Digital Currency Group Launches Yuma to Spearhead Decentralized AI Development on Bittensor Network

3 Sources

3 Sources

[1]

Barry Silbert Of Digital Currency Group Ventures Into Decentralized AI With Eyes On Bittensor Network

Cryptocurrency conglomerate Digital Currency Group (DCG) is making a big splash in the realm of decentralized artificial intelligence (AI), with a keen focus on the Bittensor TAO/USD ecosystem. What happened: Barry Silbert, the head of DCG and an early champion of cryptocurrencies, will lead the new venture called Yuma, aimed at supporting businesses that want to build and deploy AI models on Bittensor, according to a Wednesday press release. "Just like the early days of Bitcoin, which fueled the development of a new form of transparent, borderless money, we're moving from the digital ownership of assets to the decentralized ownership of intelligence," Silbert said. Yuma would help startups with capital, technical know-how, and operation support to build their models on Bittensor. For the curious, Bittensor is an open-source network that allows AI models to be shared, trained, and ranked by value. Participation and contribution are incentivized by handing out rewards in the form of the native cryptocurrency called TAO. Silbert said that Yuma would shift the power of AI and machine learning from centralized companies to an open, democratized setup. See Also: Michael Saylor's MicroStrategy Takes Wall Street By Storm, Becomes Second-Most Traded Stock After Nvidia DCG's interest in AI is not a recent phenomenon. The group made its maiden investment in Bittensor in 2021. Recently, DCG's asset management division, Grayscale, added funds dedicated to AI, including the $TAO token. Silbert will hold the position of CEO at Yuma, which will commence operations with a team of 25 employees. Why It Matters: DCG's interest in AI is not a recent phenomenon. The group made its maiden investment in Bittensor in 2021. In August, DCG's asset management division, Grayscale, launched a new fund that would expose investors to price moves of TAO. Grayscale is well-known in the industry for having launched the first publicly traded Bitcoin and Ethereum funds, namely, Grayscale Bitcoin Trust GBTC and Grayscale Ethereum Trust ETHE. DCG's move into decentralized AI signifies a growing trend in the tech industry. More companies are recognizing the potential of decentralized AI in preventing data monopolization by tech giants. Ethereum ETH/USD creator Vitalik Buterin, another influential voice in the cryptocurrency space, had earlier warned against the concentration of power in the AI industry. He batted for an ecosystem of open models running on consumer hardware rather than a few central servers controlled by a small cohort of conglomerates. Price Action: At the time of writing, TAO was exchanging hands at $480.59, up 3.25% in the last 24 hours, according to data from Benzinga Pro. Photo Courtesy: Doc Searls On Flickr.com Read Next: Core Fusion Upgrade Introduces Dual Staking And Liquid Bitcoin Staking Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors. Market News and Data brought to you by Benzinga APIs

[2]

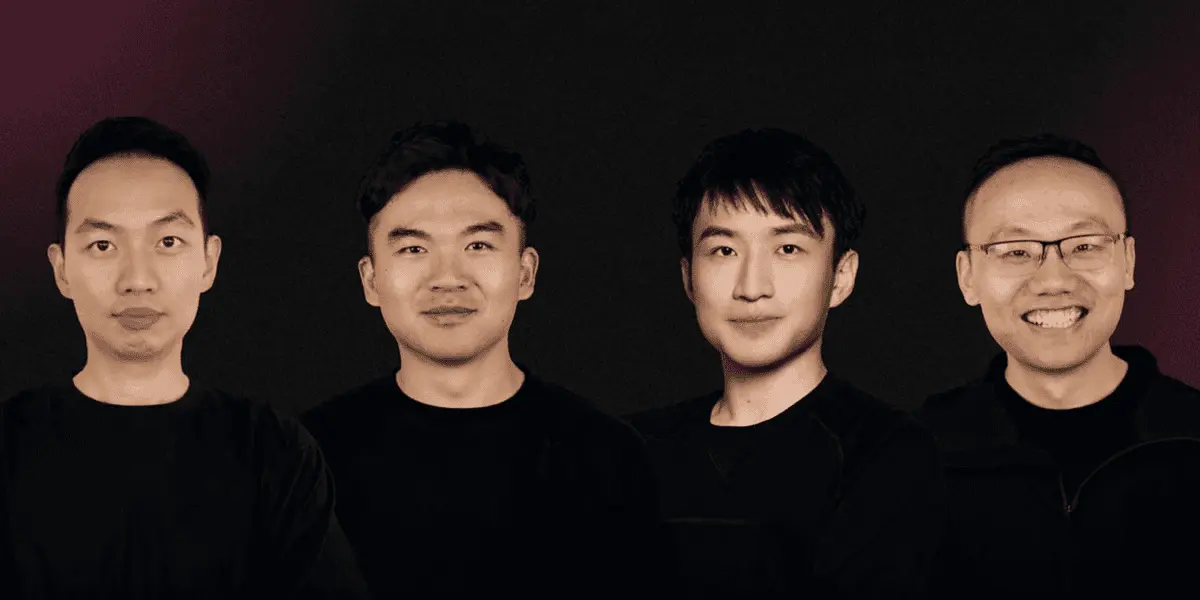

Digital Currency Group Names New Subsidiary To Promote Bittensor's Development

Barry Silbert said he saw a bright future for Bittensor's innovation Crypto venture capital firm Digital Currency Group (DCG) is looking to promote the development of Bittensor (TAO), a decentralized Artificial Intelligence (AI) protocol. The firm aims to achieve this goal through Yuma Group. This outfit will join its list of subsidiaries, including Grayscale Investments. As the companies announced, Yuma is dedicated to driving development on Bittensor. It hopes to empower developers to create, train, and access AI. The DCG founder and CEO Barry Silbert will also lead the new subsidiary in driving its vision to promote AI and crypto integration. Although the Digital Currency Group first invested in Bittensor in 2021, its relationship has grown deeper since then. The firm said it named Yuma to conform with Bittensor's "Yuma Consensus" protocol. This smart contract protocol makes it possible to incentivize creator's participation with the TAO, a token known to weather geopolitical storms. Through Bittensor, innovators can create Subnets, a marketplace for unique AI/ML services including but not limited to data storage. As a functioning ecosystem, the protocol hosts both miners and validators. While the former contributes computational power to protocol, the latter asseses contibution quality and shares the rewards. Yuma Group has created an early subnet incubator program from which it can help firms looking to create new AI-focused solutions. Thus far, it has partnered with Sturdy, Masa and Infinite Games. The Yuma subnet program entered the limelight in collaboration with Foundry. Notably, Barry Silbert said he considers the innovations around Bittensor to the early days of crypto. DCG is known as one of the biggest crypto project investors in the industry. While the crypto winter took a toll on the firm through Genesis, it has remained largely operational. Grayscale Investments played a crucial role in bringing spot Bitcoin ETF products into the market. While its Bitcoin ETF and Ethereum ETF products are less popular considering their regular outflows, they are still a favorite of top institutional investors. As reported earlier, the Michigan Pension Fund disclosed its exposure to Grayscale's Ethereum ETF products. Digital Currency Group has weathered enough storms over the past years and Silbert reiterated his confidence in helping Bittensor "transform our the world with open access to intelligence."

[3]

Bitcoin billionaire Barry Silbert talks about his next big bet -- on 'decentralized AI'

Barry Silbert isn't done yet. The billionaire entrepreneur first made his mark in finance when, at age 17, he became the youngest person in the U.S. to obtain a stockbroker license. The Maryland native went on to become a Wall Street trader before launching alternative asset platform Second Market, which he sold to NASDAQ. Silbert then hit it big with Bitcoin, buying a hoard when the price was $11 in 2012, and building the crypto conglomerate known as Digital Currency Group. On Wednesday, he announced his next big project: Yuma, a subsidiary that aspires to compete with the likes of Google and OpenAI in the field of artificial intelligence. The twist is that Yuma is going all in on a decentralized version of AI -- the idea of distributing the powerful technology across a loose network of autonomous contributors instead of relying on a giant tech company to provide the service. Speaking with Fortune, Silbert likened decentralized AI to the world wide web, which in the 1990s supplanted the "walled garden" version of the Internet run by a handful of tech firms. It's unclear if a decentralized model of AI can hold its own in an industry where the leading firms depend on massive amounts of data, high priced chips and computing power. But Silbert says he is convinced a permissionless version of AI is better -- so much so that he is becoming a hands on CEO for the first time in four years to lead Yuma. Yuma's decentralized AI ambitions revolve around a blockchain project called Bittensor, which launched in 2021 and offers tokens as incentives to spur people to contribute to a network of AI services. Launched in 2019 by a former Google engineer, Bittensor is not widely known but has attracted the support of wealthy investors including Silbert and venture capitalist Olaf Carlson-Wee, who have been buying up its token known as TAO. Acknowledging that both tokens and AI have been popular fodder for hucksters, Silbert says Yuma is downplaying the crypto angles as "blockchain scares people away." He says Yuma's focus will instead be on helping to build a network of decentralized intelligence and computing services in the form of what Bittensor calls "subnets." There are akin to applications and Yuma is currently supporting around 60 of them, but Silbert envisions there will soon be thousands. Still, crypto is very much part of the equation as Bittensor and Yuma are counting on TAO tokens to be the incentives that persuade people to contribute to the decentralized AI network. Like Bitcoin, the TAO tokens are mined using electricity and will become scarcer overtime with the overall supply capped at 21 million. Currently, the market cap of TAO is around $3.5 billion, which makes it the 34th most popular cryptocurrency, far behind the likes of Ethereum, which is 100 times the size. For now, the Bittensor network is still in an early stage of development so there is little in the way of everyday AI applications for mainstream users. There is also the question of whether, when these applications do arrive, they will be able to overcome the complexity and clunky user interfaces that have been the hallmark of both crypto and decentralized projects. Silbert says he is confident that it will not take long for developers to push those complexities to the background and build interfaces where users are unaware they are even using a Bittensor service in the first place. Meanwhile, Michael Casey, an author and journalist who chairs a group called the Decentralized AI Society, says that the solution to the user design challenge will be supplied by AI itself. He points to the burgeoning world of AI agents and predicts that it will soon be possible for users to rely on those agents to deal with all sorts of finicky applications -- including decentralized AI. Jeff Wilser, who hosts the podcast AI-Curious, says he is intrigued by decentralized AI, and the prospect of creating access to a form of artificial intelligence that is not controlled by large tech companies. But he also points out some obvious challenges: OpenAI and Google possess massive amounts of capital to develop the computing power that a successful AI project requires, and it's not clear a decentralized version will be able to muster the same resources. The challenges entails not only purchasing custom chips but building centralized data centers where processing facilities are close together -- a concept known as colocation that is key to AI efficiency. That is something a decentralized competitor will struggle to replicate, though in time clusters of services may emerge in close proximity to one another. At the same time, there is plenty of spare computing power lying around and so decentralized AI may be able to get a foothold in areas of the industry, such as training data sets, where speed isn't of the essence. Yuma's vision of a decentralized AI competitor powered by a hidden crypto layer may seem far-fetched to some. But skeptics may want to consider another decentralized project that has been a resounding success: Bitcoin, which is distributed across the world and in 15 years has grown to be bigger than all but a handful of major companies. "Just like the early days of Bitcoin, which fueled the development of a new form of transparent, borderless money, we're moving from the digital ownership of assets to the decentralized ownership of intelligence," said Silbert.

Share

Share

Copy Link

Barry Silbert's Digital Currency Group (DCG) introduces Yuma, a new subsidiary focused on promoting decentralized AI through the Bittensor network, aiming to challenge centralized AI giants and democratize AI development.

Digital Currency Group Ventures into Decentralized AI

Digital Currency Group (DCG), led by cryptocurrency pioneer Barry Silbert, is making a significant move into the realm of decentralized artificial intelligence (AI) with the launch of its new subsidiary, Yuma. This venture aims to support and develop the Bittensor network, a decentralized AI ecosystem that could potentially rival centralized AI giants

1

.Yuma's Mission and Structure

Yuma, named after Bittensor's "Yuma Consensus" protocol, is dedicated to empowering developers to create, train, and access AI models on the Bittensor network. Barry Silbert will serve as CEO of Yuma, which will begin operations with a team of 25 employees

2

.The subsidiary will provide capital, technical expertise, and operational support to startups building on Bittensor. Yuma has already established an early subnet incubator program, partnering with firms like Sturdy, Masa, and Infinite Games

2

.Bittensor Network and TAO Token

Bittensor is an open-source network allowing AI models to be shared, trained, and ranked by value. It incentivizes participation through its native cryptocurrency, TAO. The network consists of miners who contribute computational power and validators who assess contribution quality

2

.DCG's interest in Bittensor dates back to 2021 when it made its initial investment. Recently, DCG's asset management division, Grayscale, added funds dedicated to AI, including exposure to the TAO token

1

.Decentralized AI: Potential and Challenges

Silbert likens the potential of decentralized AI to the early days of the World Wide Web, which supplanted the "walled garden" version of the Internet. He believes that decentralized AI could shift power from centralized companies to an open, democratized setup

3

.However, decentralized AI faces significant challenges. Centralized AI companies like Google and OpenAI have massive capital, custom chips, and centralized data centers that are crucial for AI efficiency. It remains to be seen if a decentralized model can compete in terms of resources and processing power

3

.Related Stories

The Role of Cryptocurrency

While Yuma is downplaying the crypto aspects to avoid scaring people away, the TAO token plays a crucial role in incentivizing contributions to the Bittensor network. Like Bitcoin, TAO tokens are mined and have a capped supply of 21 million. Currently, TAO has a market cap of around $3.5 billion, making it the 34th most popular cryptocurrency

3

.Future Outlook

Despite the challenges, Silbert and other proponents of decentralized AI are optimistic about its potential. They envision a future where AI agents could help users navigate complex decentralized applications, making them more accessible to mainstream users

3

.References

Summarized by

Navi

[1]

Related Stories

Cryptocurrency Market Dynamics: Bitcoin's Surge and Grayscale's New AI-Focused Fund

18 Jul 2024

Bittensor completes first TAO halving, cutting daily issuance as decentralized AI network matures

08 Dec 2025•Business and Economy

AI and Tokenization Set to Transform Crypto Landscape in 2025

01 Jan 2025•Technology

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy