Federal Reserve's Rate Cut Dilemma: Economists Weigh In on Inflation and Economic Growth

0 Sources

0 Sources

Share

Share

Copy Link

As inflation stabilizes, economists debate the Federal Reserve's next move. Some argue for rate cuts to boost growth, while others caution against premature action.

Inflation Stabilization Sparks Rate Cut Discussions

Recent economic data has ignited a debate among economists about the Federal Reserve's next steps in monetary policy. With inflation showing signs of stabilization, some experts are advocating for interest rate cuts as early as September, while others urge caution .

Calls for Rate Cuts to Stimulate Growth

Prominent voices in the economic community are pushing for the Federal Reserve to ease its monetary policy. Economist David Rosenberg argues that the Fed should "take the foot off the brake" and implement rate cuts to stimulate economic growth . Rosenberg contends that the current policy stance is overly restrictive and may be hindering economic expansion.

Inflation Trends and Economic Indicators

The Consumer Price Index (CPI) has shown encouraging signs, with the core CPI rising by 0.2% in June, maintaining a 4.8% increase over the past year [1]. This stability in inflation metrics has led some analysts to predict a potential rate cut by the Federal Reserve as early as September. The personal consumption expenditures (PCE) price index, another key inflation measure, has also demonstrated moderation.

Federal Reserve's Cautious Approach

Despite calls for rate cuts, the Federal Reserve has maintained a cautious stance. Fed Chair Jerome Powell has emphasized the need for sustained evidence of inflation moving towards the 2% target before considering policy changes [1]. This approach reflects the Fed's commitment to price stability and its desire to avoid premature policy shifts that could reignite inflationary pressures.

Related Stories

Market Expectations and Economic Outlook

Financial markets have been closely monitoring these developments, with some investors anticipating rate cuts in the near future. However, the Fed's decision-making process remains data-dependent, with officials carefully analyzing various economic indicators before making any policy adjustments [2]. The balance between supporting economic growth and maintaining price stability continues to be a central challenge for policymakers.

Potential Impact on Consumer Spending and Business Investment

A potential rate cut could have significant implications for consumer spending and business investment. Lower interest rates typically encourage borrowing and spending, which could boost economic activity. However, the Fed must weigh these potential benefits against the risk of reigniting inflationary pressures or creating financial imbalances [1][2].

As the debate continues, economists, policymakers, and market participants remain focused on upcoming economic data releases and Federal Reserve communications for clues about the future direction of monetary policy. The delicate balance between fostering economic growth and maintaining price stability will likely remain at the forefront of economic discussions in the coming months.

References

Summarized by

Navi

Related Stories

Recent Highlights

1

OpenAI Releases GPT-5.4, New AI Model Built for Agents and Professional Work

Technology

2

AI chatbots helped teens plan violent attacks in 8 of 10 cases, new investigation reveals

Technology

3

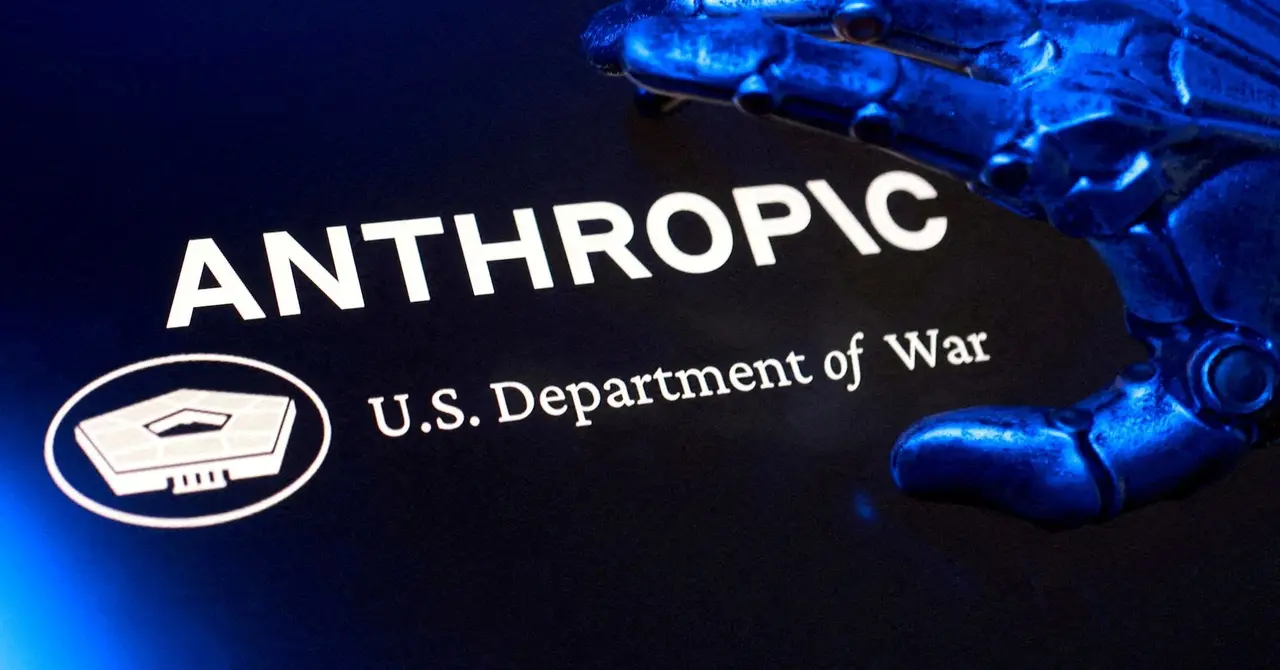

Pentagon shuts door on Anthropic talks as Microsoft and Big Tech rally behind AI firm's lawsuit

Policy and Regulation