Chinese Tech Giants Accelerate AI Investments Despite US Chip Restrictions

3 Sources

3 Sources

[1]

Despite US Limits On China's Access To Nvidia Chips, Tech Titans Like Alibaba And Tencent Ramp Up AI Investments - Alibaba Gr Hldgs (NYSE:BABA), Baidu (NASDAQ:BIDU)

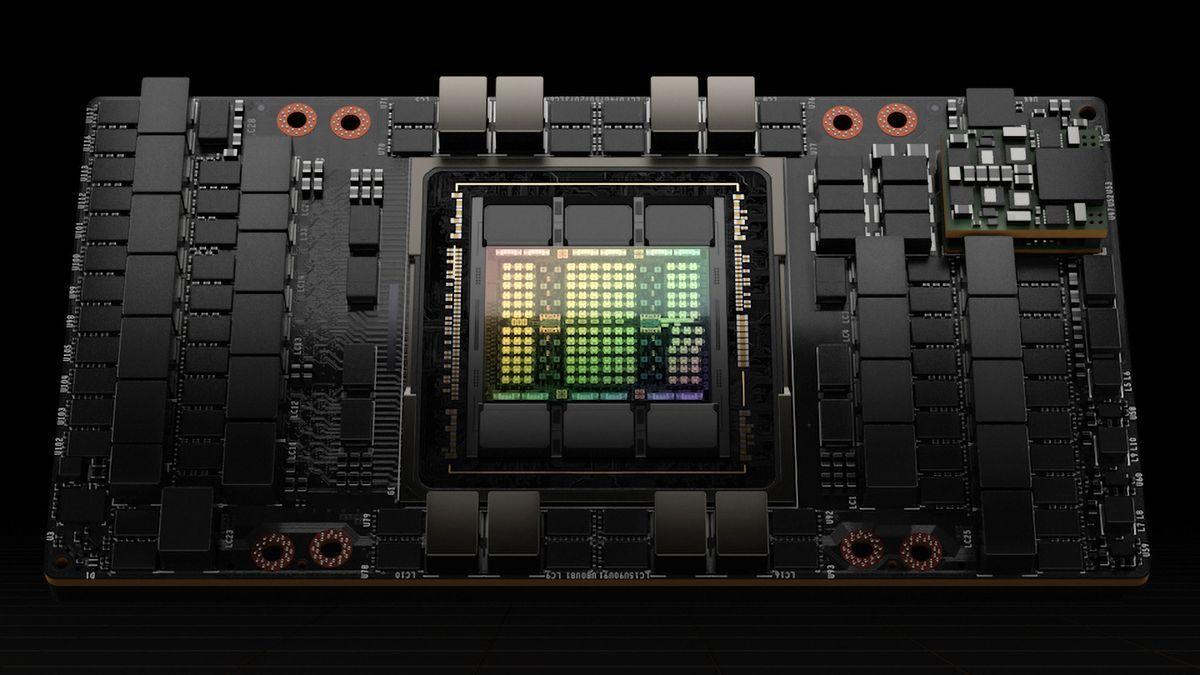

In the face of U.S. sanctions, Chinese tech giants have doubled their capital expenditure in 2024, with a heavy focus on artificial intelligence (AI) infrastructure. What Happened: Alibaba BABA, Tencent TCEHY, and Baidu BIDU together invested 50 billion Chinese yuan ($7 billion) in the first half of 2024, a significant increase from 23 billion Chinese yuan ($3.22 billion) the previous year. The investments are primarily directed towards processors and infrastructure for training large language models for AI, the Financial Times reported on Monday. ByteDance, the parent company of TikTok, has also increased its AI-related expenditure, utilizing its $50 billion cash reserve and relative freedom from investor scrutiny. Despite U.S. export controls limiting access to Nvidia Corp's NVDA leading AI processors, Chinese tech giants are acquiring lower-performance processors like Nvidia's H20. Analysts predict Nvidia will ship over a million of these processors to Chinese tech groups in the coming months. See Also: JD Stock Slips Into Death Cross After Walmart Sells Stake Why It Matters: The ramped-up investment in AI by Chinese tech giants is a response to Chinese President Xi Jinping's call for the country to boost its innovation capabilities amid the ongoing chip dispute with the U.S. Jinping pointed out that "some key, core technologies are controlled by others," indicating a lack of top scientific and technological talents. Chinese AI developers have also found ways to access advanced Nvidia Corp chips without importing them into China, leveraging computing power abroad through brokers. Since 2023, Alibaba and Tencent have directed a significant portion of their deals in China towards AI startups, marking record-high investments in the sector for both companies. This shift in focus comes at a time when the two tech giants have been scaling back their investments due to regulatory challenges, the impact of the COVID-19 pandemic, and a slowing Chinese economy. Read Next: What's Going On With Faraday Future Intelligent Electric Stock Monday? Photo by William Potter on Shutterstock This story was generated using Benzinga Neuro and edited by Pooja Rajkumari Market News and Data brought to you by Benzinga APIs

[2]

Nvidia Tech Fuels Chinese AI Growth Overseas, Alibaba Ramps Up $7B Investment - Alibaba Gr Hldgs (NYSE:BABA), NVIDIA (NASDAQ:NVDA)

Chinese tech giants boosted AI spending to $7B in H1 2024, focusing on processors and infrastructure for AI models. Chinese artificial intelligence developers have made a breakthrough in gaining access to sophisticated advanced AI chips as U.S. semiconductor sanctions on China erode their AI ambitions. The Chinese AI developers are acquiring advanced Nvidia Corp NVDA chips without importing them into China by leveraging computing power abroad through brokers. The developers are resorting to cryptocurrency-world methods, like using blockchain technology for anonymity, to bypass U.S. semiconductor sanctions, the Wall Street Journal reports. AI developers rent the computing power needed to run AI algorithms, working with overseas data centers and decentralized platforms, bypassing the cumbersome effort of importing the chips into China. Derek Aw's company, a former Bitcoin miner, loaded over 300 servers with the chips into a data center in Brisbane, Australia, after which they began processing AI algorithms for a company in Beijing, the WSJ noted. Joseph Tse is a former employee of a Shanghai-based AI startup that, according to WSJ, arranged for over 400 servers at a data center in California with Nvidia's H100 chips to train its AI model. The WSJ said Edge Matrix Computing connected over 3,000 GPUs in its decentralized network, including Nvidia chips, for AI training. Alibaba Group Holding BABA, Tencent Holding TCEHY, and Baidu Inc BIDU collectively spent 50 billion Chinese Yuan ($7 billion) on capital expenditures in the first half of this year, compared to 23 billion Chinese Yuan a year ago, focusing on processors and infrastructure for training AI models, the Financial Times reports. Chinese tech companies are purchasing lower-performance processors like Nvidia's H20, priced between $12,000 and $13,000 each. Previously, Alibaba Co-founder and chairman Joe Tsai stated that China trailed behind the U.S. in the AI race due to the U.S. sanctions, which also took a toll on Alibaba's cloud business. Analysts predict Nvidia will ship over a million units of these processors to Chinese firms in the coming months. Despite these investments, China's Big Tech capex still trails far behind that of their American counterparts, with Alphabet Inc GOOG GOOGL, Amazon.Com Inc AMZN, Meta Platforms Inc META, and Microsoft Corp MSFT spending $106 billion in the same period. Thanks to the AI frenzy, Nvidia stock has risen over 176% in the last 12 months. Alibaba is down over 7.4% due to the weak Chinese economy, escalating domestic re-commerce rivalry, and U.S. semiconductor sanctions that have damaged the e-commerce juggernaut. Price Actions: NVDA stock traded higher by 0.53% at $130.05 premarket at last check Monday. Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Photo via Shutterstock Market News and Data brought to you by Benzinga APIs

[3]

Chinese tech giants continue to splurge on AI despite U.S. chip restrictions

The three companies had a combined capital expenditure of RMB 50 billion ($7.02 billion) in the first half of the year, compared with RMB 23 billion a year earlier, with the major focus on infrastructure related to training large language models for AI. Alibaba's (BABA) capital expenditure in the first half of the year reached RMB 23 billion, more than double the amount a year ago. "We'll continue to invest in R&D and AI capex to ensure the growth of our AI-driven cloud business," its CEO Eddie Wu said in an earnings call this month. "We can expect to see a very high ROI over these next quarters." For the six months ending June 30, Tencent's (OTCPK:TCEHY) capital expenditures totaled about RMB 23.1 billion, compared to about RMB 8.4 billion spent for the same period last year. "Looking forward, we continue to invest in our platforms and technologies, including AI, enabling us to create new business value and better serve user needs," Tencent (OTCPK:TCEHY) said in its earnings report. Baidu (BIDU), which saw its cost of revenue inching higher in the second quarter on AI-related expenses, reported capital expenditures of RMB 4.2 billion in the first half of the year, up 4% from a year ago. Since 2022, the U.S. has put sanctions in place to curb the export of advanced AI chips and related equipment to China, including Nvidia's (NVDA) H100 chip and newly introduced Blackwell series. However, lower-performance chips like the H20 are still available to Chinese customers.

Share

Share

Copy Link

Despite US restrictions on China's access to advanced AI chips, major Chinese tech companies are ramping up their investments in artificial intelligence. Alibaba and Tencent are leading the charge with significant financial commitments and strategic partnerships.

Chinese Tech Giants Double Down on AI Investments

In a bold move that defies US-imposed restrictions on advanced chip access, China's tech behemoths are accelerating their artificial intelligence (AI) initiatives. Industry leaders Alibaba and Tencent are spearheading this push, demonstrating China's determination to remain competitive in the global AI race

1

.Alibaba's Ambitious AI Strategy

Alibaba Group Holding Ltd has announced a staggering $7 billion investment in AI chip development and cloud computing infrastructure

2

. This substantial financial commitment underscores the company's resolve to enhance its AI capabilities and maintain its competitive edge in the tech industry. Alibaba's cloud division is set to play a crucial role in this endeavor, focusing on the development and deployment of advanced AI technologies.Tencent's Strategic Moves

Not to be outdone, Tencent Holdings Ltd is making significant strides in the AI arena. The company has revealed plans to train over 100 large language models (LLMs) and is actively seeking partnerships to bolster its AI research and development efforts

3

. Tencent's approach demonstrates a commitment to diversifying its AI portfolio and collaborating with industry peers to drive innovation.Navigating US Chip Restrictions

The aggressive AI investments by Chinese tech giants come against the backdrop of US-imposed limitations on China's access to advanced AI chips, particularly those manufactured by NVIDIA Corporation. These restrictions have prompted Chinese companies to explore alternative strategies, including:

- Developing domestic chip manufacturing capabilities

- Leveraging existing chip inventories more efficiently

- Exploring partnerships with non-US chip suppliers

Related Stories

Impact on Global AI Landscape

The concerted efforts of Chinese tech companies to advance their AI capabilities despite external challenges are likely to have far-reaching implications for the global AI landscape. As these firms invest heavily in research, development, and infrastructure, they are positioning themselves to compete more effectively with their Western counterparts.

Future Outlook

As the AI arms race intensifies, the actions of Chinese tech giants like Alibaba and Tencent signal a new phase in the global competition for AI dominance. Their substantial investments and strategic initiatives suggest that the impact of US chip restrictions may be less severe than initially anticipated, potentially reshaping the dynamics of the international tech industry in the coming years.

References

Summarized by

Navi

Related Stories

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

ChatGPT cracks decades-old gluon amplitude puzzle, marking AI's first major theoretical physics win

Science and Research