Enovix Reports Strong Q2 2025 Results, Launches AI-1 Battery Platform

2 Sources

2 Sources

[1]

Enovix Stock Is Tumbling Thursday: What's Going On? - Enovix (NASDAQ:ENVX)

Enovix Corp ENVX reported financial results for the second quarter after the market close on Thursday. Shares are moving lower in after-hours trading. Here's a look at the key highlights from the quarter. Q2 Revenue: $7.47 million, versus estimates of $5.57 million Q2 Adjusted EPS: Loss of 13 cents, versus estimates for a loss of 17 cents Total revenue was up 98% on a year-over-year basis, driven by "strong demand" for the lithium-ion battery company's products. Enovix highlighted the launch of its AI-1 cell platform, a core battery architecture featuring advanced materials and a fully automated manufacturing process. "In the second quarter of 2025, Enovix delivered on key milestones in product development, manufacturing readiness and commercialization. We finalized the AI-1 battery platform, shipped production samples for product qualification, exceeded revenue expectations, and achieved our third straight quarter of positive gross margin," the company said in a letter to shareholders. "With AI-1 launched, mass production advancing, and new customers entering qualification, we are moving into the commercialization phase." Enovix ended the period with $203.4 million in total cash, cash equivalents and short-term investments. Guidance: Enovix expects third-quarter revenue to be between $7.5 million and $8.5 million versus estimates of $7.3 million. The company anticipates a third-quarter loss of 14 cents to 18 cents per share versus estimates for a loss of 18 cents per share. ENVX Price Action: Enovix shares were down 17.61% in after-hours, trading at $11.04 at the time of publication on Thursday, according to Benzinga Pro. Read Next: Amazon Q2 Earnings Highlights: Double Beat, 'AI Progress Across The Board Continues' Elon Musk's Tesla, LG Energy Solutions Sign $4.3 Billion Battery Deal Image: Tada Images/Shutterstock.com ENVXEnovix Corp$11.10-17.8%Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full ScoreEdge RankingsMomentum54.61GrowthN/AQualityN/AValue5.18Price TrendShortMediumLongOverviewMarket News and Data brought to you by Benzinga APIs

[2]

Enovix (ENVX) Q2 Revenue Jumps 97% | The Motley Fool

Enovix (ENVX -22.57%), a developer of advanced silicon-anode lithium-ion battery technology, released results for its second quarter of fiscal 2025 on July 31, 2025. The company posted GAAP revenue of $7.5 million, surpassing the analyst consensus estimate of $5.57 million (GAAP) and exceeding its own guidance midpoint. Its non-GAAP net loss per share came in at $0.13, outperforming expectations for a non-GAAP loss of $0.19 per share. The period showed material improvement in gross margin, reaching 31% (non-GAAP) versus (15%) in Q2 2024, while operating losses continued to narrow. Overall, the quarter featured strong commercial progress on battery platforms, manufacturing milestones in Asia, and a notable beat across key financial metrics. Source: Analyst estimates for the quarter provided by FactSet. Enovix develops and manufactures next-generation lithium-ion batteries with a focus on advanced silicon-anode technology. Its batteries are aimed at applications that demand higher energy density, faster charging, and longer cycle life, such as smartphones, smart eyewear (augmented reality), industrial handhelds, and devices used in the Internet of Things (IoT) sector. Enovix's business strategy centers on five main areas: innovating battery architecture, developing a proprietary manufacturing process, expanding through strategic acquisitions like its recent Korean facility, building a global manufacturing footprint in Asia, and targeting high-growth opportunities in consumer electronics, defense, and industrial applications. Its ability to achieve large-scale production, secure key certifications, and rapidly move from pilot to volume manufacturing has become a core measure of its current progress and future prospects. The quarter's biggest financial headline was the leap in GAAP revenue, which nearly doubled compared to Q2 2024, coming in substantially ahead of both internal guidance and analyst estimates. This jump was underpinned by strength in defense product sales manufactured at its Korean subsidiary. The higher share of these premium-margin products contributed to a turn in gross margin, with the company's non-GAAP gross margin moved from negative values in Q2 2024 into the low 30% range. Company management confirmed this was a direct result of the Korean facility's output, along with improvements in product mix following post-tariff shifts in customer demand. Operating losses continued to narrow as the company increased sales and maintained cost controls. On a non-GAAP basis, operating loss improved from $(30.96 million) in Q2 2024 to $(26.51 million) in Q2 2025. Adjusted EBITDA, a measure of profit that removes the effects of interest, taxes, depreciation, and amortization, improved from minus $25.89 million in Q2 2024 to minus $20.13 million. However, cash flow remained negative, with free cash flow (non-GAAP) for the first half of FY2025 at $(67.0 million), an improvement over the prior year's six-month result. Product innovation featured heavily, especially with the launch and sampling of the AI-1 platform -- a new family of lithium-ion batteries that pairs silicon anodes with advanced manufacturing methods. Enovix announced its first smartphone battery with energy density over 900 watt-hours per liter (Wh/L). This product also achieved fast charging at 3C (meaning the battery can be charged in about 20 minutes) and a projected cycle life of 1,000 cycles. The AI-1 platform is being sampled with two major smartphone manufacturers, a leading smart eyewear company (augmented reality glasses), and several IoT-focused customers. On the manufacturing front, the company's new Fab2 site in Malaysia reached early production, producing AI-1 batteries on high-volume equipment. This, combined with further integration of its recently acquired Korean facility, allowed Enovix to accelerate customer qualification and halve the time required for custom product development. A key regulatory milestone was also met: Enovix obtained UN38.3 certification, which is required for batteries to be shipped safely by air worldwide. This clears the way for broader commercial shipments once customer qualifications are finished. The acquisition of the Korean facility, formerly Routejade, served two purposes: it gave Enovix both vertical integration (control of more manufacturing steps, including electrode coating) and immediate access to new, high-margin defense contracts in the Asian market. Management stated that the acquisition came at a "bargain price" and significantly improved manufacturing capabilities, including supporting prototyping and production for new materials in as little as seven weeks. The Korean site also helped support the company's defense product mix, which was a major driver of higher margins this period. There were no declared or adjusted dividends for the period. The company instead moved forward with capital measures designed to strengthen its balance sheet, including a special warrant dividend program that could raise up to $255 million and an authorization for a $60 million share repurchase, which had not begun as of July 30. For Q3 FY2025, Enovix guided to GAAP revenue between $7.5 million and $8.5 million. It expects a non-GAAP operating loss between $31 million and $35 million, and a non-GAAP net loss per share of $0.14 to $0.18. These outlook figures reflect continued investment in scaling manufacturing and entering new commercial agreements, but also suggest ongoing operating losses as the business ramps. Cash and investments (GAAP) at the end of Q2 2025 stood at $203.4 million. Key factors for investors to watch in the coming quarters will be the rate at which sample shipments convert into volume purchase orders, especially with leading smartphone and smart eyewear customers. There is some risk that current high margins -- which benefited this quarter from a favorable defense mix -- may moderate as the business scales in larger consumer segments that historically feature lower margins. Management commentary confirmed that battery costs as part of bill of materials are rising, particularly as manufacturers raise capacity to meet growing demands from artificial intelligence (AI) hardware. The authentication of its technology in mass-market devices, and its ability to contain costs during the scale-up of production lines in Malaysia and Korea, will be critical to tracking progress.

Share

Share

Copy Link

Enovix, a lithium-ion battery company, reports 98% year-over-year revenue growth in Q2 2025, driven by strong demand and the launch of its AI-1 cell platform featuring advanced materials and automated manufacturing.

Enovix Reports Strong Q2 2025 Financial Results

Enovix Corp (NASDAQ:ENVX), a developer of advanced silicon-anode lithium-ion battery technology, has reported impressive financial results for the second quarter of 2025. The company's revenue surged 98% year-over-year to $7.47 million, significantly exceeding analyst estimates of $5.57 million

1

2

. This strong performance was primarily driven by robust demand for the company's lithium-ion battery products and the successful launch of its new AI-1 cell platform.

Source: Benzinga

AI-1 Cell Platform: A Technological Breakthrough

The highlight of Enovix's Q2 performance was the introduction of its AI-1 cell platform, a core battery architecture featuring advanced materials and a fully automated manufacturing process

1

. This innovative platform has enabled Enovix to achieve remarkable advancements in battery technology:- Energy Density: The company announced its first smartphone battery with an energy density exceeding 900 watt-hours per liter (Wh/L)

2

. - Fast Charging: The AI-1 platform achieved a 3C charging rate, allowing batteries to be fully charged in approximately 20 minutes

2

. - Cycle Life: The new batteries are projected to have a cycle life of 1,000 cycles, significantly enhancing their longevity

2

.

Commercial Progress and Manufacturing Milestones

Enovix has made substantial strides in commercializing its technology and expanding its manufacturing capabilities:

- Customer Sampling: The AI-1 platform is currently being sampled by two major smartphone manufacturers, a leading smart eyewear company, and several IoT-focused customers

2

. - Manufacturing Expansion: The company's new Fab2 site in Malaysia has begun early production of AI-1 batteries using high-volume equipment

2

. - Regulatory Milestone: Enovix obtained UN38.3 certification, a crucial requirement for worldwide air shipment of batteries

2

.

Related Stories

Financial Highlights and Future Outlook

Despite the strong revenue growth, Enovix reported a Q2 adjusted loss per share of $0.13, which was better than the estimated loss of $0.17

1

. The company's gross margin improved significantly, reaching 31% (non-GAAP) compared to -15% in Q2 20242

.Looking ahead, Enovix provided guidance for Q3 2025:

- Revenue: Expected to be between $7.5 million and $8.5 million

1

. - Adjusted EPS: Anticipated loss of $0.14 to $0.18 per share

1

.

Market Reaction and Investor Considerations

Source: Motley Fool

Despite the positive results, Enovix's stock experienced a significant drop of 17.61% in after-hours trading following the earnings announcement

1

. This reaction suggests that investors may have had even higher expectations or concerns about the company's future growth trajectory.As Enovix continues to innovate and expand its manufacturing capabilities, key factors for investors to monitor include:

- Conversion of sample shipments into volume purchase orders, especially from major smartphone and smart eyewear customers

2

. - Progress in scaling manufacturing operations and entering new commercial agreements

2

. - The company's ability to maintain its technological edge in the competitive lithium-ion battery market.

With its strong Q2 performance and the launch of the AI-1 platform, Enovix appears well-positioned to capitalize on the growing demand for advanced battery technologies in various sectors, including consumer electronics, defense, and industrial applications.

References

Summarized by

Navi

[2]

Related Stories

Navitas Semiconductor Pivots to AI Data Centers Amid Revenue Challenges

05 Aug 2025•Business and Economy

Innoviz Technologies Reports Strong Q2 2025 Results, Expands into Non-Automotive LiDAR Markets

14 Aug 2025•Technology

Evolv Technologies Reports Strong Q2 2025 Results, Driven by AI-Powered Security Solutions

16 Aug 2025•Business and Economy

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

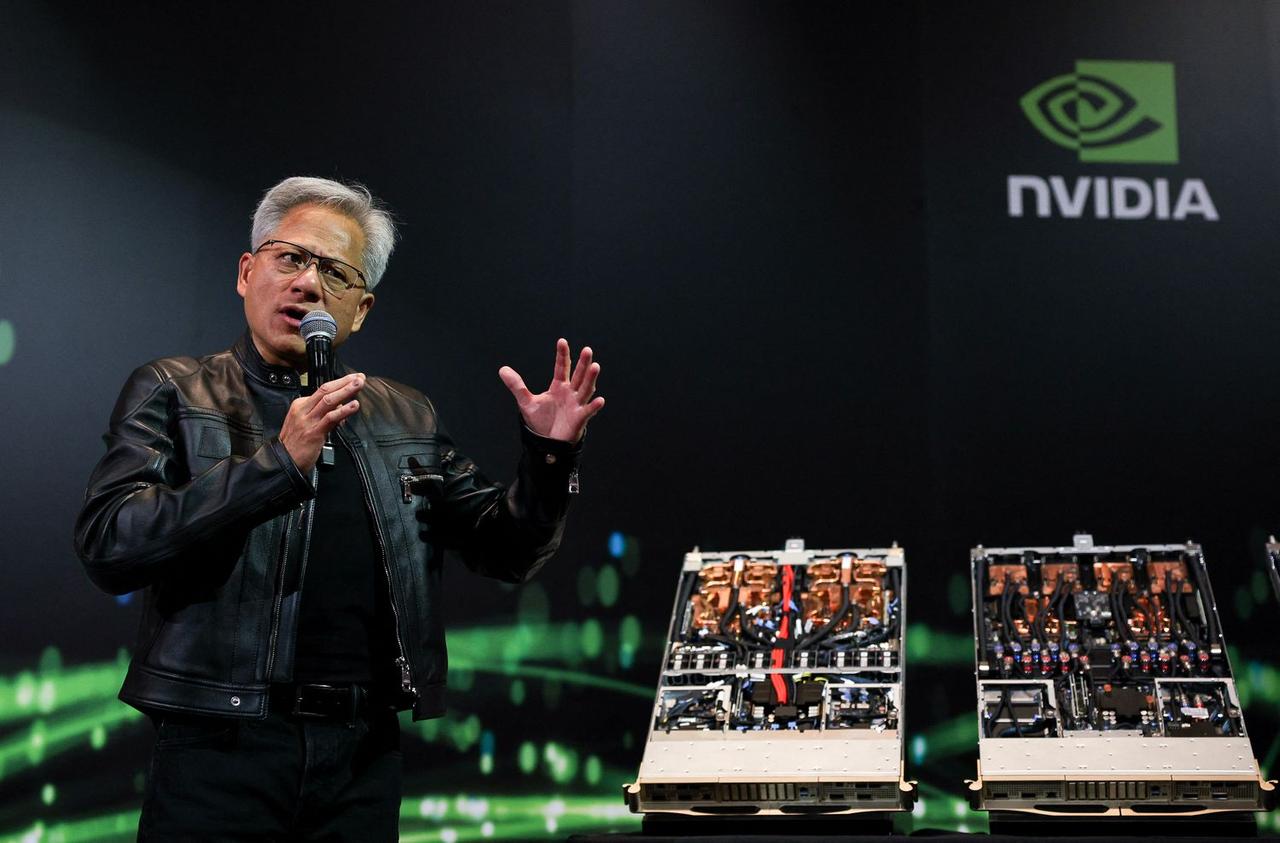

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology