DoT's AI-Powered Financial Fraud Risk Indicator Blocks 400,000 SIM Cards in India

3 Sources

3 Sources

[1]

DoT's Financial Fraud Risk Indicator Blocks 400K SIM Cards: Report

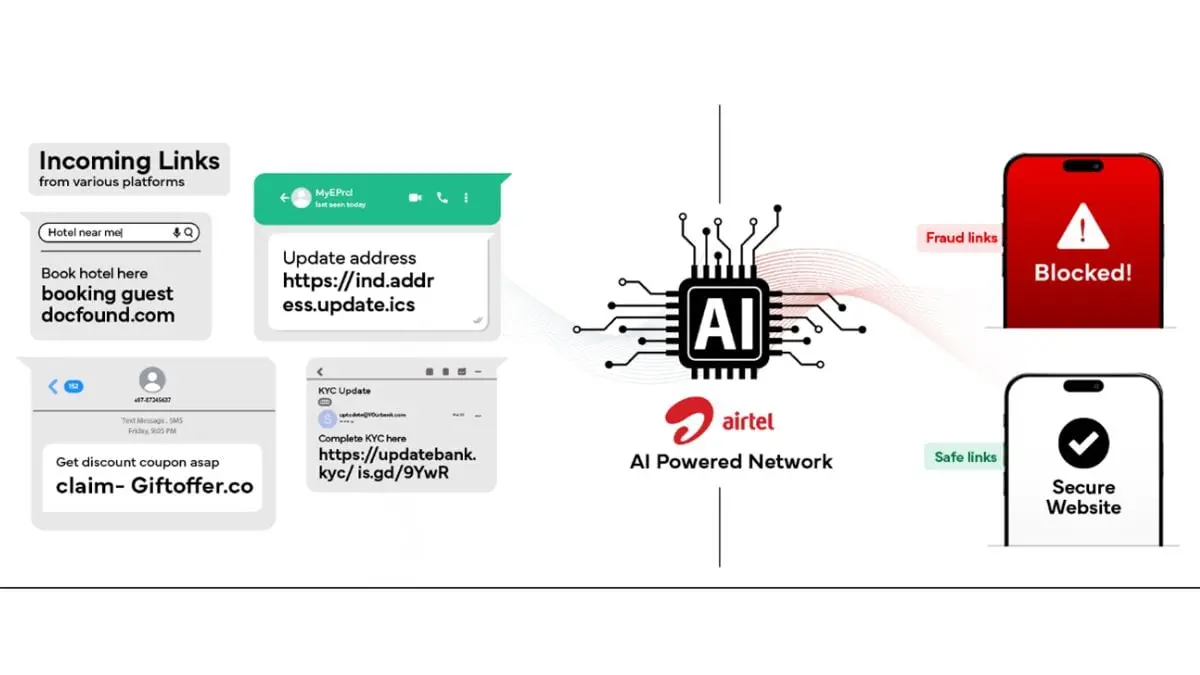

DoT reportedly said FRI prevented fraud worth crores last month The Department of Telecommunications' (DoT) Financial Fraud Risk Indicator (FRI) has reportedly blacklisted between 3,00,000 to 4,00,000 SIM cards that were linked with fraudulent activities. According to the report, the artificial intelligence (AI)-powered tool flags as many as 2,000 high-risk phone numbers on a daily basis. FRI was first introduced by DoT in May, and it is based on an analytical tool developed by the Digital Intelligence Platform. It can detect mobile numbers that have either been used in financial fraud or have a high possibility of being used. According to The Economic Times, FRI has detected and blacklisted up to 4,00,000 SIM cards associated with fraudulent activities since being operational. Citing government data, the report claimed that the tool is detecting 2,000 mobile numbers daily. These numbers are said to be flagged as high-risk for being involved with investment or job scams. Additionally, a senior DoT official told ET that these directly flagged numbers are then used to find more SIM cards on the network via AI-powered pattern matching. The official reportedly also highlighted that FRI has helped UPI platforms such as GPay, PhonePe, and Paytm prevent potentially fraudulent transactions worth crores of rupees, just in the previous month. In July, the Reserve Bank of India (RBI) advised all Scheduled Commercial Banks, Small Finance Banks, Payments Banks, and Co-operative Banks to integrate FRI into their systems. Due to this integration, the tool's time-to-action on fraud accounts has also been reduced to a few hours, the official told the publication. "This also signals increasing maturity of DoT's Digital Intelligence Platform, which was launched with the aim of real-time data exchange among stakeholders," the unnamed DoT official was quoted as saying. The indicator was first introduced in May as a new way to combat India's evolving landscape of financial fraud. It was primarily designed to solve the issue that bad actors frequently change phone numbers they use to carry out scams with. This means traditional systems cannot flag a number unless it has been used to carry out a scam. In contrast, FRI uses multiple different metrics and AI capabilities to indicate numbers that have a "risk" of being involved with scams. These numbers are then further analysed using government databases, and then a risk rating (between low, medium, and high) is assigned to them.

[2]

Nearly 400k SIMs axed for fraud

Mumbai: The telecom department's latest initiative to categorise high-risk fraud accounts has caught and blacklisted 300,000-400,000 telecom SIMs used in fraudulent schemes, show government data. The Financial Risk Indicator (FRI), launched in May, is now daily flagging 2,000 high-risk phone numbers that may be involved in investment or job scams, and other fraudulent activities. More SIMs on the network are then identified using artificial intelligence-based pattern matching. This has helped UPI platforms like Paytm, GPay and PhonePe prevent suspicious transactions worth crores of rupees in the past month, a senior official at the Department of Telecommunications (DoT) told ET. In July, banking regulator Reserve Bank of India issued an advisory to all commercial banks, co-operative banks and payments banks to integrate the FRI with their system. "As a result, time-to-action on fraud accounts has been reduced to a few hours," the DoT official said. "This also signals increasing maturity of DoT's Digital Intelligence Platform which was launched with the aim of real-time data exchange among stakeholders." Banks and financial institutions are using the FRI to take preventive measures, such as declining suspicious transactions, issuing alerts or warnings to customers, and delaying transactions flagged as high risk. The system's utility has already been demonstrated with leading institutions such as PhonePe, Punjab National Bank, HDFC Bank, ICICI Bank, Paytm and India Post Payments Bank actively using the platform, the telecom department had said previously. As part of this initiative, digital fraud prevention platform MFilterIt has deployed AI-based honeypots on X, Instagram and Facebook which scrape social media to find and interact with such scam accounts. Nearly 125 such accounts are discovered and flagged by a single AI bot daily, the company said. "These are investment scam fraudsters which may or may not be using mule accounts," said Dhiraj Gupta, cofounder and chief technology officer at MFilterIt. "We are tracking social media for these fraudsters who post tall claims like 'double your money in 6hrs' and then our bot interacts with these people posing as genuine investors. This persuades the criminals to reveal their information like UPI ID or barcode," he explained. The FRI represents a vital pre-emptive strike against fraud, said Gaurav Gupta, senior product manager at digital identity verification agency Signzy.

[3]

DoT Shuts Down 4 Lakh SIM Cards for Scam/Frauds

The government of India has become very strict in handling spam/scam and fraud communications. The Department of Telecommunications (DoT) has shut down around 3-4 lakh SIM cards in India. This is because these SIMs were categorised as high-risk fraud accounts. The government of India has become very strict in handling spam/scam and fraud communications. SIM card issuing rules have been tightened, and along with that, more surveillance systems have been implemented to identify fraudsters. According to the data from the Financial Risk Indicator (FRI), launched earlier this year (in May), 2,000 SIM cards are flagged daily for being involved in financial scams. Read More - Jio's Prepaid Plan with SonyLIV and ZEE5 OTT Benefit Using AI (artificial intelligence) based pattern matching, more SIM cards are then identified to find out scams and shut them down. Since the inception of UPI, while transacting for users have become easier, the fraudsters have leveraged it as a platform to get money from peeople. All the banks in India have already been advised to integrate FRI in their system. Read More - BSNL to Deploy Private 5G for Numaligarh Refinery According to an ET report, this has helped with reducing time to take action on fraud accounts. Using the FRI, financial insitutions and banks are able to prevent fraudulent transactions from taking place. The telcos are also adding security in their network layer so that users can be alerted whenever a fraudlent communication - via calls or text takes place.

Share

Share

Copy Link

The Department of Telecommunications in India has implemented an AI-powered tool that has successfully identified and blocked hundreds of thousands of SIM cards associated with fraudulent activities, significantly reducing financial fraud risks.

DoT Introduces AI-Powered Financial Fraud Risk Indicator

The Department of Telecommunications (DoT) in India has taken a significant step in combating financial fraud with the introduction of its AI-powered Financial Fraud Risk Indicator (FRI). Launched in May 2023, this innovative tool has already made a substantial impact on the fight against fraudulent activities in the telecom and financial sectors

1

2

.

Source: Gadgets 360

Impressive Results in Fraud Detection

Since its implementation, the FRI has successfully identified and blacklisted between 300,000 to 400,000 SIM cards associated with fraudulent activities

1

2

. The system's efficiency is evident in its ability to flag approximately 2,000 high-risk phone numbers on a daily basis, primarily linked to investment or job scams1

.AI-Powered Pattern Matching

The FRI's effectiveness is further enhanced by its use of artificial intelligence-based pattern matching. This advanced technology allows the system to identify additional SIM cards on the network that may be involved in fraudulent activities

2

. As explained by a senior DoT official, "These directly flagged numbers are then used to find more SIM cards on the network via AI-powered pattern matching"1

.

Source: ET

Impact on UPI Platforms and Financial Institutions

The implementation of FRI has had a significant positive impact on major UPI platforms such as GPay, PhonePe, and Paytm. These platforms have been able to prevent potentially fraudulent transactions worth crores of rupees in just the previous month

1

2

. The system's utility has been demonstrated with leading institutions such as Punjab National Bank, HDFC Bank, ICICI Bank, and India Post Payments Bank actively using the platform2

.Integration with Banking Systems

In July, the Reserve Bank of India (RBI) advised all Scheduled Commercial Banks, Small Finance Banks, Payments Banks, and Co-operative Banks to integrate FRI into their systems

1

. This integration has significantly reduced the time-to-action on fraud accounts to just a few hours2

.Related Stories

Innovative Approach to Fraud Detection

The FRI represents a novel approach to combating financial fraud in India. Unlike traditional systems that rely on historical data of scams, FRI uses multiple metrics and AI capabilities to indicate numbers that have a "risk" of being involved with scams

1

. These numbers are then further analyzed using government databases, and assigned a risk rating of low, medium, or high1

.Additional Measures

As part of this initiative, digital fraud prevention platform MFilterIt has deployed AI-based honeypots on social media platforms like X, Instagram, and Facebook. These honeypots scrape social media to find and interact with scam accounts, with a single AI bot discovering and flagging nearly 125 such accounts daily

2

.The implementation of the Financial Fraud Risk Indicator marks a significant advancement in India's fight against financial fraud. By leveraging artificial intelligence and real-time data exchange, the DoT has created a powerful tool that not only detects existing fraudulent activities but also predicts and prevents potential scams, thereby safeguarding the financial interests of millions of Indians.

References

Summarized by

Navi

[3]

Related Stories

India Mandates Biometric Aadhaar Verification for SIM Sales, Leveraging AI to Combat Telecom Fraud

15 Jan 2025•Policy and Regulation

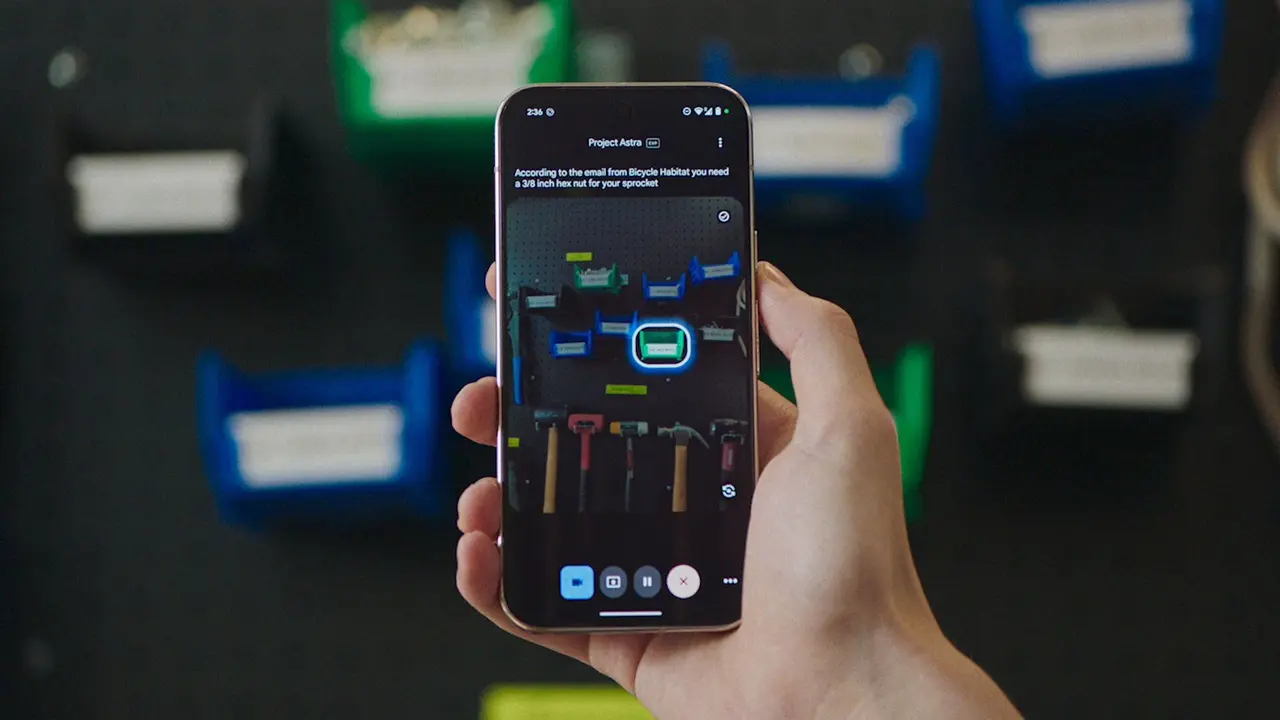

Airtel Proposes Joint Telecom Fraud Initiative with Jio and Vi, Leveraging AI to Combat Rising Cybercrime in India

27 May 2025•Technology

Airtel's AI-Powered Fraud Detection System Protects Millions in Delhi

26 Jun 2025•Technology

Recent Highlights

1

Elon Musk merges SpaceX with xAI, plans 1 million satellites to power orbital data centers

Business and Economy

2

SpaceX files to launch 1 million satellites as orbital data centers for AI computing power

Technology

3

Google Chrome AI launches Auto Browse agent to handle tedious web tasks autonomously

Technology