DRAM prices surge up to 95% in Q1 2026 as artificial intelligence boom strains global supply

4 Sources

4 Sources

[1]

DRAM prices expected to nearly double in Q1

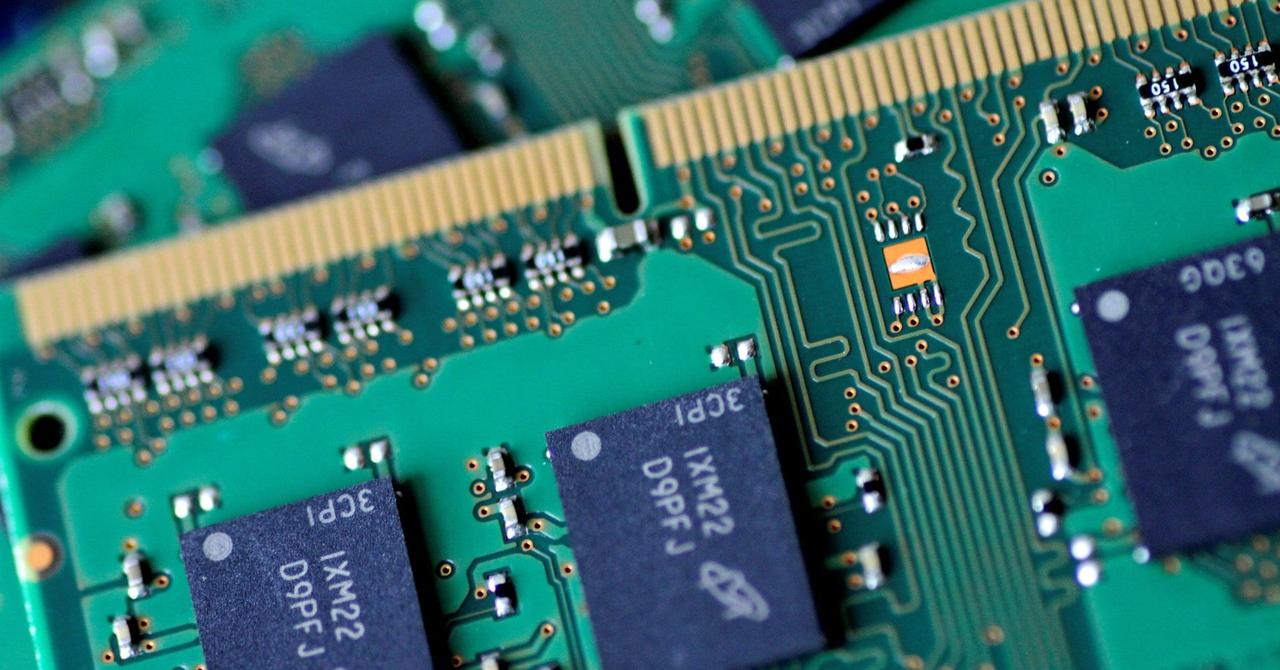

The memory shortage is worse than most of us first thought. Prices on DRAM and NAND flash memory are expected to surge in the first quarter of 2026 as AI-driven hyperscalers and cloud service providers (CSPs) continue to strain supply chains. In early January, the industry watchers at TrendForce warned the contract prices of DRAM, the kind used in everything from smartphones to servers, could rise by 55-60 percent sequentially during the first quarter of 2026. At the same time, NAND flash, which is used in solid state storage, was expected to rise by 33-38 percent. TrendForce this week revised its estimates with analysts now predicting DRAM contract pricing will surge by 90-95 percent QoQ, while NAND prices are expected to increase by 55-60 percent during the current quarter. While AI demand is largely to blame, TrendForce notes that higher-than-expected PC shipments in the fourth quarter of 2025 further exacerbated shortages. As we've previously reported, OEMs like Dell and HP tend to purchase memory in bulk about a year in advance of demand. If you noticed OEM pre-build pricing holding steady as standalone memory kits tripled in price, this is part of the reason why. But as inventories begin to draw down, and OEMs begin to restock, expect to see system prices climb. TrendForce now expects PC DRAM to roughly double in price from the holiday quarter. And the firm forecasts similarly steep increases for LPDDR memory used in notebooks and other soldered-RAM systems, as well as in smartphones. TrendForce predicts pricing on LPDDR4x and LPDDR5x memory to increase by roughly 90 percent QoQ, the "steepest increases in their history." While LPDDR memory has mostly been used in notebooks up to this point, Nvidia's most powerful rack systems contain 54 terabytes of LPDDR5x memory each, which we can't imagine is helping the situation. NAND flash pricing is also expected to surge during the quarter as hyperscalers and CSPs scramble to deploy as many SSDs as they can to support AI inference workloads. "The demand for high-performance storage has far surpassed initial expectations as AI applications driven by inference continue to grow," TrendForce wrote. "Since late 2025, leading North American CSPs have been rapidly increasing their procurement, resulting in a surge of enterprise SSD orders." As AI infrastructure continues its transition from mostly training to an inference dominated space, additional DRAM and storage are required. During large language model (LLM) inference, the model state is stored in something called the key-value cache. You can think of this as the model's short-term memory. During active use, like a chatbot session, this KV cache is computed and typically stored in HBM. When the session idles, that precomputed KV cache is then pushed to slower system memory, and in many cases eventually drops to a storage tier. By storing the KV cache, inference providers can dramatically reduce the compute required for extended multi-session inference while also improving the interactivity for users. The downside to all of this is that storing all those precomputed KV caches requires a lot of memory. If you were hoping for relief from the memory winter, don't get your hopes up. While memory vendors now have the capital for new fabs, these facilities will take years to bring online. As we previously reported, while DRAM prices are expected to peak later this year, it'll be years before they return to normal. Prices are expected to remain high through 2028. ®

[2]

Trendforce sees chip prices surging 90-95% in Q1 from previous quarter

SEOUL, Feb 2 (Reuters) - Market researcher TrendForce said on Monday that it has raised its chip price forecasts and expects conventional DRAM contract prices to jump by 90% to 95% in the January to March period of this year, from the final three months of 2025, citing the artificial intelligence boom. It previously estimated 55% to 60% price growth for dynamic random access memory for the first quarter. "Persistent AI and data center demands in 1Q26 are further worsening the global memory supply and demand imbalance, thereby increasing suppliers' pricing power," TrendForce said in a statement. Reporting by Hyunjoo Jin; Editing by Kirsten Donovan Our Standards: The Thomson Reuters Trust Principles., opens new tab

[3]

Trendforce sees chip prices surging 90-95% in Q1 from previous quarter

Market researcher TrendForce said on Monday that it has raised its chip price forecasts and expects conventional DRAM contract prices to jump by 90% to 95% in the January to March period of this year, from the final three months of 2025, citing the artificial intelligence boom. Market researcher TrendForce said on Monday that it has raised its chip price forecasts and expects conventional DRAM contract prices to jump by 90% to 95% in the January to March period of this year, from the final three months of 2025, citing the artificial intelligence boom. Budget 2026 Critics' choice rather than crowd-pleaser, Aiyar saysSitharaman's Paisa Vasool Budget banks on what money can do for you bestBudget's clear signal to global investors: India means business It previously estimated 55% to 60% price growth for dynamic random access memory for the first quarter. "Persistent AI and data center demands in 1Q26 are further worsening the global memory supply and demand imbalance, thereby increasing suppliers' pricing power," TrendForce said in a statement.

[4]

Memory chip prices surge as much as 90% so far in Q1- Counterpoint By Investing.com

Investing.com-- Memory chip prices were seen rising as much as 90% so far in the first quarter of 2026 from the prior three months, analytics firm Counterpoint Research said on Thursday, as the sector sees outsized demand from the artificial intelligence industry. The biggest driver of the rise was sharp increases in prices of general-purpose server DRAM chips, while NAND memory prices, which were seen remaining relatively muted in Q4, also rose sharply. Get more breaking insights on chipmakers and the AI industry with InvestingPro Server memory chip prices jumped on average between 90% and 98% in Q1, Counterpoint data showed. This was after a 60% to 76% increase in Q4. Sever memory prices are projected to rise another 20% in the second quarter of 2026. PC memory prices rose between 91% and 100% so far in Q1, following a 20% to 35% increase in Q4. They are also expected to rise another 15% to 20% in Q2. Higher memory chip prices stand to greatly benefit major producers such as Samsung Electronics Co Ltd (KS:005930), SK Hynix Inc (KS:000660), and Micron Technology Inc (NASDAQ:MU). The three were seen logging bumper earnings growth in 2025 on outsized demand for memory chips from the AI industry. Advanced memory is a key component of AI data centres, given the high computing requirements of generative AI models. Wall Street's so-called AI hyperscalers- a group of technology giants spending hundreds of billions on building out AI infrastructure- were seen rapidly snapping up memory chips over the past year. This prompted warnings on a potential supply shortage from several memory chip producers, with AI-fueled demand set to largely outpace production. Memory chip price surge to hit device makers The surge in memory chip prices, however, drew warnings from several consumer electronics manufacturers of higher prices and slimmer margins in the coming quarter. PC makers Lenovo Group (HK:0992) and Dell Technologies Inc (NYSE:DELL), who are major consumers of memory, warned that they would likely increase their device prices in 2026, after current memory procurement contracts expire and they have to source more inventory. "For device manufacturers, this is a double whammy - rising component costs and weakened consumer purchasing power will likely slow the demand as the quarter progresses," Jeongku Choi, senior analyst at Counterpoint said in a mailed statement. "This calls for OEMs to change procurement patterns or focus on premium models to justify the higher price by delivering more value to consumers." Smartphone makers such as Samsung, as well as videogame console makers such as Nintendo Co Ltd (TYO:7974), have also warned of headwinds from steep memory prices.

Share

Share

Copy Link

Memory chip prices are experiencing their steepest increases in history, with DRAM contract prices jumping 90-95% in Q1 2026. TrendForce revised its forecasts upward as persistent AI and data center demands worsen the global memory supply and demand imbalance. PC memory prices are doubling while NAND flash surges 55-60%, forcing device makers to warn of higher costs ahead.

Memory Chip Prices Hit Historic Highs as AI Demand Intensifies

The memory shortage has proven far worse than initially anticipated. Market researcher TrendForce dramatically revised its Q1 2026 forecasts this week, now predicting DRAM contract prices will surge by 90-95% compared to the previous quarter

1

2

. This marks a significant increase from the firm's early January estimate of 55-60% growth. The artificial intelligence boom continues to strain supply chains as hyperscalers and cloud service providers scramble to secure inventory.

Source: Reuters

NAND flash memory prices are also climbing sharply, now expected to increase by 55-60% during the current quarter, up from initial projections of 33-38%

1

. According to TrendForce, "persistent AI and data center demands in 1Q26 are further worsening the global memory supply and demand imbalance, thereby increasing suppliers' pricing power"3

.Unprecedented Surge Across All Memory Categories

The surge in memory chip prices extends across multiple product categories. PC DRAM is expected to roughly double in price from the holiday quarter, while LPDDR4x and LPDDR5x memory—used in notebooks, smartphones, and soldered-RAM systems—faces the "steepest increases in their history" at approximately 90% quarter-over-quarter

1

.Counterpoint Research data reveals server memory chip prices jumped between 90-98% in Q1, following a 60-76% increase in Q4

4

. PC memory prices rose between 91-100% so far in Q1, after a 20-35% increase in Q4. These increases are projected to continue, with server memory prices expected to rise another 20% in Q2 2026, and PC memory prices climbing an additional 15-20%4

.High Demand from the Artificial Intelligence Industry Reshapes Market Dynamics

While demand from AI-driven hyperscalers remains the primary driver, higher-than-expected PC shipments in Q4 2025 further exacerbated shortages

1

. The shift from AI training to inference-dominated workloads requires substantial additional DRAM and storage capacity. During large language models (LLMs) inference, the model state is stored in the key-value cache—essentially the model's short-term memory. When sessions idle, precomputed KV caches are pushed to system memory and eventually to storage tiers, requiring massive amounts of memory infrastructure1

.

Source: The Register

Nvidia's most powerful rack systems contain 54 terabytes of LPDDR5x memory each, illustrating the scale of AI data centers' memory requirements

1

. TrendForce noted that "the demand for high-performance storage has far surpassed initial expectations as AI applications driven by inference continue to grow," with leading North American cloud service providers rapidly increasing procurement since late 2025, resulting in a surge of enterprise SSD orders1

.Related Stories

Major Producers Benefit While Device Makers Face Pressure

The price increases stand to benefit major memory producers including Samsung, SK Hynix, and Micron, who logged bumper earnings growth in 2025 on outsized demand from the AI industry

4

. However, consumer electronics manufacturers face mounting challenges.OEMs like Dell and Lenovo, who typically purchase memory in bulk about a year in advance, have warned they will likely increase device prices in 2026 as current procurement contracts expire and they source new inventory

1

4

. Jeongku Choi, senior analyst at Counterpoint, stated: "For device manufacturers, this is a double whammy - rising component costs and weakened consumer purchasing power will likely slow the demand as the quarter progresses"4

.Smartphone makers such as Samsung and videogame console makers including Nintendo have also warned of headwinds from steep memory prices

4

.Long-Term Outlook Offers Little Relief

Those hoping for quick relief from the memory shortage should temper expectations. While memory vendors now have capital for new fabs, these facilities will take years to bring online. DRAM prices are expected to peak later in 2026 but will remain elevated through 2028

1

. The supply shortage signals a fundamental shift in the memory market, driven by AI inference workloads that require exponentially more memory infrastructure than traditional computing applications. As Wall Street's AI hyperscalers continue spending hundreds of billions on AI infrastructure, the global memory supply and demand imbalance shows no signs of immediate resolution.References

Summarized by

Navi

[1]

Related Stories

Memory shortage to persist beyond 2026 as AI demand reshapes chip industry and drives prices up

16 Jan 2026•Business and Economy

AI Demand Drives Memory Prices to Record Highs, Impacting Consumer Tech Market

31 Oct 2025•Business and Economy

AI Data Center Boom Triggers Global Memory and Storage Crisis as Prices Soar 100%

10 Nov 2025•Business and Economy

Recent Highlights

1

Pentagon threatens Anthropic with Defense Production Act over AI military use restrictions

Policy and Regulation

2

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

3

Anthropic accuses Chinese AI labs of stealing Claude through 24,000 fake accounts

Policy and Regulation