chinese entities sought access to restricted U.S. technologies via cloud services. Four of these are reported to have explicitly mentioned Amazon Web Services (AWS), although they accessed it through Chinese intermediaries rather than directly from AWS. The U.S. government has restricted exports of high-end AI chips to China, aiming to limit the Chinese military's capabilities. However, providing access through the cloud does not violate current U.S. regulations. AWS, which controls nearly a third of the global cloud infrastructure market, is one of the primary providers used by Chinese entities to gain access to powerful computing resources. For example, Reuters said Shenzhen University spent approximately $28,000 on an AWS account to access cloud servers powered by Nvidia chips, which are banned for export to China. The U.S. government is now considering tightening regulations to close this loophole. Michael McCaul, chair of the U.S. House of Representatives Foreign Affairs Committee, told Reuters that this issue has been a concern for years and needs to be addressed. The Biden administration is also working with Congress to strengthen existing controls to prevent Chinese companies from accessing advanced AI chips via cloud computing services, according to Reuters.

[8]

China is accessing U.S. AI, chips via Amazon cloud

State-linked Chinese entities are using cloud services provided by Amazon or its rivals to access advanced U.S. chips and artificial intelligence capabilities that they cannot acquire otherwise, recent public tender documents showed. The U.S. government has restricted the export of high-end AI chips to China over the past two years, citing the need to limit the Chinese military's capabilities. Providing access to such chips or advanced AI models through the cloud, however, is not a violation of U.S. regulations since only exports or transfers of a commodity, software or technology are regulated. A Reuters review of more than 50 tender documents posted over the past year on publicly available Chinese databases showed that at least 11 Chinese entities have sought access to restricted U.S. technologies or cloud services.

[9]

Report: Chinese organizations use public cloud to access restricted AI chips - SiliconANGLE

Report: Chinese organizations use public cloud to access restricted AI chips Multiple organizations in China have sought to rent high-end graphics cards from U.S. cloud providers, Reuters reported late Thursday. The news agency learned of the procurement effort by reviewing publicly-available tender documents. Those are invitations that ask companies to submit bids for a contract, in this case artificial intelligence infrastructure purchases. Under U.S. export controls that rolled out two years ago, Nvidia Corp. is prohibited from selling its high-end H100 and A100 graphics processing units to entitles in China. The rules also cover certain other data center chips optimized for AI workloads. But while such chips can't be sold or transferred to entities based in China, leasing them via the cloud is not prohibited. The documents reviewed by Reuters indicate that at least 11 Chinese organizations have sought access to "restricted U.S. technologies or cloud services." Many of those organizations planned to complete the transactions through intermediaries. According to Reuters, a university spent the equivalent of $28,000 to access Amazon Web Services Inc. instances equipped with A100 and H100 chips. In April, a research institute developing a custom large language model disclosed plans to spend a similar sum on AWS infrastructure. It intended to use the hardware to power an AI model. Microsoft Corp.'s competing Azure cloud was also named in the public tender documents. In one of the filings, a university stated that it had purchased access to OpenAI models hosted on Azure. The deal covered 40 billion tokens' worth of AI processing capacity. Like Microsoft, AWS offers access to third-party AI models in its cloud. According to Reuters, the Amazon.com Inc. unit published a number of Chinese-language marketing documents that highlighted an opportunity to try out "world-class AI models" on its platform. The news agency reported that some of the marketing materials, which included blog posts, referenced Anthropic PBC's Claude series of LLMs. Following the report, AWS updated dozens of blog posts with a note stating that not all its services are available via its cloud regions in China. A spokesperson told Reuters that "Amazon Bedrock customers are subject to Anthropic's end user license agreement, which prohibits access to Claude in China both via Amazon's Bedrock API (application programming interface) and via Anthropic's own API." The report comes as U.S. policymakers take steps to more closely regulate cloud-hosted AI models and chips.

[10]

Factbox-List of Chinese entities who have turned to the cloud for access to restricted US tech

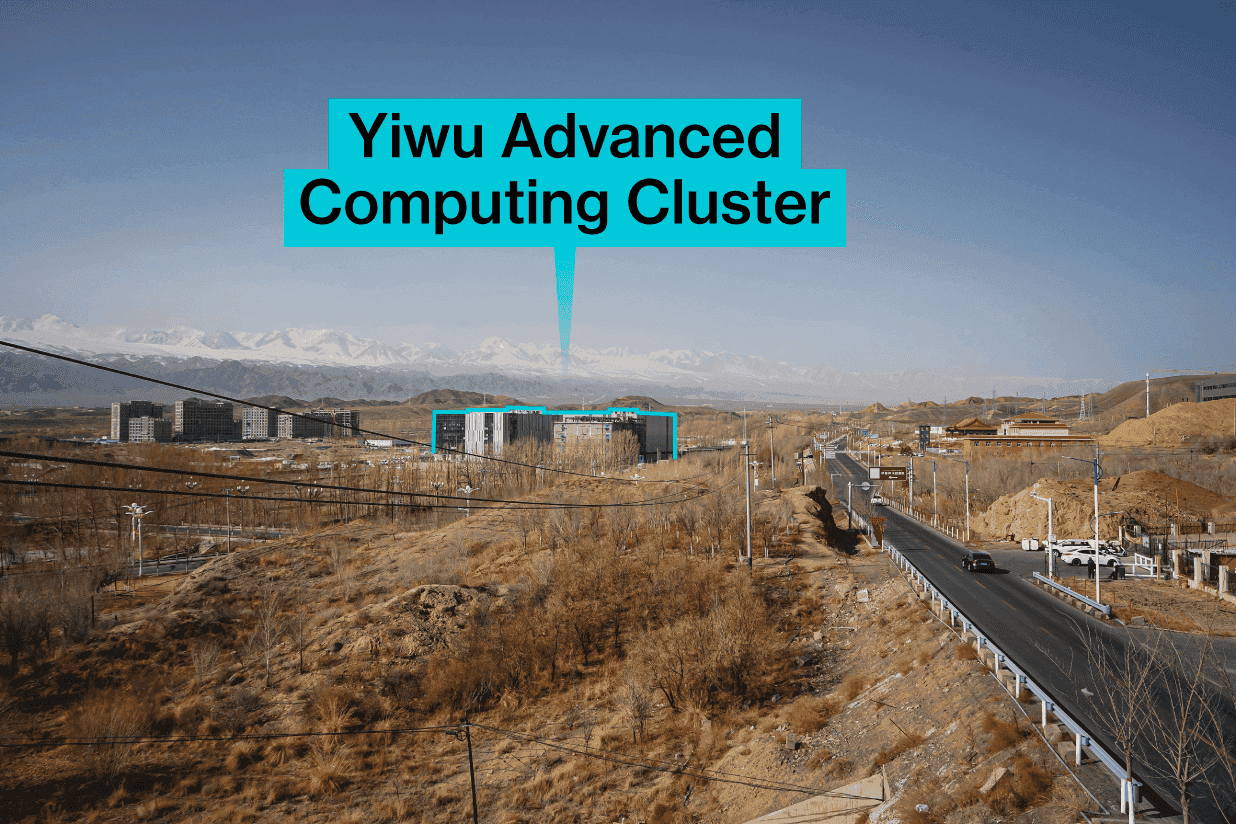

(Reuters) - State-linked Chinese entities are using cloud services provided by Amazon or its rivals to access advanced U.S. chips and artificial intelligence capabilities that they cannot acquire otherwise, recent public tender documents showed. Providing access to such technologies through the cloud is not a violation of U.S. regulations. A spokesperson for Amazon's cloud business, Amazon Web Services (AWS), said: "AWS complies with all applicable U.S. laws, including trade laws, regarding the provision of AWS services inside and outside of China." Following is a list of Chinese entities that sought access to restricted U.S. technologies through the cloud, according to the documents that were reviewed by Reuters. Entities accessing or expressing interest in accessing AI models and computing power via AWS: 1. Zhejiang Lab The state-run research institute is developing its own large-language model, GeoGPT, and said in a tender document in April that it intended to spend 184,000 yuan ($25,760) to purchase AWS cloud computing services, as its AI model could not get enough computing power from homegrown Alibaba. The institute told Reuters that it did not go through with the purchase but did not say why. Alibaba's cloud unit, Alicloud, did not respond to a request for comment. Reuters could not determine if the purchase had been completed. 2. National Center of Technology Innovation for EDA The state-backed entity, which helps Chinese companies develop chip design blueprints for mass production, said in an April tender document it spent 600,000 yuan to buy an overseas AWS account for the purpose of accessing Claude 3, an AI model developed by Anthropic. Anthropic said it does not support or allow customers or end-users within China to access Claude. The center did not respond to a request for comment. Shenzhen University spent 200,000 yuan on an AWS account to gain access to cloud servers powered by Nvidia A100 and H100 chips for an unspecified project, according to a March tender document. Exports to China of the two Nvidia chips are banned by the U.S. Shenzhen University got this service via an intermediary, Yunda Technology Ltd Co, the document showed. The university and Yunda Technology did not respond to requests for comment. Nvidia did not respond to a request for comment on Shenzhen University's spending or on any of the other Chinese entities' deals. 2. Fujian Chuanzheng Communications College The vocational college backed by the Fujian provincial government spent 85,000 yuan in August last year on an AWS account that would give it access to clusters made up of over 4,000 Nvidia A100 chips. The supplier was Xiamen Hanwei Software Technology Ltd Co, according to the August tender document. The college said in the tender document that the purchase was designed to "keep pace with the latest developments in cloud computing technology...and enhance the quality of cloud computing talent training and professional development at educational institutions." The college and Xiamen Hanwei did not respond to requests for comment. An AWS spokesperson said "the vast majority of this small tender pertained to skills training, and the very small portion that related to cloud services did not use any of the restricted AI chips." Entities accessing or expressing interest in accessing OpenAI tools via Microsoft's Azure 1. Chongqing Changan Automobile Co The state-owned car maker said in May last year it was looking for a retailer authorised by Microsoft that could set up Azure OpenAI accounts and integrate generative AI technology into the company's systems and applications. The company did not respond to a request for comment on whether it went through with the purchase. Microsoft did not respond to a request for comment and Reuters could not determine whether the purchase went through. 2. Sichuan University In April, Sichuan University said it was building a generative AI platform and purchasing 40 million Azure OpenAI tokens in order to support the delivery of this project. The supplier was Sichuan Province Xuedong Technology Co Ltd, a May tender document showed. The Chinese entities and Microsoft did not respond to requests for comment. OpenAI said in a statement its own services are not supported in China and that Azure OpenAI operates under Microsoft's policies. It did not comment on the tenders. Entities accessing or expressing interest in accessing U.S. chips via cloud services 1. Suzhou Institute of Advanced Research, University of Science and Technology of China (USTC) The USTC institute said in a March filing that it wanted to rent 500 cloud servers, each powered by eight Nvidia A100 chips for an unspecified purpose. The tender was fulfilled by Hefei Advanced Computing Center Operation Management Co Ltd, a procurement document showed in April, but the document did not name the cloud service provider and Reuters could not determine its identity. The U.S. Commerce Department added USTC to its Entity List in May 2024 for acquiring U.S. technology for quantum computing that could help China's military, and involvement in its nuclear program development. USTC did not respond to a request for comment on the transaction and on being put on the entity list. 2. Southern University of Science and Technology (SUSTech) The university's Department of Computer Science bought in April four months of usage time on a server powered by eight Nvidia A100 chips by paying 196,000 yuan to Shenzhen Yunbing Technology Co Ltd for an unspecified purpose. The university's Department of Mechanical and Energy Engineering was added in February 2022 to the Unverified List, which means parties that engage in business with the department must take additional compliance steps to address U.S. concerns about potential national security risks. SUSTech and Shenzhen Yunbing did not respond to requests for comment. 3. Tsinghua University One of the most frequent state-affiliated buyers of banned Nvidia chips said in November 2023 that it planned to spend almost half a million yuan to rent 10 or more servers, each powered by eight Nvidia A100 chips, to provide AI computing power for an unspecified purpose. The contract was awarded to Beijing Parallel Technology Co Ltd, a Reuters check showed. Neither entity responded to a request for comment. 4. China Coal Research Institute A major R&D hub for China's coal industry, the institute said in June it wanted to purchase four servers powered by Nvidia A100 chips. The institute did not respond to a request for comment. Reuters could not establish if the purchase went ahead. 5. China National Knowledge Infrastructure China National Knowledge Infrastructure, which operates the country's largest academic database, said it wanted to purchase a cloud computing account with a validity of three years that could give it access to Nvidia A100 computing power. The tender was awarded to Inner Mongolia Tongfang Exploration Technology Co Ltd, a Reuters check showed. Neither company responded to a request for comment. (Reporting by Beijing newsroom; Editing by Miyoung Kim and Muralikumar Anantharaman)

[11]

Chinese firms are gaining access to top US technology and AI via AWS

State-linked Chinese entities are leveraging cloud services from Amazon Web Services (AWS) and its competitors in order to access advanced US chips and AI capabilities that have been restricted in the nation. By accessing overseas technologies via cloud computing services, Chinese organizations can circumvent US export controls to obtain advanced technology. The news comes after around two years of US government efforts to impose strict regulations to limit the export of high-end AI chips to China in an effort to hinder the country's military's technological advancements. Anti-China regulations imposed by the US do not prevent the country from accessing such technology through cloud services, but rather the direct export or transfer of tangible goods, software or technology, therefore the country can maintain its access. A Reuters investigation of more than 50 tender documents posted to Chinese public database over the past year found that at least 11 Chinese entities sought access to restricted US technologies or cloud services - four of which named AWS as their cloud service provider, although they accessed the service through local intermediaries. One such example is Shenzhen University's 200,000 yuan ($28,000) payment to access cloud servers powered by Nvidia A100 and H100 chips, which have been banned for export to China. AWS, which accounts for around one-third of the global cloud market, or the same as Microsoft and Google combined, states that it complies with all applicable US laws. Consequentially, the US government appears to be increasingly worried about the loophole, with legislators proposing new measures to regulate remote access to US technologies via cloud services. The effectiveness of current export restrictions is also under fire.

[12]

List of Chinese entities who have turned to the cloud for access to restricted US tech

A spokesperson for Amazon's cloud business, Amazon Web Services (AWS), said: "AWS complies with all applicable U.S. laws, including trade laws, regarding the provision of AWS services inside and outside of China." Following is a list of Chinese entities that sought access to restricted U.S. technologies through the cloud, according to the documents that were reviewed by Reuters. Entities accessing or expressing interest in accessing AI models and computing power via AWS: 1. Zhejiang Lab The state-run research institute is developing its own large-language model, GeoGPT, and said in a tender document in April that it intended to spend 184,000 yuan ($25,760) to purchase AWS cloud computing services, as its AI model could not get enough computing power from homegrown Alibaba. The institute told Reuters that it did not go through with the purchase but did not say why. Alibaba's cloud unit, Alicloud, did not respond to a request for comment. Reuters could not determine if the purchase had been completed. 2. National Center of Technology Innovation for EDA The state-backed entity, which helps Chinese companies develop chip design blueprints for mass production, said in an April tender document it spent 600,000 yuan to buy an overseas AWS account for the purpose of accessing Claude 3, an AI model developed by Anthropic. Anthropic said it does not support or allow customers or end-users within China to access Claude. The center did not respond to a request for comment. Shenzhen University spent 200,000 yuan on an AWS account to gain access to cloud servers powered by Nvidia A100 and H100 chips for an unspecified project, according to a March tender document. Exports to China of the two Nvidia chips are banned by the U.S. Shenzhen University got this service via an intermediary, Yunda Technology Ltd Co, the document showed. The university and Yunda Technology did not respond to requests for comment. Nvidia did not respond to a request for comment on Shenzhen University's spending or on any of the other Chinese entities' deals. 2. Fujian Chuanzheng Communications College The vocational college backed by the Fujian provincial government spent 85,000 yuan in August last year on an AWS account that would give it access to clusters made up of over 4,000 Nvidia A100 chips. The supplier was Xiamen Hanwei Software Technology Ltd Co, according to the August tender document. The college said in the tender document that the purchase was designed to "keep pace with the latest developments in cloud computing technology...and enhance the quality of cloud computing talent training and professional development at educational institutions." The college and Xiamen Hanwei did not respond to requests for comment. An AWS spokesperson said "the vast majority of this small tender pertained to skills training, and the very small portion that related to cloud services did not use any of the restricted AI chips." Entities accessing or expressing interest in accessing OpenAI tools via Microsoft's Azure 1. Chongqing Changan Automobile Co The state-owned car maker said in May last year it was looking for a retailer authorised by Microsoft that could set up Azure OpenAI accounts and integrate generative AI technology into the company's systems and applications. The company did not respond to a request for comment on whether it went through with the purchase. Microsoft did not respond to a request for comment and Reuters could not determine whether the purchase went through. 2. Sichuan University In April, Sichuan University said it was building a generative AI platform and purchasing 40 million Azure OpenAI tokens in order to support the delivery of this project. The supplier was Sichuan Province Xuedong Technology Co Ltd, a May tender document showed. The Chinese entities and Microsoft did not respond to requests for comment. OpenAI said in a statement its own services are not supported in China and that Azure OpenAI operates under Microsoft's policies. It did not comment on the tenders. Entities accessing or expressing interest in accessing U.S. chips via cloud services 1. Suzhou Institute of Advanced Research, University of Science and Technology of China (USTC) The USTC institute said in a March filing that it wanted to rent 500 cloud servers, each powered by eight Nvidia A100 chips for an unspecified purpose. The tender was fulfilled by Hefei Advanced Computing Center Operation Management Co Ltd, a procurement document showed in April, but the document did not name the cloud service provider and Reuters could not determine its identity. The U.S. Commerce Department added USTC to its Entity List in May 2024 for acquiring U.S. technology for quantum computing that could help China's military, and involvement in its nuclear program development. USTC did not respond to a request for comment on the transaction and on being put on the entity list. 2. Southern University of Science and Technology (SUSTech) The university's Department of Computer Science bought in April four months of usage time on a server powered by eight Nvidia A100 chips by paying 196,000 yuan to Shenzhen Yunbing Technology Co Ltd for an unspecified purpose. The university's Department of Mechanical and Energy Engineering was added in February 2022 to the Unverified List, which means parties that engage in business with the department must take additional compliance steps to address U.S. concerns about potential national security risks. SUSTech and Shenzhen Yunbing did not respond to requests for comment. 3. Tsinghua University One of the most frequent state-affiliated buyers of banned Nvidia chips said in November 2023 that it planned to spend almost half a million yuan to rent 10 or more servers, each powered by eight Nvidia A100 chips, to provide AI computing power for an unspecified purpose. The contract was awarded to Beijing Parallel Technology Co Ltd, a Reuters check showed. Neither entity responded to a request for comment. 4. China Coal Research Institute A major R&D hub for China's coal industry, the institute said in June it wanted to purchase four servers powered by Nvidia A100 chips. The institute did not respond to a request for comment. Reuters could not establish if the purchase went ahead. 5. China National Knowledge Infrastructure China National Knowledge Infrastructure, which operates the country's largest academic database, said it wanted to purchase a cloud computing account with a validity of three years that could give it access to Nvidia A100 computing power. The tender was awarded to Inner Mongolia Tongfang Exploration Technology Co Ltd, a Reuters check showed. Neither company responded to a request for comment. ($1 = 7.1429 Chinese yuan renminbi) (Reporting by Beijing newsroom; Editing by Miyoung Kim and Muralikumar Anantharaman)

[13]

State-controlled Chinese entities use restricted GPUs on Amazon and Microsoft cloud services: Report

There is a loophole in American restrictions for Chinese entities and they use it. Although the U.S. government restricts sales of advanced processors for AI and HPC to China-based entities, these entities can use cloud services from companies like Amazon Web Services (AWS) and Microsoft to access advanced U.S. processors, reports Reuters. Although the U.S. government mulls restricting availability of American cloud services for AI and HPC to entities in China and other sanctioned countries, for now they can bypass export bans by using AWS, Azure, and the like. More than 50 public tender documents reviewed by Reuters reveal that at least 11 Chinese entities have pursued restricted U.S. technologies through cloud services over the past year. In fact, as many as four of these entities identified AWS as their cloud provider, although they accessed these services via Chinese intermediaries instead of directly from AWS. One notable example is Shenzhen University, which spent approximately ¥200,000 (around $28,000) on an AWS account to access cloud servers powered by Nvidia A100 and H100 processors to work on an unspecified project. These GPUs are specifically banned for export to China by the U.S., yet the university acquired access to them through an intermediary, Yunda Technology. Similarly, Zhejiang Lab, which is developing its own large-language model (LLM) called GeoGPT, considered spending ¥184,000 (around $25,800) on AWS cloud computing services citing insufficient computing power from Alibaba's Alicloud. However, the lab did not make the purchase for an unknown reason, and it also did not disclose how it ultimately met its compute performance requirements. In March, the Suzhou Institute of Advanced Research at the University of Science and Technology of China (USTC) announced a tender to rent 500 cloud servers, each equipped with eight Nvidia A100 chips, for an undisclosed purpose. By April, Hefei Advanced Computing Center Operation Management had provided the servers, though the cloud service provider remained unknown. In May, USTC was placed on the U.S. 'Entity List' due to its use of U.S. technology for quantum computing with potential military and nuclear applications. Also in April, Sichuan University announced in a tender document its plan to develop a generative AI platform, for which it intended to acquire 40 million Microsoft Azure OpenAI tokens. By May, procurement records indicated that Sichuan Province Xuedong Technology was the supplier of these tokens. Azure OpenAI operates under Microsoft's Azure policies and is therefore has no direct business ties to OpenAI. AWS and other companies involved have stated that they comply with all applicable U.S. laws. Following inquiries from Reuters, AWS updated and removed certain promotional posts on its Chinese-language platforms, reflecting heightened scrutiny over its services in China. Last October, the U.S. government first said that it was mulling restrictions on Chinese entities' access to U.S.-based cloud computing services that offer high-performance hardware for AI and HPC, amid concerns over China's use of the technology to boost its military potential. The U.S. Secretary of Commerce Gina Raimondo reiterated the plan in January. The U.S. government is now moving to close this regulatory gap. Legislation introduced in Congress would give the Commerce Department the authority to regulate remote access to U.S. processors through cloud services. The Commerce Department has also proposed new rules that would require cloud providers to verify the identity of users training large AI models and report their activities. However, it is unclear when and if any laws will be passed. However, the U.S. cannot prevent Chinese entities from accessing cloud services offered by non-American companies. The only way to do so would probably be to restrict sales of AI and HPC processors to prominent cloud providers in Europe and the Middle East, which would harm many American companies, including Nvidia. As a result, instead of using American cloud services, Chinese companies could simply switch to alternatives in Europe and the Middle East

[14]

Factbox-List of Chinese entities who have turned to the cloud for access to restricted US tech

A spokesperson for Amazon's cloud business, Amazon Web Services (AWS), said: "AWS complies with all applicable U.S. laws, including trade laws, regarding the provision of AWS services inside and outside of China." Following is a list of Chinese entities that sought access to restricted U.S. technologies through the cloud, according to the documents that were reviewed by Reuters. Entities accessing or expressing interest in accessing AI models and computing power via AWS: The state-run research institute is developing its own large-language model, GeoGPT, and said in a tender document in April that it intended to spend 184,000 yuan ($25,760) to purchase AWS cloud computing services, as its AI model could not get enough computing power from homegrown Alibaba. The institute told Reuters that it did not go through with the purchase but did not say why. Alibaba's cloud unit, Alicloud, did not respond to a request for comment. Reuters could not determine if the purchase had been completed. 2. National Center of Technology Innovation for EDA The state-backed entity, which helps Chinese companies develop chip design blueprints for mass production, said in an April tender document it spent 600,000 yuan to buy an overseas AWS account for the purpose of accessing Claude 3, an AI model developed by Anthropic. Anthropic said it does not support or allow customers or end-users within China to access Claude. The center did not respond to a request for comment. Shenzhen University spent 200,000 yuan on an AWS account to gain access to cloud servers powered by Nvidia A100 and H100 chips for an unspecified project, according to a March tender document. Exports to China of the two Nvidia chips are banned by the U.S. Shenzhen University got this service via an intermediary, Yunda Technology Ltd Co, the document showed. The university and Yunda Technology did not respond to requests for comment. Nvidia did not respond to a request for comment on Shenzhen University's spending or on any of the other Chinese entities' deals. The vocational college backed by the Fujian provincial government spent 85,000 yuan in August last year on an AWS account that would give it access to clusters made up of over 4,000 Nvidia A100 chips. The supplier was Xiamen Hanwei Software Technology Ltd Co, according to the August tender document. The college said in the tender document that the purchase was designed to "keep pace with the latest developments in cloud computing technology...and enhance the quality of cloud computing talent training and professional development at educational institutions." The college and Xiamen Hanwei did not respond to requests for comment. An AWS spokesperson said "the vast majority of this small tender pertained to skills training, and the very small portion that related to cloud services did not use any of the restricted AI chips." Entities accessing or expressing interest in accessing OpenAI tools via Microsoft's Azure The state-owned car maker said in May last year it was looking for a retailer authorised by Microsoft that could set up Azure OpenAI accounts and integrate generative AI technology into the company's systems and applications. The company did not respond to a request for comment on whether it went through with the purchase. Microsoft did not respond to a request for comment and Reuters could not determine whether the purchase went through. In April, Sichuan University said it was building a generative AI platform and purchasing 40 million Azure OpenAI tokens in order to support the delivery of this project. The supplier was Sichuan Province Xuedong Technology Co Ltd, a May tender document showed. The Chinese entities and Microsoft did not respond to requests for comment. OpenAI said in a statement its own services are not supported in China and that Azure OpenAI operates under Microsoft's policies. It did not comment on the tenders. Entities accessing or expressing interest in accessing U.S. chips via cloud services 1. Suzhou Institute of Advanced Research, University of Science and Technology of China (USTC) The USTC institute said in a March filing that it wanted to rent 500 cloud servers, each powered by eight Nvidia A100 chips for an unspecified purpose. The tender was fulfilled by Hefei Advanced Computing Center Operation Management Co Ltd, a procurement document showed in April, but the document did not name the cloud service provider and Reuters could not determine its identity. The U.S. Commerce Department added USTC to its Entity List in May 2024 for acquiring U.S. technology for quantum computing that could help China's military, and involvement in its nuclear program development. USTC did not respond to a request for comment on the transaction and on being put on the entity list. 2. Southern University of Science and Technology (SUSTech) The university's Department of Computer Science bought in April four months of usage time on a server powered by eight Nvidia A100 chips by paying 196,000 yuan to Shenzhen Yunbing Technology Co Ltd for an unspecified purpose. The university's Department of Mechanical and Energy Engineering was added in February 2022 to the Unverified List, which means parties that engage in business with the department must take additional compliance steps to address U.S. concerns about potential national security risks. SUSTech and Shenzhen Yunbing did not respond to requests for comment. One of the most frequent state-affiliated buyers of banned Nvidia chips said in November 2023 that it planned to spend almost half a million yuan to rent 10 or more servers, each powered by eight Nvidia A100 chips, to provide AI computing power for an unspecified purpose. The contract was awarded to Beijing Parallel Technology Co Ltd, a Reuters check showed. Neither entity responded to a request for comment. A major R&D hub for China's coal industry, the institute said in June it wanted to purchase four servers powered by Nvidia A100 chips. The institute did not respond to a request for comment. Reuters could not establish if the purchase went ahead. China National Knowledge Infrastructure, which operates the country's largest academic database, said it wanted to purchase a cloud computing account with a validity of three years that could give it access to Nvidia A100 computing power. The tender was awarded to Inner Mongolia Tongfang Exploration Technology Co Ltd, a Reuters check showed. Neither company responded to a request for comment. (Reporting by Beijing newsroom; Editing by Miyoung Kim and Muralikumar Anantharaman)

[15]

Chinese Firms Are Reportedly Accessing High-End Nvidia AI Chips Using AWS And Microsoft Cloud Services, Bypassing US Restrictions - Amazon.com (NASDAQ:AMZN), Dell Technologies (NYSE:DELL)