AI Stock Showdown: Nvidia vs Palantir - Billionaires' Shifting Bets and Market Outlook

7 Sources

7 Sources

[1]

Billionaires ditch Nvidia for this AI stock that's soared 2,000% since 2023

Nvidia has seen massive growth due to the AI boom. However, some hedge fund managers are shifting focus to Palantir Technologies. Like Ken Griffin and Israel Englander, they have reduced their Nvidia holdings while increasing their Palantir stakes recently. Palantir's AI tools are gaining traction, with revenue and customer acquisition growing. Nvidia has been among the largest beneficiaries of the artificial intelligence (AI) boom triggered by the introduction of ChatGPT late in 2022, with stock price soaring 715%, and its earnings per share rising 1,690% in the last 12 months, as per a report. But some of Wall Street's most influential hedge fund managers are turning their sights on a different AI stock that's recorded a 2,000% gain since January 2023 and that company is Palantir Technologies, as per a report by The Motley Fool. According to the report, Citadel Advisors' billionaire Ken Griffin disposed of 1.5 million shares of Nvidia, slashing his stake by half. He was meanwhile building up his position in Palantir by 204%, adding 902,400 shares, as per The Motley Fool report. Even Israel Englander of Millennium Management also cut his stake in Nvidia by 7% and increased his stake in Palantir by 302% as he bought 986,400 shares in the firm, according to the report. These transactions have led to a rising perception among top investors that Palantir might have even more upside in the artificial intelligence domain than Nvidia, as per The Motley Fool report. ALSO READ: Trump blasted for embarrassing typo in tariff letter -- misgenders foreign leader Nvidia keeps posting solid performances, with revenue growing 69% from year earlier to $44 billion in the latest quarter, fuelled by record demand for AI chips, according to the report. Non-GAAP net income rose 33% to $0.81 per share, as per the report. CEO Jensen Huang attributed growth to "incredibly strong" demand for AI infrastructure, reported The Motley Fool. But some investors became nervous earlier this year after a Chinese AI firm, DeepSeek, had reportedly trained a sophisticated language model on low-cost and less capable chips than those of Nvidia's top chips, as per the report. This may have been taken by some as a warning sign, but some think it might actually give Nvidia's business a boost by making AI affordable for more companies, according to The Motley Fool. Nvidia is still a clear leader in both generative and physical AI, the latter driving applications such as autonomous vehicles and robotics, as per the report. The Motley Fool reported that Wall Street has projected that Nvidia's earnings will rise at 28% annually over the next three to five years. ALSO READ: Trump's tariff bombshell sends copper prices through the roof, sends markets into frenzy -- what's next? Palantir is growing fast as during the first quarter, the company saw revenue grow 39% to $884 million and non-GAAP earnings by 62% to $0.13 per diluted share, as reported by The Motley Fool. Customer acquisition also grew 39% in total clients and 124% in spending from repeat customers, according to the report.The management also increased its full-year guidance and sales are now project to jump 36% in 2025, as per the report. The firm designs analytics software for the commercial and government sectors and its core platforms, Gotham and Foundry, let customers integrate and query complex information with analytical applications and machine learning models, as reported by The Motley Fool. Forrester Research has recognised Palantir as a leader in artificial intelligence and machine learning platforms, awarding its AIP product higher scores than similar tools from Alphabet's Google and Microsoft, according to the report. ALSO READ: VantageScore 4.0 just got a major boost - what it means for your credit and loans Why are hedge funds selling Nvidia? Some hedge fund managers believe Palantir may now offer more growth potential in the AI space and are reallocating funds accordingly. How much has Palantir's stock gained? Palantir has jumped 2,000% since January 2023, making it one of the best-performing AI stocks.

[2]

2 Popular AI Stocks That Can Drop 37% to 71%, According to Certain Wall Street Analysts | The Motley Fool

It has been a turbulent year for the U.S. markets. In early April, many stocks experienced sharp declines due to escalating trade tensions and the introduction of new tariffs by the Trump administration. Investors panicked. Headlines screamed of trade wars. But fast-forward to July, and it's a completely different picture. The benchmark S&P 500 index is sitting at record highs. Economic metrics are seeming friendlier, and optimism has crept back in. But don't let the rally fool you -- there's tension brewing just under the surface, with concerns about inflation, a weak labor market, and potential policy shifts not addressed thoroughly. Share prices of some of the biggest winners, such as Nvidia (NVDA 0.53%) and Palantir Technologies (PLTR -0.33%), seem to have risen too far, too fast. Here's what investors should know about these stocks. Semiconductor giant Nvidia is the biggest beneficiary of the artificial intelligence (AI) infrastructure boom. With unrelenting dominance in the entire AI tech stack, the company has become a hot favorite of Wall Street. But, Seaport Research Partners' senior analyst, Jay Goldberg, is not buying the hype. In early April 2025, the analyst made waves by issuing a sell rating on Nvidia with a price target of $100, which is 37% lower than its current level at this writing. His bearish stance is based on concerns about Nvidia's high valuation amid a slowdown in artificial intelligence (AI) spending as enterprises evaluate real-world use cases. The analyst is also concerned that the company reached its maximum capacity for Blackwell GPU orders for fiscal 2026, is exposed to rising competitive pressures, and faces potential export restrictions to China, all of which pose significant revenue challenges. To be fair, Nvidia isn't exactly floundering. Quite the opposite. The company's comprehensive AI platform is highly successful, with its integrated computing, storage, and design solutions becoming the backbone of modern data centers and gaming systems. The company is also making rapid inroads in relatively new use cases such as robotics, autonomous self-driving vehicles, industrial design, and edge AI. The recently launched Blackwell architecture chips, the successor to the highly popular Hopper chips, are also a significant growth catalyst. Blackwell represents a major shift in AI computing design and is already become the fastest product ramp in the company's history. Blackwell is being increasingly deployed by hyperscalers, model builders, enterprises, and sovereign customers for computationally intensive inference (real-time deployment of AI models) workloads. The success of Nvidia's AI strategy is evident from its financial performance. In its most recent quarter (the first quarter of fiscal 2026, which ended April 27), Nvidia's revenue soared 69% year over year to $44.1 billion, while non-GAAP (adjusted) net income surged 31% year over year to $19.9 billion. With the AI data center market estimated to be worth $100 billion by 2030, the company is likely to continue growing in the coming years. But here's the uncomfortable truth. The company's valuation seems quite rich, even after considering its stellar growth prospects. With a price-to-earnings (P/E) ratio of 51.4 and a price-to-sales (P/S) multiple of 26.5, growth is not enough. Investors are betting on an overtly optimistic future, in line with the company's past performance, which seems unlikely considering the many headwinds Nvidia faces in the current landscape. Hence, at these valuation levels, the stock is vulnerable to any disappointments in growth expectations or changes in market sentiment. Although Goldberg's prediction of a $100 share price target may seem extreme, it is not implausible if growth stalls or competition picks up faster than expected. Then there's Palantir, another AI-powered stock that has become the talk of Wall Street. But Rishi Jaluria of RBC Capital is ringing alarm bells. In May, Jaluria reiterated his deeply bearish stance on Palantir with an underperform rating and $40 price target, implying a 71% downside from its current share price. The analyst is deeply concerned about the sustainability of Palantir's growth trajectory since government revenue -- historically the company's segment -- is showing signs of deceleration due to rising competition and limited product differentiation. While commercial revenue appeared robust on the surface, RBC claimed that it was slightly weaker than the consensus expectation. Jaluria points out an unfavorable risk-reward balance for Palantir, as he believes the stock is trading at a premium valuation, which appears unjustified given its growth challenges and limited market differentiation. Still, there's no denying the company's AI momentum. In the first quarter, the company's revenue increased 39% year over year, while U.S. revenue rose even more impressively by 55%. What differentiates Palantir from other prominent AI players is its focus on leveraging its proprietary ontology capabilities (a mapping of real-world assets of the clients with digital assets) with large language models (LLMs) to resolve real-world business problems. This positioning becomes particularly valuable in a market where AI models are becoming increasingly commoditized. Palantir's Artificial Intelligence Platform (AIP) is now focusing on enterprise autonomy, helping companies build, test, evaluate, and deploy agents that can dramatically improve productivity. Increasing geopolitical tensions are also a tailwind for Palantir. The company's foundational U.S. government business reported 45% year-over-year growth, while U.S. commercial revenue accelerated 71% year over year in the first quarter. Clients are rapidly transitioning from pilots for AIP to multimillion-dollar deals in weeks rather than years. It is undeniable that Palantir's valuation paints a disturbing picture. Trading at over 101 times revenue and approximately 584 times earnings, Palantir's valuation far exceeds even the major technology giants. There has also been significant insider selling by high-ranking executives such as CEO Alexander C. Karp, COO Shyam Sankar, and Director Stephen Andrew Cohen, which may suggest that the stock is perceived as overvalued even by the management. Against this backdrop, short-term investors with an investment horizon of less than a year can consider taking small profits from the stock. Long-term investors with an investment horizon of more than five years and who are highly optimistic about Palantir's growth prospects can consider having a small exposure to this company even at elevated valuation levels.

[3]

2 Artificial Intelligence (AI) Stocks to Buy Before They Soar 150% and 735%, According to Certain Wall Street Analysts | The Motley Fool

Since January 2020, Nvidia shares have added 2,690% due to soaring demand for AI chips. Meanwhile, Tesla shares have added 1,010% due to excitement about self-driving cars and autonomous robots. In both cases, some Wall Street analysts expect more fireworks in the years ahead. Here's what investors should know about these companies. Beth Kindig, lead technology analyst at the I/O Fund, thinks Nvidia will trade at $410 per share by 2030, which implies a market value of $10 trillion. The investment thesis centers on rapidly growing demand for artificial intelligence (AI) hardware and software in data centers, as well as edge devices like autonomous cars and robots. Nvidia is best known for its graphics processing units (GPUs), chips also known as artificial intelligence accelerators. It holds over 90% market share in data center GPUs, and analysts at TD Cowen expect the company to maintain the same level of dominance through the end of the decade, with AI chip sales increasing 160% during that period. However, investors need to understand Nvidia is more than a chipmaker. The company also leads the market for generative AI networking gear and it has a burgeoning cloud services business. "We stopped thinking of ourselves as a chip company long ago," CEO Jensen Huang told attendees at the annual shareholder meeting in June. Importantly, while generative AI is currently the largest source of demand for Nvidia AI infrastructure, the company is well positioned to benefit as the physical AI boom unfolds. Physical AI refers to autonomous machines like cars and robots that understand, interact with, and navigate the real world. "We're working toward a day where there will be billions of robots, hundreds of millions of autonomous vehicles, and hundreds of thousands of robotic factories that can be powered by Nvidia technology," Jensen Huang explained to shareholders last month. So, can Nvidia reach $410 per share by 2030? I think so. That implies annual returns of 18%. Grand View Research estimates AI spending will increase at 36% annually through the end of the decade, which means Nvidia could achieve similar annual earnings growth. In that scenario, the stock could hit $410 per share in late 2030 at a reasonable valuation of 22 times earnings. For context, the stock currently trades at 53 times earnings, which itself is a substantial discount to the three-year average of 80 times earnings. Ark Invest analysts led by Tasha Keeney expect Tesla to trade at $2,600 per share by 2029, which implies a market value of $8.3 trillion. Their investment thesis centers on robotaxis, which are expected to account for 63% of revenue by the end of that period. Meanwhile, electric cars (26%), energy storage (10%), and insurance (1%) will comprise the remaining portion. While Alphabet's Waymo is currently the market leader, Tesla theoretically has an edge in autonomous driving technology. Its full self-driving (FSD) software is powered entirely by computer vision, rather than a costly array of lidar, radar, and cameras like Waymo. For context, Tesla says its dedicated robotaxi (the Cybercab) will cost less than $30,000, but Waymo sensors alone can cost as much as $100,000. Also, Tesla has more camera-equipped vehicles on the road collecting data than every other automaker combined. That data advantage should translate into better AI models. Indeed, Ark Invest says Teslas in FSD mode can drive 3,200 miles per crash on surface streets, which makes them an estimated 16 times safer than an average driver and six times safer than Waymo. Tesla recently started its first autonomous ride-sharing service in Austin, Texas. CEO Elon Musk says robotaxis could be a material source of revenue by late next year, and he thinks Tesla will eventually have 99% market share in what could be a multitrillion-dollar industry. Indeed, Tom Narayan at RBC Capital estimates marketwide robotaxi revenue will reach $1.7 trillion by 2040. While that outcome is plausible, I would be remiss not to mention Tesla's woes. It has lost substantial market share in electric cars in the past year due to its aging product lineup and Elon Musk's political activities. In fact, Tesla deliveries dropped 13% in the first and second quarters, despite a 35% increase in global electric car sales year to date through May, according to Morgan Stanley. So, can Tesla reach $2,600 per share by 2029? I doubt it. While I think autonomous driving technology will be a big catalyst for the company, Ark's target price implies the stock will return 60% annually over the next four-plus years. That means Tesla's earnings would need to increase at 60% annually during the same period just to maintain its already-expensive valuation of 170 times earnings.

[4]

Billionaires Sell Nvidia Stock and Buy an AI Stock Up 2,000% Since Early 2023

Nvidia (NVDA -0.74%) has been one of the biggest winners since ChatGPT started the artificial intelligence (AI) boom in late 2022. The company's trailing-12-month earnings per share have increased 1,690% since the fiscal year that ended in January 2023, and its share price has increased 715%. Yet several prominent hedge fund managers sold Nvidia during the first quarter and added shares of Palantir Technologies (PLTR 3.54%), a stock that has returned 2,000% since January 2023. The trades detailed above were made in the first quarter, so investors need to reassess both companies before deciding to buy or sell either stock. Here are the details. Nvidia: The stock Citadel and Millennium sold in the first quarter Semiconductor company Nvidia reported solid financial results in the first quarter. Revenue increased 69% to $44 billion due to what CEO Jensen Huang characterized as "incredibly strong" demand for AI infrastructure. Meanwhile, non-GAAP net income jumped 33% to $0.81 per diluted share, and earnings would have increased more quickly had it not been for new export restrictions. DeepSeek shook investor confidence in Nvidia earlier this year when it reportedly trained a sophisticated large language model with much less money (and less powerful chips) than U.S. rivals like Anthropic and OpenAI. However, concerns about a decline in AI infrastructure spending have so far been unfounded, and DeepSeek's efficient training methods may even boost demand for Nvidia chips by making AI affordable for more companies. I still see Nvidia as a worthwhile investment due to the durability of the AI boom. While generative AI is the focal point today, physical AI will gradually steal the spotlight in the years ahead. Physical AI is the technology that will let autonomous machines, like cars and robots, understand and navigate the real world, and Nvidia is well-positioned to be a winner in those markets. Nvidia graphics processing units (GPUs) are the most coveted AI accelerators on the market, and its dominance is due to a combination of better hardware and a robust ecosystem of supporting software. Most AI projects rely on Nvidia's CUDA software, and that platform includes tools for self-driving cars and robotics that should keep the company on the cutting edge of the AI boom for many years. Wall Street expects Nvidia's earnings to increase at 28% annually over the next three to five years, which makes the current valuation of 51 times earnings look tolerable. Investors with a long time horizon can hold this stock with confidence. Palantir Technologies: The stock Citadel and Millennium bought in the first quarter Palantir reported solid first-quarter financial results. Customers increased 39% to 769, and the average existing customer spent 124% more. Revenue climbed 39% to $884 million, the seventh-straight acceleration, and non-GAAP earnings increased 62% to $0.13 per diluted share. Management also raised full-year guidance; sales now are forecast to increase 36% in 2025. Palantir designs analytics software for the commercial and government sectors. Its core platforms, Gotham and Foundry, let customers integrate and query complex information with analytical applications and machine learning models. Its artificial intelligence platform (AIP) adds support for large language models and natural language processing, which lets customers apply generative AI to their operations. Management says investments in infrastructure and software architecture have positioned Palantir uniquely to deliver on demand for artificial intelligence. Forrester Research has corroborated that claim to some degree by recognizing the company as a leader in artificial intelligence and machine learning platforms, awarding its AIP product higher scores than similar tools from Alphabet's Google and Microsoft. Palantir is a good business, but the stock is outrageously expensive. It currently trades at 107 times sales, a valuation that only a handful of software companies have achieved in the last few decades. For context, the next closest company in the S&P 500 is Texas Pacific Land at 33 times sales. Palantir could fall sharply if investors sour on risky growth stocks.

[5]

These Artificial Intelligence (AI) Stocks Are Quietly Outperforming the Market

The S&P 500 has recovered and advanced after a rough patch in the middle of the first half. Investors, initially worried about the impact of President Trump's import tariffs at home, are feeling more optimistic that the economy and companies can manage the challenge. As a result, they've once again started piling into the growth stocks that led indexes higher last year, from Nvidia to Palantir Technologies. But while these companies are attracting a lot of attention, they aren't the only ones that have benefited from positive sentiment in recent days. In fact, two artificial intelligence (AI) stocks in particular have been quietly outperforming the market. They've climbed in the double digits since the start of the year, while the S&P 500 has advanced a little more than 6%. Let's check out these market-beating players. Oracle Oracle (ORCL -0.56%) stock has jumped 38% since the start of the year, buoyed by demand from AI customers. You may associate Oracle most with database management software, and that was the company's bread and butter for years, but Oracle has built upon those strengths -- adding cloud infrastructure and related services to its offerings. In fact, Oracle recently said it's on track to become the world's top cloud application company and one of the biggest cloud infrastructure players, with a total cloud growth rate to increase from 24% in the recently completed fiscal year to 40% in this new fiscal year. This is music to the ears of customers looking to build AI platforms as well as those seeking general cloud capacity. During the recent quarter, a customer asked Oracle for all available capacity -- regardless of the location -- and regarding this level of demand, Oracle co-founder Larry Ellison said he's "never seen anything remotely like this." Customers also like Oracle because it offers them a multicloud experience, or the ability to leverage the Oracle database and accomplish their projects across many clouds. So they don't have to choose just one cloud. Multicloud database revenue from Amazon, Alphabet's Google Cloud, and Microsoft Azure, surged 115% last quarter from the previous quarter, and the company expects this triple-digit growth to continue. All of this, along with the idea that the general AI market is expected to reach into the trillions in the coming decade, should drive Oracle's earnings and share price higher. So this AI stock may have what it takes to outperform the market over the long term. CrowdStrike CrowdStrike Holdings (CRWD -0.42%) has seen its shares advance 39% this year, recovering and going on to gain after a major challenge last July. A bug in a software update led to the world's biggest information technology outage -- halting everything from air travel to scheduled surgeries as CrowdStrike customers couldn't access data. The AI-driven cybersecurity giant took immediate action to remedy the problem, showing its proactive nature, and maintained solid relationships with most customers. Of course, the incident weighed on earnings as CrowdStrike offered customers compensation packages, and this effort continues to represent a headwind. But in spite of this, CrowdStrike has continued to grow, and its Falcon Flex system, allowing customers to pick and choose CrowdStrike services as needed, has been a big growth driver. In the recent quarter, Falcon Flex deals surpassing $3.2 billion increased by more than six times year over year. Total revenue and annual recurring revenue both increased in the double digits, and net cash from operations reached a record level of more than $384 million. The company predicts Falcon Flex deal momentum will boost annual recurring revenue and margin expansion in the second half of the year. Another reason to be optimistic? CrowdStrike just announced a $1 billion share repurchase authorization, a sign it's confident in its future. So as CrowdStrike's earnings continue to recover from the outage last year -- and as growth potentially accelerates -- this AI cybersecurity company may continue to roar higher, making it a top growth stock to own in the second half.

[6]

Undervalued and Ignored: 3 Artificial Intelligence (AI) Stocks With Room to Run

Most of the old guard's biggest AI-driven gains have happened. It's time for the next generation of AI stocks to step into the spotlight. There's little doubt as to the stock market's biggest winners as it relates to artificial intelligence (AI). Nvidia's (NVDA -0.46%) processors are the centerpiece of most AI data centers, while Palantir Technologies' artificial intelligence software is making the most out Nvidia's hardware. Both stocks have performed incredibly well over the course of the past couple of years. As is the case with any young industry, though, smaller companies are finally figuring out how to capitalize on AI's growth. Although outfits like Palantir and Nvidia are at no immediate risk of being dethroned in terms of size or reach, don't be surprised to see some new names taking the lead in terms of performance as we begin the next chapter of the AI era. Here are three such names to put on your radar, if not yet in your portfolio. 1. CoreWeave It's an underappreciated nuance of the business. But most companies utilizing artificial intelligence technologies don't actually own their own AI data centers. It's often cheaper and easier to simply rent cloud-based access time to these platforms. That's what CoreWeave (CRWV 5.37%) offers. Granted, cloud-accessible AI platforms aren't exactly uncommon anymore. As was noted, in fact, it's the norm within the business. CoreWeave's tech is still special though in that the company's infrastructure is purpose-built from the ground up to offer access to the industry's newest and most powerful processors, like Nvidia's GB200 Blackwell Superchip, which trains AI models 4 times faster than previous processing platforms, and performs real-time inference calculations up to 30 times faster than most platforms currently in use can. Indeed, to call CoreWeave's solutions "fifth-generation" arguably still understates the performance leap it offers its customers -- customers that include OpenAI, Microsoft, and Meta Platforms, by the way. So why haven't more investors heard of it? Although it's not a new enterprise, it is a relatively new publicly traded stock. The company's initial public offering (IPO) was in March of this year, when investors were far more concerned about the tariff talk that was upending the market. Regardless, although it's currently unprofitable, its first-quarter revenue soared 420% to nearly $1 billion. Analysts expect triple-digit top-line growth this year and next, with a swing to profitability likely by 2027. CoreWeave is obviously coming into its own now that technology giants recognize how much more they can accomplish with next-generation AI solutions. 2. Astera Labs With nothing more than a passing glance, Astera Labs (ALAB -5.81%) looks a lot like CoreWeave, seemingly making it unnecessary to own both. The two companies are actually quite different, though. CoreWeave's business model offers a turnkey solution to institutions that want access to next-generation AI computing platforms. Astera simply makes and sells much of the hardware you'll find within a data center's racks of processors connected to circuit boards, each of which is connected to another. And like CoreWeave -- and unlike much of the hardware used in artificial intelligence's early days -- much of Astera Labs' technology is purpose-built specifically for AI. Case in point: Astera's Aries line of PCIe/CXL connectivity tech supports data transmission between AI processors at speeds of up to 64 gigatransfers (64 billion transfers of digital data) per second. And it does so using Ethernet cables that are much thinner than the ones you might normally use in a home or office setting. That may not mean much to the average person, but this will: This option allows for more computing power with less power consumption and a smaller physical footprint. This ultimately translates into lower operating costs. The company also offers PCIe switches, digital signal processors, and memory controllers that similarly offer better functionality in a smaller package. But are these technological solutions the industry actually needs enough to pay a premium for? This might answer the question: Astera's revenue is expected to grow to the tune of 80% this year, pushing the company out of the red and into the black. And that's just the beginning of the growth streak analysts expect of this fast-growing up-and-comer. 3. Penguin Solutions Finally, add Penguin Solutions (PENG 2.41%) to your list of overlooked AI stocks with room to run. You've probably never heard of it, but not because it's new -- the company's been publicly traded since 2017, when it was still called SMART Global Holdings. The name change in 2024 probably isn't the reason you aren't familiar with it either. Rather, the chief reason you've probably never come across this outfit is its sheer size. With a market cap of only $1.3 billion, Penguin is not only the smallest of the three AI names in focus here, but it's just plain small. Don't let its diminutive size dissuade you, though. This outfit packs a powerful growth punch. The analyst community is looking for sales growth of 17% this year, mostly driven by growing demand for -- surprise, surprise -- its AI data center infrastructure solutions. Once again, with just a quick look, Penguin looks a lot like Astera and CoreWeave. And there's some overlap to be sure. Penguin Solutions is different enough, though. It offers some of the specialized solutions somewhere in between Astera Labs' tech and CoreWeave's service, like fault-tolerant computing memory modules, data center design and deployment services, and software specifically meant to manage the computing clusters that most modern AI data centers now utilize. The kicker: Unlike so many of its fellow AI outfits -- and especially the smaller ones -- Penguin Solutions is consistently profitable. Moreover, the stock's only trading at about 15 times this year's projected per-share profits of $1.62, which should grow 17% to $1.89 next year. Not bad for such a little outfit. Just remember that it is a small-cap stock capable of dishing out above-average volatility. You'll want to handle it accordingly.

[7]

What Are the 3 Best Bargain Artificial Intelligence (AI) Stocks to Buy Right Now? | The Motley Fool

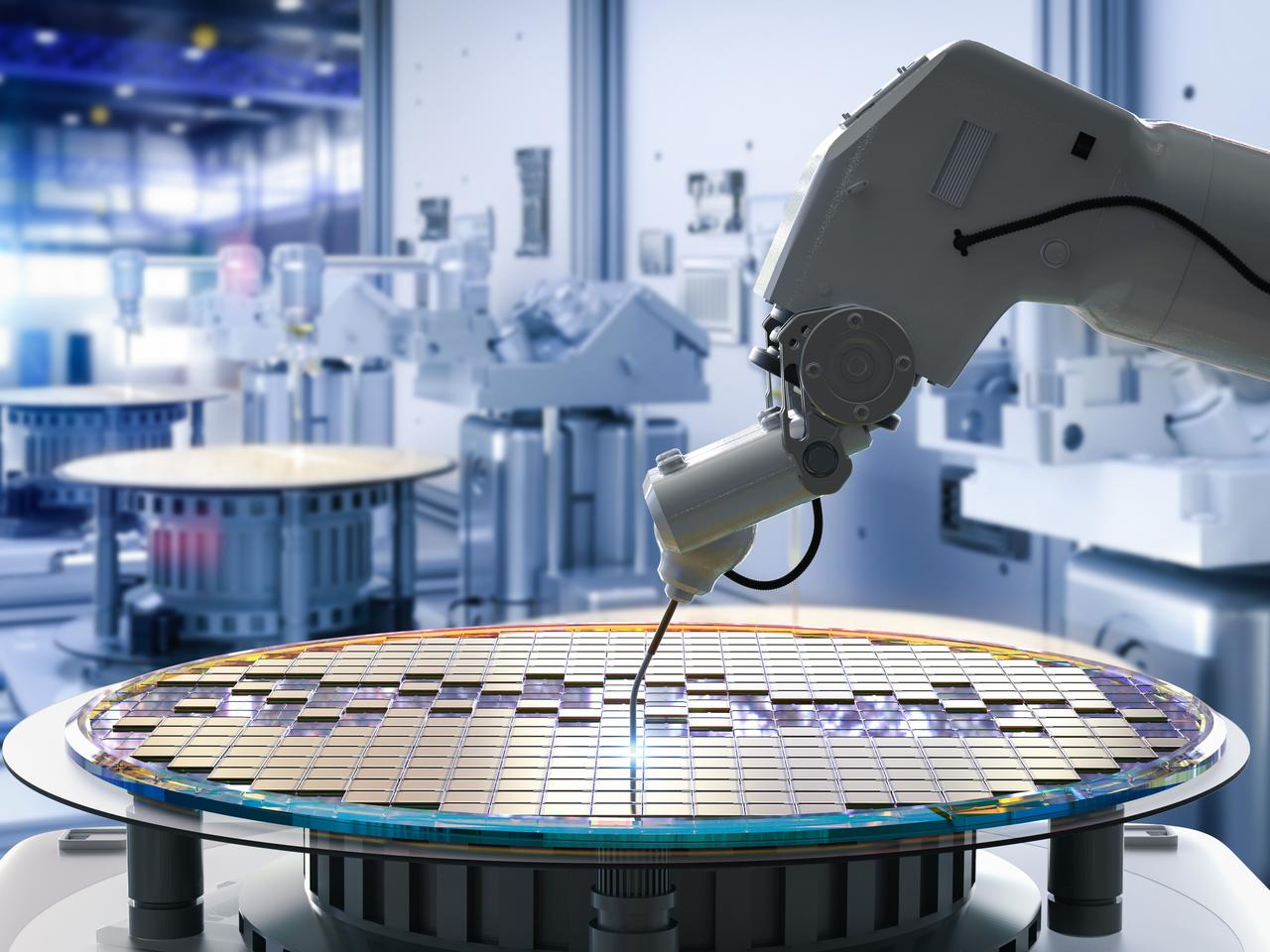

In April when the S&P 500 sunk about 19%, bargain hunters were having a field day. Today, however, the opportunities to find quality artificial intelligence (AI) stocks hanging on the discount rack may seem fewer and farther between. Trading today at around 52.5 times operating cash flow, Nvidia stock certainly doesn't seem like it's a value opportunity at first glance. Before making this determination, however, you'd be wise to remember that it's often useful to consider a stock's valuation in context of its historical valuation. In doing so, you'd find Nvidia stock's five-year average cash-flow multiple is 55.1, illustrating its less expensive valuation today. Similarly, shares of Nvidia seem admittedly higher trading at 53 times trailing earnings, but since they have a five-year average P/E ratio of 70.2, shares seem attractively priced right now. A semiconductor stalwart, investors would be hard pressed to find a company that supports advancement of the AI industry as much as Nvidia thanks to the graphics processing units it designs for data centers, where AI computing occurs. Additionally, Nvidia has ownership stakes in a variety of AI companies that are driving innovation in a variety of fields including generative AI and healthcare. Unsurprisingly, the production of sophisticated semiconductors that companies rely on to drive AI innovation is far from a simple process. That's where ASML comes in. The company provides hardware, software, and services that help facilitate the mass production of microchips found in AI applications. Most notably, the company provides semiconductor makers with extreme ultraviolet (EUV) lithography systems -- systems that enable the printing of the smallest features on microchips at the highest density. This is an invaluable tool for advanced semiconductor makers such as ASML customers Taiwan Semiconductor Manufacturing and Intel. It's hard to overstate the allure of ASML with respect to the vital role it plays in helping chipmakers; it's currently the only company worldwide to manufacture EUV lithography systems. Like with Nvidia, ASML stock's trailing P/E ratio of 33.7 might not shout "bargain," but considering its five-year trailing earnings multiple of 40.8, the current valuation seems more compelling. Climbing 2.6% since the start of 2025, Amazon stock has failed to keep pace with the S&P 500, which has risen 6.4% as of this writing. With the lack of uncertainty regarding tariffs and how they will impact the company's retail business, investors have chosen to keep their distance -- unlike 2024 when Amazon stock soared more than 44%. While the stock's lackluster rise in 2025 may be disheartening for current shareholders, it helps to provide a good entry point for prospective investors. Currently, shares are priced 36.7 times trailing earnings -- a hefty discount to their five-year average P/E of 64.1. From its cloud platform, Amazon Web Services, which supports its customers develop their own AI resources, to the development of AI tools like the virtual assistant Alexa and Amazon Q, an AI assistant used in workplace settings, the company has broad exposure to the AI industry. Plus, there's the numerous ways that Amazon is leveraging AI in everything it owns, making it even clearer that this AI powerhouse has a great opportunity to flourish in the years ahead. While it's always important to focus on the present and look toward the future, taking a peak at the past can also prove to be pretty helpful -- especially with respect to valuing stocks. At first glance, Nvidia, ASML, and Amazon may all seem to sport rich price tags, but, when taking into account their historical valuations, it becomes much clearer how they are all available at a discount right now. All three companies provide varying opportunities, but Nvidia is arguably the best choice right now for those seeking the most concentrated exposure to the burgeoning field of AI.

Share

Share

Copy Link

As the AI boom continues, billionaire investors are shifting focus from Nvidia to Palantir, with the latter's stock soaring 2,000% since 2023. This shift reflects changing perceptions of growth potential in the AI sector.

Shifting Tides in AI Investments

The artificial intelligence (AI) boom has reshaped the investment landscape, with Nvidia emerging as a clear frontrunner. However, recent trends indicate a potential shift in investor sentiment, with some billionaire hedge fund managers redirecting their focus towards Palantir Technologies

1

.

Source: ET

Nvidia's Dominance and Challenges

Nvidia has been a major beneficiary of the AI surge, with its stock price soaring 715% and earnings per share rising 1,690% in the last 12 months

1

. The company's recent performance remains strong, with revenue growing 69% year-over-year to $44 billion in the latest quarter1

. CEO Jensen Huang attributes this growth to "incredibly strong" demand for AI infrastructure1

.However, some investors have become wary. Reports of a Chinese AI firm, DeepSeek, training sophisticated language models on less expensive chips have raised concerns about Nvidia's market position

1

. Despite these challenges, Nvidia maintains its leadership in both generative and physical AI applications1

.Palantir's Rising Star

Palantir Technologies has emerged as a formidable contender in the AI space, with its stock price surging 2,000% since January 2023

1

. The company's first-quarter results showed impressive growth, with revenue increasing 39% to $884 million and non-GAAP earnings rising 62% to $0.13 per diluted share1

.

Source: Motley Fool

Palantir's success is attributed to its focus on leveraging proprietary ontology capabilities with large language models to solve real-world business problems

2

. The company's Artificial Intelligence Platform (AIP) is gaining recognition, with Forrester Research ranking it higher than similar tools from Google and Microsoft1

.Billionaire Investors' Shifting Strategies

Notable hedge fund managers are reallocating their investments from Nvidia to Palantir. Citadel Advisors' Ken Griffin reduced his Nvidia stake by half while increasing his position in Palantir by 204%

1

. Similarly, Israel Englander of Millennium Management cut his Nvidia stake by 7% and boosted his Palantir holdings by 302%1

.Related Stories

Contrasting Analyst Perspectives

While some investors are bullish on Palantir, analysts remain divided. Seaport Research Partners' Jay Goldberg issued a sell rating on Nvidia with a price target 37% lower than its current level, citing concerns about high valuation and potential slowdown in AI spending

2

.Conversely, RBC Capital's Rishi Jaluria maintains a bearish stance on Palantir, with an underperform rating and a price target implying a 71% downside

2

. Jaluria points to concerns about the sustainability of Palantir's growth trajectory and limited product differentiation2

.

Source: Motley Fool

Market Outlook and Investor Considerations

The AI market continues to evolve rapidly, with Grand View Research estimating AI spending to increase at 36% annually through the end of the decade

3

. This growth potential has led some analysts, like Beth Kindig of I/O Fund, to project ambitious targets for Nvidia, estimating it could reach a $10 trillion market value by 20303

.For Palantir, while its growth story is compelling, its current valuation of 107 times sales raises concerns about potential overvaluation and vulnerability to market sentiment shifts

4

.As the AI landscape continues to evolve, investors must carefully weigh the growth potential against the risks associated with these high-flying stocks. The coming years will likely see further shifts in the AI market as companies compete for dominance in this transformative technology sector.

References

Summarized by

Navi

[2]

Related Stories

AI Stock Market Volatility: Insider Activity and Investment Opportunities Amid Tech Sector Pullback

02 Mar 2025•Business and Economy

AI Stocks Face Turbulence as Trump's Tariffs Take Effect, but Analysts See Long-Term Potential

05 Mar 2025•Technology

AI Stocks Surge: Investors Eye Opportunities Amid Market Shifts

20 Aug 2024

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology