Dropbox Struggles with Growth Amid Transition to AI-Driven Products

2 Sources

2 Sources

[1]

Dropbox continues to struggle through "generational transition" as growth limps along

Cloud content management and sharing vendor Dropbox is continuing to struggle through what its CEO Drew Houston is calling a "generational transition", with Q4 and full year 2024 earnings indicating very sluggish growth. The company last year announced a 20% reduction in its workforce, as it sought to shift its focus away from its 'matured' File, Sync, Share (FSS) product towards the new AI-driven search product, Dash. Houston told analysts this week that whilst the changes may seem 'chaotic' from the outside, Dropbox has a clear vision and is starting from a position of strength. That being said, investors were somewhat spooked by the flat numbers and the vendor's stock price tumbled on news of the earnings. Houston said: Q4 capped a year that included difficult decisions as we continue to navigate a transition from our maturing FSS business to areas of significant growth potential. These decisions are aimed at strengthening and simplifying our FSS business, including reducing the size of our workforce and scaling back investment in non-core businesses such as FormSwift. While these decisions are introducing near-term growth headwinds, they also improve our profitability and efficiency, enabling us to invest in products like Dash that unlock significant long-term growth opportunities. The key numbers released this week include: Dropbox expects revenue to be in the range of $618 million and $621 million for the first quarter of 2025 and for full year 2025 to come in between $2.465 billion and $2.480 billion - lower than full year 2024. Houston said that Dropbox had two main objectives for 2024 - firstly to improve the collaborative user experience of the company's Teams product, where it upgraded sharing and invitation functionality, removing friction for end users and IT admins. This led to, according to the CEO, improvements in key funnel metrics, including team invites, new team creations, teams' trial conversation rates and teams' activations (all of which were up double-digit percent year-over-year). The second objective was, of course, to continue investing in Dash. Houston said: We made significant strides here. In early June, we pivoted our development work towards launching Dash for business. While we still see a viable value proposition for a self-serve individual product, it became clear that the larger near-term opportunity lies with Dash for business, where we can partner with IT admins to streamline the onboarding process for end users. In October, we launched Dash for business as a separate SKU for our installed base of teams customers, as well as non-Dropbox customers that need AI powered universal search. And while still early, we've been pleased with the customer reception so far. We exceeded our sales goals for Q4 and our pipeline is building. The feature that's resonating the most is universal search. As users come to understand how much time can be saved by being able to search all of your most important cloud apps with a single query in Dash. And in terms of plans for the year ahead, scaling Dash is Dropbox's number one priority. Houston said that the company is starting to sell Dash through its managed sales team is adding additional investments in marketing to drive awareness. He added: Over time, as we refine the product and onboarding process, we'll also tap into our product-led growth expertise to offer additional ways for customers to try, use, and buy Dash. We're investing aggressively this year to keep improving the Dash user experience, and I'm excited about our 2025 product roadmap. In our launches this year, we expect that you'll hear more about pioneering improvements to universal search and answers, new security and content governance features, improved GenAI content creation tools, and an expanded universe of SaaS application connectors, to name a few. And we expect to gain additional compliance standards that will help unlock international expansion. In short, we believe 2025 will be a big year for Dash, and we're more excited than ever about the opportunity we have in front of us. In addition to this, Houston also hopes that Dropbox's 'mature' FSS business can serve as a launchpad for Dash. Dropbox has initially been focused on offering the AI-powered tool to its Teams customers and new customers, but Houston hopes that Dash can be introduced to the company's entire FSS user base through bundling and product integrations: Bringing our FSS and Dash experiences together will help accelerate getting Dash in front of our SMB and prosumer customers. My take It has been a difficult twelve months for Dropbox - a company that has a lot of brand awareness in the market and plenty of good will. It also is in a prime position to take advantage of the generative AI momentum in the market, considering that its core proposition is sharing and managing content. Change is never easy, but CEO Drew Houston is hoping that the difficult decisions made now will pay off in the long run. He's just got to hope that he hasn't missed the momentum that is currently there in the market, with many AI investment decisions being made now. Houston said:

[2]

Dropbox's stock slides on weak forecast and stalled customer acquisition - SiliconANGLE

Dropbox's stock slides on weak forecast and stalled customer acquisition File-sharing company Dropbox Inc. delivered fourth-quarter earnings and revenue that topped Wall Street's estimates. But its revenue growth was painfully slow and guidance for the current quarter came up light, sending investors scurrying away in after-hours trading. The company reported earnings before certain costs such as stock compensation of 73 cents per share, beating the Street's target of 62 cents by a healthy margin. Revenue for the period inched up just 1% from a year earlier to $643.6 million, slightly higher than the analyst consensus estimate of $639.1 million. Despite the ever-so-slight increase in revenue, Dropbox reported a narrower profit margin, with net income of just $102.8 million in the quarter, down from $227.3 million in the year-ago period. Dropbox is an iconic name among office workers, as the company has established itself as one of the leading providers of cloud-based file storage and sharing tools. Its software is used by thousands of companies across the world to organize, manage, share and collaborate on business documents. Yet despite this lofty status, Dropbox has struggled to find ways to grow in the last few years, with its growth slowing to pedestrian-like levels. In October, Dropbox Chief Executive Drew Houston (pictured) announced a radical plan to try and turn the company around, saying that one of the problems he has identified is that the company's core file sharing business has "matured" to the point that it's going to be hard to drive any more significant growth. As part of that plan, Houston said the company will let go of 528 employees, equating to around 20% of its total workforce. In addition, the plan also calls for the company to double down on its artificial intelligence tool Dash, which is essentially an AI assistant that allows users to search for files and insights within them using their natural voice. Among other things, it can summarize the contents of customer's documents, and also create security and access controls. Houston also cited a need to streamline the company's business operations, saying that its organizational structure had become "overly complex", with an "excess layer of management" that's slowing down innovation. In an update today, Houston said the company has made a lot of progress in bringing its Dash for Business product to market, while restructuring the core file sharing business to become more efficient. "Looking ahead to 2025, we'll continue our strategy of scaling Dash and file sharing services to deliver even greater value to our customers," he said. "While still early, the positive feedback from our Dash users has been encouraging, validating the need for practical AI-powered tools that solve real customer pain-points." Despite Houston's reassurances, it's clear from Dropbox's numbers that there's still a lot of work to be done. The company's annual recurring revenue rose just 2% from a year earlier to $2.574 billion, and while the number of paying customers rose to 18.22 million, up from 18.12 million a year ago, the company admitted it had lost 15,000 compared to three months earlier. The ongoing restructuring was cited as a reason for the company's conservative guidance. For the first quarter of fiscal 2025, the company is looking at revenue of between $618 million and $621 million, well off the Street's target of $630.4 million. Investors did not like what they saw, and Dropbox's stock was down more than 7% after-hours, adding to a drop of 2% during the regular trading session. Even so, Dropbox's stock remains up 6% in the year to date, and has gained more than 31% in the last 12 months.

Share

Share

Copy Link

Dropbox faces challenges in its transition from traditional file-sharing to AI-powered tools, with sluggish growth and workforce reductions as it focuses on its new AI search product, Dash.

Dropbox's Financial Performance and Strategic Shift

Dropbox, the cloud content management and sharing vendor, is navigating through what CEO Drew Houston calls a "generational transition." The company's Q4 and full year 2024 earnings reveal sluggish growth, with revenue inching up just 1% year-over-year to $643.6 million in Q4

1

2

. Despite beating Wall Street's estimates, Dropbox's net income narrowed to $102.8 million, down from $227.3 million in the previous year2

.Workforce Reduction and Strategic Realignment

In response to these challenges, Dropbox announced a 20% reduction in its workforce, affecting 528 employees

1

2

. This move is part of a broader strategy to shift focus from its 'matured' File, Sync, Share (FSS) product towards new AI-driven offerings, particularly the search product called Dash1

.Dash: Dropbox's AI-Powered Future

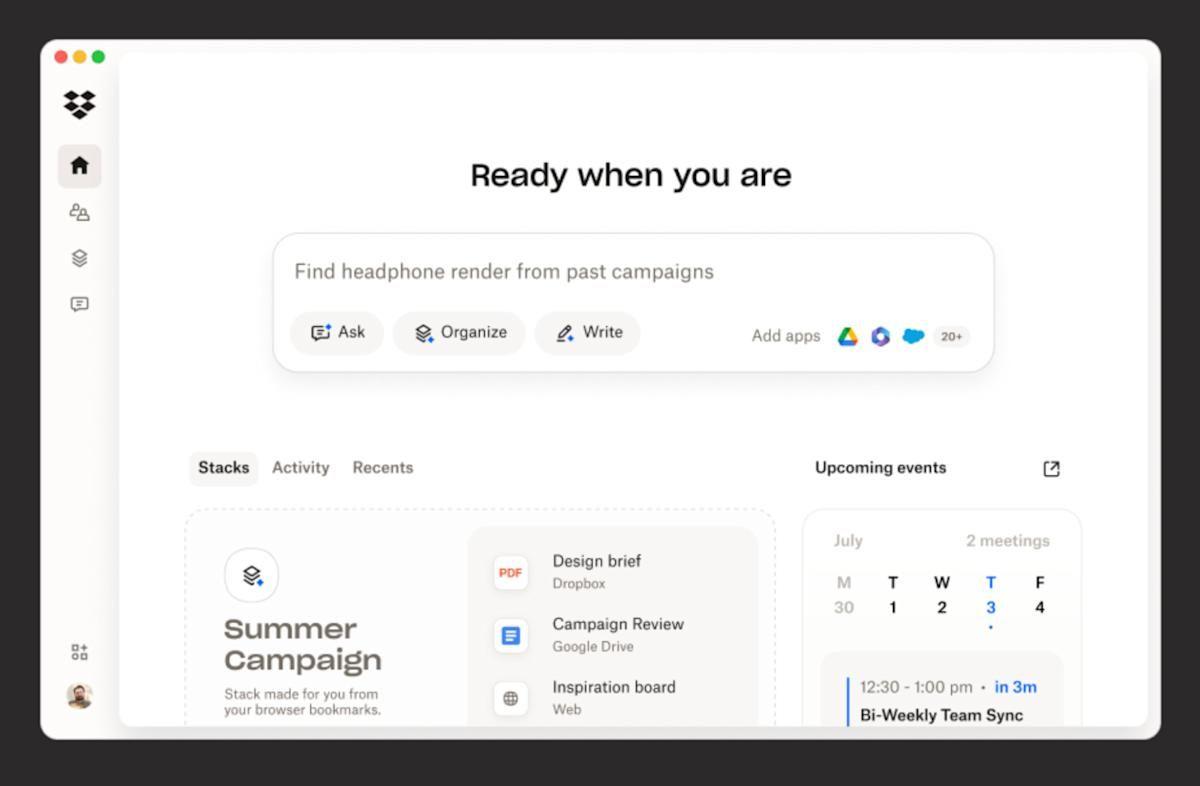

Dropbox is betting big on Dash, an AI assistant that allows users to search for files and insights using natural language. Dash can summarize document contents and create security and access controls

2

. The company has pivoted its development work towards launching Dash for business, seeing a larger near-term opportunity in partnering with IT admins to streamline user onboarding1

.Market Reception and Challenges

Despite Houston's assurances of a clear vision, investors were spooked by the flat numbers, causing Dropbox's stock price to tumble. The company's guidance for Q1 2025 revenue of $618-621 million fell short of analysts' expectations of $630.4 million

2

. Dropbox's annual recurring revenue grew by just 2% to $2.574 billion, and while paying customers increased to 18.22 million, the company lost 15,000 customers compared to the previous quarter2

.Related Stories

Future Outlook and Priorities

Scaling Dash remains Dropbox's top priority for 2025. The company plans to:

- Sell Dash through its managed sales team

- Increase marketing investments to drive awareness

- Improve the Dash user experience

- Expand SaaS application connectors

- Gain additional compliance standards for international expansion

1

Houston also hopes to leverage Dropbox's mature FSS business as a launchpad for Dash, potentially introducing it to the entire FSS user base through bundling and product integrations

1

.Industry Impact and AI Trend

Dropbox's transition reflects a broader trend in the tech industry, where companies are pivoting towards AI-driven solutions to drive growth and remain competitive. The company's struggles highlight the challenges faced by established players in adapting to rapidly evolving market demands and technological advancements

1

2

.As Dropbox continues its transformation, the success of Dash and the company's ability to effectively integrate AI into its core offerings will likely determine its future in the competitive cloud storage and content management market.

References

Summarized by

Navi

Related Stories

Recent Highlights

1

OpenAI secures $110 billion funding round from Amazon, Nvidia, and SoftBank at $730B valuation

Business and Economy

2

Trump orders federal agencies to ban Anthropic after Pentagon dispute over AI surveillance

Policy and Regulation

3

Google releases Nano Banana 2 AI image model with Pro quality at Flash speed

Technology