Global Markets Face September Slump Amid Economic Concerns

2 Sources

2 Sources

[1]

Markets reckon with familiar September pain

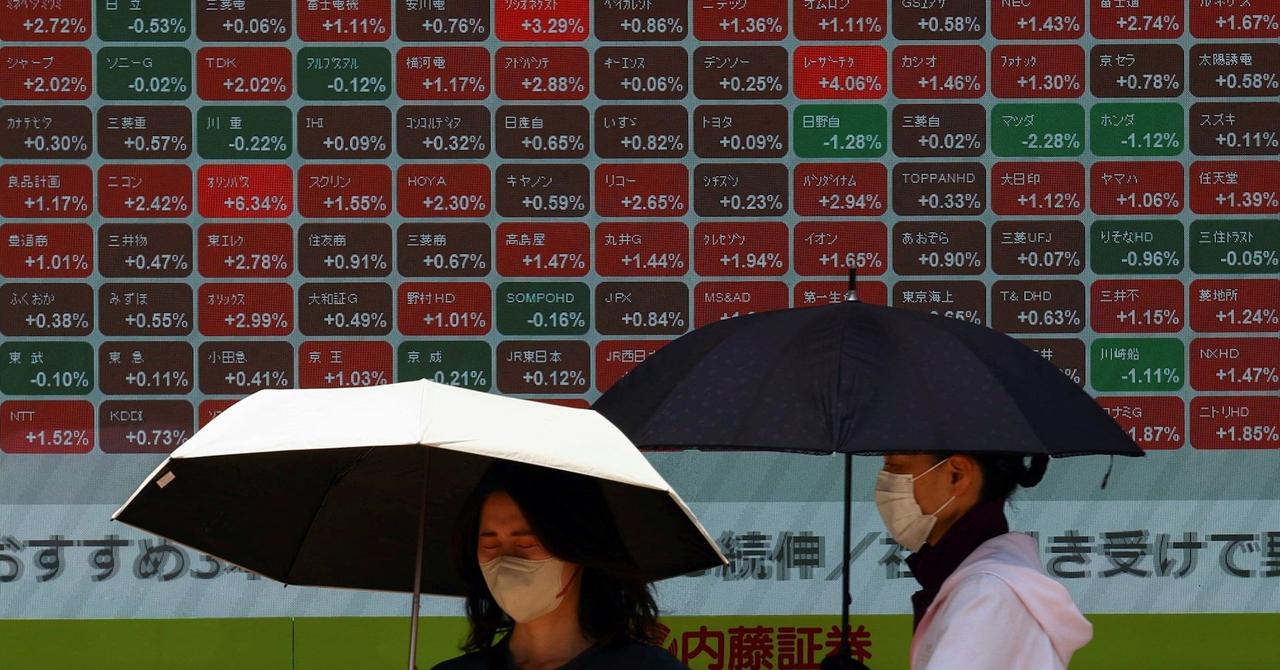

A look at the day ahead in European and global markets from Rae Wee Markets in Europe are set for a rocky start on Wednesday after Asia stocks were left in a sea of red, as worries over the global growth outlook resurfaced and as the blistering AI rally hit yet another speed bump. U.S. and European stock futures sank, while MSCI's broadest index of Asia-Pacific shares outside Japan and Japan's Nikkei were headed for their worst sessions since Aug. 5, when worries about a slowing U.S. economy and an unwinding of Japanese yen carry trades pummelled global stock markets. September has historically been a bad month for stocks, and it seems U.S. investors were eager to keep up with that tradition, after sending Wall Street sliding in their return from the Labor Day holiday. Analysts say there is no one specific reason behind the latest market rout. Tepid U.S. manufacturing data could be blamed, but so could gloom over China's shaky economic recovery and Nvidia's record sell-off. The $279 billion loss in market value of the AI darling hobbled technology stocks in Asia on Wednesday, with Japanese chip-testing equipment maker Advantest, a supplier to Nvidia, down 7%. Taiwan's TSMC fell 4%. In commodities, concerns over waning global demand sent oil prices tumbling to their weakest level in nine months. China's CNOOC Ltd led the slide in Hong Kong-listed oil shares, and was also headed for its biggest one-day percentage drop since Aug. 5. Everything seems to point to another turbulent run for markets for now, with data on U.S. job openings later on Wednesday set to provide clues on the strength of the labour market. Still, the focus remains squarely on Friday's U.S. nonfarm payrolls report for August, which could determine whether the Federal Reserve's expected rate cut this month will be regular or super-sized. Until then, investors will be walking on eggshells, and the sell-off thus far may not be the last. Key developments that could influence markets on Wednesday: (Reporting by Rae Wee; Editing by Muralikumar Anantharaman)

[2]

Stocks in seasonal sneeze as factories flunk

A look at the day ahead in U.S. and global markets from Mike Dolan Wall Street seems to be making a habit of these early month stock plunges, with Tuesday's tremor a mild aftershock from the brief August quake one month ago. Given that September historically tends to be the worst month of the year for stock market returns - with August a close second - then seasonal flurries like this probably should be treated as such. This too will likely pass. And yet there's inevitably some anxiety that the sharp retreat from near record highs is rooted in something more fundamental. And on that score, this week's critical U.S. employment report and another dour reading on global manufacturing for August cranked up the tension again. While factories in the U.S. and around the world have been spluttering for the best part of two years, there had been some sign of a manufacturing upturn earlier this year. But the sector seems to be suffering a relapse, not least as China's economy continues to struggle with its property bust and growth there wanes. U.S. output contracted again in August, according to Tuesday's release of the Institute for Supply Management's latest factory survey, even if some modest improvement in employment readings may ease fears for this week's big labor market readouts. The first of those starts today with a report on July job openings. But survey signs of a further decline in new orders and rising inventories suggested a deepening slowdown in manufacturing is taking hold. What's more, JPMorgan's global manufacturing index slipped to its weakest reading of the year and registered its second month in a row in contractionary territory. "More concerning are signs that business equipment spending is losing steam - potentially pointing to a weakening in the pace of hiring as well," the bank said in a report. While manufacturing only accounts for about 10% of the U.S. economy, it's 15% of euro zone GDP, 20% of Germany's output and 26% of China's. More dominant service sector readings are offsetting the gloom - with euro zone surveys on Wednesday showing the overall business activity signal still expanding last month and only marginally below forecast as the Paris Olympics seemed to lift the mood. Still, the factory wobble seems to have been enough to knock back the stocks again as the S&P500's 2% loss on Tuesday clocked its worst day in a month and the VIX volatility gauge jumped back above its long-term averages. Adding to the angst was a near 10% drop in artificial intelligence bellwether Nvidia, its worst day since April and marking its biggest ever one-day loss in market value with a $279 billion wipeout. The stock lost another 1% out of hours overnight after Bloomberg reported the U.S. Department of Justice has sent a subpoena to Nvidia as it deepens its probe into the AI heavyweight's antitrust practices. Stocks around the world were caught in the slipstream on Wednesday, with Japanese, Taiwanese and Korean markets all suffering 3-4% swoons. European stocks lost another 1% and Wall St stock futures remained slightly in the red. With growth clouds nudging up Federal Reserve easing expectations, there was some relief for global investors from the rally in Treasuries - sustaining the newly negative correlation between stocks and bonds that re-emerged last month. The chances of a Fed rate cut of as much as 50 basis points rose to about 40%, with 104bps now priced for the year. Two-year Treasury yields plunged to 3.83% - their lowest since May last year - and 10-year yields ebbed too. The bond rally was encouraged by a sharp drop in oil prices - which were hit by worries about global manufacturing, a likely resumption of Libyan supply after the recent outage and expectations of an increase in overall OPEC output next month. U.S. crude prices fell below $70 per barrel for the first time since Jan. 2 and year-on-year price drops are now running at close to 20%. The dollar index, which hit a two-week high on Tuesday, slipped back again. And there was little sign of a renewed "safety bid" in the likes of gold or Bitcoin, which both fell today. Japan's yen was slightly firmer after this week's latest reiteration from the Bank of Japan that it plans to continue tightening. And the Canadian dollar found a foothold as it awaits another Bank of Canada interest rate cut later today - the third of the year so far even before the Fed gets going. Key developments that should provide more direction to U.S. markets later on Wednesday: * Bank of Canada policy decision, news conference from BOC governor Tiff Macklem * US July job openings, July international trade balance, July factory goods orders; Canada July trade balance, * Federal Reserve publishes 'Beige Book' on economic conditions; European Central Bank board member Frank Elderson speaks * US corporate earnings: Hewlett Packard Enterprise, Dollar Tree, Hormel Foods, Copart (By Mike Dolan, editing by Philippa Fletcher; [email protected])

Share

Share

Copy Link

Global markets experience a traditional September decline, with stocks, bonds, and commodities facing pressure. Economic data and central bank decisions contribute to investor uncertainty.

September Slump Hits Global Markets

As the calendar turns to September, global markets are experiencing their annual bout of weakness, a phenomenon often referred to as the "September Effect." This year, the trend appears to be holding true across various asset classes, including stocks, bonds, and commodities

1

.Stocks Under Pressure

Equity markets worldwide are feeling the heat as investors grapple with economic uncertainties. The S&P 500, a benchmark for U.S. stocks, has seen a decline, reflecting broader market sentiment. European stocks have also faltered, with the pan-European STOXX 600 index experiencing its longest losing streak since February

2

.Bond Market Volatility

The bond market is not immune to the September jitters. U.S. Treasury yields have been on the rise, indicating a sell-off in government bonds. This movement in the bond market is closely tied to investor expectations regarding future interest rate decisions by central banks, particularly the Federal Reserve

1

.Commodity Markets React

Commodity markets, especially oil, are showing signs of weakness. The S&P GSCI Petroleum Index, which tracks the performance of oil-related commodities, has experienced a downturn. This decline comes despite recent production cuts announced by major oil-producing countries, suggesting that demand concerns are outweighing supply constraints

1

.Economic Data Fuels Uncertainty

Recent economic indicators have added to market anxieties. Manufacturing data from major economies, including China, the eurozone, and Britain, has shown contraction, raising concerns about global economic growth. In the United States, the Institute for Supply Management (ISM) reported that its manufacturing PMI remained in contractionary territory for the tenth consecutive month

2

.Related Stories

Central Bank Watch

Investors are closely monitoring central bank decisions, which are expected to play a crucial role in market direction. The European Central Bank (ECB) is set to meet next week, with market participants divided on whether another interest rate hike is in the cards. Meanwhile, speculation continues about the Federal Reserve's next moves, with upcoming economic data likely to influence their decision-making process

1

2

.Currency Market Dynamics

The U.S. dollar has shown strength against a basket of major currencies, benefiting from its safe-haven status during times of market uncertainty. This dollar strength has put pressure on other currencies, including the euro and emerging market currencies

1

.Looking Ahead

As markets navigate through the challenging month of September, investors are bracing for potential volatility. The interplay between economic data, central bank decisions, and geopolitical factors will likely continue to shape market sentiment in the coming weeks. While the "September Effect" is a historical trend, its impact this year appears to be amplified by the current economic landscape and global uncertainties

1

2

.References

Summarized by

Navi

[1]

[2]

Related Stories

Recent Highlights

1

OpenAI secures $110 billion funding round from Amazon, Nvidia, and SoftBank at $730B valuation

Business and Economy

2

Anthropic stands firm against Pentagon's demand for unrestricted military AI access

Policy and Regulation

3

Pentagon Clashes With AI Firms Over Autonomous Weapons and Mass Surveillance Red Lines

Policy and Regulation