Elon Musk's xAI recruits crypto experts to train AI models on digital asset markets

3 Sources

3 Sources

[1]

Elon Musk's xAI Recruits Specialists to Train AI Models on Crypto

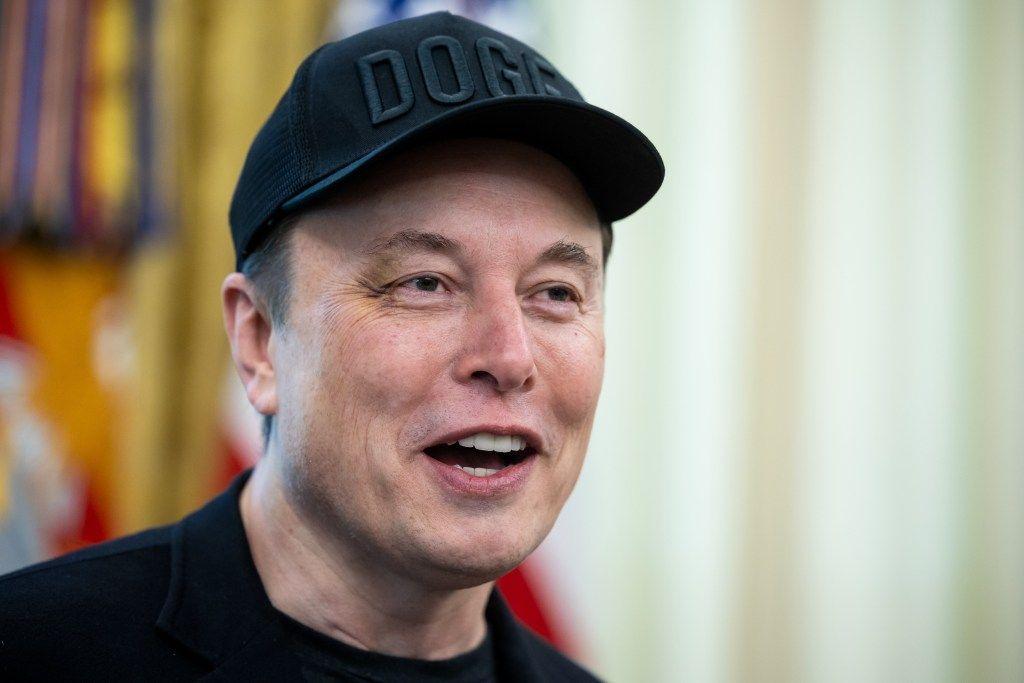

Elon Musk's artificial intelligence company xAI is hiring a crypto specialist to help train its AI systems on digital asset markets. According to a newly posted job listing, the company is recruiting a remote "Finance Expert - Crypto" to help teach xAI's models how professional crypto traders analyze on-chain data, evaluate token economics and manage risk in volatile, always-on markets. "This includes generating high-quality data in text, voice, and video formats: detailed annotations, model output critiques, step-by-step reasoning traces, audio explanations of strategies, and occasional structured video sessions," the job description reads. As part of the role, the crypto expert would also "identify and solve challenging problems from crypto, including market microstructure issues such as fragmented liquidity and miner extractable value (MEV)-related execution risks. Related: Bitcoin search, social chatter slumped in 2025 despite record prices Commenting on the job posting, Sumit Gupta, co-founder and CEO of Indian crypto exchange CoinDCX, said the role shows that the future lies in the convergence of crypto and AI. "X is already the #1 place where CT hangs out. Elon Musk wants to make xAI/ grok the #1 research platform for crypto folks too?" Gupta said in a post on X. The role is fully remote and offers hourly compensation ranging from $45 to $100, depending on experience and location. In November, Musk said X is preparing to launch a standalone encrypted messaging app called X Chat within the next few months, positioning it as a competitor to Telegram and WhatsApp. Speaking on The Joe Rogan Experience, Musk said the app uses peer-to-peer encryption similar to Bitcoin (BTC). Related: Kaito winds down crypto-backed 'Yaps' as X bans payments for 'AI slop' Last month, X's head of product Nikita Bier revealed that the platform is preparing to roll out a new "Smart Cashtags" feature that will show real-time price data for cryptocurrencies and stocks, along with related news and on-platform discussion. The tool will also surface smart contract details for crypto tokens and highlight recent mentions tied to companies, teams and market narratives.

[2]

Elon Musk's xAI Recruiting Crypto Specialists To Train Next-Generation AI Models

Elon Musk's xAI is reportedly hiring crypto finance experts to help train its artificial intelligence models to reason like professional traders rather than simply predict prices. Crypto-Native Expertise In Focus The remote role focuses on delivering high-quality market analysis grounded in real crypto behaviour, including on-chain data, derivatives, market structure, cross-exchange inefficiencies and risk management, CoinDesk reported on Tuesday. Rather than executing trades, hires will evaluate and critique AI-generated outputs, build structured reasoning frameworks and, in some cases, record audio or video insights. The goal is to teach models how experienced market participants think and explain decisions in complex environments. The move signals xAI's push to develop deeper, crypto-native financial reasoning as digital asset markets mature and institutional participation expands. It also leverages X's position as a real-time hub for crypto sentiment, narratives and breaking market developments. xAI's hiring effort comes as crypto markets retrace sharply from recent highs, following Bitcoin's slide below $100,000 and then under $80,000, increasing demand for better market interpretation tools. xAI Invests In Domain Expertise By investing in domain experts as part of its training process, xAI appears to be aiming to improve its models' ability to interpret noisy, fast-moving financial markets. Image: Shutterstock Market News and Data brought to you by Benzinga APIs

[3]

Elon Musk's xAI Is Hiring Crypto Experts to Train AI Models on Digital Asset Markets

xAI is Hiring Remote Crypto Finance Experts to Train AI Reasoning on Trading, On-Chain Data, and Risk xAI has opened a remote 'Finance Expert - Crypto' role to train its artificial intelligence (AI) models on how digital asset markets function. The announcement describes the work as expert data creation, with candidates producing annotations, evaluations, and structured reasoning for model training. The lists tasks tied to real-world trading behavior across centralized and decentralized venues. It emphasizes on-chain analysis, derivatives, market structure, and risk management in 24/7 markets.

Share

Share

Copy Link

Elon Musk's xAI is hiring crypto finance experts to teach its AI systems how professional traders analyze on-chain data, evaluate token economics, and manage risk. The remote role pays $45-$100 per hour and focuses on building AI reasoning capabilities for volatile, 24/7 crypto markets rather than simple price prediction.

xAI Seeks Crypto Finance Experts for AI Training

Elon Musk's xAI has opened applications for a remote Finance Expert position dedicated to training AI models on digital asset markets

1

. The newly posted job listing signals a strategic push to develop crypto-native financial reasoning capabilities within xAI's systems, moving beyond basic price prediction toward sophisticated market analysis2

.

Source: Analytics Insight

The role centers on teaching AI how professional crypto traders think and operate in volatile, always-on markets. Candidates will generate high-quality training data across text, voice, and video formats, including detailed annotations, model output critiques, step-by-step reasoning traces, and audio explanations of trading strategies

1

. Rather than executing actual trades, crypto experts will evaluate AI-generated outputs and build structured reasoning frameworks that reflect real-world trading behavior2

.

Source: Cointelegraph

Training AI on Complex Market Dynamics

The position requires expertise in analyzing on-chain data, evaluating token economics, and managing risk in decentralized and centralized trading venues

3

. Crypto experts will also tackle challenging problems related to market structure, including fragmented liquidity and miner extractable value (MEV)-related execution risks1

. The job description emphasizes derivatives trading, cross-exchange inefficiencies, and AI reasoning development for 24/7 market conditions3

.This approach reflects xAI's commitment to domain expertise as part of its training process, aiming to improve how AI models interpret noisy, fast-moving financial markets

2

. The fully remote role offers hourly compensation ranging from $45 to $100, depending on experience and location1

.Convergence of Crypto and AI Ecosystems

Sumit Gupta, co-founder and CEO of Indian crypto exchange CoinDCX, commented that the role demonstrates the convergence of crypto and AI. He noted that X already serves as the primary platform where crypto Twitter congregates, and suggested Elon Musk aims to position xAI and Grok as the leading research platform for crypto participants

1

.The timing aligns with broader developments at X. The platform is preparing to roll out Smart Cashtags, a feature that will display real-time price data for cryptocurrencies and stocks alongside related news and on-platform discussion

1

. The tool will surface smart contract details for crypto tokens and highlight recent mentions tied to companies, teams, and market narratives1

. Additionally, X is developing a standalone encrypted messaging app called X Chat, which uses peer-to-peer encryption similar to Bitcoin1

.Related Stories

Market Context and Strategic Implications

xAI's hiring effort comes as crypto markets retrace from recent highs, with Bitcoin sliding below $100,000 and then under $80,000, increasing demand for better market interpretation tools

2

. By leveraging X's position as a real-time hub for crypto sentiment and breaking market developments, xAI can access unique training signals that reflect actual trader behavior and market narratives2

.This move positions xAI to capture institutional demand as digital asset markets mature. The focus on on-chain analysis, derivatives, and market microstructure suggests xAI is building capabilities that address sophisticated trading needs rather than retail-focused price alerts. For crypto traders and institutions, this could mean access to AI tools that understand the nuances of fragmented liquidity, cross-chain dynamics, and execution risks that define modern digital asset trading.

References

Summarized by

Navi

[1]

[3]

Related Stories

Recent Highlights

1

Pentagon threatens Anthropic with Defense Production Act over AI military use restrictions

Policy and Regulation

2

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

3

Anthropic accuses Chinese AI labs of stealing Claude through 24,000 fake accounts

Policy and Regulation