Constellation Energy's Nuclear Power Deal with Microsoft Signals Shift in Energy Landscape

2 Sources

2 Sources

[1]

Wall Street SWOT: Constellation Energy stock rides nuclear wave amid AI boom By Investing.com

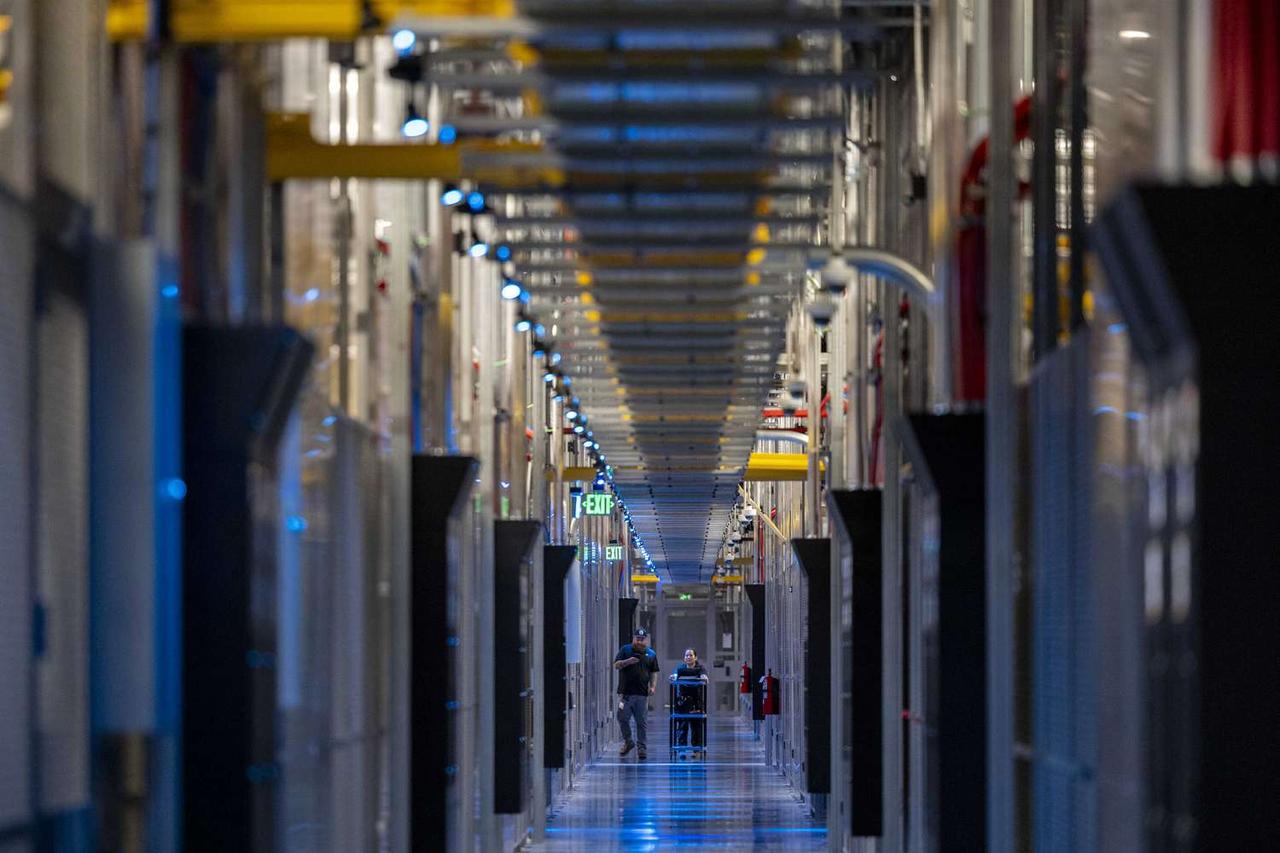

Constellation Energy (NASDAQ:CEG), the largest producer of carbon-free electricity in the United States, has captured significant attention from investors and analysts alike. The company's strategic positioning in the nuclear energy sector, coupled with its recent high-profile deals and market developments, has sparked a renewed interest in its stock. This comprehensive analysis delves into the factors driving CEG's performance and outlook. Constellation Energy has emerged as a key player in what appears to be a nuclear energy renaissance, particularly in light of the growing demand for reliable, carbon-free power sources. The company's recent announcement regarding the planned restart of a Three Mile Island reactor to supply power to Microsoft (NASDAQ:MSFT)'s data centers has been a game-changer. This development underscores the critical role of nuclear generation in supporting AI technology infrastructure, a sector experiencing explosive growth. The deal with Microsoft, while not fully disclosed in terms of pricing, is estimated to be in the triple-digit range per megawatt-hour. This partnership not only demonstrates the economic attractiveness of nuclear generation but also positions Constellation Energy at the forefront of the intersection between clean energy and technology. Constellation Energy's financial performance has been robust, with the company reporting strong results in the first quarter of 2024. Earnings per share reached $1.82, significantly surpassing analyst estimates and showing a year-over-year increase of 233%. This impressive performance has led to increased confidence in the company's ability to meet or exceed its guidance. Management has reaffirmed its 2024 guidance range of $7.23-8.03 EPS and projects at least a 10% long-term base EPS growth through 2028. While the company has not updated its financial outlook despite the strong start to the year and favorable forward commodity curves, there is speculation that an update may come in the second half of 2024. Constellation Energy's unique position in the power industry is characterized by its substantial portfolio of firm green power combined with a competitive retail book. This combination is increasingly sought after for decarbonized electric products, placing the company in a favorable position as the demand for clean energy solutions grows. The company is well-positioned to supply the growing data center-related demand, responding to requests for information (RFIs) from tech giants like Google (NASDAQ:GOOGL) and Microsoft, as well as industrial players like Nucor (NYSE:NUE) Steel, for clean power supply and potential investments in new carbon-free power generation. Constellation Energy's financial strength is further evidenced by its capital allocation strategies. The company has authorized an additional $1.0 billion in share repurchases and has $2.1-2.5 billion of unallocated capital remaining. This move signals confidence in the company's financial position and commitment to delivering shareholder value. The power industry is experiencing tightened markets, especially in the PJM Interconnection region, which is expected to improve gross margins for companies like Constellation Energy. The growing emphasis on decarbonization across various sectors of the economy is likely to continue driving demand for Constellation's services and products. The nuclear energy sector is heavily regulated, and changes in policy or safety requirements could potentially impact Constellation Energy's operations and profitability. Regulatory hurdles or delays in approving new projects or reactor restarts could slow down the company's expansion plans. Additionally, shifts in government support for nuclear energy or changes in subsidies for renewable energy sources could alter the competitive landscape. Constellation Energy's profitability is tied to energy market prices. While current market conditions are favorable, any significant downturn in energy prices could compress margins and impact the company's financial results. The volatility of energy markets and the potential for oversupply in certain regions could pose risks to the company's revenue streams. Constellation Energy's strategic focus on nuclear power places it in a unique position to capitalize on the growing energy demands of the AI and data center industry. The Microsoft deal exemplifies the potential for long-term, high-value contracts with tech giants seeking reliable, carbon-free power sources. As AI continues to drive increased energy consumption, Constellation's nuclear assets could become increasingly valuable, potentially leading to more partnerships and revenue growth. The company's large portfolio of green power assets, combined with its competitive retail book, positions it well to meet the increasing demand for decarbonized electricity. As more corporations and governments commit to carbon reduction goals, Constellation's ability to provide firm green power could lead to expanded market share and higher margins. The company's expertise in this area could also open up opportunities for new projects and partnerships in the rapidly evolving clean energy landscape. Constellation Energy's stock continues to attract attention from investors and analysts as the company navigates the evolving landscape of clean energy and technology partnerships. The analysis presented here is based on information available up to September 27, 2024. Want to gain an edge in your investment decisions? InvestingPro delivers in-depth analysis and exclusive insights on CEG that you won't find anywhere else. Our advanced platform utilizes AI and machine learning to provide accurate fair value estimates, performance predictions, and risk assessments. With InvestingPro, you'll have access to a wealth of additional tips, metrics, and expert analysis that cut through market noise and deliver clear, actionable intelligence. Don't leave your investment choices to chance - empower yourself with InvestingPro's comprehensive tools and insights. Explore CEG's full potential at InvestingPro. Should you invest in CEG right now? Consider this first: Investing.com's ProPicks is revolutionizing portfolio building for investors. This cutting-edge service harnesses the power of AI to offer easy-to-follow model portfolios designed for wealth accumulation. By identifying potential winners and employing a "let them run" strategy, ProPicks has earned the trust of over 130,000 paying members who rely on its AI-driven insights to discover promising stocks. The burning question is: Does CEG rank among these AI-selected gems? To discover if CEG made the cut and explore the full list of ProPicks' recommended stocks, visit our ProPicks platform today and elevate your investment strategy to new heights.

[2]

Constellation Energy's Nuclear Deal With Microsoft Is a Home Run - Constellation Energy (NASDAQ:CEG)

Constellation Energy CEG has been amongst the hottest stocks in the market in 2024, with its shares up 125%. Those aren't the types of returns people usually associate with utility companies in such a short period of time. However, when a company is connected to the AI revolution, it's not so surprising. Most of this return has come just over the past week. Shares are up 26% since the company announced a blockbuster deal with a top tech firm. Constellation Energy announced on Sept. 20 that it has entered into a 20-year agreement with Microsoft to supply the firm's data centers. The company plans to reopen the Three Mile Island nuclear facility and exclusively sell the generated electricity to Microsoft. This is a massive deal and deserves to be broken down further. Three Mile Island Reopening Could Set a New Precedent There are many interesting aspects of this deal. Most will first recall that in 1979, Three Mile Island was the site of the only nuclear meltdown in U.S. history. Although the accident did not directly cause any injuries or deaths, it hindered the progress of the nuclear industry for years. However, it's important to note that the reactor scheduled for reopening is not the same one from 1979. That was Unit 2, while this nuclear deal involved Unit 1. Unit 1 continued to operate after the incident but was permanently shut down in 2019 at the discretion of Constellation due to issues with its profitability. However, the shutdown was not so permanent. If the Nuclear Regulatory Commission (NRC) approves it, this deal could mark the first reopening of a shut-down nuclear site in the US. The Palisades Nuclear Plant in Michigan, owned by Holtec International, is another site under review for reopening. It's set to reopen in Oct. 2025. However, the NRC will make its final decision on whether to renew its license on Jul. 31, 2025. Watching what happens will be an important indicator of the success of the Microsoft and Constellation deal. Overall, the lack of precedent alone creates some uncertainty. However, government support for the Holtec deal adds optimism. The Biden-Harris administration is giving Holtec a $1.5 billion loan for the Palisades project. Michigan Governor Gretchen Whitmer has also expressed support. For Three Mile Island, 57% of the residents in Harrisburg, PA, said they would support the reopening as long as they don't have to pay for it. Constellation Wins on Price and Return on Investment One reason this deal is even possible is that Unit 1 was being "mothballed." This is the least immediate method for shutting down a nuclear site and leaves the option of reopening on the table. Fully decommissioning a site can take 15 to 20 years, so since it was shut down in 2019, it is still salvageable. The most recent new nuclear project to begin commercial operation in the U.S. took nearly 15 years to complete. Its cost was over $30 billion for two reactors. This shows how massive a win this could be for Constellation. It only plans to spend $1.6 billion on the reopening and wants to have it operational by 2028. Constellation is reportedly getting a sweet deal when it comes to the price of this energy. Analysts at Jefferies estimate that Microsoft will pay between $110 and $115 per megawatt-hour of electricity to Constellation. That's up to a 92% premium compared to the price for wind and solar energy in the same area. The distinction between wind and solar is important because hyperscalers like Microsoft want to fuel their data centers with renewable energy. Jefferies expects the plant to generate $785 million in revenue by 2023. That estimate would let Constellation recoup its investment in just a few years and indicate a huge return on that investment over 20 years. When it comes to constellation's production capacity, the site's addition would be no small feat. Its 873 megawatts would increase Constellation's current 22-gigawatt nuclear capacity by around 4%. Analysts Love the Deal Overall, the deal feels like a home run for Constellation, and Wall Street analysts agree. At least nine analysts raised their price targets after the deal. The average target for those firms shows just a 6% upside for the stock, but it's hard to bet against what Constellation is bringing to the table. Morgan Stanley is most bullish, increasing their price target by $80. Their target implies an upside of 19%. The article "Constellation Energy's Nuclear Deal With Microsoft Is a Home Run" first appeared on MarketBeat. Market News and Data brought to you by Benzinga APIs

Share

Share

Copy Link

Constellation Energy's stock surges following a groundbreaking 10-year nuclear power deal with Microsoft, highlighting the growing importance of clean energy in the tech sector's expansion.

Constellation Energy's Stock Soars on Microsoft Deal

Constellation Energy (NASDAQ:CEG) has seen its stock price surge by over 50% year-to-date, with a significant boost coming from a recent landmark deal with tech giant Microsoft

1

. The agreement, which spans 10 years, involves Constellation supplying nuclear power to Microsoft's data centers, marking a pivotal moment in the intersection of clean energy and technology sectors.The Nuclear Power Renaissance

The deal between Constellation Energy and Microsoft represents a renaissance for nuclear power in the United States. As the largest producer of carbon-free energy in the U.S., Constellation is well-positioned to capitalize on the growing demand for clean energy solutions

2

. This partnership not only validates nuclear energy's role in the clean energy transition but also sets a precedent for other tech companies looking to reduce their carbon footprint.Impact on Constellation Energy's Financial Outlook

The agreement with Microsoft is expected to have a significant positive impact on Constellation's financial performance. Analysts project that the deal could contribute up to $3 billion in revenue over its duration

1

. This substantial boost to the company's top line has led to increased investor confidence, as reflected in the stock's impressive performance.The AI Boom and Energy Demand

The partnership comes at a crucial time when the artificial intelligence (AI) boom is driving unprecedented demand for data center capacity. Microsoft's commitment to powering its AI and cloud services with clean energy underscores the tech industry's growing awareness of its environmental impact

2

. This deal sets a new standard for how tech companies can align their expansion plans with sustainability goals.Related Stories

Regulatory and Market Implications

The agreement between Constellation and Microsoft has caught the attention of regulators and policymakers. It aligns with the Biden administration's goals for clean energy adoption and could potentially influence future energy policies

2

. Moreover, this deal may pave the way for similar partnerships between energy providers and tech companies, reshaping the energy market landscape.Challenges and Opportunities Ahead

While the outlook for Constellation Energy appears promising, the company still faces challenges. The nuclear power industry continues to grapple with issues such as waste management and public perception. However, the Microsoft deal demonstrates that these concerns can be outweighed by the benefits of reliable, carbon-free energy production

1

.As the world increasingly focuses on decarbonization, Constellation Energy's strategic positioning in the nuclear power sector could lead to further opportunities for growth and partnerships in the tech industry and beyond.

References

Summarized by

Navi

[1]

Related Stories

Constellation Energy's Stock Soars on Three Mile Island Restart and Microsoft Deal

24 Sept 2024

Constellation Energy's Three Mile Island Reactor Restart Plan Sparks Market Surge and Microsoft Partnership

20 Sept 2024

Meta's Nuclear Power Deal Sparks AI Energy Revolution and Boosts Uranium Stocks

03 Jun 2025•Business and Economy

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy