HDD prices surge 4% as AI infrastructure and China's PC push strain global supply

4 Sources

4 Sources

[1]

HDD prices spike as AI infrastructure and China's PC push collide -- hard drives record biggest price increase in eight quarters, suppliers warn pressure will continue

Hard drives, often treated as a legacy technology, are once again being pulled into the spotlight. After nearly two years of relative calm, the hard disk drive (HDD) market is showing signs of stress again. According to a report from Digitimes Asia (quoting Nikkei), HDD contract prices jumped roughly 4% quarter over quarter in Q4 2025. That's the sharpest increase seen in eight quarters, and suppliers expect this upward pressure to persist. That might sound like a niche storage story, but in reality, it's a symptom of much larger forces reshaping the entire computing supply chain, from Chinese PC procurement policies to the rapid AI-driven expansion of U.S. data centers. The report identifies two primary demand drivers. The first is a sudden resurgence of HDD demand in China's PC market, driven by government procurement policies that favor domestically produced CPUs and operating systems. That policy shift has accelerated local PC production, and in an unexpected twist, has also boosted HDD adoption. A big part of the reason is trust, or rather, the lack of it. Sources cited in the report point to concerns around long-term data retention in SSDs, whose critical components rely on NAND flash memory that is vulnerable to "bit rot" over time spent in storage. The result has been a renewed push toward HDDs for certain use cases, reversing what had long looked like an inexorable transition toward solid-state storage. The second major pressure point is the U.S. data center sector, where demand for high-capacity nearline HDDs continues to grow. Despite years of predictions that flash storage would displace spinning disks entirely, hyperscale operators still rely heavily on HDDs for bulk storage, backups, and cold or warm data tiers. As AI workloads scale, so does the volume of data they generate, store, and move -- much of which ends up on large, relatively cost-efficient hard drives. TrendForce data cited in the report suggests that HDD manufacturers are already running at full utilization, yet still can't keep pace with demand from cloud service providers. Prices for nearline HDDs rose by a similar 4% quarter over quarter, underscoring that this isn't a localized PC phenomenon but a broader capacity problem. What makes this moment especially interesting is how it intersects with the wider AI infrastructure boom. AI data centers aren't just consuming GPUs and accelerators; they're devouring memory, storage, power equipment, and even physical construction capacity at a historic pace. High-bandwidth memory and enterprise DRAM are already in short supply, and elevated DRAM pricing has made it harder for HDD makers to control manufacturing costs, even as demand surges. After all, hard drives use lots of DRAM for cache memory. In that sense, HDD pricing pressure isn't an anomaly so much as it is collateral damage. Capital expenditure on AI infrastructure has ballooned so rapidly that it's begun showing up in macroeconomic data. Analysts have pointed out that a disproportionate share of recent U.S. GDP growth has come from investment spending tied to data centers, servers, and related infrastructure rather than consumer demand. HDDs, humble as they may seem, are part of that same CapEx wave. Unlike flash memory, which can ramp with new fabs and process shrinks, HDD production is constrained by specialized components such as read/write heads and precision media. Scaling output isn't fast or cheap, and manufacturers have been cautious about expanding capacity after years of pricing pressure and consolidation. The result is a market that can tighten quickly when demand rebounds from multiple directions at once. The bigger takeaway is that hard drives, often treated as a legacy technology, are once again being pulled into the center of the industry's growth story. Between China's shifting procurement priorities and the AI sector's insatiable appetite for data storage, spinning disks are experiencing demand dynamics few would have predicted just a couple of years ago. Whether this turns into a sustained pricing cycle or a temporary squeeze will depend on how quickly capacity expands, and whether AI infrastructure spending continues at its current breakneck pace.

[2]

First it was RAM, now it's HDDs: prices are spiking across the board

* HDD prices jumped Q4 2025 (4% QoQ) as DRAM shortages and AI demand squeeze supply. * AI data centers plus China's push for domestic PCs and SSD retention worries revive HDD demand. * Expect HDDs to cost roughly $50 more; consider buying soon as AI-driven shortages persist. A new report states that the traditional hard disk drive (HDD) market is experiencing a sharp price uptick, as the ongoing DRAM shortage continues and is expected to get worse. According to a new report from DigiTimes that quotes Nikkei and cites data from TrendForce, HDD prices have increased 4% quarter-over-quarter in Q4 2025, amounting to the most notable increase in eight quarters. HDD suppliers expect this trend to continue for the foreseeable future, says the report. As the memory shortage continues, Laptops with only 8GB of RAM could soon be the new normal If you're looking to buy a mid-range laptop anytime soon, you'll unfortunately need to accept a lower price-to-performance ratio. Posts 4 By Patrick O'Rourke The report goes on to cite the rapid expansion of AI data centers in the US and the resurgence of HDD demand in China's PC market, which is tied to government policies that emphasize domestically made PC products that, in turn, spur PC production -- and directly tied to this is HDD adoption. Related to this shift are concerns surrounding SSD data retention and data deterioration, often referred to as bit rot, leading to a resurgence in HDD interest across the board. On the AI infrastructure side, storing huge amounts of data for model training has forced AI labs to use HDD-based storage in situations where speed isn't integral, which also contributes to the recent spike in HDD cost. AI infrastructure is the culprit yet again It's not just DRAM that's getting expensive and scarce So what does this mean for the average PC parts consumer? The cost of an HDD will likely be slightly more expensive moving forward, running in the range of $50 more, according to some estimates. It's important to note that this price increase is directly tied to the broader AI infrastructure boom. Along with DRAM memory, which has surged rapidly in price and scarcity over the past few months, AI data centers are consuming GPUs, power equipment, and of course, HDDs. Adding to this, HDDs utilize DRAM for cache memory, complicating the supply situation further. So while HDDs are often viewed as legacy technology that's seldom used anymore, especially by PC parts enthusiasts, supply and prices are still notably impacted by the AI industry's never-ending thirst for more data storage. It's unclear how long this trend will continue, but if you've been thinking about buying an HDD, it might be worth pulling the trigger sooner rather than later, especially as the AI boon shows no sign of slowing down.

[3]

Oh great: HDD prices surge to highest point in 2 years with demand from China and the US

TL;DR: HDD prices are surging to a two-year high due to soaring demand from global data centers, especially US-based cloud service providers supporting AI and data-intensive workloads. Despite full manufacturing capacity, supply lags behind growing storage needs, signaling potential shortages and price hikes in 2026 across HDD, SSD, and RAM markets. Well, this won't end well... HDD prices are rocketing upwards, with prices on mechanical HDDs rising the highest they've been in the last 2 years. According to new reports from Nikkei, the demand for HDDs is through the roof, with contract HDD prices rising 4% quarter-over-quarter, the highest figure in the last 8 quarters (two years). The demand is coming mostly from large-scale data center build outs across the planet, with HDD requirements used more in US-based facilities. AI needs as much data as it can get, with cloud service providers (CSPs) using HDDs the most, as they're the most cost-effective and efficient medium for storage. The data required for AI systems scales up beyond terabytes and into exabytes, where it hosts data scaped from the internet, backups of processed data, inference logs, and so much more. Similar to AI memory, HDDs have seen gigantic adoption recently, putting suppliers under immense pressure. In a new report from DigiTimes, the Taiwanese media outlet reports: "meanwhile, demand for high-capacity nearline HDDs used in data centers remains robust, with prices for nearline HDDs rising by about 4% quarter-over-quarter. According to TrendForce, despite manufacturers operating at full utilization rates, supply continues to lag behind the expanding storage requirements of US-based CSPs, especially as AI, cloud computing, and data-intensive workloads continue to scale". Storage giants Phison and Transcend have been sending out the warning signals of impending shortages for a little while now, so it looks like 2026 could be a real rough year between RAM + SSD + HDD price increases and shortages.

[4]

Okay, Don't Panic, But HDD Prices Are Now Rising Faster Than They Have in Years; Mimicking the Great RAM Shortage

Well, storage supply lines are under massive pressure, which is why a new report claims that HDD prices are soaring rapidly, with the highest-ever increase in eight quarters. For an industry that has become one of the largest in a short span, it would certainly disrupt the supply chain balance built over the years, and a similar case applies to AI as well. Given how deeply involved Big Tech is with the technology, they are giving their all to ensure advancements in the sector, and in the midst of such a frenzy, suppliers are now 'scratching their heads' to figure out how to cater to market demand. In a report by Nikkei, it is revealed that contract HDD prices have risen by 4% QoQ, which is the highest figure in the past eight quarters. The demand is primarily driven by the large-scale data center buildout occurring worldwide, with HDD requirements being more prevalent in US-based facilities. For those unaware, AI is nothing without data, and to store large quantities of data, CSPs utilize HDDs, as they are the most cost-effective and efficient medium for storage. The data scales up to exabytes in data centers, encompassing content such as scraped web data, backups of processed data, inference logs, and other related data. Similar to AI memory, HDDs have seen massive adoption in recent times, which has put suppliers under pressure. HDD manufacturers have indirectly indicated that demand is now expected to outpace supply, and more importantly, the situation could become mainstream by 2026, with its effects being felt in the retail segment. And, given the increasing need for inference across AI data centers, the use of HDDs will continue to rise from hereon, as the data center buildout progresses. And, for HDD suppliers, it is likely more profitable to cater to the AI sector, similar to how DRAM producers prefer AI customers over general-purpose. Meanwhile, demand for high-capacity nearline HDDs used in data centers remains robust, with prices for nearline HDDs rising by about 4% quarter-over-quarter. According to TrendForce, despite manufacturers operating at full utilization rates, supply continues to lag behind the expanding storage requirements of US-based CSPs, especially as AI, cloud computing, and data-intensive workloads continue to scale. - DigiTimes Traditionally, HDDs have been known as the low-cost storage medium, but this could change soon, which is one of the reasons why firms like Transcend and Phison have already notified the market about the impending shortages.

Share

Share

Copy Link

Hard disk drive prices jumped 4% quarter-over-quarter in Q4 2025, marking the sharpest increase in two years. The surge stems from dual pressures: massive AI data center expansion in the US and China's government-backed PC procurement policies. Despite manufacturers operating at full capacity, supply lags behind demand, with experts warning the shortage could worsen through 2026.

Hard Disk Drive Price Increase Hits Eight-Quarter High

HDD prices surged 4% quarter-over-quarter in Q4 2025, representing the sharpest hard disk drive price increase seen in eight quarters, according to reports from

Nikkei

cited byDigiTimes

. Suppliers warn this upward pressure will persist, signaling a fundamental shift in what many had dismissed as legacy technology. The spike affects consumers directly, with estimates suggesting HDDs could cost roughly $50 more in the near term2

.

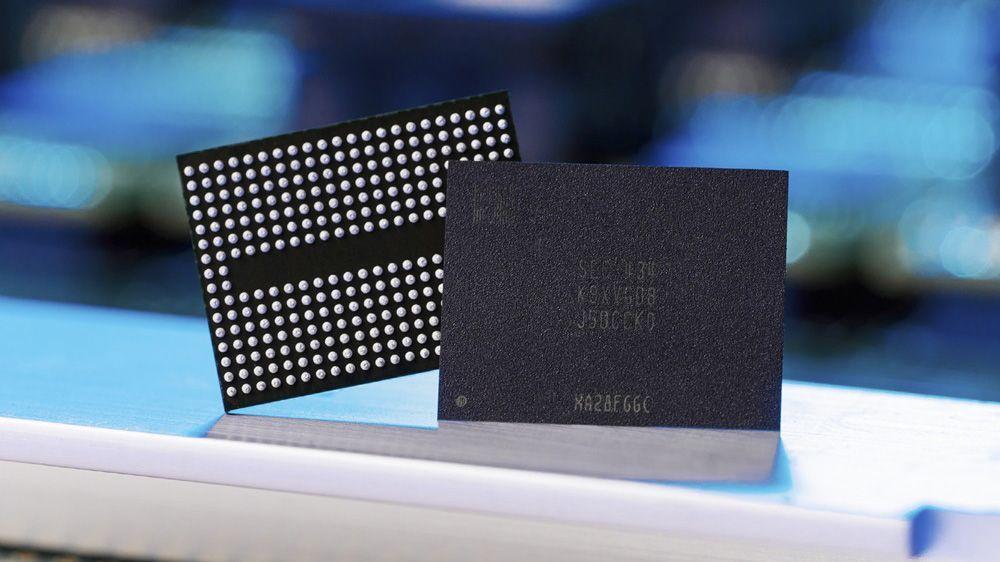

Source: XDA-Developers

Demand from AI Data Centers Drives Storage Supply Lines Pressure

The primary catalyst behind rising HDD prices is the explosive growth of AI infrastructure, particularly in US-based facilities. Cloud service providers rely heavily on hard drives for bulk data storage because they remain the most cost-effective medium for storing the massive volumes of data AI systems generate

3

. AI workloads scale beyond terabytes into exabytes, encompassing scraped web data, backups of processed data, and inference logs4

. High-capacity nearline HDDs used in data centers saw prices rise by approximately 4% quarter-over-quarter, with TrendForce reporting that manufacturers operating at full utilization rates still cannot meet expanding storage requirements1

. This demand from hyperscale operators and the global expansion of data centers has created unprecedented storage supply lines pressure across the industry.

Source: TweakTown

China's PC Market Revives HDD Adoption Amid SSD Data Retention Concerns

A second major pressure point emerges from China's PC market, where government procurement policies favoring domestically produced CPUs and operating systems have accelerated local PC production

1

. Unexpectedly, this policy shift has boosted HDD adoption due to concerns around SSD data retention and bit rot—the gradual deterioration of NAND flash memory over time2

. This renewed trust in hard drives for long-term data retention has reversed what appeared to be an inevitable transition to solid-state storage in certain use cases.

Source: Wccftech

Related Stories

DRAM Shortage Compounds Data Storage Crisis

The DRAM shortage adds another layer of complexity to the data storage crisis. HDDs utilize DRAM for cache memory, and elevated DRAM pricing has made it harder for manufacturers to control production costs even as demand surges

1

. Storage giants Phison and Transcend have already issued warnings about impending shortages, suggesting 2026 could see significant price increases and shortages across HDD, SSD, and RAM markets3

.Capital Expenditure and Supply Chain Constraints

Unlike flash memory, which can ramp production with new fabs and process shrinks, HDD manufacturing is constrained by specialized components such as read/write heads and precision media. Scaling output isn't fast or cheap, and manufacturers have been cautious about expanding capacity after years of pricing pressure and consolidation

1

. Capital expenditure on AI infrastructure has ballooned so rapidly that it now appears in macroeconomic data, with analysts noting that a disproportionate share of recent US GDP growth stems from investment spending tied to data centers and servers rather than consumer demand1

. HDD manufacturers have indirectly indicated that demand is expected to outpace supply, with effects likely becoming mainstream by 2026 and felt across the retail segment4

. For HDD suppliers, catering to AI customers may prove more profitable than serving general-purpose markets, mirroring the preference shift already seen among DRAM producers4

.References

Summarized by

Navi

[2]

[3]

Related Stories

AI Boom Triggers Storage Crisis: HDD and SSD Prices Surge Amid Supply Shortages

16 Sept 2025•Technology

AI Demand Sells Out Western Digital Hard Drives Through 2026, Long-Term Agreements Lock Supply

15 Feb 2026•Business and Economy

AI Boom Triggers Unprecedented Shortage in Memory and Storage Components

15 Oct 2025•Technology

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

Meta strikes up to $100 billion AI chips deal with AMD, could acquire 10% stake in chipmaker

Technology

3

Pentagon threatens Anthropic with supply chain risk label over AI safeguards for military use

Policy and Regulation